Dundee Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dundee Bundle

Dundee's competitive landscape is shaped by several powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate or invest in this market.

The complete report reveals the real forces shaping Dundee’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized mining equipment and advanced technologies, crucial for exploration, extraction, and processing, wield considerable bargaining power. Dundee Precious Metals Inc. faces this reality due to the limited availability of alternative providers for these unique assets, which can translate into elevated costs and less favorable contract terms.

The increasing reliance on AI and automation within mining operations further concentrates this power. A restricted number of expert technology providers in this domain amplify their leverage, impacting Dundee's operational efficiency and cost structures.

The gold mining sector, including operations like those of Dundee Precious Metals in Bulgaria, Namibia, and Serbia, heavily relies on a specialized workforce. Geologists, engineers, and seasoned mine operators are critical, and a shortage of these skilled professionals in key operating regions directly elevates their bargaining power.

This scarcity translates into increased leverage for labor suppliers, potentially driving up wages and benefit packages. For Dundee Precious Metals, this could mean higher operational expenditures and a need to focus on talent retention and development to mitigate these costs.

Energy, especially electricity and fuel, represents a significant operating expense for mining firms like Dundee Precious Metals (DPM). In 2024, global energy prices have remained a key factor influencing mining costs. For instance, Brent crude oil averaged around $80 per barrel in early 2024, impacting fuel expenses directly.

The bargaining power of energy and fuel suppliers is considerable for DPM. Reliance on a limited number of providers for essential electricity or fuel can grant these suppliers leverage, allowing them to dictate terms or prices. This concentration of supply can amplify cost pressures on DPM's operations.

Geopolitical events also play a crucial role in shaping the energy market and, consequently, DPM's costs. Disruptions in major oil-producing regions or shifts in international energy policy can lead to price volatility and supply chain insecurities, directly affecting DPM's profitability and operational continuity.

Chemical and Consumable Suppliers

The bargaining power of chemical and consumable suppliers for Dundee Precious Metals is a significant factor in its operational costs. Mining, particularly gold extraction, is heavily dependent on chemicals like cyanide, as well as various other consumables. While some of these inputs are standard and readily available, specialized reagents or those sourced from a limited number of global producers can wield considerable influence.

For instance, in 2023, the global price of cyanide, a critical component in gold leaching, experienced volatility due to supply chain pressures and increased demand from the mining sector. Dundee Precious Metals, like other gold producers, faced upward pressure on these input costs. The company's reliance on these chemicals means that any disruption or price hike from suppliers can directly impact profitability.

- Specialized Reagents: The availability and pricing of unique chemical compounds essential for specific ore processing can give suppliers significant leverage.

- Supply Chain Dependencies: Reliance on a few key manufacturers for critical consumables can lead to higher costs if these suppliers face production issues or have limited capacity.

- Commoditized Inputs: While some chemicals are commodities, even here, large volume purchases by Dundee can provide some negotiation power, though this is often offset by the critical nature of the supply.

- Geopolitical Factors: Global events impacting chemical production or transportation can create supply shortages, thereby increasing the bargaining power of remaining suppliers.

Regulatory and Permitting Service Providers

Entities providing regulatory and permitting services, while not direct material suppliers, wield considerable bargaining power. Their specialized knowledge is crucial for navigating complex environmental and social governance (ESG) regulations, a significant factor for companies like Dundee Precious Metals. For instance, in 2024, the increasing stringency of global ESG reporting requirements meant that firms with proven expertise in these areas could command higher fees and influence project timelines.

The ability of these service providers to efficiently manage permitting processes directly impacts project development and operational continuity. Delays in obtaining necessary environmental permits, often managed by these specialized consultants and legal experts, can lead to substantial cost overruns and deferred revenue. In 2024, the average time to secure major environmental permits in several key mining jurisdictions saw an uptick, underscoring the value and leverage held by experienced regulatory advisors.

- Expertise in ESG Compliance: Specialized consultants are vital for meeting evolving ESG standards, a growing concern for investors and regulators.

- Navigating Regulatory Complexity: Their ability to interpret and manage intricate local and international regulations is a key differentiator.

- Impact on Project Timelines: Delays in permitting services can significantly extend project schedules and increase capital expenditure.

- Operational Continuity: Ensuring compliance is paramount for uninterrupted mining operations, giving these providers leverage.

Suppliers of specialized mining equipment and advanced technologies, along with providers of essential chemicals like cyanide, hold significant bargaining power over Dundee Precious Metals. This leverage stems from limited alternative sources for unique assets and critical inputs, leading to potential cost increases and less favorable contract terms. The scarcity of skilled labor, particularly geologists and engineers, further amplifies the power of human capital suppliers, impacting operational expenditures.

In 2024, global energy prices, with Brent crude averaging around $80 per barrel in early 2024, directly influence fuel expenses for mining operations. Geopolitical events can also create price volatility and supply chain insecurities in the energy market. Similarly, the global price of cyanide, a critical gold leaching component, saw volatility in 2023 due to supply chain pressures, affecting Dundee Precious Metals' input costs.

Providers of regulatory and permitting services also possess considerable bargaining power. Their specialized knowledge is crucial for navigating complex ESG regulations, and in 2024, the increasing stringency of these requirements allowed experienced firms to command higher fees. Delays in obtaining environmental permits, a common issue in 2024, can lead to substantial cost overruns and deferred revenue.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Dundee Precious Metals | 2024 Data/Context |

|---|---|---|---|

| Specialized Equipment & Technology | Limited alternative providers, high R&D costs | Elevated costs, less favorable contract terms | Continued reliance on a few key innovators |

| Skilled Labor | Scarcity of specialized geologists, engineers | Higher wages, increased operational expenditures | Ongoing global shortage of mining professionals |

| Energy & Fuel | Concentrated supply, geopolitical influences | Price volatility, potential supply chain disruptions | Brent crude averaged ~$80/barrel early 2024 |

| Chemicals (e.g., Cyanide) | Supply chain pressures, specific reagent needs | Upward pressure on input costs, profitability impact | Cyanide prices volatile in 2023 due to supply/demand |

| Regulatory & Permitting Services | Expertise in ESG, complex regulations | Higher fees, potential project delays, increased CAPEX | Increased ESG reporting stringency, permit delays observed |

What is included in the product

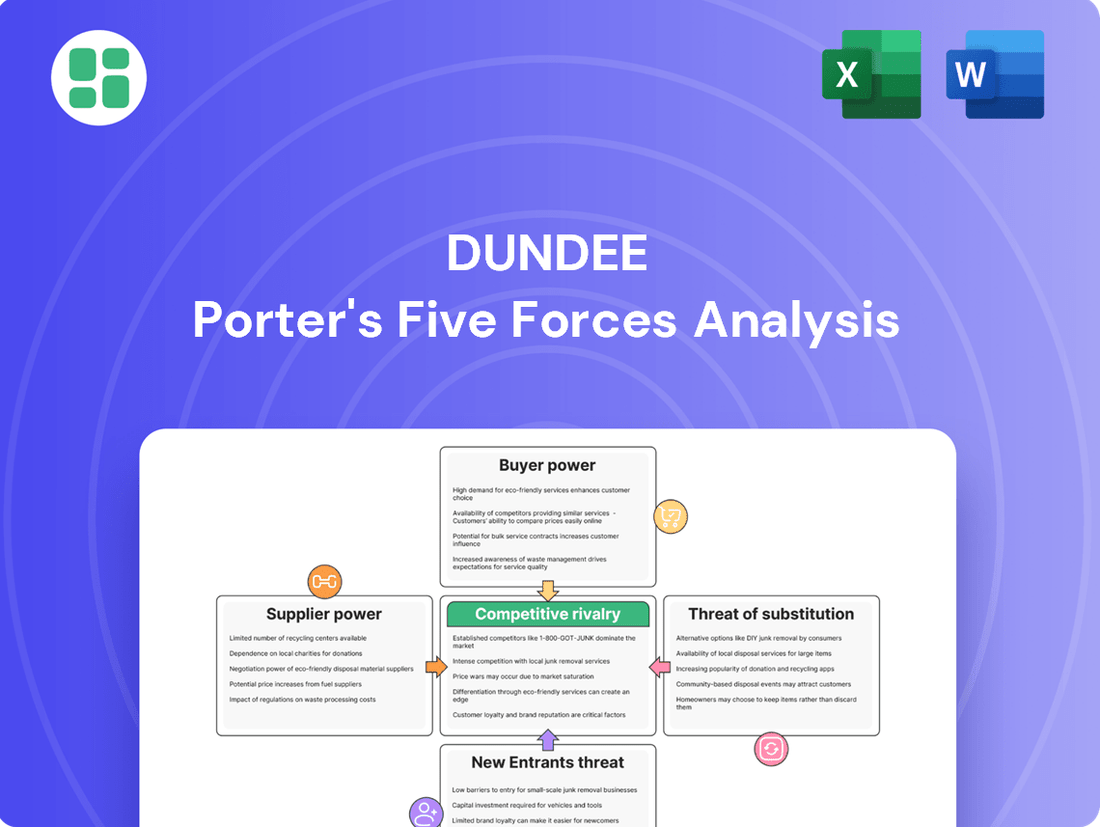

Uncovers key drivers of competition, customer influence, and market entry risks for Dundee, providing a strategic framework for understanding its industry.

Quickly identify and address competitive threats with a visual representation of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

Gold's commodity nature significantly reduces the bargaining power of individual customers for Dundee Precious Metals. Since gold is largely undifferentiated, buyers cannot negotiate prices based on unique product features; instead, global market prices driven by supply, demand, and geopolitical events dictate the value. In 2024, the average spot price of gold fluctuated, reaching highs around $2,400 per ounce, underscoring the market's influence over individual transaction terms.

Dundee Precious Metals' gold finds its way into a variety of end-use markets, from the sparkle of jewelry to the stability of investment vehicles like bullion and ETFs, and even the reserves held by central banks. It also sees use in some industrial applications. This broad reach is a significant advantage.

Because demand is spread across these different sectors, no single customer group can exert excessive power over Dundee. If, for example, jewelry sales dip due to rising gold prices, increased demand from investors or central banks can help to offset that. In 2023, global gold demand reached 4,899 tonnes, with jewelry accounting for 2,872 tonnes and investment demand at 1,555 tonnes, showcasing this diversification.

Central banks and institutional investors are major players in the gold market, frequently purchasing the precious metal to diversify their reserves or as a safe haven during times of economic or political instability. Their significant demand can influence overall market trends, but their purchasing decisions are driven by broad macroeconomic factors rather than direct negotiations with individual mining companies like Dundee Precious Metals (DPM).

While these large entities possess considerable buying power, their strategic objectives mean they are generally price takers in relation to DPM's production. For instance, in 2023, central banks collectively purchased a record 1,037 tonnes of gold, according to the World Gold Council, highlighting their substantial market presence. This large-scale, strategic buying, however, doesn't translate into direct bargaining power over the price of gold produced by a single entity like DPM.

Market Transparency and Price Discovery

The global gold market's high transparency, with prices set daily on exchanges and over-the-counter markets, significantly limits customer bargaining power. Buyers have immediate access to real-time pricing, making it challenging for any single customer to secure prices substantially below the established market rate. This transparency means producers like Dundee Precious Metals primarily act as price-takers, influenced by broader global supply and demand forces rather than individual customer negotiations.

For instance, in 2024, gold prices have shown volatility influenced by central bank policies and geopolitical events, reinforcing the market's price-discovery mechanism. Dundee Precious Metals, like its peers, operates within this transparent framework, where large institutional buyers and individual consumers alike are presented with the same market-determined prices.

- Market Transparency: Global gold prices are readily available through numerous financial news outlets and trading platforms, providing a level playing field for all participants.

- Price Discovery: Daily price determination on major exchanges like the COMEX and through OTC markets establishes a benchmark that is difficult for individual customers to deviate from.

- Limited Negotiation: The ease of accessing current market prices restricts the ability of individual buyers to negotiate significant discounts, thus weakening their bargaining power.

- Producer as Price-Taker: Dundee Precious Metals, facing a transparent and competitive market, must accept prevailing prices rather than dictating terms to customers.

Refiner and Trader Relationships

Dundee Precious Metals (DPM) engages with a well-established group of refiners and traders for its gold and copper concentrate sales. While these relationships are important, the commodity nature of DPM's concentrate allows for multiple buyers. This fungibility inherently limits the bargaining power of any single refiner or trader, as DPM can seek alternative outlets for its product.

DPM's consistent production volume and adherence to quality standards further bolster its negotiating position. For instance, in 2023, DPM reported total gold production of 263,713 ounces and copper production of 41,746 tonnes. This reliability makes DPM a stable supplier, reducing the incentive for buyers to exert undue pressure on pricing.

- DPM's established customer base includes a network of refiners and traders.

- The fungible nature of gold and copper concentrate provides DPM with alternative buyers.

- DPM's consistent production and quality strengthen its negotiating leverage.

- In 2023, DPM produced 263,713 ounces of gold and 41,746 tonnes of copper.

Dundee Precious Metals (DPM) faces limited customer bargaining power due to the commodity nature of gold and copper, which are largely undifferentiated. This means buyers cannot negotiate based on unique product features, and prices are dictated by global market forces. The broad end-use markets for DPM's products, including jewelry, investment, and industrial applications, prevent any single customer group from dominating negotiations.

The transparency of the global gold market, with prices readily available on exchanges, further curbs customer power. Buyers have access to real-time pricing, making it difficult for any single customer to secure prices substantially below the established market rate. DPM, like its competitors, operates as a price-taker, influenced by overarching supply and demand dynamics rather than individual customer demands.

DPM's established network of refiners and traders for its concentrate sales also operates within this dynamic. The fungible nature of gold and copper concentrate ensures that DPM has multiple buyer options, which inherently restricts the bargaining power of any single refiner or trader. DPM's consistent production volumes and adherence to quality standards, such as its 2023 output of 263,713 ounces of gold and 41,746 tonnes of copper, reinforce its negotiating position by making it a reliable supplier.

| Key Factor | Impact on Customer Bargaining Power | DPM Context |

| Commodity Nature | Low | Gold and copper are undifferentiated, driving prices by global markets. |

| End-Use Diversification | Low | Demand across jewelry, investment, and industrial sectors prevents single-group dominance. |

| Market Transparency | Low | Real-time pricing on exchanges limits individual negotiation leverage. |

| Supplier Reliability | Low | Consistent production (263,713 oz gold, 41,746 tonnes copper in 2023) reduces buyer incentive for price pressure. |

Same Document Delivered

Dundee Porter's Five Forces Analysis

This preview shows the exact Dundee Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for Dundee, including insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use and strategic planning.

Rivalry Among Competitors

The global gold mining industry is indeed quite fragmented, meaning there isn't one giant company calling all the shots. You have big players like Newmont Corporation and Barrick Gold, but even they don't hold a majority of the market. This fragmentation means a lot of companies, from these giants to smaller, more regional operations, are all vying for the same gold deposits, trying to capture market share, and attracting investment. In 2023, the top 10 gold mining companies, by production, still only accounted for roughly 20% of the global mine production, highlighting this dispersed nature.

Gold mining is inherently capital-intensive, meaning companies like Dundee Precious Metals face substantial fixed costs for exploration, mine development, and ongoing operations. These significant upfront investments necessitate high production volumes to effectively spread the costs and achieve economies of scale, a critical factor for profitability.

The pressure to maintain high output intensifies competitive rivalry, particularly when gold prices are subdued. In such environments, companies are driven to optimize production and reduce their all-in sustaining costs (ASSC) to remain competitive, leading to a more aggressive market dynamic.

For instance, in 2024, the average all-in sustaining cost for many mid-tier gold producers hovered around $1,200 to $1,400 per ounce, placing significant emphasis on production efficiency to ensure positive margins when market prices fluctuate.

The global distribution of gold deposits places mining firms, including Dundee Precious Metals, in diverse political landscapes. Operating across Bulgaria, Namibia, and Serbia, Dundee must contend with distinct national policies and stability levels, directly impacting operational costs and access to resources.

Resource nationalism, a growing trend where governments prioritize national benefit from mineral wealth, intensifies competition for attractive mining concessions. This can manifest as increased taxes, royalty demands, or even outright nationalization, as seen in various resource-rich nations seeking to maximize their share of profits from extractive industries.

Exploration and Acquisition Competition

Competition in the mining sector extends beyond existing operations to the crucial area of acquiring new reserves and development projects. Companies actively compete to secure promising exploration targets, often through bidding processes or strategic partnerships. This pursuit of future growth necessitates significant investment in geological surveys and early-stage development.

Mergers and acquisitions (M&A) are a primary tool for companies to expand their resource base and bolster their project pipeline. Dundee Precious Metals (DPM) exemplifies this dynamic. In 2023, DPM advanced its Čoka Rakita project, signaling internal development efforts. Concurrently, their pursuit of the Adriatic Metals acquisition, which was ongoing into early 2024, demonstrates a clear strategy of acquiring established assets to accelerate growth and gain market share in competitive regions.

- Exploration Target Acquisition: Companies invest heavily in seismic surveys and geological mapping to identify and secure high-potential exploration areas, often facing bidding wars for prime locations.

- Mergers and Acquisitions: The mining industry saw significant M&A activity in 2023 and early 2024, with companies like Dundee Precious Metals actively seeking acquisitions to expand their asset portfolios and geographic reach.

- Project Pipeline Development: Competition also involves the efficient advancement of discovered resources through feasibility studies and development, ensuring a steady supply of future production.

Sustainability and ESG Performance

Competitive rivalry in the mining sector extends beyond traditional cost and production metrics, now heavily influenced by Environmental, Social, and Governance (ESG) performance. Companies are actively vying to showcase their commitment to responsible mining to attract ethically-minded investors and secure their social license to operate.

Dundee Precious Metals, for instance, highlights its dedication to sustainable and responsible mining practices. This focus is increasingly serving as a crucial differentiator in a market where stakeholders are prioritizing corporate responsibility alongside financial returns. As of early 2024, many mining companies are reporting on their ESG initiatives, with a growing number of investment funds specifically targeting those with strong sustainability credentials.

- ESG Metrics as a Competitive Differentiator: Companies are increasingly judged on their environmental impact, social responsibility, and governance structures, not just profitability.

- Attracting Ethically Conscious Investors: A strong ESG profile is becoming essential for attracting capital from investors who prioritize sustainability and ethical business practices.

- Maintaining Social License to Operate: Demonstrating responsible mining is crucial for community relations and regulatory approval, impacting long-term operational viability.

- Dundee Precious Metals' Strategy: The company's emphasis on sustainability positions it favorably in a market where these factors are gaining significant weight in competitive evaluations.

The global gold mining industry is characterized by intense rivalry among numerous players, from large corporations to smaller, specialized firms. This competition is fueled by the pursuit of limited, high-quality gold reserves and the need to achieve economies of scale. Companies constantly strive to optimize production costs, as evidenced by the average all-in sustaining costs for mid-tier producers in 2024, which ranged from $1,200 to $1,400 per ounce.

The race for new reserves and project development is a significant battleground, with companies actively competing for exploration targets and engaging in mergers and acquisitions to bolster their asset portfolios. For instance, Dundee Precious Metals' pursuit of acquisitions in early 2024 highlights this aggressive expansion strategy. Furthermore, strong Environmental, Social, and Governance (ESG) performance is emerging as a critical differentiator, attracting ethically-minded investors and securing a social license to operate, a factor increasingly influencing competitive positioning.

| Metric | 2023/2024 Data Point | Implication for Rivalry |

|---|---|---|

| Top 10 Gold Miners' Market Share | Approx. 20% of global production (2023) | Indicates a fragmented market with many competitors |

| Mid-Tier Producer ASSC Range | $1,200 - $1,400 per ounce (2024) | Drives focus on cost efficiency and production optimization |

| M&A Activity | Active pursuit by companies like DPM (ongoing into early 2024) | Intensifies competition for acquiring resources and market share |

| ESG Focus | Increasingly a differentiator for attracting capital | Adds another layer of competition beyond financial performance |

SSubstitutes Threaten

While gold is often seen as a primary store of value, other precious metals like silver, platinum, and palladium can act as partial substitutes. For instance, platinum and palladium are crucial in catalytic converters, and their price fluctuations can influence demand for gold in certain industrial applications. Silver, too, finds use in electronics and solar panels, presenting an alternative for investors seeking exposure to precious metals.

The broader commodity market also presents a threat. Investors looking for inflation hedges or diversification might consider oil, agricultural products, or even cryptocurrencies as alternatives to gold. In 2024, the price of oil, for example, experienced significant volatility, attracting investment flows that might otherwise have gone into gold.

For investors looking for stability or protection against rising prices, traditional financial assets like government bonds, real estate, and even some stocks can serve as alternatives to gold. In 2024, for instance, the U.S. 10-year Treasury yield hovered around 4.2%, offering a predictable income stream that might draw capital away from non-yielding gold.

The emergence of digital currencies, such as Bitcoin, also presents a different kind of substitute investment. While their price swings can be dramatic, with Bitcoin experiencing significant volatility throughout 2024, some investors view them as a potential store of value or a hedge against traditional financial systems, directly competing for investment dollars that might otherwise be allocated to gold.

Technological advancements in material science pose a potential threat of substitutes for gold, particularly in industrial applications. Innovations could yield materials offering comparable conductivity and corrosion resistance at a more attractive price point. For instance, research into advanced ceramics and composite materials continues to explore their suitability for electronic components and specialized industrial uses where gold currently holds a dominant position due to its unique properties.

Shift in Investor Sentiment and Economic Outlook

The demand for gold as a safe haven is closely tied to global economic stability and inflation expectations. For instance, as of mid-2024, inflation rates in major economies, while showing some moderation from 2023 peaks, remained a key consideration for investors. A prolonged period of robust economic growth and low inflation could diminish gold's appeal, leading investors to favor assets with higher potential returns.

Geopolitical tensions also play a significant role. Periods of increased global uncertainty or conflict often drive demand for gold. Conversely, a sustained era of geopolitical calm could reduce this demand, making gold a less attractive substitute for other investment vehicles.

- Economic Growth: A strong global GDP growth forecast for 2024, projected by institutions like the IMF, could divert capital from safe-haven assets like gold.

- Inflation Expectations: While inflation has eased, persistent concerns or unexpected upticks could maintain gold's attractiveness as a hedge.

- Geopolitical Stability: A de-escalation of major global conflicts would likely reduce the immediate need for gold as a safe haven.

Recycled Gold Supply

The threat of substitutes for Dundee Precious Metals is significantly influenced by the recycled gold supply. A substantial amount of the global gold available comes from recycling, primarily from old jewelry and industrial waste. This recycled gold, while not a direct replacement for newly mined gold, can act as a substitute in the market. When gold prices are high, the incentive to recycle increases, potentially dampening demand for newly extracted gold.

This means Dundee Precious Metals faces competition not only from other gold mining companies but also from the vast existing stock of gold held above ground. In 2023, for instance, the World Gold Council reported that recycling accounted for approximately 1,100 tonnes of the total global gold supply, a notable portion that directly competes with primary production.

- Recycled Gold's Market Share: Recycling contributed around 1,100 tonnes to the global gold supply in 2023, representing a significant portion of available gold.

- Price Sensitivity: Higher gold prices incentivize greater recycling efforts, increasing the supply of above-ground gold available to the market.

- Competitive Landscape: Dundee Precious Metals competes with both primary gold producers and the readily available stock of recycled gold.

The threat of substitutes for gold is multifaceted, encompassing other precious metals, commodities, financial assets, and even digital currencies. While gold is unique, investors often seek similar investment characteristics like inflation hedging or diversification. For instance, in 2024, silver prices showed volatility, and its use in electronics meant it wasn't solely an investment play, unlike gold's primary safe-haven appeal.

In 2024, the U.S. 10-year Treasury yield averaged around 4.2%, presenting a tangible return that can draw capital away from non-yielding gold. Digital assets like Bitcoin also compete for investor attention, with Bitcoin experiencing significant price swings throughout 2024, attracting some investors as a potential store of value.

Technological advancements could also introduce new material substitutes for gold in industrial uses, although its unique properties currently limit direct replacements. The availability of recycled gold, which accounted for approximately 1,100 tonnes of global supply in 2023, also acts as a significant substitute, directly competing with newly mined gold.

| Substitute Category | Examples | 2024 Data/Trend Relevance |

| Precious Metals | Silver, Platinum, Palladium | Platinum and palladium crucial in industrial applications; silver used in electronics. |

| Commodities | Oil, Agricultural Products | Oil prices volatile in 2024, attracting investment flows. |

| Financial Assets | Government Bonds, Real Estate, Stocks | U.S. 10-year Treasury yield averaged ~4.2% in 2024, offering income. |

| Digital Assets | Cryptocurrencies (e.g., Bitcoin) | Bitcoin experienced significant volatility in 2024, seen as a potential store of value. |

| Recycled Gold | Above-ground gold supply | Accounted for ~1,100 tonnes of global supply in 2023, a direct market competitor. |

Entrants Threaten

The gold mining industry demands immense capital, creating a significant barrier for newcomers. Developing a new mine from exploration to full operation can easily cost billions of dollars and take over a decade. This high capital intensity means only well-funded entities can realistically enter the market, effectively deterring many potential competitors.

Dundee Precious Metals' own significant investments in its existing mines and ongoing development projects, such as the Timok project in Serbia, underscore this reality. The sheer scale of financial commitment required to establish and maintain a profitable gold mining operation is substantial, limiting the pool of potential new entrants and thus reducing the threat.

New entrants into the mining sector, particularly for companies like Dundee Precious Metals, face significant obstacles due to extensive regulatory and permitting hurdles. These include complex and lengthy approval processes, such as environmental impact assessments, land use permits, and crucial community agreements, which differ greatly depending on the specific jurisdiction.

Successfully navigating these intricate legal and social landscapes demands substantial expertise and considerable time investment, presenting a formidable barrier for any newcomer aiming to quickly establish operational capabilities. For instance, in 2024, the average time to obtain all necessary mining permits in jurisdictions with robust environmental regulations could extend beyond three to five years, significantly delaying project commencement.

Dundee Precious Metals, with its established operations in Bulgaria, Namibia, and Serbia, already possesses the invaluable advantage of existing relationships and deep-seated experience within these specific regions. This established presence allows them to streamline processes that would be entirely new and time-consuming for potential entrants, effectively leveraging their accumulated knowledge and local goodwill.

The difficulty in finding new, economically viable, high-grade gold deposits presents a significant barrier to entry. Exploration success rates have been declining, with fewer major discoveries reported in recent years, making it harder for new companies to secure quality reserves without substantial upfront investment.

Most of the easily accessible gold deposits have already been mined. This means any new entrant would likely face the daunting task of either investing heavily in high-risk, deep-level exploration or acquiring existing, often costly, mining operations to gain access to valuable reserves.

Specialized Expertise and Technology Requirements

The gold mining sector, including companies like Dundee Precious Metals, presents a substantial barrier to entry due to its reliance on highly specialized expertise. Success hinges on intricate knowledge of geological modeling, mine planning, efficient ore processing, and rigorous environmental stewardship. New players must overcome the significant hurdle of acquiring and retaining a highly skilled workforce capable of navigating these complex operational facets.

Furthermore, significant capital investment in cutting-edge technologies is essential for any newcomer to compete effectively. This includes advanced exploration tools, sophisticated extraction methods, and environmentally compliant processing facilities. Dundee Precious Metals, for instance, leverages decades of accumulated operational experience and a robust team of experts, giving it a distinct advantage over potential new entrants who would need to replicate this depth of knowledge and technological capability.

- High Capital Requirements: Establishing a gold mine requires extensive upfront investment in exploration, infrastructure, and processing equipment, often running into hundreds of millions of dollars.

- Technical Skill Gap: Accessing and retaining experienced geologists, mining engineers, metallurgists, and environmental specialists is critical and often difficult for new entrants.

- Technological Advancement: Staying competitive necessitates continuous investment in new technologies for exploration, extraction, and processing, demanding significant R&D budgets.

Established Supply Chains and Offtake Agreements

Newcomers face a significant hurdle due to the entrenched supply chains and existing offtake agreements held by established companies. Dundee Precious Metals, for instance, has cultivated robust relationships with key refiners, traders, and logistics partners. These established connections, often solidified through long-term offtake agreements for their mineral concentrates, provide a predictable and reliable path to market.

Building these critical relationships from the ground up is a substantial challenge for any new entrant. Securing dependable channels for product sales requires time, investment, and a proven track record in a sector where trust and consistent performance are paramount. Without these established networks, new players may struggle to find reliable buyers and efficient transportation, impacting their ability to compete effectively.

- Established Refiner Relationships: Major players like Dundee Precious Metals have long-standing contracts with specialized refiners, ensuring consistent processing of their output.

- Logistics Network: Existing companies benefit from pre-negotiated shipping and transportation agreements, reducing costs and lead times for concentrate delivery.

- Offtake Agreements: Long-term contracts with buyers guarantee sales, providing financial stability and reducing market risk for established producers.

The threat of new entrants in the gold mining industry is relatively low, primarily due to the immense capital requirements and the need for specialized expertise. Securing access to viable gold deposits and navigating complex regulatory environments also pose significant challenges for newcomers. Established players like Dundee Precious Metals benefit from existing infrastructure, skilled workforces, and strong relationships within the supply chain, creating substantial barriers to entry.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Establishing a mine requires billions of dollars for exploration, development, and infrastructure. | Deters companies without substantial funding. |

| Regulatory Hurdles | Complex permitting processes, environmental assessments, and land use agreements can take years. | Delays project timelines and increases upfront costs. |

| Exploration Difficulty | Finding high-grade, economically viable deposits is increasingly challenging. | Increases exploration risk and the need for advanced technology. |

| Technical Expertise | Requires skilled geologists, engineers, metallurgists, and environmental specialists. | New entrants must invest heavily in talent acquisition and retention. |

| Supply Chain Access | Established relationships with refiners, traders, and logistics providers are crucial. | New entrants may struggle to secure reliable buyers and efficient transportation. |

Porter's Five Forces Analysis Data Sources

Our Dundee Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry association surveys, and market research databases to comprehensively assess competitive pressures.