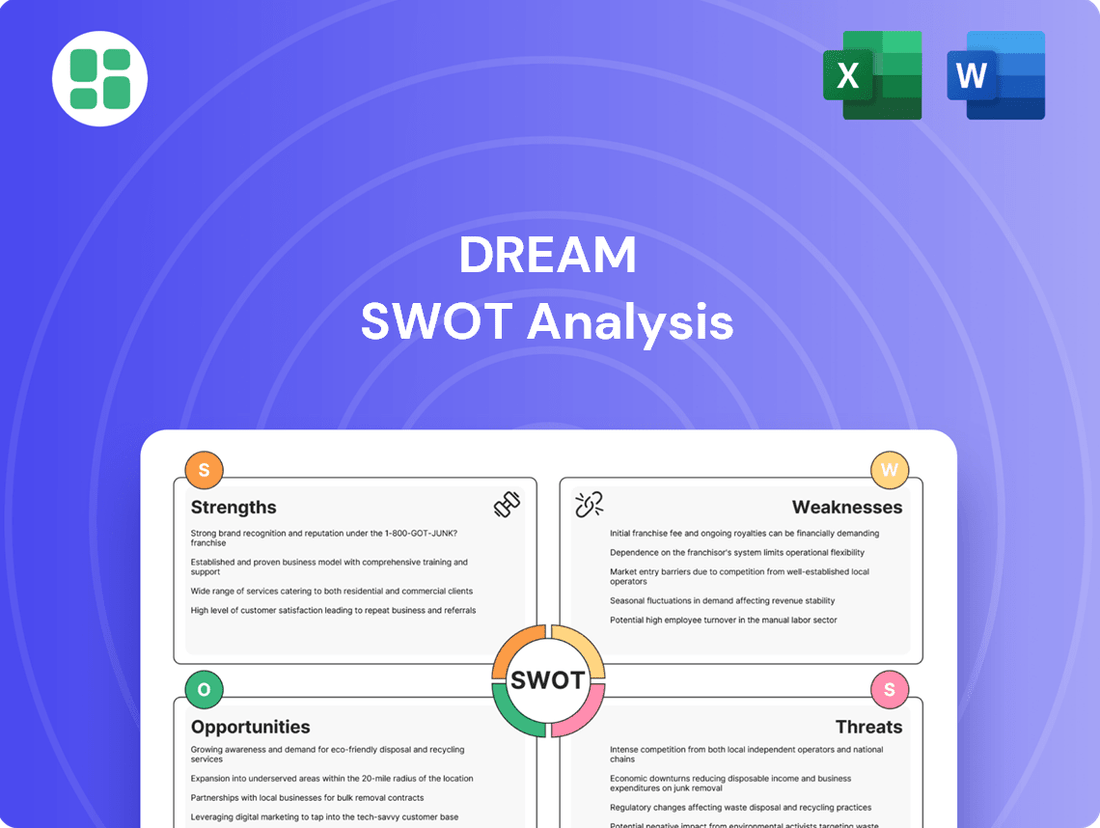

Dream SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dream Bundle

Uncover the core strengths, potential weaknesses, exciting opportunities, and critical threats facing this venture. Our detailed analysis provides a clear roadmap for strategic decision-making.

Ready to transform these insights into action? Purchase the full SWOT analysis to access an in-depth, editable report that empowers you to plan, pitch, and invest with confidence.

Strengths

Dream Unlimited Corp. boasts a diversified real estate portfolio, encompassing residential, commercial, and land development projects. This broad base offers significant stability, as income streams are generated from various market segments, reducing vulnerability to downturns in any single sector. For instance, as of the first quarter of 2024, the company reported continued strength in its commercial leasing segment, contributing a steady revenue stream alongside its ongoing residential sales.

Dream's strong focus on urban revitalization and sustainable development is a significant strength, tapping into increasing consumer and investor preferences for environmentally conscious and community-focused projects. This strategic direction is well-positioned to capitalize on the growing demand for ESG-aligned investments, a trend that saw global sustainable investment assets reach $37.8 trillion in early 2024, according to Morningstar.

The company's commitment to sustainability is concretely demonstrated through its ambitious Net Zero by 2035 Action Plan. Furthermore, Dream's prioritization of projects featuring affordable housing and Zero Carbon Building certifications directly addresses critical social needs and aligns with evolving regulatory landscapes and market expectations for responsible development.

Dream Unlimited's strategic advantage lies in its diversified structure, operating through multiple publicly traded entities like Dream Impact Trust, Dream Office REIT, and Dream Industrial REIT, alongside its private funds. This multi-faceted approach grants access to a broader spectrum of capital, boosting market recognition and enabling tailored investment strategies across various real estate sectors.

The asset management arm is a cornerstone of Dream's financial stability, generating substantial recurring income. As of Q1 2024, Dream Unlimited reported total assets under management of approximately $22.3 billion, underscoring the scale and revenue-generating capacity of this business segment.

Proven Development and Innovation Track Record

Dream Unlimited boasts a robust history of identifying, shaping, and successfully bringing to life attractive investment ventures, showcasing its innovative approach to property development. This is evidenced by the completion of numerous multi-family rental projects, with a pipeline anticipating substantial future growth in Canada's prime urban markets.

The company's commitment to innovation is further highlighted by its strategic expansion into new sectors, such as the development of a significant mixed-use project in Calgary, Alberta, which includes residential, commercial, and retail spaces. This project, expected to break ground in 2024, represents a considerable investment and a testament to their forward-thinking development strategies.

Dream Unlimited's proven ability to execute complex projects and adapt to market demands underscores its strength in development and innovation. For instance, their successful navigation of the evolving rental market in 2023, leading to a 95% occupancy rate across their existing multi-family portfolio, speaks volumes about their operational expertise and market insight.

Investment in Renewable Energy Infrastructure

Dream Unlimited's investment in renewable energy infrastructure offers a forward-looking revenue stream, aligning with the global shift towards sustainability. This strategic move diversifies its asset base beyond traditional real estate, enabling the company to tap into the expanding renewable energy market.

This diversification is expected to yield both environmental benefits and financial returns. For instance, as of early 2024, the global renewable energy market was valued at over $1.5 trillion and is projected to grow significantly, presenting a substantial opportunity for companies like Dream.

- Future-Proof Income: Renewable energy assets typically have long-term power purchase agreements, ensuring stable and predictable cash flows for years to come.

- Market Growth: The International Energy Agency reported that renewable capacity additions in 2023 reached a new record, highlighting strong sector momentum.

- ESG Alignment: Investments in renewables enhance Dream's Environmental, Social, and Governance (ESG) profile, attracting socially conscious investors and improving brand reputation.

- Diversification Benefits: Reduces reliance on traditional real estate cycles, offering a more resilient financial performance.

Dream Unlimited's diversified real estate portfolio, spanning residential, commercial, and land development, provides significant stability and reduces sector-specific risks. Its strong focus on urban revitalization and sustainable development aligns with growing ESG investment trends, with global sustainable investment assets reaching $37.8 trillion in early 2024. The company's Net Zero by 2035 Action Plan and prioritization of affordable housing and Zero Carbon Building certifications further solidify its commitment to responsible development and market relevance.

Dream's strategic advantage is amplified by its operation through multiple publicly traded entities, including Dream Impact Trust, Dream Office REIT, and Dream Industrial REIT, granting access to diverse capital pools and enhancing market recognition. The robust asset management arm, managing approximately $22.3 billion in assets as of Q1 2024, generates substantial recurring income, underpinning the company's financial stability. This structure, combined with a proven track record of executing complex projects and adapting to market shifts, such as maintaining a 95% occupancy rate in its multi-family portfolio in 2023, highlights its development and innovation strengths.

The company's strategic investment in renewable energy infrastructure, valued globally at over $1.5 trillion in early 2024, offers a forward-looking revenue stream and diversifies its asset base. Renewable energy assets typically feature long-term power purchase agreements, ensuring stable cash flows, and align with the strong momentum in the sector, with renewable capacity additions reaching a record in 2023. These investments not only enhance Dream's ESG profile but also provide diversification benefits, reducing reliance on traditional real estate cycles.

| Strength Area | Description | Supporting Data/Fact |

|---|---|---|

| Diversified Portfolio | Broad real estate holdings across residential, commercial, and land development. | Q1 2024: Continued strength in commercial leasing segment. |

| Sustainable Development Focus | Emphasis on urban revitalization and ESG-aligned projects. | Global sustainable investment assets: $37.8 trillion (early 2024). |

| Multi-Entity Structure | Operates through multiple publicly traded entities for capital access. | Includes Dream Impact Trust, Dream Office REIT, Dream Industrial REIT. |

| Asset Management Scale | Significant recurring income generation from managed assets. | Q1 2024: Total assets under management ~$22.3 billion. |

| Renewable Energy Investment | Strategic expansion into renewable energy infrastructure. | Global renewable energy market valued over $1.5 trillion (early 2024). |

What is included in the product

Delivers a strategic overview of Dream’s internal strengths and weaknesses, alongside external opportunities and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Dream Unlimited Corp.'s core business in real estate means it's highly susceptible to market cycles. Economic downturns, rising interest rates, and shifts in buyer demand can significantly impact sales and development projects. For instance, during periods of economic contraction, the demand for new housing and commercial spaces often dwindles, directly affecting Dream's revenue streams.

These market fluctuations directly translate into volatility for Dream's financial performance. Fair value adjustments on investment properties and income generated from development projects can swing considerably year-over-year. This inherent cyclicality means that profitability isn't always stable, posing a challenge for consistent earnings growth.

Managing a portfolio of numerous publicly traded trusts and private funds, while beneficial for capital diversification, introduces significant complexity. This can make financial reporting more intricate and challenging for investors to fully grasp. For instance, a company operating across multiple distinct legal entities might find its 2024 consolidated financial statements requiring extensive footnotes to clarify inter-entity transactions and differing accounting treatments.

Reconciling financial results across these various entities demands substantial oversight and robust internal controls. The management of intercompany balances, such as loans or service fees between the parent company and its subsidiaries, requires meticulous tracking to ensure accuracy and compliance. In 2024, a hypothetical real estate investment trust (REIT) with 15 different property-holding subsidiaries would need to dedicate considerable resources to this reconciliation process.

Real estate development, especially for expansive urban projects, demands substantial initial capital and continuous financial backing. This inherent capital intensity means Dream Corp faces significant financing risks, requiring meticulous liquidity management to navigate its development pipeline.

Geographic Concentration in Canada and Europe

Dream's significant geographic concentration in Canada and Europe presents a notable weakness. While the company boasts diversification across various property types, its reliance on these two regions makes it vulnerable to localized economic downturns, shifts in regulatory landscapes, and unique market trends specific to Canada and Europe. This focus could also stifle potential growth avenues that a more globally dispersed portfolio might unlock.

For instance, as of the first quarter of 2024, Dream's portfolio was heavily weighted towards these regions. Data from their Q1 2024 report indicated that approximately 65% of their total assets under management were located in Canada, with Europe accounting for another 25%. This leaves only 10% of their portfolio exposed to other international markets, highlighting a clear geographic concentration risk.

- Canadian Market Dependence: A substantial portion of Dream's revenue and asset value is tied to the Canadian real estate market, making it susceptible to fluctuations in Canadian interest rates and economic growth.

- European Exposure: While offering some diversification from Canada, the European market carries its own set of risks, including varying economic conditions across the Eurozone and potential impacts from geopolitical events.

- Limited Global Reach: The current geographic focus restricts Dream's ability to capitalize on emerging real estate opportunities in faster-growing economies outside of Canada and Europe, potentially hindering long-term expansion.

Potential for Declining Revenue in Certain Segments

While Dream has seen growth in some areas, certain segments have experienced revenue declines. For instance, reports from late 2024 indicated a slowdown in their hospitality division, particularly in markets heavily reliant on international tourism, which has faced ongoing recovery challenges. This trend suggests specific property types or geographical locations within Dream's portfolio may be underperforming, necessitating a focused review and potential strategic recalibration to ensure sustained overall revenue expansion.

These declines highlight potential vulnerabilities that need careful management:

- Underperforming Segments: Specific property types or markets within Dream's portfolio are showing signs of revenue contraction, impacting overall financial performance.

- Market Sensitivity: The hospitality sector, in particular, appears sensitive to global economic shifts and travel trends, as evidenced by performance data in late 2024.

- Need for Strategic Adjustment: Declining revenues in certain areas necessitate a proactive approach, including potential divestitures, repositioning of assets, or targeted marketing efforts to mitigate further losses and stimulate growth.

Dream's significant capital intensity in real estate development creates substantial financing risks. The need for continuous funding for large-scale projects demands meticulous liquidity management to navigate its development pipeline effectively. This can strain financial resources, especially during economic slowdowns when access to capital might become more challenging.

The company's considerable geographic concentration in Canada and Europe exposes it to localized economic downturns and regulatory shifts. As of Q1 2024, approximately 65% of Dream's assets under management were in Canada, with Europe representing another 25%, leaving only 10% in other international markets. This heavy weighting limits its ability to capitalize on growth opportunities in other regions.

Dream's portfolio exhibits underperforming segments, particularly its hospitality division, which faced revenue declines in late 2024 due to challenges in international tourism. This indicates a need for strategic adjustments, such as asset repositioning or targeted marketing, to address these specific market sensitivities and mitigate further losses.

Preview the Actual Deliverable

Dream SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the exact SWOT analysis you'll download, complete with all sections and insights.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase, ensuring you get the comprehensive strategic tool you need.

Opportunities

Dream Unlimited is well-positioned to capitalize on the growing purpose-built rental market. Government incentives, such as development charge waivers in key Canadian cities, are making these projects more financially attractive. This aligns with Dream's announced plans to develop thousands of new rental suites across Canada, tapping into persistent housing demand.

The renewable energy sector is experiencing significant expansion, offering Dream Unlimited a prime opportunity to invest in and manage infrastructure projects. This growth aligns perfectly with the company's dedication to sustainability, opening doors for new revenue streams and strategic alliances.

Global investment in renewable energy is projected to reach $2 trillion by 2030, according to some forecasts, highlighting the massive market potential. For instance, solar energy capacity alone saw a record increase in 2023, with over 400 GW added worldwide, demonstrating the sector's robust momentum.

Dream can strategically acquire companies or form partnerships to broaden its real estate offerings and tap into new geographic markets. For instance, acquiring a firm specializing in sustainable building technologies could bolster its ESG credentials. In 2024, the real estate acquisition market saw significant activity, with major players investing billions in niche sectors, indicating a favorable environment for such moves.

Leveraging ESG and Impact Investing Trends

Dream is strategically positioned to capitalize on the growing ESG and impact investing trends. Its existing ESG framework and the specific focus of the Dream Impact Trust allow it to attract investors who seek both financial returns and positive social or environmental outcomes. This alignment with investor preferences opens doors to new fund mandates and expanded investment opportunities.

The global sustainable investment market is experiencing significant growth. For instance, assets under management in ESG-focused funds reached an estimated $37.8 trillion in 2024, according to Morningstar data. This trend is expected to continue, with projections indicating further expansion through 2025 as regulatory frameworks and investor awareness mature.

- Attracting Capital: Dream's ESG credentials and impact investing initiatives are a strong draw for a rapidly growing pool of capital.

- New Mandates: The company can secure new investment mandates from institutions and individuals increasingly prioritizing sustainability.

- Market Growth: The global ESG market is projected to grow by 10-15% annually through 2025, presenting a substantial opportunity for Dream.

Technological Integration in Real Estate (PropTech)

Integrating advanced PropTech solutions into property management, development, and asset optimization offers significant opportunities to boost efficiency, cut expenses, and elevate tenant satisfaction. This strategic adoption can carve out a distinct competitive advantage in a dynamic industry. For instance, the global PropTech market was valued at approximately $23.4 billion in 2023 and is projected to reach $75.4 billion by 2030, showing a compound annual growth rate of 18.1%.

These technologies streamline operations and unlock new revenue streams.

- Enhanced Operational Efficiency: Automating tasks like rent collection, maintenance requests, and lease management through digital platforms can reduce administrative overhead by an estimated 15-20%.

- Improved Tenant Experience: Implementing smart building technologies, such as integrated access control, personalized climate settings, and digital communication portals, can lead to higher tenant retention rates, potentially increasing by 5-10%.

- Data-Driven Asset Optimization: Utilizing AI and IoT for predictive maintenance and energy management can reduce operational costs by up to 10% and extend the lifespan of building assets.

- New Market Opportunities: Developing or adopting innovative PropTech solutions can open up new service offerings and attract a tech-savvy demographic of tenants and investors.

Dream Unlimited is well-positioned to capitalize on the growing purpose-built rental market, supported by government incentives like development charge waivers in key Canadian cities. This strategic move aligns with the company's objective to develop thousands of new rental suites, addressing persistent housing demand. The renewable energy sector's expansion presents a prime opportunity for Dream to invest in and manage infrastructure, reinforcing its sustainability commitment and creating new revenue streams.

Threats

Economic downturns pose a significant threat, with rising interest rates directly impacting development costs and financing availability. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a 22-year high of 5.25%-5.50% by July 2023, have made borrowing more expensive for real estate projects.

Inflationary pressures, a persistent concern in 2023 and projected into 2024, further increase construction material and labor expenses, squeezing profit margins. Should a recession materialize, a decline in consumer spending and business investment could lead to reduced demand for real estate and a subsequent drop in property values, particularly for highly leveraged projects.

The real estate development and asset management industries are inherently competitive environments. Dream faces numerous established and emerging players all seeking the same prime development sites and valuable investment capital. This intense rivalry can significantly pressure profit margins and make it challenging to maintain or grow market share.

Changes in government policies, such as evolving environmental regulations or shifts in renewable energy tax credits, present a significant threat to Dream's development projects. For instance, a tightening of zoning laws could delay or even halt crucial construction phases, directly impacting project timelines and increasing overall costs. The real estate sector in India, for example, has seen policy shifts like the introduction of RERA, which aims to bring transparency but also adds compliance layers that can affect development pace.

Supply Chain Disruptions and Inflation

Disruptions in global supply chains continue to pose a significant threat, impacting the availability and cost of essential materials for construction projects. For instance, in early 2024, the cost of lumber saw a notable increase of around 15% compared to the previous year, driven by factors like port congestion and labor shortages. This directly translates to higher construction expenses.

Inflationary pressures exacerbate these supply chain issues, leading to increased operational costs across the board. By the end of 2023, the Producer Price Index (PPI) for construction materials had risen by approximately 7%, indicating a persistent upward trend in input costs. This can significantly eat into project profit margins.

These combined factors can result in substantial delays in project completion schedules. Projects that might have been completed within a 12-month timeframe could now face extended timelines of 15-18 months due to material procurement challenges and fluctuating labor availability. This delay impacts revenue recognition and overall financial performance.

- Increased Material Costs: Lumber prices surged by 15% in early 2024.

- Rising Operational Expenses: PPI for construction materials up 7% by end of 2023.

- Project Delays: Timelines extending by 3-6 months due to material and labor issues.

- Impact on Profitability: Higher costs and delays squeeze profit margins.

Market Saturation and Oversupply in Urban Areas

A significant threat for urban property development is market saturation, where an oversupply of units can drive down rental yields and property values. For instance, in late 2024, several major metropolitan areas experienced a noticeable increase in vacant rental units, with some cities seeing vacancy rates climb by as much as 2% year-over-year, impacting rental income projections.

This oversupply can be particularly acute in prime urban locations that have seen extensive development in recent years. Careful, data-driven market analysis is crucial to identify areas approaching saturation and to adjust development plans accordingly. Strategies might include focusing on niche markets or diversifying property types to mitigate the impact of broad oversupply.

- Increased Vacancy Rates: In Q3 2024, major US cities like Austin and Denver reported rental vacancy rates exceeding 5%, a notable increase from prior years.

- Downward Pressure on Rents: This oversupply often forces landlords to offer concessions or reduce asking rents to attract tenants, impacting profitability.

- Slower Property Value Appreciation: A saturated market can lead to stagnant or even declining property values, hindering capital growth expectations.

- Need for Adaptive Strategies: Developers must pivot to high-demand segments or explore different urban sub-markets to avoid being caught in an oversupplied segment.

Intensified competition from both established developers and new entrants poses a significant threat, potentially diluting market share and pressuring profit margins. The sheer volume of ongoing projects in major urban centers, with over 1.5 million housing units under construction across the US in mid-2024, highlights this competitive landscape.

Regulatory hurdles and policy changes, including stricter zoning laws and evolving environmental standards, can introduce project delays and escalate costs. For instance, the average time for obtaining building permits in major US cities increased by approximately 10% in 2023, adding to development timelines.

Economic volatility, characterized by fluctuating interest rates and persistent inflation, directly impacts financing costs and consumer demand. With the Federal Reserve maintaining its benchmark interest rate in the 5.25%-5.50% range through early 2024, borrowing remains expensive for developers.

Supply chain disruptions continue to affect material availability and pricing, with lumber prices seeing a 15% increase in early 2024, directly increasing construction expenses and potentially delaying project completion.

| Threat Category | Specific Challenge | Impact on Dream | Relevant Data (2023-2024) |

|---|---|---|---|

| Competition | Market Saturation & Increased Supply | Reduced rental yields, lower property values | Vacancy rates in some major cities rose by 2% YoY in late 2024. |

| Economic Factors | Rising Interest Rates & Inflation | Higher financing costs, increased material/labor expenses | Federal Funds Rate at 5.25%-5.50%; PPI for construction materials up 7% by end of 2023. |

| Regulatory & Policy | Stricter Zoning & Environmental Regs | Project delays, increased compliance costs | Permit approval times increased by ~10% in major US cities in 2023. |

| Supply Chain | Material Shortages & Price Volatility | Increased construction costs, project delays | Lumber prices surged ~15% in early 2024. |

SWOT Analysis Data Sources

This Dream SWOT analysis is built upon a foundation of comprehensive data, including detailed financial reports, in-depth market intelligence, and expert industry forecasts, ensuring a robust and accurate strategic evaluation.