Dream Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dream Bundle

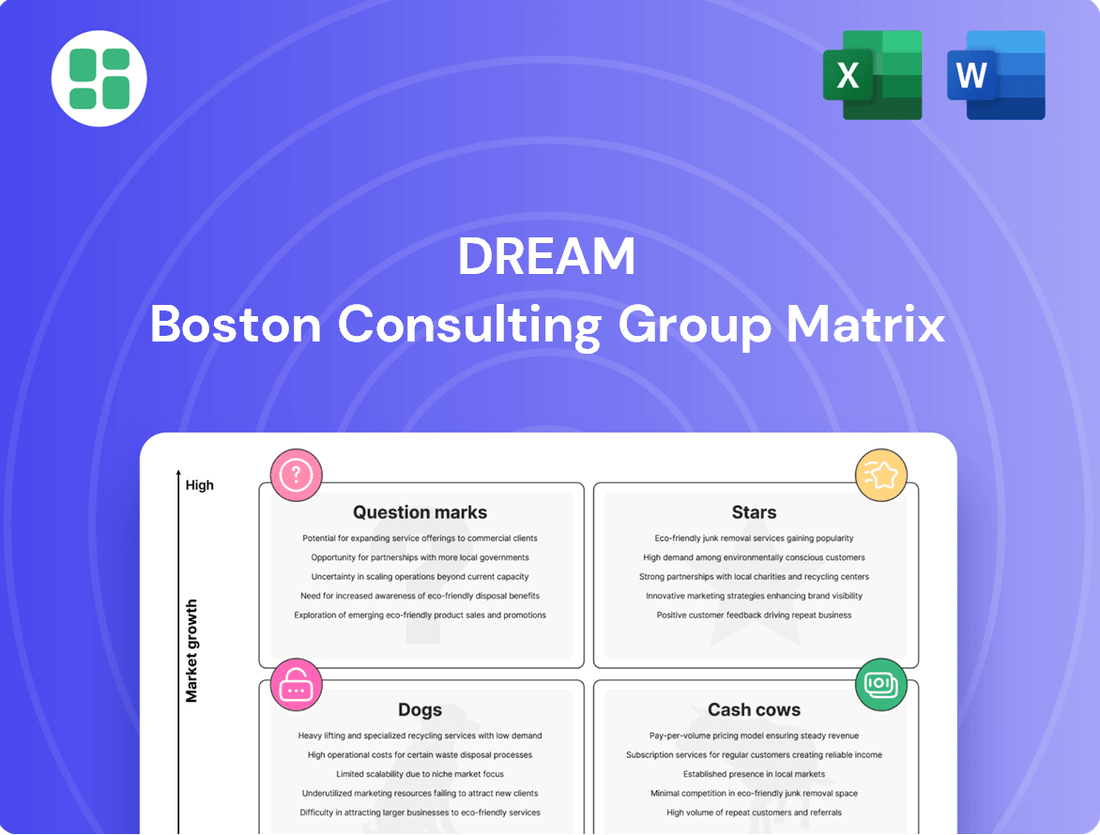

Curious about which of this company's offerings are poised for growth and which might be holding it back? Our BCG Matrix preview offers a glimpse into the strategic positioning of its products.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. You'll gain detailed insights into each product's quadrant, enabling you to make data-driven decisions about resource allocation and future investments.

Don't miss out on the strategic clarity this report provides. Invest in the full BCG Matrix today and equip yourself with the knowledge to drive your business forward with confidence.

Stars

Dream's commitment to net-zero greenhouse gas emissions by 2035 is powerfully demonstrated by its new zero-carbon urban development projects. These initiatives are poised to capture significant market share in the rapidly expanding sustainable urban living sector.

The groundbreaking of projects like Odenak in Ottawa, which earned Zero Carbon Building - Design Standard v3 certification in 2024, exemplifies this leadership. Such developments, frequently incorporating affordable housing and supported by government financing, are setting new benchmarks for environmentally conscious urban planning.

Dream's multi-family rental portfolio is a clear Star in the BCG matrix, driven by aggressive expansion. With over 1,950 units currently under construction and ambitious plans for 5,000 new units across key Canadian urban centers, the company is positioning itself for significant future growth in this segment.

The successful lease-up of Birch House in downtown Toronto in October 2024, a purpose-built rental apartment project, underscores the robust market demand. This rapid absorption indicates a strong potential for Dream to capture a dominant market share in the burgeoning purpose-built rental sector.

Dream's asset management arm is actively pursuing strategic joint ventures, exemplified by a planned investment of up to $2 billion in Canadian rental properties. This initiative targets high-growth potential, aligning with the company's strategy to expand its market presence.

With $28 billion in assets under management as of March 31, 2025, these large-scale partnerships are crucial for Dream to build on its existing expertise. Such ventures enable the company to enter new investment arenas and secure substantial market share.

High-Demand Western Canada Land Development

Dream's extensive land development projects in Western Canada, especially those with robust pre-sale numbers and upcoming projects in Saskatchewan, firmly place them in the high-growth, high-market-share category. This segment is a key component of their portfolio, showcasing strong demand and successful execution.

The company is set to continue or begin construction on 500 units across Calgary's Brighton and Alpine Park developments in 2025. These projects are anticipated to yield development and hold returns between 15% and 25% over a decade, underscoring Dream's dominant presence in these specific regional markets.

- High Demand: Strong pre-sale volumes indicate significant consumer interest in Dream's Western Canadian land developments.

- Market Share: The company's planned expansion into Saskatchewan further solidifies its leading position in key regional markets.

- Projected Returns: Anticipated 15-25% returns over 10 years on 500 units in Calgary highlight the segment's profitability and Dream's execution capabilities.

- Future Growth: Continued construction and new developments in 2025 signal ongoing investment and commitment to this high-potential sector.

Renewable Energy Program Expansion

Dream Industrial REIT is aggressively expanding its renewable energy initiatives, a move positioning it as a potential star in its portfolio. In 2024, the REIT successfully completed seven solar energy projects spanning Canada and Europe. This expansion not only solidifies its presence in existing markets but also signals a strategic push into new geographical territories.

While the renewable energy segment may currently represent a smaller portion of Dream Industrial REIT's overall asset base compared to its established real estate holdings, its rapid growth trajectory and deliberate market penetration are key indicators of high potential. This strategic focus on scaling up renewable energy infrastructure highlights a segment poised for significant future returns.

- 2024 Project Completion: Seven solar energy projects completed across Canada and Europe.

- Market Penetration: Strategic focus on entering new geographic markets for renewable energy.

- Growth Potential: Rapid expansion signifies a high-growth, high-potential segment.

- Strategic Importance: Demonstrates a commitment to scaling a crucial future-oriented business line.

Dream's multi-family rental portfolio, with over 1,950 units under construction and plans for 5,000 new units, is a clear Star. The successful lease-up of Birch House in Toronto in October 2024 highlights strong market demand for purpose-built rentals. This aggressive expansion positions Dream to capture significant market share in this growing sector.

| Segment | Market Growth | Market Share | Dream's Position | Key Data Point |

|---|---|---|---|---|

| Multi-Family Rental | High | High | Star | 5,000 new units planned |

| Land Development (Western Canada) | High | High | Star | 15-25% projected returns |

| Renewable Energy | High | Low to Medium | Potential Star/Question Mark | 7 solar projects completed in 2024 |

| Asset Management | Medium | Medium | Cash Cow/Average | $28 billion AUM (March 31, 2025) |

What is included in the product

Detailed breakdown of products across Stars, Cash Cows, Question Marks, and Dogs.

Strategic guidance on investing in Stars and Question Marks, managing Cash Cows, and divesting Dogs.

Visualize your portfolio's potential and risks with a clear, actionable framework.

Eliminate strategic guesswork by identifying growth opportunities and problem areas.

Cash Cows

Dream Industrial REIT's core industrial properties represent a significant cash cow within their portfolio. As of June 30, 2025, the REIT boasts 338 industrial assets, maintaining a robust 96.0% occupancy rate. This high utilization translates into consistent and growing net rental income.

These strategically located assets, spanning Canada, Europe, and the U.S., are the bedrock of the REIT's financial stability. They reliably contribute to strong Funds From Operations (FFO) growth and predictable cash flows, serving as a dependable source of capital for the organization.

Dream Office REIT's established downtown Toronto office properties, accounting for 77% of its rental revenue, firmly position it as a Cash Cow within the Dream BCG Matrix. These are mature, high-market-share assets in prime locations, demonstrating resilience despite broader sector headwinds.

The REIT's focus on high-quality properties, exemplified by the successful 366 Bay project completion, ensures consistent income generation. This strategic concentration on a stable, high-demand market fuels robust cash flow growth for Dream Office REIT.

The Distillery District commercial and retail assets represent a significant Cash Cow for Dream. This iconic Toronto property has shown robust performance, with occupancy rates climbing and yields improving. In 2024, its stabilized nature and prime location as a cultural and commercial hub ensure a steady stream of rental income, solidifying its role as a consistent profit generator within Dream's portfolio.

Long-Term Third-Party Asset Management Fees

Dream's long-term third-party asset management fees represent a significant cash cow. As of March 31, 2025, the company manages $28 billion in assets. This substantial and stable asset base fuels consistent fee income from its diverse portfolio of four publicly listed trusts and various private funds.

This recurring revenue stream is highly predictable, contributing a significant and reliable cash flow to Dream. The stability of these fees is a direct result of the large and well-established asset base under management.

- Established Asset Management Business: Dream oversees $28 billion in assets as of March 31, 2025.

- Consistent Fee Income: Generates predictable revenue from four publicly listed trusts and private funds.

- Stable Asset Base: The large and stable asset pool ensures consistent fee generation.

- Predictable Cash Flow: Provides a reliable and significant cash flow stream for the company.

Mature Residential Rental Portfolios

Mature residential rental portfolios, like those in the Canary District, are prime examples of cash cows. These properties, having navigated the development phase, now consistently generate predictable rental income. Their high occupancy rates, with recently completed multi-family buildings at 93% leased as of January 2025, underscore their stability and lower need for ongoing capital expenditure.

These established rental assets offer a reliable stream of recurring revenue, a hallmark of cash cow businesses. Their mature status means they require less intensive management and investment compared to growth-stage assets. This stability allows for consistent cash flow generation, bolstering overall financial performance.

- Stable Recurring Income: Mature portfolios provide a predictable and consistent revenue stream from rental payments.

- High Occupancy Rates: As of January 2025, recently completed developments boast a 93% occupancy, indicating strong demand and operational efficiency.

- Lower Ongoing Investment: Having passed the development phase, these properties require minimal new capital, maximizing profit generation.

- Predictable Cash Flow: The combination of high occupancy and reduced investment needs results in dependable cash flow for the business.

Dream Industrial REIT's portfolio of 338 industrial properties, boasting a 96.0% occupancy rate as of June 30, 2025, functions as a significant cash cow. These assets consistently generate substantial net rental income, contributing reliably to the REIT's financial strength and predictable cash flows.

Dream Office REIT's downtown Toronto office buildings, representing 77% of its rental income, are prime cash cows. Their prime locations and high-quality tenant base, evidenced by the successful 366 Bay project, ensure steady income generation and robust cash flow growth.

The Distillery District's commercial and retail spaces are a consistent profit generator for Dream. In 2024, its cultural significance and prime location maintained high occupancy and improved yields, solidifying its role as a dependable income source.

Dream's third-party asset management business, overseeing $28 billion in assets as of March 31, 2025, is a key cash cow. This generates highly predictable fee income from a diverse range of managed funds, providing a stable and significant cash flow stream.

Mature residential rental portfolios, such as those in the Canary District, are established cash cows. With recently completed buildings at 93% leased as of January 2025, these properties offer stable, recurring revenue and require minimal new capital, maximizing profit generation.

| Asset Type | Portfolio Size/Status | Occupancy (as of mid-2025) | Key Characteristic | Cash Cow Contribution |

|---|---|---|---|---|

| Industrial Properties | 338 assets | 96.0% | Consistent Net Rental Income | Strong FFO Growth |

| Downtown Toronto Offices | 77% of rental revenue | High (specific data not available for all) | Prime Location, High Quality | Predictable Cash Flow |

| Distillery District | Commercial & Retail | Improving Yields, High Occupancy | Cultural Hub, Stable Income | Consistent Profit Generator |

| Asset Management Fees | $28 billion AUM (Q1 2025) | N/A | Recurring Revenue Stream | Reliable Cash Flow |

| Mature Residential Rentals | Canary District example | 93% leased (Jan 2025) | Stable Recurring Revenue | Maximized Profit Generation |

What You’re Viewing Is Included

Dream BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no surprises—just a comprehensive strategic tool ready for your immediate use. You are seeing the exact report you will download, meticulously crafted to provide clear insights into your business portfolio. This professional-grade analysis is yours to edit, present, or integrate into your strategic planning without any further modifications required.

Dogs

Underperforming older retail properties, particularly those in less desirable locations or struggling with high vacancy rates, often find themselves in the Dogs quadrant of the BCG matrix. These assets typically represent a low market share within a stagnant or declining retail segment. For instance, in 2024, the U.S. retail vacancy rate hovered around 7.7%, with older malls and strip centers often experiencing significantly higher rates, sometimes exceeding 15-20% in struggling areas.

Arapahoe Basin Ski Resort, divested in 2024, represents a potential Dogs category asset within Dream's portfolio. While profitable, its sale signals a strategic move to shed non-core real estate holdings, possibly due to limited market share or unfulfilled growth potential relative to Dream's primary focus.

Certain legacy office properties situated in markets outside of core Toronto might be classified as Dogs within the BCG Matrix. These properties have experienced a noticeable decline in occupancy, moving from 76.6% in Q3 2023 to 74.7% in Q3 2024, indicating a shrinking tenant base.

Furthermore, these assets are grappling with reduced lease rates, making them less competitive and potentially cash traps. Their struggle to capture market share in a difficult office sector suggests limited growth prospects and a need for careful management.

Small, Undevelopable Land Holdings

Small, undevelopable land holdings, often characterized by limited size, unfavorable zoning, or placement in areas with sluggish economic activity and minimal demand, fall into the Dogs category of the BCG Matrix. These parcels represent a drain on resources, offering little in the way of appreciation or income generation, and lack a clear path to future profitability.

In 2024, the real estate market continued to see significant regional variations. For instance, while major metropolitan areas experienced robust growth, smaller, less accessible land parcels in rural or declining industrial zones struggled to attract investment. Data from Zillow Research in late 2024 indicated that median home values in some of these less desirable areas saw negligible growth, often below the national inflation rate, underscoring the challenge of realizing returns from such properties.

- Limited Market Appeal: These land parcels often face challenges due to their size, making them unsuitable for larger development projects, or their location in areas with low population density and limited infrastructure.

- Stagnant Capital: Holding onto these properties ties up capital that could be invested in more productive assets, leading to opportunity costs and reduced overall portfolio performance.

- Low Return on Investment: Without clear development potential or a strong market for resale, these holdings typically yield minimal or negative returns, failing to contribute positively to financial goals.

- 2024 Market Data: Reports from various real estate analytics firms in 2024 highlighted that undeveloped land in areas with less than 1% annual population growth saw an average appreciation of only 0.5%, significantly underperforming the national average of 4.2%.

Struggling Early-Stage Renewable Energy Ventures

Struggling early-stage renewable energy ventures represent the Stars' potential downfall in the Dream BCG Matrix. These are companies that, despite operating in a growing sector, falter due to critical operational or market challenges. For instance, a solar farm project in 2024 that couldn't secure Power Purchase Agreements (PPAs) by its operational deadline might face significant financial strain, consuming capital without generating revenue. Similarly, a new wind turbine technology experiencing unexpected component failures, leading to extended downtime, would fall into this category.

These ventures are characterized by high cash consumption and a lack of market traction, jeopardizing their future growth and Dream's overall portfolio. A notable example could be a geothermal energy startup in 2024 that encountered unforeseen geological complexities, drastically increasing drilling costs and delaying its operational launch, thus failing to achieve its projected energy output targets and market share. Such situations highlight the inherent risks in pioneering new energy technologies or markets.

- High Cash Burn Rate: Ventures like these often require substantial upfront investment for research, development, and infrastructure, leading to significant cash outflows.

- Market Entry Barriers: Difficulty in securing long-term contracts, like PPAs, can prevent early-stage companies from establishing a stable revenue stream.

- Technical Hurdles: Unforeseen technical issues or lower-than-expected energy output can severely impact a venture's viability and profitability.

- Low Market Share: Failure to achieve desired energy output or operational efficiency directly translates to an inability to capture meaningful market share.

Dogs in the BCG matrix represent business units or products with low market share in a low-growth industry. These are often cash traps, consuming resources without generating significant returns. In 2024, many older, underperforming retail properties, particularly those in less desirable locations or with high vacancy rates, fit this description, with some experiencing vacancy rates exceeding 15-20%.

These assets typically have limited growth potential and may require divestment or significant restructuring to avoid becoming a persistent drain on resources. For instance, the sale of Arapahoe Basin Ski Resort in 2024 by Dream signifies a strategic move away from assets with limited growth prospects relative to core business objectives.

Undevelopable land parcels in areas with sluggish economic activity also fall into the Dogs category. These holdings offer minimal appreciation or income, tying up capital that could be better utilized elsewhere. In 2024, undeveloped land in areas with less than 1% annual population growth saw an average appreciation of only 0.5%, highlighting their poor performance.

| Asset Type | Market Share | Industry Growth | 2024 Performance Indicator |

|---|---|---|---|

| Older Retail Properties | Low | Stagnant/Declining | Vacancy rates > 15% in some areas |

| Legacy Office Properties (Non-Core Toronto) | Low | Declining | Occupancy down from 76.6% (Q3 2023) to 74.7% (Q3 2024) |

| Undevelopable Land Parcels (Rural/Declining Zones) | Negligible | Low | Appreciation ~0.5% (areas <1% population growth) |

Question Marks

Early-stage sustainable urban communities, like the nascent phases of Ottawa's Odenak project, are prime examples of Stars in the BCG Matrix. These developments are situated within the rapidly expanding sustainable development sector, a market projected to reach trillions globally by the late 2020s.

While positioned for high growth, these communities are currently capital-intensive and have yet to capture substantial market share. For instance, net-zero building projects often require upfront investments that can be 10-20% higher than conventional construction, reflecting the need for advanced materials and technologies.

Dream's potential exploration into highly specialized or emerging real estate sectors like life sciences, data centers, or specific build-to-rent models in nascent markets would be classified as Question Marks within the Dream BCG Matrix. These sectors, while offering high growth potential, would see Dream initially holding a low market share. For instance, the global data center market was valued at approximately $226 billion in 2023 and is projected to reach over $400 billion by 2028, indicating significant expansion opportunities, but requiring substantial investment to scale and compete effectively.

Dream Industrial REIT's strategic push into new European markets like the Netherlands, Germany, and France for its renewable energy initiatives, alongside potential industrial property acquisitions in these unproven territories, positions them as Stars within the BCG framework. These ventures offer substantial growth potential, aligning with the REIT's expansion goals.

While these international expansions represent high-growth opportunities, they also come with inherent market entry risks and currently low market share. For instance, the European industrial real estate market saw significant investment in 2023, with Germany and the Netherlands being key hubs, indicating both opportunity and competition for Dream Industrial REIT.

Conversions of Office to Residential (e.g., 606-4th Ave Calgary)

The conversion of 606-4th Ave in Calgary from office to residential is a prime example of a 'Question Mark' within the BCG Matrix. This strategy targets a high-growth potential market by repurposing underutilized office space, aiming to reduce vacancy risks and create new revenue streams.

However, this venture demands substantial initial capital for renovations and faces the challenge of establishing market share in a new product category for the owner. Success hinges on effective marketing and achieving high occupancy rates quickly, which is typical for Question Marks that require careful management to transition into Stars.

In 2024, Calgary's downtown office vacancy rate hovered around 20%, making such conversions an attractive consideration. For instance, the city has seen a growing interest in adaptive reuse projects, with several proposals for office-to-residential conversions being evaluated by the municipal government. These projects often require significant upfront investment, estimated to be in the tens of millions of dollars depending on the building's size and condition, to meet residential building codes and tenant expectations.

- High-Growth Potential: Addresses the declining demand for traditional office space and the persistent need for housing.

- Low Initial Market Share: The specific converted asset has no prior residential market presence.

- Significant Investment: Requires substantial capital for redevelopment and lease-up.

- Uncertainty of Success: Dependent on market absorption and rental income generation.

Exploratory Investments in Emerging Housing Models

Investments in alternative or emerging housing models, such as co-living spaces or innovative affordable housing solutions beyond their established programs, could be classified as Exploratory Investments in the Dream BCG Matrix. These ventures are experiencing growing demand, but Dream's current market share in these specific sub-segments is likely low. This necessitates strategic investment to demonstrate their scalability and profitability.

The co-living market, for instance, has seen significant growth. In 2024, the global co-living market was projected to reach approximately $15 billion, with a compound annual growth rate (CAGR) of around 12%. This indicates a substantial opportunity for companies willing to invest in and capture market share within this evolving sector. Similarly, the demand for affordable housing solutions remains a critical global issue, with many innovative models emerging to address this need.

- Co-living Market Growth: The global co-living market is expected to reach $15 billion by 2024, with a 12% CAGR.

- Affordable Housing Demand: Significant unmet demand exists for affordable housing, driving innovation in this space.

- Market Share Opportunity: Dream's low existing market share in these segments presents a chance for strategic entry and growth.

- Scalability and Profitability: Initial investments are crucial to prove the viability and profit potential of these emerging models.

Question Marks represent ventures with high growth potential but currently low market share, demanding significant investment to capture market position. These are often new market entries or innovative projects where success is not yet guaranteed. For Dream, this could involve entering niche real estate sectors or developing novel housing solutions.

These ventures require careful strategic evaluation and substantial capital allocation to nurture them into potential Stars. The uncertainty inherent in Question Marks necessitates a measured approach, focusing on market validation and operational efficiency to drive future growth.

Examples include early-stage life sciences real estate development or specialized build-to-rent projects in emerging urban areas, where initial capital outlay is high and market penetration is minimal.

The conversion of underutilized office buildings into residential units, like the 606-4th Ave project in Calgary, exemplifies a Question Mark. This strategy taps into the high-growth residential market while addressing office vacancy, but requires significant upfront investment for redevelopment and faces the challenge of establishing a new market presence, a common trait for Question Marks.

| Venture Type | Market Growth | Market Share | Investment Need | Risk Profile |

| New Real Estate Sectors (e.g., Life Sciences) | High | Low | High | High |

| Niche Housing Models (e.g., Co-living) | High | Low | Medium to High | Medium to High |

| Adaptive Reuse Projects (e.g., Office to Residential) | High | Low (for the converted asset) | High | Medium to High |

BCG Matrix Data Sources

Our Dream BCG Matrix is constructed using comprehensive market data, encompassing sales figures, customer feedback, and competitive landscape analysis to provide actionable strategic direction.