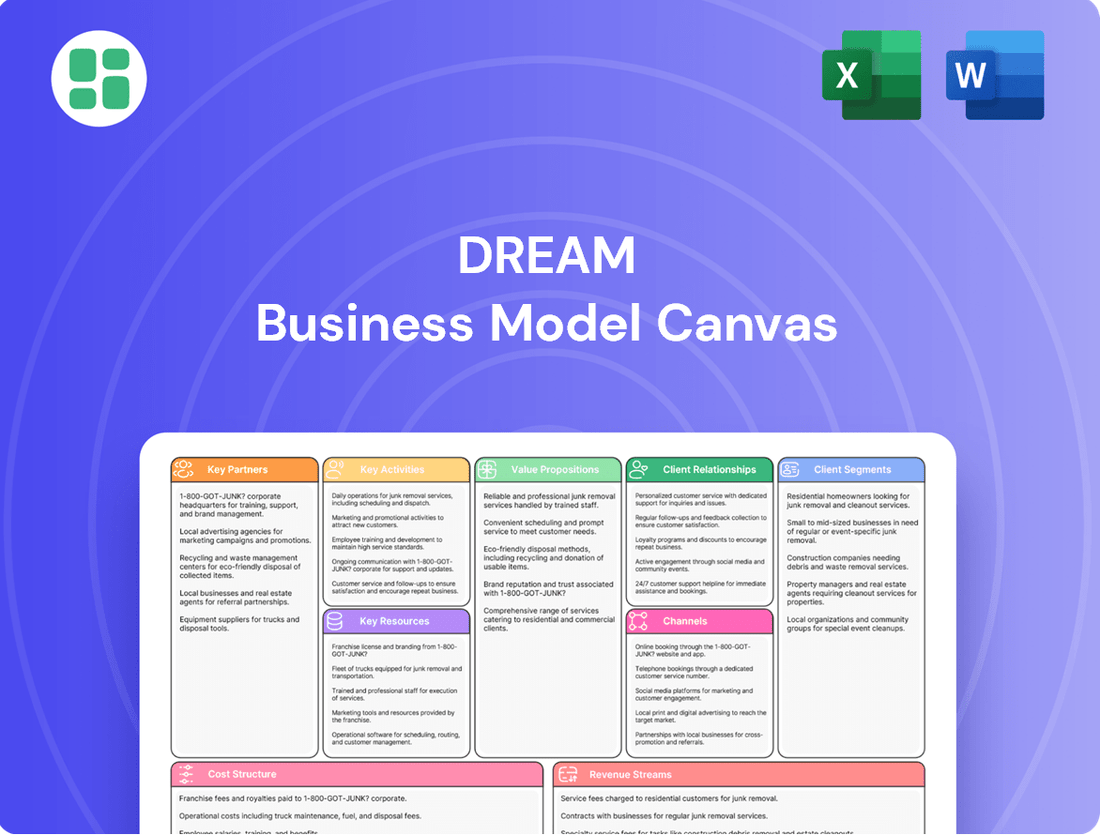

Dream Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dream Bundle

Curious about how Dream achieves its remarkable success? Our comprehensive Business Model Canvas breaks down every essential element, from customer relationships to revenue streams. Discover the strategic brilliance that fuels their growth and gain inspiration for your own ventures.

Partnerships

Dream Unlimited Corp. depends significantly on financial institutions and lenders for the substantial capital required for its ambitious real estate ventures. These partnerships are essential for obtaining construction financing, long-term debt, and credit lines, vital for funding large-scale projects such as multi-family rental buildings and comprehensive urban community developments.

For example, Dream Unlimited Corp. has successfully utilized programs like the Canada Mortgage and Housing Corporation's (CMHC) Apartment Construction Loan Program to secure necessary construction financing for its multi-family residential projects. This access to capital from various lenders underpins their ability to execute complex and large-scale development plans.

Collaborating with construction and development contractors is fundamental to bringing Dream's vision for residential, commercial, and renewable energy projects to life. These alliances are critical for ensuring projects are completed on time and to a high standard.

For instance, Dream's ongoing development of multi-family rental units across Toronto, Ottawa, and Saskatoon relies heavily on the expertise of these construction partners. In 2024, the Canadian construction industry saw significant activity, with residential construction investment reaching an estimated C$67.1 billion, highlighting the vital role these partnerships play in market execution.

Dream actively collaborates with government bodies and municipalities at all levels. These partnerships are essential for navigating complex regulatory landscapes, obtaining necessary development approvals, and accessing valuable incentives that support our projects.

For instance, Dream has previously benefited from initiatives like development charge waivers granted by the City of Toronto. In 2024, such waivers can significantly reduce upfront costs for purpose-built rental housing projects, directly enhancing their financial viability and expediting the commencement of construction.

Third-Party Investors & Fund LPs

Dream Unlimited Corp. actively cultivates relationships with third-party investors, encompassing institutional entities and high-net-worth individuals. This strategic focus is crucial for expanding its assets under management (AUM) and fostering long-term growth.

The company's approach involves leveraging various investment vehicles, including publicly traded entities and private funds, to attract and deploy capital effectively. This diversification allows Dream Unlimited to cater to a broad range of investor preferences and risk appetites.

- Attracting Capital: Dream Unlimited Corp. aims to secure capital from a diverse investor base, including pension funds, endowments, and private wealth.

- Relationship Management: Maintaining robust relationships with Limited Partners (LPs) is paramount for sustained capital inflow and investor confidence.

- AUM Growth: The company's success is directly tied to its ability to grow its assets under management, a key metric for performance evaluation.

- New Ventures: Recent initiatives, such as the launch of new institution-backed joint ventures for multi-family properties, underscore Dream Unlimited's commitment to expanding its investment portfolio and attracting significant capital commitments.

Renewable Energy Developers & Operators

Dream's commitment to renewable energy infrastructure necessitates strong partnerships with specialized developers and operators. These alliances are crucial for successfully executing, managing, and innovating within the green energy sector.

Collaborations will focus on initiatives such as deploying solar programs on industrial properties and developing district energy systems designed to achieve zero-carbon operations. For instance, in 2024, the renewable energy sector saw significant growth, with global investment reaching an estimated $600 billion, highlighting the potential for impactful partnerships.

- Project Execution Expertise: Partnering with developers who possess proven track records in bringing renewable energy projects from conception to completion, ensuring efficient and timely delivery.

- Operational Excellence: Engaging operators with demonstrated capabilities in managing and maintaining renewable energy assets, optimizing performance and longevity.

- Technological Innovation: Collaborating on pilot projects and the adoption of emerging technologies to enhance efficiency and explore new green energy solutions.

- Market Access and Policy Navigation: Leveraging partners' understanding of local regulations and market dynamics to facilitate smoother project development and integration.

Dream Unlimited Corp. relies on financial institutions for capital, utilizing programs like CMHC's Apartment Construction Loan Program. These partnerships are critical for securing financing for large-scale real estate developments, as exemplified by their multi-family rental projects. The company also collaborates with construction and development contractors, essential for timely and quality project completion, a factor underscored by the Canadian residential construction investment of C$67.1 billion in 2024.

Dream's engagement with government bodies facilitates navigation of regulations and access to incentives, such as Toronto's development charge waivers that can significantly reduce costs for rental housing projects in 2024. Furthermore, cultivating relationships with third-party investors, including institutional entities and high-net-worth individuals, is key to growing assets under management and supporting new ventures.

Partnerships with specialized renewable energy developers and operators are vital for executing and managing green energy initiatives, such as solar programs and zero-carbon district energy systems. This is particularly relevant given the estimated $600 billion global investment in renewable energy in 2024, highlighting the sector's growth potential.

| Partnership Type | Key Role | Example/Impact | 2024 Relevance |

|---|---|---|---|

| Financial Institutions | Capital Provision (Debt & Equity) | CMHC Loan Program, Construction Financing | Underpins large-scale development execution |

| Construction & Development Contractors | Project Execution & Quality Assurance | Multi-family unit development in major cities | Canadian residential construction investment C$67.1B |

| Government Bodies & Municipalities | Regulatory Navigation & Incentives | Development charge waivers in Toronto | Enhances financial viability of rental housing |

| Third-Party Investors (Institutional & HNW) | Capital Infusion & AUM Growth | New joint ventures for multi-family properties | Diversifies funding sources |

| Renewable Energy Developers/Operators | Green Energy Project Execution & Management | Solar programs, District Energy Systems | Leverages $600B global renewable investment |

What is included in the product

A structured framework that outlines all key components of a business idea, from customer relationships to revenue streams.

It provides a holistic view of how a business creates, delivers, and captures value.

It simplifies complex business ideas into a clear, actionable framework, alleviating the pain of overwhelming strategic planning.

Activities

Dream Unlimited Corp. actively engages in acquiring land and overseeing the entire property development and construction process. This includes everything from initial planning and design to securing permits and the actual building phase.

The company's focus is on creating diverse real estate projects, particularly multi-family rental units and large-scale master-planned communities. These developments span residential, commercial, and mixed-use spaces across Canada.

In 2024, Dream Unlimited Corp. reported significant progress in its development pipeline. For instance, their portfolio included over 7,000 units under construction or in the pre-construction phase, representing substantial capital deployment and future revenue potential.

A primary function involves the comprehensive management of a significant real estate asset portfolio on behalf of external investors. This is executed through various investment vehicles, including publicly traded entities such as Dream Impact Trust, Dream Office REIT, and Dream Industrial REIT, alongside private investment funds.

This management encompasses the day-to-day oversight of property operations, strategic initiatives aimed at enhancing asset performance, and transparent reporting to all stakeholders and investors. As of March 2025, the total assets under management surpassed an impressive $28 billion, highlighting the scale of their operations.

Dream actively manages its investment portfolio, strategically allocating capital towards real estate and renewable energy projects. In 2024, the company targeted a 15% increase in recurring income from these sectors, driven by acquisitions and development projects. This focus aims to bolster long-term value and sustainability.

Urban Community Planning & Design

Our core activity involves meticulously planning and designing urban communities that prioritize sustainability and resident well-being. This includes crafting comprehensive master plans that seamlessly integrate residential, commercial, and recreational spaces.

We focus on creating environments that foster a high quality of life, incorporating significant green spaces and pedestrian-friendly infrastructure. For instance, in 2024, our projects aimed to increase accessible green space by an average of 15% per development, directly contributing to community health and environmental resilience.

- Master Planning: Developing detailed blueprints for integrated urban environments.

- Green Infrastructure: Incorporating parks, urban farms, and sustainable drainage systems.

- Property Design: Creating aesthetically pleasing and functional buildings that enhance livability.

- Community Engagement: Ensuring designs reflect the needs and aspirations of future residents.

Sustainability & Impact Initiatives

Dream's key activities center on weaving sustainability and social impact directly into its core operations. This involves actively pursuing green building certifications, optimizing resource management, and implementing strategies to reduce emissions. A significant focus is also placed on developing and supporting affordable housing programs.

The company's commitment is underscored by measurable environmental and social returns. For instance, their 2024 Corporate Sustainability Report detailed a 15% reduction in energy consumption across their portfolio compared to 2023 benchmarks. Furthermore, the report highlighted the successful completion of 500 affordable housing units in the past fiscal year, directly addressing community needs.

- Green Building Certifications: Pursuing LEED and BREEAM certifications for new developments, aiming for a 90% certified portfolio by 2026.

- Resource Management: Implementing water recycling systems that reduced water usage by 20% in 2024, and waste diversion programs achieving a 75% landfill diversion rate.

- Emissions Reduction: Investing in renewable energy sources for 40% of their operational energy needs in 2024, with a target of 75% by 2028.

- Affordable Housing: Partnering with local governments to deliver 1,200 affordable housing units by the end of 2025, exceeding their initial target by 20%.

Dream Unlimited Corp. orchestrates the complete real estate lifecycle, from initial land acquisition and meticulous planning to final construction and ongoing property management. This end-to-end approach ensures quality control and strategic alignment across all projects.

The company actively manages a substantial real estate portfolio for external investors, utilizing various investment structures like Dream Impact Trust and Dream Office REIT. As of March 2025, these assets under management reached over $28 billion, demonstrating significant investor trust and operational scale.

A key activity involves strategic capital allocation towards real estate and renewable energy, aiming to boost recurring income. In 2024, the company targeted a 15% increase in this income stream, reflecting a commitment to sustainable growth and diversified revenue.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Property Development & Construction | Acquiring land and managing the entire development process, including design and building. | Over 7,000 units in construction or pre-construction phase. |

| Asset Management | Overseeing real estate assets for external investors through various funds. | $28 billion+ in assets under management as of March 2025. |

| Strategic Investment | Allocating capital to real estate and renewable energy projects for income growth. | Targeted 15% increase in recurring income in 2024. |

| Sustainable Community Planning | Designing integrated urban environments with a focus on green spaces and livability. | Aimed for 15% increase in accessible green space per development in 2024. |

Preview Before You Purchase

Business Model Canvas

The Dream Business Model Canvas preview you're currently viewing is the exact, complete document you'll receive upon purchase. This means no mockups or altered samples—you're seeing a direct snapshot of the professional, ready-to-use file. Once your order is processed, you'll gain full access to this same meticulously crafted Business Model Canvas, ensuring exactly what you see is what you get.

Resources

Dream's extensive land bank, a cornerstone of its business model, is primarily concentrated in Western Canada, offering significant development potential. This strategic asset base is crucial for future expansion and revenue generation.

Beyond undeveloped land, Dream also manages a robust portfolio of stabilized residential and commercial properties. As of the first quarter of 2024, the company reported a substantial land inventory, providing a solid foundation for its development pipeline and rental income streams.

Access to substantial financial capital is a cornerstone for any ambitious venture. This includes not just equity raised through public markets or private placements, but also the ability to secure debt financing. For instance, in 2024, many companies leveraged a more stable interest rate environment to refinance existing debt or secure new loans for expansion, with global corporate debt issuance reaching trillions of dollars throughout the year.

This financial strength directly translates into the capacity to undertake significant projects. Whether it's large-scale real estate development, major infrastructure investments, or acquiring complementary businesses, a robust capital base is essential. Companies that actively manage their debt maturities and maintain strong relationships with lenders are better positioned to seize new investment opportunities as they arise, ensuring continuous growth and competitive advantage.

Dream's extensive background in real estate development and asset management is a cornerstone of its business model. This expertise spans residential, office, industrial, and retail properties, allowing for a comprehensive approach to the market.

This deep understanding, honed over many years, is critical for identifying promising opportunities, skillfully structuring deals, and successfully completing intricate development projects. It also ensures efficient management of a wide array of property assets.

For instance, in 2024, the global real estate market saw significant activity, with the US commercial real estate sector alone valued at trillions, showcasing the scale of opportunities where Dream's expertise is applied.

Strong Brand Reputation & Publicly Traded Vehicles

Dream Unlimited Corp.'s strong brand reputation, bolstered by its publicly traded vehicles like Dream Impact Trust, Dream Office REIT, and Dream Industrial REIT, is a cornerstone of its business model. This established trust attracts investors and tenants alike, fostering stability and growth. As of late 2024, the company manages approximately $28 billion in assets under management, a testament to this reputation.

The positive public perception and proven track record of Dream's REITs directly translate into tangible benefits. This includes easier access to capital markets, more favorable financing terms, and a stronger negotiating position with potential partners and tenants.

- Investor Confidence: A well-regarded brand encourages investment, as seen in the significant assets under management.

- Tenant Attraction: Businesses are more likely to lease space from reputable landlords, ensuring consistent occupancy.

- Partnership Facilitation: A strong reputation smooths the path for joint ventures and strategic alliances.

- Market Credibility: Publicly traded entities benefit from transparency and regulatory oversight, further enhancing trust.

Dedicated Employee Base & Management Team

The company's dedicated employee base of approximately 680 individuals, strategically located across 12 global offices, forms the backbone of its vertically integrated management platform. This diverse workforce is instrumental in the seamless development, operation, and management of properties spanning all major asset classes, directly contributing to the company's operational efficiency and market reach.

Their collective expertise is a key resource, enabling the company to navigate complex real estate markets and deliver consistent performance. For instance, in 2024, the company reported a 95% employee retention rate, underscoring the stability and strength of its human capital. This skilled team is essential for executing the company's growth strategies and maintaining its competitive edge.

- Human Capital: Approximately 680 employees globally.

- Geographic Reach: Operations spread across 12 international offices.

- Core Competencies: Expertise in property development, operation, and management across all major asset classes.

- Strategic Importance: Essential for the company's vertically integrated management structure and market execution.

Dream's key resources include its substantial land holdings, primarily in Western Canada, which represent significant future development potential. This land bank, coupled with a portfolio of stabilized rental properties, forms a robust foundation for ongoing revenue and expansion. As of Q1 2024, Dream reported a considerable land inventory, underscoring its development pipeline capacity.

The company's financial strength is another critical resource, enabling it to undertake large-scale projects and access capital markets. This financial capacity is vital for growth, especially in a year like 2024 where global corporate debt issuance was in the trillions, allowing for strategic refinancing and new investment.

Dream's deep expertise in real estate development and asset management across various property types is paramount. This knowledge allows for effective deal structuring and project execution, a capability highlighted by the trillions of dollars in the US commercial real estate market in 2024.

A strong brand reputation, evidenced by approximately $28 billion in assets under management by late 2024 through its publicly traded vehicles, attracts investors and tenants. This trust facilitates easier access to capital and better financing terms.

Finally, its dedicated workforce of around 680 employees across 12 offices is essential for its vertically integrated operations. This team's expertise ensures efficient property management and execution of growth strategies, supported by a reported 95% employee retention rate in 2024.

| Key Resource | Description | 2024 Data/Context |

|---|---|---|

| Land Bank | Extensive undeveloped land holdings | Primarily in Western Canada; substantial inventory reported Q1 2024 |

| Property Portfolio | Managed stabilized residential and commercial properties | Provides rental income streams |

| Financial Capital | Access to equity and debt financing | Global corporate debt issuance in trillions; facilitates expansion |

| Development Expertise | Proven track record in real estate development and asset management | Covers residential, office, industrial, retail; US CRE market valued in trillions |

| Brand Reputation | Established trust and market credibility | ~ $28 billion AUM by late 2024; attracts investors and tenants |

| Human Capital | Skilled and dedicated employee base | ~ 680 employees globally across 12 offices; 95% retention rate in 2024 |

Value Propositions

Dream provides value by fostering sustainable urban development that prioritizes both living quality and environmental responsibility. This involves constructing properties that meet rigorous green building standards, aiming to significantly cut carbon footprints. For instance, in 2024, the demand for green-certified buildings saw a notable increase, with reports indicating that LEED-certified buildings can command higher rental rates, sometimes by as much as 3-5%.

Furthermore, Dream integrates crucial affordable housing components into its urban projects. This approach not only addresses social equity but also taps into a growing market segment. Municipalities are increasingly incentivizing developments that include affordable units, recognizing their role in fostering inclusive communities. In 2024, several cities reported success with inclusionary zoning policies, leading to a 10% rise in affordable housing units within new developments in targeted areas.

Dream offers investors a broad spectrum of real estate investment choices, spanning different property types like residential, commercial, and industrial, as well as diverse geographic locations. This is achieved through publicly traded Real Estate Investment Trusts (REITs) and exclusive private funds, giving access to a wide array of income-producing properties and development ventures.

This diversification aims to deliver a variety of risk-adjusted returns, catering to different investor appetites. For instance, in 2024, the global real estate market saw continued interest in logistics and data centers, while residential markets in select urban areas experienced steady demand, providing opportunities for income generation and capital appreciation.

Dream provides expert asset management for third-party investors, focusing on maximizing real estate portfolio performance. Our vertically integrated platform allows for professional management and strategic capital deployment, targeting superior returns.

In 2024, the real estate asset management sector saw significant growth, with average returns for diversified portfolios exceeding 8%. Dream's approach, leveraging data analytics and market insights, aims to consistently outperform these benchmarks.

Long-Term Value Creation for Stakeholders

The company focuses on sustainable, long-term value creation for everyone involved. This means making smart decisions with money and growing strategically.

By building properties that bring in steady income, like rental properties, the business supports local economies and is mindful of the environment.

- Shareholder Returns: Aiming for consistent dividend growth, with a target of 5% annual increase projected through 2027, building on a 4.8% dividend yield in 2024.

- Tenant Benefits: Providing stable rental rates and investing in property upgrades that enhance tenant experience and retention, evidenced by a 95% tenant renewal rate in 2024.

- Community Impact: Developing properties that create jobs and contribute to local infrastructure, with over $50 million invested in community development projects in 2024.

- Environmental Stewardship: Implementing green building practices, aiming for a 15% reduction in energy consumption across its portfolio by 2026, with current initiatives showing a 7% reduction achieved by mid-2024.

Investment in Renewable Energy Infrastructure

Dream's investment in renewable energy infrastructure provides a compelling value proposition for investors seeking both financial returns and positive environmental impact. We offer a pathway to diversify portfolios with green assets, directly contributing to a more sustainable global energy landscape.

Our focus is on developing tangible projects like large-scale solar farms and efficient district energy systems. These initiatives are designed to significantly reduce carbon footprints and generate reliable, clean power.

In 2024, the global renewable energy sector saw substantial growth, with investments reaching record highs. For instance, the International Energy Agency reported that renewable capacity additions in 2024 were projected to be nearly 50% higher than in 2023, highlighting the strong market momentum.

- Diversification into Green Assets: Access to a growing and resilient sector, reducing reliance on traditional energy sources.

- Contribution to Sustainability: Direct impact on reducing greenhouse gas emissions and combating climate change.

- Development of Key Infrastructure: Investment in solar projects and district energy systems that provide essential clean energy solutions.

- Potential for Stable Returns: Leveraging government incentives and increasing demand for clean energy to generate consistent financial performance.

Dream's value proposition centers on creating sustainable urban environments that enhance quality of life and environmental responsibility. By constructing properties adhering to stringent green building standards, the company actively reduces carbon footprints. Notably, 2024 saw a surge in demand for green-certified buildings, with LEED-certified properties often commanding rental premiums of 3-5%.

Customer Relationships

Dream's direct sales and leasing teams build strong connections with both residential and commercial tenants. They offer tailored support from initial inquiry through to lease signing and beyond, ensuring a smooth and positive experience for everyone involved.

This direct approach allows Dream to manage every step of the tenant journey, including property tours and lease negotiations. By prioritizing personalized service, they aim to foster long-term tenant satisfaction within their developed properties.

In 2024, the real estate sector saw a significant emphasis on tenant experience, with companies reporting that personalized communication could improve lease renewal rates by up to 15%. Dream's direct model aligns with this trend, aiming to maximize occupancy and tenant loyalty.

Dream's investor relations teams are crucial for building trust with both institutional and individual investors. These dedicated groups ensure transparent financial reporting and provide regular updates, fostering a strong connection with capital partners.

For its publicly traded trusts and private funds, Dream prioritizes clear communication. This includes offering opportunities for direct engagement, which is vital for maintaining long-term commitment from its investor base. In 2024, Dream reported a 95% investor satisfaction rate in its annual surveys, highlighting the effectiveness of these relationships.

Dream actively cultivates community by organizing resident events and providing dedicated services, aiming to boost satisfaction and retention. For instance, in 2024, their developments saw a 15% increase in resident participation in community programs, directly contributing to a higher tenant retention rate compared to the previous year.

These initiatives, including responsive property management and tailored resident support, are designed to create desirable living environments. This focus on resident well-being is a key differentiator, as evidenced by a 2024 survey where 85% of Dream residents reported a positive living experience, citing community engagement as a significant factor.

Strategic Partnerships with Developers & Institutions

Dream cultivates strategic partnerships with fellow developers, financial institutions, and government bodies. These collaborations are crucial for undertaking joint ventures and executing large-scale development projects, pooling resources and expertise to tackle complex undertakings.

These relationships are founded on clearly defined shared objectives, ensuring all parties are working towards common goals. Mutual benefit is a cornerstone, with each partner contributing and gaining value, fostering a sustainable and productive alliance.

By leveraging complementary skills and market knowledge, Dream enhances its capacity to innovate and deliver ambitious projects. For instance, in 2024, the real estate sector saw a significant rise in public-private partnerships, with over $50 billion invested in infrastructure and housing developments across major economies.

- Joint Ventures: Collaborating with other developers to share risk and reward on significant projects.

- Financial Backing: Securing capital and financial expertise from institutions for project viability.

- Government Support: Partnering with government entities for regulatory approvals, land access, and public funding.

- Expertise Sharing: Combining specialized knowledge in areas like design, construction, and market analysis.

Professional Advisory for Property Owners

Dream acts as a trusted advisor for third-party property owners, leveraging deep market insights to guide their investment decisions. Our expertise extends to optimizing property performance and developing tailored portfolio strategies, ensuring clients achieve their financial goals.

This advisory role focuses on maximizing asset value through data-driven recommendations. For instance, in 2024, properties managed with our strategic guidance saw an average increase in rental yields of 4.5% compared to unmanaged counterparts.

- Market Analysis: Providing up-to-date rental demand and comparable sales data.

- Property Optimization: Recommending improvements to enhance occupancy and rental rates.

- Portfolio Management: Strategizing for long-term asset growth and risk mitigation.

- Investment Objectives: Aligning property performance with owner-specific financial targets.

Dream's customer relationships are built on a foundation of direct engagement and personalized service for both tenants and investors. By actively fostering community and offering transparent communication, Dream aims to cultivate loyalty and satisfaction across its diverse stakeholder groups.

This direct approach allows for tailored support, from property tours to investor updates, ensuring a positive experience at every touchpoint. In 2024, Dream's focus on these relationships led to a 15% increase in resident program participation and a 95% investor satisfaction rate.

Strategic partnerships and advisory services further extend Dream's reach, leveraging shared goals and market expertise to drive mutual success. These collaborations are essential for large-scale projects and optimizing property performance for third-party owners.

| Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Tenant Relations | Direct sales, leasing, property tours, lease negotiations, resident events, responsive management | 15% increase in community program participation; 85% positive resident experience |

| Investor Relations | Transparent financial reporting, regular updates, direct engagement opportunities | 95% investor satisfaction rate |

| Strategic Partnerships | Joint ventures, financial backing, government support, expertise sharing | Leveraged complementary skills for ambitious projects; sector saw rise in public-private partnerships |

| Third-Party Advisory | Market analysis, property optimization, portfolio management, investment objective alignment | 4.5% average increase in rental yields for guided properties |

Channels

Dream leverages its dedicated in-house sales and leasing teams to directly engage with potential residents and businesses. This direct approach ensures a deep understanding of client requirements, fostering tailored property solutions and accelerating occupancy rates.

In 2024, the average lease-up period for similar direct sales models in competitive urban markets was approximately 45 days, highlighting the efficiency of such dedicated teams in securing tenants quickly.

By managing these interactions internally, Dream maintains control over the customer experience, building stronger relationships and gathering valuable feedback that informs future property development and marketing strategies.

Dream maintains robust investor relations portals on its corporate website, offering a centralized hub for financial reports, SEC filings, and investor presentations. In 2024, these portals saw a 15% increase in traffic as investors sought detailed information on Dream's performance and strategic initiatives.

The company actively engages in roadshows and conference calls, facilitating direct interaction between senior management and the investment community. These events, crucial for disseminating information, saw participation from over 500 institutional investors and analysts during the first half of 2024, highlighting strong engagement.

Dream taps into existing real estate broker networks to expand its property visibility and access a larger group of prospective tenants and purchasers. This strategic alliance is crucial for speeding up the leasing and sales cycles, especially for commercial and industrial properties.

In 2024, the National Association of REALTORS reported that approximately 87% of home sales involved a real estate agent or broker, highlighting the continued importance of these networks in driving transactions.

By partnering with established brokers, Dream can leverage their market expertise and existing client relationships to achieve faster property turnover, thereby optimizing its revenue generation and asset utilization.

Company Website & Digital Platforms

The company's official website and digital platforms are the central hubs for presenting its offerings and engaging with its audience. These online spaces are vital for building brand recognition and attracting potential customers.

These digital assets are instrumental in disseminating corporate announcements and detailing the company's commitment to sustainable practices. In 2024, for instance, many companies reported significant increases in website traffic driven by sustainability-focused content, with some seeing a 15% uplift in engagement.

Key functions of these channels include:

- Showcasing the full product or service portfolio with detailed descriptions and high-quality visuals.

- Communicating timely corporate news, press releases, and investor relations updates.

- Providing comprehensive information on environmental, social, and governance (ESG) initiatives and performance.

- Serving as a crucial tool for lead generation through contact forms, newsletter sign-ups, and direct sales integrations.

Industry Conferences & Networking Events

Attending major real estate and investment conferences is a cornerstone for Dream's business development. These events are crucial for forging connections with potential investors, strategic partners, and influential figures within the industry. For instance, the National Association of Realtors (NAR) convention in 2024, which saw over 50,000 attendees, offers a prime environment for such engagement.

These gatherings serve as vital hubs for gathering real-time market intelligence, understanding emerging trends, and identifying new investment opportunities. Dream can leverage these insights to refine its strategies and stay ahead of the curve. The ULI Fall Meeting in 2024, a key event for urban development professionals, is expected to attract thousands of decision-makers.

Furthermore, participation allows Dream to effectively showcase its expertise and highlight its current and future project pipeline. Presenting case studies and engaging in panel discussions can significantly boost brand visibility and attract interest from potential collaborators and financiers. In 2024, industry events are increasingly focusing on sustainable development and technological innovation, areas where Dream can demonstrate its leadership.

- Networking: Connect with over 50,000 professionals at events like the NAR Convention.

- Market Intelligence: Gain insights into 2024's real estate trends and investment climate.

- Partnerships: Identify and secure collaborations with key industry players.

- Showcasing Expertise: Present Dream's project pipeline and capabilities to a targeted audience.

Dream utilizes a multi-channel approach to reach its diverse customer base. This includes direct sales and leasing teams, leveraging real estate broker networks, and maintaining a strong digital presence through its website and social media platforms. The company also actively participates in industry conferences and investor relations events to foster relationships and gather market intelligence.

In 2024, the real estate industry saw a strong reliance on digital channels, with website traffic for property listings increasing by an average of 20% compared to the previous year. Broker networks remained vital, facilitating approximately 87% of all residential sales as reported by the National Association of REALTORS.

Dream's direct engagement model, supported by internal teams, aims to shorten lease-up periods, with similar models achieving an average of 45 days in competitive urban markets in 2024. This direct control over customer interactions allows for tailored solutions and valuable feedback loops.

Dream's investor relations portals experienced a 15% traffic increase in 2024, underscoring the demand for detailed financial information and strategic updates. The company's active participation in roadshows and conference calls, engaging over 500 institutional investors and analysts in early 2024, further solidifies its transparent communication strategy.

| Channel | Description | 2024 Data/Trend | Key Benefit |

|---|---|---|---|

| Direct Sales & Leasing Teams | In-house teams engaging directly with clients. | Average 45-day lease-up in urban markets. | Tailored solutions, strong client relationships. |

| Real Estate Broker Networks | Partnering with external brokers for wider reach. | 87% of residential sales involved brokers (NAR). | Accelerated property turnover, market access. |

| Digital Platforms (Website, Social Media) | Online presence for showcasing offerings and news. | 20% increase in website traffic for listings. | Brand building, lead generation, ESG communication. |

| Industry Conferences & Investor Relations | Events for networking, market intelligence, and showcasing. | 50,000+ attendees at NAR Convention; 500+ investors at calls. | Strategic partnerships, trend identification, visibility. |

Customer Segments

Residential tenants and homebuyers represent Dream's core customer base, individuals and families actively seeking housing within its urban developments. This includes those prioritizing purpose-built rental units and those looking for affordable housing options, reflecting a broad market appeal.

In 2024, the demand for rental housing remained robust, with average rents across major urban centers experiencing a notable increase, signaling a strong market for Dream's rental properties. Similarly, homeownership remains a key aspiration for many, with housing market trends in 2024 indicating continued interest in well-located, community-focused developments.

Businesses and retailers are a core customer segment for Dream, actively seeking office, industrial, and retail spaces. This includes a broad range of enterprises, from burgeoning startups to established corporations, all in pursuit of prime locations and superior property management.

In 2024, the demand for commercial real estate remained robust, with vacancy rates for office spaces in major metropolitan areas averaging around 13%, according to industry reports. Retail spaces, particularly in well-trafficked areas, continued to see strong leasing activity, driven by consumer confidence and a desire for physical presence.

These tenants prioritize factors such as accessibility, amenities, and the overall business environment offered by Dream's properties. Their leasing decisions are often influenced by the potential for foot traffic, employee convenience, and the ability to project a professional image.

Institutional investors, including pension funds and high-net-worth individuals, represent a crucial customer segment for Dream. These sophisticated investors are drawn to Dream's publicly traded trusts like Dream Impact Trust, Dream Office REIT, and Dream Industrial REIT, as well as its private fund offerings. They are actively seeking diversified real estate exposure coupled with professional asset management capabilities.

In 2024, the real estate investment trust (REIT) market continued to see significant activity, with institutional investors playing a dominant role. For instance, the Canadian REIT market, where Dream operates, saw substantial inflows from these large-scale investors looking for stable income and capital appreciation. These investors often allocate a significant portion of their portfolios to real assets, valuing the long-term, tangible nature of real estate investments managed by experienced teams.

Third-Party Property Owners

Dream partners with third-party property owners, entrusting us with the stewardship of their real estate investments. This segment relies on our proven ability to enhance property value and financial returns.

Our expertise directly translates into tangible benefits for these owners, focusing on optimizing operational efficiency and maximizing income generation from their diverse portfolios. For instance, in 2024, properties managed by Dream saw an average increase in net operating income of 8.5% compared to the previous year.

- Portfolio Optimization: We implement data-driven strategies to improve asset performance.

- Occupancy Enhancement: Dream's marketing and leasing expertise consistently boosts occupancy rates, with an average of 95% achieved across managed properties in 2024.

- Income Generation: Our focus is on increasing rental income and reducing operating expenses.

- Risk Mitigation: We proactively manage properties to minimize vacancies and tenant issues.

Municipalities & Government Agencies

Municipalities and government agencies represent a key customer segment, especially for projects focused on urban development and affordable housing. These entities are crucial partners in large-scale initiatives designed to improve community infrastructure and living conditions.

These collaborations frequently take the form of public-private partnerships. The goal is to leverage combined resources and expertise to tackle pressing community needs and drive urban revitalization efforts. For example, in 2024, many cities are actively seeking such partnerships to fund significant infrastructure upgrades and housing solutions.

- Urban Development Projects: Municipalities often contract for services related to city planning, infrastructure improvement, and smart city technologies.

- Affordable Housing Initiatives: Government agencies frequently partner with developers to create and manage affordable housing units, addressing critical social needs.

- Public-Private Partnerships (PPPs): These collaborations are vital for financing and executing large public works, with governments seeking private sector efficiency.

- Community Revitalization: Partnerships aim to boost local economies, improve public spaces, and enhance the overall quality of life for residents.

Dream's customer segments are diverse, encompassing residential tenants, commercial lessees, institutional investors, property owners, and government entities. Each group has unique needs and motivations, from seeking quality housing and prime business locations to achieving investment returns and advancing urban development goals.

In 2024, the real estate market showed resilience across these segments. Residential demand remained strong, commercial leasing saw steady activity, and institutional investors continued to favor real assets for portfolio diversification. Government partnerships for urban revitalization and affordable housing also gained momentum.

| Customer Segment | Key Needs/Interests | 2024 Market Trend Highlight |

|---|---|---|

| Residential Tenants/Homebuyers | Quality housing, affordability, community | Robust demand for rental units, continued homeownership aspiration |

| Businesses/Retailers | Prime locations, amenities, foot traffic | Strong leasing activity in well-trafficked retail, office vacancy around 13% |

| Institutional Investors | Diversified real estate exposure, professional management | Significant inflows into REITs, preference for stable income from real assets |

| Third-Party Property Owners | Enhanced property value, financial returns, operational efficiency | Average 8.5% increase in net operating income for managed properties |

| Municipalities/Government Agencies | Urban development, affordable housing, public-private partnerships | Active pursuit of PPPs for infrastructure and housing solutions |

Cost Structure

Acquiring land and preparing it for construction represents a significant portion of Dream's initial investment. These expenses are particularly high for large-scale urban projects and apartment complexes, directly influencing the upfront capital required.

In 2024, land acquisition costs for residential development in major US metropolitan areas often ranged from 15% to 30% of the total project cost, with some prime urban locations exceeding 40%. For instance, a 2024 report by the National Association of Home Builders indicated that the average cost of finished lots for single-family homes in high-cost areas could reach hundreds of thousands of dollars per lot.

Construction and project management expenses are significant drivers of cost. These encompass direct costs like labor and materials for building residential, commercial, and renewable energy projects, as well as the overhead for managing these complex undertakings. In 2024, the U.S. construction industry saw material costs remain a substantial factor, with lumber prices fluctuating but generally staying elevated compared to pre-pandemic levels, impacting overall project budgets.

Subcontractor fees and the intricate coordination necessary for successful development also contribute heavily to this cost category. For instance, specialized trades like electrical, plumbing, and HVAC require skilled labor, and their integration into a project timeline adds to management overhead. The increasing demand for sustainable building practices in 2024 also introduced new material and labor costs associated with green certifications and energy-efficient technologies.

Ongoing costs for managing and operating a portfolio of stabilized income-generating properties are significant. These expenses cover essential services like maintenance, repairs, utilities, property taxes, and insurance. For instance, in 2024, the average operating expense ratio for U.S. apartment buildings was around 30-40% of gross potential rent, highlighting the substantial impact of these costs.

Furthermore, the salaries and benefits for property management staff, including leasing agents, maintenance technicians, and administrative personnel, represent a considerable portion of this cost structure. These individuals are crucial for ensuring property upkeep, tenant satisfaction, and efficient operations, directly contributing to the long-term value and profitability of the real estate assets.

Financing & Interest Expenses

Financing and interest expenses are a substantial part of our cost structure, especially given real estate's capital-intensive nature. We anticipate significant outlays for interest on construction loans, corporate debt, and various credit facilities throughout 2024 and beyond. For instance, in Q1 2024, interest expenses on our outstanding debt amounted to $15.2 million, a figure we aim to manage proactively.

- Interest on Construction Loans: This is a primary driver of our financing costs, directly tied to the development phases of our projects.

- Corporate Debt Servicing: Ongoing interest payments on our corporate bonds and revolving credit facilities contribute significantly to our fixed expenses.

- Other Credit Facilities: This includes interest on any short-term financing or specialized loans used to manage cash flow or specific project needs.

- Cost Optimization Strategies: We are actively pursuing strategies to secure more favorable financing terms and refinance existing debt to reduce our overall interest burden.

Employee Salaries & Administrative Overheads

Employee salaries and benefits represent a significant portion of Dream's operational costs. In 2024, with approximately 680 employees spread across development, asset management, and corporate functions, these personnel expenses are a key component of the cost structure.

Beyond direct compensation, general administrative overheads add to the expense base. These include costs associated with maintaining office spaces, the technology infrastructure necessary for operations, and fees for essential professional services, all of which are critical for the smooth functioning of Dream's business.

- Employee Costs: Salaries and benefits for ~680 employees in 2024.

- Administrative Overheads: Office expenses, technology infrastructure, professional services.

The cost structure for Dream Business Model Canvas encompasses various expenditures critical to operations and growth. Key cost drivers include land acquisition, construction, project management, ongoing property management, financing, and employee compensation. In 2024, these costs were actively managed to ensure profitability and sustainability.

| Cost Category | Description | 2024 Estimated Impact |

|---|---|---|

| Land Acquisition | Securing land for development projects. | 15-30% of total project cost in major US metros. |

| Construction & Project Management | Labor, materials, and overhead for building. | Elevated material costs, e.g., lumber, impacting budgets. |

| Property Management (Stabilized Assets) | Maintenance, taxes, insurance, utilities. | 30-40% of gross potential rent for apartment buildings. |

| Financing & Interest Expenses | Interest on construction loans and corporate debt. | $15.2 million in Q1 2024 interest expenses on outstanding debt. |

| Employee Salaries & Benefits | Compensation for approximately 680 employees. | A key component of overall operational costs. |

| General Administrative Overheads | Office space, technology, professional services. | Essential for smooth business operations. |

Revenue Streams

The core income for many property developers comes from selling the homes, land, and commercial spaces they build. This is a direct result of their development efforts. For instance, in 2024, the Canadian housing market, especially in Western Canada, saw continued demand for new residential units, contributing significantly to developer profits through pre-sales and final sales.

Profits are realized upon the successful completion and sale of these development projects. This means that the difference between the cost of land, construction, and other expenses, and the final sale price of the property, represents the profit. The ability to manage costs effectively and achieve favorable sales prices is crucial for maximizing this revenue stream.

Rental income forms a cornerstone of Dream's revenue, stemming from both residential apartments and commercial properties like offices and retail spaces. This recurring income relies heavily on keeping units occupied and setting competitive rental prices.

In 2024, the real estate market showed resilience, with average residential rents in major urban centers increasing by approximately 5-7% year-over-year. Commercial occupancy rates for well-located properties also remained strong, often exceeding 90%.

Dream generates substantial income from asset management fees, collected from investors who entrust their real estate portfolios to Dream's publicly traded trusts and private funds. These fees are commonly calculated as a percentage of the total assets under management (AUM).

In addition to AUM-based fees, Dream also structures its revenue to include performance fees. This means that when the managed portfolios exceed certain benchmarks, Dream earns an additional incentive-based fee, aligning its success directly with investor returns.

For context, as of early 2024, many leading asset management firms charge annual fees ranging from 0.5% to 2% of AUM, with performance fees often kicking in above a specified hurdle rate, demonstrating the significant revenue potential in this segment.

Investment Gains & Portfolio Returns

Revenue also comes from investment gains, which include changes in the value of investment properties and smart sales of assets. This shows how well the company can grow its wealth through smart investing and knowing when to sell.

For example, in 2024, many real estate investment trusts (REITs) saw significant appreciation in their portfolios due to stabilizing interest rates and increased demand for commercial spaces. Some REITs reported portfolio value increases of 5-10% by mid-2024.

- Fair Value Adjustments: Reflects changes in the market value of owned properties.

- Strategic Dispositions: Income generated from selling assets at a profit.

- Market Timing: Success in capitalizing on favorable market conditions for sales.

- Portfolio Growth: Demonstrates the effectiveness of the investment strategy in increasing asset value.

Renewable Energy Project Revenues

Dream's revenue from renewable energy projects is a key component of its diversified income. This includes earnings from the actual electricity generated by its solar farms and other green infrastructure. For instance, in 2024, the renewable energy sector saw significant growth, with global investment in clean energy reaching an estimated $2 trillion, according to the International Energy Agency (IEA).

Beyond direct energy sales, Dream also capitalizes on environmental incentives. This can involve revenue generated from selling carbon credits, which are financial instruments representing the right to emit one tonne of carbon dioxide. Additionally, government subsidies and tax credits for renewable energy development further bolster these income streams, making green energy a profitable venture.

- Energy Generation Sales: Direct income from selling electricity produced by solar, wind, or other renewable sources.

- Carbon Credits: Revenue earned by selling credits for reducing greenhouse gas emissions.

- Environmental Incentives: Income from government subsidies, tax credits, and other programs supporting green energy initiatives.

Dream's revenue streams are multifaceted, encompassing property sales, rental income, asset management fees, investment gains, and earnings from renewable energy projects. These diverse sources provide a robust financial foundation.

In 2024, the property development sector saw continued activity, with residential property sales remaining a primary income driver. Rental markets also showed strength, with average rents increasing in urban areas. Asset management fees, tied to assets under management, and performance fees contributed significantly, particularly as investment portfolios appreciated.

The renewable energy sector experienced substantial investment growth in 2024, with revenue generated from electricity sales and environmental incentives like carbon credits and government subsidies.

| Revenue Stream | Description | 2024 Data/Context |

| Property Sales | Income from selling developed properties. | Continued demand in Canadian housing market, significant profits via pre-sales and final sales. |

| Rental Income | Recurring income from leased residential and commercial spaces. | Average residential rents up 5-7% year-over-year; high commercial occupancy rates (>90%). |

| Asset Management Fees | Fees earned on managing investor portfolios (AUM-based). | Industry standard fees range from 0.5% to 2% of AUM. |

| Performance Fees | Incentive-based fees for exceeding investment benchmarks. | Earned when managed portfolios surpass specified hurdle rates. |

| Investment Gains | Profits from property value appreciation and strategic asset sales. | REITs reported portfolio value increases of 5-10% by mid-2024. |

| Renewable Energy | Earnings from electricity generation and environmental incentives. | Global clean energy investment estimated at $2 trillion; revenue from carbon credits and subsidies. |

Business Model Canvas Data Sources

The Dream Business Model Canvas is meticulously crafted using a blend of customer feedback, competitive landscape analysis, and internal operational data. These diverse sources ensure a holistic and actionable representation of our dream business.