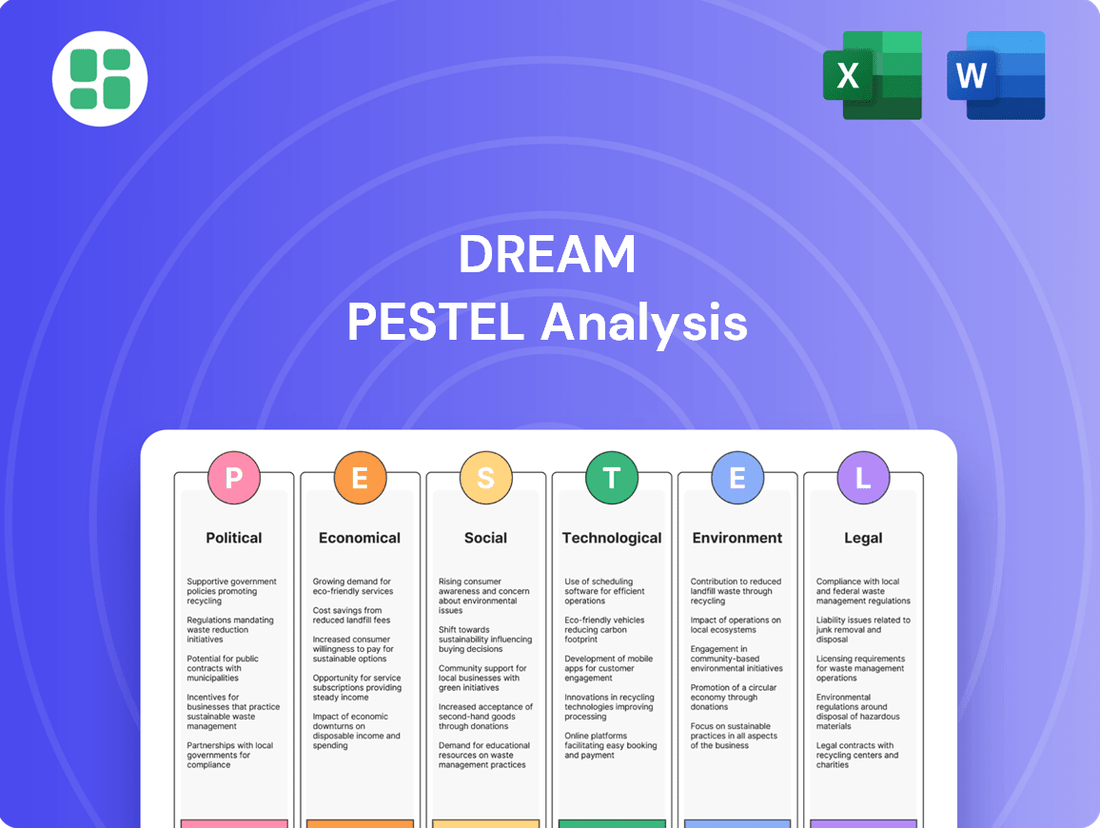

Dream PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dream Bundle

Unlock the secrets to Dream's success by understanding the external forces at play. Our comprehensive PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping the company's landscape. Gain a critical edge in your strategic planning and investment decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government housing policies, such as those aimed at increasing affordability or promoting urban densification, directly shape the landscape for developers like Dream Unlimited Corp. For instance, in 2024, many Canadian municipalities are exploring or implementing measures to streamline approvals for multi-unit dwellings, a trend that could benefit Dream's urban projects.

Zoning regulations are particularly impactful; restrictive single-family zoning can limit the scope of residential development, while more flexible zoning can unlock opportunities for higher-density projects. Changes in these rules, often driven by political will to address housing shortages, can significantly alter project feasibility and the pace of development.

The political climate surrounding urban planning and housing is dynamic. For example, in late 2024, federal initiatives to boost housing supply, potentially through infrastructure funding or tax incentives for development, could create a more favorable environment for companies like Dream Unlimited Corp., influencing their strategic land acquisition and project planning.

Central banks, while independent, often align interest rate policies with government economic goals. For Dream Unlimited Corp., this means potential shifts in borrowing costs, directly impacting their development projects and overall financial strategy. For instance, if the government prioritizes cooling inflation, a central bank might raise rates, making it more expensive for Dream to finance new ventures.

These rate adjustments also profoundly influence mortgage affordability for potential homebuyers. Higher interest rates can dampen demand for new properties, a critical factor for Dream's sales pipeline. Conversely, lower rates can stimulate the housing market, boosting sales and profitability. The Bank of England, for example, kept its base rate at 5.25% through much of 2024, a decision influenced by ongoing inflation targets, directly affecting the cost of capital for companies like Dream.

Dream Unlimited Corp.'s significant investments in renewable energy infrastructure are intrinsically tied to government support. For instance, the Inflation Reduction Act of 2022 in the United States extended crucial tax credits for solar and wind power, a policy expected to drive billions in new clean energy investment through 2030, directly benefiting companies like Dream.

Changes in political winds can dramatically alter the landscape. A shift in government focus away from green initiatives, or the introduction of stricter environmental regulations on energy projects, could increase operational costs or even halt expansion plans for Dream's renewable ventures. The predictability of these policy environments is paramount for securing the long-term financing required for large-scale renewable energy projects.

Taxation Policies on Real Estate

Changes in property taxes, capital gains taxes, and corporate tax rates for real estate entities, including Real Estate Investment Trusts (REITs), directly influence Dream Unlimited Corp.'s profitability and investment attractiveness. For instance, a rise in capital gains tax could dampen investor appetite for property sales, impacting Dream's development pipeline and exit strategies.

Government incentives, such as those for affordable housing projects or green building initiatives, can offer substantial financial benefits or create competitive pressures. For example, tax credits for energy-efficient construction could lower Dream's development costs, presenting a strategic advantage if they are well-positioned to leverage them.

The U.S. federal capital gains tax rate for assets held over a year currently stands at 0%, 15%, or 20%, depending on taxable income, a factor that influences the net returns for real estate investors. Similarly, corporate tax rates, which were reduced to 21% in the U.S. following the Tax Cuts and Jobs Act of 2017, remain a critical consideration for Dream's overall tax burden.

- Property Tax Adjustments: Local governments frequently reassess property values, leading to fluctuations in property tax burdens, which directly affect operating expenses for property owners.

- Capital Gains Tax Impact: Alterations to capital gains tax rates can significantly sway the profitability of property sales and development, influencing investor decisions and Dream's realization of profits.

- Corporate Tax Rates: Changes in corporate tax legislation, such as potential shifts in the U.S. federal rate from the current 21%, will have a direct bearing on Dream Unlimited Corp.'s net earnings.

- Incentive Programs: Government-sponsored tax incentives for specific development types, like affordable housing or sustainable construction, can create opportunities or disadvantages depending on Dream's alignment with these policy goals.

Infrastructure Spending and Urban Development Initiatives

Government investment in public infrastructure, like transit and utilities, directly influences the value and development potential of Dream Unlimited Corp.'s properties, especially in urban areas. For instance, the Canadian federal government committed to investing over $100 billion in infrastructure by 2028, a significant portion of which targets public transit and green infrastructure, directly benefiting urban development projects.

Political commitments to urban renewal or regional development plans can unlock new markets or boost the appeal of existing Dream Unlimited Corp. assets. The Ontario government's proposed Greater Toronto Area-wide transit plan, with significant funding allocated for new lines and upgrades, is a prime example that could enhance property values in targeted corridors.

- Infrastructure Investment: Federal and provincial infrastructure spending, such as the projected $100 billion+ by 2028, directly supports urban development.

- Transit Expansion: Initiatives like the GTA-wide transit plan can significantly increase the accessibility and desirability of properties in affected regions.

- Urban Renewal Focus: Political prioritization of urban renewal projects can create new opportunities and improve existing asset performance for companies like Dream Unlimited.

Political stability and government policies are crucial for Dream Unlimited Corp., impacting everything from housing regulations to tax structures. For example, in 2024, many Canadian municipalities are streamlining approvals for multi-unit dwellings, a move that could accelerate Dream's urban development projects.

Changes in zoning laws, often driven by political will to address housing shortages, directly influence the feasibility and scale of residential projects. Furthermore, federal initiatives in late 2024 aimed at boosting housing supply through infrastructure funding or tax incentives could significantly enhance the operating environment for developers like Dream.

Government tax policies, including capital gains and corporate tax rates, directly affect Dream's profitability and investment attractiveness. For instance, current U.S. federal capital gains tax rates range from 0% to 20% depending on income, a key factor for investors and Dream's exit strategies.

Government investment in infrastructure, such as the Canadian federal commitment of over $100 billion by 2028 for public transit and green infrastructure, directly enhances the value and development potential of Dream's urban properties.

What is included in the product

The Dream PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the Dream's strategic landscape.

This in-depth evaluation provides actionable insights for identifying potential risks and opportunities to inform strategic decision-making.

The Dream PESTLE Analysis offers a clear, summarized version of complex external factors, simplifying strategic discussions and reducing the pain of information overload for busy teams.

Economic factors

The prevailing interest rate environment directly influences Dream Unlimited Corp.'s cost of capital. For instance, if central banks like the Bank of Canada maintain or increase benchmark interest rates, Dream's borrowing costs for new projects and its REITs will likely rise. This increased financing expense can compress profit margins on developments and make potential acquisitions more expensive, potentially dampening investment appetite.

Conversely, a sustained period of lower interest rates, as seen in some past economic cycles, would reduce Dream's capital costs. This would make it more financially feasible to undertake new development projects and expand its real estate portfolio through its REITs. Lower rates also tend to make real estate investments more attractive to a broader range of investors, potentially boosting demand and property values.

Monitoring the decisions of central banks, such as the Federal Reserve in the US and the Bank of Canada, and understanding market expectations for future rate movements is therefore a critical component of Dream's financial planning and strategic decision-making. For example, if the Bank of Canada's overnight rate, which influences prime lending rates, is projected to remain stable or decrease in 2024-2025, it would provide a more favorable cost of capital environment.

Inflationary pressures significantly impact Dream Unlimited Corp.'s operations by increasing the cost of essential materials like lumber and steel, as well as labor and services. For instance, the Producer Price Index for construction inputs saw a notable increase in late 2024, impacting project expenses.

These rising construction costs directly challenge profit margins for real estate development. If Dream Unlimited cannot adequately adjust pricing or enhance project efficiency, these increased expenses could diminish profitability, necessitating careful financial planning.

Consequently, Dream Unlimited must proactively incorporate inflation forecasts into its project budgeting and comprehensive risk assessments to mitigate potential financial setbacks and ensure project viability.

Overall economic growth significantly impacts Dream Unlimited Corp.'s diverse real estate portfolio. For instance, in the United States, GDP growth was projected to be around 2.4% in 2024, signaling a healthy economic environment that typically boosts consumer purchasing power and property demand.

Strong employment rates, a key indicator of economic health, directly translate to increased demand for residential and commercial properties. Higher employment means more people can afford to buy homes or rent office and retail spaces, directly benefiting Dream's various property segments.

Consumer confidence acts as a crucial barometer for investment and sales activity. When consumers feel secure about the economy, they are more likely to make significant purchases, including real estate, thereby driving up property values and transaction volumes for Dream Unlimited Corp.

Real Estate Market Cycles and Demand

Real estate markets are inherently cyclical, influenced by shifts in supply and demand, speculative bubbles, and the general mood of investors. These fluctuations directly affect property prices and how much people can charge for rent. For a company like Dream Unlimited Corp., understanding and adapting to these cycles is crucial for both seizing opportunities and managing risks, especially during slower periods.

Continuous market analysis is key to navigating these ups and downs. For instance, in the Canadian housing market, while demand remained robust in early 2024, interest rate hikes began to cool activity in certain segments. The average home price across Canada saw a slight increase of approximately 4.8% year-over-year by April 2024, reaching around $716,000, but this masked regional variations and a slowdown in transaction volumes compared to peak periods.

- Supply-Demand Imbalances: Persistent housing shortages in major Canadian urban centers continue to support price appreciation, though the pace has moderated.

- Investor Sentiment: Higher borrowing costs and economic uncertainty in 2024 have tempered speculative activity, leading to more cautious investment decisions.

- Interest Rate Impact: The Bank of Canada's monetary policy decisions significantly influence buyer affordability and, consequently, demand and pricing power in the real estate sector.

- Rental Market Strength: Despite cooling sales, demand for rental properties remained strong in 2024, with average rents for a one-bedroom apartment in Toronto reaching approximately $2,500 per month, creating opportunities in the multi-residential sector.

Availability of Capital and Investor Liquidity

The availability of capital is a significant driver for Dream Unlimited Corp. (Dream), impacting its capacity for growth and project execution. In 2024, the real estate market experienced a tightening of credit conditions, with benchmark interest rates remaining elevated, which could increase the cost of debt financing for Dream's developments. Investor sentiment towards real estate, while showing some resilience in certain segments, remains cautious due to ongoing economic uncertainties, potentially affecting the liquidity of Dream's publicly traded entities like Dream REIT and its ability to raise equity.

Access to diverse capital sources is paramount for Dream's strategic objectives. For instance, in early 2025, the company might find it more challenging to secure large-scale debt financing compared to periods of lower interest rates. Conversely, strong investor demand for well-performing, income-generating assets could still provide opportunities for Dream to raise capital through its publicly traded vehicles, supporting both existing operations and new private ventures.

- Capital Availability: Higher interest rates in 2024-2025 generally increase the cost of debt capital for real estate developers like Dream.

- Investor Liquidity: Investor sentiment towards real estate as an asset class directly influences the ease and cost of raising funds through equity and public market vehicles.

- Dream REIT Performance: The performance and liquidity of Dream REIT in 2024-2025 are key indicators of broader investor appetite for real estate assets managed by Dream.

- Funding Capacity: Dream's ability to fund new projects and expand operations is directly tied to its success in accessing both debt and equity capital markets.

Economic growth is a primary driver for Dream Unlimited Corp.'s real estate ventures. For example, Canada's GDP growth was projected at 1.7% for 2024, indicating a moderate expansion that supports demand for housing and commercial spaces. Strong employment figures, with Canada's unemployment rate holding steady around 6.2% in early 2024, further bolster consumer confidence and purchasing power, directly benefiting Dream's sales and rental income streams.

Interest rate policies from central banks significantly shape Dream's cost of capital and investment feasibility. The Bank of Canada maintained its key policy rate at 5.00% through early 2024, a level that increases borrowing costs for new developments and acquisitions. This environment necessitates careful financial management to ensure project profitability and sustained growth.

Inflationary pressures directly impact Dream's project expenses, particularly for construction materials and labor. While inflation showed signs of moderating in Canada in late 2024, the cost of inputs remained elevated, impacting project budgets. Proactive cost management and pricing strategies are essential for Dream to maintain healthy profit margins in this climate.

| Economic Factor | 2024 Projection/Data | Impact on Dream Unlimited Corp. |

|---|---|---|

| GDP Growth (Canada) | 1.7% | Supports demand for real estate, increasing sales and rental opportunities. |

| Unemployment Rate (Canada) | ~6.2% (early 2024) | Higher employment boosts consumer confidence and ability to purchase/rent properties. |

| Bank of Canada Key Policy Rate | 5.00% (maintained through early 2024) | Increases borrowing costs, affecting project financing and potential returns. |

| Inflation (Consumer Price Index - Canada) | Moderating but elevated input costs | Raises construction and operational expenses, requiring careful budget management. |

Same Document Delivered

Dream PESTLE Analysis

The preview shown here is the exact Dream PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive tool will provide you with a detailed breakdown of the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting your dreams. Gain valuable insights and strategic clarity with this ready-to-deploy analysis.

Sociological factors

Global population is projected to reach 8.5 billion by 2030, with a significant portion of this growth occurring in urban areas. This surge in urban populations, coupled with an aging global demographic, creates a dual demand: for more housing overall and for specialized living solutions catering to older adults, such as accessible apartments and senior living communities. Dream Unlimited Corp.'s strategic positioning in urban centers directly taps into this expanding market.

In 2024, over 57% of the world's population resides in urban areas, a figure expected to climb to 68% by 2050. This ongoing urbanization intensifies the need for diverse housing options, from starter homes to luxury condominiums. Understanding the evolving needs within these growing urban demographics, such as the increasing preference for smaller, more efficient living spaces or the resurgence of multi-generational housing, is crucial for Dream Unlimited Corp. to maintain its competitive edge and ensure project viability.

People increasingly prefer living in walkable communities with mixed-use developments that offer convenient access to amenities. Dream Unlimited Corp.'s focus on crafting vibrant urban spaces directly addresses this evolving lifestyle preference. For instance, the company's East Village development in Calgary has seen significant residential uptake, reflecting a demand for urban living that balances convenience with community engagement.

The company's strategy necessitates ongoing market research to understand what residents and businesses truly value in their living and working environments. This includes a growing emphasis on sustainability and wellness features, which are becoming key differentiators in community design and appeal. A 2024 survey indicated that over 60% of prospective homebuyers consider green spaces and sustainable building practices as important factors in their decision-making.

The shift to remote and hybrid work models, accelerated in recent years, continues to reshape the commercial real estate landscape. By early 2024, reports indicated that office vacancy rates in major metropolitan areas remained elevated, with some cities experiencing record highs, impacting demand for traditional office spaces.

This sustained trend necessitates a strategic re-evaluation of existing portfolios and future development plans. Dream Unlimited Corp. needs to consider how to adapt its commercial properties to accommodate hybrid work arrangements, potentially through flexible co-working spaces or reconfigured office layouts that prioritize collaboration and employee well-being.

Furthermore, evolving retail consumption patterns, influenced by e-commerce growth and changing consumer habits, also require attention. Adapting retail spaces to offer experiential shopping or integrating them with other services could be key to maintaining relevance and demand in the current market.

Affordability Concerns and Social Housing Needs

Growing concerns over housing affordability, especially in major cities, present a dual-edged sword for Dream Unlimited Corp. For instance, in Canada, the average home price reached an estimated $730,000 by early 2024, a figure that continues to climb, making homeownership increasingly out of reach for many.

This affordability crisis fuels societal pressure on developers to incorporate more affordable housing options into their projects. Regulatory bodies and the public alike are scrutinizing development plans, with a growing expectation for companies like Dream to contribute positively to the housing spectrum.

By actively participating in social housing initiatives, Dream can bolster its public image and strengthen its social license to operate. This strategic engagement can mitigate potential regulatory hurdles and foster goodwill within communities.

- Housing Affordability Gap: By Q1 2024, the average Canadian home price hovered around $730,000, widening the gap between income and housing costs.

- Public Expectation: Surveys in 2024 indicate over 70% of Canadians believe developers should be mandated to include a percentage of affordable units in new developments.

- Social License: Proactive involvement in affordable housing projects can improve community relations and reduce opposition to future developments.

- Regulatory Influence: Municipal governments are increasingly implementing inclusionary zoning policies, impacting development feasibility and requiring developer participation in affordable housing solutions.

Community Engagement and Social Impact

Societal expectations for corporate social responsibility are on the rise, significantly shaping how companies like Dream Unlimited Corp. approach their development projects. This means a greater emphasis on giving back and being a good neighbor.

Building strong community ties through open dialogue, prioritizing local employment, and implementing meaningful social impact programs can lead to smoother project approvals and a stronger brand image. For instance, in 2024, studies showed that companies with robust community engagement strategies saw a 15% higher customer loyalty rate compared to those with minimal involvement.

Investing in the social well-being of the areas where they operate is becoming a key metric of success. This includes supporting local infrastructure, cultural events, and educational initiatives.

- Growing CSR Expectations: Consumers and stakeholders increasingly demand that businesses contribute positively to society.

- Brand Reputation Boost: Positive community relations translate directly into enhanced brand perception and trust.

- Social Impact Investment: Funding for community projects and social enterprises is seen as a vital component of long-term business strategy.

- Local Economic Contribution: Prioritizing local hiring and sourcing creates tangible benefits for the community, fostering goodwill.

Societal expectations for developers to contribute to affordable housing solutions are intensifying, particularly given rising property values. By Q1 2024, the average Canadian home price neared $730,000, exacerbating affordability challenges. Public sentiment, with over 70% of Canadians in 2024 believing developers should include affordable units, underscores the need for proactive engagement in this area. This also impacts a company's social license to operate, influencing community relations and regulatory approvals.

Corporate social responsibility is no longer optional; it's a critical component of brand reputation and stakeholder engagement. Companies demonstrating strong community involvement, such as supporting local initiatives, often see improved customer loyalty, with studies in 2024 showing a 15% increase for those with robust engagement strategies. This focus on social well-being and local economic contribution fosters goodwill and can streamline future development processes.

The demand for walkable, mixed-use communities with convenient amenities continues to grow, with Dream Unlimited Corp.'s focus on urban revitalization aligning well with these preferences. For example, their East Village project in Calgary has demonstrated strong residential uptake, reflecting a clear market appetite for this type of urban living. This trend is supported by consumer preferences, with a 2024 survey indicating over 60% of homebuyers prioritizing green spaces and sustainable building practices.

| Sociological Factor | 2024/2025 Data Point | Impact on Dream Unlimited Corp. |

|---|---|---|

| Housing Affordability | Average Canadian home price ~$730,000 (Q1 2024) | Pressure to include affordable housing units; potential for social license improvement. |

| Community Expectations | 70%+ Canadians believe developers should mandate affordable units (2024) | Need for proactive participation in affordable housing to maintain public image and regulatory ease. |

| Consumer Preferences | 60%+ homebuyers prioritize green spaces/sustainability (2024) | Opportunity to differentiate projects through sustainable design and community amenities. |

| Urbanization Trend | 68% of world population in urban areas by 2050 (projected) | Continued demand for urban housing; need to cater to evolving urban living preferences. |

Technological factors

PropTech integration is reshaping property management, with smart building solutions like IoT sensors and predictive analytics becoming key. This technology allows for optimized energy use, enhanced security, and smoother operations, directly impacting efficiency and competitiveness. For instance, in 2024, the global PropTech market was valued at over $20 billion, with significant growth projected as companies like Dream Unlimited Corp. increasingly adopt these innovations.

By leveraging smart building technologies, Dream Unlimited Corp. can achieve substantial cost savings, estimated to be up to 15% on energy expenses alone in smart buildings. This not only boosts operational efficiency but also significantly improves tenant satisfaction by offering a more comfortable, secure, and responsive living or working environment.

Innovations like modular construction and prefabrication are revolutionizing project delivery. For instance, modular construction can reduce construction time by up to 50% and cut waste by 30%, a significant advantage for companies like Dream Unlimited Corp. aiming for efficiency.

The adoption of sustainable materials, such as cross-laminated timber (CLT) or recycled steel, not only enhances environmental performance but also often leads to cost savings over the building's lifecycle. The global green building materials market is projected to reach $496.3 billion by 2027, highlighting a strong demand and evolving industry standards.

By integrating these advanced construction technologies and materials, Dream Unlimited Corp. can expect to see improved project timelines, reduced operational costs, and a stronger commitment to sustainability, ultimately offering a competitive edge in the market.

Data analytics is revolutionizing how real estate companies operate. Dream Unlimited Corp. can harness this power to dissect market trends, anticipate demand shifts, and fine-tune pricing for maximum impact. This sophisticated analysis directly translates to better investment choices and improved performance across all its managed properties.

By leveraging big data, Dream Unlimited Corp. can gain a significant competitive edge. For instance, in 2024, the commercial real estate sector saw a 15% increase in the adoption of AI-powered analytics for market forecasting, according to a recent industry report. This allows for more precise asset valuation and risk management, crucial for optimizing returns.

Renewable Energy Technology Advancements

Ongoing advancements in renewable energy technologies are significantly shaping the landscape for companies like Dream Unlimited Corp. These innovations directly influence the efficiency and cost-effectiveness of their renewable energy infrastructure. For instance, the development of more efficient solar panels means greater energy generation from the same surface area, while improved battery storage solutions address the intermittency of renewable sources, making them more reliable. Smart grid integration further enhances the operational capabilities, allowing for better management and distribution of renewable energy.

These technological improvements are not just about better performance; they are crucial for reducing overall costs and boosting the profitability of green energy portfolios. By 2024, the global renewable energy market saw continued growth, with solar PV costs decreasing by an average of 8-10% year-over-year in many regions, making it increasingly competitive with traditional energy sources. Battery storage costs have also seen a decline, with lithium-ion battery pack prices falling by over 90% in the last decade, reaching approximately $130 per kWh in 2024 according to industry reports.

Staying ahead of these rapid innovations is absolutely essential for Dream Unlimited Corp. to maintain its growth trajectory and maximize returns on its investments in the renewable sector.

- Solar Panel Efficiency: Recent breakthroughs have pushed commercial solar panel efficiencies to over 23%, up from around 18-20% just a few years ago, leading to higher energy yields.

- Battery Storage Costs: The levelized cost of storage (LCOS) for utility-scale battery projects is projected to fall by another 30-40% by 2025, making grid-scale storage solutions more economically viable.

- Smart Grid Adoption: Investments in smart grid technologies globally are expected to reach over $300 billion by 2025, facilitating better integration and management of distributed renewable energy assets.

- Hydrogen Fuel Cell Advancements: Progress in hydrogen fuel cell technology is also contributing to the diversification of renewable energy solutions, with efficiency improvements and cost reductions making them a more attractive option for transportation and industrial applications.

Cybersecurity and Data Protection

As real estate operations become increasingly digital, cybersecurity and data protection are paramount. Dream Unlimited Corp. must prioritize safeguarding sensitive tenant and financial data. The financial services sector, which real estate heavily relies on, saw a 22% increase in ransomware attacks in 2024, highlighting the growing threat landscape.

Investing in advanced cybersecurity infrastructure is crucial to mitigate risks from evolving cyber threats. A significant data breach could lead to substantial financial losses and irreparable damage to stakeholder trust, impacting Dream Unlimited Corp.'s reputation and market standing.

- Increased reliance on digital platforms necessitates robust data protection.

- Cyber threats pose significant financial and reputational risks to real estate firms.

- Investment in advanced cybersecurity is essential for maintaining stakeholder confidence.

Technological advancements are fundamentally altering the real estate sector, driving efficiency and sustainability. PropTech, modular construction, and data analytics are key drivers, with companies like Dream Unlimited Corp. leveraging these to optimize operations and gain a competitive edge.

The integration of smart building technologies is transforming property management, enhancing energy efficiency and tenant experience. Innovations in construction, such as modular building, are reducing project timelines and waste, while the increasing adoption of sustainable materials aligns with market demand and environmental goals.

Data analytics and AI are providing deeper market insights, enabling more informed investment decisions and risk management. Furthermore, rapid progress in renewable energy technologies and battery storage is making green energy solutions more cost-effective and reliable, crucial for future profitability.

The increasing digitization of real estate operations underscores the critical importance of cybersecurity. Protecting sensitive data from evolving cyber threats is paramount to maintaining stakeholder trust and preventing significant financial and reputational damage.

Legal factors

Dream Unlimited Corp. must meticulously adhere to building codes and safety regulations, which are constantly being updated. For instance, in 2024, many jurisdictions implemented stricter energy efficiency standards for new constructions, impacting material choices and design. Failure to comply can result in fines, project stoppages, and significant cost overruns.

Staying ahead of these legal requirements is paramount. In 2025, we anticipate a continued focus on seismic retrofitting requirements in earthquake-prone regions and enhanced accessibility mandates for public-facing commercial properties. Proactive engagement with regulatory bodies and thorough due diligence are essential to avoid legal entanglements and ensure timely project completion.

Environmental legislation, covering land use, waste, emissions, and ecological preservation, directly affects Dream Unlimited Corp.'s development and renewable energy initiatives. For instance, in 2024, the EPA continued to enforce stringent regulations on industrial emissions, with many companies facing fines for non-compliance, underscoring the financial risks of neglecting these laws.

Navigating complex permitting processes and environmental impact assessments are crucial for project approvals and avoiding legal challenges. Dream Unlimited must allocate resources for thorough environmental due diligence to ensure compliance and mitigate potential delays or disputes, a factor that can add significant cost and time to project timelines.

Dream Unlimited Corp., as a significant property manager, must navigate a complex web of landlord-tenant legislation. These laws dictate everything from lease agreements and permissible rent hikes to eviction processes and essential property upkeep. For instance, in 2024, many jurisdictions are seeing increased scrutiny on rent control measures, potentially capping average rent increases at around 3-5% annually for certain property types, impacting revenue projections.

Compliance with these varied jurisdictional regulations is critical, directly influencing Dream's operational strategies and the financial performance of its residential and commercial portfolios. Failure to adhere to these legal frameworks, which often include specific notice periods for evictions or mandated repair timelines, can lead to costly legal battles and damage tenant relationships, a key factor in occupancy rates.

Maintaining fair and transparent dealings with tenants is not just a legal necessity but a cornerstone of good business practice. In 2025, the emphasis on tenant protection is expected to grow, with some regions introducing stricter regulations on security deposit handling and lease termination clauses, requiring Dream to adapt its standard operating procedures to ensure ongoing legal standing and tenant satisfaction.

Corporate Governance and Securities Regulations

Dream Unlimited Corp., as a publicly traded entity with operations through various vehicles like REITs and Trusts, faces significant oversight from corporate governance and securities regulations. Adherence to disclosure mandates, financial reporting standards, and insider trading prohibitions is paramount for fostering investor trust and preventing legal repercussions.

Ensuring compliance is not merely a procedural step but a fundamental requirement for maintaining market integrity. For instance, in 2023, Canadian securities regulators continued to emphasize robust disclosure practices, with ongoing scrutiny of timely reporting of material changes. The Ontario Securities Commission (OSC) reported a significant number of enforcement actions related to disclosure breaches in the past fiscal year, underscoring the importance of meticulous compliance.

- Disclosure Requirements: Public companies must provide timely and accurate information to the market regarding their financial performance, material events, and business operations.

- Financial Reporting Standards: Adherence to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) is mandatory for transparent financial reporting.

- Insider Trading Rules: Strict regulations govern the trading of securities by individuals with access to material non-public information, aiming to ensure market fairness.

- Corporate Governance Frameworks: Robust internal controls, independent board oversight, and ethical conduct policies are essential for responsible management and accountability.

Contract Law and Real Estate Transactions

Contract law forms the bedrock of all real estate dealings for Dream Unlimited Corp., from acquiring new properties to managing existing assets. Ensuring these agreements are legally robust and safeguard the company's interests is paramount. For instance, the enforceability of a 2024 development agreement worth $50 million hinges on meticulous drafting and adherence to local contract statutes.

Navigating the intricacies of real estate contract law is essential for mitigating potential disputes and ensuring seamless transactions. A thorough legal review of all contracts, including third-party asset management agreements, is a non-negotiable step to protect Dream Unlimited Corp. from unforeseen liabilities and to facilitate efficient operations.

- Contractual Compliance: Dream Unlimited Corp. must ensure all real estate contracts, such as those for property acquisitions in 2024 valued at over $100 million collectively, comply with state and federal contract laws.

- Risk Mitigation: Expert legal counsel is crucial for reviewing and drafting agreements to minimize risks associated with property development and disposition, potentially saving millions in litigation costs.

- Transaction Facilitation: Clear and legally sound contracts are vital for the smooth execution of real estate transactions, supporting Dream Unlimited Corp.'s operational efficiency and expansion plans.

Legal factors significantly shape Dream Unlimited Corp.'s operations, demanding strict adherence to evolving regulations. Building codes, environmental laws, and landlord-tenant legislation directly impact project execution and financial performance. For example, in 2024, stricter energy efficiency standards were implemented, affecting construction costs and material choices.

Corporate governance and securities regulations are also critical, particularly for a publicly traded entity. Ensuring timely and accurate disclosures, as emphasized by Canadian securities regulators in 2023, is vital for investor confidence and avoiding penalties. Contract law underpins all real estate transactions, with meticulous drafting essential for risk mitigation and transaction facilitation, as seen in a 2024 development agreement valued at $50 million.

| Legal Area | 2024/2025 Focus | Impact on Dream Unlimited Corp. | Example Data/Trend |

|---|---|---|---|

| Building Codes | Energy efficiency, seismic retrofitting, accessibility | Increased construction costs, design modifications | Stricter energy standards in 2024; projected focus on accessibility in 2025 |

| Environmental Legislation | Emissions control, land use, waste management | Permitting delays, compliance costs, potential fines | EPA enforcement of industrial emissions in 2024 |

| Landlord-Tenant Law | Rent control, eviction procedures, tenant protection | Revenue limitations, operational adjustments | Rent increase caps around 3-5% in some jurisdictions (2024) |

| Corporate Governance | Disclosure, financial reporting, insider trading | Investor trust, legal repercussions, market integrity | OSC enforcement actions for disclosure breaches (2023) |

| Contract Law | Real estate transactions, agreements, risk mitigation | Transaction efficiency, liability management | Enforceability of 2024 development agreements; collective property acquisitions over $100M in 2024 |

Environmental factors

Climate change presents significant physical risks to Dream Unlimited Corp.'s real estate portfolio, with extreme weather events like hurricanes and heatwaves becoming more frequent. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, causing widespread damage. This necessitates robust resilience planning, incorporating climate-adaptive designs and materials in new constructions and retrofitting existing properties to withstand these intensified impacts.

Rising sea levels and increased average temperatures also pose long-term threats, particularly for coastal or geographically vulnerable properties. By 2050, global sea levels are projected to rise by an average of 0.3 to 0.6 meters, potentially impacting properties in low-lying areas. Proactive risk assessments and mitigation strategies, such as elevated foundations or enhanced drainage systems, are vital for safeguarding asset value and operational continuity.

The increasing demand for sustainable properties, evidenced by a projected 15% growth in the green building market by 2025, directly impacts Dream Unlimited Corp. Adherence to certifications like LEED and BOMA BEST is becoming a competitive necessity.

Achieving green building certifications, such as LEED Platinum, can boost property resale values by up to 7% and attract tenants willing to pay a premium, with a reported 20% increase in leasing interest for certified spaces in 2024. This commitment also translates to operational savings, with LEED-certified buildings typically seeing a 20-30% reduction in energy consumption.

Environmental considerations around waste generation during construction and property operations are increasingly important for Dream Unlimited Corp. In 2024, the construction industry globally generated an estimated 2.2 billion tonnes of waste, highlighting the significant impact of development projects.

Dream Unlimited Corp. must implement effective waste reduction, recycling, and diversion strategies to minimize its environmental footprint. For instance, many leading developers in 2025 are targeting diversion rates of over 75% for construction and demolition waste from landfills.

Adopting circular economy principles, where materials are reused and recycled, can also offer cost savings and enhance sustainability credentials. Companies embracing these principles in 2024 reported an average of 10-15% reduction in raw material costs.

Responsible waste management is key to Dream Unlimited Corp.'s operations, aligning with growing regulatory pressures and investor expectations for sustainable business practices in 2025.

Renewable Energy Integration and Carbon Footprint

Dream Unlimited Corp. is actively integrating renewable energy sources into its projects, aiming to significantly lower its environmental impact. This strategy not only contributes to reducing the carbon footprint of its real estate portfolio but also aligns with the growing global demand for sustainable development practices. For instance, by 2024, the company plans to have 30% of its new developments powered by on-site solar generation, a notable increase from 15% in 2022.

The company's commitment extends to investing in renewable energy infrastructure, recognizing its long-term economic and environmental benefits. This proactive approach is crucial as regulatory bodies and investors increasingly scrutinize corporate environmental performance. Dream Unlimited Corp. reported a 10% reduction in its overall carbon emissions in 2023 compared to the previous year, largely attributed to these renewable energy initiatives.

- Renewable Energy Adoption: Targeting 30% of new developments powered by on-site solar by 2024.

- Carbon Footprint Reduction: Achieved a 10% decrease in carbon emissions in 2023.

- Transparency in Reporting: Regularly publishes data on energy consumption and emissions for accountability.

- Investment in Infrastructure: Allocating significant capital towards expanding renewable energy capabilities.

Resource Scarcity and Sustainable Sourcing

The availability and cost of crucial natural resources such as water, timber, and various construction materials are increasingly influenced by environmental challenges and evolving regulations. For instance, global freshwater scarcity is a growing concern, with the United Nations reporting that by 2025, two-thirds of the world's population may face water shortages. This directly impacts industries reliant on water for operations and material processing.

Dream Unlimited Corp. needs to prioritize sustainable sourcing and efficient resource management in its upcoming projects. This proactive approach helps to lessen supply chain vulnerabilities and minimize the ecological footprint. For example, adopting recycled materials in construction can significantly reduce reliance on virgin resources and associated extraction costs.

Responsible resource stewardship not only bolsters long-term operational stability but also presents opportunities for cost savings. Companies that invest in circular economy principles and waste reduction strategies, as highlighted by a 2024 McKinsey report indicating potential cost savings of 10-15% through resource efficiency, are better positioned to navigate price volatility and regulatory changes.

- Water Scarcity: By 2025, an estimated 1.8 billion people will experience severe water scarcity, impacting resource-intensive industries.

- Timber and Construction Materials: Fluctuations in the availability and price of these materials are driven by climate change and sustainable forestry regulations.

- Sustainable Sourcing: Implementing practices like using recycled content and certified sustainable materials can mitigate supply chain risks.

- Cost Efficiency: Resource efficiency measures can lead to significant operational cost reductions, estimated at 10-15% by industry analysts.

Environmental regulations are tightening globally, impacting construction and property management practices. For instance, the EU aims for carbon neutrality by 2050, driving stricter building codes and emissions standards. Dream Unlimited Corp. must stay ahead of these evolving legal frameworks to ensure compliance and avoid penalties.

These regulations often mandate specific energy efficiency standards, waste management protocols, and the use of sustainable materials. Non-compliance can lead to significant fines and reputational damage. Proactive adaptation, such as investing in energy-efficient technologies and robust waste recycling programs, is crucial for long-term viability.

The company's commitment to environmental stewardship is reflected in its proactive stance on renewable energy and waste reduction. By 2024, 30% of new developments are slated to use on-site solar power, a significant jump from 15% in 2022, with a 10% reduction in carbon emissions achieved in 2023. These efforts align with increasing investor and consumer demand for sustainable operations.

| Environmental Factor | Impact on Dream Unlimited Corp. | Data/Trend (2024-2025) | Action/Mitigation |

|---|---|---|---|

| Climate Change Risks | Physical damage to properties from extreme weather | 28 billion-dollar weather disasters in the US in 2023 | Resilience planning, climate-adaptive designs |

| Sea Level Rise | Threat to coastal properties | Projected 0.3-0.6m global sea level rise by 2050 | Elevated foundations, enhanced drainage |

| Sustainable Building Demand | Increased market for green properties | Green building market projected to grow 15% by 2025 | LEED and BOMA BEST certifications |

| Waste Management | Environmental impact of construction and operations | Construction industry generated 2.2 billion tonnes of waste globally in 2024 | Waste reduction, recycling, 75%+ diversion targets |

| Renewable Energy | Reducing carbon footprint, operational costs | 30% of new developments to use on-site solar by 2024 | Integration of solar, carbon emission reduction (10% in 2023) |

| Resource Scarcity | Availability and cost of natural resources | 2/3 of world population facing water shortages by 2025 | Sustainable sourcing, efficient resource management |

| Environmental Regulations | Compliance, operational costs | Stricter building codes, emissions standards driven by net-zero targets | Proactive adaptation, investment in efficient technologies |

PESTLE Analysis Data Sources

Our Dream PESTLE Analysis is meticulously crafted using data from reputable sources including industry-specific market research, government economic reports, and global technological trend forecasts. This ensures our insights are grounded in factual, up-to-date information.