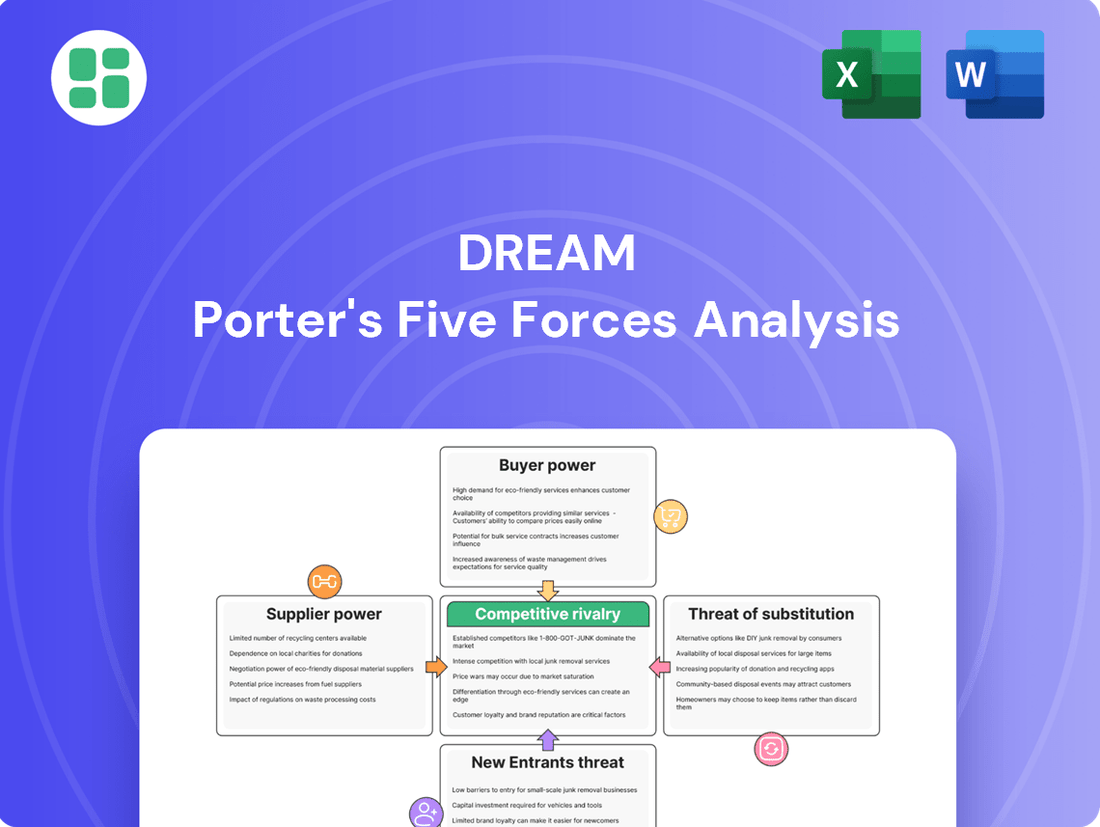

Dream Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dream Bundle

Dream's competitive landscape is shaped by the interplay of five key forces, revealing both opportunities and challenges within its market. Understanding these dynamics is crucial for strategic planning and sustained success.

The complete report reveals the real forces shaping Dream’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Dream Unlimited is significantly influenced by access to prime urban land. In 2024, the cost of desirable land parcels in major Canadian cities, where Dream Unlimited often operates, continued to be a major factor. For instance, average commercial land prices in downtown Toronto saw an increase of approximately 7% year-over-year, reaching over CAD $2,000 per square foot in prime locations.

This scarcity and high demand for urban land, particularly parcels zoned for mixed-use or sustainable development, empower landowners. They can dictate higher prices, directly affecting Dream Unlimited's project feasibility and overall profitability. The ability of landowners to command premium prices due to limited availability in sought-after areas represents a substantial source of supplier power.

Suppliers offering specialized construction materials and technology, particularly those focused on sustainability and innovation, wield significant bargaining power. Dream Unlimited's commitment to developing sustainable urban communities means a reliance on unique eco-friendly components and advanced green technologies, directly enhancing the leverage of these niche providers. For instance, the global green building materials market was valued at approximately $279.4 billion in 2023 and is projected to reach $798.6 billion by 2030, indicating strong demand for specialized, sustainable products.

The scarcity of highly skilled labor in specialized trades, such as advanced construction techniques or sustainable building practices, significantly boosts the bargaining power of suppliers in these areas. For instance, a shortage of certified electricians for smart home installations or experienced geothermal technicians can lead to increased labor costs for developers like Dream Unlimited. In 2024, the U.S. Bureau of Labor Statistics projected a 4% growth in construction laborers, but a much higher demand for specialized roles like solar photovoltaic installers, indicating a potential squeeze on availability for specific expertise.

Financial Institutions and Capital Providers

Financial institutions and capital providers, such as banks and investment funds, hold considerable sway over Dream Unlimited's operations, particularly when it comes to securing project financing. Their decisions on lending terms, interest rates, and overall willingness to fund large-scale, long-term real estate or renewable energy infrastructure projects are paramount. For instance, in early 2024, the Bank of Canada maintained its key interest rate at 5%, a level that significantly influences borrowing costs for developers like Dream Unlimited.

The ability of these capital providers to dictate terms directly impacts Dream Unlimited's capacity to initiate and sustain its ambitious ventures, especially during periods of economic uncertainty. For example, if interest rates rise, the cost of capital increases, potentially making projects less viable or requiring Dream Unlimited to seek more favorable, albeit potentially more restrictive, financing arrangements.

- Lenders' Influence: Banks and other financial institutions determine the availability and cost of debt financing.

- Investor Appetite: The willingness of equity investors to participate in projects shapes Dream Unlimited's funding structure.

- Interest Rate Sensitivity: Dream Unlimited's project feasibility is directly tied to prevailing interest rates, which can fluctuate based on central bank policies.

Renewable Energy Component Manufacturers

Dream Unlimited's reliance on manufacturers for solar panels and wind turbines means these suppliers hold significant bargaining power. Global supply chain disruptions, such as those seen in 2023 affecting polysilicon for solar panels, can increase component costs, impacting Dream Unlimited's project economics. For instance, the average price of solar panels saw fluctuations throughout 2023 due to material availability and shipping costs.

- Supplier Concentration: A limited number of dominant manufacturers for specialized renewable energy components can dictate terms.

- Technological Dependence: Dream Unlimited's need for cutting-edge, efficient components means they may be tied to suppliers with proprietary technology.

- Input Cost Volatility: Fluctuations in raw material prices, like rare earth metals for wind turbine magnets, directly affect component manufacturers' pricing power.

- Market Demand: High global demand for renewable energy components, as projected to grow significantly by 2030, can empower suppliers to raise prices.

Dream Unlimited faces significant supplier power from landowners in prime urban locations, particularly in markets like Toronto where land costs rose approximately 7% year-over-year in 2024. Specialized providers of sustainable building materials and advanced construction technologies also hold leverage due to growing demand, with the green building materials market projected to reach $798.6 billion by 2030. Furthermore, the scarcity of skilled labor in specialized construction trades, coupled with volatile input costs for renewable energy components, allows these suppliers to command higher prices, impacting project profitability.

| Supplier Category | Key Influencing Factors | Impact on Dream Unlimited | Relevant Data (2024/2023) |

|---|---|---|---|

| Urban Landowners | Scarcity, High Demand, Zoning | Increased acquisition costs, reduced project feasibility | Toronto commercial land prices up ~7% YoY |

| Sustainable Materials & Tech Providers | Specialization, Innovation, Market Demand | Higher component costs, reliance on niche suppliers | Green building materials market: $279.4B (2023) |

| Specialized Labor Providers | Skill Shortages, Demand for Expertise | Elevated labor costs for specific trades | Projected 4% growth in construction laborers (US BLS) |

| Renewable Energy Component Manufacturers | Supply Chain Disruptions, Input Cost Volatility | Fluctuating component prices, potential project delays | Solar panel price volatility in 2023 |

What is included in the product

This analysis evaluates the five competitive forces impacting Dream, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly visualize competitive intensity with a dynamic, interactive threat matrix, simplifying complex industry dynamics for confident strategic planning.

Customers Bargaining Power

In 2024, the residential real estate market experienced varied conditions. For instance, while some areas saw a slight increase in housing inventory, leading to more negotiation room for buyers, others remained highly competitive with low supply. This dynamic directly impacts how much leverage customers have when purchasing or renting properties.

Commercial real estate in 2024 presented a mixed bag. With office vacancy rates still adjusting post-pandemic in many urban centers, tenants often found themselves with greater bargaining power. Conversely, sectors like logistics and industrial real estate continued to show strong demand, limiting customer leverage due to tight supply.

Interest rates, a key factor influencing purchasing power, remained a significant consideration throughout 2024. Fluctuations in mortgage rates, for example, could either empower buyers with more affordable financing or constrain them, thereby shifting the balance of negotiation power between sellers and customers in all real estate segments.

When potential buyers or renters have many similar housing options from competing developers, their ability to negotiate prices or terms increases significantly. This is a key aspect of customer bargaining power. For instance, in 2024, the Canadian housing market saw a notable increase in new housing starts in major urban centers, providing more choices for consumers and potentially boosting their leverage.

Institutional investors, a key customer segment for Dream Unlimited's various investment vehicles, are highly sophisticated. Their deep understanding of financial markets and significant capital deployment capabilities mean they can negotiate favorable terms, including lower management fees and higher expected returns. For instance, as of late 2024, institutional investors collectively manage trillions of dollars, giving them substantial leverage in deal-making across the real estate and alternative investment sectors.

Price Sensitivity of End-Users

The price sensitivity of residential purchasers and renters, along with commercial and industrial tenants, significantly shapes Dream Unlimited's pricing strategies. In today's competitive real estate landscape, buyers and tenants are increasingly discerning, actively seeking the best value for their investment or rental dollar. This forces developers like Dream Unlimited to adopt more competitive pricing models or differentiate their offerings with superior features and amenities to capture and maintain market share.

For instance, in 2024, the average price per square foot for new residential properties in major Canadian markets, where Dream Unlimited often operates, remained a key consideration for buyers. Fluctuations in interest rates and overall economic conditions further amplify this sensitivity. Developers must carefully balance construction costs, desired profit margins, and market demand to set prices that are both attractive to customers and sustainable for the business.

- Price Sensitivity: Residential buyers and renters, as well as commercial and industrial tenants, are highly attuned to pricing, influencing Dream Unlimited's sales and leasing strategies.

- Competitive Markets: In areas with numerous development options, customers can easily compare offerings, compelling developers to offer competitive pricing or added value.

- Value Proposition: Dream Unlimited must ensure its projects provide a strong value proposition, whether through price, quality, location, or unique features, to attract and retain customers.

- Market Dynamics: Economic conditions and interest rate changes in 2024 directly impacted the affordability and purchasing power of potential Dream Unlimited customers.

Demand for Sustainable and Impact Investments

The increasing demand for sustainable and impact investments can shift bargaining power. While Dream Unlimited might attract a dedicated customer base for these offerings, the overall market size for genuinely sustainable properties or impact-focused projects plays a crucial role. If this niche market remains relatively small, customers within it may indeed wield greater influence due to fewer alternative options.

For instance, a 2024 report by the Global Sustainable Investment Alliance indicated that sustainable investments globally reached $37.4 trillion in 2022, showing a significant, albeit concentrated, growth. This suggests that while the trend is strong, the depth of truly impactful and sustainable options within specific real estate sectors could still empower discerning buyers.

- Market Size: The total value of sustainable investments globally reached $37.4 trillion in 2022, indicating a growing but potentially concentrated market for specialized offerings.

- Customer Leverage: If the supply of genuinely sustainable or impact-focused properties is limited relative to this demand, customers in this segment may possess increased bargaining power.

- Niche Appeal: Dream Unlimited's focus can attract a specific customer segment, but the broader market availability of similar investments will ultimately dictate the extent of their customers' leverage.

Customers hold significant sway when they have numerous choices or when switching costs are low. In 2024, the abundance of housing options in certain Canadian markets, like those experiencing increased housing starts, empowered buyers to negotiate better terms. Conversely, in high-demand sectors such as logistics, limited supply meant customers had less leverage.

| Market Segment | Customer Bargaining Power (2024) | Key Factors |

|---|---|---|

| Residential Real Estate (Canada) | Moderate to High (Varies by Location) | Increased housing inventory in some areas; fluctuating interest rates impacting affordability. |

| Commercial Real Estate (Office) | High (in many urban centers) | Elevated vacancy rates post-pandemic leading to tenant leverage. |

| Industrial/Logistics Real Estate | Low | Strong demand and tight supply limiting customer negotiation power. |

| Institutional Investors | Very High | Significant capital, market sophistication, and ability to negotiate fees and returns. |

Preview the Actual Deliverable

Dream Porter's Five Forces Analysis

This preview showcases the complete Dream Porter's Five Forces Analysis, offering a comprehensive examination of industry competitive forces. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this detailed strategic tool, ready for immediate application to your business needs.

Rivalry Among Competitors

The Canadian real estate development and management landscape is quite crowded. It's a mix of many small local businesses, larger regional companies, and even national giants. Dream Unlimited faces competition from both publicly traded corporations and privately held entities across all its business areas.

This fragmentation means Dream Unlimited is up against a broad spectrum of competitors vying for the same resources. They compete for prime land, for the chance to develop new projects, and ultimately, for the attention and business of customers in various markets.

For instance, in 2023, the Canadian housing market saw significant activity, with over 2.1 million housing starts projected by CMHC, indicating a robust development environment where numerous builders and developers are actively engaged.

In mature real estate markets, competition often intensifies as companies compete for a finite number of profitable ventures. The overall growth rate of the Canadian real estate market, which experienced a 5.8% increase in housing starts in 2023 according to CMHC, directly influences how fiercely developers and investors battle for market share.

Dream Unlimited's ability to stand out through unique property designs, eco-friendly elements, and a focus on building vibrant urban communities directly influences the intensity of competition. For example, in 2024, the company continued to emphasize its commitment to sustainability, with a significant portion of its new developments incorporating green building certifications, aiming to attract environmentally conscious buyers and tenants.

While Dream Unlimited strives for unique offerings, the real estate market is crowded with competitors also vying for market share by providing value-added services and distinct selling points. Many developers in 2024 were actively promoting smart home technology integration and flexible living spaces as key differentiators, making it crucial for Dream Unlimited to maintain its innovative edge.

High Fixed Costs and Exit Barriers

The real estate development sector, where Dream Porter operates, is characterized by significant upfront investments in land acquisition, construction, and infrastructure. These substantial fixed costs, coupled with lengthy project timelines, create formidable exit barriers. Companies often find themselves committed to seeing projects through, even when market conditions sour, to recoup their initial capital outlay.

This commitment can fuel intense competition. During economic downturns, developers may resort to aggressive pricing strategies or push more inventory onto an already saturated market to maintain cash flow and occupancy rates. This dynamic directly escalates rivalry as firms compete fiercely for buyers and tenants, often sacrificing profit margins to simply survive.

- High Capital Intensity: Projects often require hundreds of millions, if not billions, of dollars in upfront capital. For instance, a single large-scale mixed-use development can easily exceed $500 million in development costs.

- Long Project Lifecycles: From planning and zoning to construction and sales, a major real estate project can take 3-7 years or more to complete, locking in capital for extended periods.

- Exit Barriers: Once construction begins, abandoning a project can lead to significant financial penalties, loss of permits, and reputational damage, making completion the less costly option.

- Market Saturation Risk: In 2024, many major urban markets experienced a slowdown in demand, leading to increased vacancy rates in commercial properties, forcing developers to compete more aggressively on price.

Competition for Capital and Acquisitions

Dream Unlimited faces intense competition not just for its housing units but also for crucial financial resources. This includes vying for investor capital, which is essential for funding new projects and expansion. In 2024, the real estate development sector saw significant competition for funding as interest rates remained elevated, potentially increasing the cost of capital for companies like Dream Unlimited.

Furthermore, the pursuit of attractive acquisition targets such as prime land parcels, income-generating existing properties, and renewable energy projects is a fierce battleground. Other developers, private equity firms, and large institutional investors are all actively seeking these opportunities. This competition directly influences the availability and price of these key assets, impacting Dream Unlimited's strategic growth options.

- Investor Capital: Competition for capital intensifies when market conditions are uncertain, as seen in 2024, where access to financing became a critical differentiator for developers.

- Acquisition Targets: The scarcity of desirable land in growth corridors means developers like Dream Unlimited must offer competitive bids, often driving up acquisition costs.

- Renewable Energy Projects: As sustainability becomes a key investment criterion, competition for viable renewable energy projects, which Dream Unlimited is exploring, is also increasing.

Dream Unlimited operates in a highly competitive Canadian real estate market, facing rivalry from numerous small, regional, and national players. This intense competition extends to securing prime land, developing projects, and attracting customers, as evidenced by the 2.1 million housing starts projected in Canada for 2023, indicating a crowded development environment.

The high capital intensity and long project lifecycles in real estate create significant exit barriers, forcing companies to compete fiercely, even during market downturns, often through aggressive pricing. For example, a single large development can cost over $500 million, and projects can take 3-7 years to complete.

Competition also extends to securing financial resources and acquisition targets, with companies like Dream Unlimited vying for investor capital and desirable properties against private equity and institutional investors. In 2024, elevated interest rates further intensified the competition for financing.

| Competitive Factor | Description | 2023/2024 Relevance |

|---|---|---|

| Market Fragmentation | Numerous small, regional, and national competitors | High intensity across all business segments |

| Capital Intensity & Exit Barriers | Large upfront investments, long project timelines | Forces commitment and can lead to price competition |

| Competition for Capital | Vying for investor funding | Intensified in 2024 due to elevated interest rates |

| Competition for Assets | Bidding for land and properties | Drives up acquisition costs for desirable locations |

SSubstitutes Threaten

For residential properties, substitutes like renting, co-living, or living outside major urban centers pose a threat to Dream Unlimited. In 2024, the rental market continued to be a strong alternative, with average rents in major Canadian cities like Toronto and Vancouver seeing increases of 8-12% year-over-year, making ownership a less accessible option for some.

Economic conditions and shifting lifestyle preferences further fuel this threat. Many individuals, particularly younger demographics, prioritize flexibility and affordability, leading them to embrace renting or exploring more communal living arrangements rather than committing to traditional homeownership in areas where Dream primarily operates.

The increasing prevalence of remote work presents a significant threat of substitutes for traditional commercial office spaces. As more companies embrace flexible work arrangements, the demand for physical office leases diminishes, impacting portfolios like Dream Unlimited's. For instance, by the end of 2023, a significant portion of the workforce continued to work remotely at least part-time, a trend that shows no signs of reversing.

Furthermore, the robust expansion of e-commerce offers a compelling substitute for brick-and-mortar retail. Consumers increasingly prefer the convenience of online shopping, leading to reduced foot traffic and sales in physical stores. This shift directly affects the demand for Dream Unlimited's retail properties, as evidenced by the continued growth in online sales, which accounted for over 20% of total retail sales in many developed economies by early 2024.

Investors seeking returns beyond real estate investment trusts (REITs) like Dream Impact Trust, Dream Office REIT, or Dream Industrial REIT have a wide array of alternative investment vehicles. These include traditional stocks and bonds, which offer varying levels of risk and liquidity. For instance, as of Q1 2024, the S&P 500 index had returned approximately 10% year-to-date, presenting a competitive alternative to REIT yields.

Private equity and venture capital also serve as significant substitutes, particularly for investors willing to lock up capital for longer periods in exchange for potentially higher returns. In 2023, global private equity fundraising reached over $1 trillion, indicating substantial capital allocation to these sectors, diverting funds that might otherwise flow into REITs.

Furthermore, direct investments in other asset classes such as commodities, cryptocurrencies, or even direct real estate ownership (outside of REIT structures) represent further substitutes. The global alternative assets market was valued at an estimated $13.9 trillion in 2023, demonstrating the breadth of options available to investors and the constant pressure on REITs to remain competitive in attracting capital.

Diversification of Energy Sources

While Dream Unlimited focuses on renewable energy infrastructure, a significant threat comes from the diversification of energy sources. Consumers and industries might shift their energy consumption patterns towards other alternatives or embrace enhanced energy efficiency measures, bypassing the need for the specific renewable assets Dream invests in.

Technological breakthroughs in energy storage, such as advancements in battery technology or hydrogen fuel cells, could offer viable substitutes. For instance, by mid-2024, global investment in energy storage solutions was projected to reach hundreds of billions of dollars, indicating a strong potential for these technologies to disrupt traditional energy models.

- Energy Efficiency Gains: Increased adoption of energy-saving technologies and practices can reduce overall demand for electricity, impacting the volume of renewable energy required.

- Technological Advancements: Innovations in areas like advanced nuclear fission, fusion energy, or even more efficient fossil fuel extraction could emerge as competitive alternatives.

- Grid Modernization: Smarter grids and decentralized energy systems might allow for greater integration of diverse, smaller-scale energy sources, potentially diminishing reliance on large-scale renewable projects.

Self-Development or In-house Property Management

For large corporations or institutional clients, the ability to manage their real estate portfolios internally presents a significant substitute for third-party property management services. This in-house capability can reduce reliance on external providers like Dream Unlimited, especially for core property management functions.

This threat is amplified as companies increasingly invest in sophisticated property management software and hire dedicated internal teams. For instance, a 2024 report indicated that over 60% of large real estate investment trusts (REITs) have expanded their in-house asset and property management divisions to gain greater control and potentially lower operational costs.

- Cost Savings: In-house management can sometimes offer cost efficiencies by eliminating third-party fees, though this depends on the scale and complexity of the portfolio.

- Control and Customization: Companies can tailor property management strategies precisely to their specific business objectives and brand standards.

- Strategic Integration: Managing properties internally allows for tighter integration with overall corporate strategy and financial planning.

The threat of substitutes for Dream Unlimited's residential properties is significant, with renting and co-living arrangements offering greater flexibility and affordability, especially for younger demographics. In 2024, rising rental costs in major Canadian cities, like the 8-12% year-over-year increases seen in Toronto and Vancouver, further pushed potential buyers towards renting.

In the commercial real estate sector, the increasing adoption of remote and hybrid work models by companies directly substitutes the need for traditional office spaces. By the end of 2023, a substantial portion of the workforce continued to work remotely, a trend that is expected to persist, impacting demand for Dream's office portfolio.

The retail segment faces a strong substitute in e-commerce, as consumers increasingly opt for the convenience of online shopping. This shift has led to reduced foot traffic in physical stores, a trend supported by online sales accounting for over 20% of total retail sales in developed economies by early 2024.

For investors, alternative assets like stocks, bonds, private equity, and direct real estate investments serve as substitutes for REITs. For example, the S&P 500's approximate 10% year-to-date return in Q1 2024 offered a competitive alternative to REIT yields, while global private equity fundraising exceeding $1 trillion in 2023 highlighted significant capital diversion.

| Property Type | Substitute | 2024 Trend/Data Point | Impact on Dream Unlimited |

|---|---|---|---|

| Residential | Renting, Co-living | 8-12% YoY rent increase in Toronto/Vancouver | Reduced demand for ownership, increased rental appeal |

| Commercial Office | Remote/Hybrid Work | Continued significant remote workforce participation | Decreased demand for physical office leases |

| Retail | E-commerce | Online sales >20% of total retail sales | Reduced foot traffic and sales in physical stores |

| Real Estate Investments (REITs) | Stocks, Bonds, Private Equity | S&P 500 ~10% YTD return (Q1 2024) | Competition for investor capital |

Entrants Threaten

Entering sectors like large-scale real estate development or renewable energy infrastructure requires immense upfront capital. For instance, a major urban community development project might necessitate hundreds of millions, if not billions, of dollars in initial investment for land acquisition, planning, and construction. This financial hurdle alone prevents many aspiring developers or investors from even considering entry.

The real estate sector is a minefield of regulations, from intricate zoning laws and environmental impact studies to stringent building codes and a labyrinth of permits. For instance, in 2024, the average time to obtain a building permit in major US cities often exceeded 6-12 months, with some projects facing even longer delays due to complex reviews.

Successfully navigating these regulatory complexities demands specialized legal and technical expertise, significant financial investment, and considerable time. New entrants lacking this deep understanding and established relationships with regulatory bodies face a substantial barrier to entry, making it difficult to launch operations efficiently.

Securing prime land in bustling urban centers is a significant hurdle for newcomers. Established developers like Dream Unlimited often have an advantage due to their deep-rooted connections with landowners and local government officials, making it tough for new players to acquire desirable plots.

In 2024, the average price per square foot for prime residential land in major Canadian cities like Toronto continued to be exceptionally high, often exceeding CAD $1,000, presenting a substantial capital barrier. New entrants find it difficult to match the access to land banks and the established reputation that companies like Dream Unlimited have cultivated over years.

Brand Reputation and Customer Trust

Brand reputation and customer trust are formidable barriers to entry in the real estate sector. Dream Unlimited has cultivated a strong reputation over its long history, associated with quality construction, sustainable practices, and consistent on-time project delivery. This established trust makes it challenging for newcomers to quickly gain market acceptance and attract the same level of buyer, tenant, and investor confidence.

New entrants face significant hurdles in replicating the deep-seated trust that established players like Dream Unlimited command. For instance, in 2024, customer satisfaction surveys consistently showed that established developers with a proven track record, like Dream Unlimited, received higher ratings for reliability and overall experience compared to newer, less-tested entities. This trust translates directly into sales velocity and investor interest, creating a steep climb for any new competitor.

- Established Trust: Dream Unlimited's long-standing presence and consistent delivery of quality projects have built significant brand equity.

- Customer Loyalty: Repeat business and positive word-of-mouth from satisfied customers act as a deterrent to new entrants.

- Perceived Risk: Buyers and investors often perceive new entrants as carrying a higher risk profile compared to developers with a history of successful projects.

- Market Acceptance: Building comparable market acceptance and brand recognition takes considerable time and investment, a challenge for new real estate companies.

Expertise in Specialized Segments

Dream Unlimited's commitment to sustainable urban development, impact investing, and renewable energy infrastructure presents a significant barrier to new entrants due to the specialized expertise required. This niche knowledge spans areas such as green building certifications, intricate community engagement processes, and the complex financial structuring necessary for impact-driven projects.

Developing this level of specialized acumen can be a lengthy and costly undertaking for potential competitors. For instance, navigating the intricacies of obtaining LEED Platinum certification for large-scale urban projects, a key aspect of sustainable development, demands a deep understanding of environmental science, engineering, and regulatory frameworks. Similarly, securing financing for renewable energy infrastructure, which often involves long-term power purchase agreements and specific tax equity structures, requires financial expertise not readily available in the broader market.

- Niche Expertise Required: Green building, community planning, and impact investment structuring are critical for Dream Unlimited's model.

- Barrier to Entry: Newcomers must invest heavily in acquiring or developing this specialized knowledge.

- Cost and Time Investment: Building proficiency in areas like LEED certification and renewable energy finance is resource-intensive.

- Competitive Advantage: Dream Unlimited's established expertise in these specialized segments creates a formidable hurdle for potential rivals.

The threat of new entrants in the real estate sector, particularly for companies like Dream Unlimited, is significantly mitigated by high capital requirements and complex regulatory environments. For instance, in 2024, the average cost to develop a mid-sized residential project could easily run into tens of millions of dollars, a substantial barrier for smaller firms. Furthermore, navigating zoning laws, building permits, and environmental assessments, which can take over a year in some major markets as of 2024, demands specialized expertise and resources that newcomers often lack.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including public company filings, market research reports from leading firms, and industry-specific trade publications. This comprehensive approach ensures a robust understanding of competitive dynamics.