Dow SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dow Bundle

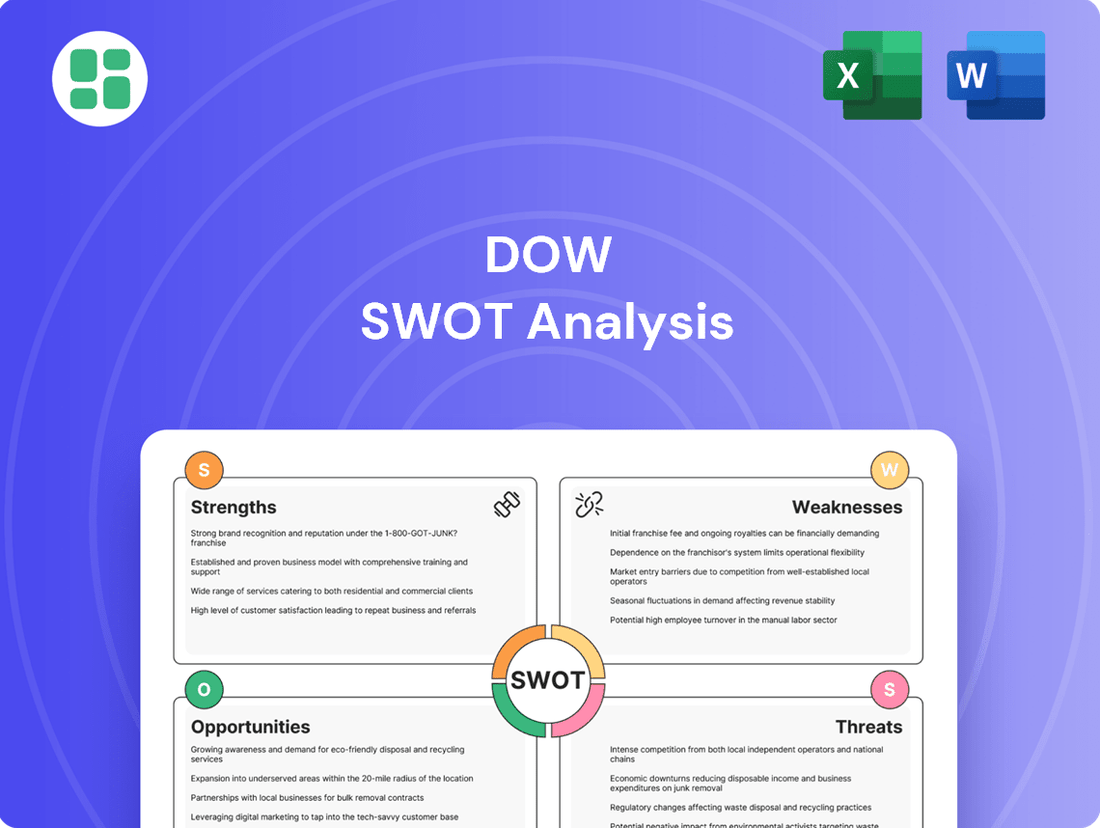

While the Dow Jones Industrial Average boasts immense brand recognition and a diversified portfolio, understanding its true market position requires a deeper dive. Our comprehensive SWOT analysis reveals the intricate web of its strengths, the subtle weaknesses, the burgeoning opportunities, and the critical threats that shape its future.

Ready to unlock the full strategic picture? Purchase our complete SWOT analysis to gain actionable insights, expert commentary, and an editable format perfect for investors, analysts, and strategists looking to navigate the complexities of the market.

Strengths

Dow's strength lies in its remarkably diverse and integrated product portfolio. This breadth, covering everything from plastics and industrial intermediates to coatings and silicones, ensures its materials are fundamental across numerous vital sectors such as packaging, infrastructure, consumer goods, and automotive. This strategic diversification significantly mitigates risk by lessening reliance on any single market, thereby fostering greater financial stability.

The company's organizational structure, divided into key segments like Performance Materials & Coatings, Industrial Intermediates & Infrastructure, and Packaging & Specialty Plastics, is a testament to its ability to effectively target and serve high-growth market opportunities. For example, in the first quarter of 2024, Dow reported net sales of $10.6 billion, with its Packaging & Specialty Plastics segment contributing a substantial $5.2 billion, highlighting the segment's significant role in the company's overall performance and its reach into critical growth areas.

Dow's global presence is a significant strength, with operations spanning over 98 manufacturing sites across 31 countries. This extensive network allows Dow to effectively serve a diverse customer base worldwide and capitalize on regional market trends, bolstering its competitive position. In 2023, Dow reported net sales of $47.0 billion, underscoring the scale of its global operations and market penetration.

Dow demonstrates a robust commitment to sustainability and innovation, with over 90% of its research and development portfolio geared towards ambitious 2025 Sustainability Goals. These goals encompass critical areas such as fostering a circular economy, actively protecting the climate, and developing safer materials for consumers and the environment.

The company is making significant investments in pioneering sustainable chemistry, exemplified by initiatives like Path2Zero, which targets achieving net-zero carbon emissions. Furthermore, Dow is expanding its range of circular economy products, such as the REVOLOOP line, to meet increasing market demand for environmentally conscious solutions.

This strategic focus on sustainability not only aligns with evolving customer preferences but also positions Dow to potentially secure a notable competitive advantage in the marketplace by offering innovative, eco-friendly products and processes.

Robust R&D and Technological Leadership

Dow's commitment to research and development is a cornerstone of its strength, with substantial investments fueling its technological leadership. The company actively leverages its deep expertise in chemistry and materials science to create unique products and solutions that address complex market demands. This focus on innovation is not just theoretical; Dow has been honored with numerous Edison Awards, recognizing its forward-thinking strategies, including the integration of artificial intelligence to expedite research and development cycles and enhance product creation.

For instance, in 2023, Dow reported approximately $2.5 billion in R&D spending, a testament to its dedication to staying at the forefront of materials science. This continuous pipeline of innovation allows Dow to not only maintain its competitive edge but also to proactively adapt to shifting industry trends and customer requirements, ensuring its continued relevance and leadership in the global marketplace.

Key aspects of Dow's R&D and technological leadership include:

- Significant R&D Investment: Dow consistently allocates substantial resources to research and development, underpinning its innovation strategy.

- Edison Award Recognition: The company has received multiple Edison Awards, highlighting its success in developing pioneering solutions, including AI-driven advancements.

- Materials Science Expertise: Dow's core strength lies in its profound understanding and application of chemistry and materials science to create differentiated offerings.

- Adaptability and Market Responsiveness: Continuous innovation enables Dow to effectively respond to evolving market needs and maintain its leadership position.

Financial Discipline and Shareholder Returns

Dow has shown strong financial discipline, even with economic headwinds. They've focused on cutting costs and selling off non-core assets, which really helps their financial health and cash generation. For example, in the first quarter of 2024, Dow reported adjusted EBITDA of $2.5 billion, demonstrating operational efficiency despite market fluctuations.

This financial prudence translates directly into rewarding shareholders. Dow has a history of consistent dividend payments and share buybacks, making it a solid choice for investors seeking income. In 2023, the company returned approximately $4.1 billion to shareholders through dividends and share repurchases, underscoring this commitment.

- Consistent Dividend Payments: Dow's reliable dividend payouts appeal to income-oriented investors.

- Share Repurchase Programs: Buybacks enhance shareholder value by reducing the number of outstanding shares.

- Cost Management Initiatives: Ongoing efforts to control expenses improve profitability and cash flow.

- Strategic Asset Optimization: Divestitures of non-essential assets strengthen the balance sheet and focus resources.

Dow's integrated business model, spanning diverse chemical and materials segments, provides significant resilience. This integration allows for operational efficiencies and a broad market reach, as evidenced by its substantial sales across various sectors. The company's strategic segmentation, such as the strong performance of its Packaging & Specialty Plastics division, which contributed $5.2 billion in net sales in Q1 2024, highlights its ability to capitalize on key growth areas.

Dow's extensive global footprint, with operations in 31 countries, is a critical strength, enabling it to serve a wide customer base and adapt to regional market dynamics. This global presence is reflected in its 2023 net sales of $47.0 billion, demonstrating significant market penetration and operational scale.

A strong commitment to innovation and sustainability underpins Dow's competitive advantage. With over 90% of its R&D focused on 2025 Sustainability Goals and significant investments in areas like circular economy products, Dow is positioning itself for future growth and market leadership. This dedication is further validated by its consistent recognition through Edison Awards for its pioneering solutions.

Dow's financial discipline is a key strength, characterized by effective cost management and strategic asset optimization. The company's ability to generate strong adjusted EBITDA, such as $2.5 billion in Q1 2024, despite market volatility, showcases its operational efficiency. Furthermore, Dow's commitment to shareholder returns, including approximately $4.1 billion distributed in 2023 through dividends and buybacks, enhances its appeal to investors.

| Metric | Value (Q1 2024) | Value (2023) | Significance |

|---|---|---|---|

| Net Sales | $10.6 Billion | $47.0 Billion | Demonstrates broad market reach and scale of operations. |

| Packaging & Specialty Plastics Sales | $5.2 Billion | N/A | Highlights a key growth segment's contribution. |

| Adjusted EBITDA | $2.5 Billion | N/A | Indicates strong operational efficiency and profitability. |

| Shareholder Returns | N/A | $4.1 Billion | Underscores commitment to rewarding investors. |

What is included in the product

Delivers a strategic overview of Dow’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing competitive weaknesses.

Weaknesses

Dow's reliance on raw materials and energy makes it vulnerable to price swings. For instance, in the first quarter of 2024, elevated natural gas prices, a key feedstock, directly pressured Dow's margins in its Europe, Middle East, and Africa segment, impacting its ability to maintain stable profitability.

Dow's financial health is significantly influenced by the broader economic climate, and current trends show a weakening market demand, especially in Europe and China. This global economic slowdown poses a direct threat to the company's revenue streams.

A prolonged recession or even a mild economic downturn can severely impact key sectors that rely on Dow's products, such as the construction industry, which is a major contributor to their sales. This could lead to reduced volumes and pressure on profit margins.

For instance, in the first quarter of 2024, Dow reported a decline in sales, partly attributed to softer demand in its Packaging & Specialty Plastics segment, reflecting these macroeconomic headwinds.

The chemical industry, by its very nature, demands substantial investment in operational infrastructure and rigorous adherence to a complex web of regulations. For Dow, this translates into significant expenses related to safety protocols, environmental monitoring, and waste management, all of which are subject to federal, state, local, and international oversight. These ongoing compliance costs can directly impact profit margins and reduce the company's capacity for reinvestment or strategic financial maneuvering.

Challenges with Persistent Chemicals and Regulatory Scrutiny

Dow faces significant challenges due to its historical and current product portfolio, particularly concerning persistent chemicals like PFAS. These substances are under increasing regulatory pressure globally, leading to potential fines and restrictions. For instance, by the end of 2024, several US states are expected to implement new PFAS regulations, impacting product formulations and market access.

The company is also navigating a landscape of high-profile lawsuits related to PFAS contamination, which can result in substantial legal costs and reputational damage. Consumer awareness regarding the potential health and environmental impacts of these chemicals is also on the rise, creating a demand for safer alternatives. This shift necessitates considerable investment in research and development to create and market new, sustainable chemical solutions, potentially impacting profit margins in the short to medium term.

- Regulatory Tightening: Increased governmental scrutiny on PFAS chemicals, with potential for new bans and stricter usage limits in 2024-2025.

- Litigation Risks: Ongoing legal battles and potential for future lawsuits concerning environmental and health impacts of persistent chemicals.

- Consumer Demand for Alternatives: Growing market preference for products free from PFAS, pushing Dow to accelerate development of safer substitutes.

- R&D Investment Needs: Significant capital allocation required to innovate and transition away from legacy chemical formulations.

Competitive Pressures and Market Share Fluctuations

Dow faces significant competitive pressures in the chemical industry, with major rivals such as BASF and DuPont constantly vying for market share. This intense rivalry can lead to pricing challenges and impact sales volumes. For instance, Dow reported a slight dip in revenue and a marginal loss of market share in the second quarter of 2025 when juxtaposed with some of its key competitors, highlighting the dynamic nature of its market position.

The company's market share can fluctuate due to the strategic moves and product innovations of its competitors. In the first half of 2025, while Dow maintained its overall standing, certain specialized segments saw increased competition, leading to a more fragmented market share distribution among top players.

- Intense Rivalry: Dow competes directly with global chemical giants like BASF, DuPont, and LyondellBasell.

- Pricing Pressures: Strong competition often translates into pressure on product pricing, affecting profit margins.

- Market Share Dynamics: Dow experienced a slight erosion of market share in Q2 2025 compared to select competitors, indicating the need for continuous strategic adaptation.

Dow's profitability is susceptible to fluctuations in raw material and energy costs, as seen in Q1 2024 when higher natural gas prices impacted margins. The company's performance is also tied to the broader economic climate, with softening demand in key markets like Europe and China posing a threat to revenue, as evidenced by a Q1 2024 sales decline in its Packaging & Specialty Plastics segment.

The chemical industry's capital-intensive nature and stringent regulatory environment contribute to significant compliance costs for Dow, affecting reinvestment capacity. Furthermore, Dow faces challenges related to its PFAS product portfolio, with increasing regulatory scrutiny and potential litigation, as several US states are expected to implement new PFAS regulations by the end of 2024.

Intense competition from rivals like BASF and DuPont creates pricing pressures and can lead to market share shifts, as indicated by a slight revenue dip and market share loss in Q2 2025 compared to some competitors. This dynamic market requires continuous strategic adaptation to maintain its competitive edge.

| Weakness | Description | Example/Impact |

|---|---|---|

| Raw Material & Energy Volatility | Dependence on volatile commodity prices. | Q1 2024: Elevated natural gas prices pressured margins in EMEA segment. |

| Economic Sensitivity | Vulnerability to global economic downturns. | Q1 2024: Softer demand in Packaging & Specialty Plastics contributed to sales decline. |

| Regulatory & Compliance Costs | High expenses for safety, environmental monitoring, and waste management. | Ongoing costs impact profit margins and reinvestment capacity. |

| PFAS Product Challenges | Regulatory pressure and litigation risks associated with persistent chemicals. | Anticipated new state regulations by end of 2024; ongoing lawsuits. |

| Intense Competition | Rivalry with major chemical companies impacting pricing and market share. | Slight market share erosion noted in Q2 2025 compared to select competitors. |

What You See Is What You Get

Dow SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global push for sustainability is accelerating, with consumers and businesses alike prioritizing products that minimize environmental impact and embrace circular economy principles. This growing demand presents a significant opportunity for companies like Dow.

Dow is strategically positioned to leverage this trend through substantial investments in sustainability initiatives. For instance, their Path2Zero project aims to achieve net-zero Scope 1 and 2 emissions by 2050, demonstrating a commitment to lower-carbon production. Furthermore, the acquisition of Circulus, a mechanical recycler, directly addresses the circular economy demand by enabling the production of high-performance circular resins, offering customers tangible solutions for their sustainability goals.

Dow is well-positioned to capitalize on expansion opportunities within emerging and high-growth markets. The company's strategic alignment with key sectors like new energy, environmental protection, and advanced electronics directly taps into robust global demand. For instance, the global market for advanced electronics is projected to reach over $1 trillion by 2025, offering significant growth avenues for Dow's specialized materials.

Furthermore, Dow's focus on market verticals such as packaging, infrastructure, mobility, and consumer applications aligns with strong underlying demand trends. The global packaging market alone was valued at approximately $1 trillion in 2024 and is expected to grow steadily, driven by e-commerce and sustainable packaging solutions. This strategic focus allows Dow to leverage its material science expertise to meet evolving consumer and industrial needs in these dynamic sectors.

Dow's commitment to technological advancement, highlighted by its Edison Awards, creates significant opportunities. Continued investment in areas like advanced robotics and AI allows Dow to speed up research and development, making production more efficient and bringing new products to customers quicker. This focus on innovation is crucial for staying ahead.

Strategic Partnerships and Collaborations

Dow actively pursues strategic partnerships across public, private, academic, and non-governmental sectors. These collaborations are crucial for tackling global issues and furthering the company's sustainability objectives. For instance, a recent collaboration with Macquarie Asset Management for Diamond Infrastructure Solutions aims to optimize existing assets and explore novel business models, thereby enhancing financial flexibility and opening new avenues for growth.

These strategic alliances provide Dow with access to new technologies, markets, and expertise, accelerating innovation and market penetration. By joining forces with entities that share its vision, Dow can leverage combined strengths to develop more effective solutions for complex challenges, such as circular economy initiatives and carbon reduction. Such partnerships are vital for navigating the evolving landscape of the chemical industry and maintaining a competitive edge.

- Focus on Sustainability: Partnerships are key to achieving Dow's ambitious sustainability targets, including its 2030 climate protection goals and net-zero aspirations.

- Asset Optimization: Collaborations like the one with Macquarie Asset Management help Dow unlock value from its existing infrastructure and explore new revenue streams.

- Innovation Acceleration: By working with diverse organizations, Dow can speed up the development and deployment of cutting-edge materials and technologies.

- Market Access: Strategic alliances can open doors to new geographic regions and customer segments, expanding Dow's global reach.

Asset Optimization and Portfolio Streamlining

Dow's strategic asset review, including its European operations, presents a significant opportunity to streamline its portfolio. By divesting or optimizing underperforming assets, the company can redirect capital towards more profitable and growth-oriented segments. This focus is crucial for enhancing long-term competitiveness.

The company's commitment to reducing capital expenditures (CapEx) further supports this optimization drive. For instance, in 2023, Dow announced plans to reduce its CapEx by approximately $1 billion, aiming for greater efficiency. This financial flexibility allows for strategic reinvestment in core, high-margin businesses, thereby improving overall profitability.

- Portfolio Optimization: Dow can leverage its ongoing strategic review to exit non-core or low-margin businesses, sharpening its focus.

- Capital Allocation: Reduced CapEx frees up resources that can be strategically deployed into areas with higher growth potential and better returns.

- Operational Footprint: Streamlining operations, particularly in regions like Europe, can lead to cost efficiencies and improved supply chain management.

- Financial Flexibility: These actions collectively enhance Dow's financial health, providing greater capacity for innovation and shareholder returns.

Dow is poised to benefit from the increasing global demand for sustainable products and solutions. The company's investments in recycling technologies and its commitment to net-zero emissions by 2050, exemplified by the Circulus acquisition and the Path2Zero initiative, directly address these market needs.

Expansion into high-growth sectors like new energy, advanced electronics, and mobility presents substantial revenue opportunities. With the advanced electronics market projected to exceed $1 trillion by 2025, Dow's material science expertise is well-positioned to capture significant market share.

Strategic partnerships are crucial for Dow to accelerate innovation and market penetration. Collaborations, such as the one with Macquarie Asset Management for Diamond Infrastructure Solutions, aim to optimize assets and explore new business models, enhancing financial flexibility and growth prospects.

Dow's ongoing portfolio optimization, including its European operations review, allows for capital reallocation to more profitable segments. This strategic focus, coupled with reduced capital expenditures, as seen with the $1 billion CapEx reduction announced in 2023, enhances financial flexibility for reinvestment in high-growth areas.

Threats

A global economic slowdown or outright recession poses a significant threat to Dow. Reduced consumer spending and industrial activity directly impact demand for Dow's diverse product portfolio, from packaging to automotive materials. For instance, if major economies like China or the Eurozone experience contraction, Dow's revenue streams tied to these regions could see substantial declines.

Persistent macroeconomic headwinds have already forced Dow to adjust its strategic plans. The company has acknowledged delaying certain capital-intensive projects and is actively pursuing cost optimization measures to navigate potential downturns. This proactive stance highlights the management's awareness of the sensitivity of their business to broader economic cycles.

The chemical industry, including giants like Dow, is navigating a landscape of increasingly stringent environmental regulations. Policies targeting persistent chemicals, such as per- and polyfluoroalkyl substances (PFAS), are tightening globally. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) proposed national drinking water standards for several PFAS compounds, signaling a significant compliance challenge.

These evolving regulations translate into substantial compliance costs for Dow. The need to invest in new technologies for pollution control, develop safer chemical alternatives, and manage potential remediation efforts can significantly impact operational budgets and research and development priorities. Failure to comply could also lead to substantial fines, as seen with other chemical companies facing penalties for environmental violations.

The pressure to adapt to these environmental policies directly affects Dow's operational flexibility and profitability. Companies may need to phase out certain products or reconfigure manufacturing processes, which can be costly and time-consuming. By 2025, the expectation is for even more proactive measures from chemical manufacturers to address sustainability concerns and avoid future regulatory penalties.

The chemical industry is fiercely competitive, with global giants constantly vying for market share, often leading to intense price wars that squeeze profit margins. Dow's financial results for the first quarter of 2024, for instance, highlighted how lower pricing in key segments directly impacted sales volumes and operating income, a trend that continued to be a concern through much of 2024.

Supply Chain Disruptions and Geopolitical Instability

Global supply chain disruptions and ongoing geopolitical uncertainties present significant threats to Dow's operations. These factors directly influence the availability and cost of essential raw materials and impact logistics, potentially leading to increased operational expenses and margin compression, particularly in regions like Europe.

The company has noted these challenges impacting its performance. For instance, in the first quarter of 2024, Dow reported that higher input costs, partly attributable to these global pressures, affected its earnings. Geopolitical tensions also create volatility in energy prices, a key input for Dow's chemical manufacturing processes.

- Supply Chain Volatility: Continued disruptions can hinder the timely and cost-effective procurement of feedstocks and delivery of finished goods, impacting production schedules and customer fulfillment.

- Geopolitical Risk: Escalating conflicts and trade disputes can lead to sanctions, tariffs, and altered market access, directly affecting Dow's global sales and manufacturing footprint.

- Energy Price Fluctuations: Instability in global energy markets, driven by geopolitical events, can significantly increase Dow's production costs, especially for energy-intensive chemical processes.

- Regional Impact: Specific regions, such as Europe, have experienced more pronounced effects from these threats, leading to higher operating costs and reduced profitability for Dow in those areas during 2024.

Technological Disruption and Substitution

Technological disruption presents a significant threat, particularly through the rise of competing materials and processes that could substitute Dow's core offerings. For instance, advancements in bio-based polymers or advanced composites could challenge traditional petrochemical-derived plastics and materials. Dow's reliance on established chemical processes means a rapid, unforeseen technological leap in areas like sustainable manufacturing or novel material science could erode its market share if adaptation is slow.

Dow's 2024 R&D spending, reported at approximately $2.7 billion, highlights its commitment to innovation, yet the sheer pace of technological change remains a persistent challenge. Emerging technologies in areas such as advanced battery materials or carbon capture solutions, while potential opportunities, also represent areas where new entrants or existing competitors could develop disruptive substitutes for Dow's current product lines. Failure to anticipate and integrate these shifts could lead to obsolescence of existing product portfolios.

Consider these specific potential disruptions:

- Emergence of Advanced Bio-plastics: Significant investment in biodegradable and compostable plastics from renewable sources could directly substitute Dow's conventional polymer offerings in packaging and consumer goods.

- Development of Novel Catalysts: Breakthroughs in catalysis could enable more efficient, lower-emission production of chemicals, potentially rendering some of Dow's existing manufacturing processes less competitive.

- Carbon-Negative Materials: Innovations in materials that actively sequester carbon could pose a long-term threat to carbon-intensive traditional materials produced by Dow.

- Digitalization of Manufacturing: Increased adoption of AI and automation in chemical production could lead to new, more agile competitors with lower operational costs, impacting Dow's cost structure.

Dow faces significant threats from intensifying competition and potential price wars within the chemical industry. This competitive pressure can lead to reduced profit margins, as seen in Dow's first-quarter 2024 results where lower pricing impacted sales volumes and operating income. The company must continually innovate and optimize its cost structure to maintain its market position against both established global players and emerging regional competitors.

SWOT Analysis Data Sources

This Dow SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded perspective.