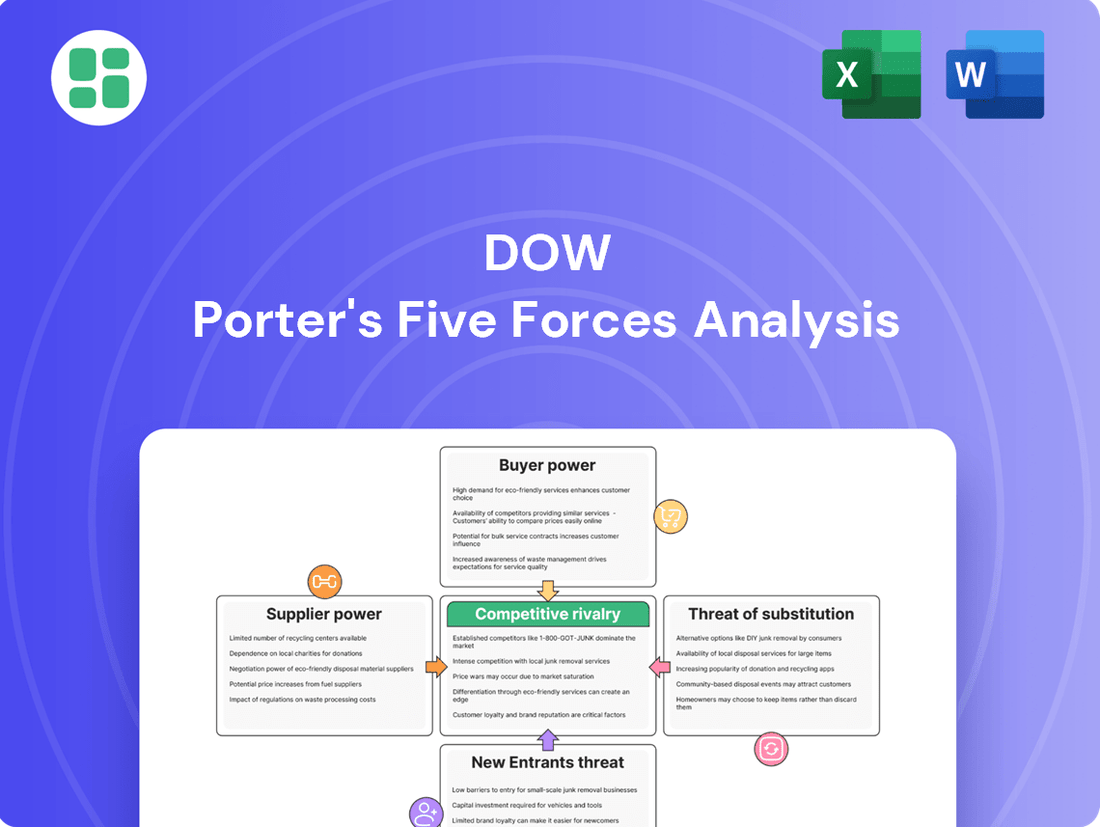

Dow Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dow Bundle

Dow's competitive landscape is shaped by powerful forces, from the intensity of rivalry to the bargaining power of buyers and suppliers. Understanding these dynamics is crucial for navigating the chemical industry.

This brief overview only hints at the intricate web of competitive pressures. Unlock the full Porter's Five Forces Analysis to explore Dow’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Dow's reliance on a few key raw materials, like crude oil and natural gas, grants substantial power to its suppliers. In 2024, the volatility in energy markets directly influenced Dow's feedstock costs, with oil prices fluctuating significantly throughout the year, impacting production expenses.

Supply disruptions or price surges for these essential inputs directly affect Dow's production costs and overall profitability. For instance, geopolitical events in major oil-producing regions can create ripple effects on feedstock availability and cost for chemical manufacturers like Dow.

The specialized nature of certain chemical feedstocks can further limit the pool of viable suppliers, thereby increasing their negotiating leverage over Dow. This concentrated supplier base means fewer alternatives for Dow, potentially leading to less favorable pricing and supply terms.

When a few large suppliers control essential raw materials, their bargaining power significantly increases. This concentration can lead to situations where these suppliers dictate terms and pricing, making it challenging for companies like Dow to secure favorable agreements.

For instance, in 2024, the global semiconductor industry, a critical component for many advanced materials and manufacturing processes, continued to see high concentration. Companies like TSMC, a dominant player, held substantial leverage due to their advanced manufacturing capabilities and limited competition in cutting-edge chip production.

This supplier concentration directly impacts a company's cost structure and operational flexibility. If Dow faces a market where only a handful of suppliers can provide a vital input, those suppliers are in a strong position to demand higher prices or impose stricter delivery schedules, potentially squeezing Dow's profit margins.

Dow Inc. faces significant supplier power due to the substantial costs associated with switching. These costs encompass not only the financial outlay for re-qualifying new suppliers and adjusting intricate supply chains but also the time and resources dedicated to renegotiating contracts. For instance, the chemical industry often relies on highly specialized raw materials, making the transition to alternative suppliers a complex and potentially disruptive process.

Uniqueness of Inputs

When suppliers offer highly specialized or proprietary materials that are essential for Dow's unique product offerings, their ability to dictate terms grows. If these critical inputs lack readily available substitutes or cannot be manufactured in-house, Dow's negotiation leverage diminishes, forcing acceptance of supplier-imposed conditions. This situation is particularly relevant for advanced catalysts or novel chemical compounds that are difficult to source elsewhere.

The uniqueness of inputs directly impacts supplier bargaining power. For instance, if a key supplier for Dow's advanced polymers holds patents on essential additives, their power is amplified. In 2024, the chemical industry saw continued reliance on specialized raw materials, with some niche chemical producers experiencing significant pricing power due to limited production capacity and high demand from major players like Dow.

- Proprietary Technology: Suppliers with patented or unique production processes for critical inputs gain considerable leverage.

- Limited Substitutability: If Dow cannot easily find alternative sources or develop internal capabilities for a specific material, the supplier's power increases.

- Criticality of Input: The more vital an input is to Dow's final product differentiation and performance, the stronger the supplier's position.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Dow's business operations significantly amplifies their bargaining power. If a supplier can credibly threaten to start producing the same products Dow offers, it introduces a direct competitive risk, diminishing Dow's negotiation leverage.

This scenario is particularly relevant for suppliers of specialty chemicals or advanced technologies, where they possess unique expertise or intellectual property. For instance, a supplier of a critical catalyst used in Dow's polymer production might consider establishing its own polymer manufacturing facility, thereby directly competing with Dow.

- Forward Integration Threat: Suppliers may enter Dow's market, becoming direct competitors.

- Leverage Impact: This possibility strengthens suppliers' negotiating positions for raw materials or components.

- Specialty Suppliers: The risk is higher with suppliers of specialized inputs or proprietary technologies.

- Industry Example: A key technology provider for advanced materials could potentially develop its own end-products, impacting Dow's market share.

Dow's bargaining power with suppliers is significantly influenced by the concentration of suppliers for critical raw materials like ethylene and propylene. In 2024, the global supply of these petrochemical feedstocks remained tight due to capacity constraints and strong demand, allowing major producers to command higher prices. This limited supplier base, coupled with the high cost of switching, gives these suppliers considerable leverage over Dow, impacting its cost structure and profitability.

| Factor | Impact on Dow | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage. | High for key petrochemical feedstocks. |

| Switching Costs | High costs deter Dow from changing suppliers. | Significant due to specialized equipment and contracts. |

| Input Uniqueness | Proprietary materials give suppliers pricing power. | Relevant for specialized catalysts and additives. |

| Forward Integration Threat | Suppliers may become competitors. | A potential risk for specialty chemical inputs. |

What is included in the product

Analyzes the competitive intensity within Dow's industry by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Pinpoint and neutralize competitive threats by visualizing the intensity of each force, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Dow's customers, particularly large players in sectors like automotive and packaging, can wield considerable bargaining power. In 2024, these consolidated buyers, by placing substantial orders, can demand concessions such as reduced pricing or more favorable payment schedules. Their ability to shift to alternative suppliers with relative ease amplifies their leverage, impacting Dow's profitability.

For highly commoditized products, like basic polyethylene, Dow faces significant customer bargaining power due to the abundance of suppliers. In 2024, the global polyethylene market was valued at approximately $110 billion, with numerous players offering similar grades, intensifying price competition and empowering buyers.

Conversely, Dow's differentiated products, such as its advanced silicone technologies used in sectors like automotive and electronics, significantly reduce customer bargaining power. These specialized materials offer unique performance characteristics that are difficult for customers to find elsewhere, allowing Dow to command premium pricing and maintain stronger margins.

Customers face varying switching costs when changing suppliers for materials, a key factor in their bargaining power. For complex, integrated applications where Dow’s products are deeply embedded in their manufacturing processes or product designs, these switching costs can be quite high.

This high integration reduces customer power because the effort and expense involved in changing suppliers often outweigh any potential cost savings they might achieve. For instance, in the automotive sector, where Dow’s specialty plastics are integral to vehicle components, retooling and requalification processes can cost millions, making a switch prohibitive.

Price Sensitivity of End Markets

The price sensitivity of Dow's customers is heavily tied to the demand within their own end markets. For instance, in sectors like consumer goods or construction, where competition is fierce, Dow's clients face continuous pressure to cut expenses. This pressure directly translates into strong demands for lower pricing from Dow, particularly impacting commodity product margins.

This dynamic means that when demand in these downstream markets softens, customers are less able to absorb higher raw material costs, pushing that burden back onto suppliers like Dow. For example, a slowdown in the housing market in 2023 directly impacted demand for building materials, forcing Dow to contend with more price-sensitive buyers.

- High Competition in End Markets: Many of Dow's customers operate in highly competitive industries, forcing them to seek cost reductions.

- Commodity Product Vulnerability: Products with fewer differentiators are more susceptible to price-based competition from customers.

- Impact of Economic Cycles: Downturns in key sectors like automotive or construction amplify customer price sensitivity.

- Customer Cost Pass-Through: Customers often try to pass increased input costs directly onto their own customers, increasing pressure on Dow's pricing.

Customer's Threat of Backward Integration

Large customers, particularly those with substantial purchasing volumes, can exert significant bargaining power by threatening to integrate backward and produce materials they currently source from Dow. This capability, while a substantial undertaking, serves as a potent negotiation tool.

The credible threat of a major customer producing its own inputs can force suppliers like Dow to offer more favorable terms. This is especially true for high-volume, commoditized materials where the cost of internal production might become competitive.

For example, consider the automotive industry. A major car manufacturer purchasing millions of specific plastic components could, in theory, invest in its own injection molding facilities. While this would require significant capital investment and expertise, the mere possibility can influence pricing discussions with current suppliers.

- Customer Capability: Large customers often possess the financial resources and technical know-how to consider backward integration.

- Threat Leverage: The credible threat of in-house production can force suppliers to concede on price or other contractual terms.

- Commodity Focus: This power is amplified for high-volume, less specialized materials where the economics of self-production are more viable.

Dow's customers, especially large entities in sectors like automotive and packaging, hold considerable bargaining power. In 2024, these consolidated buyers, through substantial order volumes, can negotiate for lower prices or more flexible payment terms. Their ability to switch to alternative suppliers relatively easily enhances their leverage, directly impacting Dow's profitability.

The bargaining power of Dow's customers is significantly influenced by the availability of substitute products and the ease with which they can switch suppliers. For commoditized chemicals, where many suppliers offer similar specifications, customers can readily shift their business, putting downward pressure on prices. For instance, in 2024, the global market for ethylene, a key building block for many plastics, saw numerous producers, enabling buyers to source from various suppliers and negotiate aggressively on price.

Conversely, Dow's ability to offer highly differentiated products, such as specialized polymers for advanced electronics or high-performance coatings, substantially weakens customer bargaining power. These unique materials often have few direct substitutes, and the cost and complexity of switching to an alternative can be prohibitive for customers. This allows Dow to maintain premium pricing and stronger profit margins on these specialized offerings.

Customer switching costs are a critical factor in their bargaining power. When Dow's materials are deeply integrated into a customer's manufacturing processes or product designs, the expense and time required to change suppliers can be substantial. For example, in the aerospace industry, where Dow's advanced adhesives and sealants are used in critical applications, the requalification process alone can take months and involve significant testing, making customers hesitant to switch.

The price sensitivity of Dow's customers is closely linked to the competitive intensity and demand within their own end markets. In sectors like consumer durables or construction, where profit margins are often squeezed by intense competition, customers are highly motivated to reduce their input costs. This pressure is frequently passed on to suppliers like Dow, particularly for less differentiated products.

When demand in these downstream markets weakens, customers are less able to absorb increased raw material costs from suppliers like Dow. This dynamic was evident in 2023, as a slowdown in the global construction sector led to reduced demand for building materials, forcing Dow to contend with more price-conscious buyers seeking cost concessions.

| Customer Characteristic | Impact on Dow's Bargaining Power | 2024 Relevance/Example |

|---|---|---|

| High Purchasing Volume | Increases customer leverage for price negotiation. | Large automotive manufacturers ordering significant quantities of plastics. |

| Availability of Substitutes | Weakens customer power, especially for commoditized products. | Numerous suppliers for basic polyethylene, allowing buyers to switch easily. |

| Switching Costs | High switching costs reduce customer power. | Specialty silicones used in electronics require extensive re-qualification. |

| Price Sensitivity | High sensitivity amplifies customer pressure for lower prices. | Customers in competitive consumer goods markets demand cost reductions. |

| Threat of Backward Integration | Credible threat can force concessions from suppliers. | Major chemical users considering in-house production of key intermediates. |

Same Document Delivered

Dow Porter's Five Forces Analysis

This preview showcases the complete Dow Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises or placeholder content. You'll gain instant access to this fully formatted and ready-to-use analysis, empowering you with actionable insights.

Rivalry Among Competitors

The materials science sector is marked by a few major global companies like BASF, LyondellBasell, and ExxonMobil Chemical, which fuels strong competition. These giants have substantial financial backing, advanced research and development, and widespread operations, intensifying rivalry across many product categories.

Dow faces significant pressure from these large competitors, often competing on factors such as production scale, technological innovation, and the breadth of its market presence. For instance, in 2024, BASF reported sales of approximately €60 billion, showcasing the immense scale of its operations and its competitive standing.

Dow's competitive rivalry is shaped by its ability to differentiate products. While some offerings are commodities, Dow emphasizes specialized solutions with unique performance characteristics. This differentiation, driven by innovation and application expertise, helps lessen direct price competition among industry players.

Innovation is a critical tool for Dow to manage rivalry. The company's commitment to research and development allows it to introduce new materials and sustainable solutions, setting it apart from competitors. For instance, Dow's investment in advanced materials for sectors like electronics and mobility provides a competitive advantage.

In 2023, Dow reported significant R&D expenditures, underscoring its focus on innovation. This investment is crucial for developing proprietary technologies and specialized products that are harder for rivals to replicate, thereby reducing the intensity of head-to-head price wars.

In mature segments of the chemical industry, a slow market growth rate, often below 3%, significantly intensifies competitive rivalry. Companies must aggressively fight for existing market share, leading to price wars and reduced profitability. For example, commodity chemicals often experience such conditions.

Conversely, in rapidly expanding areas like sustainable packaging solutions or advanced materials for electric vehicles, the market growth rate can exceed 10% annually. These growing segments offer more opportunities for expansion without necessarily engaging in direct cannibalization of existing business, allowing for a less intense competitive dynamic.

Dow's strategic focus on these high-growth, sustainable segments, such as its investments in bio-based plastics and materials for battery technology, aims to mitigate the impact of intense rivalry found in more mature chemical markets. This strategic pivot is crucial for maintaining growth and profitability.

Exit Barriers

High exit barriers, like specialized assets and substantial fixed costs in chemical manufacturing, can trap companies in an industry even when profits are scarce. This can result in persistent overcapacity and fierce price competition among remaining players.

For instance, the chemical industry often involves significant investments in plant and equipment, making it difficult and costly to shut down operations or repurpose assets. In 2024, the global chemical industry's capital expenditure was projected to remain robust, underscoring the long-term commitment and specialized nature of its infrastructure.

- Specialized Assets: Chemical plants are highly specific and cannot easily be converted to other uses, increasing the cost of exiting.

- Fixed Costs: High ongoing costs for maintenance, security, and environmental compliance continue even if production ceases.

- Long-Term Contracts: Commitments to suppliers and customers can make immediate withdrawal financially punitive.

- Industry Overcapacity: The presence of companies unable to exit easily can lead to an excess of supply, driving down prices and profitability for all.

Cost Structure and Economies of Scale

Companies with superior cost structures, often achieved through economies of scale in production, efficient supply chains, and integrated operations, possess a significant competitive advantage. Dow, as a major global chemical producer, benefits immensely from its vast operational scale. This scale allows for lower per-unit production costs, a critical factor in price-sensitive markets where even small cost differentials can impact market share.

Dow's ability to leverage its size translates into substantial cost efficiencies. For instance, its integrated manufacturing sites, which often allow for the reuse of byproducts and energy, further reduce operational expenses. This cost leadership is a key differentiator when competing against other large chemical conglomerates and smaller, specialized players alike.

- Economies of Scale: Dow's global production capacity, reaching millions of metric tons for key products, enables significant cost reductions per unit.

- Supply Chain Efficiency: Investments in logistics and global sourcing networks allow Dow to procure raw materials and distribute finished goods at competitive prices.

- Integrated Operations: Dow's backward and forward integration in certain value chains minimizes external dependencies and associated costs.

- 2024 Cost Advantage: In 2024, Dow's focus on operational excellence and digitalization initiatives continued to drive efficiency gains, contributing to its competitive cost position amidst fluctuating raw material prices.

Competitive rivalry within the materials science sector is intense, driven by the presence of large, well-established global players like BASF and LyondellBasell, who possess significant financial resources and advanced R&D capabilities. Dow contends with these giants by focusing on product differentiation through innovation and specialized solutions, rather than solely on price, especially in high-growth areas like sustainable packaging and electric vehicle materials. While mature segments see price wars due to slow growth and high exit barriers, Dow's strategic investments in innovation and efficiency, such as its 2023 R&D spending and 2024 operational excellence initiatives, aim to mitigate these pressures and maintain a competitive cost advantage through economies of scale and integrated operations.

| Competitor | 2024 Estimated Sales (EUR Billions) | Key Competitive Factor |

|---|---|---|

| BASF | ~60 | Scale, R&D, Market Presence |

| LyondellBasell | ~45 | Operational Efficiency, Product Portfolio |

| ExxonMobil Chemical | ~40 | Integration with Upstream, Scale |

SSubstitutes Threaten

Dow's extensive portfolio, particularly in plastics and chemicals, is vulnerable to substitutes. For instance, the packaging sector sees a growing shift towards paper-based alternatives, impacting demand for Dow's polymer solutions. In 2024, the global bioplastics market is projected to reach over $10 billion, indicating a significant alternative material trend.

Construction materials also present substitution risks, with wood and composite materials increasingly favored over traditional plastics in certain applications. This trend is fueled by a growing emphasis on sustainability and performance. The global market for engineered wood products alone was valued at approximately $180 billion in 2023, highlighting the scale of these material shifts.

The constant evolution of sustainable and high-performance alternatives presents an ongoing challenge for Dow. Innovations in areas like advanced composites and biodegradable polymers can erode market share if Dow does not adapt its product development and offerings accordingly.

The threat of substitutes for Dow's products is significantly influenced by the performance-price trade-off. If alternative materials can match Dow's performance at a lower cost, or even offer superior performance at a comparable or slightly higher price point, customers may switch.

For instance, in the construction sector, while Dow's insulation materials offer excellent thermal performance, the rising cost of energy in 2024 might make less efficient but cheaper alternatives more appealing to some builders, especially in price-sensitive markets.

Dow's challenge is to continually highlight the long-term value and superior performance characteristics of its materials, justifying any price premium and mitigating the allure of lower-cost substitutes.

Customer willingness to embrace alternatives is a significant factor. For instance, the increasing consumer demand for eco-friendly packaging, driven by a growing awareness of environmental issues, directly impacts the demand for traditional materials. Surveys in 2024 indicated that over 60% of consumers are willing to pay more for sustainable products, highlighting this shift.

Regulatory changes can also accelerate the adoption of substitutes. Bans on single-use plastics, which have been implemented in various regions globally, force industries to seek alternative materials. In 2024, over 40 countries had some form of plastic bag ban or tax in place, directly influencing material choices.

Dow's strategic response involves continuous innovation in sustainable materials. The company invested $1.5 billion in 2024 into research and development for bio-based and recyclable solutions, aiming to preemptively address these evolving market needs and regulatory landscapes.

Innovation in Competing Industries

Innovation in competing industries poses a significant threat of substitution for Dow. For example, breakthroughs in advanced ceramics or high-strength natural fiber composites could offer compelling alternatives to Dow's polymer products in sectors like automotive or construction. Dow's revenue from specialty plastics, a key segment, is vulnerable to these material science advancements.

Dow must actively track and adapt to technological progress in non-traditional sectors that could yield substitute materials. Consider the automotive industry's push for lightweighting; while Dow offers advanced polymers, innovations in magnesium alloys or carbon fiber composites developed by aerospace suppliers could displace these solutions. In 2024, the global advanced materials market, encompassing many potential substitutes, was projected to reach hundreds of billions of dollars, highlighting the scale of this competitive landscape.

- Technological Advancements: Innovations in metal alloys, ceramics, and natural fiber composites offer direct substitutes for Dow's polymer offerings.

- Market Vulnerability: Dow's established polymer solutions face potential displacement in key end-markets like automotive and construction.

- Competitive Response: Continuous monitoring and R&D investment are crucial for Dow to counter threats from cross-industry material innovations.

Lifecycle and Sustainability Concerns

Growing environmental awareness is a significant factor driving the threat of substitutes for traditional materials, especially plastics. Consumers and regulators are increasingly scrutinizing the full lifecycle impact of products, from raw material sourcing to end-of-life disposal. This heightened concern makes alternatives perceived as more sustainable or renewable, such as biodegradable polymers or materials derived from recycled content, more appealing.

Dow's strategic response to this evolving landscape involves a strong emphasis on circular economy initiatives. The company is investing heavily in advanced recycling technologies to process post-consumer plastic waste, aiming to create a closed-loop system. Furthermore, Dow is developing and expanding its portfolio of bio-based solutions, utilizing renewable feedstocks to produce materials with a lower environmental footprint.

- Growing Demand for Sustainable Alternatives: Reports indicate a substantial increase in consumer preference for products with clear sustainability credentials, directly impacting material choices in packaging and consumer goods. For instance, by 2024, the global market for bioplastics is projected to reach significant growth, driven by these environmental concerns.

- Dow's Circular Economy Investments: Dow's commitment to the circular economy is evidenced by its partnerships and investments in recycling infrastructure and innovative chemical recycling processes. These efforts are designed to recapture value from plastic waste, reducing reliance on virgin resources and mitigating the substitution threat.

- Innovation in Bio-Based Materials: The development of bio-based polymers and chemicals is a key strategy for Dow. These materials offer a renewable alternative to fossil fuel-based plastics, addressing concerns about resource depletion and carbon emissions.

The threat of substitutes for Dow's products is substantial, particularly as industries seek more sustainable and cost-effective materials. Innovations in areas like bioplastics and engineered wood directly challenge Dow's traditional polymer and chemical offerings. For example, the global bioplastics market is expected to exceed $10 billion in 2024, demonstrating a clear shift towards alternatives.

Customer willingness to adopt these substitutes is amplified by growing environmental awareness and regulatory pressures. Bans on single-use plastics, in place in over 40 countries by 2024, force businesses to explore alternatives, directly impacting demand for conventional materials.

Dow's strategic response includes significant investment in R&D for bio-based and recyclable solutions, with $1.5 billion allocated in 2024. This proactive approach aims to mitigate the erosion of market share by offering competitive, sustainable alternatives that align with evolving market demands and regulatory landscapes.

| Substitute Material Category | Key Applications | Market Trend/Data (2023-2024) | Impact on Dow |

|---|---|---|---|

| Bioplastics | Packaging, Consumer Goods | Global market projected over $10 billion in 2024; growing consumer preference for sustainable options. | Direct competition with Dow's polymer solutions. |

| Engineered Wood & Composites | Construction, Automotive | Global engineered wood market valued at approx. $180 billion in 2023; favored for sustainability and performance. | Potential displacement of plastics in building and vehicle components. |

| Advanced Ceramics & Metal Alloys | Automotive, Aerospace, Electronics | Global advanced materials market projected in hundreds of billions; innovations offer lightweighting and durability. | Threatens Dow's specialty plastics in high-performance applications. |

Entrants Threaten

The materials science and chemical manufacturing sectors are inherently capital-intensive. Companies need substantial upfront investment for advanced plants, specialized equipment, and extensive infrastructure, creating a formidable barrier for newcomers. For instance, constructing a new ethylene cracker, a foundational element in petrochemical production, can easily cost billions of dollars, a sum few new entrants can readily access.

This significant financial hurdle effectively deters many potential competitors. Only well-established companies with deep pockets or those with access to substantial financing can realistically consider entering these markets at a scale that allows for competitive pricing and efficient production. Dow's existing, state-of-the-art facilities and integrated supply chains thus represent a considerable advantage, making it difficult for new players to match its operational efficiency and cost structure.

Dow's substantial economies of scale in manufacturing and raw material sourcing create a formidable barrier for new entrants. For instance, in 2024, Dow's massive production volumes allow for significantly lower per-unit costs compared to any newcomer attempting to establish a similar footprint. This cost advantage makes it difficult for new companies to compete on price without achieving comparable scale, a feat requiring immense capital investment.

The chemical industry's reliance on a steep experience curve further solidifies Dow's competitive position. Decades of operational refinement have optimized processes, reduced waste, and improved efficiency, leading to lower production costs that are hard for new players to replicate quickly. This accumulated knowledge and operational expertise represent a significant, albeit intangible, asset that deters potential entrants.

The chemical industry, particularly at the scale and complexity of Dow's operations, is characterized by a significant threat from new entrants stemming from high intellectual property and R&D intensity. Dow's extensive portfolio of patents, covering both its manufacturing processes and product formulations, creates a formidable barrier. For instance, in 2024, Dow continued to invest billions in research and development, aiming to secure new patents and maintain its technological edge, making it challenging for newcomers to enter without either infringing on existing IP or undertaking similarly costly and time-consuming innovation cycles.

New companies looking to enter this space would need to either acquire or license existing technologies, which is often prohibitively expensive, or embark on their own lengthy and capital-intensive R&D journeys. The need for specialized technical expertise, deeply embedded within Dow's workforce and research divisions, further compounds this challenge. Without this deep knowledge base, replicating Dow's advanced chemical synthesis and application development capabilities would be nearly impossible, thus limiting the practical threat of new entrants.

Regulatory Hurdles and Environmental Compliance

The chemical industry is heavily regulated worldwide, posing a significant barrier to new entrants. Navigating these complex environmental, health, and safety (EHS) regulations requires substantial investment and expertise. For instance, in 2024, companies seeking to operate in the European Union must comply with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, which can involve extensive data submission and testing, costing millions of euros per substance.

Obtaining the necessary permits and adhering to strict emission standards, particularly for hazardous materials, adds to the upfront costs and time commitment for any new player. The lengthy approval processes for new chemical facilities can delay market entry for years. Furthermore, the ongoing costs associated with maintaining compliance, such as waste management and safety protocols, create a continuous financial burden that deters potential competitors.

- Global EHS Regulations: Chemical companies must adhere to a patchwork of international and national environmental, health, and safety laws.

- Permitting and Emission Standards: Acquiring operational permits and meeting stringent emission limits for pollutants are costly and time-consuming.

- Hazardous Material Management: Strict protocols for handling, storing, and transporting hazardous chemicals are mandatory, increasing operational complexity and cost.

- Compliance Investment: In 2024, the average cost for a new chemical plant to achieve full regulatory compliance can range from tens to hundreds of millions of dollars, depending on scale and location.

Established Distribution Channels and Brand Loyalty

Dow's deeply entrenched global distribution networks and decades-long relationships with major clients present a significant barrier to new entrants. In 2024, securing reliable supply chains and access to key markets remains a formidable challenge for newcomers, as Dow's established infrastructure and logistics are critical for consistent B2B chemical supply.

The company's strong brand reputation, built on a legacy of reliability and consistent quality, fosters significant customer loyalty. New competitors would need substantial investment and time to cultivate comparable trust and displace incumbent suppliers, a factor particularly crucial in industries where product integrity is paramount.

- Established Distribution: Dow's extensive global logistics and supply chain infrastructure are difficult and costly for new entrants to replicate.

- Customer Relationships: Long-standing ties with key industrial customers create a significant switching cost and loyalty barrier.

- Brand Reputation: Dow's decades of delivering consistent quality and reliability build trust that new entrants struggle to match.

The threat of new entrants in the materials science and chemical manufacturing sectors is significantly mitigated by the immense capital requirements for establishing operations. Dow's existing infrastructure and scale, built over decades, represent a substantial financial barrier. For instance, in 2024, the cost to build a new, world-scale ethylene cracker alone can exceed $5 billion, a figure that deters most potential new players. This high entry cost means that only well-capitalized entities can realistically consider competing, thereby limiting the practical threat to Dow's market position.

Furthermore, the industry's reliance on proprietary technology and extensive research and development creates another formidable barrier. Dow's significant patent portfolio and ongoing investment in innovation, which totaled approximately $1.3 billion in R&D in 2024, make it difficult for newcomers to match its technological capabilities. Replicating Dow's advanced manufacturing processes and product formulations without infringing on existing intellectual property requires substantial time and financial resources, further reducing the threat of new entrants.

Regulatory hurdles and the need for established distribution networks also play a crucial role in limiting new entrants. Compliance with global environmental, health, and safety (EHS) regulations, such as REACH in Europe, can cost millions of dollars per substance in 2024. Combined with the difficulty of replicating Dow's established customer relationships and global logistics, these factors create a high barrier to entry, ensuring that the threat from new competitors remains relatively low.

| Barrier Type | Description | Example/Data Point (2024) |

| Capital Requirements | High upfront investment for plants and equipment. | Ethylene cracker construction cost: $5 billion+ |

| Intellectual Property & R&D | Patented technologies and ongoing innovation. | Dow's 2024 R&D Investment: ~$1.3 billion |

| Regulatory Compliance | Navigating complex global EHS laws. | REACH compliance cost: Millions of dollars per substance |

| Distribution & Customer Relationships | Established logistics and client loyalty. | Difficulty replicating decades-old supply chain integration. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of extensive data, including company annual reports, industry-specific market research, and regulatory filings. This comprehensive approach ensures a robust understanding of competitive dynamics.