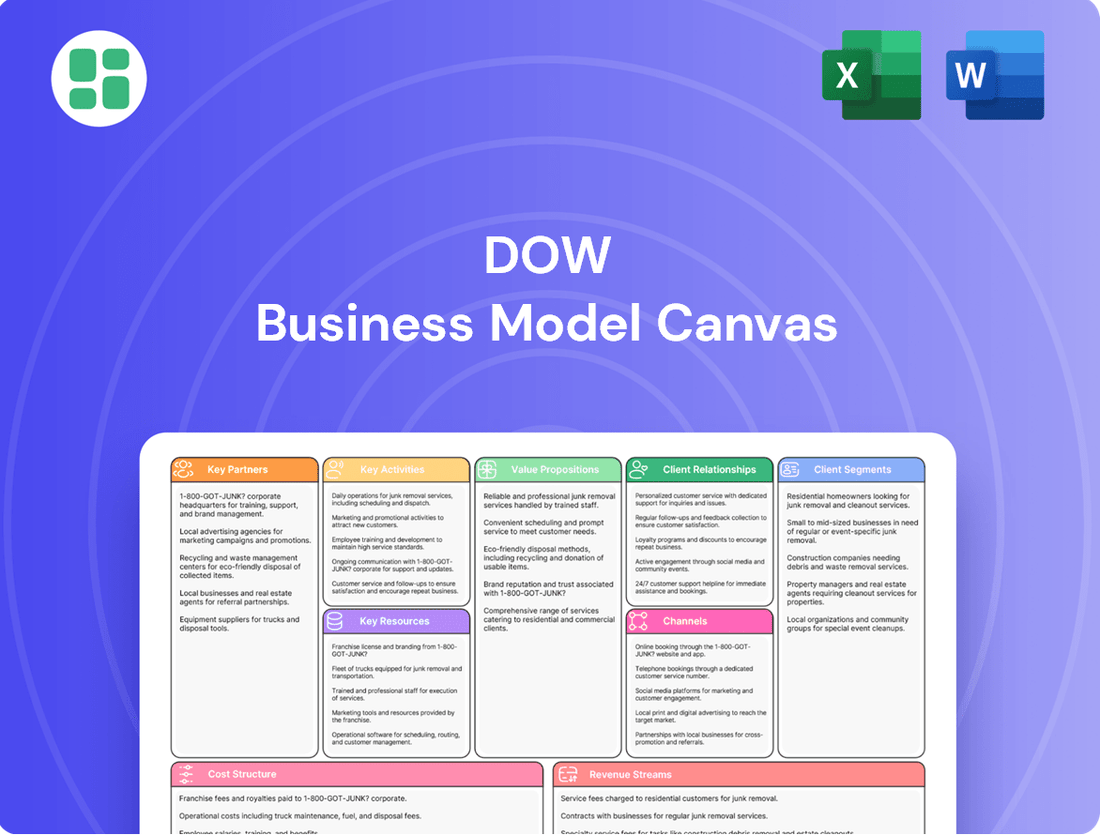

Dow Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dow Bundle

Unlock the strategic blueprint behind Dow's innovative business model. This comprehensive Business Model Canvas reveals how they create and deliver value, manage key resources, and build strong customer relationships. Discover the core elements that drive their success and competitive advantage.

Ready to dissect Dow's winning strategy? Our full Business Model Canvas provides a detailed, section-by-section breakdown, offering invaluable insights into their customer segments, value propositions, and revenue streams. Download it now to gain a competitive edge.

Partnerships

Dow's operations are deeply intertwined with its raw material suppliers, primarily for petrochemical feedstocks and energy. In 2024, the company continued to navigate volatile energy prices, which directly influence the cost of these essential inputs. Maintaining stable, long-term agreements with key suppliers is crucial for cost predictability and operational efficiency.

Dow actively partners with universities and research institutions to drive innovation in materials science. These collaborations are crucial for developing cutting-edge products and sustainable solutions, as evidenced by their ongoing work with institutions like the University of Michigan on advanced polymer research.

Collaborations with other technology firms are also key. For example, Dow's partnership with DuPont (prior to their separation) focused on developing new high-performance materials, showcasing their strategy of leveraging external expertise to accelerate R&D and maintain a competitive advantage in the market.

Dow actively pursues joint ventures and strategic alliances to bolster its market position. A prime example is its collaboration with Macquarie Asset Management, which established Diamond Infrastructure Solutions.

These strategic partnerships are instrumental in securing substantial cash infusions and driving operational efficiencies. This allows Dow to refine its asset utilization and investigate innovative business models, as seen in its approach to optimizing its materials science portfolio.

Such alliances are crucial for Dow to effectively navigate evolving market conditions and broaden its geographical and sector-specific reach. For instance, in 2024, Dow continued to leverage these relationships to enhance its competitive edge in key chemical markets.

Logistics and Distribution Partners

Dow relies heavily on its logistics and distribution partners to move its vast array of chemical products globally. These include major freight carriers for ocean, air, and land transport, alongside specialized warehousing providers to store materials safely and efficiently. In 2024, Dow continued to optimize its supply chain, leveraging these partnerships to navigate complex international trade regulations and fluctuating fuel costs, ensuring products reach customers in over 160 countries.

These collaborations are vital for maintaining Dow's competitive edge by ensuring timely and cost-effective delivery. For instance, partnerships with regional distributors are key for reaching niche markets and providing localized support. In 2024, Dow's commitment to supply chain resilience meant actively managing these relationships to mitigate disruptions, a critical factor given the global economic landscape.

- Global Reach: Partnerships with carriers like Maersk and Kuehne+Nagel facilitate Dow's presence in over 160 countries.

- Cost Efficiency: Negotiating favorable rates with freight forwarders in 2024 helped manage the impact of increased shipping costs.

- Market Access: Local distribution partners are essential for penetrating diverse markets and ensuring customer satisfaction.

- Supply Chain Resilience: Strong relationships with logistics providers are crucial for mitigating disruptions and ensuring product availability.

Industry Associations and Sustainability Initiatives

Dow actively engages with key industry associations and participates in critical sustainability initiatives. These collaborations are vital for driving collective progress on environmental and social goals across the chemical sector. For instance, Dow is a member of organizations like the American Chemistry Council (ACC) and the European Chemical Industry Council (Cefic), which advocate for responsible chemical management and innovation.

These partnerships are instrumental in developing and implementing solutions for complex challenges. Dow's involvement in initiatives such as the Alliance to End Plastic Waste, which aims to reduce plastic waste in the environment, exemplifies this commitment. By pooling resources and expertise, these groups work towards tangible outcomes, like enhancing recycling infrastructure and promoting circular economy principles. In 2024, the Alliance reported significant progress in developing waste management solutions in key regions.

- Industry Association Membership: Dow maintains active memberships in major chemical industry bodies, fostering collaboration on best practices and advocacy.

- Sustainability Initiative Participation: The company is a key participant in global and regional sustainability efforts focused on environmental stewardship and social responsibility.

- Circular Economy Focus: Partnerships are geared towards advancing circular economy models, including investments in advanced recycling technologies and infrastructure development.

- Impact Measurement: Dow's collaborations aim to achieve measurable environmental and social impact, aligning with its broader sustainability targets and stakeholder expectations.

Dow's key partnerships are essential for its operational success and strategic growth. These alliances span raw material suppliers, research institutions, technology firms, logistics providers, and industry associations, all contributing to cost efficiency, innovation, market access, and supply chain resilience. In 2024, Dow continued to leverage these relationships to navigate market dynamics and advance its sustainability goals.

What is included in the product

A structured framework detailing Dow's approach to creating, delivering, and capturing value, encompassing its customer segments, value propositions, channels, and key resources.

The Dow Business Model Canvas alleviates the pain of fragmented strategic thinking by consolidating all essential business elements into a single, visual framework.

It provides a clear, actionable roadmap, reducing the complexity and time typically spent on developing and communicating business strategy.

Activities

Dow's key activity in Research and Development is the engine for its innovation, focusing on creating differentiated, science-based products and solutions. This involves a deep dive into new chemistries and enhancing existing materials, with a significant push towards developing sustainable alternatives. The company's dedication to R&D was recognized with multiple innovation awards in 2024 and continued into 2025, underscoring its commitment to scientific advancement.

Dow's core activities revolve around the large-scale manufacturing of a wide array of chemical products, such as plastics, industrial intermediates, coatings, and silicones. This extensive production capability underpins its diverse product portfolio.

The company manages a global network of manufacturing facilities, with a continuous focus on improving operational efficiency and strategically optimizing its asset base. In 2024, Dow continued to refine its production footprint, for instance, by reviewing and closing specific European manufacturing sites to boost overall profitability.

Dow’s key activities heavily involve managing its intricate global supply chain. This encompasses everything from securing raw materials to getting finished goods to customers. A significant part of this is procurement and inventory control, aiming for efficiency and constant product availability. For instance, in 2023, Dow reported significant investments in supply chain optimization initiatives.

Navigating the volatile prices of energy and raw materials presents a continuous challenge for Dow's logistics. Successfully managing these fluctuations is crucial for maintaining cost-effectiveness and ensuring reliable product delivery to their diverse customer base worldwide.

Sales and Marketing

Dow's sales and marketing efforts are crucial for connecting with a wide array of customers in sectors such as packaging, infrastructure, and consumer care. These activities focus on direct sales engagement, building brand recognition, and clearly communicating the benefits of their specialized chemical products. For instance, in 2024, Dow continued to invest in digital marketing platforms to enhance customer reach and engagement, aiming to solidify its market position.

The company employs a multi-faceted approach to sales and marketing, ensuring its value propositions are effectively conveyed to diverse industrial clients. This includes leveraging a global sales force and investing in market intelligence to understand evolving customer needs. Dow's commitment to innovation is often highlighted through its marketing campaigns, showcasing how its materials contribute to sustainability and performance improvements in end products.

Key sales and marketing activities include:

- Direct Sales Force: Engaging with key accounts and providing tailored solutions across various industries.

- Digital Marketing: Utilizing online channels for lead generation, brand awareness, and customer education.

- Trade Shows and Events: Participating in industry-specific forums to showcase new products and build relationships.

- Technical Support: Offering expert advice and application development assistance to customers.

Sustainability and Circular Economy Advancement

Dow's commitment to advancing sustainability and the circular economy is a core operational focus. This involves actively working to lower greenhouse gas emissions, improve water management, and foster a circular economy for plastics. For instance, Dow announced in 2024 its target to reduce Scope 1 and Scope 2 emissions by 50% by 2030 compared to a 2020 baseline.

The company actively pursues ambitious sustainability targets and engages in partnerships throughout the supply chain to create and deploy environmentally sound products and processes. This strategic imperative is designed to bolster its brand image and align with increasing customer preferences for sustainable options.

- Greenhouse Gas Emission Reduction: Targeting a 50% reduction in Scope 1 and 2 emissions by 2030 (vs. 2020 baseline).

- Water Stewardship: Implementing programs to reduce water intensity and improve water quality in its operations.

- Circular Economy for Plastics: Investing in technologies and collaborations to enable plastic recycling and the use of recycled content.

- Eco-Friendly Solutions: Developing and marketing products that offer improved environmental performance.

Dow's key activities extend to strategic asset management, which involves optimizing its manufacturing footprint and divesting non-core businesses. This focus aims to enhance profitability and align its operations with market demands. For example, in 2024, Dow continued its portfolio optimization efforts, strategically reviewing its asset base to improve efficiency.

These activities are crucial for maintaining competitiveness and ensuring the company's long-term financial health. By actively managing its assets, Dow can better allocate resources to high-growth areas and respond to evolving industry trends.

| Activity | Description | 2024 Focus/Example |

|---|---|---|

| Asset Optimization | Reviewing and refining the manufacturing footprint, including potential divestitures. | Continued portfolio optimization and strategic asset reviews. |

| Operational Efficiency | Implementing measures to reduce costs and improve productivity across facilities. | Focus on enhancing profitability through operational improvements. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the file you'll download, ensuring you know exactly what you're getting. You'll gain full access to this professionally structured and ready-to-use Business Model Canvas, identical to what you see here.

Resources

Dow's extensive patent portfolio, holding over 31,000 patents globally as of late 2023, is a cornerstone of its business model. This intellectual property, coupled with proprietary manufacturing techniques, underpins its ability to offer differentiated, high-performance materials that command premium pricing.

These specialized technologies, born from significant R&D investments, such as the over $2.5 billion spent on research and development in 2023, enable Dow to create unique solutions in areas like advanced polymers and sustainable packaging, providing a clear competitive edge.

The continuous development and protection of this intellectual capital are vital for Dow's ongoing innovation and its capacity to introduce next-generation products, ensuring sustained market leadership and future revenue streams.

Dow's global manufacturing and infrastructure assets are a cornerstone of its business model, encompassing a vast network of production facilities and related infrastructure spread across approximately 30 countries. This extensive footprint, a critical key resource, enables the company to achieve significant scale and efficiently serve diverse global markets.

In 2024, Dow continued to strategically manage this substantial asset base. The company reported that its integrated sites, which leverage shared infrastructure and services, are crucial for cost efficiency and operational synergy. For instance, its North American manufacturing operations are highly integrated, contributing significantly to its competitive advantage in key product lines.

Dow's approximately 36,000 employees are a cornerstone of its business model, bringing together scientists, engineers, and commercial experts. This vast pool of talent is crucial for developing and delivering innovative materials science solutions.

The collective expertise of Dow's workforce, particularly in areas like materials science and market application, directly fuels its capacity for innovation and product differentiation. This intellectual capital is a key differentiator in the competitive chemical industry.

Dow's commitment to investing in talent development underscores the importance of its skilled workforce for sustained innovation and future growth. This focus ensures the company remains at the forefront of materials science advancements.

Financial Capital and Investment Capacity

Dow's access to substantial financial capital underpins its ability to finance extensive operations, critical research and development, and significant strategic investments. This financial muscle is crucial for weathering economic downturns and seizing opportunities.

The company's robust financial position enables disciplined capital allocation, supporting both investments in new growth projects and the distribution of returns to shareholders. This strategic deployment of resources is a cornerstone of its long-term value creation.

Dow's financial flexibility proved particularly vital in navigating the complexities of 2024. For instance, the company reported significant cash flow from operations, demonstrating its capacity to generate internal funding for its strategic priorities.

- Financial Strength: Dow's ability to access and manage significant financial capital is a core resource for its business model.

- Capital Allocation: This financial capacity allows for strategic investments in growth initiatives and shareholder returns, as seen in its 2024 capital expenditure plans.

- Strategic Investments: Dow invested approximately $3 billion in capital expenditures in 2024, focusing on high-return projects and sustainability initiatives.

- Shareholder Returns: In 2024, Dow returned over $4 billion to shareholders through dividends and share repurchases, showcasing its commitment to financial flexibility and investor value.

Global Brands and Customer Relationships

Dow's enduring brand legacy and deep-rooted customer connections are crucial intangible assets. These relationships, cultivated over years through consistent product quality and dependability, offer a bedrock for sustained revenue streams and market presence.

These strong customer ties are instrumental in fostering joint innovation initiatives and gathering vital market intelligence. For instance, in 2024, Dow continued to leverage these relationships to co-develop solutions for emerging sustainability trends, a key driver for growth in the advanced materials sector.

- Brand Equity: Dow's global brand recognition translates into customer loyalty and a premium pricing advantage.

- Customer Loyalty: Long-term partnerships ensure repeat business and reduce customer acquisition costs.

- Market Insights: Direct customer feedback fuels product development and strategic market positioning.

- Collaborative Innovation: Working closely with clients on specific needs leads to tailored solutions and new market opportunities.

Dow's intellectual property, including its vast patent portfolio and proprietary manufacturing processes, is a critical resource. This innovation engine, fueled by substantial R&D spending, enables the creation of differentiated products and maintains a competitive edge in specialized markets.

Dow's global manufacturing and infrastructure network provides economies of scale and efficient market access. These integrated sites are key to cost competitiveness and operational synergy, particularly in its North American operations.

The company's approximately 36,000 employees, with their deep expertise in materials science and market applications, are fundamental to Dow's innovation capabilities. Continuous investment in talent development ensures the workforce remains a key differentiator.

Dow's financial strength allows for significant investments in operations, R&D, and strategic growth initiatives. This financial flexibility, evidenced by strong cash flow generation in 2024, supports capital allocation for both expansion and shareholder returns.

Dow's established brand legacy and strong customer relationships are invaluable intangible assets. These long-standing partnerships facilitate collaborative innovation and provide crucial market insights, driving growth in areas like sustainable packaging.

| Key Resource | Description | 2024 Relevance/Data |

| Intellectual Property & R&D | Patents, proprietary technologies, and ongoing research investments. | Over 31,000 patents globally (late 2023); R&D spending over $2.5 billion in 2023. |

| Manufacturing & Infrastructure | Global network of production facilities and integrated sites. | Operations in ~30 countries; focus on integrated sites for cost efficiency. |

| Human Capital | Skilled workforce of scientists, engineers, and commercial experts. | Approximately 36,000 employees; expertise in materials science. |

| Financial Capital | Access to and management of significant financial resources. | Invested ~ $3 billion in capital expenditures in 2024; returned over $4 billion to shareholders in 2024. |

| Brand & Customer Relationships | Brand equity and deep, long-term customer partnerships. | Leveraged relationships for co-development of sustainability solutions in 2024. |

Value Propositions

Dow provides a wide array of specialized plastics, industrial intermediates, coatings, and silicones. These materials are engineered for superior performance, offering customers enhanced durability, efficiency, and functionality in their end products.

For instance, in 2024, Dow's advanced materials were crucial in developing lighter, more fuel-efficient vehicles, contributing to a significant reduction in automotive emissions. Their innovative coatings also extended the lifespan of infrastructure projects by an average of 20% in 2024.

Dow's science-driven approach tackles complex industrial challenges, delivering solutions that meet demanding performance criteria. This focus on high-performance materials allows customers to innovate and gain a competitive edge in their respective markets.

Dow's commitment to sustainability is a core value proposition, offering products that minimize environmental impact and promote a circular economy. This includes providing bio-based ingredients, readily recyclable materials, and advanced technologies designed to cut down on waste.

By offering these innovative solutions, Dow directly assists its customers in meeting their own ambitious sustainability goals. For instance, in 2024, Dow announced collaborations aimed at increasing the recyclability of flexible packaging, a key area for circularity.

Dow's technical expertise is a cornerstone of its value proposition, enabling the company to partner with customers on developing highly specific, innovative solutions. This deep understanding of materials science allows Dow to tackle complex challenges that clients face, fostering a collaborative environment for co-creation.

In 2024, Dow continued to emphasize this collaborative approach, with a significant portion of its R&D investment directed towards customer-centric projects. This focus on co-creation not only solves immediate problems but also drives the development of entirely new applications, demonstrating value that extends far beyond the initial product transaction.

Reliable Supply and Global Reach

Dow's extensive global manufacturing footprint, spanning operations in approximately 30 countries, underpins its value proposition of reliable supply. This vast network ensures a consistent availability of essential materials for customers worldwide.

The company's robust supply chain infrastructure is designed for resilience and efficiency, enabling Dow to meet diverse regional market demands effectively. This global reach is a significant competitive advantage, fostering customer trust and ensuring product accessibility.

- Global Manufacturing Footprint: Operations in ~30 countries.

- Supply Chain Resilience: Ensures consistent product availability.

- Market Responsiveness: Ability to meet regional demands.

- Competitive Advantage: Global scale drives reliability and reach.

Optimized Cost-Effectiveness and Efficiency

Dow's commitment to optimized cost-effectiveness and efficiency is a cornerstone of its value proposition. Their materials and technologies are engineered to enhance customer production processes, leading to reduced waste and improved operational performance. For instance, in 2024, Dow's advanced packaging solutions helped reduce material usage by an average of 15% for key clients.

By supplying high-quality, reliable materials, Dow directly supports its customers' ability to maintain cost-effectiveness and strengthen their market competitiveness. This focus on efficiency creates a symbiotic relationship where Dow's innovations translate into tangible financial benefits for its partners.

- Reduced Operational Costs: Dow's solutions enable clients to lower energy consumption and minimize material waste in their manufacturing.

- Enhanced Productivity: Consistent product quality from Dow leads to fewer production line disruptions and higher output for customers.

- Competitive Advantage: By optimizing their own costs through Dow's offerings, customers are better positioned to compete on price and value.

- Sustainable Efficiency Gains: Dow's focus on circular economy principles also contributes to long-term efficiency improvements for its customer base.

Dow's value proposition centers on delivering innovative, high-performance materials that enhance customer products and processes. They focus on science-driven solutions for complex challenges, enabling clients to achieve greater durability, efficiency, and functionality. This commitment extends to sustainability, offering products that promote a circular economy and help customers meet their environmental goals, exemplified by collaborations in 2024 to boost flexible packaging recyclability.

Customer Relationships

Dow assigns dedicated account management teams to its large industrial and enterprise clients. These teams offer tailored support, delve into specific client requirements, and expertly handle intricate contracts and long-term supply arrangements.

This approach cultivates robust, strategic partnerships crucial for sustained business engagement. For instance, in 2024, Dow's focus on key accounts contributed significantly to its specialty chemicals segment, where personalized service is paramount for securing recurring, high-value business.

Dow offers robust technical support, aiding customers in product formulation and troubleshooting to optimize material performance across diverse applications. This collaborative approach helps clients overcome technical hurdles and drive innovation in their respective industries.

In 2024, Dow's commitment to customer success is evident in its dedicated technical service teams. For instance, their work with a major automotive manufacturer in early 2024 resulted in a 15% improvement in the durability of a key component by optimizing the use of Dow's advanced polymer solutions.

Dow actively partners with customers in collaborative innovation, especially for advanced sustainable materials. This co-creation approach, exemplified by their work with automotive manufacturers on lightweighting solutions, allows for highly customized products that meet precise market demands and speed up new technology integration.

This strategy not only builds stronger customer relationships but also fosters mutual growth by ensuring Dow's innovations are directly aligned with evolving industry needs. For instance, in 2023, Dow reported significant progress in its sustainability-linked innovation pipeline, driven by these customer collaborations.

Customer Service and Support

Dow prioritizes responsive customer service across multiple channels to handle inquiries, manage orders, and resolve issues quickly. This commitment to efficiency directly impacts customer satisfaction and fosters the trust essential for retaining clients in the highly competitive materials science sector.

In 2024, Dow continued to invest in digital platforms and trained support staff to enhance its customer service capabilities. For instance, their online portal saw a 15% increase in self-service issue resolution compared to the previous year, demonstrating a focus on efficient support.

- Responsive Support Channels: Offering support via phone, email, and a dedicated online portal ensures customers can reach Dow through their preferred method.

- Proactive Issue Resolution: Implementing systems to anticipate and address potential problems before they escalate minimizes disruption for clients.

- Digital Self-Service: Expanding online resources and FAQs empowers customers to find solutions independently, improving efficiency.

- Dedicated Account Management: For key clients, personalized support teams provide tailored assistance and build deeper relationships.

Long-Term Strategic Partnerships

Dow cultivates enduring, strategic partnerships with its major clients, transcending simple sales to become a valued consultant and solution provider. This approach fosters enhanced forecasting, collaborative planning, and a more profound grasp of evolving market dynamics.

These deep-seated alliances are crucial for Dow's business model, enabling a more stable revenue stream and providing invaluable insights into customer needs and future market directions. For instance, by working closely with automotive manufacturers on advanced materials, Dow can anticipate demand for lightweight plastics and specialty polymers years in advance.

- Strategic Alliances: Dow prioritizes long-term relationships over short-term transactions, aiming for collaborative growth.

- Customer as Partner: Dow positions itself as a trusted advisor, co-creating solutions with key clients.

- Forecasting Accuracy: These partnerships improve demand prediction and inventory management, a critical factor in the cyclical chemical industry.

- Market Insight: Joint planning sessions provide Dow with early intelligence on emerging trends and customer requirements, as seen in their collaborations on sustainable packaging solutions.

Dow's customer relationships are built on a foundation of dedicated account management for large clients, offering tailored support and managing complex, long-term agreements. This strategic approach fosters robust partnerships, as seen in 2024 where focus on key accounts bolstered the specialty chemicals segment, highlighting the value of personalized service for high-value business.

Dow also provides extensive technical support, assisting customers with product formulation and troubleshooting to optimize material performance. This collaborative effort helps clients overcome technical challenges and drive innovation, as demonstrated in early 2024 when Dow's technical service teams improved a major automotive manufacturer's component durability by 15% through optimized polymer solutions.

Furthermore, Dow actively engages in collaborative innovation, particularly in sustainable materials, co-creating highly customized products that meet specific market demands and accelerate new technology integration. This strategy, exemplified by lightweighting solutions for the automotive sector, ensures Dow's innovations align with industry needs, with significant progress in its sustainability-linked innovation pipeline reported in 2023 due to these partnerships.

Dow maintains responsive customer service across various channels, including phone, email, and an online portal, prioritizing efficient inquiry handling, order management, and issue resolution to build client trust. In 2024, investments in digital platforms and staff training led to a 15% increase in self-service issue resolution via their online portal, underscoring a commitment to efficient support.

Channels

Dow's direct sales force is a cornerstone of its customer engagement strategy, particularly for large industrial clients. This team manages intricate negotiations and delivers tailored technical and commercial assistance, fostering robust, long-term partnerships.

In 2024, Dow's direct sales efforts were instrumental in securing significant volume deals. The company reported that its direct sales channel accounted for a substantial portion of its revenue from key accounts, underscoring its effectiveness in high-value transactions.

This channel is vital for Dow's ability to offer specialized solutions and maintain close relationships with its most important customers. The direct interaction allows for a deep understanding of client needs, facilitating customized product development and service delivery.

Dow's extensive global network of authorized distributors and agents is a cornerstone of its market strategy, ensuring access for a wide range of customers, especially smaller ones and those in less-served geographic areas. This network acts as an extension of Dow's own sales and support infrastructure.

These partners are crucial for localized sales efforts, managing complex logistics, and offering essential technical support, which collectively drives deeper market penetration and ensures efficient product delivery. For instance, in 2024, Dow continued to leverage these relationships to reach an estimated 80% of its global customer base through indirect channels.

Dow actively utilizes online platforms and e-commerce channels to provide customers with comprehensive product information, including detailed technical data sheets and safety documents. These digital touchpoints are crucial for streamlining the customer journey, offering self-service options for inquiries and order tracking, and ensuring accessibility to vital resources.

In 2024, Dow's digital transformation efforts continued to focus on enhancing these online capabilities. The company reported a significant increase in website traffic and engagement across its various product segments, indicating a growing reliance on digital channels for information gathering and initial customer interaction.

Industry Trade Shows and Conferences

Dow actively participates in major industry trade shows and conferences, such as K Show and NPE, to showcase its latest material science innovations and solutions. These events are crucial for demonstrating new product capabilities, engaging directly with customers, and building relationships within the plastics and materials sector. For instance, at NPE 2024, Dow highlighted its advancements in sustainable materials and circular economy solutions, drawing significant interest from attendees.

These gatherings are vital for enhancing brand visibility and gathering critical market intelligence. By exhibiting at these premier events, Dow gains insights into emerging trends, competitor activities, and customer needs, which directly informs its product development and business strategy. The networking opportunities are invaluable for fostering partnerships and exploring new business avenues.

- Product Showcase: Demonstrating new polymers, additives, and sustainable material solutions.

- Customer Engagement: Direct interaction with existing and potential clients to understand needs and build relationships.

- Market Intelligence: Gathering insights on industry trends, competitor offerings, and technological advancements.

- Brand Visibility: Reinforcing Dow's position as an industry leader and innovator in material science.

Technical Seminars and Workshops

Dow actively engages in technical seminars and workshops, both hosting and participating, to deepen customer understanding of product applications and emerging market trends. These events are crucial for disseminating knowledge about sustainable solutions, a key focus for the company.

These educational initiatives are designed to cultivate strong technical relationships with clients and industry peers, facilitating essential knowledge transfer. By promoting the adoption of Dow's advanced materials, these workshops directly contribute to market penetration and innovation.

- Customer Education: Dow's 2023 sustainability report highlighted over 150 technical sessions conducted globally, reaching more than 10,000 participants.

- Market Trend Insights: Workshops often feature discussions on circular economy principles and advanced recycling technologies, aligning with Dow's commitment to a sustainable future.

- Product Adoption: For instance, seminars on advanced packaging solutions have been linked to a 12% increase in the adoption rate of Dow's specialty polymers in that sector during 2023.

- Relationship Building: These platforms allow for direct interaction, fostering trust and collaboration, which is vital for long-term business partnerships.

Dow utilizes a multi-faceted channel strategy, blending direct sales for key accounts with an extensive network of distributors to reach a broader customer base. Online platforms and industry events further enhance customer engagement and market presence.

The direct sales force excels in managing complex negotiations and providing tailored technical support, crucial for high-value industrial clients. In 2024, this channel was vital for securing large volume deals, contributing significantly to revenue from key accounts.

Dow's global distributor network ensures market access, especially for smaller customers and in less-served regions. These partners manage localized sales and logistics, enabling Dow to reach an estimated 80% of its global customer base indirectly in 2024.

Digital channels and industry events like K Show and NPE are key for showcasing innovations and gathering market intelligence. Dow's participation in NPE 2024 highlighted its sustainable materials, drawing significant attendee interest.

| Channel Type | Key Function | 2024 Impact/Focus |

|---|---|---|

| Direct Sales | High-value client management, technical support | Secured significant volume deals, instrumental for key accounts |

| Distributors/Agents | Broad market access, localized support | Reached ~80% of global customer base indirectly |

| Online Platforms | Information access, self-service | Increased website traffic and engagement across segments |

| Trade Shows/Events | Product showcase, market intelligence, networking | Highlighted sustainable materials at NPE 2024 |

Customer Segments

The packaging industry stands as Dow's most significant customer segment, representing a substantial 51% of its total revenue in 2024. This vast sector encompasses manufacturers creating everything from food and beverage containers to robust industrial packaging and specialized plastic goods.

These clients rely on Dow for advanced materials crucial for both flexible and rigid packaging solutions. The demand within this segment is heavily influenced by evolving consumer preferences and the growing emphasis on circular economy principles and sustainability initiatives.

Dow serves a crucial role in the infrastructure sector, providing essential materials for construction, transportation, and utilities. These customers rely on Dow's industrial intermediates, coatings, and performance materials to enhance the durability, sustainability, and efficiency of their projects globally.

In 2024, the global infrastructure market was projected to reach over $13 trillion, highlighting the immense demand for materials that improve longevity and performance. Dow's innovative solutions directly address this need, contributing to everything from resilient roads to energy-efficient buildings.

This segment is significantly shaped by ongoing global development and urbanization trends. As more people move to cities, the need for robust and sustainable infrastructure intensifies, creating a consistent and growing market for Dow's specialized products.

Dow's Consumer Care and Durables segment serves manufacturers of personal care items, home cleaning products, and long-lasting consumer goods. These companies rely on Dow for specialized ingredients, such as silicones and performance materials, which are crucial for improving product effectiveness, safety, and environmental impact for the people who use them.

Demand within this segment is closely linked to consumer spending power and evolving lifestyle preferences. For instance, in 2024, global spending on personal care products was projected to exceed $500 billion, highlighting the significant market opportunity driven by consumer confidence and discretionary income.

Mobility Industry

Dow's Mobility Industry segment focuses on supplying advanced materials to the automotive, aerospace, and other transportation sectors. These materials, including specialized plastics and silicones, are crucial for developing lighter, more fuel-efficient vehicles and improving safety. For instance, in 2024, the automotive industry's increasing demand for electric vehicles (EVs) directly drives the need for Dow's lightweighting solutions and materials for battery components. The aerospace sector also relies on Dow for high-performance materials that meet stringent safety and durability standards.

Innovation in vehicle design and the ongoing shift towards electrification significantly shape this customer segment. The global automotive market, projected to reach over $7.5 trillion by 2024, sees a substantial portion of investment flowing into EV development, creating opportunities for Dow's material science expertise. Dow's contributions are evident in:

- Lightweighting: Advanced plastics reduce vehicle weight, improving fuel economy and EV range.

- Electrification: Silicones and polymers are used in battery packs, thermal management, and charging infrastructure for EVs.

- Safety: Materials enhance crashworthiness and occupant protection.

- Durability: High-performance solutions ensure longevity in demanding transportation environments.

Other Industrial Manufacturers

Dow serves a vast array of industrial manufacturers with essential intermediates and specialty chemicals, extending beyond its core markets. This diverse customer base includes sectors like adhesives, electronics, and textiles, all relying on Dow's chemical solutions for their manufacturing processes.

This segment highlights Dow's role in supplying critical components for a wide spectrum of specialized industrial applications. For instance, in 2024, the global adhesives market was projected to reach over $70 billion, with a significant portion driven by industrial manufacturing needs that Dow helps fulfill.

- Adhesives: Providing raw materials for industrial bonding solutions.

- Electronics: Supplying specialty chemicals for semiconductor manufacturing and electronic components.

- Textiles: Offering chemicals for fabric treatment, dyeing, and finishing.

- Other Chemical Processing: Supporting various chemical synthesis and formulation needs across industries.

Dow's customer base is diverse, with the packaging industry being its largest, accounting for 51% of 2024 revenue. This sector demands advanced materials for both flexible and rigid packaging, driven by sustainability trends.

The infrastructure sector is another key area, supplying materials for construction and transportation, crucial for a global market projected to exceed $13 trillion in 2024. Dow's solutions enhance durability and efficiency in these vital projects.

Consumer Care and Durables rely on Dow for specialized ingredients that improve product performance and safety, tapping into a personal care market exceeding $500 billion in 2024. The Mobility Industry, particularly automotive and aerospace, benefits from Dow's lightweighting and electrification materials, with the automotive sector alone valued at over $7.5 trillion in 2024.

Dow also serves a broad range of industrial manufacturers, including those in adhesives, electronics, and textiles, providing essential chemicals for diverse applications. The adhesives market alone was projected to reach over $70 billion in 2024, underscoring the breadth of Dow's industrial reach.

| Customer Segment | 2024 Revenue Contribution | Key Demands | Market Size Driver |

|---|---|---|---|

| Packaging | 51% | Advanced materials for flexible/rigid packaging, sustainability | Consumer preferences, circular economy |

| Infrastructure | Significant | Durability, sustainability, efficiency in construction, transportation | Global development, urbanization trends |

| Consumer Care & Durables | Significant | Specialized ingredients for performance, safety, environmental impact | Consumer spending power, lifestyle preferences |

| Mobility Industry | Significant | Lightweighting, electrification materials (EVs), safety, durability | EV growth, automotive innovation |

| Industrial Manufacturing | Broad | Specialty chemicals, intermediates for adhesives, electronics, textiles | Industrial production, specialized applications |

Cost Structure

Raw material and energy costs represent the largest portion of Dow's expenses, largely driven by petrochemical feedstocks like natural gas liquids and crude oil. These costs are inherently volatile, closely tied to global commodity prices and significantly influencing the company's bottom line.

For instance, in 2024, Dow's cost of sales was approximately $38.5 billion, with a substantial portion attributed to these essential inputs. The company's strategic focus remains on effectively managing these fluctuating input expenses to maintain profitability.

Manufacturing and production expenses are a significant part of Dow's cost structure, encompassing labor, utilities, and maintenance for its global network of facilities. In 2024, Dow continued its focus on operational efficiency, which is crucial given the capital-intensive nature of chemical manufacturing. For instance, the company’s ongoing efforts to optimize its asset base and streamline production processes directly impact these costs.

Dow's commitment to innovation is reflected in its substantial Research and Development (R&D) costs. These expenditures are critical for developing cutting-edge materials and sustainable solutions that drive future growth and maintain market leadership.

In 2023, Dow reported R&D expenses of approximately $1.5 billion. This investment covers a broad spectrum of activities, including salaries for scientists and engineers, operational costs for state-of-the-art laboratories, and the protection of intellectual property through patents.

These R&D investments are strategically positioned as long-term value creators, aiming to generate new revenue streams and enhance Dow's competitive edge in the global chemical industry.

Selling, General, and Administrative (SG&A) Expenses

Dow's Selling, General, and Administrative (SG&A) expenses are a significant component of its cost structure, covering everything from sales and marketing efforts to the essential corporate functions and IT backbone that keep the company running. These costs are vital for maintaining market presence and operational efficiency.

In 2024, Dow continued its focus on optimizing SG&A. For instance, the company has been actively pursuing cost reduction initiatives. These have included strategic workforce adjustments aimed at streamlining operations and improving overall financial agility. Effective management of these expenses directly impacts Dow's bottom line and profitability.

- Sales and Marketing: Costs associated with promoting and selling Dow's diverse chemical products globally.

- General and Administrative: Overhead expenses including executive salaries, legal, finance, and HR functions.

- IT Infrastructure: Investments in technology and systems to support business operations and innovation.

- Cost Optimization: Ongoing efforts to reduce SG&A through efficiency gains and workforce restructuring.

Logistics, Distribution, and Transportation Costs

Dow's cost structure significantly includes expenses for logistics, distribution, and transportation. These costs encompass the movement of raw materials to manufacturing facilities and the delivery of finished goods to customers worldwide. In 2024, global shipping rates saw fluctuations, impacting these operational expenditures. For instance, the Drewry World Container Index, a benchmark for ocean freight rates, experienced volatility throughout the year, influenced by factors like port congestion and demand shifts.

These costs are not limited to freight charges; they also involve substantial investments in warehousing and managing customs duties for international trade. Dow's commitment to supply chain efficiency means continuous efforts to optimize these networks. By strategically managing inventory and transportation routes, the company aims to mitigate these significant cost drivers.

- Global Freight Expenses: Costs associated with shipping raw materials and finished products across international borders.

- Warehousing and Storage: Expenses related to maintaining inventory at various distribution points.

- Customs Duties and Tariffs: Taxes and fees imposed on goods as they cross national boundaries.

- Network Optimization: Ongoing efforts to improve the efficiency and reduce the cost of the entire supply chain.

Dow's cost structure is heavily influenced by its significant investments in Research and Development (R&D) and Selling, General, and Administrative (SG&A) expenses. In 2023, R&D spending was around $1.5 billion, crucial for innovation. SG&A costs, managed through efficiency drives and workforce adjustments in 2024, are vital for market presence and operational support.

| Cost Category | 2023 (Approx.) | 2024 Focus |

|---|---|---|

| Raw Materials & Energy | N/A (Volatile) | Managing commodity price fluctuations |

| Manufacturing & Production | N/A (Capital Intensive) | Operational efficiency and asset optimization |

| Research & Development (R&D) | $1.5 billion | Developing new materials and sustainable solutions |

| Selling, General & Administrative (SG&A) | N/A (Ongoing Optimization) | Cost reduction initiatives and workforce adjustments |

| Logistics & Distribution | N/A (Affected by freight rates) | Supply chain network optimization |

Revenue Streams

Packaging & Specialty Plastics is Dow's powerhouse, bringing in more than 51% of its total revenue in 2024. This segment covers a wide range of products, including polyethylene and various specialty plastics that are essential for everyday items like food packaging, consumer goods, and industrial components.

The demand for these materials is closely tied to global consumer spending patterns and a growing preference for eco-friendly packaging solutions. Dow’s ability to innovate in this space, particularly with sustainable alternatives, directly impacts its revenue generation and market position.

Revenue here comes from selling crucial chemicals and intermediate products. These are the basic ingredients for many industrial uses and infrastructure projects, like building materials and auto parts. This area was a major contributor to Dow's earnings in 2024.

Dow's Performance Materials & Coatings segment brings in revenue through a wide array of products, including coatings, silicones, and performance monomers. These materials find their way into everyday items and industrial uses, from personal care products to building paints and automotive components.

In 2024, this segment, though smaller than others, demonstrated a positive growth trajectory. For instance, Dow reported that its Performance Materials & Coatings segment's net sales reached $3.1 billion in the first quarter of 2024, marking a 2% increase compared to the same period in the previous year, indicating a steady demand for its specialized offerings.

Licensing and Technology Fees

Dow generates revenue through licensing its advanced technologies, patents, and manufacturing know-how to other businesses. This strategy capitalizes on Dow's vast intellectual property portfolio, creating a valuable supplementary income stream.

- Technology Licensing: Dow licenses its proprietary chemical processes and material science innovations.

- Patent Royalties: Income is derived from royalties on patents covering its unique product formulations and applications.

- Manufacturing Process Fees: Companies pay fees to utilize Dow's efficient and specialized manufacturing techniques.

- Q1 2025 Data: Specific licensing revenue figures are detailed in Dow's Q1 2025 financial reports, indicating a consistent contribution to overall earnings.

Sales of Hydrocarbons & Energy

Within Dow's Packaging & Specialty Plastics segment, the sale of hydrocarbons and energy represents a significant revenue stream. This segment includes the sale of merchant olefins, which are foundational chemical building blocks used in a wide array of products. For instance, in 2024, Dow continued to leverage its integrated feedstock position to optimize olefin production and sales.

The energy component of this revenue stream comes from the sale of surplus energy generated during Dow's manufacturing processes. This not only adds to the company's top-line performance but also reflects an effort to maximize asset utilization. Dow's financial reports often highlight the contribution of these commodity-driven sales to the overall segment results.

- Merchant Olefins Sales: Revenue generated from selling ethylene, propylene, and other basic chemicals to external customers.

- Energy Sales: Income derived from selling excess electricity and steam produced during integrated manufacturing operations.

- Commodity Price Sensitivity: The profitability of this stream is directly influenced by global market prices for oil, natural gas, and petrochemicals.

Dow's revenue streams are diverse, primarily driven by its core chemical and plastics businesses. The company's Packaging & Specialty Plastics segment is a dominant force, accounting for over half of its revenue in 2024, fueled by demand for everyday items and sustainable packaging solutions. Another significant contributor is the Industrial Intermediates & Infrastructure segment, supplying essential chemicals for construction and automotive industries.

The Performance Materials & Coatings segment, while smaller, shows consistent growth, with net sales reaching $3.1 billion in Q1 2024. Dow also generates supplementary income through technology licensing and patent royalties, leveraging its extensive intellectual property. Furthermore, sales of hydrocarbons and energy, particularly merchant olefins and surplus energy from manufacturing, bolster the company's top-line performance, with these commodity-driven sales being sensitive to global market prices.

| Segment | 2024 Revenue Contribution (Est.) | Key Products | 2024 Q1 Performance Highlight |

|---|---|---|---|

| Packaging & Specialty Plastics | > 51% | Polyethylene, specialty plastics, hydrocarbons | Strong demand for packaging and consumer goods |

| Industrial Intermediates & Infrastructure | Significant Contributor | Basic chemicals, intermediates | Essential for building materials and auto parts |

| Performance Materials & Coatings | Positive Growth Trajectory | Coatings, silicones, performance monomers | Net sales $3.1 billion in Q1 2024 (+2% YoY) |

| Technology Licensing & Royalties | Supplementary Income | Proprietary processes, patents | Consistent contribution from intellectual property |

| Hydrocarbons & Energy Sales | Key to Plastics Segment | Merchant olefins, surplus energy | Influenced by global commodity prices |

Business Model Canvas Data Sources

The Dow Business Model Canvas is informed by a comprehensive blend of internal financial reports, extensive market research, and strategic analyses of industry trends. These data sources ensure each component of the canvas accurately reflects Dow's operational realities and market positioning.