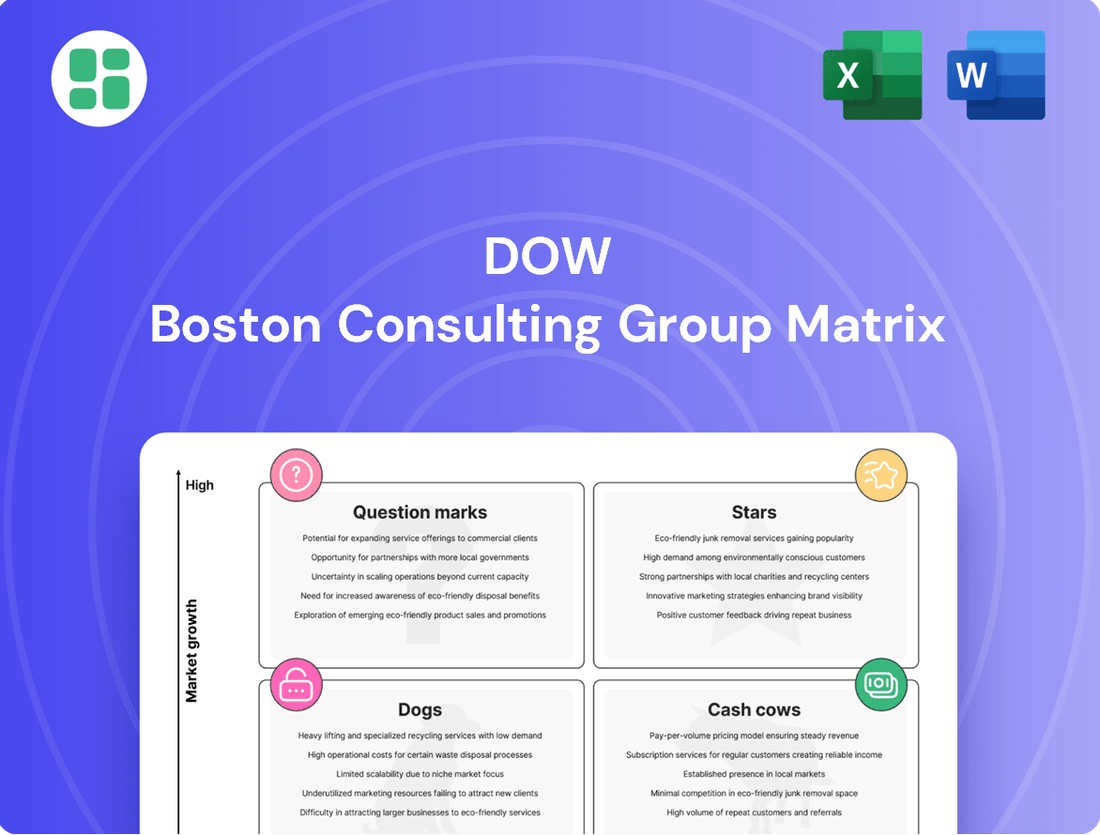

Dow Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dow Bundle

Uncover the strategic positioning of a company's product portfolio with the Dow BCG Matrix, categorizing offerings into Stars, Cash Cows, Dogs, and Question Marks. This foundational framework helps identify growth opportunities and resource allocation. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your business strategy.

Stars

Dow's Circular & Renewable Solutions segment, bolstered by the REVOLOOP™ resins and the Circulus acquisition, signifies a strategic push into the burgeoning circular economy. This area is a key growth driver for the company.

Dow has set an ambitious target to bring millions of metric tons of circular and renewable solutions to market by 2030. This commitment underscores their leadership aspirations in the sustainable materials sector, a market experiencing rapid expansion.

While these initiatives demand considerable capital, they are strategically positioned to capitalize on growing consumer and industrial demand for environmentally friendly products. This focus on sustainability is expected to yield significant returns as the market matures.

Dow's downstream silicones, particularly those for electronics and personal care, are seeing impressive volume increases and sustained growth. The broader silicone market is expected to expand at a compound annual growth rate exceeding 5% until 2033, highlighting a dynamic sector where Dow is strategically raising prices and boosting its footprint in response to strong demand.

MobilityScience™ Solutions represents Dow's commitment to the burgeoning automotive and transportation markets, focusing on advanced materials essential for electrification, lightweighting, and enhanced connectivity. This strategic business unit operates within a high-growth sector, directly benefiting from the global surge in electric and autonomous vehicle adoption.

In 2024, the automotive industry continued its significant transformation, with electric vehicle sales projected to reach over 18 million units globally, a substantial increase from previous years. Dow's MobilityScience™ is positioned to capitalize on this trend by providing critical material solutions that enable longer battery life, improved vehicle efficiency, and enhanced safety features, thereby supporting manufacturers in meeting these evolving demands.

High-Performance Specialty Plastics for Sustainable Packaging

Dow is strategically focusing on high-performance specialty plastics for sustainable packaging, even as the broader Packaging & Specialty Plastics segment experiences challenges. This targeted investment aligns with robust consumer and regulatory pressure favoring recyclable and circular materials. Dow's commitment to innovation and collaboration in this specialized area ensures a solid market position within a rapidly expanding, high-value sector.

This segment is experiencing significant growth, with the global sustainable packaging market projected to reach over $400 billion by 2027. Dow’s investments are geared towards capturing a larger share of this expanding market.

- Market Growth: The demand for sustainable packaging solutions, particularly those utilizing advanced specialty plastics, is a key driver.

- Innovation Focus: Dow is investing in R&D for materials that enhance recyclability and reduce environmental impact.

- Partnership Strategy: Collaborations with value chain partners are crucial for developing and scaling these advanced solutions.

- Competitive Advantage: This niche focus allows Dow to differentiate itself and maintain strong market share in a growing segment.

Path2Zero Project (Future Ethylene/Derivatives)

The Path2Zero Project, aiming for a net-zero ethylene cracker and derivatives complex in Fort Saskatchewan, is a key growth initiative for Dow, despite a construction delay to better align with market conditions.

This project is designed to triple capacity and is projected to deliver significant EBITDA growth by 2030, underscoring its role in Dow's decarbonization goals and long-term profitability strategy.

- Strategic Importance: A cornerstone of Dow's long-term decarbonization and profitable growth strategy.

- Capacity Expansion: Targets a significant tripling of ethylene and derivatives capacity.

- Financial Outlook: Aims for substantial EBITDA growth by 2030.

- Market Position: Positioned as a star due to its future market potential and strategic alignment.

Dow's focus on high-performance specialty plastics for sustainable packaging positions this segment as a potential star in the BCG matrix. The global sustainable packaging market is projected to reach over $400 billion by 2027, indicating substantial growth potential. Dow's investments in innovation and partnerships are designed to capture a significant share of this expanding, high-value sector, giving it a strong competitive advantage.

What is included in the product

The Dow BCG Matrix categorizes business units based on market growth and share, guiding strategic decisions.

The Dow BCG Matrix provides a clear, visual representation of your portfolio, alleviating the pain of uncertainty by identifying strategic growth opportunities.

Cash Cows

Dow's core polyethylene business is a powerhouse within its Packaging & Specialty Plastics segment. This mature, high-volume operation is a consistent cash generator for the company, leveraging its integrated asset base and significant scale. In 2024, despite some market headwinds and pricing pressures, polyethylene sales remained a substantial contributor to Dow's overall financial performance, underpinning its ability to fund other growth initiatives.

Dow's integrated industrial intermediates, like ethylene, are foundational to its operations, acting as essential building blocks for a wide array of its products. These large-scale production facilities embody substantial capital commitments, delivering a reliable, albeit fluctuating, stream of cash.

Despite current market oversupply, the inherent integration and sheer volume of these operations solidify their position as enduring cash generators for Dow. For instance, in 2023, Dow's Materials Science segment, heavily reliant on these intermediates, reported net sales of $19.8 billion, highlighting the segment's significant contribution to the company's overall financial performance and its role as a cash cow.

Dow's established architectural coatings business, a key player in the Performance Materials & Coatings segment, operates within a mature market. This segment benefits from Dow's strong brand recognition and extensive distribution network, ensuring a stable revenue stream. In 2024, the architectural coatings market generally saw steady demand, with Dow's segment contributing significantly to overall profitability.

Mature Polyurethanes & Construction Chemicals

Dow's Mature Polyurethanes & Construction Chemicals represent a classic Cash Cow within its Industrial Intermediates & Infrastructure segment. These products cater to established industries, particularly construction, where they are indispensable building blocks. Despite potential volume shifts influenced by broader economic cycles, these offerings typically generate consistent cash flow, a testament to their strong market presence and broad utility.

The demand for polyurethanes and construction chemicals is intrinsically linked to global infrastructure development and housing starts. For instance, in 2023, construction spending in the United States saw a notable increase, providing a stable backdrop for these mature product lines. Dow's strategic focus on these segments leverages their long-standing customer relationships and the essential nature of their chemical solutions.

- Market Maturity: Polyurethanes and construction chemicals operate in well-developed markets with established demand patterns.

- Steady Cash Flow: These products are known for their ability to generate reliable cash flows, supporting Dow's overall financial health.

- Economic Sensitivity: While mature, these segments can experience some volume variability tied to macroeconomic conditions affecting construction and manufacturing.

- Strategic Importance: They form a foundational part of Dow's portfolio, providing stability and funding for growth initiatives in other business units.

Upstream Siloxanes Production

Dow's upstream siloxanes production stands as a significant player in the industry, underpinning its extensive silicones business. This segment benefits from substantial production capacity, a critical factor in supplying raw materials for a wide array of downstream applications.

Despite current market conditions characterized by overcapacity and downward price pressure across the industry, this large-scale manufacturing base is a key contributor to Dow's cash flow. The ability to produce these foundational materials efficiently, even in a challenging environment, solidifies its role as a cash cow.

- Market Position: Dow holds a dominant position in upstream siloxanes, a mature but essential market segment.

- Financial Contribution: The segment generates substantial cash due to its high-volume production capabilities, despite pricing pressures.

- Strategic Importance: Upstream siloxanes are foundational, providing critical inputs for Dow's higher-margin downstream silicone products.

- Industry Dynamics: While facing overcapacity, the segment's scale allows it to weather industry cycles and maintain profitability.

Dow's core polyethylene business, a cornerstone of its Packaging & Specialty Plastics segment, consistently generates substantial cash. This high-volume, mature operation benefits from Dow's integrated asset base and significant scale. In 2024, polyethylene sales remained a critical financial contributor, enabling investment in other growth areas despite market pressures.

Dow's established architectural coatings business, part of the Performance Materials & Coatings segment, operates in a mature market. Strong brand recognition and an extensive distribution network ensure a stable revenue stream, with steady demand observed in 2024, bolstering profitability.

Mature polyurethanes and construction chemicals, vital to the Industrial Intermediates & Infrastructure segment, are classic cash cows. These products serve established industries like construction, providing consistent cash flow due to their broad utility and strong market presence, even with some economic cycle sensitivity.

Dow's upstream siloxanes production is a dominant force, underpinning its silicones business. Despite industry overcapacity and pricing challenges in 2024, its high-volume production base remains a significant cash contributor, essential for downstream silicone products.

| Business Segment | Product Category | BCG Classification | 2023 Net Sales (USD Billions) | 2024 Outlook |

|---|---|---|---|---|

| Packaging & Specialty Plastics | Polyethylene | Cash Cow | (Segment Contribution Significant) | Steady demand, funding growth |

| Performance Materials & Coatings | Architectural Coatings | Cash Cow | (Segment Contribution Significant) | Stable revenue, strong profitability |

| Industrial Intermediates & Infrastructure | Polyurethanes & Construction Chemicals | Cash Cow | (Segment Contribution Significant) | Consistent cash flow, economic sensitivity |

| Materials Science | Upstream Siloxanes | Cash Cow | $19.8 (Materials Science Segment) | High volume, weathering price pressure |

Delivered as Shown

Dow BCG Matrix

The BCG Matrix report you are currently previewing is the precise, fully formatted document you will receive upon purchase. This means no watermarks, no incomplete sections, and no demo content—just the comprehensive strategic analysis ready for immediate implementation. You can be confident that the insights and structure you see here are exactly what you'll be able to utilize for your business planning and decision-making processes.

Dogs

Dow's divestiture of a 40% stake in its U.S. Gulf Coast infrastructure assets to Macquarie Asset Management exemplifies a strategic move often seen in the BCG Matrix. These divested assets, likely characterized by lower growth potential or a less direct strategic fit with Dow's core operations, would typically be classified as Cash Cows or even Question Marks if their future prospects were uncertain, thus justifying their placement in the divestiture category.

Dow's ethylene cracker in Böhlen, Germany, has been identified as a 'Dog' within its portfolio. This strategic decision stems from a comprehensive European asset review, highlighting significant structural challenges and elevated energy expenses prevalent in the region.

The Böhlen facility's low profitability and diminished market share, exacerbated by a demanding market landscape, directly informed its 'Dog' classification. Dow's exit from this asset is a calculated move aimed at optimizing its overall portfolio performance and resource allocation.

Dow's European chlor-alkali and vinyl plants in Schkopau, Germany, are positioned as Dogs in the BCG Matrix. These facilities are scheduled for closure as part of Dow's strategic move to streamline its European operations.

The decision to shut down these plants signals underperformance, likely stemming from factors such as a limited market share, elevated operational expenses, and challenging regional market dynamics. For instance, the European chlor-alkali market faced significant energy cost pressures in 2023, impacting profitability for many producers.

By divesting or ceasing operations at these underperforming assets, Dow aims to prevent them from becoming cash drains and to enhance overall business efficiency. This strategic rationalization is crucial for focusing resources on more promising segments of the company's portfolio.

Basic Siloxanes Plant in Barry, UK

The decision to close the basic siloxanes plant in Barry, UK, is a strategic move by Dow as part of its broader European restructuring efforts. This action specifically targets assets facing ongoing structural difficulties.

This particular plant likely struggled with a diminished market share and profitability within the highly competitive upstream siloxanes sector. Global overcapacity in this market segment further exacerbated these challenges, making the plant's closure a necessary step for portfolio optimization.

- Asset Retirement: The Barry plant closure aligns with Dow's strategy to divest or shut down underperforming assets.

- Market Dynamics: Persistent global overcapacity in basic siloxanes likely pressured margins and market position.

- Portfolio Optimization: Dow aims to streamline its operations by exiting segments with structural headwinds.

- Financial Impact: While specific financial data for the Barry plant's closure in 2024 is not publicly detailed, Dow's overall restructuring efforts are designed to improve profitability and cash flow. For example, Dow announced in 2023 plans to achieve $1 billion in cost savings by the end of 2024 through various initiatives, which would include asset rationalization.

Telone™ Product Line

Dow's recent divestiture of its Telone™ product line, an agricultural fumigant, positions it within the BCG Matrix as a potential 'Dog'. This move indicates that Telone™ was likely operating in a market with limited growth prospects or was a niche offering where Dow's competitive advantage was not substantial enough to warrant continued investment. Such divestitures are strategic maneuvers to reallocate resources to more promising business segments.

The Telone™ product line, primarily used for soil fumigation in agriculture, faced evolving regulatory landscapes and increasing demand for more sustainable pest management solutions. While it held a specific market share, its growth trajectory might not have aligned with Dow's broader strategic objectives for high-growth, high-return businesses.

Dow's decision to sell Telone™ aligns with a broader trend of chemical companies refining their portfolios. For instance, in 2024, the agricultural chemicals market continued to see consolidation and strategic realignments as companies focused on innovation in areas like biologicals and precision agriculture, potentially making legacy products like Telone™ less central to their future growth strategies.

- Divestiture Rationale: Telone™ likely represented a mature product in a market with modest growth, fitting the profile of a 'Dog' in the BCG Matrix.

- Resource Allocation: Selling Telone™ allows Dow to free up capital and management attention for core businesses with higher growth potential.

- Market Dynamics: The agricultural fumigant market faces pressures from environmental regulations and the rise of alternative pest control methods.

- Strategic Focus: Dow's strategic priorities likely lie in areas offering greater innovation and market expansion opportunities.

Dow's classification of certain assets as Dogs in the BCG Matrix signifies businesses with low market share and low growth potential. These are typically candidates for divestiture or closure to avoid draining resources. The company's strategic review in 2023 and 2024 identified several such assets within its European operations, including facilities in Germany and the UK.

The Böhlen ethylene cracker and the Schkopau chlor-alkali and vinyl plants in Germany, along with the Barry UK siloxanes plant, were all identified as Dogs. Their underperformance, driven by structural challenges, high energy costs, and market pressures, led to decisions for closure or divestiture. This rationalization aims to improve overall portfolio efficiency and focus on more profitable segments.

Dow's divestiture of the Telone™ product line further exemplifies this strategy, positioning it as a Dog due to its mature market and limited growth prospects. These actions are part of Dow's broader plan to optimize its business portfolio, reallocating capital and management focus towards areas with higher growth and return potential.

Question Marks

Dow is making significant strides in advanced recycling, notably through its collaboration with Mura Technology. This partnership aims to transform plastics that are typically difficult to recycle into valuable new materials, aligning with Dow's commitment to a circular economy. The global advanced recycling market is projected to reach $8.8 billion by 2030, indicating substantial future growth potential.

However, these cutting-edge technologies are still in their nascent stages of development and scaling. They demand considerable capital outlay, and it will take time before they achieve significant market penetration and demonstrate consistent profitability. For instance, Mura Technology's facilities require substantial investment to reach operational scale.

Dow's introduction of bio-circular attributed products, like those for carpet tile backing, signifies a strategic move into sustainable materials. These innovations tap into a burgeoning market eager for eco-friendly options.

As relatively new offerings, these bio-circular products likely represent low market share for Dow in 2024. Significant investment in marketing and consumer adoption will be crucial for their growth and to elevate their position within Dow's portfolio.

Dow's niche innovations in e-mobility materials, like advanced battery components and thermal management solutions, represent potential stars or question marks in the BCG matrix. These specialized products target high-growth segments within electric vehicles, but they currently hold a low market share.

For example, Dow's development of novel electrolyte additives for solid-state batteries aims to enhance energy density and safety, a critical need for next-generation EVs. While the market for these advanced batteries is still emerging, projected to grow significantly in the coming years, Dow's current penetration is minimal, requiring substantial investment in research and development to capture future market share.

Digital Solutions for Materials Optimization

Dow's potential ventures into digital solutions for materials optimization align with the high-growth potential of Industry 4.0. These initiatives, while representing new territory for a traditional materials science company, could tap into a rapidly expanding market. For instance, the global digital twin market, which can be leveraged for material optimization, was projected to reach $15.1 billion by 2027, growing at a CAGR of 33.5%.

Such digital offerings would likely start with a low market share, characteristic of a question mark in the BCG matrix. This necessitates substantial investment in research and development, software infrastructure, and talent acquisition to build a competitive edge. Companies investing in this space are often focused on creating platforms that offer predictive analytics for material performance and supply chain visibility.

- Digital Twin Adoption: The increasing adoption of digital twins in manufacturing, projected to grow significantly, offers a pathway for materials optimization.

- AI in Materials Science: The integration of artificial intelligence in materials discovery and design is a key driver for digital solutions in this sector.

- Supply Chain Transparency: Enhanced supply chain transparency through digital platforms can lead to better material sourcing and waste reduction, a critical optimization area.

Specialized Additives for Sustainable Coatings

Dow's specialized additives for sustainable coatings represent potential question marks within its portfolio. While the broader coatings segment might be a cash cow, these innovative additives, designed for emerging applications like low-VOC or bio-based architectural coatings, are likely in early market stages. Their focus on growing sustainability demand is strategic, but they require continued investment to achieve significant market penetration and scale. For instance, the global sustainable coatings market was valued at approximately $100 billion in 2023 and is projected to grow significantly, with specialized additives playing a crucial role.

These additives are being developed to meet increasingly stringent environmental regulations and consumer preferences for greener products. Examples include advanced binders and rheology modifiers that enable waterborne formulations with performance comparable to solvent-based systems. The challenge lies in the initial R&D costs and the need to educate the market and customers on the benefits of these new technologies, which can slow adoption rates.

- Targeting Growth: Focus on emerging markets for sustainable and high-performance coatings.

- Investment Needs: Requires ongoing R&D and market development funding.

- Market Penetration: Currently low penetration necessitates strategies to build adoption.

- Sustainability Drivers: Capitalizes on increasing demand for environmentally friendly solutions.

Dow's ventures into advanced recycling technologies, like those with Mura Technology, and its development of bio-circular attributed products for applications such as carpet tile backing, represent classic question marks. These initiatives target growing sustainable markets but are in early stages with low market share in 2024, requiring substantial investment to scale and gain traction.

Similarly, Dow's niche innovations in e-mobility materials, such as advanced battery components and thermal management solutions, along with potential digital solutions for materials optimization leveraging AI and digital twins, are positioned as question marks. These areas show high growth potential, but Dow's current market penetration is minimal, necessitating significant R&D and market development efforts.

Dow's specialized additives for sustainable coatings also fall into the question mark category. While the broader coatings market may be mature, these specific additives for low-VOC or bio-based applications are in early development, facing the challenge of initial R&D costs and market education to achieve wider adoption.

| Dow Product/Initiative | BCG Category | Market Growth Potential | Current Market Share | Investment Need |

| Advanced Recycling Tech (e.g., Mura) | Question Mark | High (Circular Economy Focus) | Low | High (Capital for Scaling) |

| Bio-Circular Attributed Products | Question Mark | High (Sustainability Demand) | Low (2024) | Moderate (Marketing & Adoption) |

| E-Mobility Materials (Battery Components) | Question Mark | Very High (EV Growth) | Minimal | High (R&D, Market Entry) |

| Digital Solutions for Materials Optimization | Question Mark | High (Industry 4.0) | Minimal | High (R&D, Talent, Infrastructure) |

| Specialized Additives for Sustainable Coatings | Question Mark | High (Green Building & Coatings) | Low | Moderate (R&D, Market Education) |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, including sales figures, market share reports, and industry growth projections, to provide a clear strategic overview.