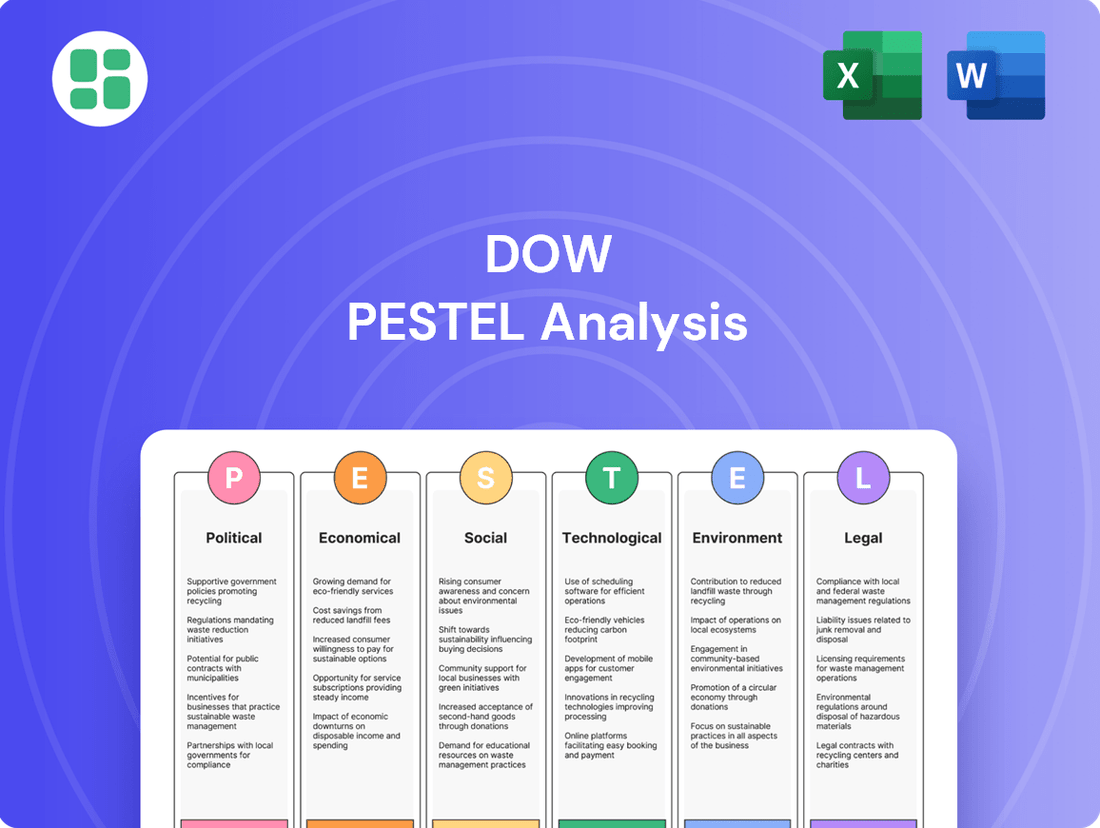

Dow PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dow Bundle

Navigate the complex external forces shaping Dow's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting this industry giant. Gain the strategic foresight needed to anticipate challenges and capitalize on opportunities. Download the full analysis now and empower your decision-making with actionable intelligence.

Political factors

Global trade policies, including tariffs and trade agreements, significantly influence Dow's operational landscape. Escalating trade tensions between major economic blocs, such as the US and China, can disrupt supply chains and affect market access for Dow's diverse chemical products. For instance, the imposition of tariffs in 2023-2024 on key industrial inputs or finished goods could directly increase Dow's cost of production or dampen demand in specific international markets, impacting its financial performance.

Geopolitical instability remains a significant concern for Dow. The ongoing conflict in Ukraine, for instance, has continued to create ripples through global energy markets, directly impacting the cost of feedstocks essential for chemical production. This volatility in raw material prices, a persistent issue throughout 2024 and into 2025, forces Dow to constantly re-evaluate its production expenses and pricing strategies.

These widespread geopolitical tensions also contribute to supply chain disruptions, affecting the timely delivery of both raw materials and finished products. Dow's extensive global manufacturing footprint means it must actively manage these risks, which can lead to increased logistical costs and unpredictable market access, a challenge that has been particularly acute in the 2024-2025 period.

Governments globally are stepping up with policies and incentives to promote green technologies. This includes support for clean energy, circular economy principles, and sustainable manufacturing processes. For instance, the Inflation Reduction Act in the US, enacted in 2022, offers significant tax credits for clean energy projects and manufacturing, with an estimated $370 billion allocated for climate and energy investments.

Dow is well-positioned to capitalize on these trends. By directing its investments towards areas like carbon capture technologies, the development of bio-based materials, and advanced chemical recycling, Dow can align with these government initiatives. This strategic alignment not only supports its own ambitious sustainability targets but also enhances its market competitiveness as demand for greener products grows.

Domestic Regulatory Environment

Changes in domestic regulatory environments, particularly in the United States, significantly shape Dow's operational landscape. For instance, evolving regulations around chemical reporting and the restriction of certain substances directly influence compliance costs and the direction of product innovation. Dow must remain agile, adapting to new requirements, including those pertaining to per- and polyfluoroalkyl substances (PFAS) and other chemicals identified as high priorities for regulatory scrutiny.

The U.S. Environmental Protection Agency (EPA), for example, has been actively developing regulations for PFAS, which could impact a wide range of Dow's products. These regulatory shifts necessitate ongoing investment in research and development to ensure product compliance and explore alternative materials. Dow's ability to navigate these domestic regulatory changes is crucial for maintaining its market position and ensuring long-term business sustainability.

- U.S. EPA Actions on PFAS: The EPA's proposed rules and ongoing actions regarding PFAS compounds, such as setting drinking water standards, directly affect industries using these chemicals.

- Chemical Reporting Requirements: Mandates like those under the Toxic Substances Control Act (TSCA) require extensive data submission and risk assessments for chemical substances.

- Substance Restrictions: Regulations that restrict or ban specific chemicals can force companies like Dow to reformulate products or find substitutes, impacting supply chains and R&D priorities.

International Chemical Strategies

The European Union's commitment to a 'toxic-free' environment through its Chemicals Strategy for Sustainability (CSS) and the Eco-design for Sustainable Products Regulation (ESPR) significantly impacts global chemical companies like Dow. These regulations are designed to boost the circular economy and enhance the overall environmental sustainability of products throughout their lifecycle.

Dow must therefore adapt its operations and product development to align with these increasingly rigorous international standards. This includes a thorough evaluation of its existing chemical portfolio and manufacturing processes to ensure compliance and maintain market access in key regions.

- EU's CSS and ESPR: Aim to create a 'toxic-free' environment and improve product environmental sustainability.

- Global Impact: Compels companies like Dow to reassess their product lines and production methods.

- Market Adaptation: Requires proactive evaluation of portfolios to meet stringent global environmental benchmarks.

Government policies promoting green technologies, such as the US Inflation Reduction Act with its substantial climate investments, create opportunities for Dow. The company can leverage these incentives by focusing on sustainable materials and carbon capture, aligning with global trends towards environmental responsibility and potentially boosting its market competitiveness through 2025.

Evolving domestic regulations, particularly in the US concerning chemicals like PFAS, necessitate significant investment in R&D and product reformulation for Dow. Adapting to stringent requirements from bodies like the EPA is crucial for compliance and maintaining market access, impacting operational costs and strategic priorities throughout 2024 and 2025.

International regulatory frameworks, like the EU's Chemicals Strategy for Sustainability, compel global companies like Dow to enhance product lifecycle sustainability and embrace circular economy principles. This requires a proactive reassessment of chemical portfolios to meet increasingly rigorous environmental benchmarks and ensure continued market presence.

Geopolitical instability continues to impact Dow's operations, with conflicts affecting energy markets and raw material costs. Supply chain disruptions, exacerbated by global tensions, increase logistical expenses and create market access challenges, a persistent issue for the company in 2024 and projected into 2025.

What is included in the product

This PESTLE analysis for Dow meticulously examines how Political, Economic, Social, Technological, Environmental, and Legal factors create both challenges and advantages for the company's global operations.

It provides actionable insights for strategic decision-making, enabling Dow to navigate the complex external landscape and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The overall health of the global economy and industrial production is a critical driver for Dow, as its materials are fundamental to numerous industries including packaging, infrastructure, and consumer goods. A robust global economy typically translates to higher demand for chemicals.

While the U.S. economy has demonstrated resilience, global industrial production is projected for moderate growth in 2025. This uneven global expansion means demand for Dow's products will likely vary significantly by region and sector.

Fluctuations in energy and feedstock prices are critical economic factors for Dow, directly impacting its operational costs. For instance, the price of natural gas, a key feedstock and energy source, saw significant volatility in early 2024, with prices in the US hovering around $2.00 per million British thermal units (MMBtu) in February 2024, down from over $3.00 MMBtu in late 2023.

Lower energy and feedstock costs, as experienced in early 2024, generally translate into improved operating earnings and healthier margins for Dow. Conversely, a sharp increase in these prices, such as the surge in crude oil prices to over $80 per barrel in early 2024, can pressure Dow's competitiveness and profitability by increasing production expenses.

Demand from key sectors like automotive, construction, electronics, and packaging is a major driver for Dow's product sales. For instance, the automotive sector's recovery and shift towards electric vehicles are expected to boost demand for Dow's lightweight plastics and battery materials. In 2024, global automotive production is projected to see moderate growth, creating a favorable environment for these segments.

The energy transition is a significant tailwind, with increasing demand for materials used in renewable energy infrastructure and electric vehicle batteries. Dow is well-positioned to capitalize on this trend, anticipating strong growth in its performance materials division. Analysts project the global battery materials market to expand significantly through 2025, underscoring this opportunity.

Capital Expenditure Trends

Capital expenditures within the chemical sector experienced a dip in 2024, but a rebound is anticipated for 2025. This resurgence in spending is largely driven by a strategic shift towards sustainable technologies, including significant investments in carbon capture and advanced chemical recycling processes.

Dow's commitment to these forward-looking areas is paramount for securing its competitive edge and fostering sustained growth in an evolving market landscape. For instance, Dow announced in early 2025 a multi-billion dollar investment in a new facility dedicated to producing advanced polymers derived from recycled materials, aiming to increase its recycled content by 30% by 2028.

- Projected 2025 CapEx Growth: Chemical industry capital expenditures are expected to increase in 2025 following a subdued 2024.

- Investment Focus: Key areas for investment include carbon capture technologies and chemical recycling of plastics.

- Dow's Strategic Alignment: Dow's investments in sustainability are critical for its long-term market position.

- Real-World Impact: Dow's 2025 investment in recycled polymer production underscores its commitment to circular economy principles.

Currency Fluctuations and Trade Balances

Currency fluctuations significantly influence Dow's financial performance. For instance, a stronger US dollar can reduce the value of international sales when translated back into dollars, impacting net sales and profitability. Conversely, a weaker dollar can boost overseas earnings.

Trade balances are also critical. Dow, as a global chemical producer, is sensitive to changes in international trade policies. Tariffs and trade disputes can disrupt supply chains and increase the cost of raw materials or finished goods, potentially leading to higher prices for consumers and reduced demand.

For example, in Q4 2023, Dow reported that foreign currency headwinds impacted earnings per share by $0.02. The ongoing global economic uncertainty and potential for increased protectionist measures in key markets like the EU and China continue to pose risks to global trade volumes for chemical products.

- Currency Impact: Dow's Q4 2023 earnings were negatively affected by $0.02 per share due to unfavorable currency movements.

- Trade Sensitivity: The chemical industry relies heavily on global trade, making it vulnerable to tariffs and retaliatory measures.

- Macroeconomic Uncertainty: Ongoing geopolitical tensions and trade policy shifts create a complex environment for international sales and supply chain management.

Global economic growth directly impacts demand for Dow's diverse product portfolio, which serves sectors from packaging to infrastructure. While the U.S. economy shows resilience, projected moderate global industrial production growth for 2025 suggests varied regional demand for Dow's materials.

Fluctuations in energy and feedstock prices, such as natural gas, critically influence Dow's operational costs and profitability. For instance, the price of natural gas, a key input, averaged around $2.00 per MMBtu in early 2024, a decrease from late 2023, generally benefiting margins.

The energy transition is a significant driver, increasing demand for materials in renewable energy and electric vehicles, a trend Dow is positioned to leverage. The global battery materials market is expected to expand substantially through 2025, highlighting this opportunity.

Currency exchange rates and trade balances are crucial for Dow's international operations. Unfavorable currency movements, like the $0.02 per share impact reported in Q4 2023, and potential trade policy shifts can significantly affect profitability and supply chain stability.

Preview Before You Purchase

Dow PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Dow PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape surrounding Dow.

Sociological factors

Consumers are increasingly seeking products that are good for the planet, pushing companies to offer eco-friendly options. This means more demand for things like chemicals made from plants, items that break down naturally, and materials that don't contribute as much to climate change.

Dow is responding to this trend by investing in solutions that are circular and renewable. For instance, they are working on using recycled plastics and developing more sustainable packaging, directly catering to this growing societal preference for greener choices.

In 2024, the global market for sustainable packaging alone was projected to reach over $350 billion, showing the significant economic force behind this consumer movement. Dow's strategic alignment with these values positions them well to capture a share of this expanding market.

The world's population continues to grow, with projections indicating it will reach 8.5 billion by 2030. This surge, coupled with a rapid shift towards urban living, with over 55% of the global population already residing in cities, directly fuels demand for materials in packaging, construction, and consumer products. Dow's advanced polymers and specialty chemicals are crucial in developing solutions for these expanding urban centers, from more durable and sustainable building materials to lighter-weight components for vehicles that reduce fuel consumption.

Public and regulatory scrutiny over chemical safety, particularly concerning substances like 1,4-dioxane and PFAS, significantly shapes Dow's product development and market reception. For instance, increasing consumer demand for PFAS-free products, driven by health concerns, is pushing companies like Dow to innovate and reformulate. This trend directly impacts Dow's product portfolio, requiring substantial investment in research and development for safer alternatives.

Dow's response to these health and safety concerns, including transparency about chemical usage and proactive research into safer materials, is crucial for maintaining market acceptance and navigating the evolving legal landscape. The company's commitment to addressing these issues can lead to a competitive advantage by anticipating regulatory changes and meeting growing consumer demand for environmentally responsible products. Failure to do so could result in reputational damage and potential legal liabilities, as seen with ongoing litigation surrounding chemical exposures.

Workforce Diversity and Inclusion

Dow's dedication to workforce diversity, equity, and inclusion (DEI) is a significant sociological factor. Companies are increasingly recognizing that a diverse workforce drives innovation and better reflects global customer bases. In 2023, Dow reported that women represented 30.5% of its global workforce and 30.1% of its management positions, highlighting ongoing efforts to enhance representation.

This focus is not just about social responsibility; it's a strategic imperative for attracting top talent and fostering a culture where varied perspectives can thrive. By building diverse teams, Dow aims to enhance its understanding of different markets and customer needs. The company's 2023 sustainability report detailed progress in areas like employee resource groups and inclusive leadership training, underscoring its commitment to embedding DEI principles across the organization.

- Talent Attraction: A strong DEI reputation is vital for attracting a wider pool of skilled candidates in a competitive global labor market.

- Innovation Driver: Diverse teams are proven to be more innovative, bringing a broader range of ideas and problem-solving approaches.

- Market Reflection: Reflecting the diversity of its global customer base helps Dow better understand and serve its markets.

- Employee Engagement: An inclusive culture boosts employee morale, retention, and overall productivity.

Community Engagement and Social Impact

Dow actively invests in community engagement, understanding that positive social impact is crucial for its long-term success and reputation. The company's commitment extends to supporting local initiatives, fostering strong relationships within the communities where it operates.

In 2023, Dow's philanthropic efforts included significant contributions to STEM education programs, aiming to inspire the next generation of scientists and engineers. This focus on education aligns with the growing societal expectation for corporations to play a role in developing human capital.

- STEM Education Support: Dow provided funding and employee volunteer hours to various educational institutions and non-profits, aiming to enhance science, technology, engineering, and mathematics learning.

- Charitable Giving: The company's charitable donations in 2023 supported a range of causes, from environmental conservation to community development projects, reflecting a broad commitment to social well-being.

- Employee Volunteerism: Dow encourages its employees to volunteer their time and skills, further embedding the company within local communities and amplifying its social impact.

- Community Partnerships: Dow collaborates with local organizations and governments to address specific community needs, ensuring its initiatives are relevant and impactful.

Societal shifts towards sustainability are a major driver for Dow, with consumers increasingly demanding eco-friendly products and packaging. This is evidenced by the global sustainable packaging market, projected to exceed $350 billion in 2024, a clear indicator of consumer preference for greener choices.

Growing global population and urbanization, expected to reach 8.5 billion by 2030 with over 55% urban living, directly increase demand for Dow's materials in essential sectors like construction and consumer goods.

Heightened public and regulatory scrutiny over chemical safety, particularly concerning substances like PFAS, is compelling Dow to invest heavily in R&D for safer alternatives, impacting product development and market acceptance.

Dow's focus on diversity, equity, and inclusion (DEI) is crucial for talent attraction and innovation, with women holding 30.5% of global workforce positions and 30.1% of management roles in 2023.

Technological factors

Dow's foundation is built on relentless innovation in materials science, consistently developing specialized products for rapidly expanding markets. The company's commitment to R&D is evident in its numerous innovation awards received throughout 2024 and the first half of 2025, recognizing breakthroughs in areas like advanced coatings and electronic-grade solvents.

These technological advancements directly translate into competitive advantages, with Dow's high-performance polymers, for instance, finding critical applications in sectors demanding enhanced durability and efficiency. The company's investment in cutting-edge research ensures its product pipeline remains robust, addressing evolving customer needs and driving growth.

The chemical industry's embrace of digitalization and AI is a significant technological shift, boosting efficiency and fostering innovation. Dow is actively integrating AI into its manufacturing, aiming to streamline operations, cut down on waste, and speed up the delivery of new products. For instance, in 2024, Dow highlighted its use of advanced analytics to improve yield in its ethylene production, a core process for many of its materials.

Dow is actively developing and implementing sustainable production technologies, like carbon capture and chemical recycling, which are vital for its future environmental performance and financial health. These advancements are key to reducing emissions and creating a more circular economy for its products.

A significant investment by Dow is its commitment to building the world's first net-zero ethylene and derivatives complex. This project, expected to be operational by 2030, highlights the company's dedication to decarbonization efforts and sets a new benchmark for the industry.

Bio-based and Circular Economy Technologies

Innovation in bio-based chemicals, biodegradable plastics, and advanced recycling technologies is crucial for tackling plastic waste and meeting consumer demand for sustainable, circular solutions. These advancements are reshaping the materials landscape, offering alternatives to traditional fossil-fuel-based products.

Dow is actively investing in and commercializing these forward-looking technologies. The company is developing post-consumer recycled (PCR) resins to incorporate recycled content into its product offerings. Furthermore, Dow is engaging in strategic collaborations aimed at advancing new and improved recycling technologies, demonstrating a commitment to a circular economy.

- Dow's investment in PCR resins aims to increase the use of recycled materials in packaging and other applications.

- Collaborations on advanced recycling technologies, such as chemical recycling, are being pursued to create a more closed-loop system for plastics.

- The company's focus on bio-based alternatives supports the transition away from petrochemical feedstocks.

Product Performance and Application Advancements

Technological progress is a major driver for Dow, allowing the company to develop products with superior performance. This includes advanced materials like lightweight composites crucial for electric vehicles (EVs) and innovative self-healing polymers that extend product lifespans. For instance, Dow's investment in R&D for sustainable solutions is reflected in its growing portfolio of bio-based and recycled content materials, aligning with market demand for eco-friendly options.

These product advancements directly address shifting industry requirements and unlock new avenues for growth. Dow's focus on application development means its materials are tailored for specific, high-value uses. In 2024, the company highlighted its progress in areas like advanced packaging solutions and materials for renewable energy infrastructure, indicating a strategic response to global megatrends.

- Lightweight Composites: Enabling greater fuel efficiency and range in transportation sectors, particularly EVs.

- Self-Healing Polymers: Enhancing durability and reducing maintenance needs across various applications, from coatings to consumer goods.

- Moisture-Sensitive Formulations: Improving performance and shelf-life in products like adhesives and sealants.

- Sustainable Innovations: Increasing the use of recycled content and bio-based feedstocks in product lines.

Dow's technological prowess is a cornerstone of its competitive edge, driving innovation in materials science and specialty products. The company's significant R&D investments, totaling billions annually, consistently yield breakthroughs in areas like advanced coatings, electronic-grade solvents, and high-performance polymers, as evidenced by its numerous innovation awards throughout 2024 and the first half of 2025.

Digitalization and AI are transforming Dow's operations, enhancing efficiency and accelerating new product development. In 2024, Dow reported a notable improvement in ethylene production yields through the application of advanced analytics, showcasing the tangible benefits of integrating AI into its core manufacturing processes.

Dow is at the forefront of developing sustainable technologies, including carbon capture and chemical recycling, critical for reducing its environmental footprint and fostering a circular economy. The company's ambitious project to build the world's first net-zero ethylene and derivatives complex, slated for operation by 2030, underscores its commitment to decarbonization and industry leadership.

The company's focus on bio-based chemicals and advanced recycling technologies is reshaping the materials landscape, offering sustainable alternatives to traditional petrochemicals and addressing the growing demand for circular solutions. Dow's strategic investments in post-consumer recycled (PCR) resins and collaborations on advanced recycling technologies are key initiatives in this transition.

| Technology Area | Dow's Focus/Investment | Impact/Application | 2024/2025 Data Point |

|---|---|---|---|

| Advanced Materials | Lightweight composites, self-healing polymers | Enhanced durability, fuel efficiency in EVs | Growing portfolio of bio-based and recycled content materials |

| Digitalization & AI | Advanced analytics in manufacturing | Improved operational efficiency, reduced waste | Reported yield improvements in ethylene production |

| Sustainability | Carbon capture, chemical recycling, bio-based chemicals | Reduced emissions, circular economy solutions | Net-zero ethylene complex project underway |

| Recycling Technologies | Post-consumer recycled (PCR) resins, collaborations | Increased use of recycled content in products | Engaging in strategic collaborations for advanced recycling |

Legal factors

Dow navigates a complex global regulatory landscape for chemicals, including the Toxic Substances Control Act (TSCA) in the United States and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) in the European Union. These regulations govern chemical safety, require extensive reporting, and impose restrictions on certain substances, impacting Dow's product development and market access.

Staying compliant with ever-changing chemical regulations is paramount for Dow. For instance, the increasing scrutiny and potential restrictions on per- and polyfluoroalkyl substances (PFAS) present a significant challenge, requiring substantial investment in research and development for alternatives. In 2024, companies like Dow are actively managing compliance with new chemical notification processes, which can involve lengthy review periods and substantial data submission requirements, directly influencing product launch timelines and costs.

Dow Chemical has faced significant environmental litigation, including a notable case in New Jersey concerning 1,4-dioxane contamination. This lawsuit, and others like it, underscore the substantial financial risks stemming from historical manufacturing practices, potentially leading to considerable expenses for environmental damages and cleanup operations.

Such legal challenges represent ongoing liabilities, as companies like Dow must navigate complex regulatory landscapes and address the long-term consequences of chemical production. The financial impact of these environmental liabilities can be substantial, affecting profitability and requiring significant investment in remediation efforts.

The EU's Corporate Sustainability Reporting Directive (CSRD) significantly impacts companies like Dow by mandating comprehensive disclosure of environmental, social, and governance (ESG) practices. This includes detailed reporting on environmental impact and specific chemical usage, demanding robust data tracking systems.

Compliance with CSRD, which came into full effect for many large companies in 2024, necessitates enhanced transparency and potentially impacts Dow's governance structures. Failure to meet these stringent requirements could lead to regulatory scrutiny and affect investor confidence.

Product Safety and Stewardship

Legal frameworks globally mandate rigorous product safety and stewardship, requiring companies like Dow to ensure their offerings are safe from creation through disposal. This includes compliance with regulations such as REACH in Europe and TSCA in the United States, which govern the registration, evaluation, authorization, and restriction of chemicals. Dow's proactive approach, exemplified by its 'Safer Materials' initiative, directly addresses these legal mandates and evolving public demand for responsible chemical management.

Dow's commitment to product stewardship is not merely a compliance exercise but a strategic imperative. The company invests significantly in research and development to identify and mitigate potential risks associated with its products. For instance, in 2023, Dow reported spending over $1 billion on sustainability initiatives, a portion of which directly supports safer product development and lifecycle management, aligning with increasing regulatory scrutiny and consumer awareness regarding chemical safety.

- Regulatory Compliance: Adherence to global chemical regulations (e.g., REACH, TSCA) is paramount.

- Product Lifecycle Management: Ensuring safety from raw material sourcing to end-of-life disposal.

- Sustainability Investments: Significant R&D allocation towards safer materials and processes, exceeding $1 billion in 2023.

- Stakeholder Expectations: Meeting and exceeding public and governmental demands for responsible chemical stewardship.

Trade and Antitrust Laws

Dow, as a global chemical giant, navigates a complex web of international trade and antitrust laws. These regulations, designed to ensure fair competition and prevent monopolistic behavior, directly impact Dow's operations and market access. For instance, tariffs imposed on chemical imports or exports can significantly alter supply chain costs and product pricing strategies. In 2024, ongoing trade disputes and the potential for new tariffs, particularly between major economic blocs, represent a significant area of focus for Dow's legal and compliance teams.

Antitrust scrutiny is also a constant factor. Regulatory bodies worldwide monitor mergers, acquisitions, and business practices to prevent any actions that could stifle competition. Dow must ensure its collaborations and market strategies adhere to these stringent rules to avoid substantial fines and reputational damage. Recent antitrust investigations into large corporations in related industries highlight the critical need for proactive compliance and robust legal frameworks within Dow's global operations.

- Global Trade Regulations: Dow must comply with varying international trade laws, including those concerning tariffs and import/export controls, which can influence material costs and market entry.

- Antitrust Compliance: Adherence to antitrust laws is crucial to prevent anti-competitive practices, ensuring fair market competition and avoiding legal penalties.

- Impact of Trade Disputes: Ongoing geopolitical tensions and trade disagreements in 2024 can lead to increased tariffs and trade barriers, affecting Dow's international supply chains and profitability.

- Regulatory Oversight: Dow faces scrutiny from competition authorities globally, necessitating careful management of its business practices to maintain market access and avoid legal challenges.

Dow operates within a stringent legal framework governing intellectual property, crucial for protecting its innovations. Patent laws in various jurisdictions ensure that Dow's proprietary chemical processes and product formulations are safeguarded, encouraging continued investment in research and development. In 2024, the company actively manages its patent portfolio, filing new applications and defending existing ones against infringement, which is vital for maintaining its competitive edge.

Litigation risk remains a constant consideration, particularly concerning product liability and environmental claims. As seen in past cases involving chemical contamination, Dow must allocate resources to manage potential legal disputes and ensure compliance with evolving environmental standards. The company's proactive approach to risk management and its investment in sustainable practices are designed to mitigate these legal exposures.

| Legal Factor | Impact on Dow | 2024/2025 Relevance |

|---|---|---|

| Intellectual Property Protection | Safeguards R&D investments and competitive advantage through patents. | Active patent management and new filings are critical for innovation. |

| Product Liability & Environmental Litigation | Potential for significant financial penalties and operational disruptions. | Ongoing management of environmental claims and compliance with evolving standards. |

| Regulatory Compliance Costs | Expenses associated with meeting chemical safety and reporting requirements (e.g., REACH, TSCA). | Continued investment in compliance systems and data management is essential. |

Environmental factors

Dow is actively pursuing its commitment to combat climate change, with a clear focus on reducing greenhouse gas emissions. The company has set ambitious 'Protect the Climate' targets, demonstrating its dedication to a low-carbon future.

Significant investments are being made in projects like the Path2Zero facility in Alberta, Canada. This initiative is designed to decarbonize Dow's operations and develop products with a lower emissions footprint, aligning with global sustainability efforts.

The increasing global focus on reducing plastic waste and fostering a circular economy presents a significant environmental factor for Dow. The company's commitment to transforming plastic waste into valuable commercial solutions is a direct response to this imperative.

Dow's ambitious target is to ensure that 100% of its packaging applications are reusable or recyclable by 2035. This strategic direction is crucial for navigating evolving regulatory landscapes and meeting consumer demand for sustainable products.

In 2023, Dow reported progress in its circular economy initiatives, with over 1.2 million metric tons of plastic waste processed through its advanced recycling technologies. This demonstrates a tangible step towards achieving its sustainability goals.

Dow acknowledges the significant influence of evolving climate patterns on water resources and biodiversity. This understanding drives their strategic initiatives, particularly focusing on enhancing water resilience at their operational sites and within the broader surrounding ecosystems. For instance, by 2025, Dow aims to have water stewardship plans in place at all its key water-dependent facilities, a crucial step in managing this vital resource.

The company is actively implementing land management strategies to support nature conservation efforts. These plans are designed to not only mitigate environmental impact but also to contribute positively to the health of natural habitats. Dow's commitment extends to ensuring that their operations coexist harmoniously with the environment, reflecting a growing industry trend towards integrating ecological considerations into core business practices.

Sustainable Sourcing and Feedstocks

The chemical industry, including Dow, is increasingly focused on sustainable sourcing and the use of renewable feedstocks. This shift involves moving away from traditional fossil-based resources towards materials like bio-based chemicals derived from plants or waste streams. For instance, Dow has been investing in technologies to utilize recycled plastics and explore bio-based alternatives for its product lines.

Dow's innovation efforts directly address this environmental factor by developing products with a lower carbon footprint and reduced reliance on virgin fossil fuels. Their commitment is reflected in targets to increase the use of renewable and recycled content in their manufacturing processes. In 2024, the company highlighted progress in developing advanced recycling technologies, aiming to process a greater volume of post-consumer plastic waste into valuable chemical building blocks.

Key initiatives and data points include:

- Increased investment in advanced recycling technologies: Dow aims to scale up mechanical and advanced recycling to process millions of metric tons of plastic waste annually by 2030.

- Development of bio-based materials: The company is actively researching and commercializing chemicals derived from renewable sources, such as biomass, to replace petrochemical feedstocks.

- Circular economy partnerships: Collaborations with waste management companies and other industry players are crucial for securing sustainable feedstock supplies.

- Product portfolio transformation: Dow is redesigning products to incorporate higher percentages of recycled and bio-based content, enhancing their environmental profile.

Pollution and Emissions Control

Dow places significant emphasis on minimizing its environmental footprint, with a particular focus on pollution and emissions control across its global operations. This commitment is vital for navigating an increasingly stringent regulatory landscape and maintaining stakeholder confidence. For instance, in its 2023 sustainability report, Dow highlighted its efforts to reduce greenhouse gas emissions intensity by 5% compared to 2022, aligning with its broader decarbonization goals.

The company's dedication to world-leading operations performance in environment, health, and safety is a cornerstone of its strategy. This includes robust systems for monitoring and managing emissions, ensuring compliance with local and international environmental standards. Dow aims to achieve net-zero Scope 1 and Scope 2 emissions by 2050, a target that necessitates continuous innovation in pollution abatement technologies and operational efficiency.

- Emissions Reduction Targets: Dow is committed to reducing its greenhouse gas emissions intensity, with a specific goal for 2030.

- Operational Excellence: The company strives for world-leading performance in environmental, health, and safety metrics.

- Regulatory Compliance: Adherence to environmental regulations is paramount for maintaining operational licenses and public trust.

- Sustainability Reporting: Transparent reporting on environmental progress, including emissions data, is a key aspect of Dow's accountability.

Dow's environmental strategy centers on climate action and circular economy principles. The company is investing heavily in decarbonization, exemplified by its Path2Zero facility in Alberta, Canada, aiming for net-zero Scope 1 and 2 emissions by 2050. A key focus is transforming plastic waste into valuable products, with a goal for all packaging to be reusable or recyclable by 2035. In 2023, Dow processed over 1.2 million metric tons of plastic waste, showcasing tangible progress in its sustainability initiatives.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Dow draws from a comprehensive blend of public and proprietary data, including government reports, economic indicators, and market research from leading firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in current business realities.