dormakaba Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

dormakaba Holding Bundle

Unlock the strategic landscape surrounding dormakaba Holding with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping their market. This expert-crafted report provides actionable intelligence to inform your own business strategy.

Gain a critical advantage by dissecting the technological advancements and environmental regulations impacting dormakaba Holding's operations. Our detailed analysis equips you with the foresight needed to navigate these external forces effectively. Download the full version now and elevate your decision-making.

Political factors

Evolving government regulations significantly shape dormakaba's operations. Stricter building safety codes, like updated fire resistance standards implemented in the EU, necessitate continuous product innovation and rigorous testing to ensure compliance. For instance, the increasing focus on accessibility mandates, such as the Americans with Disabilities Act (ADA) in the US, requires dormakaba to adapt its door hardware and access control systems.

Regional variations in these regulations present a complex challenge, demanding product adaptation to meet diverse market requirements. dormakaba must navigate differing compliance standards across North America, Europe, and Asia, impacting manufacturing processes and market entry strategies. This necessitates a flexible approach to product development to ensure seamless market access and maintain competitiveness globally.

dormakaba's global operations are significantly impacted by trade policies. For instance, the company's reliance on international supply chains means that tariffs on components, such as those seen in trade disputes between major economies in late 2023 and continuing into 2024, can directly increase production costs. These tariffs can also affect the competitiveness of dormakaba's finished products in various markets.

Geopolitical shifts and evolving trade agreements are crucial considerations. Changes in trade pacts or the imposition of new trade barriers can disrupt the flow of goods, impacting dormakaba's ability to import necessary parts or export its security solutions efficiently. For example, a slowdown in global trade growth projected for 2024, influenced by ongoing trade tensions, could present challenges.

dormakaba's global operations are significantly influenced by political stability. For instance, ongoing geopolitical tensions in Eastern Europe, which began in early 2022, continue to pose risks to supply chains and market access in affected regions, potentially impacting dormakaba's European sales and production.

Political unrest in emerging markets can disrupt local demand for security solutions and complicate investment decisions for new facilities or market entries. The company must continuously assess these risks, as seen in its 2023/2024 financial reporting, which often includes disclosures on potential impacts from regional instability.

Government Spending on Infrastructure and Construction

Government investment in infrastructure, public buildings, and smart city projects significantly influences the demand for dormakaba's access and security solutions. Increased spending on new construction and upgrades directly translates to a greater need for advanced door hardware, access control systems, and security management platforms. For instance, in 2024, many governments worldwide continued to prioritize infrastructure development, with the U.S. Infrastructure Investment and Jobs Act alone allocating substantial funds towards transportation and public works, creating opportunities for companies like dormakaba.

Public procurement policies and construction stimulus packages can present both growth avenues and potential hurdles. Favorable policies that streamline the bidding process for security and access solutions can accelerate project timelines and market penetration. Conversely, stringent regulations or preference for local suppliers might pose challenges. The European Union's recovery fund, for example, includes significant investments in digital and green transitions, which often necessitate smart building technologies that incorporate sophisticated access control.

- Increased Demand: Government infrastructure spending, such as the projected USD 1.5 trillion in infrastructure investment in the US through 2027, drives demand for dormakaba's security and access solutions in new public buildings and renovations.

- Smart City Integration: Initiatives like smart city development often require integrated access control and security systems, aligning with dormakaba's product portfolio and creating new market segments.

- Procurement Dynamics: Public procurement policies can favor large-scale projects, potentially benefiting dormakaba's ability to secure contracts for major infrastructure developments, but also requiring adaptation to specific tender requirements.

- Economic Stimulus Impact: Stimulus packages aimed at the construction sector, like those seen in various Asian economies post-pandemic, can boost overall construction activity, indirectly increasing the market for dormakaba's offerings.

Data Privacy and Security Regulations

Stricter data privacy laws like the EU's GDPR and similar regulations globally significantly impact dormakaba's digital access control and cloud solutions. Compliance requires robust data protection measures for sensitive access credentials, impacting system design and data handling protocols.

Ensuring compliance involves substantial investment in secure infrastructure, ongoing audits, and employee training, adding to operational costs. For instance, companies globally spent an estimated $1.5 trillion on cybersecurity in 2023, with a significant portion dedicated to data privacy compliance.

dormakaba must navigate these complexities to maintain customer trust, as breaches of access data can lead to severe reputational damage and financial penalties. The average cost of a data breach in 2024 was reported to be $4.73 million.

- Increased Compliance Costs: Implementing and maintaining data privacy controls for digital access systems requires significant financial outlay.

- Customer Trust Imperative: Protecting sensitive access data is crucial for retaining clients and avoiding reputational damage.

- Regulatory Landscape Evolution: dormakaba must adapt to evolving data protection laws across different operating regions.

- Cybersecurity Investment: Continuous investment in cybersecurity is essential to safeguard digital access solutions.

Government regulations are a significant force shaping dormakaba's market presence, from building safety standards to data privacy laws impacting digital access solutions. Navigating these varying, often stricter, requirements across different regions demands continuous product adaptation and investment in compliance, directly influencing operational costs and market access strategies.

Government investment in infrastructure and public projects presents a direct growth opportunity for dormakaba, as seen in the continued global focus on infrastructure development throughout 2024. Favorable public procurement policies can streamline market entry, though adaptation to specific tender requirements remains key for securing large-scale contracts.

Geopolitical shifts and trade policies directly affect dormakaba's global supply chains and product competitiveness. Tariffs, trade barriers, and economic instability in key regions, as observed in late 2023 and continuing into 2024, necessitate agile supply chain management and market diversification to mitigate risks.

| Factor | Impact on dormakaba | Example/Data Point |

|---|---|---|

| Building Safety Regulations | Requires product innovation and compliance testing | EU fire resistance standards |

| Data Privacy Laws | Increases operational costs for digital solutions | GDPR compliance; average data breach cost in 2024: $4.73 million |

| Infrastructure Spending | Drives demand for access and security solutions | US Infrastructure Investment and Jobs Act (2024) |

| Trade Policies & Geopolitics | Affects supply chain costs and market access | Tariffs on components (late 2023/2024); global trade growth slowdown (2024 projection) |

What is included in the product

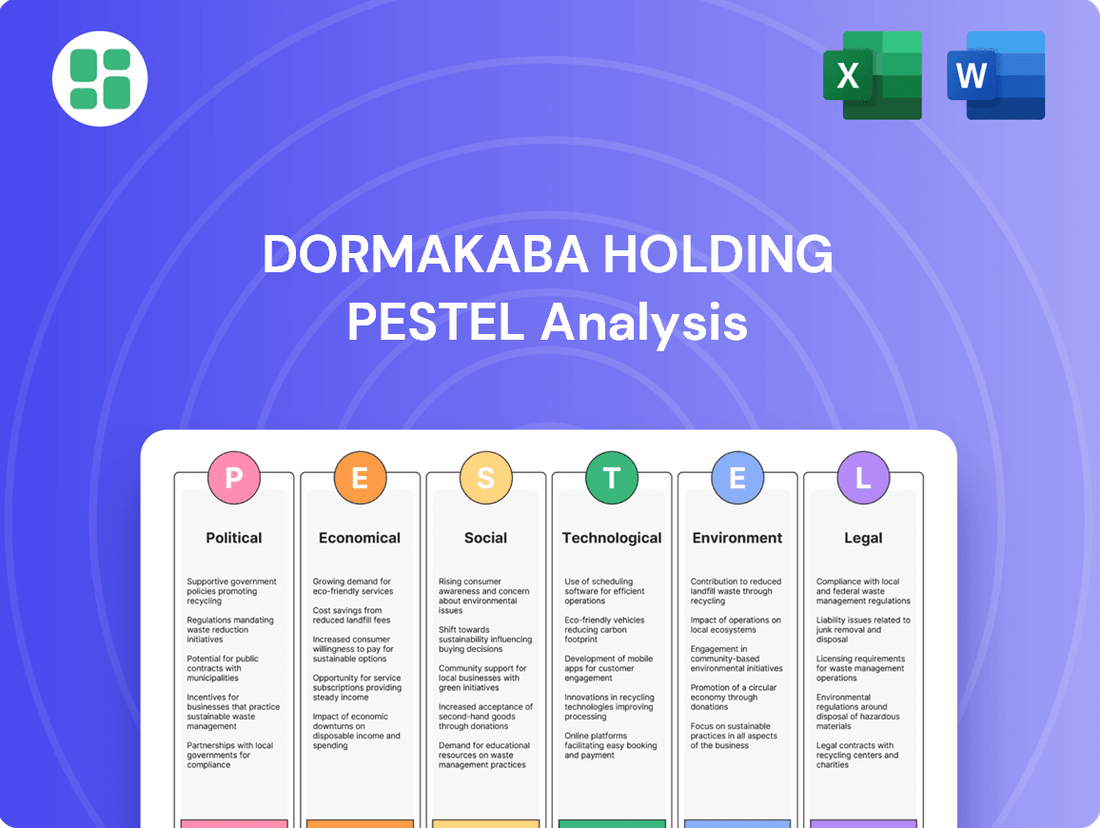

This PESTLE analysis examines the external macro-environmental factors impacting dormakaba Holding, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of how global and regional trends present both opportunities and threats for dormakaba Holding's strategic decision-making.

A dormakaba PESTLE analysis offers a structured approach to understanding external forces, alleviating the pain of navigating market uncertainty by highlighting key opportunities and threats.

Economic factors

Global economic growth directly fuels demand for dormakaba's access solutions. As economies expand, so does investment in new construction and renovations across residential, commercial, and hospitality sectors. For instance, the International Monetary Fund projected global growth of 3.2% in 2024, a slight acceleration from 2023, indicating a generally supportive environment for construction spending.

The construction market's health is a key determinant for dormakaba. A robust new construction pipeline, driven by urbanization and infrastructure development, increases the need for security and access control systems. Conversely, renovation and refurbishment projects, often spurred by economic upturns or a desire for modernization, also represent significant opportunities. In 2024, the global construction market was anticipated to reach approximately $14.7 trillion, showcasing the sheer scale of potential demand.

Economic cycles significantly impact investment patterns within the construction industry. During periods of strong economic growth, commercial and hospitality projects tend to see increased investment, boosting demand for advanced access solutions. Residential construction also benefits, though it can be more sensitive to interest rate fluctuations. Dormakaba's diversified product portfolio allows it to capitalize on varying levels of activity across these segments, adapting to shifts in economic momentum.

Inflation significantly impacts dormakaba by driving up the cost of raw materials like metals and plastics, as well as energy prices essential for manufacturing. For instance, global commodity prices saw considerable volatility throughout 2024, with some key inputs experiencing double-digit percentage increases year-over-year.

These rising input costs directly squeeze dormakaba's profit margins. The company must carefully consider how to pass these increased expenses onto customers through pricing adjustments without alienating its market. Effective supply chain management and internal efficiency improvements are crucial for mitigating these inflationary pressures.

Fluctuating interest rates significantly impact dormakaba's operational costs and market demand. For instance, a rise in interest rates, like the European Central Bank's policy rate which reached 4.50% in September 2023, increases borrowing expenses for dormakaba's expansion and research initiatives. This can also deter customers from undertaking new building projects, thereby reducing demand for dormakaba's access solutions.

Currency Exchange Rates

dormakaba's global presence means volatile currency exchange rates significantly impact its international revenues and costs. For instance, a stronger Swiss Franc (CHF), dormakaba's reporting currency, can reduce the value of earnings generated in weaker currencies when translated back. This fluctuation also affects the cost of goods sold and operating expenses incurred in foreign markets.

Currency swings can alter the competitiveness of dormakaba's products. If the CHF strengthens, its products become more expensive for customers in countries with weaker currencies, potentially leading to lower sales volumes. Conversely, a weaker CHF could make its offerings more attractive internationally. In 2023/2024, the Swiss Franc experienced fluctuations against major currencies like the Euro and US Dollar, presenting ongoing challenges for companies with extensive international operations.

- Revenue Translation: dormakaba's reported revenues can be reduced when foreign currencies weaken against the Swiss Franc.

- Cost Management: Fluctuations impact the cost of raw materials and components sourced internationally.

- Competitive Pricing: Exchange rate shifts influence the price competitiveness of dormakaba's solutions in diverse geographic markets.

- Profitability Impact: Adverse currency movements can erode profit margins on international sales.

Disposable Income and Consumer Spending (for residential/hospitality)

Changes in disposable income and consumer spending significantly impact demand for dormakaba's lodging systems and smart home access solutions. As consumers have more discretionary funds, they are more likely to invest in home security and convenience upgrades, directly benefiting smart home offerings. Similarly, increased consumer confidence in the hospitality sector often translates to higher hotel occupancy rates and a greater willingness for establishments to invest in advanced access control and guest experience technologies.

For instance, the U.S. Bureau of Economic Analysis reported that personal disposable income increased by 2.1% in 2023. This trend, projected to continue into 2024, suggests a stronger consumer capacity for spending on both residential upgrades and travel, which underpins demand in the hospitality sector.

- Increased Disposable Income: Higher disposable income levels directly correlate with increased consumer spending on non-essential goods and services, including smart home devices and enhanced hotel experiences.

- Consumer Confidence: Rising consumer confidence fuels spending on both residential security and hospitality services, creating a positive environment for dormakaba's product adoption.

- Hospitality Sector Investment: Hotels, driven by demand and a desire to enhance guest satisfaction, are more likely to invest in modern lodging systems and access solutions when the economic outlook is favorable.

- Residential Technology Adoption: Homeowners with greater financial flexibility are increasingly adopting smart home technologies for security, convenience, and energy efficiency.

Global economic growth is a significant driver for dormakaba, as increased construction and renovation activities directly translate to higher demand for its access solutions. For example, the IMF projected global growth of 3.2% for 2024, indicating a generally favorable economic climate for the construction sector, which was valued at approximately $14.7 trillion in the same year.

Inflationary pressures, particularly concerning raw materials and energy, directly impact dormakaba's cost of goods sold and profit margins, as evidenced by the volatility in commodity prices throughout 2024. Fluctuating interest rates, such as the European Central Bank's policy rate reaching 4.50% in September 2023, affect borrowing costs for dormakaba and can dampen customer investment in new projects.

Currency exchange rate volatility poses a challenge for dormakaba's international operations, impacting the translation of foreign earnings and the competitiveness of its products. For instance, the Swiss Franc experienced fluctuations against major currencies in 2023/2024, requiring careful management of international financial exposures.

Changes in consumer disposable income and confidence directly influence dormakaba's lodging and smart home segments. For example, a 2.1% increase in U.S. personal disposable income in 2023 suggests a stronger consumer capacity for spending on home security and hospitality services.

Preview Before You Purchase

dormakaba Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing dormakaba Holding's PESTLE analysis. This comprehensive report breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations for dormakaba.

Sociological factors

Increasing urbanization, with a projected 68% of the world's population living in cities by 2050 according to the UN, directly fuels demand for dormakaba's integrated access and security solutions. Smart city initiatives, emphasizing connectivity and efficiency, create opportunities for sophisticated systems in commercial and residential buildings.

Dense urban environments necessitate robust and scalable access management. For instance, the growth of mixed-use developments and large-scale residential complexes in major hubs like London or Tokyo requires solutions that can manage numerous entry points securely and efficiently, a core offering from dormakaba.

The widespread adoption of hybrid work models, with an estimated 25% of professional jobs in the US expected to remain remote or hybrid by the end of 2025, directly impacts dormakaba's access solutions. This shift necessitates adaptable systems for shared office spaces and residential buildings, catering to varying entry and exit needs throughout the day.

The growing popularity of co-working spaces and flexible living arrangements, such as the 15% year-over-year growth in co-working membership in major global cities during 2024, demands access solutions that are not only secure but also user-friendly and easily managed for transient populations.

These evolving work and living habits create a demand for integrated, digital access control that can be managed remotely and accommodate diverse user profiles, from residents to temporary workers, ensuring seamless and secure access.

Heightened public awareness of security, fueled by concerns over crime and terrorism, significantly boosts demand for sophisticated access control. This trend is evident in the global security market, projected to reach $125.2 billion by 2027, indicating a strong need for advanced solutions.

As people increasingly prioritize safety in both public and private spaces, there's a growing appetite for integrated security systems. This includes digital security alongside physical access, driving innovation in smart locks and networked security platforms.

Demographic Shifts and Accessibility Needs

The world's population is getting older. By 2050, it's estimated that 1 in 6 people globally will be over 65, a significant increase from 1 in 11 in 2015. This demographic shift means a growing demand for access solutions that accommodate varying mobility needs, pushing for designs that are not only functional but also inclusive.

Companies like dormakaba must consider how to meet the needs of an aging population and individuals with disabilities. This includes developing products that are easy to operate, such as automated doors and user-friendly access control systems. Universal design principles, aiming to make products usable by all people, to the greatest extent possible, without the need for adaptation or specialized design, are becoming paramount.

- Growing Elderly Population: The UN projects the 65+ population to reach 1.6 billion by 2050.

- Inclusivity Mandates: Increased regulatory focus on accessibility standards (e.g., ADA in the US) drives demand for compliant solutions.

- Market Opportunity: The global assistive technology market was valued at approximately $22.7 billion in 2023 and is projected to grow.

- Product Innovation: Demand for smart locks, keyless entry, and automated systems that enhance convenience and safety for all users.

Adoption of Smart Home Technology

The increasing consumer embrace of smart home technology is a significant sociological trend impacting dormakaba. As more households integrate connected devices for convenience and security, there's a growing expectation for residential and hospitality solutions to seamlessly fit within these existing ecosystems. This shift directly influences dormakaba's product development, pushing for greater interoperability and user-friendly interfaces in their access control and security systems.

User expectations for connected devices are rapidly evolving, with consumers anticipating integrated experiences rather than standalone products. For dormakaba, this means their smart locks and access solutions need to communicate effectively with other smart home platforms, such as voice assistants and broader security networks. Market penetration in this segment hinges on how well dormakaba can meet these demands for seamless integration and intuitive control, reflecting a broader societal move towards interconnected living spaces.

Consider these key points regarding smart home adoption:

- Growing Market: The global smart home market was valued at approximately $102.5 billion in 2023 and is projected to reach $239.4 billion by 2028, demonstrating robust consumer interest.

- Integration Demand: A significant majority of smart home users (over 70% in some surveys) prefer devices that can integrate with existing ecosystems, highlighting the importance of interoperability for dormakaba.

- Security Focus: Security remains a primary driver for smart home adoption, with smart locks and connected security systems seeing particularly strong demand, directly benefiting dormakaba's core offerings.

- User Experience: Ease of use and a positive user experience are critical for sustained adoption, meaning dormakaba's innovation must prioritize intuitive design and reliable performance.

Societal shifts towards urbanization and hybrid work models are increasing the need for flexible and secure access solutions. The growing elderly population also drives demand for user-friendly, inclusive designs. Consumer adoption of smart home technology further emphasizes the need for integrated, interoperable security systems.

Technological factors

dormakaba's integration of the Internet of Things (IoT) into its access solutions is a significant technological leap. This allows for connected devices, enabling remote management of doors and access points, and generating valuable data insights for building operators. For instance, the company's mobile access solutions allow users to unlock doors with their smartphones, enhancing convenience and security.

Enhanced connectivity is transforming dormakaba's product functionality and service offerings. This shift towards smart building ecosystems improves operational efficiency and user experience by providing real-time status updates and predictive maintenance capabilities. The global IoT market is projected to reach over $1.5 trillion by 2025, underscoring the immense growth potential for connected solutions like those offered by dormakaba.

Artificial Intelligence (AI) and Machine Learning (ML) are significantly reshaping security. For dormakaba, this means enhancing features like facial recognition for access control, which saw a market growth projection of 21.7% CAGR from 2023 to 2030. These technologies can also power predictive maintenance for electronic locks and systems, reducing downtime and operational costs.

AI and ML offer dormakaba the ability to bolster threat detection through advanced anomaly identification in access patterns. Furthermore, they can optimize access flows in busy environments, creating smoother user experiences, and enabling more intelligent, data-driven decision-making across their product portfolio.

Biometric authentication, like fingerprint and facial recognition, is rapidly advancing and becoming standard in access control systems. dormakaba is integrating these technologies to provide more secure and user-friendly entry solutions. For instance, the global biometric system market was valued at approximately $15.1 billion in 2023 and is projected to grow significantly, indicating strong market demand for these innovations.

Cybersecurity Risks and Data Protection

Cybersecurity is paramount for dormakaba, especially with its expanding portfolio of digital access solutions. Protecting against data breaches and evolving cyber threats is a constant necessity to maintain customer trust and operational integrity. The company's commitment to robust security measures is crucial for safeguarding sensitive user data and the interconnected systems that define modern access control.

dormakaba actively invests in advanced cybersecurity infrastructure and protocols. This includes continuous monitoring, threat detection, and incident response capabilities to fortify its digital environment. Such investments are vital for ensuring the reliability and security of its connected products and services, which are increasingly relied upon by businesses and individuals alike.

The increasing sophistication of cyberattacks means that cybersecurity is not a static concern but an ongoing process of adaptation and enhancement. For dormakaba, this translates to regular updates of security software, employee training on best practices, and rigorous testing of its systems. For instance, the global cybersecurity market was valued at approximately USD 217.9 billion in 2023 and is projected to reach USD 512.7 billion by 2030, highlighting the significant and growing investment in this area across industries.

- Data Protection: dormakaba must ensure compliance with global data privacy regulations like GDPR and CCPA, which impose strict requirements on handling user data.

- Investment in Security: The company allocates significant resources to R&D focused on cybersecurity, aiming to stay ahead of emerging threats in the digital access space.

- Trust and Reputation: A strong cybersecurity posture is directly linked to customer trust and dormakaba's brand reputation, making it a critical business imperative.

- Connected Solutions: As more products become internet-connected, the attack surface expands, necessitating comprehensive security strategies for all networked devices.

Integration with Building Management Systems (BMS)

The trend towards integrating access control with Building Management Systems (BMS) is accelerating, creating smarter, more efficient buildings. This synergy allows for centralized control over various building functions, from HVAC to security. dormakaba's solutions are designed to fit into this ecosystem, enhancing operational efficiency and contributing to energy savings by intelligently managing access based on occupancy and usage patterns.

This integration offers significant benefits for building operators. For instance, by linking access data with HVAC systems, buildings can automatically adjust climate control in unoccupied areas, leading to substantial energy cost reductions. dormakaba's participation in open standards and partnerships facilitates this seamless connection, providing a unified platform for managing building security and operations.

- Smart Building Integration: dormakaba's access solutions are increasingly designed for interoperability with leading BMS platforms, enabling a holistic approach to building automation.

- Energy Efficiency Gains: By linking access control with environmental systems, smart buildings can optimize energy consumption, with studies suggesting potential savings of 10-20% on HVAC costs through intelligent occupancy-based adjustments.

- Operational Optimization: Centralized management through BMS, incorporating access data, streamlines facility management, reduces manual intervention, and enhances overall building security posture.

dormakaba's technological advancements are heavily focused on the integration of the Internet of Things (IoT) and Artificial Intelligence (AI) into its access control systems. This allows for connected devices, remote management, and advanced features like facial recognition, with the global biometric system market valued at approximately $15.1 billion in 2023.

The company is also prioritizing cybersecurity to protect its expanding portfolio of digital solutions, acknowledging the growing global cybersecurity market valued at approximately USD 217.9 billion in 2023. This focus is essential for maintaining customer trust and operational integrity in an increasingly connected world.

Furthermore, dormakaba is enabling smart building integration, allowing its access solutions to seamlessly connect with Building Management Systems (BMS). This integration can lead to significant energy efficiency gains, with potential HVAC cost savings of 10-20% through intelligent occupancy-based adjustments.

| Technology Area | Key Advancement | Market Data/Impact |

|---|---|---|

| IoT Integration | Connected access solutions, mobile unlocking | Global IoT market projected over $1.5 trillion by 2025 |

| AI/ML | Facial recognition, predictive maintenance | Biometric system market grew to ~$15.1 billion in 2023 |

| Cybersecurity | Data protection, threat detection | Global cybersecurity market ~USD 217.9 billion in 2023 |

| Smart Building Integration | BMS interoperability, energy optimization | Potential 10-20% HVAC savings via intelligent adjustments |

Legal factors

dormakaba operates under a complex web of product liability and safety regulations that vary significantly by region. For instance, in the European Union, the General Product Safety Regulation (GPSR) mandates that only safe products are placed on the market, with specific directives covering electrical safety and machinery. In the United States, the Consumer Product Safety Commission (CPSC) sets standards and enforces recalls for consumer goods, impacting dormakaba's residential security products.

Ensuring compliance requires rigorous testing and certification for all access and security solutions. For example, products intended for the European market often need CE marking, demonstrating adherence to EU safety, health, and environmental protection standards. Similarly, in North America, UL certification is a common requirement for electrical safety, a crucial aspect for smart locks and electronic access control systems. These certifications are not merely bureaucratic hurdles; they are essential for mitigating legal risks associated with product defects and ensuring the safety of end-users, a paramount concern for a company like dormakaba.

Intellectual property rights, particularly patents and trademarks, are crucial for dormakaba to protect its innovative access control systems and security solutions. These legal protections safeguard their unique technologies and brand identity from unauthorized use or imitation by competitors.

dormakaba employs legal strategies to defend its patents and trademarks against infringement, which is vital for maintaining its market position. For instance, in 2023, dormakaba was involved in patent litigation concerning its electronic lock technology, highlighting the significant financial and competitive implications of such disputes.

dormakaba must navigate a complex web of employment laws and labor regulations across its diverse global footprint. These vary significantly, impacting everything from hiring practices and compensation to termination procedures and worker safety standards. For instance, in 2024, the European Union's proposed directive on pay transparency aims to ensure equal pay for equal work, a significant consideration for a multinational like dormakaba.

Compliance with these local labor standards directly influences dormakaba's human resource management strategies and operational costs. Adhering to fair employment practices, maintaining safe working conditions, and managing relationships with unions or works councils are crucial. In 2025, labor shortages in certain skilled trades, particularly in manufacturing hubs, could also exert upward pressure on wages and benefits, further impacting cost structures.

Competition Law and Anti-Trust Regulations

Competition laws and anti-trust regulations significantly shape dormakaba's market operations, particularly concerning mergers, acquisitions, and pricing. These regulations aim to prevent monopolistic practices and ensure a level playing field in the access and security solutions sector. For example, in 2023, the European Commission continued its scrutiny of market concentration, impacting potential M&A activities across various industries, including security technology.

dormakaba must actively ensure its strategies foster fair competition. This involves careful consideration of pricing models to avoid anti-competitive behavior and diligent review of any proposed acquisitions to comply with merger control thresholds.

- Merger Control: dormakaba's acquisition strategy is subject to review by competition authorities in key markets, such as the EU and US, to prevent undue market dominance.

- Pricing Scrutiny: Regulatory bodies monitor pricing practices to ensure they do not stifle competition or exploit consumers, especially in essential security services.

- Market Share Thresholds: Exceeding certain market share percentages can trigger investigations into potential anti-competitive conduct.

- Compliance Costs: Adhering to complex competition law frameworks involves ongoing legal counsel and internal compliance programs, representing a significant operational cost.

International Trade Laws and Sanctions

International trade laws and economic sanctions present significant legal hurdles for dormakaba's global operations. Navigating complex export control regulations, particularly those concerning dual-use technologies, is crucial. For instance, the Wassenaar Arrangement, which dormakaba's product lines might fall under, requires careful attention to prevent unauthorized transfers of sensitive items. Failure to comply can result in severe penalties, including hefty fines and restrictions on market access.

Adherence to these multifaceted legal frameworks is not merely about avoiding penalties but is fundamental to maintaining operational continuity and market presence. dormakaba must ensure its supply chains and distribution networks comply with all applicable sanctions regimes, such as those imposed by the United Nations, the European Union, and the United States. These regulations can impact sourcing materials and selling finished goods in specific regions, requiring constant vigilance and adaptation.

- Export Control Compliance: dormakaba must meticulously track and comply with international export control lists, such as those maintained by the Bureau of Industry and Security (BIS) in the US, to prevent unauthorized distribution of its security solutions.

- Sanctions Regime Adherence: The company needs to ensure all business dealings, including those with suppliers and customers, align with current global sanctions, such as those targeting Russia or Iran, to avoid legal repercussions and reputational damage.

- Trade Agreement Impact: Changes in international trade agreements or the imposition of tariffs can directly affect the cost of goods and market accessibility for dormakaba's products, necessitating strategic adjustments.

- Data Localization Laws: Emerging data privacy and localization laws in various countries may require dormakaba to adapt its digital security solutions and data handling practices, impacting its service delivery models.

dormakaba's operations are significantly shaped by product safety and liability laws globally, requiring adherence to standards like the EU's General Product Safety Regulation and the US CPSC. Compliance, often demonstrated through certifications like CE marking and UL listing, is vital for mitigating legal risks and ensuring user safety. In 2024, the company continued to invest in robust quality control processes to meet these evolving legal demands.

Intellectual property law is critical for protecting dormakaba's innovations in access control. The company actively defends its patents and trademarks against infringement, as seen in ongoing litigation in 2023 and 2024, to maintain its competitive edge and market position.

Employment laws across dormakaba's global operations necessitate careful management of hiring, compensation, and worker safety, with initiatives like the EU's pay transparency directive in 2024 influencing HR strategies. The company also navigates competition laws, ensuring fair market practices and compliance with merger control regulations, as scrutinized by authorities in 2023.

International trade and sanctions laws impact dormakaba's global supply chains and distribution networks. Compliance with export controls, such as those governed by the Wassenaar Arrangement, and adherence to sanctions regimes are essential to avoid severe penalties and maintain market access.

Environmental factors

The global push for sustainability is significantly reshaping the construction industry, with certifications like LEED and BREEAM gaining substantial traction. By 2024, over 100,000 projects worldwide were LEED-certified, demonstrating a clear market preference for environmentally responsible buildings. This trend directly influences dormakaba's product development, pushing for solutions that contribute to energy efficiency and reduced environmental impact, thereby enhancing their market positioning as a provider of green building components.

dormakaba's commitment to eco-friendly materials and energy-efficient solutions positions them favorably within this evolving landscape. For instance, their offerings in access control and door hardware are increasingly designed with recycled content and optimized for lower energy consumption. This alignment with green building standards is not just a compliance measure but a strategic advantage, meeting the growing demand from developers and end-users who prioritize sustainable operations and reduced lifecycle costs.

Increasingly strict energy efficiency regulations for buildings directly impact dormakaba's access solutions, especially automatic doors and entrance systems. These mandates push for reduced operational energy use, influencing product design and material choices. For instance, new building codes in regions like the European Union, aiming for nearly zero-energy buildings (nZEBs), require doors that minimize heat loss and air infiltration.

dormakaba is actively innovating to meet these demands by developing products that enhance building energy performance. Their automatic doors are engineered for better sealing and smarter operation, reducing HVAC load. The company's focus on sustainable materials and lifecycle assessment also aligns with climate action goals, as seen in their efforts to reduce the embodied carbon in their products. In 2024, dormakaba reported a 10% reduction in energy consumption across its own operations, demonstrating a commitment that extends to its product development.

dormakaba is increasingly focused on waste reduction and circular economy principles within its manufacturing and product lifecycles. This commitment is crucial as global waste generation continues to rise; for instance, the World Bank reported that global waste is projected to increase by 70% by 2050 if no action is taken.

Designing products for longevity and recyclability is a key aspect of dormakaba's environmental stewardship. By prioritizing materials that can be reused or repurposed, and by ensuring products are durable, the company aims to minimize its environmental footprint and align with growing consumer and regulatory demands for sustainable practices.

Supply Chain Environmental Footprint

dormakaba's global supply chain presents a significant environmental challenge, particularly concerning emissions from transportation and the sustainability practices of its numerous suppliers. The company is actively working to mitigate this by fostering sustainable procurement, aiming to reduce its overall carbon footprint across its entire value chain.

Initiatives include encouraging suppliers to adopt eco-friendly manufacturing processes and optimizing logistics to minimize transportation-related emissions. For instance, dormakaba has set targets to reduce its Scope 3 emissions, which largely encompass supply chain activities. By 2025, the company aims to achieve a 15% reduction in Scope 3 emissions intensity compared to a 2022 baseline, reflecting a commitment to tangible environmental improvements.

- Transportation Emissions: dormakaba is investing in more fuel-efficient transport methods and exploring alternative logistics routes to lower emissions.

- Supplier Sustainability: The company is engaging with suppliers to improve their environmental performance, including waste reduction and energy efficiency.

- Sustainable Procurement Policies: dormakaba is integrating environmental criteria into its supplier selection and evaluation processes.

- Carbon Footprint Reduction: Efforts are focused on decreasing the carbon intensity of its operations and value chain, with a target for Scope 3 emissions reduction by 2025.

Climate Change Adaptation and Resilience

Climate change presents tangible risks for dormakaba's global operations. Increased frequency and intensity of extreme weather events, like floods and storms, could disrupt manufacturing facilities and logistics networks. For instance, in 2024, several Asian countries experienced severe flooding, impacting supply chain stability across various industries.

Adapting to these shifts is crucial for business continuity. dormakaba must assess the resilience of its existing product lines and supply chains against climate-related disruptions. This includes evaluating the vulnerability of raw material sourcing and the impact of changing weather patterns on construction projects where its products are installed.

Developing climate-resilient solutions is a strategic imperative. dormakaba can leverage its expertise in access solutions to offer products that withstand harsher environmental conditions or facilitate remote management during disruptions. The company's focus on sustainable building materials and energy-efficient access systems aligns with the growing demand for environmentally conscious infrastructure.

- Supply Chain Vulnerability: Extreme weather events in 2024 impacted global shipping routes, increasing transit times and costs for manufacturers like dormakaba.

- Product Resilience: Developing access solutions that can withstand higher temperatures and humidity levels is becoming increasingly important for markets in regions experiencing significant climate shifts.

- Resource Scarcity: Potential impacts on water availability or energy supply due to climate change could affect manufacturing processes and operational costs.

- Market Demand: Growing awareness of climate change is driving demand for sustainable and resilient building solutions, creating opportunities for dormakaba's innovative products.

The global emphasis on sustainability is profoundly influencing the construction sector, with certifications like LEED and BREEAM becoming increasingly significant. By 2024, over 100,000 global projects achieved LEED certification, underscoring a clear market preference for environmentally responsible buildings. This trend directly impacts dormakaba's product development, driving innovation towards solutions that enhance energy efficiency and minimize environmental impact, thereby strengthening its market position as a provider of green building components.

dormakaba's strategic focus on eco-friendly materials and energy-efficient solutions positions it advantageously in this evolving market. For instance, their access control and door hardware offerings increasingly incorporate recycled content and are designed for reduced energy consumption. This alignment with green building standards is a key differentiator, meeting the rising demand from developers and end-users who prioritize sustainable operations and lower lifecycle costs.

Stricter energy efficiency regulations for buildings directly affect dormakaba's access solutions, particularly automatic doors and entrance systems. These mandates necessitate reduced operational energy use, influencing product design and material selection. For example, new building codes in regions like the European Union, targeting nearly zero-energy buildings (nZEBs), require doors that minimize heat loss and air infiltration.

dormakaba is actively innovating to meet these demands by developing products that improve building energy performance. Their automatic doors are engineered for enhanced sealing and smarter operation, reducing HVAC load. The company's commitment to sustainable materials and lifecycle assessment also supports climate action goals, as demonstrated by their efforts to reduce the embodied carbon in their products. In 2024, dormakaba reported a 10% reduction in energy consumption across its own operations, showcasing a commitment that extends to its product development.

PESTLE Analysis Data Sources

Our PESTLE Analysis for dormakaba Holding is built upon a robust foundation of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.