dormakaba Holding Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

dormakaba Holding Bundle

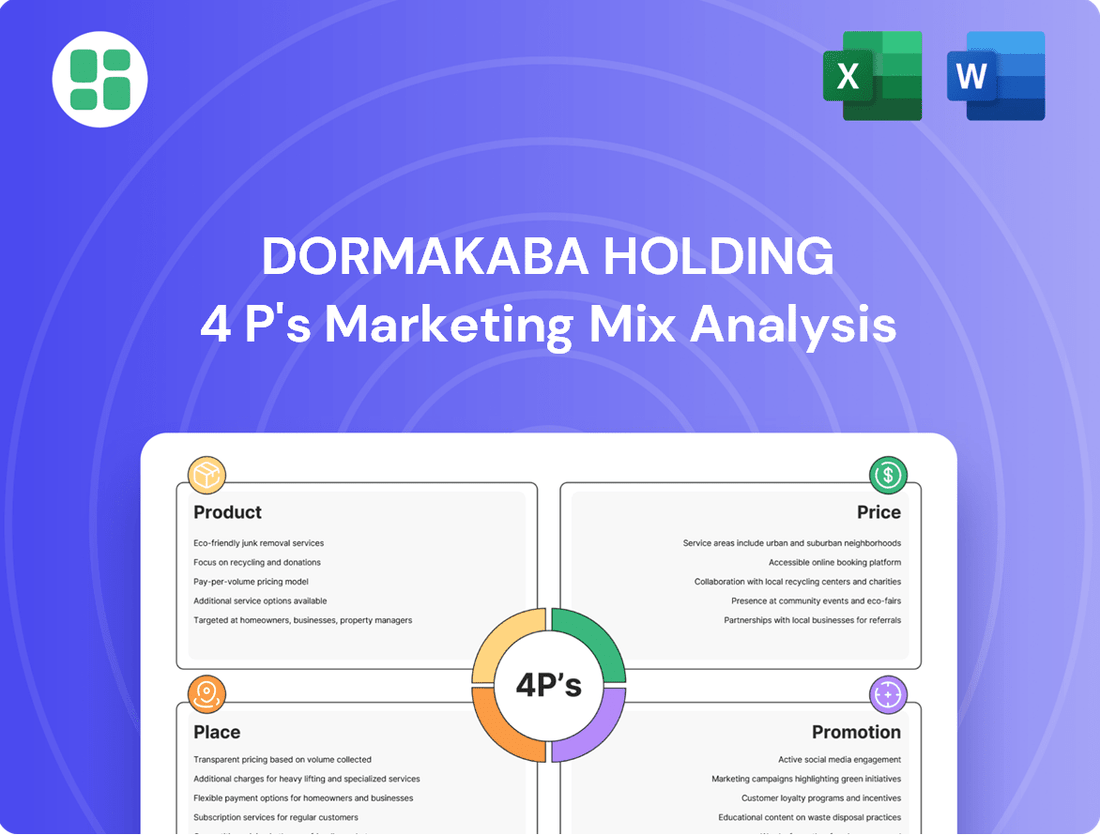

dormakaba Holding's marketing mix strategically leverages its diverse product portfolio, from access solutions to smart locking systems, to meet global security needs. Their pricing reflects a balance of innovation and accessibility, while their extensive distribution network ensures widespread availability. This comprehensive approach is further amplified by targeted promotional efforts aimed at both B2B and B2C markets.

Want to uncover the intricate details of dormakaba Holding's product innovation, pricing strategies, channel management, and promotional campaigns? Save hours of research and gain actionable insights with our complete, editable 4Ps Marketing Mix Analysis, perfect for strategic planning and competitive benchmarking.

Product

dormakaba's Comprehensive Access Solutions Portfolio is a cornerstone of their marketing mix, showcasing a vast array of products and services for secure building access. This includes everything from classic door locks to sophisticated electronic systems and even specialized glass solutions for interiors and hospitality.

The breadth of this portfolio is impressive, designed to meet the unique security and convenience demands across numerous sectors. Whether it's for a bustling airport, a secure data center, or a welcoming hotel, dormakaba aims to provide tailored access management.

For instance, dormakaba reported a revenue of CHF 2.8 billion for the fiscal year 2022/23, underscoring the significant market presence and demand for their integrated access solutions. This financial performance highlights the effectiveness of their diverse product strategy in capturing various market segments.

dormakaba's product strategy heavily emphasizes smart and connected innovations, focusing on intelligent access solutions that are both interoperable and user-friendly. This commitment is evident in their development of digital ecosystems and advanced electronic locking systems.

The EntriWorX Ecosystem is a prime example, streamlining digital planning and operational processes for buildings. Furthermore, the Quantum Pixel⁺ hotel electronic lock showcases integration with modern conveniences like digital wallets, enhancing guest experiences and operational flexibility. These advancements are key to dormakaba's vision for smarter building management.

dormakaba's commitment to sustainability is evident in its product development, focusing on eco-conscious designs that deliver enduring value and minimize environmental footprint across a building's lifespan. This approach aligns with a growing market demand for green building solutions.

Technologies like MotionIQ, an intelligent automatic sliding door system, exemplify this focus by significantly cutting energy loss. By precisely managing door open and close cycles, MotionIQ contributes to improved building energy efficiency, a key consideration for new construction and retrofits in 2024 and 2025.

Furthermore, the Door Efficiency Calculator tool empowers architects and planners. This resource facilitates informed, sustainable design choices, helping to quantify the environmental benefits of dormakaba's solutions and supporting green building certifications.

Solutions for Critical Infrastructure

dormakaba's "Solutions for Critical Infrastructure" segment focuses on specialized access control and security technologies for high-risk environments. This includes airports, data centers, and government facilities, where uninterrupted operation and stringent security are paramount. The company's product development actively addresses the increasing demand for sophisticated physical security in interconnected critical systems.

Innovations like the skyra turnstile system and automated personal screening solutions highlight dormakaba's dedication to strengthening security in sensitive locations. These advanced offerings are designed to meet the rigorous standards required for protecting national infrastructure and vital data repositories. For instance, in 2024, the global critical infrastructure protection market was valued at an estimated $175 billion, with a projected compound annual growth rate of 6.5% through 2030, underscoring the significant market opportunity for dormakaba's specialized solutions.

- Airport Security Enhancements: Solutions like automated boarding gate access and advanced screening technologies improve passenger flow and security.

- Data Center Access Control: Robust physical security measures, including biometric access and secure data hall entry, protect sensitive information.

- Government Facility Protection: High-security doors, integrated access management, and perimeter security systems safeguard sensitive government operations.

- Networked Facility Integration: dormakaba's offerings are designed for seamless integration into broader security networks, ensuring comprehensive protection for critical infrastructure.

Focus on User Experience and Barrier-Free Access

dormakaba's commitment to user experience and barrier-free access is a key differentiator. Their product development actively prioritizes enhancing user comfort, safety, and overall accessibility. This approach ensures that their solutions cater to a wider range of users and environments.

A prime example is the EasyAssist door assistant. This innovative product offers a low-energy drive, facilitating barrier-free and hygienic passage in diverse settings. This directly addresses the growing demand for inclusive design in public and commercial spaces.

- Focus on User Comfort: Products are designed to be intuitive and easy to operate for everyone.

- Enhanced Safety: Features are integrated to minimize risks and ensure secure passage.

- Barrier-Free Access: Solutions actively remove physical and operational obstacles.

- Hygienic Solutions: Products contribute to healthier environments, particularly relevant in post-2020 considerations.

dormakaba's product strategy centers on a comprehensive access solutions portfolio, ranging from traditional locks to advanced electronic systems and glass solutions. This broad offering caters to diverse security and convenience needs across sectors like airports and hotels. The company's focus on smart, connected, and sustainable innovations, such as the EntriWorX Ecosystem and MotionIQ, positions them for growth in the evolving smart building market.

| Product Category | Key Features/Examples | Target Market | 2024/2025 Relevance |

|---|---|---|---|

| Access Solutions | Electronic locks, mechanical locks, key management systems | Residential, Commercial, Hospitality | Continued demand for integrated security and convenience. |

| Smart & Connected Access | EntriWorX Ecosystem, Quantum Pixel⁺ hotel lock | Smart Buildings, Hospitality, Enterprise | Growth in IoT and digital access management. |

| Critical Infrastructure Security | Turnstiles (skyra), screening solutions | Airports, Data Centers, Government Facilities | Increasing need for robust physical security in high-risk environments. |

| Sustainability Focused | MotionIQ automatic doors, Door Efficiency Calculator | New Construction, Retrofits, Green Buildings | Emphasis on energy efficiency and reduced environmental impact. |

What is included in the product

This analysis delves into dormakaba Holding's marketing mix, examining their product portfolio, pricing strategies, distribution channels, and promotional activities. It provides insights into how these elements contribute to their market positioning and competitive advantage.

Condenses dormakaba's 4P marketing mix into actionable insights, alleviating the pain of complex strategy by providing a clear, concise overview for swift decision-making.

Serves as a pain point reliever by simplifying dormakaba's 4Ps into a digestible format, enabling quick understanding and alignment across teams and stakeholders.

Place

dormakaba’s global distribution network is a cornerstone of its market strategy, enabling access to over 130 countries. This expansive reach ensures its security and access solutions are available to a diverse and growing international customer base.

The company’s commitment to global accessibility is further demonstrated by its robust logistics and supply chain infrastructure, which supported its reported net sales of CHF 2,855 million for the fiscal year ending June 30, 2023. This network is crucial for delivering its wide range of products efficiently across different regions.

dormakaba effectively utilizes a hybrid approach, combining direct sales channels with a strong network of carefully selected distribution partners. This dual strategy allows for deep market penetration and tailored customer service in various regional markets, adapting to local needs and regulations.

dormakaba strategically expands its market presence through key partnerships and acquisitions, aiming to broaden its customer base and geographical reach. This approach is crucial for integrating new technologies and accessing untapped markets efficiently.

A prime example of this strategy is the July 2025 collaboration with Basepoint Building Automations. This alliance is designed to significantly boost dormakaba's access automation capabilities and market penetration within the Midwest and Great Plains areas of the United States.

These carefully chosen partnerships allow dormakaba to accelerate the introduction of innovative access solutions to new customer segments. By joining forces, the company can achieve greater market penetration and offer advanced products with enhanced speed and precision.

dormakaba is strategically focusing on key regional markets for expansion, with North America identified as a primary growth engine. The company has set an ambitious target to grow its North American presence at a rate of GDP plus 2% annually for the next three years. This growth will be achieved through concentrated efforts in specific geographic areas and by optimizing the customer experience.

In addition to North America, dormakaba is experiencing robust organic growth in its established European markets. Germany and the UK/Ireland regions are showing particular strength, largely due to successful project-based business within critical industry sectors.

Integrated Sales and Service Approach

dormakaba's integrated sales and service approach extends far beyond simply distributing products. They provide a full spectrum of support, encompassing installation, crucial preventative maintenance, and expert specification writing and consulting services. This holistic strategy guarantees clients receive assistance at every stage of a building project, from the earliest discussions through to long-term upkeep.

This commitment to comprehensive support is particularly evident in dormakaba's robust service infrastructure. For instance, in the United States, the company operates an extensive network of service branches. This strategic placement is designed to enhance customer convenience significantly and bolster overall operational efficiency, ensuring prompt and effective service delivery.

The value of this integrated approach is substantial. For example, dormakaba's service division plays a vital role in customer retention and revenue generation. In fiscal year 2023/24, dormakaba reported that its Services segment generated approximately CHF 778 million in revenue, highlighting the financial importance of these offerings.

- Comprehensive Support: dormakaba offers installation, preventative maintenance, and consulting services throughout the building lifecycle.

- US Service Network: A strong network of service branches in the US maximizes customer convenience and operational efficiency.

- Revenue Contribution: The Services segment contributed approximately CHF 778 million to dormakaba's revenue in fiscal year 2023/24.

Optimized Supply Chain and Shared Services

dormakaba is actively transforming its operations by building regional shared service centers. This strategic move has already seen over ten countries migrate transactional activities, streamlining processes and boosting efficiency. The goal is to simplify operations and create a more cost-effective global supply chain.

This initiative is fundamentally about enhancing resilience and simplicity within dormakaba's supply chain. By consolidating transactional functions, the company aims to achieve greater cost-efficiency. A key aspect is leveraging its established local-for-local operations footprint to build a more robust and responsive network.

- Regional Shared Service Centers: Over ten countries have migrated transactional activities, enhancing operational efficiency.

- Supply Chain Optimization: Focus on resilience, simplicity, and cost-efficiency across the global network.

- Local-for-Local Footprint: Capitalizing on existing local operations to strengthen regional supply chains.

dormakaba's global presence is supported by an extensive distribution network reaching over 130 countries, ensuring product availability and efficient delivery. This reach, combined with a hybrid sales approach leveraging direct channels and partners, allows for deep market penetration and tailored customer service across diverse regions.

Strategic partnerships, like the July 2025 collaboration with Basepoint Building Automations to enhance access automation in the US Midwest, are key to accelerating market entry for new solutions. The company is also prioritizing growth in North America, targeting GDP plus 2% annual growth, while seeing strong organic expansion in Germany and the UK/Ireland.

dormakaba's integrated sales and service model provides comprehensive support, from installation to maintenance and consulting. This is backed by a robust US service network designed for customer convenience and efficiency, with the Services segment contributing significantly to revenue, generating approximately CHF 778 million in fiscal year 2023/24.

Operational efficiency is being boosted through regional shared service centers, with over ten countries already migrating transactional activities to simplify processes and create a more cost-effective global supply chain, emphasizing resilience and local-for-local operations.

| Metric | FY 2023/24 | Target/Comment |

| Net Sales | CHF 2,855 million (FY ending June 30, 2023) | Global reach supports sales |

| Services Revenue | ~ CHF 778 million | Significant contribution to overall revenue |

| North America Growth Target | GDP + 2% annually | Key growth engine for next three years |

| Countries with Migrated Transactional Activities | Over 10 | Part of regional shared service center initiative |

Full Version Awaits

dormakaba Holding 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive dormakaba Holding 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You can confidently purchase knowing you're getting the exact version of this valuable market insight.

Promotion

dormakaba's strategic presence at global trade fairs like BAU 2025 and HITEC 2025 is a key element of its marketing mix, specifically within the 'Promotion' pillar. These exhibitions are vital for demonstrating cutting-edge access solutions and the company's forward-thinking approach to security and sustainability.

Participation in these high-profile events allows dormakaba to directly engage with a global audience of industry professionals, potential clients, and partners. For instance, at BAU 2025, the company can highlight its latest product launches and technological advancements, reinforcing its brand image as an innovator in the access control sector.

These trade shows also provide invaluable opportunities for market intelligence gathering and competitive analysis. By observing industry trends and competitor activities, dormakaba can refine its product development and marketing strategies, ensuring it remains at the forefront of the security and access solutions market through 2025 and beyond.

dormakaba's promotional strategy strongly emphasizes innovation and sustainability, aligning with increasing market demand for smart and eco-friendly building solutions. Their campaigns frequently center on themes like 'For Every Place That Matters,' underscoring how their products contribute to societal well-being through enhanced safety, security, and environmental responsibility.

This focus is particularly relevant as the global green building market is projected to reach $2.18 trillion by 2027, according to some market analyses, indicating a significant consumer and industry shift towards sustainable practices. dormakaba's commitment to developing smart access solutions and energy-efficient products directly addresses this growing segment, positioning them favorably for future growth.

dormakaba actively utilizes digital marketing to showcase its comprehensive offerings, particularly its integrated access solutions like the EntriWorX Ecosystem. This digital ecosystem streamlines the entire lifecycle of access solutions, from initial planning and installation to ongoing operation, demonstrating a commitment to digital innovation.

The company enhances customer engagement through its website by featuring an interactive city map. This tool allows users to explore dormakaba's products within a detailed 3D model, creating an immersive and personalized experience that highlights the practical application of their solutions.

While specific 2024/2025 digital marketing spend figures for dormakaba are not publicly detailed, the company's strategic focus on digital platforms aligns with industry trends. For instance, the global digital marketing market size was estimated to be over $600 billion in 2023 and is projected to continue its robust growth, underscoring the importance of such digital initiatives for companies like dormakaba.

Investor and Analyst Engagement

dormakaba actively engages the financial community through transparent communication channels. This includes regular investor and analyst presentations, comprehensive half-year reports, and dedicated Capital Markets Days. These forums are crucial for updating stakeholders on strategic advancements, financial results, and upcoming growth plans.

For instance, the Capital Markets Day 2024 served as a key platform to detail the company's progress and outlook. Such consistent engagement aims to bolster investor confidence and solidify dormakaba's market standing. The company reported a revenue of CHF 2.5 billion for the fiscal year 2023/24, indicating its operational scale and market presence.

- Investor Relations Channels: Regular presentations, half-year reports, Capital Markets Days.

- Communication Focus: Strategic progress, financial performance, future growth initiatives.

- Objective: Reinforce investor confidence and enhance market positioning.

- Fiscal Year 2023/24 Performance: Reported revenue of CHF 2.5 billion.

Public Relations and Media Releases

dormakaba leverages public relations and media releases as a key component of its marketing strategy. The company actively communicates significant developments, including new product introductions, collaborations, financial performance updates, and advancements in sustainability. This proactive approach ensures consistent visibility and reinforces dormakaba's position as an industry leader.

The strategic use of media outreach is crucial for disseminating information and shaping public perception. By issuing press releases, dormakaba informs stakeholders about its innovations and business activities, fostering transparency and trust. This communication channel is vital for reaching a broad audience, from investors to end-users.

Awards serve as powerful endorsements, and dormakaba strategically highlights its accolades to bolster brand credibility. For instance, securing wins at the 2025 SIA New Products and Solutions Awards for EntriWorX™ Insights and CenconX™ Safe Lock provides tangible proof of their product excellence. These recognitions are amplified through media channels to enhance market standing.

Key PR activities include:

- Announcements of new product launches and technological advancements.

- Reporting on financial results and strategic business developments.

- Highlighting sustainability initiatives and corporate social responsibility efforts.

- Leveraging industry awards and recognitions to build brand reputation.

dormakaba's promotional efforts are multifaceted, encompassing digital marketing, public relations, and direct engagement through industry events. The company's digital strategy centers on showcasing integrated solutions like the EntriWorX Ecosystem, aiming to streamline the entire lifecycle of access management. This digital push aligns with the broader market trend, where the global digital marketing market was valued at over $600 billion in 2023.

Public relations activities focus on announcing new products, financial performance, and sustainability initiatives, reinforcing dormakaba's leadership position. Awards, such as those at the 2025 SIA New Products and Solutions Awards, are strategically leveraged to enhance brand credibility. These efforts are supported by a reported revenue of CHF 2.5 billion for the fiscal year 2023/24, demonstrating the scale of their operations.

| Promotional Activity | Key Focus/Objective | Supporting Data/Example |

|---|---|---|

| Digital Marketing | Showcasing integrated solutions (EntriWorX Ecosystem) | Global digital marketing market > $600 billion (2023) |

| Public Relations | New products, financial updates, sustainability | Awards at 2025 SIA New Products and Solutions Awards |

| Industry Events | Demonstrating innovation (BAU 2025, HITEC 2025) | CHF 2.5 billion revenue (FY 2023/24) |

Price

dormakaba employs a value-based pricing strategy, aligning its prices with the perceived benefits of its integrated access and security solutions. This approach highlights the security, convenience, and sustainability advantages offered across a building's entire lifecycle.

The company focuses on delivering enhanced customer value by bridging the physical and digital realms within its products. This integration supports its pricing by demonstrating superior functionality, improved operational efficiency, and long-term cost savings for clients.

For the first half of the 2024/25 fiscal year, dormakaba Holding saw its organic net sales grow, with pricing playing a key role alongside volume increases. This strategic pricing approach was particularly evident in the Access Solutions segment, where it significantly boosted growth.

The company's ability to achieve higher price realizations demonstrates a strong command of its market position and an effective response to challenging economic conditions. This focus on pricing strategy underscores dormakaba's commitment to profitable growth.

dormakaba has reaffirmed its commitment to achieving its mid-term financial objectives, targeting an annual organic sales growth rate of 3-5% through fiscal year 2025/26. This growth is underpinned by a strategic focus on margin expansion, with an adjusted EBITDA margin goal set between 16-18%.

The company's ongoing transformation program is a key driver for this margin enhancement, focusing on operational efficiencies and optimized procurement strategies. These initiatives are designed to bolster profitability and ensure the company's long-term financial health.

This dedication to improving profitability directly informs dormakaba's pricing strategies, ensuring that pricing decisions align with the objective of sustainable financial performance and value creation for stakeholders.

Cost Savings and Portfolio Optimization

dormakaba is actively pursuing strategic initiatives to reduce product complexity, a key element in optimizing its marketing mix. By streamlining its door closer portfolio, the company anticipates substantial cost savings, projected to reach significant levels by the 2027/28 fiscal year. These efficiencies are crucial for maintaining competitive pricing in the market.

These cost efficiencies directly translate into improved profitability, allowing dormakaba to reinvest in its product development and marketing efforts. This focus on operational simplification, including consolidating software platforms and minimizing hardware variations, underpins the company's commitment to a lean and effective business model.

- Streamlining product lines: Aims to cut costs by reducing SKUs and manufacturing complexity.

- Software platform consolidation: Expected to lower IT expenses and improve user experience.

- Hardware portfolio minimization: Focuses on core, high-demand products to boost efficiency.

- Projected cost savings: Significant financial benefits anticipated by the 2027/28 fiscal year.

Competitive and Accessible Pricing Models

dormakaba employs competitive and accessible pricing models, evident in their provision of product price books for commercial hardware and electronic access solutions. This structured approach allows customers to easily understand cost structures, ensuring market competitiveness. For more complex or customized projects, clients can engage with sales consultants to receive tailored pricing, making their advanced security solutions accessible to a broad range of businesses.

The company's commitment to accessibility is further demonstrated by its tiered product offerings, catering to different budget requirements within the security market. For instance, their residential access control systems often present more entry-level price points compared to enterprise-level integrated solutions. This strategy ensures that dormakaba can serve a wider customer base, from individual homeowners to large corporations, maintaining a strong market presence.

- Structured Pricing: Availability of product price books for commercial hardware and electronic access.

- Personalized Consultations: Access to sales consultants for tailored pricing on complex solutions.

- Market Competitiveness: Pricing designed to be attractive and accessible to target markets.

- Tiered Offerings: Products available at various price points to suit different customer needs and budgets.

dormakaba's pricing strategy is deeply intertwined with its value proposition, emphasizing the long-term benefits and integrated security solutions it offers. For the first half of fiscal year 2024/25, the company saw positive organic net sales growth, with pricing being a significant contributor, particularly in the Access Solutions segment.

The company's ability to achieve higher price realizations reflects its strong market positioning and adaptability to economic conditions. This focus on strategic pricing supports its mid-term financial objectives, including an annual organic sales growth target of 3-5% through fiscal year 2025/26 and an adjusted EBITDA margin of 16-18%.

dormakaba's efforts to reduce product complexity, such as streamlining its door closer portfolio, are projected to yield significant cost savings by fiscal year 2027/28. These efficiencies are crucial for maintaining competitive pricing and enhancing overall profitability.

| Metric | FY 2024/25 (H1) | Target FY 2025/26 |

|---|---|---|

| Organic Sales Growth | Positive Growth | 3-5% |

| Adjusted EBITDA Margin | N/A | 16-18% |

| Cost Savings from Product Streamlining | Ongoing | Significant by FY 2027/28 |

4P's Marketing Mix Analysis Data Sources

Our dormakaba 4P's analysis is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside current market intelligence from industry publications and competitor benchmarking. This ensures a comprehensive understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.