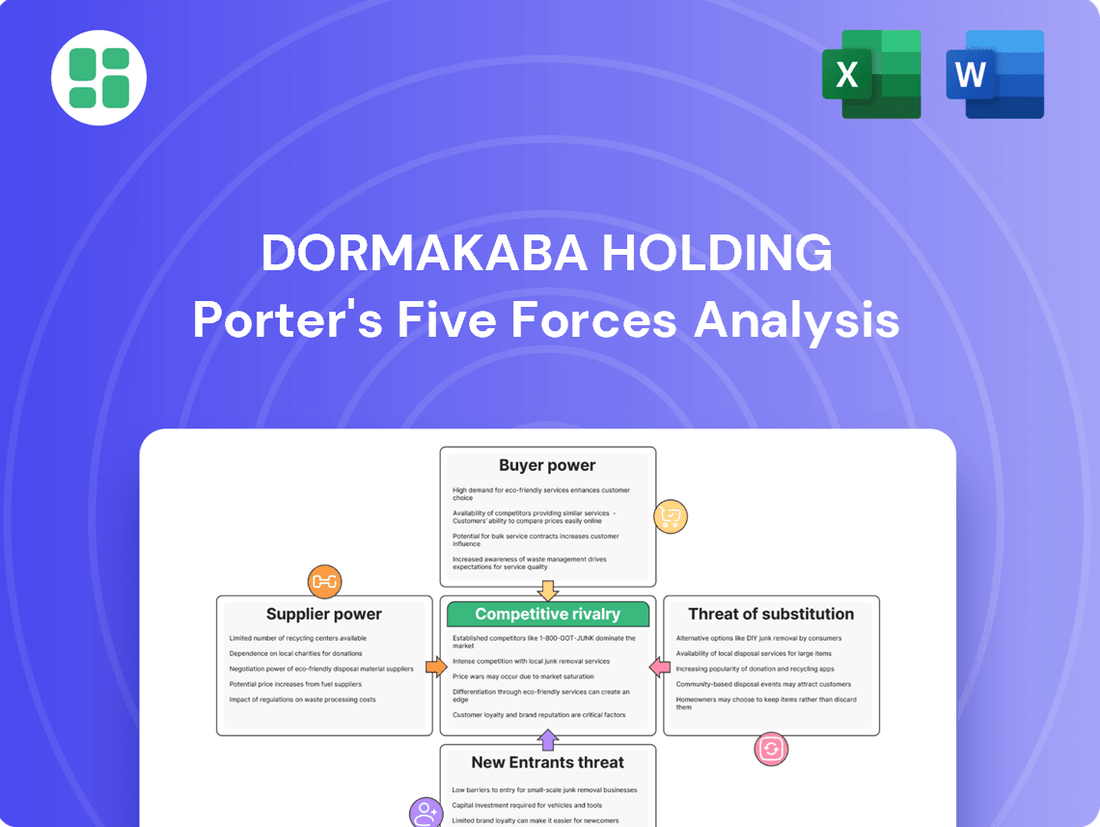

dormakaba Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

dormakaba Holding Bundle

dormakaba Holding operates in a competitive landscape shaped by several key forces. The bargaining power of buyers can be significant, especially for large construction projects, while the threat of new entrants is moderate due to capital requirements and established brand loyalty. The intensity of rivalry among existing players is high, driven by product innovation and pricing strategies.

The complete report reveals the real forces shaping dormakaba Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

dormakaba's reliance on a few key suppliers for specialized components, such as advanced locking mechanisms or unique electronic security chips, significantly amplifies supplier bargaining power. If these suppliers are few and possess unique manufacturing capabilities, dormakaba has limited alternatives, forcing it to accept less favorable terms.

dormakaba's switching costs from its suppliers are a key factor in assessing supplier bargaining power. If dormakaba needs to change suppliers, it might incur significant expenses related to retooling manufacturing equipment or requalifying new materials to ensure they meet strict quality and performance standards. These costs can be substantial, particularly for specialized components used in their access control and security solutions.

The presence of long-term supply agreements can also create switching costs. Renegotiating or terminating existing contracts might involve penalties or legal complexities, further binding dormakaba to current suppliers. For instance, if a supplier has invested in custom tooling specifically for dormakaba's product lines, the cost of replicating that tooling with a new supplier would be a significant barrier.

In 2023, dormakaba reported total sales of CHF 2.89 billion. The proportion of these sales attributable to raw materials and components from key suppliers directly influences the impact of switching costs. If a significant portion of their cost of goods sold relies on highly specialized, custom-made parts, the bargaining power of those particular suppliers would be elevated due to the high switching costs dormakaba would face.

dormakaba's reliance on suppliers for highly differentiated or proprietary components significantly influences supplier bargaining power. If key suppliers provide unique technology or intellectual property that dormakaba cannot easily replicate or source elsewhere, these suppliers gain considerable leverage. For instance, in 2024, dormakaba's focus on advanced electronic access control systems means that specialized chip manufacturers or software developers offering unique security protocols hold substantial influence.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into dormakaba's market, becoming direct competitors in access and security solutions, is a significant factor influencing their bargaining power. If key component suppliers, for instance, possess the technical expertise and market understanding, they could potentially leverage their existing capabilities to manufacture finished products.

This forward integration risk is heightened if suppliers perceive greater profit margins in dormakaba's end-market than in their current supply role. For example, if a specialized electronics supplier to dormakaba sees a substantial opportunity in the smart lock market, they might consider developing their own branded solutions. This would directly challenge dormakaba’s market share and pricing power.

- Supplier Capability Assessment: dormakaba must continuously evaluate the technical and manufacturing capabilities of its key suppliers to gauge their potential for forward integration.

- Market Attractiveness for Suppliers: The profitability and growth prospects within dormakaba's core markets will influence suppliers' incentives to enter these spaces.

- Competitive Landscape Impact: Successful forward integration by suppliers would intensify competition, potentially leading to price wars and reduced market share for dormakaba.

Importance of dormakaba to Suppliers

The significance of dormakaba's business to its suppliers plays a crucial role in determining supplier bargaining power. If dormakaba constitutes a substantial percentage of a supplier's total sales, the supplier's leverage is likely diminished. This is because the supplier would be hesitant to jeopardize a significant revenue stream by demanding unfavorable terms. For instance, if a key component supplier derives over 20% of its revenue from dormakaba, it would likely be more accommodating to dormakaba's pricing and delivery requests.

Conversely, if dormakaba represents a smaller portion of a supplier's customer base, the supplier's bargaining power tends to be stronger. In such scenarios, the supplier is less dependent on dormakaba and can afford to push for better pricing, higher quality standards, or more favorable contract conditions. This is particularly true for specialized suppliers who can readily find alternative buyers for their products or services.

- Supplier Dependence: dormakaba's purchasing volume directly impacts its influence over suppliers. High volume purchases can lead to volume discounts and more favorable contract terms.

- Supplier Concentration: The number of suppliers available for critical components or raw materials affects dormakaba's negotiating position. A concentrated supplier market grants more power to suppliers.

- Switching Costs: The ease or difficulty for dormakaba to switch suppliers influences supplier power. High switching costs empower existing suppliers.

- Supplier Profitability: If dormakaba is a highly profitable client for a supplier, the supplier may be more inclined to maintain the relationship with favorable terms.

dormakaba's bargaining power with its suppliers is notably influenced by the concentration of suppliers for critical components. If a limited number of suppliers can provide specialized parts, like advanced electronic security chips, dormakaba faces elevated supplier leverage. This situation is exacerbated if these suppliers have unique manufacturing capabilities, making it difficult for dormakaba to find viable alternatives.

The cost of switching suppliers significantly impacts dormakaba's negotiating position. High switching costs, arising from the need to retool equipment or requalify materials for specialized components, empower existing suppliers. For example, if a supplier has invested in custom tooling for dormakaba's product lines, the expense of replicating this with a new supplier can be substantial, reinforcing the current supplier's power.

The threat of suppliers integrating forward into dormakaba's market, particularly in the growing smart lock sector, also increases supplier bargaining power. If suppliers perceive greater profit potential in finished security solutions, they may leverage their technical expertise to become direct competitors, intensifying market pressure on dormakaba.

| Factor | Impact on dormakaba | Example Scenario |

|---|---|---|

| Supplier Concentration | High (Limited suppliers for specialized components) | A single manufacturer of advanced biometric sensors for high-security locks. |

| Switching Costs | High (Significant investment in retooling/re-qualification) | Changing a supplier for custom-engineered electronic locking mechanisms. |

| Forward Integration Threat | Moderate to High (Suppliers entering the end-market) | A specialized chip manufacturer developing its own branded smart home security systems. |

| Supplier Dependence on dormakaba | Low (dormakaba is a small client for the supplier) | A niche supplier for unique casing materials that serves many clients. |

What is included in the product

This analysis unpacks the competitive forces shaping dormakaba Holding's market, examining the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats from new entrants and substitutes.

Instantly visualize the competitive landscape for dormakaba, highlighting key threats and opportunities to inform strategic adjustments.

Streamline competitive analysis by providing a clear, actionable framework for understanding dormakaba's market position.

Customers Bargaining Power

dormakaba's customer base exhibits a degree of concentration, particularly within its enterprise and hospitality segments. For instance, major hotel chains and large commercial developers often represent significant, recurring orders, granting them considerable bargaining power. These key clients, by consolidating their purchasing across multiple properties or projects, can leverage their substantial order volumes to negotiate more favorable pricing and terms, directly impacting dormakaba's margins.

The availability of substitute products significantly influences dormakaba's customer bargaining power. If customers can easily find comparable access and security solutions from competitors like ASSA ABLOY or Allegion, their ability to negotiate better terms or switch suppliers increases. For instance, in 2024, the global smart lock market, a key area for dormakaba, was projected to reach over $10 billion, indicating a highly competitive landscape with numerous alternatives available to consumers and businesses.

Switching from dormakaba's integrated access control and security systems to a competitor's typically involves significant costs and complexities for customers. These can include the expense of retraining personnel on new hardware and software, the capital outlay for replacing existing installed infrastructure, and the intricate process of integrating a new system with existing building management or IT networks. For instance, a large commercial building or a university campus relying on dormakaba's advanced solutions would face substantial disruption and financial burden if they were to migrate.

Customer Price Sensitivity

dormakaba's customers exhibit varying degrees of price sensitivity depending on the product or solution. For standard door hardware, which can be more commoditized, customers are likely to be more price-sensitive, giving them greater bargaining power.

However, for integrated access control systems, advanced security solutions, or services where reliability and long-term performance are critical, customers may prioritize these factors over initial cost. This reduced price sensitivity in specialized segments limits their bargaining power.

For example, in the commercial building sector, a significant portion of dormakaba's revenue, the total cost of ownership and the integration capabilities of security systems often outweigh minor price differences. This is particularly true for projects with stringent security requirements or where downtime could be extremely costly.

- High Price Sensitivity: Standard door locks and general hardware components.

- Lower Price Sensitivity: Integrated electronic access control systems, high-security solutions, and specialized solutions for critical infrastructure.

- Impact on Bargaining Power: Increased power for customers in commoditized segments, reduced power for customers seeking specialized, reliable solutions.

- Market Observation: In 2024, the demand for smart and integrated security solutions continued to grow, suggesting a willingness among certain customer segments to pay a premium for advanced features and reliability.

Threat of Backward Integration by Customers

The threat of backward integration by dormakaba's customers can significantly impact its bargaining power. If major clients, such as large construction firms or facility management companies, possess the financial and technical capabilities, they might consider developing their own access and security solutions internally. This capability directly translates into increased leverage, as they can credibly threaten to bypass dormakaba and produce the necessary products themselves, potentially leading to price concessions or altered contract terms.

For instance, a large enterprise with substantial IT infrastructure and a need for standardized security systems might evaluate the cost-effectiveness of in-house development versus continued reliance on dormakaba. The potential for such integration is heightened if dormakaba's offerings are perceived as commoditized or if customers can acquire existing technology providers. This possibility acts as a constant pressure point, influencing dormakaba's pricing strategies and service level agreements.

- Customer Integration Capability: Assess the financial and technical resources of key customers to determine their potential for developing in-house access and security solutions.

- Market Trends: Monitor industry trends that might encourage customer integration, such as increasing demand for customized solutions or dissatisfaction with existing supplier offerings.

- Competitive Landscape: Analyze if customers have acquired or are likely to acquire competitors that offer similar product lines to dormakaba, thereby increasing their in-house capabilities.

- Cost-Benefit Analysis: Understand the cost implications for customers to produce these solutions internally versus continuing to purchase from dormakaba, as this drives the viability of backward integration.

dormakaba's customers, particularly large enterprises and hospitality groups, possess significant bargaining power due to their concentrated purchasing and the availability of numerous substitutes in the competitive access and security market. For example, the global smart lock market, a key segment for dormakaba, was valued at over $10 billion in 2024, highlighting the intense competition and readily available alternatives for customers.

The high costs and complexities associated with switching security systems further influence customer leverage. Migrating from dormakaba's integrated solutions often involves substantial expenses for retraining, new hardware, and system integration, which can make customers hesitant to switch unless significant advantages are offered.

While some customer segments, like those purchasing standard hardware, exhibit high price sensitivity, others seeking advanced, reliable security solutions show lower price sensitivity. This dichotomy means dormakaba faces stronger customer bargaining power in commoditized product areas compared to its specialized, high-security offerings.

| Customer Segment | Price Sensitivity | Bargaining Power Influence |

|---|---|---|

| Large Hotel Chains/Developers | Moderate to High | High (due to volume and potential for standardization) |

| Commercial Building Owners (Standard Hardware) | High | High (due to commoditization and substitutes) |

| Critical Infrastructure/High-Security Facilities | Low | Low (due to focus on reliability and integration) |

Full Version Awaits

dormakaba Holding Porter's Five Forces Analysis

This preview displays the comprehensive dormakaba Holding Porter's Five Forces Analysis, detailing the competitive landscape of the access solutions industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. Rest assured, there are no placeholders or sample content; you get the complete, ready-to-use analysis as presented.

Rivalry Among Competitors

The global access and security solutions market is characterized by a significant number of competitors, ranging from large multinational corporations to smaller, specialized firms. This diverse landscape intensifies competitive rivalry as companies battle for market share.

Giants like ASSA ABLOY, a major player with extensive product lines and global reach, directly compete with dormakaba. Beyond these industry leaders, numerous regional and niche providers offer specialized solutions, further fragmenting the market and increasing competitive pressure.

The global access and security solutions market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) of around 7.5% through 2027. This healthy growth rate suggests that the industry can support multiple players without immediate pressure to aggressively poach market share from competitors. For companies like dormakaba, this environment generally translates to less intense direct rivalry as there is ample opportunity for all participants to grow their businesses.

dormakaba's product differentiation is a key factor in managing competitive rivalry. Their focus on smart, secure, and sustainable access solutions, often integrated into broader building management systems, sets them apart from competitors offering more basic hardware. This advanced functionality and emphasis on security and sustainability create a unique value proposition.

The switching costs for customers in the access control and security solutions market can be substantial. Implementing dormakaba's systems often involves significant upfront investment in hardware, software, and installation. Furthermore, the integration of these systems with existing building infrastructure and the need for specialized training for staff create a sticky customer base, making it less likely for them to switch to a competitor without considerable disruption and expense.

Exit Barriers

dormakaba, operating in the access and security solutions market, faces considerable exit barriers. These are driven by substantial investments in specialized manufacturing equipment and extensive research and development (R&D) for advanced security technologies. For instance, companies in this sector often have highly specific production lines for electronic locks, access control systems, and related hardware, making them difficult to repurpose or sell off if a business decides to exit.

These high fixed costs and the specialized nature of assets mean that even struggling firms may continue to operate to avoid significant losses on asset disposal. This can prolong competition, as unprofitable entities remain in the market, potentially intensifying price wars or product innovation cycles. The need to maintain a global service and support network also represents a significant ongoing commitment.

- Specialized Assets: Manufacturing facilities tailored for security hardware are not easily transferable to other industries.

- High Fixed Costs: Significant capital is tied up in R&D and advanced production capabilities.

- Brand and Reputation: Established brands in security solutions have built trust over time, creating an emotional and reputational barrier to exiting the market.

- Regulatory Compliance: Meeting stringent security and safety standards requires ongoing investment and expertise, making withdrawal complex.

Competitive Strategies Employed

Competitive rivalry within the access solutions industry is intense, with key players like dormakaba employing a multi-faceted approach. This includes aggressive price competition on traditional hardware, alongside significant investment in product innovation. Companies are heavily focused on developing and marketing advanced solutions such as smart locks, biometric scanners, and cloud-based access management systems, leveraging trends in AI and IoT to differentiate themselves.

Marketing and branding are crucial battlegrounds, with firms striving to build strong brand recognition and trust, particularly for high-security applications. Expansion into new geographic markets and the broadening of service offerings, including installation, maintenance, and software support, are also primary strategies to capture market share and customer loyalty.

- Product Innovation: Focus on smart locks, biometrics, and cloud-based systems, driven by AI and IoT integration.

- Market Expansion: Entering new geographic regions and diversifying service portfolios.

- Branding and Marketing: Building strong brand equity and customer trust.

- Price Competition: Particularly on established product lines, while investing in higher-margin innovative solutions.

Competitive rivalry in the access and security solutions market is robust, driven by a mix of large global players and specialized regional firms. dormakaba actively competes through significant investment in product innovation, focusing on smart and integrated security solutions. This intense competition is further fueled by the need to differentiate through advanced technology and comprehensive service offerings.

The market's healthy growth, projected around 7.5% CAGR through 2027, allows for expansion rather than solely aggressive market share capture. However, price competition on traditional hardware remains a factor, balanced by higher-margin innovative products. dormakaba's strategy leverages product differentiation and high switching costs to mitigate direct rivalry.

Key competitive strategies include aggressive product innovation, particularly in smart locks and biometric systems, and expanding service portfolios. Building strong brand equity and trust is crucial, especially for high-security applications.

| Competitor | Key Focus Areas | Market Presence |

|---|---|---|

| ASSA ABLOY | Integrated access solutions, digital security | Global |

| dormakaba | Smart access, security, sustainability | Global |

| Allegion | Residential and commercial security, access control | Global |

| Salto Systems | Electronic locks, access control software | Global |

SSubstitutes Threaten

The threat of substitutes for dormakaba's products is influenced by the price-performance trade-off. For example, while dormakaba offers advanced electronic access control systems, traditional mechanical locks remain a viable, albeit less sophisticated, substitute. These mechanical locks often come at a significantly lower price point, appealing to budget-conscious customers, even if they lack the advanced features and security of electronic systems.

Customer willingness to switch to alternative security solutions for dormakaba products is influenced by perceived value and complexity. If integrated systems like those offered by dormakaba are seen as overly expensive or difficult to manage, customers might consider simpler, standalone options. For instance, a small business might find a basic keypad entry system more appealing than a full biometric access control system if the latter’s cost and integration demands outweigh its perceived benefits.

Technological advancements are a significant threat to dormakaba, as new solutions can emerge that bypass traditional access control. For instance, the rapid development in biometrics, like facial recognition and advanced fingerprint scanners, offers alternative methods for securing entry. The global biometric system market was valued at approximately $22.6 billion in 2023 and is projected to grow substantially, indicating a strong shift towards these technologies.

Indirect Substitutes and Behavioral Changes

Beyond direct product replacements, the threat of substitutes for dormakaba's offerings extends to alternative security measures and evolving user behaviors. For instance, increased reliance on human security guards can reduce the demand for automated access control systems, particularly in certain commercial or event settings. In 2023, the global security services market was valued at approximately $230 billion, highlighting the significant investment in human security personnel.

Architectural design choices that inherently limit access, such as reinforced building structures or strategically placed physical barriers, can also act as substitutes by reducing the need for sophisticated electronic or mechanical security systems. Furthermore, shifts in how spaces are utilized, like the rise of remote work reducing the occupancy and therefore the security needs of office buildings, can diminish the overall demand for dormakaba's core products. The global remote work trend saw around 30% of employees working remotely at least part-time in 2024, a substantial increase from pre-pandemic levels.

- Human Security: The significant global security services market, valued around $230 billion in 2023, represents a substantial alternative to automated security solutions.

- Architectural Design: Building designs incorporating inherent access limitations can reduce reliance on traditional security hardware.

- Behavioral Shifts: The widespread adoption of remote work, with approximately 30% of employees working remotely part-time in 2024, lowers the demand for physical access control in many commercial spaces.

- Remote Access Solutions: The increasing availability and adoption of remote access technologies present a substitute by offering alternative methods of managing and granting access without traditional physical keying or card systems.

Evolution of Security Paradigms

The threat of substitutes for dormakaba's physical access solutions is evolving as security paradigms shift. A significant trend is the move towards purely digital identity verification, which could lessen the need for traditional key cards or even physical locks. For instance, biometric authentication, like facial recognition or fingerprint scanning, is becoming more sophisticated and widely adopted, offering a seamless alternative for access control.

Furthermore, advancements in perimeter-based surveillance systems, such as advanced sensors and drone technology, can also act as substitutes. These systems can provide comprehensive security coverage for an area, potentially reducing the reliance on securing individual entry points with dormakaba's hardware. This shift means that customers might opt for integrated digital security platforms rather than solely investing in physical access hardware.

Consider the growing market for smart home and smart building technologies. These often incorporate integrated security features that manage access digitally, bypassing traditional lock mechanisms. For example, a study by Statista in 2024 projected the global smart home market to reach over $200 billion, indicating a strong consumer and commercial interest in connected, digital security solutions.

- Digital Identity Verification: Biometric systems (facial, fingerprint) are replacing physical credentials.

- Perimeter Security: Drones and advanced sensors offer an alternative to securing individual access points.

- Smart Building Integration: Connected systems manage access digitally, reducing reliance on traditional hardware.

- Market Trends: The global smart home market's projected growth highlights a demand for integrated digital security.

The threat of substitutes for dormakaba's physical access solutions remains significant, driven by technological advancements and changing consumer preferences. Traditional mechanical locks, while less sophisticated, offer a lower price point, making them a viable substitute for budget-conscious customers. The increasing adoption of biometric systems, such as facial recognition and fingerprint scanning, presents a direct alternative to physical credentials, with the global biometric system market valued at approximately $22.6 billion in 2023.

Furthermore, the rise of integrated smart building technologies and digital identity verification methods are eroding the need for traditional hardware. For instance, the global smart home market was projected to exceed $200 billion in 2024, indicating a strong consumer shift towards connected, digital security solutions. Even human security services, a market valued at around $230 billion in 2023, can act as a substitute by providing comprehensive security coverage that might reduce the reliance on securing individual entry points.

| Substitute Category | Example | Market Relevance/Data Point |

|---|---|---|

| Lower-Tech Physical Locks | Traditional Mechanical Locks | Lower price point, appeals to budget-conscious segments. |

| Digital Identity & Biometrics | Facial Recognition, Fingerprint Scanners | Global biometric system market: ~$22.6 billion (2023). |

| Integrated Smart Systems | Smart Home Security Hubs | Global smart home market projected >$200 billion (2024). |

| Human Security Services | On-site Security Guards | Global security services market: ~$230 billion (2023). |

| Behavioral Shifts | Remote Work Adoption | ~30% of employees worked remotely part-time in 2024. |

Entrants Threaten

Entering the access and security solutions market demands substantial capital. Companies need to invest heavily in research and development to keep pace with evolving technologies, establish state-of-the-art manufacturing facilities, and build extensive global distribution and service networks. For instance, in 2023, dormakaba reported R&D expenses of CHF 174.2 million, highlighting the ongoing commitment to innovation required in this sector.

These significant upfront costs act as a formidable barrier for potential new entrants. The sheer financial outlay necessary for product development, production capacity, and market penetration can deter many smaller or less-resourced companies from even attempting to compete with established players like dormakaba.

dormakaba, a global leader in access solutions, benefits significantly from economies of scale, allowing it to spread fixed costs over a larger production volume. This cost advantage makes it challenging for new entrants to match dormakaba's pricing. For example, in 2023, dormakaba reported a revenue of CHF 2.87 billion, indicating substantial operational capacity.

Furthermore, dormakaba leverages economies of scope by offering a wide range of integrated security products and services, from door hardware to electronic access control systems. This broad portfolio creates a more compelling offering for customers and increases switching costs, acting as a barrier to entry for newcomers who may struggle to replicate such a comprehensive suite of solutions.

dormakaba benefits from strong brand recognition and established customer relationships, making it difficult for new entrants to gain traction. Customers often invest heavily in integrated security systems, creating significant switching costs due to the need for new hardware, software, and retraining. For instance, a business upgrading its entire access control system might face expenses in the tens of thousands of dollars, alongside the disruption of operations.

Access to Distribution Channels

New entrants face significant hurdles in securing effective distribution channels within the access control and security solutions market. Established companies like dormakaba have cultivated deep, long-standing relationships with crucial partners, including security system integrators, specialized distributors, and certified installers. These established networks are not easily replicated by newcomers, as trust and proven track records are paramount in this sector.

The difficulty in penetrating these established channels is a major barrier. For instance, in 2024, the global physical security market, which includes access control, was valued at over $100 billion, with a significant portion reliant on these established distribution partnerships. New entrants often struggle to gain the attention and commitment of these key intermediaries, who prioritize reliable suppliers with a history of performance and support.

- Established Relationships: Existing players benefit from years of trust and collaboration with integrators and installers, making it difficult for new companies to break in.

- Channel Control: Major distributors and installers often have exclusive or preferred agreements with incumbent suppliers, limiting opportunities for new entrants.

- Technical Expertise and Support: Distribution partners require robust technical support and training, which new entrants may find costly and time-consuming to establish at the required level.

- Market Inertia: Many customers and channel partners are hesitant to switch from proven solutions and suppliers, creating inertia that favors established brands.

Regulatory and Legal Barriers

The access and security industry is heavily regulated, creating significant hurdles for potential new entrants. Obtaining necessary licenses and certifications, adhering to stringent safety standards, and navigating complex compliance requirements demand substantial investment in time and resources. For instance, in 2024, companies operating in this sector must comply with evolving data privacy regulations like GDPR and CCPA, which add layers of complexity and cost to product development and market entry.

These regulatory and legal barriers effectively raise the cost of entry, deterring smaller or less capitalized firms. New players must demonstrate adherence to a multitude of national and international standards, such as those set by organizations like ISO and ANSI, which often require rigorous testing and auditing. The ongoing evolution of these standards, driven by technological advancements and security concerns, necessitates continuous adaptation and investment, further solidifying the position of established players like dormakaba.

- Regulatory Compliance Costs: New entrants face substantial costs associated with obtaining and maintaining licenses, certifications, and adhering to safety standards in the access and security sector.

- Data Privacy Regulations: Compliance with evolving regulations like GDPR and CCPA (as of 2024) adds complexity and expense to market entry for new companies.

- Industry Standards: Adherence to rigorous international standards (e.g., ISO, ANSI) requires significant investment in testing, auditing, and product development.

- Continuous Adaptation: The need to constantly adapt to new security threats and technological advancements, as well as evolving regulations, poses an ongoing challenge for new entrants.

The threat of new entrants in the access and security solutions market is generally low for dormakaba. This is due to several significant barriers that new companies must overcome. High capital requirements for research, development, and manufacturing, coupled with the need for extensive distribution and service networks, present substantial upfront costs. For example, dormakaba's 2023 R&D investment of CHF 174.2 million underscores the continuous innovation expenditure required.

Economies of scale and scope further deter new entrants. dormakaba's substantial revenue of CHF 2.87 billion in 2023 allows it to achieve cost efficiencies that are difficult for smaller, newer companies to match. Moreover, its broad product portfolio increases customer switching costs, as replicating such an integrated offering is complex and expensive for newcomers.

Established brand reputation, strong customer loyalty, and the high cost of switching systems for clients create another layer of defense. Furthermore, navigating the intricate web of regulatory compliance and obtaining necessary certifications in 2024 adds considerable expense and time, making market entry challenging for less-established entities.

| Barrier Type | Description | Example for dormakaba (2023/2024 Data) |

| Capital Requirements | High investment needed for R&D, manufacturing, and distribution. | R&D Expenses: CHF 174.2 million |

| Economies of Scale | Cost advantages due to large-scale production. | Revenue: CHF 2.87 billion |

| Brand Loyalty & Switching Costs | Established customer relationships and high costs for customers to change providers. | Significant investment for businesses to replace integrated security systems. |

| Regulatory Hurdles | Complex compliance, licensing, and certification requirements. | Adherence to evolving data privacy regulations (GDPR, CCPA) and industry standards. |

Porter's Five Forces Analysis Data Sources

Our dormakaba Porter's Five Forces analysis is built upon a foundation of robust data, drawing from the company's official annual reports, investor relations materials, and industry-specific market research from firms like Statista and IBISWorld.