dormakaba Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

dormakaba Holding Bundle

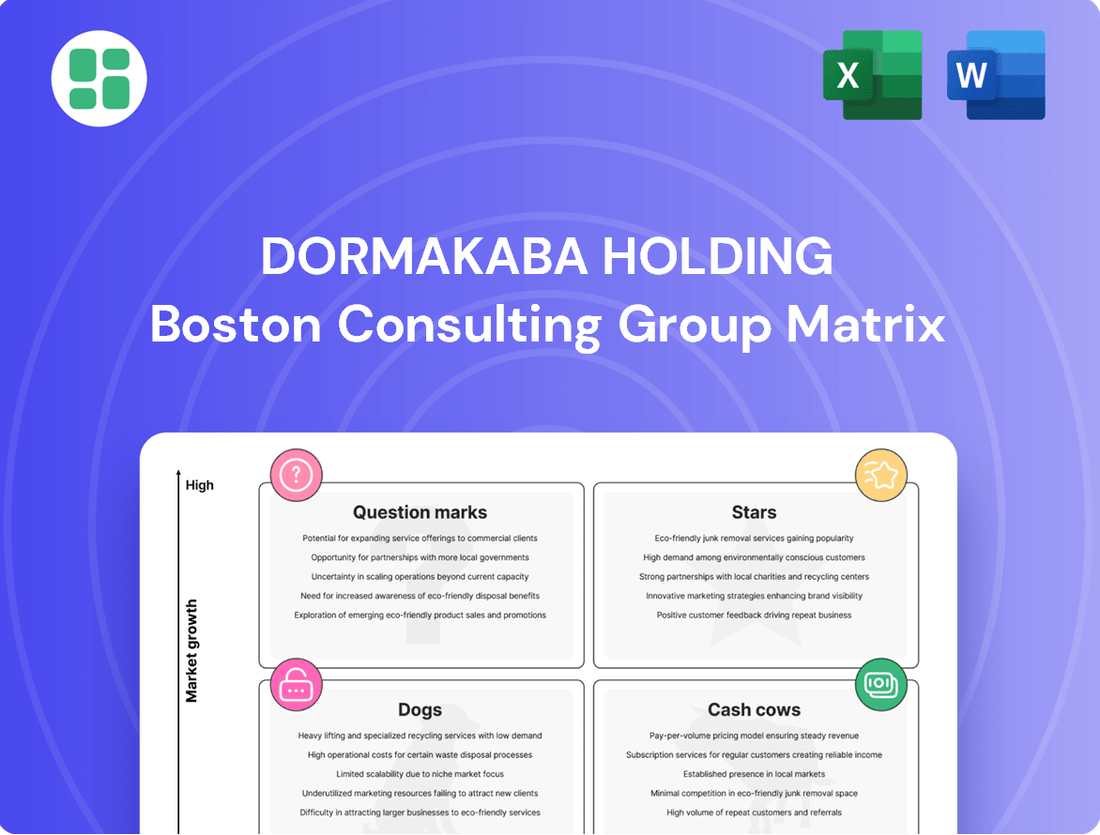

Curious about dormakaba Holding's strategic product portfolio? Our BCG Matrix analysis reveals which segments are driving growth and which might need a closer look. Understand their current market standing to anticipate future opportunities.

This preview offers a glimpse into dormakaba's potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full BCG Matrix for detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investment and product strategies.

Don't miss out on the complete picture! Purchase the full dormakaba Holding BCG Matrix to gain a comprehensive understanding of their market position and receive data-backed recommendations for strategic decision-making.

Stars

dormakaba's digital access control systems, featuring cloud-connected locks and mobile access, are a key growth driver. These advanced electronic solutions meet the rising demand for smart, integrated security in today's buildings. The company's focus on innovation, such as the EntriWorX Ecosystem, is crucial for expanding its market share in this sector, which is benefiting from urbanization and digitalization. For instance, dormakaba reported a 9% organic growth in its Access Solutions segment for the fiscal year 2023/2024, with digital solutions being a primary contributor.

dormakaba is heavily investing in integrated security platforms, merging diverse access and security functions into unified solutions. This strategy caters to clients desiring streamlined building security management throughout its lifecycle. The company highlighted these advancements at major industry events like BAU 2025 and ISC West 2025, signaling its ambition to lead in this expanding market.

dormakaba's hospitality solutions, especially its Quantum Pixel+ and digital wallet key technologies, are driving strong growth, particularly in North America. This segment benefits from the industry's push towards mobile and touchless access, a trend that saw significant acceleration in 2024 as hotels upgraded their guest experiences.

The company's active participation in key industry events like HITEC 2025 underscores its commitment to innovation and market leadership in this high-potential area. This strategic focus positions dormakaba to capitalize on the ongoing digital transformation within the hospitality sector, aiming for continued market share gains.

Access Solutions for Critical Infrastructure

dormakaba's commitment to securing critical infrastructure, such as airports, data centers, and healthcare facilities, places it in a high-growth sector. The company is actively securing substantial project wins within these vital areas. For instance, their Skyra solution for remote access and collaborations on automated personnel screening showcase their cutting-edge technological offerings.

This strategic focus aligns with global imperatives for heightened security and specialized access control. dormakaba is well-positioned to capitalize on these trends, leveraging its established expertise and market standing. In 2024, the demand for robust security solutions in these sectors continued to surge, driven by increasing cyber threats and the need for seamless, secure operations.

- High-Growth Market: Critical infrastructure access is a rapidly expanding segment.

- Advanced Solutions: Products like Skyra and automated screening demonstrate technological leadership.

- Global Demand: Increased focus on security and specialized access fuels market growth.

- Project Wins: dormakaba is consistently securing significant projects in this area.

Sustainable and Energy-Efficient Access Solutions

dormakaba's sustainable and energy-efficient access solutions, particularly their automatic sliding doors, are seeing increased demand. This is driven by a growing market preference for eco-friendly building practices and stricter environmental regulations. The Door Efficiency Calculator tool further supports this by highlighting long-term cost savings for customers.

The company's commitment to sustainability is evidenced by their recognition as a 'Europe's Climate Leader'. This positions them well in a niche market where environmental consciousness translates into tangible business advantages and customer appeal. For instance, energy-efficient doors can reduce building operational costs significantly, a key consideration for many developers and building managers.

- Market Growth: The global market for green building materials and technologies is expanding, with energy efficiency being a primary driver.

- Regulatory Impact: Stricter building codes and energy performance standards worldwide are compelling adoption of sustainable solutions.

- Cost Savings: dormakaba's solutions offer demonstrable reductions in energy consumption, leading to lower operational expenses for building owners.

- Brand Reputation: Being a recognized 'Climate Leader' enhances dormakaba's brand image and attracts environmentally conscious clientele.

dormakaba's digital access control systems, like cloud-connected locks and mobile access, are performing strongly. These advanced electronic solutions are meeting the increasing demand for smart, integrated security in buildings. The company's focus on innovation, such as the EntriWorX Ecosystem, is key to growing its market share in this sector, which is benefiting from urbanization and digitalization. For example, dormakaba reported 9% organic growth in its Access Solutions segment for the fiscal year 2023/2024, with digital solutions being a major contributor.

dormakaba is investing significantly in integrated security platforms, combining various access and security functions into unified systems. This strategy targets clients seeking simplified building security management throughout the building's life. The company showcased these advancements at major industry events like BAU 2025 and ISC West 2025, indicating its aim to lead in this growing market.

dormakaba's hospitality solutions, specifically its Quantum Pixel+ and digital wallet key technologies, are driving robust growth, particularly in North America. This segment is benefiting from the industry's shift towards mobile and touchless access, a trend that accelerated in 2024 as hotels enhanced guest experiences. The company's active participation in key industry events like HITEC 2025 highlights its dedication to innovation and market leadership in this promising area.

dormakaba's commitment to securing critical infrastructure, such as airports, data centers, and healthcare facilities, positions it in a high-growth sector. The company is actively securing significant project wins in these vital areas. For instance, their Skyra solution for remote access and collaborations on automated personnel screening demonstrate their cutting-edge technological offerings. In 2024, the demand for robust security solutions in these sectors continued to rise, driven by increasing cyber threats and the need for seamless, secure operations.

dormakaba's sustainable and energy-efficient access solutions, especially their automatic sliding doors, are experiencing increased demand. This is due to a growing market preference for eco-friendly building practices and stricter environmental regulations. The Door Efficiency Calculator tool further supports this by demonstrating long-term cost savings for customers.

| dormakaba Product Category | BCG Matrix Classification | Rationale | Key Growth Drivers (2024/2025) | Market Share/Performance Indicator |

| Digital Access Control Systems | Star | High growth potential, strong market position. Digitalization and smart building trends are driving demand. | Cloud connectivity, mobile access, IoT integration, cybersecurity focus. | 9% organic growth in Access Solutions segment (FY 2023/2024), increasing adoption of digital solutions. |

| Hospitality Solutions | Star | Rapidly growing market driven by guest experience enhancement. Mobile and touchless access are key trends. | Mobile key technology, digital wallet integration, contactless entry. | Strong growth in North America, active participation in hospitality tech events (HITEC 2025). |

| Critical Infrastructure Security | Star | High-growth sector driven by global security imperatives and specialized access needs. | Remote access solutions (Skyra), automated screening, advanced threat protection. | Consistent project wins in airports, data centers, healthcare; surge in demand due to cyber threats in 2024. |

| Sustainable/Energy-Efficient Doors | Question Mark/Potential Star | Growing market due to environmental focus and regulations, but market share might still be developing. | Automatic sliding doors, energy efficiency, eco-friendly building practices. | Increased demand driven by environmental consciousness and regulatory compliance; recognized as a 'Europe's Climate Leader'. |

What is included in the product

The dormakaba Holding BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment and resource allocation.

A clear BCG Matrix visualization simplifies complex portfolio analysis, relieving the pain of strategic decision-making.

Cash Cows

Traditional door hardware, including established mechanical door closers and architectural fittings, are dormakaba's cash cows. These mature products operate in a stable market where dormakaba enjoys a substantial market share, ensuring consistent revenue. For fiscal year 2024, dormakaba reported a robust performance in its Access Solutions segment, which heavily features these traditional offerings, highlighting their continued profitability.

dormakaba's Key & Wall Solutions and OEM segment, especially its movable walls, are performing exceptionally well. This business has seen robust organic net sales growth and strong profitability, highlighting its position as a cash cow for the company.

These mature product lines enjoy a solid market presence and consistent demand across commercial and institutional sectors. For instance, in the fiscal year 2023/24, dormakaba reported that its Key & Wall Solutions segment, which includes movable walls, maintained a healthy performance, contributing significantly to the group's overall financial strength.

The substantial cash flow generated by this segment is a key advantage. It provides dormakaba with the financial flexibility to either reinvest in its more dynamic business units or to effectively manage its operational expenditures.

dormakaba's established mechanical locking systems represent a cornerstone of their business, acting as reliable cash cows. These products, with their deep market penetration and long history, consistently generate substantial revenue, underpinning the company's financial stability. Their essential nature for basic security across diverse building types ensures a steady demand.

The mature market for these mechanical systems means that capital expenditure for growth is relatively low. This allows dormakaba to enjoy high profit margins and significant cash flow generation from these product lines. For instance, in fiscal year 2024, dormakaba reported robust performance in its Access Solutions segment, which heavily features these established mechanical offerings, contributing significantly to overall profitability.

After-Sales Services for Installed Base

dormakaba's after-sales services for its installed base of access and security solutions represent a significant Cash Cow. These services, encompassing maintenance, repair, and upgrades, generate a substantial portion of the company's recurring revenue. Customer loyalty and the critical need for continuous system functionality ensure a stable and predictable cash flow from this segment.

The mature and low-growth nature of this market segment allows dormakaba to achieve high-profit margins. These margins are crucial for funding investments in operational efficiency and supporting infrastructure, further solidifying its Cash Cow status. For instance, in fiscal year 2024, dormakaba reported robust performance in its Services business unit, which is heavily reliant on its installed base.

- Recurring Revenue Generation: After-sales services provide a consistent and predictable income stream, leveraging dormakaba's extensive installed base.

- High Profitability: The low-growth, high-loyalty nature of this segment typically yields strong profit margins.

- Investment Support: Profits generated here can be reinvested into enhancing service delivery and infrastructure for improved customer satisfaction and operational efficiency.

- Stability in Revenue: In FY24, dormakaba’s Services segment demonstrated resilience, contributing significantly to overall financial stability.

Entrance Systems (Mature Automatics)

dormakaba's Entrance Systems, particularly their mature automatic offerings, are prime examples of cash cows within their portfolio. These systems, fundamental to the functionality of countless commercial and public spaces, consistently generate robust revenue streams. Despite ongoing technological advancements, the core demand for reliable automatic doors in established markets remains strong, requiring minimal incremental investment to maintain their market position.

The steady cash flow from these mature automatic entrance systems allows dormakaba to fund investments in other business segments. For instance, in fiscal year 2023, dormakaba reported a total revenue of CHF 2.82 billion, with their Access Solutions segment, which includes entrance systems, contributing significantly. This segment’s performance underscores the stability these mature products provide.

- Established Market Presence: Mature automatic entrance systems benefit from widespread adoption and long-standing customer relationships in commercial and public infrastructure.

- Consistent Revenue Generation: Their essential nature ensures a predictable and stable income, even in slower economic periods.

- Low Investment Needs: Once established, these products typically require less marketing and R&D expenditure compared to newer ventures.

- Support for Innovation: The reliable profits from these cash cows enable dormakaba to allocate capital towards developing and expanding its high-growth potential product lines.

dormakaba's traditional door hardware, such as mechanical door closers and architectural fittings, are solid cash cows. These products operate in mature markets where dormakaba holds a significant market share, ensuring a steady flow of revenue. For the fiscal year 2024, the Access Solutions segment, which includes these traditional offerings, demonstrated robust performance, underscoring their continued profitability.

The Key & Wall Solutions and OEM segment, particularly movable walls, represent another strong cash cow. This area has experienced impressive organic net sales growth and high profitability. These mature product lines benefit from consistent demand in commercial and institutional sectors, maintaining a healthy performance as reported for the fiscal year 2023/24, contributing significantly to dormakaba's financial strength.

| Product Category | BCG Matrix Status | Key Financial Indicator (FY24) | Market Characteristic |

| Traditional Door Hardware | Cash Cow | Robust Performance in Access Solutions | Stable Market, High Market Share |

| Key & Wall Solutions (Movable Walls) | Cash Cow | Strong Profitability, Robust Organic Growth | Consistent Demand, Established Presence |

| Mechanical Locking Systems | Cash Cow | Significant Revenue Generation | Deep Market Penetration, Low Growth |

| After-Sales Services | Cash Cow | Resilient Contribution to Services Segment | Recurring Revenue, High Loyalty |

| Entrance Systems (Automatic Doors) | Cash Cow | Significant Contribution from Access Solutions | Mature Market, Steady Demand |

Delivered as Shown

dormakaba Holding BCG Matrix

The dormakaba Holding BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professionally designed, analysis-ready report for immediate strategic application. You can trust that the insights and structure presented here are precisely what you'll be able to edit, print, or present to your stakeholders without any further modifications. This comprehensive BCG Matrix provides a clear overview of dormakaba's business units, allowing for informed decision-making and strategic planning.

Dogs

Divested regional businesses, such as dormakaba's exit from the Sub-Saharan Africa market and the sale of its UK entrance systems service business, are classic examples of 'Dogs' in the BCG matrix. These operations often exhibit low market growth and a weak competitive position, making them drains on company resources.

In 2023, dormakaba reported CHF 1.31 billion in sales from its Services segment, but the divestiture of certain regional service businesses, like the UK operations, suggests these specific units were underperforming and not contributing positively to overall growth or profitability. These were likely areas with limited future potential and high operational costs.

Outdated legacy hardware products represent dormakaba's Dogs in the BCG Matrix. These are older systems that don't fit with the company's focus on smart, connected access solutions. Think of older mechanical locks or basic electronic access readers that are being phased out.

These products often face declining market share because newer, more advanced technologies are available. Competition in these older segments can also be fierce and price-driven, leading to lower returns for dormakaba. For instance, the market for basic mechanical locks, while still present, is highly commoditized.

dormakaba's strategy includes reducing its investment in these areas. This means they are actively looking to minimize the number of these legacy hardware products they offer and support. This strategic pruning helps focus resources on more profitable and growth-oriented smart products.

Niche, low-demand mechanical components often find themselves in the Dogs quadrant of the BCG matrix. These are highly specialized or traditional parts with a limited market, and their growth prospects are typically quite low. For instance, dormakaba might have legacy door hardware components that are no longer widely adopted due to technological advancements or changing building codes.

Products in this category might serve a dwindling customer base or struggle against cheaper substitutes, leading to very little cash flow. dormakaba's 2024 financial reports might show these specific product lines contributing minimally to overall revenue and profitability, perhaps even requiring a net cash outflow to maintain production or support existing customers.

Continuing to invest heavily in these Dog products is usually not a wise strategy. The returns on investment are likely to be poor, and resources could be better allocated to more promising areas of the business. dormakaba's strategic decisions would likely involve phasing out or divesting these components rather than attempting to revitalize them.

Underperforming Niche Key Systems in Slower Markets

Within dormakaba's Key Systems segment, certain niche products, especially those prevalent in European and North American markets, have experienced stagnant sales. This flat performance, coupled with a potentially low market share within their specific niche, positions these offerings as potential dogs in the BCG matrix.

These underperforming niche systems may be facing challenges such as intense competition, a lack of differentiation, or an inability to keep pace with technological advancements or changing customer preferences. For instance, if a niche product relies on outdated technology or a business model that is no longer favored, its market share could dwindle, leading to reduced revenue and profitability.

- Stagnant Sales: Specific niche offerings within Key Systems, particularly in Europe and North America, have reported flat sales growth.

- Low Market Share: If these niche products also hold a diminutive market share within their specialized segments, their position weakens further.

- Competitive Pressures: These segments may be struggling against more agile competitors or products better aligned with current market demands.

- Limited Cash Contribution: The combination of flat sales and low market share results in minimal cash generation for the company.

High-Complexity, Low-Margin Custom Solutions

High-Complexity, Low-Margin Custom Solutions represent projects that demand significant engineering expertise and tailored development but offer limited profit potential and struggle with widespread adoption. These often involve unique client requirements that, while technically challenging, do not translate into substantial financial returns or future market expansion.

For instance, dormakaba might encounter situations where a specific, highly customized access control system is developed for a single large client. While this showcases technical prowess, the extensive customization means it's not easily replicated or sold to a broader market, thus limiting scalability. In 2023, dormakaba reported a net profit margin of approximately 6.6%, highlighting the importance of optimizing the profitability of each solution, including those that are complex.

The company's strategic objective to reduce complexity directly addresses the challenges posed by these custom solutions. By streamlining product offerings and focusing on standardized, yet adaptable, systems, dormakaba aims to improve resource allocation and enhance overall profitability. This strategic shift is crucial for maintaining competitive margins in a dynamic market.

- Resource Drain: These solutions consume engineering hours and capital without commensurate profit generation.

- Limited Scalability: Customization inherently restricts the ability to replicate and sell solutions to a wider customer base.

- Margin Erosion: High development costs coupled with low selling prices can significantly depress profit margins.

- Strategic Alignment: dormakaba's focus on simplification aims to move away from such resource-intensive, low-return offerings.

Certain legacy mechanical key systems and components within dormakaba's portfolio are considered Dogs. These products operate in mature or declining markets with low growth potential and often face intense price competition, leading to modest or negative cash flow. dormakaba's strategic focus is to minimize investment and eventually phase out these offerings.

| Category | Description | Market Growth | Competitive Position | Cash Flow |

| Legacy Mechanical Keys | Older, non-electronic key systems and components. | Low/Declining | Weak/Commoditized | Low/Negative |

| Niche Mechanical Components | Specialized, low-demand parts with limited market adoption. | Very Low | Weak | Minimal |

| Outdated Access Hardware | Older electronic readers and basic locks being replaced by smart solutions. | Low | Weak | Low |

Question Marks

Emerging mobile access technologies, like digital wallet integrations and smartphone-based key systems, represent a burgeoning market fueled by a strong consumer demand for convenience and the broader trend of digitalization. This segment is experiencing rapid growth, with projections indicating a significant expansion in the coming years as more users embrace these advanced solutions.

While dormakaba is actively participating in this evolving space, its current market share in these newer mobile access applications may still be developing as the technology matures and gains broader market acceptance. Significant investments in research and development, alongside strategic market adoption initiatives, are crucial for these offerings to transition from their current position into high-growth 'Stars' within the BCG matrix.

Solutions that blend artificial intelligence with advanced biometric authentication, such as facial recognition achieved through strategic alliances, are emerging as a significant growth area within the security sector. The potential market for these innovative technologies is substantial, indicating a promising future.

However, dormakaba's current footprint in these sophisticated and rapidly evolving segments is likely still in its early stages. This means their market share is probably small compared to established players or the overall market size.

These cutting-edge products demand significant financial investment for research, development, and market entry. For instance, the global AI in cybersecurity market was projected to reach around $38.6 billion in 2023 and is expected to grow substantially, highlighting the investment required. dormakaba's investment in these areas, while cash-intensive, holds the promise of substantial returns if they manage to capture a meaningful share of this expanding market.

dormakaba's EntriWorX Ecosystem, featuring IoT-enabled door systems and analytics platforms, is positioned as a Question Mark in the BCG Matrix. These advanced solutions tap into the burgeoning smart building market, offering crucial data and remote management for enhanced security and operational efficiency. The global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $180 billion by 2028, indicating substantial growth potential.

While these offerings are innovative and address a clear market need, their market share is still developing. The success of these products hinges on aggressive market penetration and adoption. dormakaba's substantial investment in this area necessitates a strategic push to gain traction and establish a dominant presence, otherwise, they risk becoming a Dog if market acceptance falters.

New Market Entries (e.g., specific multi-housing digital solutions)

dormakaba's strategic push into new areas like digital solutions for multi-housing, as seen in their 2024 initiatives, positions them in a high-growth sector. These ventures, while promising, often start with a smaller market share as they establish their presence.

Significant investment in sales, marketing, and product innovation is crucial for these new market entries to gain traction and capture potential growth. For example, the smart access solutions market, a key area for multi-housing digital offerings, was projected to reach over $12 billion globally by 2024, indicating substantial opportunity.

- High Growth Potential: The multi-housing digital solutions market is experiencing rapid expansion, driven by demand for convenience and security.

- Initial Low Market Share: As a new entrant or with new product lines, dormakaba's initial market share in these specific sub-segments is likely to be modest.

- Significant Investment Required: Capital is needed for product development, sales force expansion, and marketing campaigns to build brand awareness and customer adoption.

- Market Opportunity: The increasing adoption of smart home technologies in residential buildings presents a substantial revenue opportunity for dormakaba's digital offerings.

Next-Generation Automated Door Solutions (e.g., EasyAssist)

Next-generation automated door solutions, such as dormakaba's EasyAssist, represent a significant investment for the company, aligning with the Star quadrant of the BCG Matrix. These products, focused on enhanced barrier-free access, energy efficiency, and smart building integration, are experiencing growing demand. The market for these advanced solutions is expanding rapidly, driven by new building regulations and sustainability initiatives. For instance, the global automated doors market was valued at approximately USD 3.5 billion in 2023 and is projected to grow at a CAGR of over 5% through 2030, with smart features being a key driver.

The potential for these innovative doors is substantial, but their current market share requires dedicated efforts to scale. dormakaba's commitment to R&D and market penetration for products like EasyAssist positions them to capture this growth. The company's strategy likely involves aggressive marketing and sales efforts to educate the market and establish a strong foothold.

- High Growth Potential: Driven by increasing demand for accessibility and smart building technology.

- Significant Investment Required: To expand production, marketing, and sales channels for rapid market share acquisition.

- Competitive Landscape: Facing competition from established players and new entrants in the smart building solutions space.

- Strategic Importance: These solutions are crucial for dormakaba's long-term vision of providing integrated building access and security.

dormakaba's EntriWorX Ecosystem, featuring IoT-enabled door systems and analytics platforms, is positioned as a Question Mark in the BCG Matrix. These advanced solutions tap into the burgeoning smart building market, offering crucial data and remote management for enhanced security and operational efficiency. The global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $180 billion by 2028, indicating substantial growth potential.

While these offerings are innovative and address a clear market need, their market share is still developing. The success of these products hinges on aggressive market penetration and adoption. dormakaba's substantial investment in this area necessitates a strategic push to gain traction and establish a dominant presence, otherwise, they risk becoming a Dog if market acceptance falters.

BCG Matrix Data Sources

Our BCG Matrix for dormakaba Holding is built on a foundation of robust data, encompassing financial reports, market research, and competitor analysis to provide a comprehensive view of their product portfolio.