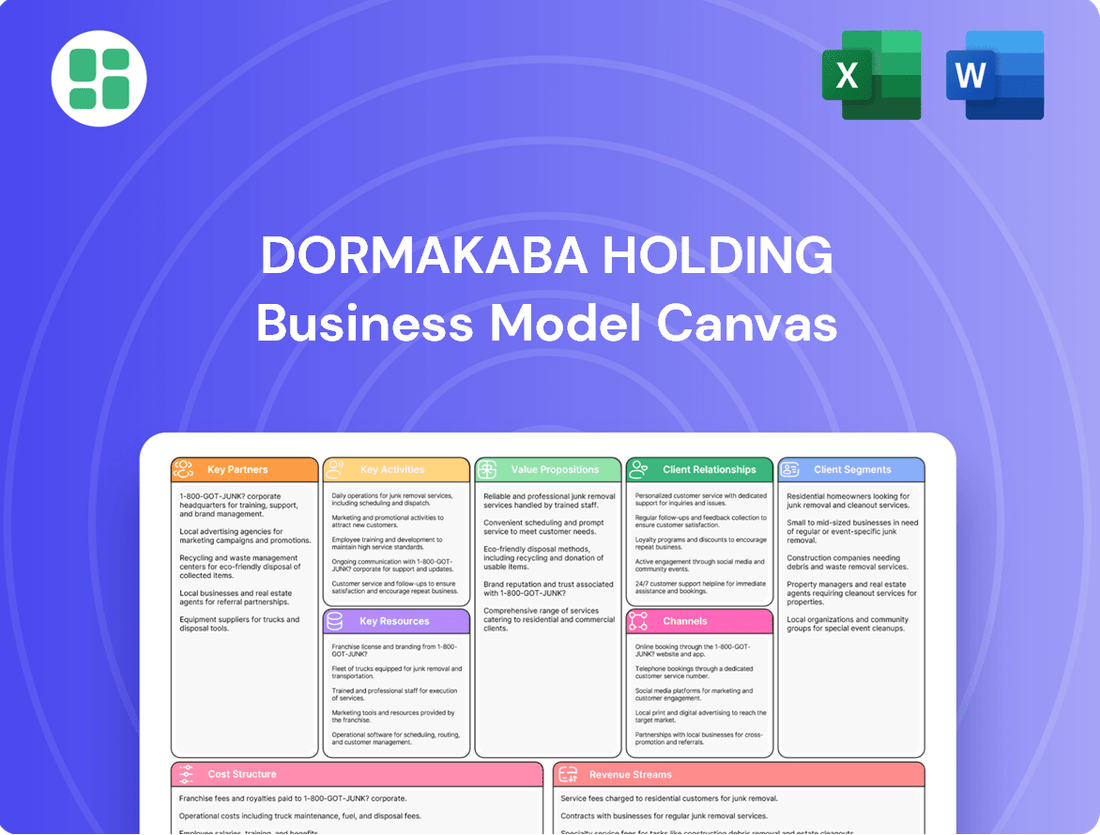

dormakaba Holding Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

dormakaba Holding Bundle

Explore the strategic core of dormakaba Holding's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with diverse customer segments, build strong partnerships, and generate revenue through innovative solutions. Understand their key resources and activities that drive value in the security and access solutions market.

Ready to dissect dormakaba Holding's winning formula? Our full Business Model Canvas provides an in-depth look at their value propositions, customer relationships, and cost structures, offering critical insights for anyone looking to understand market leaders. Download the complete, professionally formatted canvas to gain a strategic advantage.

Partnerships

dormakaba collaborates with technology and software integrators to embed its access and security solutions into wider building management systems, smart home platforms, and IoT networks. This strategic alignment allows for enhanced functionality, such as cloud-based access control and sophisticated smart building features, ultimately boosting value for the end-user.

Distributors and installers are a cornerstone of dormakaba's global strategy, acting as the crucial link for bringing their physical access solutions to market. These partners are indispensable for the sales process, ensuring products are correctly installed, and providing vital ongoing maintenance. Their local presence and expertise are key to navigating diverse customer requirements and complex project demands.

In 2024, dormakaba continued to leverage its extensive network of over 10,000 distributors and installers worldwide. This network allows the company to achieve significant market penetration, reaching customers in over 130 countries. The efficiency of this channel is reflected in dormakaba's consistent revenue growth, with the company reporting a strong performance in its fiscal year 2023/2024, driven in part by the effective reach provided by these partnerships.

dormakaba actively partners with construction companies and architects, integrating its access and security solutions from the initial design stages of new builds and significant renovations. This early collaboration, exemplified by projects like the highly anticipated One Vanderbilt in New York City, ensures seamless integration and compliance with evolving building codes and security requirements.

OEM Partners

dormakaba collaborates with Original Equipment Manufacturers (OEMs) to embed its advanced access control and security components into a wider array of products. This strategic approach allows dormakaba to tap into new markets and customer segments by leveraging the established distribution channels and brand recognition of its partners. For instance, by integrating its technology into smart home devices or automotive systems, dormakaba can reach consumers who might not directly seek out its specialized solutions.

This symbiotic relationship enables dormakaba to focus on its core technological strengths, such as electronic locking systems and key management, while the OEM partner handles the broader product development and market penetration. This indirect market expansion is crucial for increasing brand visibility and driving sales volume without the overhead of direct consumer marketing in every niche. In 2024, the smart home device market alone was projected to reach over $150 billion globally, presenting a significant opportunity for embedded access solutions.

Key benefits of these OEM partnerships include:

- Expanded Market Reach: Accessing new customer bases through partners' existing product ecosystems.

- Leveraging Core Competencies: Focusing on specialized technology development while partners handle product integration and marketing.

- Cost-Effective Expansion: Reducing direct sales and marketing expenses by utilizing partner channels.

- Innovation Acceleration: Faster integration of new technologies into a broader range of consumer and industrial goods.

Sustainability & Research Organizations

dormakaba actively partners with sustainability organizations and research bodies like EcoVadis and the Science Based Targets initiative (SBTi). These collaborations are crucial for advancing dormakaba's Environmental, Social, and Governance (ESG) objectives. For instance, EcoVadis provides sustainability ratings, and in 2023, dormakaba achieved a Gold rating, placing them in the top 5% of companies assessed.

These alliances are instrumental in fostering product innovation that minimizes environmental impact and strengthens dormakaba's standing as a leader in sustainable solutions. The company's commitment is further demonstrated by its participation in SBTi, which guides the development of science-based emissions reduction targets aligned with the Paris Agreement. By mid-2024, dormakaba had made significant progress in setting these ambitious targets across its value chain.

- EcoVadis Gold Rating: Achieved in 2023, signifying top-tier sustainability performance.

- Science Based Targets initiative (SBTi): Commitment to setting emissions reduction targets aligned with climate science.

- Product Innovation: Partnerships drive the development of eco-friendly products and solutions.

- Reputation Enhancement: Collaborations bolster dormakaba's image as a responsible and sustainable enterprise.

dormakaba's key partnerships extend to technology and software integrators, enabling seamless embedding of their access solutions into broader smart building ecosystems. This collaboration enhances functionality, offering cloud-based control and advanced smart features that increase end-user value. Additionally, partnerships with construction firms and architects ensure dormakaba's access and security systems are integrated from the earliest design phases of new developments.

The company also relies heavily on a global network of over 10,000 distributors and installers, vital for market reach and proper product implementation. In 2024, this network facilitated dormakaba's presence in over 130 countries, contributing to its consistent revenue growth. Furthermore, collaborations with Original Equipment Manufacturers (OEMs) allow dormakaba to embed its technology into diverse products like smart home devices, expanding market access cost-effectively.

| Partner Type | Role | 2024 Impact/Data |

| Technology & Software Integrators | System integration, enhanced functionality | Enabling cloud-based access control and IoT integration. |

| Distributors & Installers | Market reach, sales, installation, maintenance | Over 10,000 partners globally, serving 130+ countries. Contributed to strong fiscal year 2023/2024 performance. |

| Construction Companies & Architects | Early-stage integration in new builds/renovations | Ensuring seamless integration and compliance with building codes. |

| Original Equipment Manufacturers (OEMs) | Embedding components into partner products | Leveraging partner channels for market access in smart home ($150B+ market projection) and automotive sectors. |

What is included in the product

dormakaba's Business Model Canvas focuses on delivering secure access solutions to a broad range of customers, leveraging its strong brand and integrated product offerings through diverse sales and distribution channels.

This model emphasizes innovation in smart access technology and a commitment to customer service, ensuring long-term value creation across its global operations.

The dormakaba Holding Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex security and access solutions, allowing stakeholders to quickly grasp how the company addresses customer needs for enhanced safety and convenience.

Activities

dormakaba's commitment to Research & Development is a cornerstone of its strategy, driving innovation in secure and sustainable access solutions. The company consistently invests in developing cutting-edge technologies like digital planning tools and cloud-based access control systems. This focus ensures they stay ahead in a rapidly evolving market.

In fiscal year 2023, dormakaba reported an R&D expenditure of CHF 166.7 million, representing approximately 4.8% of net sales. This investment fuels the creation of next-generation products, including energy-efficient solutions, which are increasingly important for customers and align with global sustainability trends.

Manufacturing & Production is the engine that creates dormakaba's diverse product range, from essential door hardware to sophisticated access control and entrance systems. This core activity focuses on ensuring high quality and operational efficiency across all product lines, including specialized lodging systems.

In 2024, dormakaba continued to emphasize optimizing its production processes. A significant aspect of this strategy involves integrating sustainable practices, such as investing in solar energy at its manufacturing facilities. This not only contributes to environmental goals but also enhances cost efficiency by reducing energy expenses.

dormakaba's sales, marketing, and distribution strategy is multifaceted, aiming to connect with a broad customer base worldwide. This involves direct sales teams, a robust distributor network, and participation in key industry events such as BAU 2025 and ISC West 2025 to highlight their latest product advancements.

The company also invests in digital channels to enhance customer interaction and reach. In fiscal year 2023/24, dormakaba reported a revenue of CHF 2.8 billion, underscoring the scale of their global operations and the effectiveness of their market outreach.

Installation & Service Provision

dormakaba's key activities include providing expert installation services for their access solutions. This ensures that products are fitted correctly, maximizing their performance and longevity. This focus on proper installation directly contributes to customer satisfaction and reduces potential service calls.

Beyond initial setup, dormakaba offers comprehensive after-sales support. This encompasses regular maintenance, timely repairs, and proactive upgrades to keep systems running smoothly and efficiently. This commitment to ongoing service fosters strong customer relationships and creates a predictable stream of recurring revenue for the company.

To enhance their service delivery, dormakaba actively trains its sales and service teams on new, innovative tools. For instance, the Door Efficiency Calculator helps them assess and demonstrate the value of their solutions to clients, further strengthening their service offering.

- Installation Expertise: Ensuring correct and efficient setup of access control systems.

- After-Sales Support: Offering maintenance, repair, and upgrade services to extend product life and customer satisfaction.

- Service Team Training: Equipping staff with tools like the Door Efficiency Calculator to provide enhanced customer value and drive recurring revenue.

Strategic Acquisitions & Divestments

Strategic acquisitions, like the February 2025 purchase of Montagebedrijf van den Berg B.V. and a minority stake in Safetrust Inc., are crucial for dormakaba. These moves are designed to broaden market reach, integrate cutting-edge technologies, and refine the company's overall business portfolio. This active M&A strategy directly supports growth and innovation.

Divestments play an equally important role by simplifying the business structure and enhancing operational efficiency. By shedding non-core assets, dormakaba can focus resources on its most promising areas, leading to a more streamlined and agile organization. This strategic pruning is key to maintaining competitive advantage.

- Market Expansion: Acquisitions directly increase dormakaba's footprint in new geographic regions or customer segments.

- Technology Integration: Purchasing companies with advanced technologies allows dormakaba to quickly adopt and implement innovative solutions.

- Portfolio Optimization: Both acquisitions and divestments help dormakaba align its offerings with market demands and strategic priorities.

dormakaba's key activities revolve around innovation through robust Research & Development, efficient Manufacturing & Production, and strategic Sales, Marketing & Distribution. They also provide crucial Installation Expertise and ongoing After-Sales Support, all while actively pursuing Strategic Acquisitions and Divestments to optimize their portfolio and market position.

The company's R&D investment in fiscal year 2023 was CHF 166.7 million, highlighting its commitment to developing advanced access solutions. In fiscal year 2023/24, dormakaba achieved net sales of CHF 2.8 billion, demonstrating the broad reach of its sales and distribution efforts.

| Key Activity | Description | Fiscal Year 2023/24 Data/Event |

|---|---|---|

| Research & Development | Innovation in secure and sustainable access solutions. | CHF 166.7 million R&D expenditure (FY23). |

| Manufacturing & Production | High-quality production of diverse access systems. | Focus on sustainable practices and solar energy integration in 2024. |

| Sales, Marketing & Distribution | Global market reach through direct sales, distributors, and digital channels. | Net sales of CHF 2.8 billion (FY23/24). |

| Installation & After-Sales Support | Ensuring proper product function and customer satisfaction through ongoing services. | Training sales/service teams with tools like the Door Efficiency Calculator. |

| Strategic Acquisitions & Divestments | Portfolio optimization and market expansion. | Acquisition of Montagebedrijf van den Berg B.V. (Feb 2025); stake in Safetrust Inc. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for dormakaba Holding you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis you will gain access to. Once your order is complete, you will download this exact file, ready for your strategic review and application.

Resources

dormakaba's intellectual property, including over 1,800 active patents and applications as of late 2023, is a cornerstone of its business model. This extensive patent portfolio safeguards its innovative access and security technologies and designs.

These patents are crucial for maintaining a competitive edge in the market, allowing dormakaba to differentiate its offerings. They also serve as a vital foundation for its ongoing research and development efforts, driving future product innovation.

dormakaba operates a network of global manufacturing facilities, leveraging advanced technology to produce its comprehensive portfolio of access and security solutions. These sites are crucial for maintaining product quality and enabling efficient global distribution.

In 2024, dormakaba continued its focus on operational excellence, with investments in automation and digital manufacturing processes across its key production hubs. This technological advancement aims to boost output and precision for products ranging from door hardware to sophisticated electronic access systems.

Sustainability is a growing priority, with initiatives like on-site solar energy generation being implemented at select facilities to improve energy efficiency and reduce the company's environmental footprint, aligning with broader corporate responsibility goals.

dormakaba's highly skilled workforce, encompassing engineers, R&D specialists, sales professionals, and service technicians, is a cornerstone of its business model. This expertise is critical for driving innovation in access solutions and ensuring the high quality of their products.

The company's investment in its people directly translates to superior technical support and the cultivation of robust customer relationships. For instance, in fiscal year 2023, dormakaba reported a significant portion of its employees dedicated to R&D and technical roles, underscoring the importance of this skilled workforce in maintaining their competitive edge.

Brand Reputation & Trust

dormakaba's brand reputation, built on decades of providing reliable and secure access solutions, is a cornerstone of its business. This established trust is critical for securing contracts with clients who prioritize safety and dependability, such as those in the critical infrastructure and financial sectors.

The company's commitment to innovation further bolsters its brand, positioning dormakaba as a leader in smart access technology. This reputation directly influences customer acquisition and retention, as demonstrated by their strong market presence.

- Brand Strength: dormakaba consistently ranks high in customer perception for security and reliability.

- Customer Loyalty: A significant portion of their revenue is derived from repeat business, reflecting strong customer trust.

- Market Perception: In 2024, industry surveys highlighted dormakaba as a preferred provider for high-security applications.

Global Distribution & Service Network

dormakaba's extensive global distribution and service network is a cornerstone of its business model, enabling it to serve customers in over 130 countries. This vast reach is facilitated by a robust system of sales offices, distributors, installers, and service centers.

This widespread infrastructure is crucial for dormakaba's market penetration and its ability to provide responsive customer support. By having local presence, the company can ensure timely installation, maintenance, and after-sales service, which are critical in the security and access solutions industry.

Key aspects of this network include:

- Global Reach: Operations spanning over 130 countries, demonstrating significant international market presence.

- Comprehensive Support: A network of sales offices, distributors, installers, and service centers ensures end-to-end customer engagement.

- Market Access: Facilitates efficient delivery and implementation of dormakaba's product portfolio across diverse geographical regions.

- Customer Service: Enables prompt and localized support, enhancing customer satisfaction and loyalty.

dormakaba's key resources are its robust intellectual property, extensive global manufacturing capabilities, and a highly skilled workforce. These elements are crucial for innovation, quality production, and customer support.

The company’s brand reputation for reliability and security, coupled with its vast distribution and service network, further solidifies its market position. These intangible and physical assets are fundamental to its ability to deliver value and maintain customer trust.

In fiscal year 2023, dormakaba held over 1,800 active patents, underscoring its commitment to R&D. Furthermore, its global operations in 2024 continued to emphasize technological advancements in manufacturing to ensure product quality and efficient delivery.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Intellectual Property | 1,800+ active patents and applications (late 2023) | Protects innovation, provides competitive edge, drives future R&D. |

| Manufacturing & Infrastructure | Global manufacturing facilities | Ensures product quality, enables efficient global distribution, focus on automation in 2024. |

| Human Capital | Skilled workforce (engineers, R&D, sales, technicians) | Drives innovation, ensures technical support, cultivates customer relationships. |

| Brand & Network | Brand reputation, global distribution/service network (130+ countries) | Builds trust, secures contracts, facilitates market penetration and customer support. |

Value Propositions

dormakaba provides advanced security and safety solutions designed to safeguard individuals, valuable assets, and sensitive data. These offerings are crucial for sectors with demanding security needs, such as government facilities and financial institutions.

The company’s portfolio includes high-security locking mechanisms, sophisticated access control systems that manage who can enter where and when, and specialized solutions for protecting critical infrastructure. For instance, dormakaba's access control solutions are integral to many corporate environments, with their systems managing millions of access events daily worldwide.

dormakaba offers intelligent, connected access solutions designed for effortless entry and exit, significantly boosting building efficiency and user satisfaction. Think mobile access, automated doors, and integrated management systems that simplify operations.

In 2024, the demand for such convenient and secure access control systems continued to grow, driven by smart building initiatives and a focus on enhanced user experience. dormakaba's commitment to seamless integration ensures that managing access within a facility becomes a straightforward, user-friendly process.

dormakaba is dedicated to providing sustainable and energy-efficient solutions that assist clients in minimizing their environmental impact and reaching their green objectives. The Door Efficiency Calculator is a prime example, offering tangible data on energy savings and CO2 emission reductions.

This commitment is reflected in their product development, aiming to create doors and access solutions that contribute to a lower carbon footprint for buildings. In 2024, the emphasis on energy efficiency in construction and building management continued to grow, making dormakaba's offerings particularly relevant.

Integrated & Scalable Solutions

dormakaba provides a robust suite of integrated and scalable solutions, encompassing both physical and digital access control systems. These offerings are designed to work harmoniously within larger building infrastructures, allowing for seamless expansion and adaptation to changing requirements.

This approach ensures that clients receive comprehensive security and access management that can grow with their operations. For instance, dormakaba’s portfolio includes everything from mechanical locks to advanced biometric readers and cloud-based software. The company's focus on interoperability means these diverse components can be unified into a single, manageable system.

The value proposition centers on delivering a complete ecosystem of access solutions. This allows for:

- Seamless integration of physical and digital security elements.

- Scalability to accommodate growing or changing building needs.

- A comprehensive approach to building access management.

- Adaptability within broader smart building ecosystems.

Reliability & Long-term Value

Customers experience the lasting benefit of dormakaba's durable, high-quality products, which are designed for longevity. This commitment to quality translates into reliable after-sales services, ensuring that products maintain their performance over extended periods. Consequently, customers enjoy extended product lifecycles, leading to a robust return on their investment.

The emphasis on superior engineering and ongoing support offers customers significant peace of mind. This focus directly contributes to a reduced total cost of ownership, as the need for frequent replacements or extensive repairs is minimized. For instance, dormakaba's commitment to durability is reflected in their rigorous testing protocols, ensuring products meet stringent industry standards.

- Durable Products: dormakaba products are engineered for resilience and extended use, minimizing the need for premature replacement.

- Reliable After-Sales: Consistent support and maintenance services ensure product functionality and customer satisfaction throughout the ownership period.

- Long Product Lifecycles: The combination of quality manufacturing and support extends the useful life of dormakaba solutions.

- Reduced Total Cost of Ownership: Customers benefit from lower long-term expenses due to product durability and efficient service.

dormakaba's value proposition is built on providing comprehensive, integrated, and scalable access solutions that enhance security, efficiency, and user experience. Their offerings span physical and digital security, ensuring seamless integration within building infrastructures and adaptability for future needs.

Customer Relationships

For dormakaba's significant clients, including large corporations and those undertaking specific projects, dedicated account managers are a cornerstone of their customer relationship strategy. These managers provide tailored service and strategic advice, supporting clients from initial project phases through the entire lifespan of a building.

This personalized approach is crucial for nurturing robust, enduring relationships. In 2024, dormakaba's focus on key accounts, which often represent substantial revenue streams, underscores the value placed on understanding and addressing the intricate requirements of these partners.

dormakaba provides extensive technical support and training, empowering customers to maximize the value of their security solutions. This commitment extends to equipping their own sales teams, such as training on the Door Efficiency Calculator, to ensure clients receive expert guidance from the outset.

dormakaba enhances customer relationships through robust self-service and digital platforms. These include online portals offering comprehensive product details and digital planning tools, enabling customers to independently access resources, manage their systems, and discover solutions. For instance, the EntriWorX Ecosystem provides advanced digital planning capabilities specifically for access control systems.

Partnership Engagement Programs

dormakaba actively cultivates partnerships through dedicated engagement programs, fostering strong ties with distributors and installers. These initiatives are designed to ensure consistent knowledge sharing and promote collaborative growth, which is vital for expanding market presence and maintaining high service standards.

- Distributor Training and Certification: Programs like dormakaba’s certified installer training equip partners with in-depth product knowledge and installation best practices, enhancing service quality and customer satisfaction.

- Joint Marketing and Sales Initiatives: Collaborative efforts with key partners in 2024 focused on co-branded campaigns and lead generation, directly contributing to increased sales pipeline visibility.

- Loyalty and Performance Incentives: Reward structures are in place to acknowledge and encourage high-performing partners, driving deeper engagement and commitment to the dormakaba brand.

- Technical Support and Collaboration Platforms: Providing partners with direct access to technical expertise and collaborative platforms streamlines issue resolution and fosters innovation in solution development.

Innovation & Co-creation

dormakaba actively involves customers and partners in its innovation pipeline. This collaborative approach ensures their solutions directly address market needs and anticipate future trends. For example, their Architects Connect 2024 event served as a platform for vital idea exchange.

By integrating feedback loops and engaging in joint development, dormakaba refines its offerings. This co-creation process is crucial for staying ahead in a dynamic market.

- Customer Feedback Integration: dormakaba utilizes direct customer input to guide product development, ensuring relevance.

- Partner Collaboration: Working with partners allows for shared expertise and faster innovation cycles.

- Market Anticipation: Co-creation helps dormakaba identify and respond to emerging customer demands and technological shifts.

- Event-Driven Ideation: Events like Architects Connect 2024 foster open dialogue and generate new solution concepts.

dormakaba prioritizes strong customer relationships through dedicated account management for key clients, offering tailored services and strategic advice throughout a project's lifecycle. This personalized approach is further bolstered by extensive technical support and training, ensuring clients and partners can maximize the value of their security solutions.

Digital platforms and self-service portals provide customers with easy access to product information and planning tools, streamlining their experience. Furthermore, dormakaba actively fosters partnerships with distributors and installers through training, joint marketing, and incentive programs, promoting collaborative growth and consistent service standards.

The company also integrates customer and partner feedback directly into its innovation pipeline, exemplified by events like Architects Connect 2024, ensuring solutions remain market-relevant and anticipate future needs.

| Customer Relationship Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| Dedicated Account Management | Tailored service and strategic advice for significant clients and specific projects. | Focus on key accounts representing substantial revenue streams. |

| Technical Support & Training | Empowering customers and partners with product knowledge and best practices. | Training sales teams on tools like the Door Efficiency Calculator. |

| Digital & Self-Service Platforms | Online portals for product details, planning tools, and system management. | EntriWorX Ecosystem for advanced access control planning. |

| Partner Engagement | Cultivating ties with distributors and installers through engagement programs. | Joint marketing and sales initiatives with key partners for increased sales pipeline visibility. |

| Innovation Collaboration | Involving customers and partners in the innovation pipeline through feedback and co-creation. | Architects Connect 2024 event facilitated idea exchange and solution concept generation. |

Channels

dormakaba leverages a global direct sales force to engage directly with key clients, including large enterprises, government entities, and significant construction projects. This direct interaction facilitates the sale of complex, integrated security solutions and allows for tailored consultations and negotiations.

In fiscal year 2023/24, dormakaba reported a revenue of CHF 2.87 billion, with a significant portion of this revenue likely influenced by the high-value, direct sales engagements that characterize this channel. The direct sales force is crucial for understanding and addressing the intricate security needs of these major clients.

dormakaba's extensive network of authorized distributors and resellers is crucial for reaching a broad customer base, including smaller businesses and niche markets. These partners are vital for local sales and often manage inventory, ensuring product availability across diverse regions.

In 2024, dormakaba continued to leverage this channel, with a significant portion of its revenue generated through these indirect sales partnerships. These collaborators provide essential on-the-ground support, handling installation and initial customer service, which enhances dormakaba's overall customer experience and market penetration.

Integrators and system installers are vital partners, bringing dormakaba's specialized access and security products to life within larger, more complex building projects. These professionals are key to delivering comprehensive solutions, often by meshing our offerings with other building technologies to create seamless, integrated systems for clients.

For instance, in 2024, the global market for integrated security systems saw significant growth, with many projects requiring the expertise of these specialized installers to ensure interoperability and optimal performance. Their ability to combine dormakaba's advanced hardware with software from other vendors allows for truly holistic building management.

Online Platforms & E-commerce

dormakaba leverages its corporate website and digital channels as crucial touchpoints for customers seeking detailed product information, technical specifications, and support. While not a primary direct-to-consumer e-commerce model for all its solutions, these platforms facilitate engagement and can be used for the sale of smaller items or essential spare parts. In 2024, the company continued to invest in enhancing its digital presence to streamline customer access to resources and product data.

- Digital Presence: Corporate website serves as a central hub for product catalogs, technical documentation, and service information.

- E-commerce Functionality: Limited e-commerce capabilities are utilized for specific product categories, such as spare parts or smaller accessories, enhancing accessibility for maintenance and upgrades.

- Customer Engagement: Digital platforms are key for lead generation, customer support, and providing valuable content to architects, specifiers, and end-users.

- Data Integration: Online platforms are increasingly integrated with backend systems to provide real-time product availability and support information.

Trade Fairs & Industry Events

Trade fairs and industry events are vital for dormakaba to connect directly with its audience. These gatherings allow the company to present its latest innovations and comprehensive security solutions, fostering valuable interactions.

For instance, participation in major international trade fairs such as BAU 2025 and ISC West 2025 provides a crucial platform. Here, dormakaba can effectively showcase new products and demonstrate the seamless integration of its offerings. These events are key to engaging with potential and existing customers, as well as building relationships with partners.

- Product Launches: Major trade shows are critical for unveiling new access control systems and smart lock technologies.

- Customer Engagement: Events facilitate direct feedback and relationship building with architects, specifiers, and end-users.

- Brand Visibility: Demonstrating integrated solutions at events like ISC West enhances dormakaba's market presence and thought leadership.

- Partnership Development: Networking opportunities at BAU 2025 help forge new collaborations with installers and distributors.

dormakaba utilizes a multi-channel approach to reach its diverse customer base, encompassing direct sales for large projects, a robust distributor network for broader market penetration, and specialized integrators for complex solutions. Digital channels and industry events further bolster engagement and brand visibility.

In fiscal year 2023/24, dormakaba reported CHF 2.87 billion in revenue, with these varied channels playing a significant role in achieving this financial performance. The strategic use of each channel ensures tailored customer engagement and effective market coverage.

| Channel | Reach | Key Function | 2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Key Clients, Large Enterprises | Tailored Consultations, Complex Solutions | Drives high-value project sales |

| Distributors & Resellers | Broad Customer Base, Smaller Businesses | Local Sales, Product Availability | Essential for market penetration |

| Integrators & System Installers | Complex Building Projects | Seamless System Integration | Crucial for interoperability |

| Digital Channels (Website) | All Customers | Product Info, Support, Lead Gen | Enhances customer access to resources |

| Trade Fairs & Events | Industry Stakeholders | Product Launches, Relationship Building | Showcases innovation, builds partnerships |

Customer Segments

Commercial and office buildings, encompassing both new builds and retrofits, represent a significant customer segment for dormakaba. These clients seek sophisticated access control and door hardware to enhance security, streamline operations, and improve the overall user experience for employees and visitors. For instance, in 2023, the global commercial real estate market saw substantial investment, with office space transactions continuing to be a key component, highlighting the ongoing demand for modernization of these facilities.

Hotels, resorts, and other lodging establishments represent a core customer segment for dormakaba, seeking advanced access control to enhance guest experience and operational efficiency. They require robust solutions for guest room security, common area access, and secure back-of-house management. In 2024, the global hospitality market continued its recovery, with occupancy rates in many regions surpassing pre-pandemic levels, driving demand for upgraded security and access systems.

dormakaba's offerings, such as their Saffire™ EVO electronic locks, cater directly to these needs by providing keyless entry and seamless integration with property management systems (PMS). This integration is crucial for streamlining check-in/check-out processes and managing guest access across various property zones. The increasing adoption of smart hotel technology further fuels the demand for these specialized solutions.

Hospitals, clinics, and aged-care facilities are key customers for dormakaba, demanding access solutions that balance stringent hygiene requirements with critical accessibility and robust security. These facilities need specialized systems, such as automated doors that minimize touch points and advanced locking mechanisms for sensitive areas like operating rooms or pharmacies. The global healthcare construction market was valued at approximately $1.2 trillion in 2023 and is projected to grow significantly, indicating a strong demand for integrated security and access control solutions.

Retail & Shopping Centers

Retail and shopping centers are a key customer segment for dormakaba, requiring solutions that enhance customer experience and operational efficiency. These environments often need sophisticated systems to manage the high volume of foot traffic, secure valuable inventory, and control staff access to different areas. For instance, in 2024, the global retail market continued its recovery, with many centers focusing on creating safer and more seamless entry and exit points to attract shoppers back. dormakaba's entrance systems, including automatic doors and security turnstiles, play a vital role in this, ensuring smooth customer flow while maintaining security.

The specific needs of this segment translate into a demand for reliable and aesthetically pleasing hardware. This includes robust door closers, panic bars for emergency exits, and advanced access control systems for back-of-house areas. These solutions not only contribute to the overall security of the premises but also support the operational needs of retailers. For example, efficient access control can streamline inventory management and staff deployment, crucial factors in the competitive retail landscape of 2024.

- Customer Flow Management: Entrance systems and automatic doors facilitate smooth, high-volume pedestrian traffic, enhancing the shopper experience.

- Inventory Security: Robust door hardware and access control systems protect merchandise and sensitive areas from unauthorized entry.

- Staff Access Control: Secure solutions for back-of-house operations ensure only authorized personnel can access stockrooms, offices, and other critical zones.

- Safety and Compliance: Emergency exit hardware and fire-rated doors meet stringent safety regulations, vital for public spaces.

Government & Critical Infrastructure

Government and critical infrastructure clients, including agencies managing national security, transportation hubs like airports, and vital data centers, represent a crucial customer segment for dormakaba. These entities demand uncompromising security and dependable access management due to the sensitive nature of their operations and the potential impact of breaches.

dormakaba addresses these stringent requirements by offering specialized, high-security solutions. For instance, in 2024, government spending on cybersecurity and physical security infrastructure saw a notable increase, with global government cybersecurity spending projected to reach over $130 billion. This highlights the demand for robust solutions in this sector.

- High-Security Access: Providing advanced physical access control systems designed to meet rigorous government and defense standards.

- Reliability in Critical Environments: Ensuring uninterrupted operation and fail-safe mechanisms for airports, data centers, and utility facilities.

- Compliance and Certification: Offering products and solutions that adhere to stringent international and national security certifications.

- Integrated Security Solutions: Delivering comprehensive access management, door hardware, and key management systems tailored for sensitive locations.

Educational institutions, from universities to K-12 schools, form a significant customer base for dormakaba, requiring durable and secure access solutions. These facilities need to manage access for students, faculty, and staff across various buildings and specialized areas like laboratories or administrative offices. In 2024, the global education technology market continued its expansion, with a growing emphasis on campus safety and streamlined access for a large, transient population.

dormakaba's product range, including robust door hardware, electronic locks, and integrated access control systems, is well-suited to the dynamic environment of educational campuses. These solutions help create secure learning environments while facilitating efficient daily operations. The need for solutions that can handle high traffic and provide granular access control is paramount.

| Customer Segment | Key Needs | dormakaba Solutions | 2024 Market Context |

|---|---|---|---|

| Educational Institutions | Campus security, access for students/staff, control of specialized areas | Durable door hardware, electronic locks, integrated access control | Growing EdTech market, focus on campus safety |

Cost Structure

dormakaba's commitment to innovation is reflected in its substantial Research & Development (R&D) expenditure, a key component of its cost structure. This investment fuels the creation of new access and security solutions, encompassing everything from cutting-edge hardware to advanced software engineering. For the fiscal year 2023, dormakaba reported R&D expenses amounting to CHF 146.3 million, representing a notable portion of their overall operational costs. This strategic allocation is crucial for maintaining their competitive edge in a rapidly evolving technological landscape.

dormakaba's manufacturing and production costs are a significant component, encompassing raw material procurement, direct labor, factory overheads, and energy consumption for their broad product range. In fiscal year 2023/24, the company continued its focus on streamlining these expenses.

Operational efficiency initiatives, such as lean manufacturing principles and supply chain optimization, are key strategies employed to manage these costs. dormakaba also emphasizes sustainable practices, which can lead to long-term cost reductions through reduced waste and energy usage.

dormakaba's cost structure heavily features expenses for its global sales force, encompassing salaries, commissions, and training, as well as significant investment in marketing campaigns designed to build brand awareness and product demand across diverse markets.

The company allocates substantial resources to managing its extensive distribution networks and logistics, ensuring efficient product delivery and customer service worldwide. This includes costs associated with warehousing, transportation, and partner management, crucial for market penetration and maintaining a competitive edge.

Participation in key industry trade shows and events represents another considerable expenditure, vital for showcasing new products, networking with potential clients and partners, and reinforcing dormakaba's presence in the global security and access solutions sector.

Personnel Costs

For dormakaba, a global entity with a workforce exceeding 15,000 individuals, personnel expenses are a substantial component of its overall cost structure. These costs encompass salaries, comprehensive benefits packages, and ongoing training and development initiatives that span every operational area, including research and development, manufacturing, sales, and administrative functions.

In fiscal year 2023, dormakaba reported personnel expenses amounting to CHF 1.28 billion. This figure highlights the significant investment in human capital required to maintain its global operations and drive innovation.

- Employee Count: Over 15,000 globally.

- Cost Category: Salaries, benefits, and training.

- Fiscal Year 2023 Personnel Costs: CHF 1.28 billion.

- Impact: A major driver of the company's overall cost structure.

Administrative & IT Infrastructure Costs

dormakaba's cost structure includes significant administrative and IT infrastructure expenses. These encompass general and administrative (G&A) costs such as corporate overheads, legal, and finance departments, as well as the crucial, ongoing investment in IT infrastructure and shared service centers.

The company is actively working to optimize these costs. A key initiative is the ramp-up of regional shared service centers, designed to streamline operations and enhance overall efficiency. For instance, in the fiscal year 2023/24, dormakaba reported that its administrative expenses represented a notable portion of its overall cost base, reflecting the investment in global support functions and digital transformation.

- Administrative Expenses: Covering corporate functions like legal, finance, and HR.

- IT Infrastructure: Ongoing costs for developing, maintaining, and upgrading technology systems.

- Shared Service Centers: Investment in regional centers to improve operational efficiency and cost management.

- Fiscal Year 2023/24 Impact: These costs are a significant component of dormakaba's total expenditures, essential for global operations and strategic initiatives.

dormakaba's cost structure is heavily influenced by its significant investments in Research & Development (R&D), manufacturing, global sales and marketing, and personnel. These areas represent the core expenditures necessary to maintain its market position and drive future growth.

The company's commitment to innovation is evident in its R&D spending, which reached CHF 146.3 million in fiscal year 2023. Manufacturing and production costs, encompassing raw materials and labor, are managed through efficiency initiatives. Personnel expenses, a substantial CHF 1.28 billion in FY 2023, cover a global workforce of over 15,000 employees.

| Cost Category | FY 2023 Expenditure (CHF million) | Key Components |

|---|---|---|

| Research & Development | 146.3 | New product development, software engineering |

| Personnel Expenses | 1,280 | Salaries, benefits, training for 15,000+ employees |

| Manufacturing & Production | N/A (Focus on streamlining) | Raw materials, direct labor, factory overheads |

| Sales, Marketing & Distribution | N/A (Significant investment) | Sales force, marketing campaigns, logistics |

| Administrative & IT | N/A (Optimized via shared services) | Corporate overheads, IT infrastructure, shared service centers |

Revenue Streams

dormakaba's primary revenue stream is generated through the direct sale of its extensive portfolio of access and security products. This includes everything from traditional door hardware and mechanical locks to sophisticated electronic access control systems, automated entrance solutions, and even movable wall systems.

These product sales represent the largest portion of dormakaba's net sales, underscoring their importance to the company's overall financial performance. For the fiscal year 2024, dormakaba reported net sales of CHF 2.61 billion, with product sales forming the foundational element of this figure.

Service and maintenance contracts are a cornerstone for dormakaba, generating a reliable recurring revenue stream. These long-term agreements cover the upkeep, repair, and ongoing support for their sophisticated access and security systems, ensuring continued functionality for their clients.

This predictable income is crucial for financial stability. For instance, in fiscal year 2023/24, dormakaba reported a strong performance, with their Services segment playing a vital role in this success, contributing significantly to the overall revenue and profitability through these essential contracts.

dormakaba's shift towards digital offerings means a significant portion of their revenue now comes from software licenses and recurring subscriptions. This includes access control software delivered as a service, such as MATRIX as a Service (MATRIXaaS), and platform solutions like EntriWorX.

For the fiscal year 2023/24, dormakaba reported that its Services segment, which heavily features these software-based revenue streams, saw a substantial increase, highlighting the growing importance of these recurring income models.

Installation & Project Fees

dormakaba generates revenue from the professional installation of its sophisticated access and security systems. This is particularly evident in large-scale projects, such as those found in commercial buildings, airports, and stadiums, where the complexity and scope of the installation demand specialized expertise.

These project fees represent a significant revenue stream, reflecting the value dormakaba provides in ensuring seamless integration and optimal performance of its security solutions. For example, in fiscal year 2023, dormakaba reported a substantial portion of its revenue derived from service and project-based activities, underscoring the importance of this segment.

- Complex System Installation: Revenue is generated from the physical setup and configuration of advanced access control, door hardware, and security management systems.

- Large-Scale Project Focus: A key driver is the company's involvement in major infrastructure and commercial developments, requiring extensive installation services.

- Expertise and Value: Fees are structured to reflect the specialized knowledge and on-site labor required for successful deployment of integrated security solutions.

- Service-Based Revenue: This stream is closely tied to the company's ability to manage and execute intricate installation projects, contributing to overall service revenue.

OEM Sales

OEM Sales represent a significant revenue stream for dormakaba, where they supply components and integrated access technologies to other manufacturers. These partners then embed dormakaba's solutions into their own product lines, expanding the reach of their technology. For instance, dormakaba's expertise in electronic locking systems can be integrated into furniture, cabinets, or even vehicles manufactured by other companies.

This strategy allows dormakaba to leverage its core competencies while tapping into new markets through its partners' established distribution channels. The company's commitment to innovation in access control and security solutions makes its offerings attractive to Original Equipment Manufacturers looking to enhance their product value. For the fiscal year 2024, dormakaba reported that its OEM business continued to be a vital contributor to overall group revenue, though specific segment figures are typically consolidated within broader reporting categories.

- Component Sales: Revenue generated from selling individual parts or modules of dormakaba's access control systems to other manufacturers.

- Integrated Solutions: Income from providing fully assembled or semi-integrated access technology units that partners incorporate into their finished goods.

- Technology Licensing: Potential revenue from licensing dormakaba's patented technologies to OEMs for use in their proprietary products.

- Partnership Growth: The expansion of this revenue stream is driven by the success and market penetration of the partner companies utilizing dormakaba's offerings.

dormakaba's revenue is multifaceted, extending beyond direct product sales to include vital service and software-based income. For the fiscal year 2024, the company achieved net sales of CHF 2.61 billion, with its Services segment, encompassing maintenance, software, and installation, playing an increasingly significant role. This diversification into recurring revenue models, such as software-as-a-service and long-term maintenance contracts, provides financial stability and reflects the growing demand for integrated, digital security solutions.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Product Sales | Direct sale of locks, access control systems, and entrance solutions. | Foundation of net sales (CHF 2.61 billion). |

| Services & Maintenance | Recurring revenue from upkeep, repair, and support contracts. | Key contributor to financial stability and segment growth. |

| Software & Subscriptions | Income from access control software licenses and SaaS models. | Growing segment, highlighted by increased Services revenue. |

| Installation & Projects | Fees for professional setup of complex security systems in large-scale projects. | Significant portion of service-based revenue. |

| OEM Sales | Supplying components and technologies to other manufacturers. | Vital contributor to group revenue through partnerships. |

Business Model Canvas Data Sources

The dormakaba Holding Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research reports, and operational data. This multi-faceted approach ensures each component accurately reflects the company's strategic positioning and market realities.