DNV GL Group AS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

DNV GL Group AS is a powerhouse in maritime classification and energy sector consulting, boasting significant strengths in its global reach and deep technical expertise. However, understanding the full scope of its market position, potential threats, and strategic opportunities requires a deeper dive.

Want the full story behind DNV GL's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DNV's global leadership is underscored by its presence in over 100 countries, solidifying its position as an independent authority in assurance and risk management. This expansive reach, coupled with a 160-year legacy of trust, allows DNV to significantly influence industry standards and provide crucial guidance to a wide array of clients worldwide.

DNV GL Group AS boasts a robust and diverse industry portfolio, operating across critical sectors such as maritime, oil & gas, energy systems, and business assurance. This wide reach, which also includes supply chain & product assurance and digital solutions, shields the company from the volatility of any single market. For instance, in 2023, the maritime sector continued its strong performance, while the energy transition segment saw significant growth in demand for advisory services related to renewable energy projects.

DNV demonstrated robust financial performance in 2024, achieving operating revenues of NOK 34,966 million, a notable 10.7% increase from the prior year. This consistent growth trajectory underscores the company's operational efficiency and market relevance.

The group's strong balance sheet provides a solid foundation for future investments and strategic initiatives. Significant capital allocation towards research and development further solidifies DNV's commitment to innovation and long-term expansion.

Pioneering Digitalization and AI Integration

DNV is making significant strides in digitalizing its operations, with substantial investments in artificial intelligence and machine learning. This focus enhances their service efficiency and predictive capabilities, particularly in areas like cybersecurity. For instance, DNV's commitment to digital trust frameworks, exemplified by the establishment of DNV Cyber, positions them as a leader in the evolving assurance landscape.

The group's strategic push into digital solutions is a key strength. DNV's ongoing development and integration of AI and machine learning are designed to sharpen their predictive analytics and bolster cybersecurity offerings. This digital transformation is not just about internal improvements; it's about redefining how assurance services are delivered in an increasingly connected world.

- AI and Machine Learning Integration: DNV is actively embedding AI and ML to boost service efficiency and predictive analytics.

- Digital Trust Frameworks: The establishment of entities like DNV Cyber underscores their commitment to digital trust and security.

- Enhanced Cybersecurity: Investments in digitalization directly translate to improved cybersecurity solutions for clients.

- Leadership in Assurance: DNV's proactive approach to technological advancement places them at the forefront of digital assurance.

Commitment to Sustainability and Energy Transition

DNV's strategic focus on the energy transition and sustainability is a significant strength, positioning the company at the forefront of global decarbonization efforts. Their work in developing standards for alternative fuels, like ammonia and methanol, and their investments in carbon capture and storage (CCS) and renewable energy projects directly address growing market demand and align with international environmental objectives. For instance, DNV's 2024 Energy Transition Outlook report highlights that while challenges remain, the pace of change in renewable energy deployment and electrification is accelerating, a trend DNV is actively shaping and benefiting from.

This commitment translates into tangible business opportunities and market leadership. DNV is actively involved in certifying and verifying the sustainability credentials of businesses and projects worldwide, a critical service as regulatory and investor pressure for ESG (Environmental, Social, and Governance) compliance intensifies. Their expertise is sought after in areas such as offshore wind development and the safe integration of new energy technologies, reinforcing their reputation as a trusted advisor in a rapidly evolving energy landscape.

Key areas of DNV's strength in this domain include:

- Leadership in Decarbonization Standards: DNV plays a crucial role in setting industry benchmarks for emissions reduction and sustainable practices across various sectors.

- Investment in Future Energy Solutions: Significant investment in areas like CCS, hydrogen, and advanced battery storage positions DNV to capitalize on emerging energy technologies.

- Growing Demand for ESG Assurance: The increasing global emphasis on sustainability drives demand for DNV's verification and certification services, ensuring compliance and trust.

- Expertise in Renewable Energy Integration: DNV's deep knowledge in offshore wind, solar, and other renewables makes them indispensable partners in the energy transition.

DNV's extensive global presence, spanning over 100 countries, solidifies its status as an independent authority in assurance and risk management. This broad reach, combined with a 160-year history of trust, allows DNV to significantly influence industry standards and offer vital guidance to a diverse client base worldwide.

The company's financial health is robust, as evidenced by its 2024 operating revenues of NOK 34,966 million, marking a substantial 10.7% increase year-over-year. This consistent growth highlights DNV's operational effectiveness and market relevance.

DNV's strategic emphasis on the energy transition and sustainability is a key strength, positioning it at the forefront of global decarbonization efforts. Their work in developing standards for alternative fuels and investing in carbon capture and storage (CCS) and renewable energy projects directly addresses growing market demand and aligns with international environmental goals. For example, DNV's 2024 Energy Transition Outlook report indicates an accelerating pace in renewable energy deployment and electrification, a trend DNV is actively shaping and benefiting from.

DNV's commitment to digital transformation is evident through substantial investments in AI and machine learning, enhancing service efficiency and predictive capabilities, particularly in cybersecurity. The establishment of DNV Cyber exemplifies their dedication to digital trust frameworks, positioning them as a leader in the evolving assurance landscape.

| Key Strength Area | Description | Supporting Data/Fact |

| Global Reach & Reputation | Extensive presence in over 100 countries with a 160-year legacy of trust. | Influences industry standards and provides crucial guidance worldwide. |

| Financial Performance | Consistent revenue growth. | 2024 operating revenues of NOK 34,966 million, a 10.7% increase from 2023. |

| Energy Transition & Sustainability Focus | Leadership in decarbonization standards and investment in future energy solutions. | Active in developing standards for alternative fuels (ammonia, methanol) and investing in CCS and renewables. DNV's 2024 Energy Transition Outlook highlights accelerating renewable energy growth. |

| Digitalization & AI Integration | Investment in AI/ML for enhanced service efficiency and cybersecurity. | Establishment of DNV Cyber demonstrates commitment to digital trust frameworks. |

What is included in the product

Delivers a strategic overview of DNV GL Group AS’s internal and external business factors, highlighting its strengths in technical expertise and global reach against threats from market disruption and evolving regulations.

Identifies key threats and opportunities, enabling proactive risk mitigation and strategic advantage for DNV GL Group AS.

Weaknesses

DNV's reliance on regulatory frameworks means that changes in maritime emissions standards, energy transition policies, or digital security mandates directly impact their service offerings and demand. For instance, shifts in international maritime organizations' decarbonization targets, like those set by the IMO 2023 strategy, can either boost DNV's verification services or necessitate rapid adaptation of their expertise.

Uncertainty or abrupt changes in government policies, particularly in key markets like renewable energy or offshore wind development, can disrupt project pipelines and affect DNV's revenue streams. A sudden policy reversal on subsidies for green hydrogen, a sector DNV is active in, could slow investment and reduce the need for their certification and advisory services.

DNV GL Group AS operates in sectors demanding significant investment in expert personnel and cutting-edge technology, inherently leading to high operational costs. For instance, maintaining its global network of surveyors and advanced digital platforms for maritime classification and energy sector advisory requires substantial capital outlay. This capital intensity, while necessary for specialized services, can pressure profit margins if not offset by efficient operations and premium pricing strategies.

DNV's reliance on sectors like oil & gas and maritime, which are inherently cyclical, presents a notable weakness. A significant downturn in either of these industries, perhaps driven by volatile energy prices or shifts in global trade, could disproportionately affect DNV's revenue streams. For example, a slowdown in new vessel construction, a key area for DNV's classification services, directly translates to fewer projects and reduced income for those specific divisions.

Intense Competition in Niche Markets

DNV GL Group AS operates within highly competitive sectors, facing established players in assurance, certification, and risk management. While DNV maintains a strong market presence, intense rivalry in specialized segments like sustainability verification and digital health technologies presents a significant challenge. This competition can lead to downward pressure on pricing and potentially erode market share in these growth areas.

For instance, the global market for sustainability consulting and assurance is projected to grow substantially, with numerous firms vying for a piece of this expanding pie. In 2024, the sustainability reporting software market alone was valued at approximately USD 1.2 billion and is expected to reach USD 2.5 billion by 2029, indicating a highly contested space where DNV must continually innovate to maintain its edge.

- Intense rivalry from established and emerging competitors in assurance and certification services.

- Pricing pressures in niche markets such as sustainability and digital transformation solutions.

- Risk of market share erosion in specialized segments due to aggressive competitor strategies.

Talent Acquisition and Retention Challenges

DNV GL Group AS faces a significant hurdle in acquiring and keeping highly specialized technical talent, particularly in demanding sectors such as maritime engineering, energy systems, and cybersecurity. The intense competition for professionals with these niche skills can make recruitment difficult and costly.

A scarcity of qualified individuals in these critical areas poses a direct risk to DNV GL's growth trajectory and could potentially compromise the quality of its services. For instance, as of early 2024, the global demand for cybersecurity experts significantly outstripped supply, with estimates suggesting millions of unfilled positions worldwide, a trend that directly impacts companies like DNV GL that rely heavily on such expertise.

- Specialized Skill Shortage: Difficulty in finding and retaining personnel with deep expertise in maritime, energy, and cyber fields.

- Growth Constraint: A limited pool of specialized talent can hinder the company's ability to expand its service offerings and take on new projects.

- Service Quality Impact: Insufficient skilled staff could lead to a decline in the accuracy and effectiveness of DNV GL's assessments and certifications.

DNV GL Group AS's dependence on specific industries like oil and gas, which are subject to market volatility, poses a significant risk. Fluctuations in energy prices or global trade slowdowns, as seen with the impact of geopolitical events on shipping volumes in late 2023 and early 2024, can directly reduce demand for DNV's classification and advisory services.

The company's high operational costs, stemming from the need for specialized personnel and advanced technology, can compress profit margins if not managed efficiently. For example, maintaining a global network of experts and sophisticated digital platforms for maritime and energy sector assessments requires substantial and ongoing investment.

Intense competition from both established and emerging players in assurance, certification, and risk management services creates pricing pressures. In the rapidly growing sustainability consulting market, which was valued at approximately USD 1.2 billion in 2024, DNV faces challenges in maintaining market share against numerous competitors.

DNV GL also faces a critical weakness in its ability to attract and retain highly specialized technical talent, particularly in fields like cybersecurity and advanced energy systems. The global shortage of cybersecurity professionals, with millions of unfilled positions estimated in early 2024, directly impacts DNV's capacity to deliver services in this crucial area.

Preview Before You Purchase

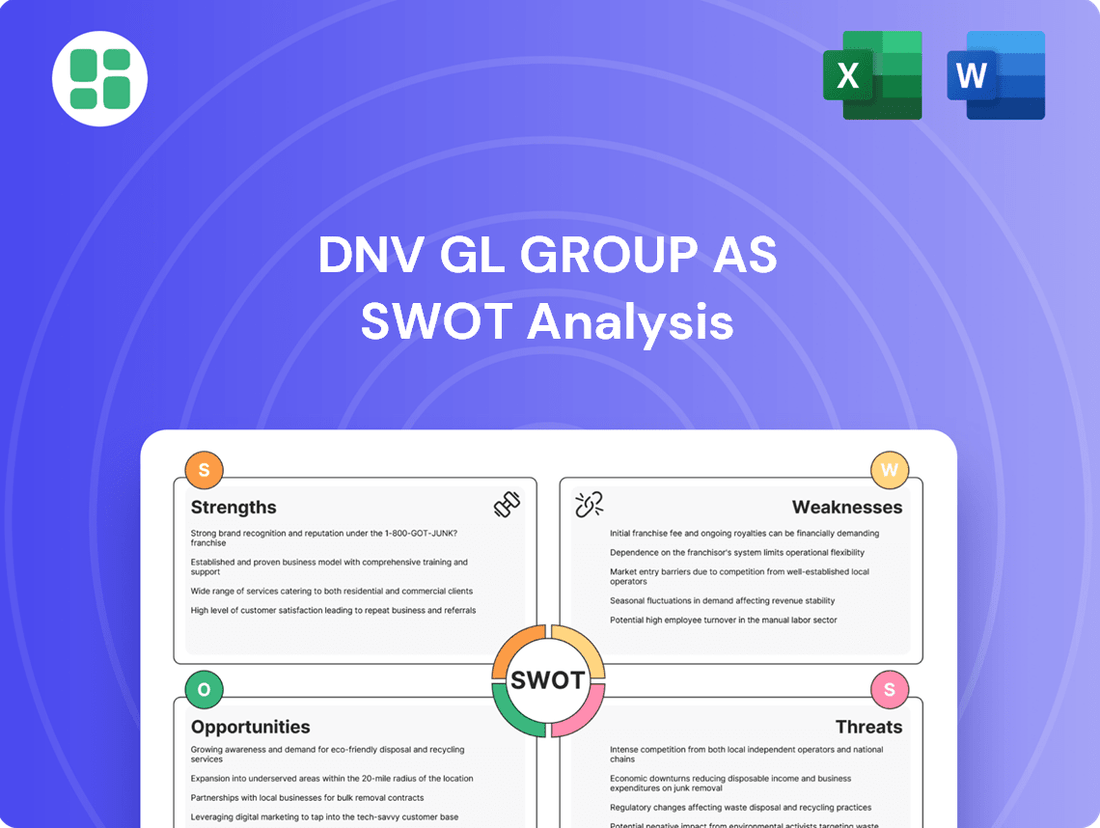

DNV GL Group AS SWOT Analysis

The preview you see is the same DNV GL Group AS SWOT Analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown offers a comprehensive understanding of the company's strategic position. Unlock the full insights and actionable strategies by completing your purchase.

Opportunities

The global push for sustainability is accelerating, creating a significant opportunity for companies like DNV. This growing demand for Environmental, Social, and Governance (ESG) services, including certifications and advisory, is a key driver for growth.

DNV is strategically positioned to benefit from this trend, already offering expertise in critical areas such as carbon reduction strategies and the integration of renewable energy sources. Their established reputation in verification and assurance services further strengthens their ability to capture market share in this expanding sector.

For instance, the global ESG investing market was projected to reach $41 trillion by 2022, and continues its upward trajectory, highlighting the substantial revenue potential for DNV's sustainability-focused services in the coming years, including 2024 and 2025.

The healthcare sector's accelerating shift towards digital platforms, from telemedicine to AI-driven diagnostics, creates a fertile ground for DNV's expertise. This digital evolution, however, amplifies the need for robust cybersecurity, a domain where DNV is actively investing. Their strategic acquisitions in AI-powered healthcare software and advanced cybersecurity solutions position them to capitalize on this dual trend, driving significant revenue growth in the coming years.

The accelerating energy transition is making Carbon Capture and Storage (CCS) technologies increasingly vital. DNV GL Group AS is well-positioned to capitalize on this trend, given its extensive experience in certifying and assuring CO2 transport and storage infrastructure. This includes expertise in novel carrier designs, presenting a significant opportunity for growth.

Increased Adoption of Alternative Fuels in Maritime

The maritime industry's commitment to decarbonization is fueling a significant increase in orders for vessels powered by alternative fuels like LNG, methanol, and ammonia. DNV's established expertise in classifying these new fuel types positions them to capitalize on this fleet-wide transition, which is expected to accelerate through 2024 and 2025.

This trend presents a substantial growth avenue for DNV. For instance, by the end of 2024, DNV had already approved over 1,000 vessels for alternative fuel use, highlighting their market leadership. The ongoing development and adoption of these cleaner fuels will continue to drive demand for DNV's classification and advisory services.

- Growing Demand for LNG-Fueled Vessels: LNG remains a dominant alternative fuel, with DNV's classification of LNG carriers and dual-fuel vessels seeing consistent growth.

- Methanol and Ammonia as Future Fuels: DNV is actively involved in projects and approvals for methanol and ammonia-fueled ships, anticipating a significant market share in the coming years.

- Hydrogen's Emerging Role: While still in earlier stages, DNV's research and development in hydrogen fuel cell technology for maritime applications offer long-term growth potential.

- Regulatory Tailwinds: International Maritime Organization (IMO) regulations and regional emission targets are powerful drivers for the adoption of alternative fuels, benefiting classification societies like DNV.

Leveraging AI and Digital Twins for Predictive Services

DNV is well-positioned to capitalize on the growing demand for predictive services driven by AI and digital twins. The company's expertise in these areas allows for enhanced risk management and operational efficiency for clients across various sectors. This integration is projected to unlock new revenue streams by offering advanced solutions that improve safety and performance, aligning with industry trends towards data-driven decision-making.

The expansion of AI and digital twin capabilities opens up significant opportunities for DNV to develop innovative service models. For instance, by 2025, the global digital twin market is expected to reach USD 32.5 billion, indicating substantial growth potential. DNV can leverage this by offering:

- Predictive maintenance solutions for offshore wind turbines, reducing downtime and operational costs.

- AI-powered risk assessment for maritime operations, enhancing safety and compliance.

- Digital twin simulations for optimizing energy grid performance and reliability.

The increasing global focus on sustainability and Environmental, Social, and Governance (ESG) factors presents a significant opportunity for DNV. This trend is driving demand for their verification, certification, and advisory services in areas like carbon reduction and renewable energy integration. The global ESG investing market's continued growth, projected to exceed $41 trillion by 2022 and onward, underscores the substantial revenue potential for DNV's sustainability-focused offerings through 2024 and 2025.

The accelerating energy transition, particularly in the maritime sector, is a key growth area. DNV's expertise in classifying vessels powered by alternative fuels such as LNG, methanol, and ammonia positions them to benefit from the increasing orders for these cleaner ships. By the end of 2024, DNV had already approved over 1,000 vessels for alternative fuel use, demonstrating their market leadership in this evolving landscape.

DNV is also well-positioned to capitalize on the expansion of AI and digital twin technologies. The global digital twin market is expected to reach USD 32.5 billion by 2025, offering DNV opportunities to develop innovative service models. These include predictive maintenance for offshore wind, AI-powered risk assessment in maritime operations, and digital twin simulations for energy grid optimization.

| Opportunity Area | Key Growth Driver | DNV's Position/Action | Market Data/Projection |

|---|---|---|---|

| Sustainability & ESG Services | Global push for ESG compliance and investment | Leading provider of certification and advisory | ESG investing market > $41 trillion (2022) |

| Maritime Decarbonization | Stricter emissions regulations and alternative fuel adoption | Expertise in LNG, methanol, ammonia fuel classification | Over 1,000 alternative fuel vessels approved by end of 2024 |

| AI & Digital Twins | Demand for predictive analytics and operational efficiency | Developing predictive maintenance and simulation services | Digital twin market projected to reach $32.5 billion by 2025 |

Threats

Global geopolitical tensions, including ongoing conflicts and trade disputes, continue to create significant economic uncertainty. These factors can disrupt vital global supply chains, leading to project delays and increased costs for DNV's clients. For instance, the International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected global growth to slow to 2.9% in 2025, down from 3.2% in 2024, citing persistent geopolitical fragmentation as a key drag.

Policy volatility stemming from these instabilities directly impacts DNV's operational environment and client demand for assurance and advisory services. Reduced investment in key industries, a consequence of heightened risk aversion, can translate into fewer new projects and a potential slowdown in the adoption of new technologies that DNV supports. This environment necessitates agile strategies to navigate shifting market conditions and client priorities.

The rapid advancement of technologies like artificial intelligence, advanced automation, and sophisticated remote sensing presents a significant threat to DNV GL Group AS. These innovations could fundamentally alter traditional inspection and assurance processes, areas where DNV has historically excelled.

If DNV is too slow to adopt or effectively integrate these emerging technologies, it risks falling behind competitors who are quicker to leverage AI for predictive maintenance or drone-based inspections, potentially eroding its market share and competitive edge.

For instance, the global AI market was valued at approximately $136.6 billion in 2022 and is projected to reach over $1.3 trillion by 2030, indicating the immense potential for disruption and the need for rapid adaptation.

New competitors, especially those focused on cutting-edge technology like AI and advanced data analytics, are a significant threat. These companies can offer streamlined, potentially cheaper assurance services, particularly in the digital realm, directly impacting DNV's existing market position.

Cybersecurity Risks to Digital Infrastructure

DNV GL Group AS, like many organizations heavily invested in digital transformation and platforms such as Veracity, faces significant cybersecurity risks. The increasing reliance on these digital infrastructures, coupled with DNV's own provision of cybersecurity services, creates a dual exposure to cyber threats.

A successful cyberattack could have severe repercussions. These include:

- Reputational Damage: A major data breach or system compromise would likely tarnish DNV's brand image, impacting its credibility in the market.

- Financial Losses: Costs associated with incident response, system recovery, regulatory fines, and potential legal liabilities could be substantial. For instance, the average cost of a data breach in 2024 is projected to reach $17.6 million globally, according to IBM's Cost of a Data Breach Report.

- Erosion of Customer Trust: Clients entrusting DNV with sensitive data would lose confidence, potentially leading to a decline in business and service adoption.

Variability in Global Decarbonization Pace and Policy Consistency

The pace of global decarbonization varies significantly, with some nations aggressively pursuing green policies while others lag, creating an uneven playing field for renewable energy adoption and related services. For instance, while the EU aims for ambitious emissions reductions, progress in other major economies remains slower, impacting the scale and predictability of demand for DNV's expertise.

Inconsistent policy frameworks, such as shifting subsidies or changing carbon pricing mechanisms, introduce market uncertainty. This fluctuation can hinder long-term investment decisions for DNV and its clients in green technologies and infrastructure. A prime example is the unpredictable nature of renewable energy incentives in some emerging markets, which can deter substantial capital deployment.

- Uneven Global Transition: The International Energy Agency (IEA) reported in late 2023 that while renewable energy capacity additions are accelerating globally, the pace is not uniform across all regions.

- Policy Volatility Impact: Fluctuations in government support for green initiatives, like changes in feed-in tariffs or tax credits, can directly affect the projected revenue streams for DNV's advisory and certification services.

- Strategic Planning Challenges: The lack of consistent, long-term policy signals makes it difficult for DNV to forecast demand and allocate resources effectively for its decarbonization solutions.

Intensifying global competition, particularly from agile, tech-focused startups, poses a significant threat by offering specialized, potentially lower-cost digital assurance services. Furthermore, DNV faces the risk of technological obsolescence if it fails to rapidly integrate advancements like AI and automation into its core offerings, potentially losing market share to more innovative competitors. The ongoing cybersecurity landscape presents a substantial threat, with the average cost of a data breach projected to reach $17.6 million globally in 2024, impacting DNV's reputation and client trust.

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of DNV GL Group AS's official financial statements, extensive market research reports, and expert industry analyses, ensuring a robust and well-informed assessment.