DNV GL Group AS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping DNV GL Group AS. Our comprehensive PESTLE analysis provides actionable insights to navigate these external influences and identify strategic opportunities. Download the full version now to gain a competitive edge.

Political factors

Global geopolitical shifts and evolving trade policies directly influence DNV's operational landscape, especially within its core maritime and oil & gas sectors. For instance, increased protectionist measures or trade disputes could slow down global shipping volumes, impacting the demand for DNV's classification and certification services. In 2024, ongoing geopolitical tensions in Eastern Europe continued to affect energy markets, a key area for DNV's risk management and assurance offerings.

Governmental policies and subsidies are a significant tailwind for DNV's expansion in the renewable energy sector. For instance, the U.S. Inflation Reduction Act (IRA), enacted in 2022, offers substantial tax credits for clean energy projects, spurring investment and demand for DNV's expertise in areas like offshore wind and hydrogen development.

These regulatory incentives and frameworks are directly accelerating the adoption of cleaner energy solutions. In Europe, the REPowerEU plan aims to fast-track renewable energy deployment, which translates into increased opportunities for DNV's technical assurance and advisory services, supporting the transition to a safer, smarter, and greener future.

International conventions and agreements, such as those from the International Maritime Organization (IMO) and global climate accords, significantly influence the operational requirements for DNV's clients, particularly in the maritime and energy sectors. For instance, the IMO's Ballast Water Management Convention, fully in force since 2017, mandates specific treatment systems, impacting ship design and operations. DNV's expertise is crucial in certifying these systems and ensuring compliance.

As a leading classification society and independent expert, DNV actively helps industries navigate and meet these increasingly stringent global standards. The organization's role in developing and applying rules for new technologies, such as ammonia-fueled vessels, demonstrates its commitment to adapting to evolving international regulations. DNV's 2023 annual report highlights a growing demand for its services in supporting the energy transition, directly linked to international climate agreements.

Evolving international frameworks, like the upcoming Energy Efficiency Design Index (EEDI) Phase 3 requirements for new ships, necessitate continuous adaptation in DNV's service portfolio. This ensures DNV maintains its relevance and expertise in areas such as decarbonization, digitalization, and safety, offering clients the necessary guidance and certification to operate within the global regulatory landscape.

National Energy Policies and Security

National energy policies are a significant driver for DNV GL Group AS, shaping investment in both traditional and renewable energy sectors. Governments worldwide are increasingly prioritizing energy security and decarbonization, directly impacting the types of projects DNV's clients undertake. For instance, the European Union's commitment to renewable energy targets, aiming for 42.5% by 2030, influences demand for DNV's expertise in offshore wind and solar projects.

These policies directly dictate the scope and scale of energy infrastructure development, affecting everything from oil and gas exploration to the deployment of advanced grid technologies. DNV's role in advising clients on navigating these evolving regulatory landscapes, including compliance with emissions standards and the integration of new energy sources, is crucial for successful project execution.

- Energy Security Focus: Governments are implementing policies to reduce reliance on single energy suppliers, boosting investment in domestic and diversified energy sources.

- Decarbonization Mandates: Ambitious climate targets, such as those set by the US for reducing greenhouse gas emissions by 50-52% from 2005 levels by 2030, are accelerating investments in renewables and low-carbon technologies.

- Policy Influence on Investment: National incentives and regulatory frameworks directly guide capital allocation towards specific energy projects, impacting DNV's client project pipelines.

Healthcare Policy and Regulation

Government policies and regulations within the healthcare sector, especially concerning medical device certification, data privacy (like GDPR), and quality standards, directly impact DNV GL Group's healthcare assurance services. For instance, in 2024, the European Union continued to enforce the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), requiring rigorous certification processes that DNV GL facilitates, impacting its revenue streams from device manufacturers.

Shifts in national healthcare priorities or funding can alter the demand for DNV GL's certification, verification, and training services for healthcare providers and manufacturers. For example, increased government investment in digital health initiatives in 2024 spurred demand for DNV GL's cybersecurity and data integrity services for health tech companies.

Compliance with these stringent policies is paramount for DNV GL and its clients. Failure to adhere to evolving regulations, such as updated patient safety directives or environmental standards for medical waste disposal, can lead to penalties and reputational damage, underscoring the critical role of regulatory adherence in DNV GL's operational strategy.

Governmental policies and regulatory frameworks are pivotal for DNV GL Group AS, influencing its strategic direction and market opportunities across various sectors. The push for energy security and decarbonization by nations globally directly shapes investment trends, favoring renewable energy projects where DNV offers expertise. For instance, the EU's aim for 42.5% renewable energy by 2030 significantly boosts demand for DNV's services in offshore wind and solar.

National climate targets, such as the US goal to cut greenhouse gas emissions by 50-52% from 2005 levels by 2030, are a major catalyst for investments in low-carbon technologies. These mandates directly influence capital allocation, impacting DNV's client project pipelines and the types of assurance and advisory services required for compliance and innovation.

Furthermore, international agreements like those from the International Maritime Organization (IMO) set operational standards for DNV's maritime clients, such as the Ballast Water Management Convention. DNV's role in certifying compliance with evolving regulations, like the upcoming EEDI Phase 3 for ships, is crucial for maintaining its market position and supporting clients in navigating a complex global regulatory landscape.

What is included in the product

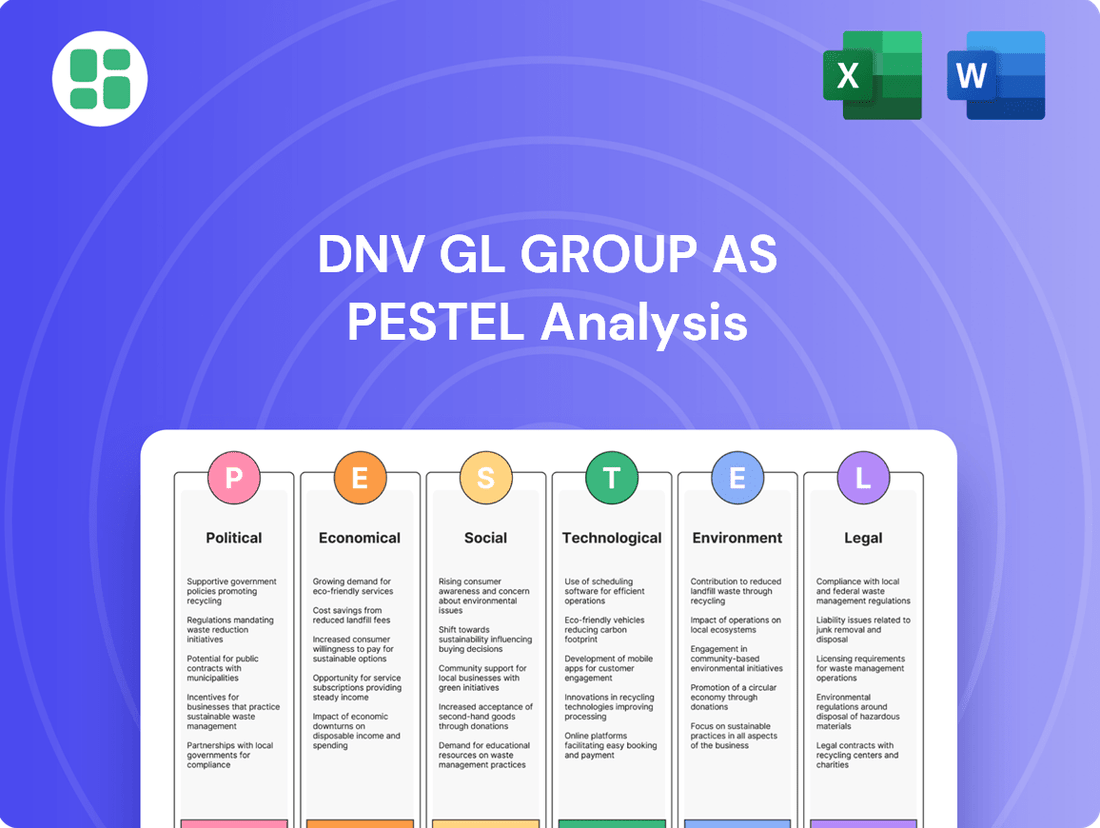

This PESTLE analysis of DNV GL Group AS examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

It provides a comprehensive understanding of the external forces shaping the maritime classification and assurance services sector, highlighting key trends and potential impacts.

A concise PESTLE analysis of DNV GL Group AS that highlights key external factors, acting as a readily available tool to alleviate concerns about market volatility and strategic planning.

Economic factors

Global economic growth significantly shapes investment in DNV's core sectors. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that directly correlates with increased capital expenditure in maritime, oil & gas, and energy industries. This translates to higher demand for DNV's classification and technical assurance services.

During periods of robust economic expansion, such as anticipated in 2024 and 2025, we often see a surge in new shipbuilding orders and expansion of energy infrastructure. This uptick in activity directly benefits DNV, as these projects require rigorous classification and certification. For example, the global shipbuilding order book saw a notable increase in capacity in early 2024, indicating a positive outlook for DNV's service offerings.

Conversely, economic slowdowns or recessions, which can occur due to geopolitical instability or inflation concerns, tend to curb investment. Reduced capital expenditure by oil and gas majors or delays in renewable energy projects can directly impact DNV's revenue. The volatility in oil prices, for example, can influence exploration budgets, thereby affecting the demand for DNV's specialized services in that sector.

Volatility in commodity prices, especially for oil and gas, creates a direct economic ripple effect for DNV's energy sector clients. For instance, during periods of high oil prices, such as the average Brent crude price of around $82 per barrel in early 2024, there's often a surge in investment for exploration and production projects, boosting demand for DNV's technical assurance and advisory services.

Conversely, a sharp decline in commodity prices, like the drop seen in late 2023, can lead to project deferrals or cancellations. This directly impacts the financial health of DNV's key clients, potentially slowing down their spending on essential services, including risk management and certification, which are critical for operational safety and regulatory compliance.

Global investment in the energy transition is surging, with DNV's analysis projecting over $1.5 trillion annually by 2025. This massive capital reallocation directly fuels DNV's growth in renewable energy advisory and certification, particularly in offshore wind and solar power.

The increasing focus on decarbonization is driving significant investment in emerging clean technologies like green hydrogen. DNV's expanding expertise in these nascent sectors positions it to capitalize on this trend, as evidenced by a projected 20% year-over-year growth in its hydrogen consulting services through 2025.

Inflation and Interest Rate Environment

High inflation and rising interest rates present a significant challenge for DNV GL Group AS. As of early 2025, global inflation remains a persistent concern, with many central banks continuing to maintain elevated interest rates to curb price pressures. For instance, the US Federal Reserve's benchmark interest rate has been held steady in the 5.25%-5.50% range through early 2025, impacting borrowing costs worldwide.

This economic climate directly affects DNV's clients. Increased cost of capital can lead to project delays or cancellations across various sectors, from renewable energy to maritime, thereby reducing the demand for DNV's assurance and advisory services. Furthermore, DNV itself faces higher operational expenses due to inflation, which can squeeze profit margins if not effectively managed through pricing strategies or cost efficiencies.

- Impact on Clients: Higher borrowing costs can deter investment in new projects, affecting DNV's service volume.

- DNV's Operational Costs: Inflationary pressures increase DNV's expenses for labor, materials, and energy.

- Interest Rate Environment: Central bank policies, such as the US Federal Reserve's sustained higher rates, influence global capital costs.

- Profitability Concerns: The combined effect of reduced client spending and increased operational costs can negatively impact DNV's profitability.

Supply Chain Resilience and Costs

The economic stability of global supply chains directly influences DNV GL Group AS's operational efficiency and the cost structures of its clients. Recent data from the World Trade Organization (WTO) in late 2024 highlights persistent supply chain vulnerabilities, with shipping costs remaining elevated compared to pre-pandemic levels. These disruptions can translate into project delays and increased expenses for clients seeking assurance and risk management services.

In volatile economic conditions, DNV's expertise in verifying supply chain performance becomes increasingly vital. For instance, the International Monetary Fund (IMF) projected in early 2025 that geopolitical tensions would continue to exert upward pressure on logistics costs, potentially impacting sectors reliant on global trade. This heightened need for robust supply chain assessment strengthens DNV's market position.

- Elevated Shipping Costs: Global shipping rates, while fluctuating, remained approximately 30% higher in early 2025 compared to 2019 averages, according to maritime analytics firms.

- Project Delays: A significant percentage of businesses reported experiencing project delays in 2024 due to supply chain bottlenecks, impacting their ability to invest in external verification services.

- Increased Demand for Risk Assessment: DNV observed a 15% year-on-year increase in demand for supply chain risk assessment services by the end of 2024, driven by economic uncertainty.

Economic growth directly fuels demand for DNV's core services. The IMF's projection of 3.2% global growth for 2024 suggests increased capital expenditure in maritime and energy sectors, translating to more classification and assurance projects for DNV. This positive economic outlook supports higher order books in shipbuilding and expansion in energy infrastructure, both key drivers for DNV's business.

However, economic headwinds like persistent inflation and elevated interest rates, with the US Federal Reserve maintaining rates between 5.25%-5.50% in early 2025, pose challenges. These conditions increase borrowing costs for DNV's clients, potentially leading to project delays and reduced demand for services. Simultaneously, DNV faces higher operational expenses due to inflation, impacting its profitability.

Volatile commodity prices, such as Brent crude averaging around $82 per barrel in early 2024, create a direct impact. High prices incentivize exploration and production, boosting demand for DNV's technical assurance. Conversely, price drops can lead to project deferrals, affecting client spending on essential risk management and certification services.

| Economic Factor | Impact on DNV GL Group AS | Supporting Data (Early 2024 - Early 2025) |

| Global Economic Growth | Increased demand for classification, assurance, and technical advisory services in maritime and energy sectors. | IMF projected 3.2% global growth for 2024. Notable increase in global shipbuilding order book capacity. |

| Inflation & Interest Rates | Higher client borrowing costs leading to potential project delays; increased DNV operational expenses. | US Federal Reserve benchmark rate held at 5.25%-5.50% through early 2025. Persistent inflation concerns globally. |

| Commodity Prices (Oil & Gas) | High prices drive investment in exploration and production, boosting demand; low prices lead to project deferrals. | Average Brent crude price around $82/barrel in early 2024. |

| Supply Chain Stability | Vulnerable supply chains increase project delays and costs for clients, enhancing demand for DNV's risk assessment. | Shipping costs remained ~30% higher than 2019 averages in early 2025. 15% year-on-year increase in demand for supply chain risk assessment by end of 2024. |

Full Version Awaits

DNV GL Group AS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of DNV GL Group AS delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. It provides actionable insights for understanding the external landscape and informing business decisions.

Sociological factors

Societal awareness around environmental, social, and governance (ESG) issues is intensifying, compelling businesses to prioritize sustainability. This growing demand directly influences DNV's core business, as companies increasingly turn to DNV for verification and advisory services to validate their ESG claims. For instance, the global sustainable finance market is projected to reach $50 trillion by 2025, highlighting a substantial opportunity for DNV's expertise in green finance and ESG assurance.

Companies are actively seeking DNV's support to enhance their sustainability performance, reduce their environmental impact, and bolster their social responsibility credentials. This is evident in the rising number of ESG reporting frameworks and certifications being adopted globally. DNV's role in providing independent assurance for these initiatives is crucial, as demonstrated by the increasing complexity of supply chain transparency requirements, where DNV offers critical verification services.

This societal evolution presents DNV with significant growth avenues in emerging sectors such as renewable energy, circular economy solutions, and ethical sourcing. As regulatory bodies and investors place greater emphasis on ESG metrics, DNV's ability to provide trusted data and insights positions it favorably to capitalize on these expanding markets, anticipating continued growth in demand for its sustainability-focused services through 2025.

Societies are increasingly prioritizing the health, safety, and overall well-being of employees, particularly in sectors like maritime and oil & gas where risks are inherent. This heightened awareness directly fuels the demand for DNV's specialized risk management and assurance services. Companies are actively investing in strong safety cultures and seeking external validation of their safety protocols to safeguard their teams and their brand image.

As public expectations for worker protection continue to climb, DNV's proficiency in safety assessment and training becomes even more vital. For instance, in 2023, the International Labour Organization reported that workplace accidents and diseases still cost the global economy billions annually, underscoring the persistent need for expert safety solutions.

Public sentiment towards industries, particularly fossil fuels and even aspects of the energy transition, directly impacts investment flows and regulatory scrutiny, which in turn can affect DNV GL. For instance, a 2024 report by the International Energy Agency highlighted a growing public demand for faster decarbonization, leading to increased pressure on energy companies to adopt cleaner practices, a trend DNV actively supports through its services.

While DNV operates independently, its client base is inherently tied to industries facing this public perception. Companies in sectors like oil and gas, which are under intense public examination regarding their environmental impact, rely on DNV's expertise to ensure safety and responsible operations.

DNV's commitment to promoting safety, environmental stewardship, and ethical conduct within these industries is crucial for its clients' social license to operate. By helping clients navigate public concerns and demonstrate adherence to high standards, DNV reinforces its own reputation and strengthens its value proposition in a socially conscious market.

Talent Attraction and Retention

DNV Group AS faces significant challenges in attracting and retaining top talent due to shifting global workforce demographics and evolving employee expectations. The demand for specialized engineers, technical experts, and digital professionals remains high, impacting DNV's ability to innovate and deliver services effectively. For instance, a 2024 report indicated a global shortage of skilled engineers, with demand outstripping supply in key sectors DNV serves.

Societal trends are also reshaping recruitment. Employees increasingly prioritize work-life balance, diversity, and working for organizations with a clear purpose. DNV's recruitment strategies must adapt to these preferences to remain competitive in the talent market. Surveys from 2024 suggest that over 60% of job seekers consider company culture and values as important as salary when choosing an employer.

- Demographic Shifts: An aging workforce in some regions and a younger generation with different career aspirations necessitate flexible talent management.

- Skills Gap: The rapid advancement of digital technologies creates a continuous need for upskilling and attracting new digital specialists.

- Evolving Work Culture: Emphasis on diversity, inclusion, and purpose-driven work influences how DNV attracts and retains its workforce.

- Global Competition: DNV competes for talent not only within the maritime and energy sectors but also with technology companies for digital expertise.

Societal Acceptance of New Technologies

Societal acceptance significantly shapes how quickly new technologies, like autonomous shipping or advanced carbon capture systems, are adopted. For instance, a 2024 survey indicated that while 60% of the public expressed interest in autonomous vehicle technology, only 35% felt comfortable with it operating without human oversight in all scenarios, highlighting a gap DNV aims to bridge.

DNV's role in providing independent assurance and certification is crucial for building public trust in these emerging innovations. By verifying the safety and reliability of technologies such as advanced battery systems for maritime use, DNV helps to overcome public skepticism and foster wider acceptance. This independent validation is key to de-risking adoption for both businesses and consumers.

The successful deployment of technologies DNV helps to qualify hinges on public understanding and acceptance. For example, in the renewable energy sector, public support for offshore wind farms, often bolstered by clear communication about environmental benefits and safety standards verified by bodies like DNV, has been a significant driver of growth. Without this societal buy-in, regulatory hurdles and project delays can impede progress.

- Public Perception: Surveys in 2024 revealed a nuanced public view on automation, with comfort levels varying significantly by application.

- Trust Building: DNV's certification processes for new maritime technologies, such as hydrogen fuel cells, aim to enhance user confidence.

- Adoption Rates: Societal readiness directly impacts the speed at which innovations like electric ferries gain traction, with early adopters often influenced by perceived safety and environmental benefits.

- Regulatory Influence: Positive societal sentiment can lead to more favorable regulatory frameworks, accelerating the market entry for certified technologies.

Societal awareness of ESG issues is a significant driver for DNV's services, with the global sustainable finance market projected to hit $50 trillion by 2025, creating substantial opportunities for DNV's expertise in green finance and ESG assurance.

Heightened societal focus on employee health and safety, particularly in high-risk sectors, directly increases demand for DNV's specialized risk management and assurance services, as workplace accidents continue to cost billions annually.

Public perception influences the adoption of new technologies, with DNV's independent assurance playing a key role in building trust and overcoming skepticism for innovations like autonomous shipping, which saw only 35% public comfort with full automation in 2024 surveys.

| Societal Factor | Impact on DNV | Supporting Data (2024/2025 Projections) |

| ESG Awareness | Increased demand for verification and advisory services. | Sustainable finance market to reach $50 trillion by 2025. |

| Health & Safety Focus | Higher demand for risk management and assurance. | Workplace accidents cost billions globally; DNV provides critical safety solutions. |

| Technology Acceptance | Need for DNV's assurance to build public trust. | Public comfort with full automation in vehicles around 35% (2024 survey). |

Technological factors

The maritime sector, a core area for DNV, is seeing significant digital transformation. For instance, by the end of 2024, over 15% of the global fleet is expected to be equipped with advanced digital monitoring systems, according to industry reports. This trend necessitates DNV's continuous development of sophisticated software and digital assurance platforms to remain competitive.

Artificial intelligence and automation are reshaping energy and healthcare, DNV's other key markets. In the energy sector, AI is projected to optimize grid management and predictive maintenance, with investments in AI for energy forecastings alone reaching an estimated $5 billion globally in 2024. DNV's ability to integrate these technologies into its risk management and performance optimization services is crucial for its future growth.

Remote inspection capabilities, powered by digitalization, are becoming increasingly vital. By 2025, it's estimated that up to 30% of routine inspections in certain industrial sectors could be conducted remotely. DNV's investment in enhancing these capabilities ensures clients receive efficient, data-driven insights, thereby strengthening DNV's value proposition in a rapidly evolving technological landscape.

The rapid development of new energy technologies like hydrogen, ammonia as fuel, and advanced battery storage presents substantial growth avenues for DNV. For instance, the global green hydrogen market is projected to reach $143.4 billion by 2030, according to BloombergNEF, highlighting the scale of opportunity.

DNV's core strengths in technical assurance, certification, and advisory are vital for building confidence and reducing risks associated with these emerging technologies, thereby speeding up their market adoption. Their work in certifying the first large-scale offshore green hydrogen production facility, announced in 2024, exemplifies this role.

To maintain its leadership, DNV must continue investing in research and development, alongside cultivating specialized expertise in areas such as floating offshore wind, a sector expected to grow significantly, with projections indicating a potential of 20 GW installed capacity globally by 2030.

The increasing reliance on interconnected digital systems across all sectors significantly amplifies the importance of cybersecurity and data integrity, directly impacting DNV GL Group AS's assurance services. This heightened dependency means that any breach or corruption of data can have severe operational and reputational consequences for DNV's clients.

DNV is actively involved in providing critical services for assessing and certifying the cybersecurity resilience of both operational technology (OT) and information technology (IT) systems. For instance, in 2023, DNV reported a significant increase in demand for its OT cybersecurity services, particularly within the maritime and energy sectors, reflecting the growing vulnerability of these critical infrastructures.

The ever-evolving threat landscape, with cyberattacks becoming more sophisticated, necessitates continuous updates and enhancements to DNV's cybersecurity offerings. This ensures they can effectively protect client assets and sensitive data against emerging risks, a crucial aspect of maintaining trust and relevance in the digital age.

Advanced Analytics and Predictive Maintenance

The increasing volume of sensor data, coupled with advancements in analytics, is revolutionizing how industries like maritime, oil & gas, and energy manage their assets. DNV is at the forefront, integrating these capabilities into its software and consulting to enable more precise predictive maintenance and operational improvements. This technological shift helps clients boost asset performance, minimize downtime, and bolster safety protocols.

DNV's commitment to this technological evolution is evident in its investment in digital solutions. For instance, their Veracity platform aggregates and analyzes vast datasets, providing actionable insights for asset management. This move towards proactive risk mitigation, driven by data and analytics, is a significant technological factor shaping DNV's strategic direction and client offerings.

- Data-driven insights: DNV's platforms process millions of data points from operational assets, enabling early detection of potential failures.

- Predictive maintenance adoption: Industry surveys indicate a growing preference for predictive maintenance over traditional reactive approaches, with adoption rates projected to increase significantly by 2025.

- Software development: DNV actively develops and refines its digital tools, such as their asset performance management software, to capitalize on advanced analytics.

- Safety enhancements: By predicting equipment failures, DNV's solutions directly contribute to a safer operating environment, reducing the likelihood of incidents.

Innovation in Healthcare Technology

The healthcare sector is experiencing a whirlwind of technological innovation, particularly in areas like digital health platforms and remote patient monitoring. These advancements are not just changing how care is delivered but also opening up new avenues for DNV's expertise in assurance and certification. For instance, the global digital health market was valued at approximately USD 211 billion in 2023 and is projected to grow significantly, indicating a substantial need for rigorous validation of these new solutions.

DNV needs to be proactive in understanding and adapting to the evolving regulatory landscape surrounding these new technologies. This includes keeping up with best practices for devices that are essentially software (Software as a Medical Device or SaMD) and the burgeoning field of telehealth. The market for SaMD alone is expected to reach over USD 60 billion by 2027, highlighting the critical importance of DNV's role in ensuring safety and efficacy.

This rapid technological evolution directly expands DNV's potential service offerings within the healthcare industry. By providing assurance for these cutting-edge solutions, DNV can solidify its position as a trusted partner in a sector that is increasingly reliant on digital and remote capabilities.

- Digital Health Market Growth: The global digital health market was valued at roughly USD 211 billion in 2023, signaling a vast and expanding area for DNV's services.

- SaMD Market Expansion: The Software as a Medical Device market is projected to exceed USD 60 billion by 2027, presenting a significant opportunity for DNV's certification expertise.

- Telehealth Adoption: Increased adoption of telehealth services necessitates robust assurance frameworks for remote patient monitoring and virtual care platforms.

- Regulatory Adaptation: Staying ahead of evolving regulations for new medical devices and digital health solutions is crucial for DNV to maintain its relevance and value proposition.

Technological advancements are fundamentally reshaping DNV's core markets, demanding continuous adaptation and innovation in its service offerings. The maritime sector, for instance, is witnessing a significant digital transformation, with over 15% of the global fleet expected to feature advanced digital monitoring systems by the end of 2024.

Artificial intelligence and automation are also key drivers in the energy sector, where AI is projected to optimize grid management and predictive maintenance, with global investments in AI for energy forecasting alone estimated at $5 billion for 2024. DNV's ability to integrate these technologies into its risk management services is paramount for future growth.

The increasing reliance on interconnected digital systems across all industries amplifies the need for robust cybersecurity and data integrity, directly impacting DNV's assurance services. The market for Software as a Medical Device (SaMD) is expected to surpass $60 billion by 2027, underscoring the critical need for DNV's validation expertise in healthcare.

| Technology Area | Impact on DNV | Key Growth Projection/Data Point (2024/2025) |

|---|---|---|

| Digitalization & IoT | Enhanced asset monitoring, remote inspections, data-driven insights | Over 15% of global fleet to have advanced digital monitoring by end of 2024 |

| Artificial Intelligence & Automation | Optimized operations, predictive maintenance, risk assessment | $5 billion global investment in AI for energy forecasting in 2024 |

| Cybersecurity | Increased demand for assurance services, protection of critical infrastructure | Significant increase in demand for OT cybersecurity services in 2023 (DNV report) |

| Emerging Energy Technologies | Certification and assurance for new fuels and storage solutions | Green hydrogen market projected to reach $143.4 billion by 2030 (BloombergNEF) |

| Digital Health & SaMD | Assurance for telehealth, remote monitoring, and software-based medical devices | SaMD market projected to exceed $60 billion by 2027 |

Legal factors

International maritime regulations, particularly those from the International Maritime Organization (IMO) focusing on decarbonization like the Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII), are in constant flux. These evolving legal frameworks directly shape DNV's essential classification services for the maritime industry.

DNV is instrumental in guiding shipowners and operators through the complexities of these stringent new legal requirements. For instance, the IMO's 2023 CII ratings showed a significant portion of the global fleet needing improvement, highlighting the critical need for expert guidance.

Failure to comply with these increasingly rigorous international laws can result in substantial financial penalties and operational disruptions. This makes DNV's specialized knowledge and certification services vital for ensuring maritime safety and environmental compliance.

Governments worldwide are enacting significant new legislation to accelerate the energy transition, focusing on areas like renewable energy deployment, carbon capture technologies, and the expansion of emissions trading schemes. For instance, the European Union's Fit for 55 package aims to cut emissions by at least 55% by 2030, impacting energy infrastructure investments and operational standards across the continent.

These evolving legal frameworks directly influence DNV's clients by setting operational requirements, from the permitting processes for new wind and solar farms to the stringent environmental reporting mandates for industrial facilities. Compliance with regulations such as the Inflation Reduction Act in the United States, which offers substantial tax credits for clean energy, is becoming a critical factor in project viability.

DNV's expertise in interpreting and advising on this complex, fast-changing legal environment is therefore crucial. Their advisory services help clients navigate requirements for carbon capture utilization and storage (CCUS) projects and ensure adherence to international standards like ISO 14064 for greenhouse gas accounting, thereby de-risking investments and facilitating market access.

DNV Group AS, like many global organizations, faces significant legal challenges concerning data protection and privacy. With an increasing reliance on digital services and software, DNV and its clients are subject to stringent regulations worldwide, such as the General Data Protection Regulation (GDPR) in Europe and similar frameworks in other regions. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the critical need for compliance.

Compliance is paramount for DNV's software solutions and its handling of sensitive client information, especially within sectors like healthcare where data privacy is a major concern. A data breach can lead to substantial financial penalties and severe reputational damage, impacting client trust and future business opportunities. For example, in 2023, numerous high-profile data breaches across various industries resulted in millions of dollars in fines and significant loss of customer confidence.

Product Liability and Certification Standards

Legal frameworks governing product liability and mandatory certification standards are critical for DNV GL Group AS, particularly within its assurance business. These regulations dictate the requirements for products to gain market access globally. For instance, in 2024, the European Union continued to emphasize stringent product safety regulations, impacting sectors like medical devices and industrial machinery, which are key areas for DNV's certification services.

DNV's role in providing certifications directly supports clients in meeting these complex legal and regulatory compliance demands. Any evolution in liability laws or the introduction of new certification mandates, such as those emerging in the renewable energy sector in 2025, directly influences the scope and demand for DNV's testing, inspection, and certification (TIC) services.

- Product Liability: Evolving legal interpretations of producer responsibility impact DNV's risk assessment and assurance services.

- Certification Standards: Changes in international standards, like ISO certifications, directly affect DNV's core business operations and revenue streams.

- Regulatory Compliance: DNV's ability to navigate and interpret global regulations is paramount for clients seeking market entry.

- Market Access: Adherence to certification standards, often legally mandated, is a prerequisite for DNV's clients to access key global markets.

Antitrust and Competition Law

Antitrust and competition laws are critical for DNV GL Group AS, a global assurance and risk management firm. These regulations, enforced by bodies like the European Commission and the US Federal Trade Commission, dictate how companies can operate to ensure fair market practices. For DNV, this means carefully navigating rules around pricing, collaboration, and market dominance.

DNV's operations, particularly in areas like classification, certification, and digital solutions for the maritime and energy sectors, are subject to scrutiny. The company must ensure its business practices do not stifle competition or create monopolies. For instance, in 2024, the global regulatory landscape continued to emphasize the importance of preventing anti-competitive behavior, with significant fines levied against companies in various industries for market manipulation.

Compliance with these laws is paramount for DNV to maintain its reputation and avoid legal repercussions. Failure to adhere to antitrust regulations can result in substantial fines, reputational damage, and restrictions on business activities. DNV's commitment to independence and trust hinges on its ability to operate within these legal frameworks, ensuring a level playing field for all market participants.

- Global Enforcement: Antitrust authorities worldwide, including the EU and US, actively monitor markets for anti-competitive practices.

- Merger Control: DNV's potential acquisitions or mergers must undergo rigorous review to ensure they do not harm competition.

- Market Conduct: DNV's pricing strategies, service offerings, and collaborations are subject to scrutiny under competition law.

- Reputational Risk: Non-compliance can lead to significant fines and damage DNV's standing as a trusted, independent service provider.

DNV GL Group AS operates within a complex web of international and national legal frameworks that significantly influence its business. Maritime regulations, such as the IMO's EEXI and CII, are constantly evolving, directly impacting DNV's classification services and requiring clients to adapt their fleets. For example, the 2023 CII ratings indicated a widespread need for fleet efficiency improvements, underscoring the critical role of DNV's expertise in navigating these legal shifts.

Governments globally are implementing new legislation to drive the energy transition, affecting DNV's advisory services in areas like renewable energy projects and carbon capture technologies. The EU's Fit for 55 package, aiming for a 55% emissions reduction by 2030, and the US Inflation Reduction Act, offering clean energy tax credits, are key examples of legal drivers that shape investment viability and operational standards for DNV's clients.

Data protection laws, such as GDPR, pose significant legal challenges for DNV, especially concerning its digital services and sensitive client data. Non-compliance can result in substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, highlighting the critical importance of robust data privacy measures for DNV and its clients.

Product liability and certification standards are fundamental to DNV's assurance business, dictating market access for its clients. Evolving regulations, like those in the EU for medical devices and industrial machinery in 2024, directly influence the demand for DNV's testing, inspection, and certification services, making compliance a prerequisite for market entry.

Environmental factors

The global push towards decarbonization, exemplified by targets like Net Zero by 2050, is profoundly shaping DNV GL Group AS's operational landscape. This commitment directly fuels demand for DNV's expertise in emissions reduction strategies, energy efficiency improvements, and the integration of low-carbon energy sources.

DNV's services in verifying carbon footprints and certifying sustainable technologies are increasingly critical as businesses and governments strive to meet stringent environmental regulations. For instance, the International Energy Agency (IEA) reported in 2024 that renewable energy sources accounted for over 30% of global electricity generation, a trend DNV actively supports through its assurance and advisory services.

The global push towards circular economy models, focusing on reducing waste and managing resources responsibly, opens significant avenues for DNV's assurance and advisory services. Many businesses are actively seeking DNV's expertise to validate their supply chain sustainability, certify the eco-friendliness of their materials, and rigorously assess their waste management protocols.

This environmental trend directly fuels demand for DNV's capabilities in conducting comprehensive lifecycle assessments and verifying eco-design principles. For instance, the European Union's Circular Economy Action Plan, updated in late 2023, aims to boost sustainable product design and reduce waste across various sectors, creating a clear market for DNV's specialized verification services.

Growing global concern over biodiversity loss and ecosystem degradation is significantly shaping how companies, particularly in sectors like maritime and energy, approach their projects and daily operations. This heightened awareness translates into stricter regulations and a greater demand for environmentally responsible practices.

DNV's expertise in conducting environmental impact assessments and managing ecological risks is therefore becoming increasingly vital. Clients are actively seeking DNV's guidance to reduce their environmental impact and ensure adherence to evolving environmental laws. For instance, DNV's work on offshore wind projects often involves detailed ecological surveys to protect marine life, a critical aspect of their service portfolio.

This trend directly fuels the demand for DNV's specialized knowledge in sustainable development. As of 2024, the global market for environmental consulting, which includes biodiversity assessments, is projected to continue its upward trajectory, driven by both regulatory pressures and corporate sustainability goals. DNV is well-positioned to capitalize on this growth, offering solutions that balance industrial needs with ecological preservation.

Increased Focus on Environmental Reporting and Disclosure

Stakeholder pressure and evolving regulations are driving a significant increase in demand for transparent environmental reporting and disclosure. Frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the Corporate Sustainability Reporting Directive (CSRD) are becoming standard. DNV plays a crucial role by offering verification and assurance services for environmental data, thereby helping companies build credibility for their sustainability claims.

This growing emphasis on environmental accountability creates a substantial market opportunity for DNV's independent verification of Environmental, Social, and Governance (ESG) performance. For instance, in 2023, the global ESG reporting market was valued at approximately $1.1 billion and is projected to grow substantially. DNV's expertise in this area positions it to capitalize on this expansion by providing essential assurance services.

- Growing Regulatory Landscape: The EU's CSRD, effective from 2024 for large companies, mandates detailed sustainability reporting, increasing the need for third-party assurance.

- Investor Demand for Transparency: A significant majority of investors, over 70% in recent surveys, consider ESG factors material to their investment decisions, pushing companies towards robust disclosure.

- DNV's Assurance Services: DNV's verification services provide independent validation of reported environmental data, enhancing trust and compliance for businesses.

- Market Growth: The market for ESG assurance services is expected to see a compound annual growth rate (CAGR) of over 15% through 2027, highlighting a strong demand for DNV's offerings.

Impact of Extreme Weather Events

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, present significant physical risks to DNV's clientele across the maritime, oil & gas, and energy sectors. These events directly threaten the integrity and operational continuity of their assets.

This trend amplifies the demand for DNV's core competencies in risk management, structural integrity assessments, and resilience planning. As weather patterns become more volatile, clients increasingly rely on DNV's expertise to navigate these challenges.

DNV's role is crucial in assisting clients to engineer and manage assets that can better withstand harsher environmental conditions. For instance, in 2024, the global insured losses from natural catastrophes were estimated to be around $130 billion, highlighting the growing financial impact of extreme weather.

- Increased Asset Vulnerability: Clients face higher risks of damage, downtime, and operational disruptions due to storms, floods, and heatwaves.

- Elevated Demand for Resilience Services: DNV's risk assessment and engineering solutions are becoming indispensable for ensuring long-term asset viability.

- Strategic Importance of Adaptation: Investing in resilient infrastructure, supported by DNV's guidance, is a key strategy for clients to mitigate future losses and maintain competitiveness.

The intensifying global focus on environmental sustainability, driven by climate change and resource scarcity, directly impacts DNV GL Group AS. This necessitates a strategic alignment with decarbonization efforts and the circular economy, creating demand for DNV's assurance and advisory services in emissions reduction, sustainable design, and waste management.

DNV's expertise is crucial for clients navigating stricter environmental regulations and increasing stakeholder expectations for transparency. The company's role in verifying carbon footprints, certifying sustainable practices, and assuring ESG reporting is paramount, as evidenced by the substantial growth in the ESG assurance market, projected to exceed 15% CAGR through 2027.

The physical impacts of climate change, such as extreme weather events, also heighten the need for DNV's risk management and resilience planning services. As global insured losses from natural catastrophes reached approximately $130 billion in 2024, clients increasingly rely on DNV to ensure asset integrity and operational continuity in a more volatile environment.

PESTLE Analysis Data Sources

Our PESTLE analysis for DNV GL Group AS is informed by a comprehensive review of official government publications, international financial institutions, and leading industry analysis firms. This approach ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the maritime and energy sectors.