DNV GL Group AS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

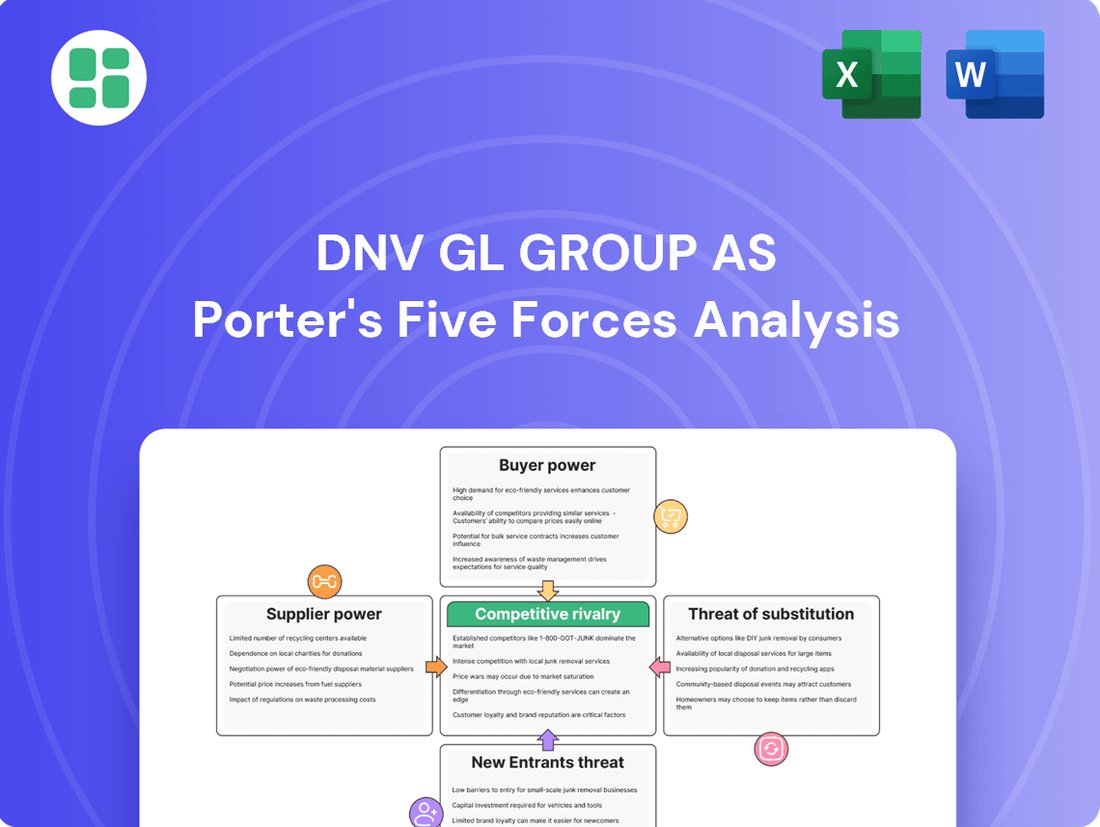

Understanding the competitive landscape for DNV GL Group AS is crucial for strategic success. Our analysis reveals moderate bargaining power of buyers and suppliers, while the threat of substitutes is significant due to evolving technological solutions.

The complete report reveals the real forces shaping DNV GL Group AS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DNV GL Group AS, a leader in maritime classification and risk management, faces significant supplier power stemming from its reliance on highly specialized expertise. The company's operations hinge on a deep pool of engineers, maritime specialists, and consultants with niche skills in areas like offshore wind, hydrogen technology, and digital solutions. For instance, in 2024, the demand for cybersecurity consultants in the maritime sector saw a notable increase, driving up rates for experienced professionals. This scarcity of top-tier talent, especially those possessing cross-industry insights, grants these experts and specialized firms considerable leverage in negotiations.

To counter this, DNV GL Group AS must allocate substantial resources towards attracting, retaining, and continuously developing its workforce. This investment is crucial not only for maintaining its competitive edge but also for ensuring the consistent high quality of its services. The ability to secure and keep these in-demand professionals directly impacts DNV's capacity to innovate and deliver value to its clients in rapidly evolving technological landscapes.

Suppliers of specialized software and advanced technology, particularly in areas like AI and data analytics, can hold significant bargaining power over DNV GL Group AS. This is especially true if their offerings are unique or difficult for DNV to replicate internally. For example, if a supplier's proprietary simulation software is critical for DNV's risk assessment services and switching to an alternative would incur substantial costs and delays, that supplier can negotiate from a position of strength.

The increasing reliance on digital solutions and AI within the maritime, energy, and other sectors DNV serves amplifies this supplier leverage. Companies providing cutting-edge platforms that enhance DNV's assurance and risk management capabilities, and which are not readily available elsewhere, can dictate terms. This is a key consideration for DNV as it invests in its own digital ecosystem, like the Veracity platform, to build in-house expertise and reduce dependence on external technology providers.

Accreditation bodies and sources of regulatory information, such as ISO and various national agencies, wield considerable influence. DNV GL Group AS's core business relies on its ability to meet and certify adherence to these global and national standards.

The availability and cost of accessing up-to-date regulatory data directly affect DNV's operational effectiveness. In 2024, the increasing complexity and volume of international regulations, particularly in areas like maritime safety and renewable energy, underscore the critical nature of these supplier relationships.

Specialized Equipment and Testing Facilities

DNV GL Group AS, particularly in its technical assurance and inspection services, can face significant supplier bargaining power when specialized equipment or advanced testing facilities are required. If these resources are scarce, costly to acquire, or demand unique accreditation, suppliers hold considerable leverage. This situation is especially pronounced in sectors needing intricate material analysis or extensive component validation.

For example, imagine DNV needing access to a unique, high-pressure testing rig for offshore wind turbine components. If only a few global suppliers offer such a facility, and the capital investment for DNV to build its own is prohibitive, these suppliers can dictate terms. In 2024, the global market for specialized industrial testing equipment saw continued growth, with some niche segments experiencing supply chain constraints, further amplifying supplier power in those areas.

- Limited Availability of Specialized Testing Equipment: Suppliers of highly specific or custom-built testing apparatus for industries like aerospace or advanced materials can command higher prices and stricter terms due to limited production capacity and high development costs.

- Capital Intensity of Advanced Facilities: Access to state-of-the-art laboratories for material science, non-destructive testing, or environmental simulation often requires substantial capital investment, concentrating this capability in fewer hands and increasing supplier bargaining power.

- Unique Certifications and Accreditation: Suppliers possessing unique certifications or accreditations required for specific industry standards (e.g., for nuclear or medical device testing) have a distinct advantage, as DNV cannot easily substitute their services.

Geopolitical and Economic Stability

Geopolitical and economic stability significantly influence DNV GL Group AS's supplier bargaining power. The company's global reach means that regional instability, such as conflicts or political uncertainty, can disrupt the availability and cost of essential services, particularly local expertise and operational resources.

For instance, inflationary pressures in key operational regions can directly increase the cost of DNV's inputs, giving suppliers in those areas more leverage. In 2024, several regions experienced heightened inflation, impacting the cost of specialized labor and local services that DNV relies on.

- Regional Instability: Geopolitical events can limit access to qualified personnel and essential operational resources in affected areas.

- Inflationary Pressures: Rising costs for services in specific markets strengthen the bargaining position of local suppliers.

- Supply Chain Disruptions: Economic downturns or sanctions can reduce the availability of necessary inputs, increasing supplier power.

The bargaining power of suppliers for DNV GL Group AS is notably high due to the specialized nature of many inputs. This includes highly skilled personnel, proprietary software, and unique testing facilities. For example, in 2024, the demand for cybersecurity experts in maritime sectors drove up rates for these professionals, giving them significant leverage. Similarly, suppliers of advanced simulation software critical for risk assessment can dictate terms due to high switching costs for DNV.

Furthermore, accreditation bodies and sources of regulatory information also exert considerable influence, as DNV's core business depends on adhering to and certifying these standards. The increasing complexity of global regulations in 2024, particularly in maritime safety and renewable energy, highlights the critical nature of these supplier relationships. Suppliers of specialized testing equipment and advanced facilities also hold substantial power, especially when their offerings are scarce or require unique certifications, as seen with high-pressure testing rigs for offshore wind components.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on DNV GL Group AS | 2024 Data/Trend Example |

|---|---|---|---|

| Specialized Expertise (e.g., Cybersecurity Consultants) | Scarcity of talent, high demand, niche skills | Increased labor costs, potential delays in project execution | Increased rates for maritime cybersecurity professionals |

| Proprietary Software/Technology | Uniqueness of offering, high switching costs, difficulty in replication | Potential for higher licensing fees, dependence on vendor updates | Critical simulation software for risk assessment |

| Accreditation & Regulatory Bodies | Essential for DNV's core business, reliance on compliance | Need to invest in staying updated, potential costs for compliance | Increasing complexity of international maritime safety regulations |

| Specialized Testing Equipment/Facilities | Limited availability, high capital investment for alternatives, unique certifications | Higher operational costs, potential project bottlenecks | Growth in specialized industrial testing equipment market with supply chain constraints |

What is included in the product

This analysis delves into the competitive forces impacting DNV GL Group AS, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the maritime classification and assurance services sector.

Instantly visualize competitive pressures with a dynamic, interactive model of DNV GL Group AS's Porter's Five Forces, allowing for rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

DNV's customer base is dominated by large, global corporations in sectors like maritime and energy. These significant clients, such as major shipping lines or international oil companies, wield considerable bargaining power due to the sheer volume of services they procure. For instance, a single large shipping conglomerate might represent a substantial portion of DNV's maritime classification revenue, giving them leverage to negotiate pricing and service specifics.

This leverage allows these major customers to push for competitive pricing, tailored service agreements, and adaptable contract conditions. Their ability to potentially shift their business to alternative providers, or even to consolidate their assurance needs across fewer suppliers, further amplifies their negotiation strength. In 2023, the global maritime industry saw continued consolidation, with larger players increasing their market share, potentially enhancing their collective bargaining power with service providers like DNV.

As the shipping and energy sectors continue to consolidate, customers are evolving into larger, more informed entities. This trend significantly amplifies their collective bargaining power. For instance, major shipping lines merging in 2023-2024, like the potential consolidation discussions in the container shipping sector, create fewer, but much larger, clients for service providers like DNV.

These increasingly sophisticated clients possess deep knowledge of market pricing, readily available alternative service providers, and a clear understanding of their own operational capabilities. This allows them to effectively negotiate terms and put pressure on DNV's pricing structures and service packages, particularly as they focus on digital transformation and cost optimization.

While regulatory mandates for classification and certification services inherently limit customers' ability to completely opt out, their bargaining power isn't entirely diminished. Customers can still select from various reputable classification societies, including DNV GL, influencing the market. For instance, in 2024, the maritime industry continues to see competition among major players for new builds and existing fleet services, allowing shipowners to negotiate terms.

Availability of In-house Capabilities

The bargaining power of customers for DNV GL Group AS is influenced by their ability to develop in-house capabilities. Larger clients, particularly those in sectors with significant technical operations, might consider building their own teams for routine inspections or data analysis. This potential for backward integration, even if only for a portion of services, can give them leverage when negotiating prices or service levels with DNV.

While developing comprehensive in-house expertise for highly specialized or complex assurance and risk management services remains a substantial investment, the mere possibility of partial self-sufficiency acts as a potent bargaining tool. This threat can encourage DNV to offer more competitive pricing or tailored solutions to retain these valuable clients.

For instance, a major energy company might assess the cost-benefit of bringing certain predictive maintenance analytics in-house. If DNV's pricing for these services, which could represent a significant portion of a client's annual spend, is perceived as too high, the client might explore building a smaller internal team. This is especially relevant as the cost of advanced analytics software and skilled personnel becomes more accessible.

- Potential for Backward Integration: Customers can develop in-house technical assurance and risk management capabilities, particularly for routine tasks.

- Cost of In-house Development: While high for complex services, partial integration is a credible threat.

- Bargaining Chip: The ability to perform services internally provides customers with leverage in negotiations.

- Industry Trends: Increased accessibility of analytics tools and skilled personnel can bolster this customer power.

Switching Costs and Long-term Relationships

Switching classification societies or assurance providers can be a complex and costly undertaking for customers. These costs often include significant administrative burdens, such as re-documentation and updating internal systems. There are also technical hurdles to overcome, like ensuring seamless integration with existing operational processes. The potential for operational disruptions during this transition further deters customers from switching, creating a form of customer lock-in. However, DNV must consistently prove its value and deliver exceptional service to maintain these relationships, as trust and long-term partnerships are paramount in the maritime and energy assurance sectors.

In 2023, DNV reported a revenue of €2.7 billion, highlighting its established presence and the value customers place on its services. This figure underscores the importance of retaining existing clients, as the cost and effort associated with switching can be substantial. For instance, a shipping company might face weeks of administrative work and potential delays in vessel certifications if they change their classification society. This reinforces the need for DNV to focus on continuous improvement and customer satisfaction to mitigate the risk of customers seeking alternatives, even with the inherent switching costs.

- Administrative Costs: Re-documentation, updating records, and internal process changes.

- Technical Integration: Ensuring compatibility of new systems and processes with existing operations.

- Operational Disruptions: Potential delays in certifications or operational downtime during the transition.

- Relationship Value: Long-term partnerships are crucial in a trust-based industry, requiring DNV to consistently demonstrate value.

DNV's large corporate clients, especially in maritime and energy, possess significant bargaining power due to their substantial service volumes. This allows them to negotiate pricing and service terms effectively, a trend amplified by industry consolidation. For example, major shipping lines merging in 2023-2024 create fewer, but larger, clients for DNV, increasing their leverage.

Customers can also develop in-house capabilities for certain services, acting as a bargaining chip. The increasing accessibility of analytics tools in 2024 makes partial self-sufficiency more feasible, pressuring DNV on pricing for services like predictive maintenance analytics.

| Customer Bargaining Power Factor | Description | Impact on DNV | Example/Data Point (2023-2024) |

|---|---|---|---|

| Volume of Purchases | Large clients represent a significant portion of DNV's revenue. | High leverage for price and service negotiation. | Major shipping conglomerates can influence classification revenue. |

| Availability of Alternatives | Customers can switch to other classification societies. | DNV must remain competitive and deliver value. | Competition among major classification players for new builds in 2024. |

| Potential for Backward Integration | Clients can develop in-house technical capabilities. | Threat of self-sufficiency increases negotiation power. | Energy companies assessing in-house predictive analytics. |

| Switching Costs | High administrative and technical hurdles to change providers. | Creates customer lock-in, but requires continuous value demonstration. | DNV's 2023 revenue of €2.7 billion indicates strong client retention. |

Full Version Awaits

DNV GL Group AS Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis of DNV GL Group AS delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The detailed insights provided will equip you with a thorough understanding of the strategic forces shaping DNV GL's operating environment.

Rivalry Among Competitors

The classification, assurance, and risk management sector is a tight race, with giants like Bureau Veritas, Lloyd's Register, ABS, and SGS, plus DNV, holding significant sway. These established global entities boast vast networks and trusted reputations, making competition for market dominance fierce.

In 2024, this intense rivalry is evident. For instance, Bureau Veritas reported revenues of over €6.5 billion for 2023, highlighting its substantial market presence and the scale of operations these major players manage. Their diverse service offerings further intensify the competition, as they vie for contracts across numerous industries worldwide.

Competitive rivalry within the maritime and energy sectors is intensifying, largely fueled by rapid advancements in digitalization and technology. DNV GL Group AS and its competitors are pouring significant resources into areas like artificial intelligence, remote inspection tools, and data analytics. This technological race is a primary driver of competition, as firms vie to offer more efficient and predictive services to clients.

A key battleground for competitive advantage lies in the effective innovation and integration of these digital solutions. For instance, the development and deployment of digital twins, which create virtual replicas of physical assets, allow for enhanced monitoring and predictive maintenance. In 2024, many industry players reported increased R&D spending specifically on these digital transformation initiatives, aiming to capture market share through superior technological offerings.

While DNV GL's traditional classification markets are mature, the company is actively pursuing growth in newer sectors like renewable energy, cybersecurity, and digital health. The global renewable energy market, for instance, was valued at approximately $1.5 trillion in 2023 and is projected to grow significantly, attracting intense competition.

This pursuit of emerging areas creates a highly competitive landscape. Competitors are aggressively vying for contracts and partnerships in these high-growth niches, particularly in areas driven by new compliance requirements such as decarbonization mandates. For example, the demand for maritime decarbonization solutions is rapidly increasing, with numerous players offering services and technologies.

Pricing Pressure and Service Scope

Large clients in the maritime and energy sectors, DNV GL's core markets, frequently leverage their purchasing power to negotiate lower prices. This is evident in the competitive bidding processes for classification and advisory services, where price is a significant factor. For instance, in 2024, major shipowners continued to seek cost efficiencies, putting pressure on service providers like DNV to maintain competitive pricing structures.

Competitors are actively broadening their service portfolios to capture a larger share of client spending. This includes offering integrated solutions that bundle traditional assurance services with digital advisory, cybersecurity, and sustainability consulting. Companies that can provide a more comprehensive and flexible suite of services, adapting to evolving client needs in 2024, gain a distinct advantage, forcing DNV to continuously innovate and demonstrate its unique value proposition.

- Pricing pressure from large customers remains a key challenge for DNV GL.

- Competitors are expanding service scopes to include digital and sustainability advisory.

- Flexible engagement models are becoming a differentiator in the market.

- DNV must highlight superior value beyond just price to maintain market share.

Regulatory Landscape and Standards Development

The competitive arena for DNV GL Group AS is significantly shaped by a dynamic regulatory environment. International and national rules are constantly evolving, impacting everything from maritime safety to energy transitions. For instance, the International Maritime Organization (IMO) continuously updates its regulations, such as those concerning greenhouse gas emissions, which directly affect the services DNV GL offers.

Classification societies like DNV GL are not passive observers; they actively contribute to the development of these crucial standards. This involvement can provide a distinct edge, allowing them to anticipate changes and offer compliant solutions ahead of competitors. Conversely, failing to adapt quickly to new requirements, like the upcoming EU Taxonomy Regulation's impact on sustainable finance reporting, can necessitate substantial investment and potentially hinder market position.

The capacity to swiftly understand and implement these new regulatory mandates is a key differentiator. Companies that can efficiently navigate and operationalize changes, such as new cybersecurity standards for critical infrastructure, often gain a competitive advantage. This agility is paramount in sectors where compliance is non-negotiable and directly tied to operational approval and market access.

- Regulatory Influence: Evolving international (e.g., IMO 2024 sulfur cap) and national regulations are primary competitive drivers.

- Standards Development: DNV GL's participation in bodies like ISO, shaping standards, offers a potential first-mover advantage.

- Adaptation Costs: Significant investment is often required to meet new standards, impacting competitive positioning.

- Agility as a Factor: Rapid interpretation and implementation of new rules, like those for hydrogen safety, are critical competitive strengths.

The competitive rivalry in the classification, assurance, and risk management sector is exceptionally high, with major players like Bureau Veritas, SGS, and Lloyd's Register constantly vying for market share. These established firms, including DNV GL Group AS, possess extensive global networks and strong brand recognition, making it difficult for new entrants to gain a foothold. The market is characterized by intense competition on both service quality and price, particularly from large clients who leverage their purchasing power.

In 2024, this rivalry is further amplified by a technological arms race, as companies invest heavily in digitalization, AI, and data analytics to offer more advanced and predictive services. For example, Bureau Veritas's reported 2023 revenues exceeding €6.5 billion underscore the scale of operations and the financial muscle deployed by key competitors. This drive for technological superiority creates a dynamic environment where innovation is a critical differentiator, pushing all players, including DNV, to continuously adapt and enhance their offerings to maintain a competitive edge.

| Competitor | 2023 Revenue (approx.) | Key Competitive Focus |

| Bureau Veritas | €6.5 billion+ | Digitalization, Sustainability Services |

| SGS | CHF 6.6 billion+ | Testing, Inspection, Certification breadth |

| Lloyd's Register | £1.3 billion+ | Maritime, Energy Transition Solutions |

| DNV GL Group AS | NOK 32.4 billion+ | Digital Transformation, Decarbonization |

SSubstitutes Threaten

Large, well-resourced organizations may choose to build or enhance their internal capabilities for risk management and compliance. This insourcing can reduce their dependence on external assurance providers like DNV GL. For instance, a major energy company might invest in advanced simulation software and hire specialized engineers to perform internal safety assessments, thereby bypassing the need for certain third-party certifications.

While complete self-certification is uncommon in heavily regulated sectors, companies can substitute some external services by bringing specific functions in-house. This trend is growing as businesses seek greater control and cost efficiency. In 2024, the global market for internal audit services alone was estimated to be worth over $60 billion, indicating a significant capacity for internal expertise development.

For DNV's advisory and risk management consulting, general management consulting firms and specialized engineering consultancies present a significant threat of substitutes. These competitors can offer comparable strategic advice and project-specific risk assessments, particularly in less regulated sectors.

For instance, major global consulting players like Accenture and McKinsey & Company, while not always directly competing on DNV's core technical expertise, can vie for broader strategic advisory mandates where deep technical specialization is less critical. Their extensive client networks and brand recognition allow them to be viable alternatives for companies seeking high-level business guidance.

Furthermore, a multitude of smaller, niche engineering consultancies can also serve as substitutes for DNV's specialized services. These firms might focus on specific industries or technologies, offering competitive pricing and tailored solutions that can attract clients looking for highly targeted expertise, potentially impacting DNV's market share in those segments.

The increasing sophistication of technological solutions, particularly AI-driven analytics and IoT sensors, presents a significant threat of substitutes for traditional assurance services. These technologies can independently monitor assets, manage compliance, and assess risk, potentially reducing the need for external assurance providers.

While DNV GL Group AS actively integrates these advancements into its offerings, the independent availability of such tools to customers or competing tech firms creates a substitute pathway for achieving similar outcomes. For instance, in 2024, the global AI market was projected to reach over $200 billion, indicating a substantial investment and development in these alternative capabilities.

Insurance and Financial Risk Transfer Mechanisms

The threat of substitutes for DNV GL's risk management and assurance services is moderate. For certain aspects of risk, companies might see insurance as a direct substitute. Instead of investing significantly in prevention and mitigation, a business could choose to purchase comprehensive insurance policies to offload financial risk, particularly for assets that are less critical or easily insurable.

This substitution is more prevalent when the cost of prevention outweighs the potential cost of a loss, or when the likelihood of an incident is perceived as low. For example, a company might opt for higher deductibles and robust insurance coverage rather than implementing extensive safety protocols for certain non-core operations.

- Insurance as a Risk Transfer Tool: Companies can transfer financial risks associated with potential incidents to insurers, potentially reducing the need for internal risk mitigation investments.

- Cost-Benefit Analysis: The decision to substitute insurance for prevention often hinges on a cost-benefit analysis, where the premium cost is weighed against the expense of implementing and maintaining risk reduction measures.

- Impact on Assurance Services: While insurance covers financial losses, it does not replace the need for assurance and verification of operational safety and compliance, which are core DNV GL offerings.

Governmental Agencies or Industry Associations

Governmental agencies and industry associations can present a threat of substitutes by developing their own compliance or assurance programs. For instance, in 2024, the European Union continued to enhance its regulatory frameworks, such as the Digital Services Act and the Digital Markets Act, which require specific compliance measures that could, in some areas, be seen as an alternative to traditional third-party assurance for certain digital services.

These bodies might offer services that directly compete with independent assurance providers, especially for specific regulatory adherence. If these programs become more comprehensive or are mandated, they could diminish the demand for external auditors in those particular niches. For example, national data protection authorities often provide guidance and compliance checklists that, while not direct substitutes, can reduce the perceived need for external validation for smaller organizations.

- Regulatory Compliance Programs: Agencies like the U.S. Securities and Exchange Commission (SEC) issue detailed compliance guidelines that companies must follow, acting as a form of self-imposed assurance.

- Industry Standards and Certifications: Associations may develop proprietary certification processes that offer an alternative assurance pathway for specific industry practices.

- Direct Oversight: In sectors like critical infrastructure, government bodies might conduct direct audits or require specific internal reporting, lessening reliance on external assurance.

- Data Protection Frameworks: Regulations such as GDPR or CCPA mandate specific data handling practices, with compliance often verified through internal processes or national supervisory authorities rather than solely external audits.

The threat of substitutes for DNV GL's services is moderate, primarily stemming from internal capabilities, generalist consulting firms, and technological advancements. Companies increasingly insource risk management and compliance functions, leveraging internal expertise and advanced software. For instance, the global internal audit market exceeded $60 billion in 2024, highlighting a significant capacity for in-house services.

General management and niche engineering consultancies also offer alternative solutions for advisory and risk assessments, particularly in less specialized areas. Furthermore, AI and IoT technologies are emerging as substitutes, capable of independent monitoring and risk assessment, with the global AI market projected to surpass $200 billion in 2024.

Insurance also acts as a substitute, allowing companies to transfer financial risks rather than investing solely in prevention. While insurance covers financial losses, it doesn't replace the core assurance and verification services DNV GL provides.

Government agencies and industry bodies can also pose a threat by developing their own compliance programs, potentially reducing reliance on external assurance providers in specific regulatory areas.

Entrants Threaten

The classification and assurance industry, especially within maritime and oil & gas sectors, presents formidable entry barriers. These are primarily driven by rigorous international regulations and the necessity for extensive accreditations, making it exceptionally difficult for newcomers to gain traction.

Aspiring entrants require substantial capital investment, a proven history of successful operations, and widespread global recognition from authoritative bodies such as the International Association of Classification Societies (IACS). Without these, competing effectively against established entities like DNV GL Group AS is nearly impossible.

DNV GL Group AS operates in sectors demanding highly specialized technical expertise. Think about the maritime, oil & gas, and renewable energy industries; they require a deep, nuanced understanding of complex engineering, safety regulations, and operational challenges. New entrants would struggle immensely to replicate this level of ingrained knowledge.

Building a global workforce of highly skilled engineers and subject matter experts, as DNV has done over decades, is a significant hurdle. This isn't just about hiring; it's about cultivating a culture of rigorous quality and a reputation for unwavering reliability. For example, DNV's involvement in certifying offshore wind turbines requires decades of accumulated experience in structural integrity and risk assessment, a knowledge base not easily or quickly acquired.

The maritime classification and assurance sector, where DNV operates, demands substantial upfront capital. Building a global network of offices, state-of-the-art laboratories, and recruiting specialized talent requires significant investment, creating a high barrier for potential new entrants.

Existing companies like DNV leverage considerable economies of scale and scope. For instance, DNV’s extensive fleet of vessels surveyed and its broad service portfolio allow for cost efficiencies that new entrants would struggle to match without massive initial outlays, making it challenging to compete on price.

Brand Reputation and Customer Trust

In the assurance and risk management sector, brand reputation and customer trust are absolutely critical. DNV GL Group AS, for instance, has cultivated a formidable reputation over its 160-year history, built on a bedrock of independence, integrity, and deep technical expertise. This established trust is a significant barrier for any new competitor aiming to enter the market.

New entrants would face an uphill battle in replicating DNV's long-standing credibility. Gaining the confidence of clients, particularly in industries where safety and reliability are paramount, takes years, if not decades, to build. This is essential for securing the long-term contracts that are typical in sectors like maritime, oil and gas, and renewable energy.

- Brand Legacy: DNV's 160-year history translates into deeply ingrained customer trust.

- Trust as a Differentiator: In risk management, trust is not just a feature; it's a core requirement for business.

- Barriers to Entry: Newcomers would need substantial time and consistent performance to match DNV's established reputation.

- Contractual Significance: High-stakes industries rely on proven track records, making it difficult for new entrants to win critical business quickly.

Intellectual Property and Digital Platform Development

DNV GL Group AS, now DNV, has heavily invested in its proprietary software and data platforms, such as Veracity, and developed advanced digital assurance methodologies. This significant investment in intellectual property and technological innovation acts as a substantial barrier for potential new entrants.

New competitors would need to replicate DNV's sophisticated digital tools or acquire comparable technologies, a process demanding considerable research and development expenditure and considerable time.

- Veracity Platform Growth: DNV's Veracity platform, launched in 2017, has seen continuous development and adoption, hosting a growing ecosystem of maritime and energy sector data and applications, indicating a strong and expanding digital asset.

- R&D Investment: While specific figures for digital platform development are not always publicly itemized, DNV's overall R&D spending, which supports innovation in areas like digital assurance, is a key indicator of the resources required to build such capabilities. For example, in 2023, DNV reported significant investments in digitalization and innovation initiatives.

- Talent Acquisition Costs: Developing and maintaining cutting-edge digital platforms requires highly specialized talent, the acquisition and retention of which represent a substantial cost for any new entrant aiming to compete on a similar technological level.

The threat of new entrants for DNV GL Group AS (now DNV) is generally low due to several significant barriers. These include high capital requirements, stringent regulatory compliance, and the need for specialized expertise. For instance, obtaining accreditations from bodies like the International Association of Classification Societies (IACS) is a lengthy and costly process, demanding proven operational history and global recognition.

DNV's established brand reputation and the deep trust it has cultivated over its 160-year history are formidable deterrents. In sectors where safety and reliability are paramount, such as maritime and energy, clients are hesitant to engage with unproven entities, making it difficult for newcomers to secure the long-term contracts that underpin DNV's business model.

The company's substantial investment in proprietary digital platforms, like Veracity, and advanced assurance methodologies creates a technological barrier. New entrants would need to invest heavily in research and development to replicate these sophisticated tools or acquire comparable technologies, a challenge compounded by the need for specialized talent.

| Barrier Type | Description | DNV's Advantage |

|---|---|---|

| Capital Requirements | Establishing global operations, labs, and recruiting talent requires significant upfront investment. | DNV possesses a well-established global infrastructure and a large, skilled workforce. |

| Brand Reputation & Trust | 160 years of operation has built deep customer confidence in DNV's independence and expertise. | New entrants struggle to match DNV's credibility, crucial for high-stakes industries. |

| Technical Expertise | Deep knowledge in complex engineering, safety, and operational challenges is essential. | DNV has cultivated decades of specialized knowledge across maritime, oil & gas, and renewables. |

| Digital Platforms & IP | Proprietary software like Veracity and advanced digital assurance methods represent significant R&D investment. | Replicating DNV's digital assets demands substantial time and financial resources for new competitors. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for DNV GL Group AS is built upon a foundation of comprehensive data, including DNV GL's own annual reports and investor presentations, alongside industry-specific market research from firms like IHS Markit and Wood Mackenzie.

We supplement this with insights from financial databases such as Refinitiv Eikon and Bloomberg, as well as regulatory filings and news from key industry associations to provide a robust competitive landscape assessment.