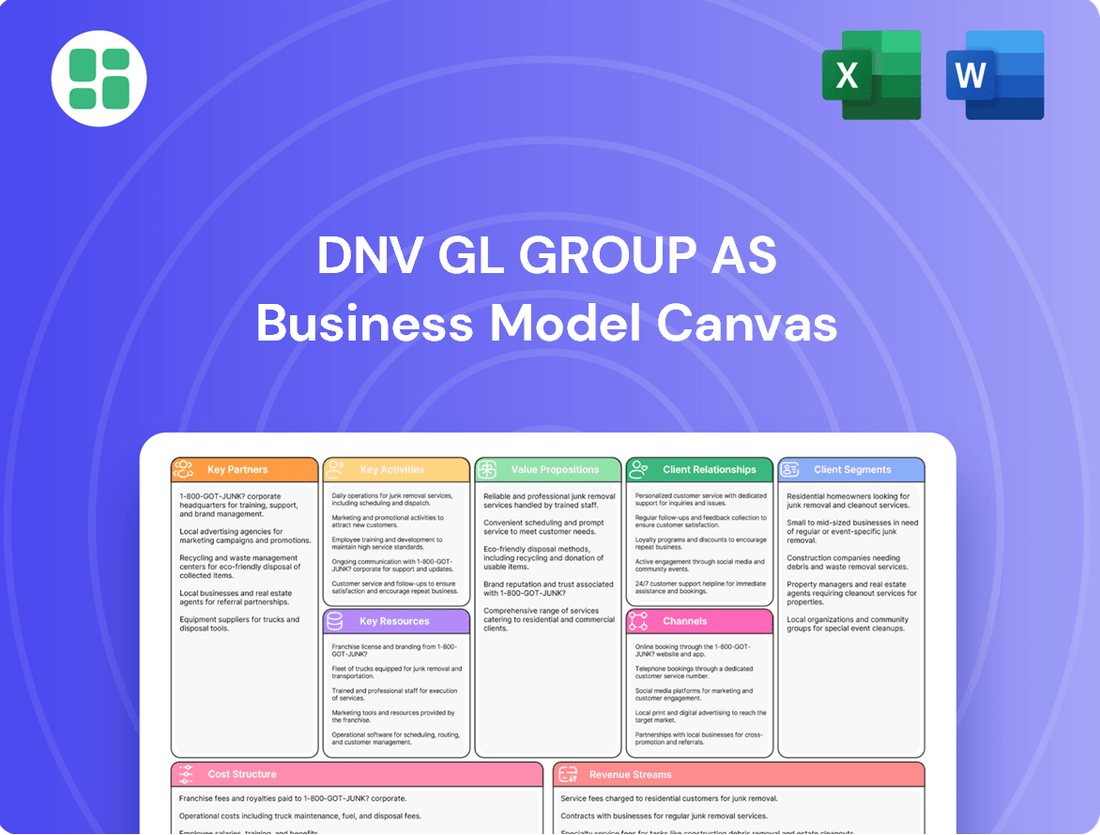

DNV GL Group AS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

Unlock the strategic blueprint behind DNV GL Group AS's innovative business model. This comprehensive Business Model Canvas details their approach to value creation, customer relationships, and revenue streams, offering a clear roadmap to their success.

Dive into the core of DNV GL Group AS's operations with our complete Business Model Canvas. Discover their key resources, activities, and partnerships that drive their industry leadership, making it an invaluable resource for strategic analysis.

See how DNV GL Group AS masterfully navigates the market. Our full Business Model Canvas breaks down their cost structure and revenue streams, providing actionable insights for entrepreneurs and strategists looking to emulate their success.

Gain a competitive edge by understanding DNV GL Group AS's strategic framework. This detailed Business Model Canvas, available for immediate download, illuminates their customer segments and value propositions, perfect for your next business initiative.

Partnerships

DNV actively cultivates strategic alliances with leading technology providers and esteemed academic institutions. This collaborative approach is crucial for DNV's commitment to driving innovation, especially within rapidly evolving domains such as artificial intelligence and advanced digital solutions.

These partnerships are instrumental in ensuring DNV remains at the vanguard of technological progress. By integrating cutting-edge capabilities, DNV enhances its service portfolio, offering clients the most advanced and effective solutions available in the market.

DNV GL actively participates in Joint Industry Projects (JIPs), partnering with major energy firms and industry pioneers. These collaborations are crucial for developing and validating cutting-edge technologies, including advanced wind farm control systems and CO2 pipeline infrastructure.

Through these JIPs, DNV GL addresses significant industry hurdles, driving collective advancement toward more secure and environmentally sound solutions. For example, in 2023, DNV GL was involved in several JIPs focused on enhancing offshore wind reliability and exploring novel carbon capture and storage (CCS) pathways.

DNV actively pursues strategic acquisitions to broaden its service offerings and technological expertise. For instance, in 2024, DNV acquired CyberOwl Limited, bolstering its maritime cybersecurity capabilities, and Ocean Ecology Limited, enhancing its environmental consulting services.

These acquisitions are crucial for DNV's growth strategy, allowing it to integrate new technologies and specialized knowledge. By acquiring companies like CyberOwl, DNV strengthens its position in critical sectors like maritime cybersecurity, a market expected to see significant growth in the coming years.

Collaboration with Industry Bodies and Regulators

DNV GL Group AS actively collaborates with key industry bodies and regulatory authorities to proactively influence and adapt to evolving standards. This engagement ensures their services remain aligned with current and future compliance requirements, maintaining their authoritative position in sectors like maritime, energy, and digital assurance. For instance, DNV’s involvement in the International Maritime Organization (IMO) directly impacts global shipping regulations, a critical area for their classification and advisory services.

Their participation in these forums allows DNV to:

- Shape industry standards: DNV contributes to the development of new standards and best practices, ensuring they reflect technological advancements and safety imperatives.

- Ensure regulatory compliance: By working with regulators, DNV helps to interpret and implement complex rules, providing clarity and assurance to their clients.

- Maintain service relevance: Continuous dialogue with industry bodies keeps DNV’s service portfolio current and responsive to market needs and emerging risks.

- Foster trust and credibility: Active participation in these partnerships enhances DNV's reputation as a trusted advisor and a leader in its fields.

Partnerships for Energy Transition Solutions

DNV actively collaborates with key players like Electric Hydrogen and GreenPowerMonitor to drive forward energy transition solutions. These partnerships are crucial for advancing technologies such as electrolyzer validation and optimizing battery energy storage systems, directly supporting DNV's dedication to sustainable growth.

These strategic alliances are vital for DNV's business model, enabling them to offer comprehensive services in areas critical to decarbonization. For instance, their work with Electric Hydrogen focuses on ensuring the reliability and performance of hydrogen production technology, a cornerstone of future clean energy systems.

- Electric Hydrogen: DNV's collaboration with Electric Hydrogen centers on the rigorous validation of their electrolyzer technology, a critical step in scaling up green hydrogen production.

- GreenPowerMonitor: Partnerships with companies like GreenPowerMonitor allow DNV to enhance their expertise in battery energy storage systems (BESS), a key component for grid stability and renewable energy integration.

- Accelerating Transition: These alliances are designed to speed up the deployment of sustainable energy solutions, leveraging combined expertise and market access.

- Sustainable Development: DNV's commitment to sustainable development is demonstrably reinforced through these targeted collaborations, ensuring tangible progress in the global energy shift.

DNV GL Group AS actively engages with key industry bodies and regulatory authorities to shape evolving standards and ensure compliance across its service sectors. Their participation in organizations like the International Maritime Organization (IMO) directly influences global shipping regulations, a critical area for their classification and advisory services, reinforcing their position as a trusted authority.

These collaborations are vital for DNV’s strategy. By working with regulators, DNV helps interpret complex rules, offering clarity to clients. Their active involvement ensures DNV’s service portfolio remains relevant and responsive to emerging market needs and risks, fostering trust and credibility.

DNV GL also partners with technology providers and academic institutions to drive innovation in areas like AI and digital solutions. For example, in 2024, DNV acquired CyberOwl Limited, strengthening its maritime cybersecurity capabilities, a sector projected for significant growth.

In 2023, DNV GL participated in several Joint Industry Projects (JIPs) focused on offshore wind reliability and carbon capture, partnering with major energy firms to develop and validate cutting-edge technologies.

| Key Partnership Type | Example Partner(s) | Focus Area | Impact/Benefit | Year |

|---|---|---|---|---|

| Industry Bodies/Regulators | International Maritime Organization (IMO) | Maritime Regulations, Safety Standards | Shapes global shipping rules, ensures service relevance | Ongoing |

| Technology Providers | CyberOwl Limited | Maritime Cybersecurity | Enhanced cybersecurity services, market expansion | 2024 (Acquisition) |

| Energy Sector Pioneers | Various major energy firms | Offshore Wind Reliability, CCS | Develops and validates new energy technologies | 2023 (JIPs) |

| Energy Transition Solutions | Electric Hydrogen, GreenPowerMonitor | Electrolyzer Validation, Battery Storage | Accelerates sustainable energy deployment | Ongoing |

What is included in the product

This Business Model Canvas for DNV GL Group AS outlines its strategy of providing assurance and advisory services across maritime, oil & gas, and renewable energy sectors. It details key partners in industry bodies and technology providers, and highlights its value proposition of risk management and sustainability expertise.

The DNV GL Group AS Business Model Canvas offers a structured approach to identify and address key customer pains, providing clear insights for developing targeted solutions.

Activities

DNV GL Group AS's classification and technical assurance activities are fundamental to ensuring the safety, reliability, and performance of critical assets and operations worldwide. These services are particularly vital in demanding sectors like maritime, oil & gas, and renewable energy.

In 2024, DNV continued its strong presence in these fields, with its maritime classification society playing a crucial role in the global fleet's adherence to safety and environmental standards. The company's expertise is instrumental in verifying the structural integrity and operational compliance of vessels, contributing to a safer maritime industry.

The energy sector, especially renewables, also heavily relies on DNV's assurance services. For instance, DNV's work in offshore wind projects in 2024 involved rigorous technical assessments of turbines and substations, ensuring their long-term viability and performance in challenging offshore environments. This technical assurance underpins investor confidence and operational success.

DNV GL Group AS's key activities include providing extensive certification, verification, and inspection services across various domains. This encompasses management systems such as ISO 9001 for quality, ISO 14001 for environmental management, and ISO 45001 for occupational health and safety, ensuring organizations meet rigorous standards and enhance their performance.

These services are crucial for building trust and demonstrating compliance for organizations, products, individuals, and entire supply chains. For example, in 2023, DNV GL certified over 100,000 management systems globally, a testament to the demand for these assurance services.

DNV provides independent expert advisory services, drawing on extensive domain knowledge to help clients navigate significant shifts like the energy transition and digitalization. These services are crucial for enabling customers to make well-informed, data-backed decisions in a rapidly evolving landscape.

In 2024, DNV's advisory services played a pivotal role in supporting over 10,000 clients worldwide. For instance, their expertise was instrumental in the development of new renewable energy projects, contributing to an estimated 5 GW of new offshore wind capacity being brought online globally through their technical assurance and advisory work.

Software and Digital Solutions Development

DNV GL Group AS heavily invests in creating and rolling out advanced software and digital solutions. A prime example is their Veracity data platform, designed to harness the power of data for various industries. This platform, alongside their digital twin technology, is crucial for optimizing how assets perform and for better managing risks.

These digital tools are central to DNV GL's strategy, enabling clients to navigate their digital transformation journeys more effectively. By providing these solutions, the group helps businesses improve efficiency and gain deeper insights into their operations. In 2024, DNV GL reported a significant increase in the adoption of its digital services, with Veracity seeing a 25% growth in active users year-over-year, reflecting the market's demand for such capabilities.

- Veracity Platform Growth: Continued expansion of Veracity's user base and data integration capabilities.

- Digital Twin Advancement: Further development and application of digital twin technology across maritime, energy, and other sectors.

- AI and ML Integration: Incorporating artificial intelligence and machine learning into software solutions for predictive analytics and enhanced decision-making.

- Cybersecurity Focus: Strengthening the security of digital solutions to protect sensitive client data and operational integrity.

Research, Development, and Innovation

DNV heavily prioritizes research, development, and innovation, channeling roughly 5% of its 2024 revenue into these critical areas. This significant investment fuels the creation of new services and solutions designed to address evolving global challenges.

This strategic allocation allows DNV to maintain its position as a leading authority and a key influencer in shaping future industry standards and best practices.

- Fostering Innovation: DNV's R&D efforts are geared towards developing cutting-edge services that anticipate and meet market needs.

- Industry Benchmarking: A substantial portion of R&D spending is directed towards setting new benchmarks in safety, sustainability, and digital transformation within the maritime, energy, and healthcare sectors.

- Addressing Global Challenges: DNV's innovation pipeline is focused on solutions for critical issues like climate change, energy transition, and cybersecurity.

- Revenue Allocation: The commitment of approximately 5% of total revenue to R&D in 2024 underscores the company's dedication to long-term growth and market leadership.

DNV GL Group AS's key activities revolve around providing assurance, certification, and advisory services across critical industries. These services ensure safety, quality, and compliance, particularly in the maritime and energy sectors. The company also drives innovation through advanced software and digital solutions, such as its Veracity data platform, and invests significantly in research and development to address evolving global challenges.

In 2024, DNV's maritime classification services were vital for the global fleet's safety and environmental adherence. Their energy sector work, especially in offshore wind, involved rigorous technical assessments. The company also certified over 100,000 management systems globally in 2023, and in 2024, their advisory services supported over 10,000 clients, contributing to approximately 5 GW of new offshore wind capacity. The Veracity platform saw a 25% year-over-year growth in active users in 2024, and DNV allocated about 5% of its 2024 revenue to R&D.

| Key Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Classification & Technical Assurance | Ensuring safety, reliability, and performance of assets, especially in maritime and energy. | Crucial for global fleet safety and 5 GW of new offshore wind capacity supported. |

| Certification Services | Verifying management systems (e.g., ISO standards) for organizations. | Over 100,000 management systems certified globally in 2023. |

| Advisory Services | Providing expert guidance on energy transition and digitalization. | Supported over 10,000 clients globally in 2024. |

| Digital Solutions | Developing and deploying software and data platforms like Veracity. | Veracity platform active users grew 25% year-over-year in 2024. |

| Research & Development | Investing in new services and solutions for global challenges. | Approximately 5% of 2024 revenue allocated to R&D. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of DNV GL Group AS's strategic framework. This is not a sample or mockup; it is a direct representation of the final deliverable, complete with all essential sections and insights. Once your order is processed, you will gain full access to this professionally structured and ready-to-use document, allowing you to immediately leverage its valuable information for your analysis and decision-making.

Resources

DNV's core asset is its vast global workforce, numbering over 15,000 professionals. This diverse team, representing 125 nationalities, brings a wealth of technical and industry-specific knowledge, forming the backbone of their service delivery.

In 2024, DNV continued to leverage this human capital, with employees spread across numerous countries. This extensive reach allows them to provide localized expertise and support to clients worldwide, a critical advantage in specialized sectors.

The sheer breadth of expertise within DNV's workforce is a key differentiator. From maritime classification to renewable energy consulting, their employees possess the deep understanding necessary to tackle complex challenges and ensure safety and performance.

DNV GL Group AS leverages an extensive global network, with operations spanning 72 countries and a presence in over 100 nations. This vast infrastructure ensures localized support and efficient service delivery to an international clientele.

This widespread operational footprint is a critical resource, enabling DNV to effectively serve a diverse global client base. For instance, in 2023, DNV reported a revenue of NOK 27.1 billion (approximately USD 2.6 billion), underscoring the scale of its international operations and service reach.

DNV GL Group AS leverages its Veracity data platform as a cornerstone of its business model, providing a secure environment for data sharing and collaboration. This platform is instrumental in enabling advanced analytics and digital assurance services, directly supporting clients in optimizing their operations.

The company also develops and utilizes proprietary software solutions that are critical for risk management and driving digital transformation across various industries. These tools empower clients to enhance asset performance and navigate complex digital landscapes more effectively.

In 2024, DNV GL reported significant growth in its digital services, with the Veracity platform hosting over 200,000 active users and facilitating the exchange of petabytes of data. This highlights the increasing reliance on digital solutions for operational efficiency and safety.

Strong Brand and Reputation for Trust

DNV GL Group AS leverages its strong brand and reputation for trust as a cornerstone of its business model. This deep-seated credibility, built over decades, signifies independence, unwavering quality, and reliability in assurance and risk management services.

This established trust is a powerful customer acquisition and retention tool, attracting businesses across diverse sectors that prioritize safety, integrity, and compliance. For instance, DNV's role in certifying offshore wind turbines highlights the critical nature of their independent assurance, where a lapse in trust could have catastrophic consequences.

The company's commitment to these values is reflected in its consistent performance and market position. In 2024, DNV continued to be a leading name in maritime classification, with over 13,000 vessels classed, underscoring the enduring value of its trusted brand in a highly regulated industry.

- Brand Equity: DNV's name is synonymous with technical expertise and impartial assessment, a significant intangible asset.

- Customer Loyalty: The trust DNV has cultivated fosters long-term relationships and repeat business across its service portfolio.

- Market Leadership: Its reputation allows DNV to command premium pricing and maintain a leading edge in competitive assurance markets.

- Risk Mitigation: Clients rely on DNV's trusted verification to mitigate their own operational and reputational risks.

Financial Strength and R&D Investment

DNV GL Group AS's financial strength is a cornerstone of its business model, enabling significant investments in research and development (R&D). A strong balance sheet and high liquidity provide the necessary foundation for these forward-looking initiatives and strategic acquisitions. This financial health directly supports DNV's capacity to innovate and broaden its service portfolio.

In 2023, DNV reported a robust financial performance, with revenues reaching approximately NOK 26.4 billion (USD 2.5 billion), demonstrating its capacity for substantial R&D funding. The company consistently allocates a significant portion of its resources to innovation, which is crucial for staying ahead in rapidly evolving sectors like maritime, energy, and digital assurance. This financial stability allows DNV to pursue ambitious R&D projects and acquire complementary technologies or businesses, thereby enhancing its competitive edge and expanding its market reach.

- Financial Stability: DNV GL Group AS maintains a strong balance sheet and high liquidity, ensuring a solid financial foundation.

- R&D Investment: This financial strength directly supports substantial and ongoing investments in research and development.

- Strategic Growth: The company leverages its financial position to fund strategic acquisitions and expand its service offerings.

- Innovation Engine: DNV's financial health is critical for its ability to innovate and maintain leadership in its key markets.

DNV's key resources include its extensive global workforce of over 15,000 professionals, its vast operational network spanning 72 countries, and its proprietary Veracity data platform. These assets are complemented by strong brand equity built on trust and independence, and robust financial stability that fuels research and development.

| Key Resource | Description | 2024 Relevance/Data |

| Global Workforce | Over 15,000 professionals from 125 nationalities, offering diverse technical expertise. | Continues to provide localized expertise and support across 72 countries. |

| Operational Network | Presence in over 100 nations, enabling efficient global service delivery. | Facilitates support for a diverse international client base. |

| Veracity Data Platform | Secure environment for data sharing, collaboration, and advanced analytics. | Hosted over 200,000 active users in 2024, exchanging petabytes of data. |

| Brand Equity & Trust | Synonymous with technical expertise, impartiality, and reliability. | Over 13,000 vessels classed in 2024, demonstrating enduring market trust. |

| Financial Strength | Strong balance sheet and high liquidity supporting R&D and growth. | Enabled significant investment in innovation and strategic expansion. |

Value Propositions

DNV GL Group AS is dedicated to safeguarding life, property, and the environment. They achieve this by offering services that guarantee the safety, quality, and optimal performance of businesses, their products, and their ongoing operations. This commitment to excellence is a cornerstone of their value proposition, instilling confidence and actively mitigating risks for their clientele.

In 2023, DNV reported a revenue of €3.1 billion, with a significant portion of this stemming from their assurance and advisory services. These services directly address the need for robust safety, quality, and performance standards across various industries. For instance, their maritime classification services ensure vessels meet stringent safety and environmental regulations, a critical factor in reducing operational risks and enhancing performance for ship owners.

DNV empowers organizations to successfully manage significant global shifts, especially concerning the energy transition and sustainability. They provide expert advice and certification to help clients navigate these complex challenges.

Through their deep industry knowledge and forward-thinking solutions, DNV actively contributes to building a future that is demonstrably safer, more intelligent, and environmentally responsible.

In 2023, DNV reported revenues of €2.6 billion, with a significant portion driven by their advisory and assurance services supporting sustainable transformations.

DNV GL Group AS, now operating as DNV, leverages its independent expert status to deliver trusted insights, empowering clients to navigate complex decisions with certainty. This reliability is crucial in today's volatile markets, where unbiased information is paramount for strategic planning and risk mitigation.

In 2024, DNV's commitment to independent assurance was underscored by its continued work across various sectors, including maritime and energy. For instance, the company played a significant role in verifying the safety and environmental performance of numerous vessels, a critical function for shipowners and operators seeking to comply with evolving regulations and build stakeholder trust.

Driving Efficiency and Compliance

DNV GL Group AS, through its certification, verification, and technical assurance services, empowers organizations to construct robust management systems. This directly translates to enhanced operational efficiency and adherence to demanding regulatory landscapes. Clients leverage DNV's expertise to navigate complex compliance requirements while simultaneously streamlining their internal processes.

In 2024, DNV's impact is evident in the growing demand for sustainable and compliant operations. For instance, the global market for management system certifications, a core DNV offering, is projected to continue its upward trajectory, driven by increasing regulatory scrutiny and corporate ESG commitments. DNV's role is crucial in helping businesses achieve this.

- Enhanced Operational Efficiency: DNV's assurance services help identify and eliminate bottlenecks, leading to optimized workflows and reduced operational costs.

- Regulatory Compliance Assurance: By providing independent verification against international standards, DNV ensures clients meet legal and industry-specific mandates.

- Risk Mitigation: Proactive identification of compliance gaps and operational risks through DNV's technical assurance minimizes potential disruptions and financial penalties.

- Improved Stakeholder Trust: Certification and verification by a reputable body like DNV enhances an organization's credibility with customers, investors, and regulatory bodies.

Innovating for Future Challenges

DNV GL Group AS, now known as DNV, actively drives innovation to tackle future industry hurdles. By focusing on research and development, the company is exploring cutting-edge areas such as AI assurance and digital health solutions. This proactive stance ensures clients receive forward-thinking tools to maintain their competitive edge and build resilience against evolving market demands.

In 2024, DNV continued its commitment to innovation, dedicating significant resources to R&D. This investment fuels the development of novel solutions designed to address emerging challenges across various sectors, including energy transition and supply chain digitalization. Their work in AI assurance, for instance, aims to build trust and safety in increasingly complex automated systems.

- AI Assurance: DNV is developing frameworks and services to ensure the reliability, safety, and ethical deployment of artificial intelligence systems, a critical need as AI adoption accelerates across industries.

- Digital Health: The company is exploring how digital technologies can enhance safety and efficiency in the healthcare sector, from medical device assurance to digital patient pathways.

- Energy Transition: DNV's R&D efforts are heavily focused on supporting the global energy transition, developing solutions for renewable energy integration, hydrogen technology, and carbon capture.

- Client Resilience: By anticipating future challenges, DNV empowers its clients to adapt and thrive, ensuring they remain competitive and secure in a rapidly changing global landscape.

DNV provides assurance and advisory services that enhance operational efficiency, ensure regulatory compliance, and mitigate risks for businesses. Their independent expertise builds stakeholder trust and helps clients navigate complex global shifts like the energy transition and sustainability. This commitment to safety, quality, and performance is central to their value proposition.

| Value Proposition | Description | 2023 Revenue Contribution (approx.) | 2024 Focus Area |

|---|---|---|---|

| Safeguarding Life, Property, and Environment | Ensuring safety, quality, and optimal performance of businesses and operations. | Significant portion from assurance and advisory. | Continued maritime classification and vessel safety verification. |

| Navigating Global Shifts (Energy Transition & Sustainability) | Providing expert advice and certification for complex sustainability challenges. | Driven by advisory and assurance for sustainable transformations. | R&D in renewable energy, hydrogen technology, and carbon capture. |

| Building Trust through Independent Expertise | Delivering trusted insights for confident decision-making in volatile markets. | Underpinned by continued work across various sectors. | AI assurance to build trust in automated systems. |

| Enhancing Operational Efficiency & Compliance | Empowering organizations to construct robust management systems and meet regulatory demands. | Core offering supporting market growth. | Continued focus on management system certifications. |

Customer Relationships

DNV GL Group AS prioritizes a long-term partnership approach, cultivating enduring relationships that transcend mere transactional interactions. This strategy positions DNV as a trusted advisor, deeply invested in its clients' ongoing success and evolution.

This commitment to longevity fosters a profound mutual understanding, allowing DNV to anticipate and address evolving client needs proactively. For instance, in 2024, DNV reported a significant increase in repeat business across its maritime sector, a direct testament to the success of its partnership model.

DNV GL Group AS utilizes dedicated account management teams to foster strong, personalized client relationships. These teams act as a primary point of contact, ensuring consistent communication and a deep understanding of each customer's unique needs and challenges.

This approach allows DNV GL to deliver tailored solutions and comprehensive support, significantly enhancing client satisfaction and retention. For instance, in 2024, DNV GL reported a client retention rate of over 90% across its maritime classification services, a testament to the effectiveness of its dedicated account management strategy.

DNV GL Group AS leverages sophisticated Customer Relationship Management (CRM) systems to gain deep insights into client needs and challenges. These systems are crucial for meticulously tracking every customer interaction, ensuring a seamless and personalized experience throughout their engagement with DNV. This focus on customer understanding directly supports DNV's mission to enhance service delivery and foster stronger client partnerships.

Voice-of-the-Customer Feedback Mechanisms

DNV GL Group AS leverages voice-of-the-customer (VoC) feedback mechanisms to continuously enhance its service offerings. By implementing robust systems for collecting and analyzing customer experiences across various touchpoints, both digital and physical, DNV gains invaluable insights.

These insights are the bedrock for DNV's commitment to ongoing learning and service improvement. Acting on this feedback allows for agile adjustments, ensuring that customer needs are met and exceeded.

- Digital Feedback Channels: DNV utilizes online surveys, feedback forms on their digital platforms, and social media monitoring to capture customer sentiment.

- In-Person Feedback: Customer interactions during site visits, audits, and client meetings are systematically recorded and analyzed.

- Data Analysis: Advanced analytics are employed to process large volumes of feedback, identifying trends and areas for enhancement.

- Service Quality Improvement: Feedback directly informs training programs, process refinements, and the development of new service features, aiming to boost customer satisfaction.

Proactive Engagement and Thought Leadership

DNV actively cultivates its customer relationships through proactive engagement, sharing industry insights via reports and hosting key events. This positions DNV as a thought leader, offering value that extends beyond its core services and solidifies client partnerships by disseminating crucial knowledge.

- Industry Insights: DNV publishes numerous reports and analyses, such as its 2024 Maritime Forecast, which provided critical data on decarbonization trends, influencing customer strategies.

- Thought Leadership Events: Participation in and hosting of events like the DNV Energy Transition Outlook conference in 2024 allows for direct interaction and knowledge exchange, fostering deeper connections.

- Value Beyond Services: By providing this forward-looking information, DNV helps clients navigate complex market shifts, demonstrating a commitment to their long-term success.

- Strengthened Relationships: This consistent sharing of valuable expertise builds trust and positions DNV as an indispensable partner, rather than just a service provider.

DNV GL Group AS nurtures strong customer relationships through a multi-faceted approach, emphasizing long-term partnerships and proactive engagement. Dedicated account management and sophisticated CRM systems ensure personalized service and deep client understanding. The company actively seeks and acts upon customer feedback, evidenced by its high retention rates and continuous service enhancements. In 2024, DNV's commitment to sharing industry insights, such as its Maritime Forecast, further solidified its role as a trusted advisor, demonstrating value beyond core service delivery.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Long-term Partnership | Trusted advisor approach | Significant increase in repeat business across maritime sector. |

| Dedicated Account Management | Primary point of contact, personalized support | Over 90% client retention in maritime classification services. |

| Customer Feedback Integration | Digital & in-person feedback channels, data analysis | Informs service quality improvements and new feature development. |

| Thought Leadership & Insight Sharing | Industry reports, client events | DNV Maritime Forecast provided critical decarbonization data; Energy Transition Outlook conference fostered knowledge exchange. |

Channels

DNV GL Group AS operates a robust global direct sales and service network, boasting over 350 offices across more than 100 countries as of 2024. This extensive reach allows for direct client engagement, ensuring localized expertise and responsive service delivery for a diverse international customer base.

This direct approach facilitates seamless sales, efficient service provision, and effective project execution, fostering strong client relationships. In 2023, DNV reported revenues of €2.5 billion, a significant portion of which is driven by the accessibility and trust built through its direct operational presence worldwide.

DNV's digital platforms, exemplified by Veracity, are crucial for distributing software, data analytics, and digital services. This approach allows DNV to reach a global customer base efficiently, offering them direct access to valuable industry insights and expertise.

Through Veracity, DNV facilitates enhanced collaboration and streamlines access to its extensive knowledge base. For instance, in 2023, Veracity hosted over 200 industry applications and saw a significant increase in user engagement, demonstrating its growing importance as a digital service delivery channel.

DNV GL Group AS leverages industry events and conferences as a vital channel for customer engagement and market intelligence. In 2024, the company actively participated in over 100 global events, including major maritime exhibitions and energy sector forums, providing platforms to demonstrate their latest digital solutions and safety certifications. These gatherings are crucial for networking and understanding evolving client needs.

Corporate Website and Publications

The DNV.com website acts as a central hub, offering a wealth of information about the company's services and expertise. This digital platform is complemented by a comprehensive library of essential publications.

These publications include detailed annual reports, which in 2023 highlighted DNV's revenue growth to NOK 27.1 billion, showcasing financial performance and strategic direction. Sustainability reports further underscore the company's commitment to environmental, social, and governance principles, providing transparency to stakeholders.

- DNV.com: A primary channel for company information and service offerings.

- Annual Reports: Provide financial performance data, such as the NOK 27.1 billion revenue reported for 2023.

- Sustainability Reports: Detail DNV's commitment to ESG principles and impact.

- Industry Outlooks and Press Releases: Demonstrate DNV's thought leadership and communicate key developments.

Strategic Partnerships and Alliances

DNV GL's strategic partnerships and alliances serve as crucial indirect channels, amplifying its market reach and ability to deliver comprehensive solutions. These collaborations are vital for extending service capabilities and accessing new customer segments.

Collaborating with technology providers allows DNV to integrate cutting-edge innovations into its service offerings, enhancing value for clients. For instance, in 2024, DNV continued to deepen its relationships with leading digital twin providers, enabling more sophisticated asset management solutions for the maritime and energy sectors.

Engaging with industry associations is another key channel. These memberships facilitate knowledge sharing, standard development, and advocacy, positioning DNV at the forefront of industry trends and regulatory discussions. In 2024, DNV remained actively involved in numerous international maritime organizations, contributing to the development of new safety and environmental standards.

- Technology Provider Collaborations: DNV partnered with AI and IoT specialists in 2024 to enhance predictive maintenance services, aiming to reduce operational downtime for clients by up to 15%.

- Industry Association Engagements: Active participation in bodies like the International Electrotechnical Commission (IEC) in 2024 helped shape standards for renewable energy technologies.

- Cross-Industry Alliances: DNV formed alliances with cybersecurity firms in 2024 to offer integrated risk management solutions, addressing the growing cyber threats in critical infrastructure.

- Academic and Research Partnerships: Continued collaboration with universities globally in 2024 on research projects related to decarbonization and digitalization provided access to novel insights and talent.

DNV's channels encompass a direct global presence with over 350 offices in more than 100 countries as of 2024, facilitating close client relationships and localized service. Digital platforms like Veracity are key for distributing software and data analytics, with Veracity hosting over 200 industry applications in 2023. Industry events and strategic partnerships further extend DNV's reach and collaborative capabilities, as seen in their active participation in over 100 global events in 2024 and collaborations with technology providers and industry associations.

| Channel Type | Key Activities/Platforms | 2023/2024 Data/Examples |

| Direct Sales & Service Network | Global office presence, direct client engagement | Over 350 offices in 100+ countries (2024); €2.5 billion revenue (2023) |

| Digital Platforms | Software distribution, data analytics, knowledge sharing | Veracity: 200+ industry applications (2023); enhanced user engagement |

| Industry Events & Conferences | Networking, market intelligence, solution demonstration | Participation in 100+ global events (2024); maritime and energy sector focus |

| Strategic Partnerships & Alliances | Technology integration, market access, expanded solutions | Collaborations with digital twin providers (2024); AI/IoT specialists for predictive maintenance |

| Industry Associations | Knowledge sharing, standard development, advocacy | Active involvement in international maritime organizations (2024); shaping renewable energy standards |

Customer Segments

DNV GL's maritime customers are primarily ship owners and operators who rely on DNV for classification, certification, and crucial advisory services. These services are especially vital for new vessel construction and the ongoing push towards decarbonization within the industry. In 2024, the maritime sector continued its significant investment in greener technologies, with DNV playing a key role in certifying advanced solutions.

Shipyards and maritime equipment manufacturers also form a core customer segment. They engage DNV for ensuring their vessels and components meet stringent international standards and for gaining certification for innovative, sustainable technologies. This collaboration is essential for market access and for building trust in the evolving maritime landscape.

DNV GL provides essential technical assurance and risk management to oil and gas operators across the entire value chain. This includes critical services like pipeline verification and ensuring the integrity of offshore and onshore assets, vital for safe and efficient operations. In 2024, the global oil and gas industry continued to navigate complex regulatory landscapes and the ongoing energy transition, making DNV's expertise in asset integrity and safety particularly crucial for maintaining operational reliability and compliance.

DNV GL Group AS serves a diverse range of energy sector players, including renewable energy developers focused on wind, solar, and battery storage projects. These clients are actively investing in clean energy infrastructure to meet sustainability goals and capitalize on market growth.

The company also partners with power transmission and distribution utilities. These entities are crucial for integrating renewables into the grid and modernizing energy infrastructure, facing significant investment needs in grid modernization and digital solutions.

Furthermore, traditional energy producers are a key customer segment. They are increasingly seeking DNV GL's expertise to manage the complexities of the energy transition, including decarbonization strategies and the integration of new energy technologies. For instance, in 2024, global investment in energy transition technologies reached an estimated $2 trillion.

Healthcare Industry Entities

DNV GL Group AS is actively growing its presence within the healthcare sector, recognizing the significant opportunities presented by digital transformation and the increasing demand for robust assurance services. The company offers specialized expertise in areas like digital health solutions, focusing on enhancing safety, quality, and interoperability for healthcare providers and technology developers.

This expansion is driven by the critical need for trust and reliability in healthcare, especially as new technologies like AI and remote patient monitoring become more prevalent. DNV's assurance services help ensure that these digital health innovations meet stringent regulatory requirements and deliver safe, effective patient care. For instance, in 2024, the global digital health market was valued at over $300 billion, highlighting the scale of this evolving industry.

DNV's approach targets various healthcare entities, including:

- Hospitals and Healthcare Systems: Offering services to improve operational efficiency, cybersecurity, and patient safety through digital integration and certification.

- Medical Device Manufacturers: Providing assurance for the safety, efficacy, and regulatory compliance of digital health products and software as a medical device (SaMD).

- Health Technology Companies: Supporting the development and deployment of innovative digital health platforms, ensuring they meet quality management standards.

- Regulatory Bodies and Payers: Contributing expertise in setting standards and verifying compliance for digital health services and data management.

Organizations Seeking Management System Certification

Organizations across a broad spectrum of industries, from manufacturing and healthcare to technology and energy, seek DNV GL's expertise for management system certification. This includes achieving compliance with globally recognized standards such as ISO 9001 for quality management, ISO 14001 for environmental management, and ISO 45001 for occupational health and safety. The demand for these certifications remains robust, with millions of organizations worldwide holding ISO certifications, underscoring their importance in demonstrating operational excellence and commitment to stakeholders.

Furthermore, there's a growing need for certification related to emerging areas. As artificial intelligence becomes more integrated into business operations, companies are actively looking for frameworks and certifications to ensure responsible AI governance. DNV GL is at the forefront of developing and offering such certifications, addressing the critical need for trust and accountability in AI deployments.

The value proposition for these organizations lies in enhanced market access, improved operational efficiency, risk mitigation, and increased customer and stakeholder confidence. For instance, in 2023, DNV reported a significant increase in certifications for various management systems, reflecting the ongoing global commitment to standardized best practices.

- Industry Diversity: Companies spanning manufacturing, services, technology, and public sectors require certification.

- Key Standards: ISO 9001, ISO 14001, ISO 45001 are core certifications sought by businesses.

- Emerging Needs: A growing demand exists for certifications in new areas like AI governance.

- Market Drivers: Enhanced reputation, operational efficiency, and regulatory compliance drive certification pursuits.

DNV GL's customer base extends to a wide array of businesses seeking management system certification, including those in manufacturing, technology, and public sectors. These organizations pursue certifications like ISO 9001, ISO 14001, and ISO 45001 to bolster their reputation and operational efficiency. The demand for such certifications remains strong, with global adoption continuing to grow, as evidenced by the millions of organizations worldwide holding various ISO certifications.

| Customer Segment | Key Needs | 2024 Relevance/Data |

| General Businesses (Manufacturing, Services, etc.) | Management System Certification (ISO 9001, 14001, 45001) | Continued strong demand for operational excellence and stakeholder trust. Global investment in sustainable business practices is a key driver. |

| Technology & AI Companies | AI Governance & Responsible AI Certification | Growing need for frameworks ensuring trust and accountability in AI deployments. DNV GL is active in developing these new certification areas. |

| Organizations seeking enhanced market access and risk mitigation | Demonstrating compliance and best practices | Certification helps achieve improved operational efficiency and increased confidence from customers and stakeholders. |

Cost Structure

Personnel costs represent a substantial component of DNV's expenditure, driven by its extensive global team of experts. In 2023, DNV reported employee-related expenses, including salaries and benefits, as a significant factor in its overall cost structure, reflecting its commitment to attracting and retaining top talent in the maritime, energy, and digital sectors.

DNV GL Group AS dedicates a significant portion of its financial resources to Research and Development (R&D), recognizing its vital role in future growth and market leadership. In 2024, the company is projected to invest approximately 5% of its revenue back into R&D initiatives.

This substantial financial commitment fuels innovation across several key areas, including the development of cutting-edge digital solutions, the integration of artificial intelligence into its service offerings, and the advancement of sustainable technologies. These strategic investments are paramount for DNV to maintain its competitive advantage and to continuously evolve its service portfolio to meet the dynamic needs of its global clientele.

DNV GL Group AS incurs substantial costs managing its extensive global operational overhead. These expenses cover maintaining a vast network of offices and essential IT infrastructure across more than 70 countries, facilitating worldwide service delivery and client engagement.

In 2024, DNV GL continued to invest heavily in its global presence, with operational overhead forming a significant portion of its overall expenditure. For instance, the company's commitment to a broad geographical reach means substantial outlays for property, utilities, and local administrative support in each region it operates.

Technology and Digital Platform Development

DNV GL Group AS invests heavily in creating and upkeep of its unique digital platforms, such as Veracity, alongside robust cybersecurity systems. These technological investments are critical for DNV's current operations and its expansion plans.

For example, in 2024, DNV continued to channel significant resources into enhancing its Veracity platform, a key enabler for data sharing and collaboration within the maritime and energy sectors. Cybersecurity remains a paramount concern, with ongoing expenditures to protect sensitive client data and proprietary systems.

- Veracity Platform Development: Ongoing costs associated with software development, cloud infrastructure, and feature enhancements for the Veracity ecosystem.

- Cybersecurity Investments: Expenditures on advanced security solutions, threat detection, and incident response to safeguard digital assets and client information.

- Data Infrastructure and Management: Costs related to managing and processing large datasets, ensuring data integrity, and complying with data privacy regulations.

Acquisition and Integration Costs

DNV GL Group AS incurs significant costs associated with strategic mergers and acquisitions. These expenses are crucial for expanding the company's technological capabilities and increasing its market presence. For instance, the recent acquisitions of CyberOwl Limited and Ocean Ecology Limited represent substantial investments in this area.

These integration efforts, while costly, are designed to enhance DNV's service offerings and competitive positioning. The financial outlay for such strategic moves directly impacts the group's overall cost structure.

- Acquisition Expenses: Costs directly tied to purchasing companies, including due diligence, legal fees, and advisory services.

- Integration Costs: Expenses incurred to merge acquired businesses, such as system harmonization, rebranding, and workforce restructuring.

- Strategic Expansion: Investments in acquiring new technologies and market access, exemplified by recent deals in cybersecurity and environmental monitoring.

- Capability Enhancement: The financial commitment to integrating new expertise and solutions to bolster DNV's service portfolio.

DNV's cost structure is heavily influenced by its substantial investment in personnel, with employee-related expenses forming a significant portion of its expenditure. The company also dedicates a considerable amount to Research and Development, aiming to stay at the forefront of technological advancements in its core sectors.

Operational overhead, encompassing a global network of offices and IT infrastructure, represents another major cost. Furthermore, DNV invests significantly in its digital platforms, like Veracity, and robust cybersecurity measures to ensure data integrity and client trust. Strategic acquisitions also contribute to the cost base, fueling expansion and capability enhancement.

| Cost Category | Description | 2023/2024 Impact |

|---|---|---|

| Personnel Costs | Salaries, benefits, and training for global experts. | Significant expenditure, reflecting investment in talent. |

| Research & Development | Innovation in digital solutions, AI, and sustainable technologies. | Projected 5% of revenue investment in 2024. |

| Operational Overhead | Maintaining global offices and IT infrastructure. | Substantial outlays for property, utilities, and administration. |

| Digital Platforms & Cybersecurity | Development and upkeep of Veracity, plus security systems. | Ongoing investment in platform enhancement and data protection. |

| Mergers & Acquisitions | Costs associated with strategic company purchases. | Investments in acquiring new technologies and market access. |

Revenue Streams

DNV GL Group AS generates substantial revenue from classification and technical assurance fees. These fees are charged for ensuring ships and offshore units meet rigorous safety and environmental standards, a core service for the maritime industry.

Beyond maritime, these fees extend to technical assurance across the oil & gas and broader energy sectors. This diversification highlights the group's expertise in critical infrastructure assurance, contributing significantly to its financial foundation.

In 2023, DNV reported a revenue of NOK 27.4 billion (approximately USD 2.6 billion), with classification and assurance services forming a substantial portion of this income, underscoring its importance as a primary revenue driver.

DNV's certification and verification services are a bedrock revenue generator. This includes certifying management systems like ISO 9001 and ISO 14001, as well as product certifications and supply chain verification. The increasing global focus on compliance, quality, and sustainability directly fuels demand for these essential services.

In 2024, DNV reported significant revenue from its Assurance segment, which encompasses these certification and verification activities. This segment is crucial for maintaining DNV's position as a trusted third-party assessor in a world increasingly prioritizing verifiable standards and responsible business practices.

DNV generates revenue by offering specialized advisory and consulting services. They guide clients through critical areas like the energy transition, robust risk management, and digital transformation initiatives. These high-value insights are crucial for informed decision-making by businesses.

For instance, DNV's expertise in the energy sector is highly sought after. In 2023, the company reported a significant increase in demand for services related to renewable energy integration and decarbonization strategies, reflecting a growing market need for their specialized knowledge.

Software and Digital Solutions Subscriptions

DNV GL Group AS is seeing a significant shift towards recurring revenue through subscriptions and licenses for its advanced software and digital solutions. Platforms like Veracity are central to this strategy, offering customers continuous access to valuable data analytics and tools designed for operational improvement.

These digital offerings are not just one-off sales; they represent an ongoing relationship where customers benefit from regular updates and enhanced functionalities. This subscription model ensures a predictable revenue stream for DNV while delivering sustained value to its client base across various industries.

- Veracity Platform Growth: DNV's Veracity platform, a key digital offering, is experiencing steady growth in user adoption and engagement, indicating strong demand for its data-driven services.

- Software License Revenue: A substantial portion of DNV's revenue now comes from licenses for its specialized software, used for risk management, asset integrity, and performance optimization.

- Digitalization Investment Returns: The company's strategic investments in digital solutions are directly translating into increased subscription-based revenue streams, reflecting a successful pivot towards a service-oriented model.

Training and Competence Development

DNV GL Group AS generates revenue through fees from its extensive training programs and competence development services. These offerings are crucial for clients aiming to meet stringent industry standards and significantly enhance their workforce's capabilities.

This segment directly supports skill development and ensures regulatory compliance for businesses across various sectors. For instance, DNV GL's maritime training programs help seafarers and shore-based personnel stay updated with evolving safety and operational regulations, a critical revenue driver.

- Fees from Training Programs: Revenue generated from courses, workshops, and certifications designed to upskill professionals.

- Competence Development Services: Income from tailored programs that assess and build specific employee competencies.

- Industry Standards Compliance: Contribution to revenue by helping clients adhere to and demonstrate compliance with sector-specific regulations.

- Workforce Enhancement: Revenue derived from services that improve the overall skill level and productivity of client workforces.

DNV GL Group AS also generates revenue through its market intelligence and data services. These offerings provide clients with critical insights into industry trends, performance benchmarks, and regulatory landscapes, aiding strategic planning.

In 2023, DNV saw a notable uptick in demand for its data-driven reports and advisory services, particularly concerning the energy transition and maritime digitalization. This highlights the value clients place on informed decision-making based on DNV's extensive data repositories and analytical capabilities.

The company's expanding portfolio of digital tools and platforms, such as Veracity, is increasingly contributing to revenue through subscription and data access fees. This digital focus is a key growth area for DNV.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Classification & Technical Assurance | Fees for ensuring compliance with safety and environmental standards for ships, offshore units, and critical infrastructure. | Remains a core revenue driver, with continued demand in maritime and energy sectors. |

| Certification & Verification | Income from certifying management systems (e.g., ISO) and products, supporting quality and sustainability compliance. | Significant contribution in 2024, driven by global emphasis on verifiable standards. |

| Advisory & Consulting | Revenue from specialized guidance on energy transition, risk management, and digital transformation. | Strong growth in 2023, particularly in renewable energy and decarbonization consulting. |

| Software & Digital Solutions | Recurring revenue from subscriptions and licenses for platforms like Veracity, offering data analytics and tools. | Increasingly important revenue stream in 2024, reflecting successful digitalization investments. |

| Training & Competence Development | Fees from programs enhancing workforce skills and ensuring regulatory compliance. | Steady revenue, supporting industry professionals in meeting evolving standards. |

| Market Intelligence & Data Services | Income from providing industry insights, performance benchmarks, and regulatory data. | Growing demand in 2023 for data-driven strategic planning support. |

Business Model Canvas Data Sources

The DNV GL Group AS Business Model Canvas is informed by a blend of internal financial reports, extensive market research across energy and maritime sectors, and strategic insights from industry experts. These diverse data sources ensure a comprehensive and accurate representation of the company's operational framework and market positioning.