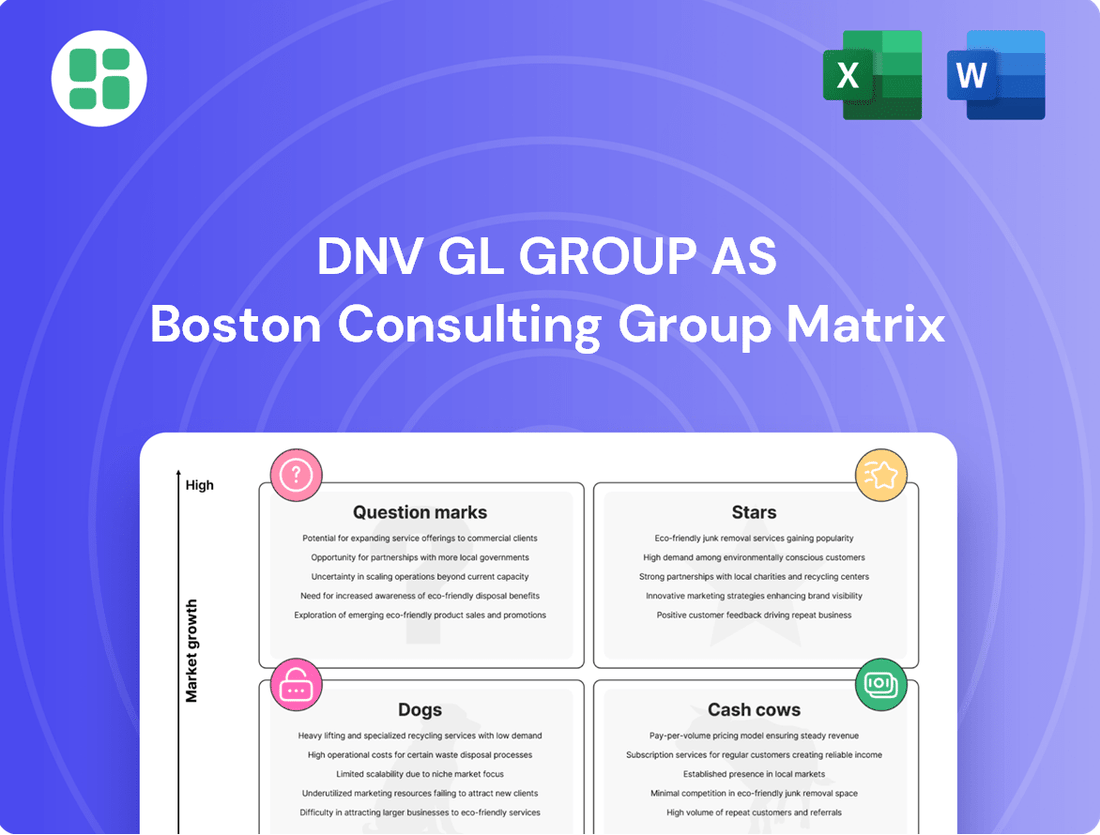

DNV GL Group AS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

Curious about DNV GL Group AS's strategic positioning? This BCG Matrix preview highlights their key business units, but the real power lies in the full report. Understand which segments are driving growth and which require careful resource management.

Unlock the complete DNV GL Group AS BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. This detailed analysis provides the actionable insights needed to optimize your investment strategy and product portfolio.

Don't miss out on the full DNV GL Group AS BCG Matrix, offering a clear roadmap to capitalize on their strengths and address potential weaknesses. Purchase the complete report for data-driven recommendations and a strategic advantage in a competitive market.

Stars

DNV GL Group AS, now known as DNV, is a powerhouse in renewable energy certification and advisory, especially in offshore wind, solar PV, and the emerging hydrogen market. Their comprehensive services are crucial for a sector fueled by global decarbonization goals and substantial investment.

The company's Energy Transition Outlook 2024 underscores the relentless growth of renewables, painting a picture of a high-demand market where DNV commands a significant presence. This robust market position suggests DNV's renewable energy certification and advisory services are likely a star in their portfolio.

DNV's cybersecurity and digital assurance for industrial systems is likely a Star in the BCG matrix. The increasing digitalization of critical infrastructure in maritime, energy, and oil & gas sectors fuels a high demand for DNV's specialized services. DNV Cyber, launched in mid-2024 with over 500 experts, consolidates existing strengths and recent acquisitions, positioning it to capitalize on this growing market.

DNV is a major player in maritime decarbonization, providing classification and advisory services for emerging alternative fuels like LNG, methanol, and ammonia, alongside energy efficiency solutions. This positions them as a key enabler for the industry's shift towards sustainability.

The maritime sector is experiencing a surge in investment driven by stringent regulations such as FuelEU Maritime and the International Maritime Organization's (IMO) ambitious targets for 2030 and 2050. These mandates are creating a substantial growth opportunity for decarbonization technologies and services.

DNV's leadership is evident in its significant market share for classifying new vessels designed to operate on alternative fuels. For instance, in 2023, DNV held a substantial portion of the order book for vessels intended to use methanol as fuel, demonstrating their strong position in this high-demand segment.

ESG Verification and Reporting Services

DNV's ESG Verification and Reporting Services, a key offering within its Business Assurance division, are positioned as a strong performer, likely falling into the 'Star' category of the BCG Matrix. This is driven by the escalating global focus on sustainability and the increasing demand for credible third-party validation of corporate ESG performance.

The market for ESG assurance is expanding rapidly as businesses grapple with stakeholder expectations and evolving regulations. DNV's expertise in verification, reporting, and management system certification directly addresses these needs, making its services highly sought after.

In 2024, DNV's Business Assurance division, which houses these ESG services, experienced a significant revenue increase of 15%. This robust growth underscores the strong market demand and DNV's competitive advantage in this burgeoning sector.

- Market Growth: The global emphasis on sustainability fuels demand for ESG verification and reporting.

- Stakeholder & Regulatory Drivers: Companies require assurance to meet investor and compliance demands.

- DNV's Offering: Services include ESG verification, reporting, and management system certification.

- Financial Performance: DNV's Business Assurance saw a 15% revenue increase in 2024, highlighting strong market traction.

AI Assurance and Responsible AI Services

DNV's commitment to AI assurance and responsible AI is a significant growth area, fitting into the Stars category of the BCG matrix. The company secured key projects in 2024 focused on the security of AI-enabled systems and third-party AI maturity assessments, highlighting a strong market demand. This strategic focus taps into the rapidly expanding need for robust AI governance and safety, positioning DNV for substantial future growth.

The market for AI assurance is experiencing rapid expansion as businesses integrate artificial intelligence across various sectors. DNV's proactive investment in research and development has established them as an early leader. This advantage is crucial in a field where trust and reliability are paramount, especially as AI adoption accelerates globally.

- High Market Growth: The increasing adoption of AI across industries fuels demand for assurance and governance services.

- DNV's Expertise: Early investment in responsible AI and securing milestone projects in 2024 demonstrates DNV's leadership.

- Strategic Positioning: DNV is well-placed to capitalize on the nascent but critical market for AI trust and safety.

- Future Potential: The company's established presence and expertise suggest strong long-term growth prospects in this emerging field.

DNV's expertise in offshore wind certification and advisory services is a clear Star in their BCG matrix. The global offshore wind market is projected to grow significantly, with substantial investments pouring into new projects. DNV's established track record and deep technical knowledge make them a go-to partner for developers navigating complex certification processes.

The company's role in certifying offshore wind farms, from feasibility studies to operational compliance, is critical for attracting investment and ensuring project success. DNV's Energy Transition Outlook 2024 highlights the accelerating pace of offshore wind development, reinforcing the strong market demand for their services.

DNV's maritime decarbonization services, particularly those related to alternative fuels like methanol and ammonia, are also Stars. The maritime industry is under immense pressure to reduce emissions, leading to a surge in demand for classification and advisory services for vessels using these new fuels. DNV's significant market share in classifying new vessels for alternative fuels, as evidenced by their strong position in the methanol-fueled vessel order book in 2023, confirms this Star status.

Their ESG Verification and Reporting Services are another strong contender for the Star category. The increasing global focus on sustainability and the growing demand for credible ESG assurance are driving rapid market expansion. DNV's 15% revenue increase in their Business Assurance division in 2024 directly reflects the strong market traction and their competitive edge in this vital sector.

DNV's AI assurance and responsible AI offerings are emerging Stars. The company's proactive engagement in 2024 with projects focused on AI system security and maturity assessments positions them to capitalize on the burgeoning market for AI governance and safety. This strategic focus taps into the rapidly expanding need for trust and reliability in AI-enabled systems.

| Business Area | BCG Category | Key Drivers | 2024 Data/Insights |

|---|---|---|---|

| Offshore Wind Certification & Advisory | Star | Global decarbonization goals, substantial investment in renewables, complex certification needs. | High demand driven by accelerating offshore wind development. |

| Maritime Decarbonization (Alternative Fuels) | Star | Stringent regulations (FuelEU Maritime, IMO targets), industry shift to sustainable fuels. | Significant market share in classifying methanol-fueled vessels (2023 order book). |

| ESG Verification & Reporting Services | Star | Escalating global focus on sustainability, stakeholder expectations, evolving regulations. | 15% revenue increase in Business Assurance division (2024). |

| AI Assurance & Responsible AI | Star | Rapid AI adoption, need for AI governance and safety, trust and reliability paramount. | Secured key projects in 2024 for AI system security and maturity assessments. |

What is included in the product

This BCG Matrix overview for DNV GL Group AS highlights strategic recommendations for investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

A DNV GL Group AS BCG Matrix visualizer simplifies strategic decision-making by clearly categorizing business units, alleviating the pain of complex portfolio analysis.

Cash Cows

DNV's traditional maritime classification services represent a strong cash cow. This mature market, governed by established regulations, ensures consistent demand for DNV's expertise.

In 2024, DNV's dominance was evident as 29% of all newly ordered ships opted for its classification rules, showcasing a significant market share. This core business generates reliable and substantial cash flow with minimal need for extensive marketing due to its fundamental importance and DNV's well-earned reputation.

Even with the ongoing energy transition, the traditional oil and gas industry continues to be a vital market, though its growth is moderating. DNV plays a crucial role here by offering indispensable technical assurance, risk management, and pipeline integrity solutions for current infrastructure, where safety and operational effectiveness are top priorities.

This sector is a reliable revenue generator for DNV because the services provided are absolutely critical for the industry's functioning, and DNV boasts extensive expertise and a strong presence in this market.

In 2024, DNV reported significant contributions from its oil and gas assurance services, reflecting the sustained demand for safety and integrity management in a sector that, while evolving, still represents a substantial portion of global energy supply.

DNV's Business Assurance division generates consistent revenue through its certification services for established management standards like ISO 9001, ISO 14001, and ISO 45001. These certifications are essential for businesses globally, ensuring quality, environmental responsibility, and workplace safety. This mature market segment represents a stable income source for the company.

In 2024, DNV continued to see strong demand for these foundational certifications. For instance, the number of ISO 9001 certifications worldwide remained robust, with over a million certificates issued across various industries. This ongoing adoption underscores the enduring value and consistent revenue potential of DNV's management system certification offerings.

Industrial Inspection and Verification Services

Industrial Inspection and Verification Services represent a significant Cash Cow for DNV GL Group AS. This mature segment offers routine inspection, verification, and asset integrity services across diverse industrial sectors, driven by stringent regulatory requirements and the continuous need for operational safety and performance assurance.

DNV's established reputation and extensive experience have secured a high market share in this predictable demand area, making these services a consistent and substantial contributor to the group's revenue. For instance, in 2023, DNV reported a total revenue of NOK 27.4 billion, with a notable portion stemming from its established service lines in asset integrity and assurance.

- Consistent Revenue Generation: These services provide a stable income stream due to ongoing compliance needs.

- High Market Share: DNV's strong position in this mature market ensures significant revenue capture.

- Predictable Demand: Regulatory mandates and operational necessities create a reliable customer base.

- Asset Integrity Focus: Ensuring the safety and performance of existing industrial assets is a core, ongoing requirement.

Legacy Software Solutions for Established Industries

DNV GL's legacy software solutions, deeply integrated into established industries like maritime and oil & gas, represent significant cash cows. These offerings, focused on asset management and operational continuity, benefit from high client retention due to their critical role in mature business processes. For example, DNV GL's Veracity platform, which underpins many of these solutions, saw a substantial increase in data onboarded in 2023, indicating continued client reliance and usage.

The stability of revenue from these mature software products stems from their essential nature and the embedded costs of switching for existing clients. While not experiencing rapid expansion, their consistent licensing and support fees provide a predictable and reliable income stream for the DNV GL Group. This steady cash flow is vital for funding investments in newer, potentially high-growth areas of the business.

- High Client Retention: Legacy software ensures consistent licensing and support revenue from established clients in mature industries.

- Stable Revenue Streams: Embedded nature and essential functions lead to predictable income, bolstering DNV GL's financial stability.

- Operational Support: Solutions for maritime and oil & gas asset management are critical for ongoing client operations.

- Veracity Platform Growth: Increased data onboarding on platforms like Veracity in 2023 highlights continued client engagement with these core solutions.

DNV's traditional maritime classification services are a prime example of a cash cow, benefiting from consistent demand in a mature, regulation-driven market. In 2024, DNV classified 29% of newly ordered ships, underscoring its significant market share and the reliable cash flow generated by this fundamental business. This strong position means minimal marketing spend is required due to its essential nature and DNV's established reputation.

The oil and gas assurance services also function as a cash cow, providing indispensable technical assurance and risk management for existing infrastructure. Despite the energy transition, this sector remains vital, and DNV’s expertise ensures a steady revenue stream. In 2024, these services showed sustained demand, contributing significantly to DNV's revenue, highlighting the ongoing need for safety and integrity management in a critical energy sector.

DNV's Business Assurance division, offering certifications for ISO standards like 9001 and 14001, represents another strong cash cow. These certifications are crucial for businesses worldwide, ensuring quality and compliance, thus creating a stable income source. The continued global adoption of ISO 9001, with over a million certificates issued worldwide in 2024, demonstrates the enduring value and predictable revenue from these services.

| Service Area | BCG Matrix Category | Key Characteristics | 2024 Relevance/Data |

|---|---|---|---|

| Maritime Classification | Cash Cow | Mature market, consistent demand, high market share, regulatory driven. | 29% of newly ordered ships classified by DNV. |

| Oil & Gas Assurance | Cash Cow | Critical for existing infrastructure, steady revenue, DNV's expertise. | Significant contribution to revenue in 2024. |

| Business Assurance (ISO Certifications) | Cash Cow | Essential for global businesses, stable income, high client retention. | Continued robust demand for ISO 9001, over 1 million certificates worldwide. |

Delivered as Shown

DNV GL Group AS BCG Matrix

The DNV GL Group AS BCG Matrix preview you see is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains the full BCG Matrix report, ready for immediate application in your business planning. You're viewing the exact, professionally formatted file that will be yours to edit, present, or integrate into your strategic decision-making processes without any additional steps or revisions.

Dogs

Certain highly commoditized or basic inspection services in saturated markets, where smaller local competitors can offer lower prices, may represent Dogs in DNV GL Group AS's BCG Matrix. These services might have low differentiation and limited growth potential, potentially tying up resources with minimal strategic return. For instance, basic building code inspections in mature construction markets often fall into this category. DNV would likely seek to minimize investment or divest from such highly competitive, low-margin offerings.

Outdated training programs, particularly those focused on technologies or regulations that are no longer current, represent a classic 'dog' in the BCG matrix. For instance, if DNV GL Group AS continues to invest heavily in training for legacy maritime safety standards that have been replaced by updated International Maritime Organization (IMO) regulations, these programs would fall into this category. Such offerings are likely experiencing declining enrollment and demand, failing to attract new clients or retain existing ones seeking contemporary expertise.

These underperforming training modules consume valuable resources for upkeep and delivery without generating substantial new revenue or contributing to market share growth. In 2024, companies across various sectors are increasingly prioritizing digital transformation and sustainability, making outdated technical training a significant drain. If DNV GL's older programs require substantial maintenance costs but have seen a drop in participation, for example, a 30% decrease in course bookings compared to the previous year, they would clearly fit the 'dog' profile, hindering overall profitability.

Non-strategic niche advisory in declining sub-segments represents areas where DNV GL Group AS might offer specialized consulting for very specific, shrinking markets. Think about consulting on certain types of fossil fuel exploration or outdated industrial processes where DNV doesn't hold a strong competitive edge. These markets are often small and have limited growth prospects, making them less strategically important for DNV's overall business direction.

For instance, in 2024, the global market for advisory services related to legacy industrial equipment maintenance in sectors experiencing significant technological disruption might fall into this category. While these services can still generate revenue, their declining nature and lack of alignment with DNV's focus on energy transition and digital solutions mean they are unlikely to be growth drivers or core strategic pillars.

Legacy IT Systems or Infrastructure Support

Legacy IT Systems or Infrastructure Support, within the context of DNV GL Group AS's BCG Matrix, would likely be categorized as a Dog. This is because these services are built on older, less efficient technologies or support niche systems that clients are phasing out. For example, in 2024, many companies are still grappling with the costs of maintaining outdated ERP systems, which often require specialized, expensive support personnel.

These legacy IT services might demand a significant amount of maintenance effort, yet offer declining utility or revenue. This situation makes them prime candidates for divestiture or a thorough re-evaluation of their strategic importance. Consider the ongoing costs associated with maintaining COBOL-based systems, which, while still functional for some critical operations, represent a shrinking market and increasing support challenges.

- High Maintenance Costs: Legacy systems often incur disproportionately high costs for upkeep and specialized support.

- Declining Client Demand: As technology advances, demand for support of older, less efficient systems naturally decreases.

- Strategic Re-evaluation: DNV GL Group AS would need to assess whether continuing to support these systems aligns with its long-term strategic goals or if divestment is a more prudent option.

Services with Low Client Adoption in Undifferentiated Markets

Within the DNV GL Group AS BCG Matrix, services categorized as 'Dogs' represent offerings that have struggled to gain substantial market traction, particularly in undifferentiated markets. These services, despite initial investments, show both low market share and low growth. For instance, a hypothetical DNV GL consulting service focused on a highly commoditized area of environmental compliance, where many competitors offer similar basic services, might fall into this category. Such services require careful evaluation to determine if a strategic pivot or divestment is the most prudent course of action.

The challenge for these 'Dog' services lies in their inability to carve out a distinct niche or offer a compelling unique selling proposition in markets saturated with similar offerings. For example, if a DNV GL digital solution for basic asset integrity management in a mature industry like onshore oil and gas sees minimal uptake, it could be classified as a Dog. This is often due to intense price competition and a lack of perceived added value over existing, often cheaper, alternatives. In 2023, the global market for such basic compliance software saw growth rates below 3%, with market share for any single provider remaining fragmented.

- Low Market Share: Services in this quadrant typically hold a small percentage of the total market, often less than 5%, indicating a lack of competitive advantage.

- Low Market Growth: The overall market for these services is experiencing minimal expansion, often below 2% annually, limiting opportunities for organic growth.

- Need for Strategic Review: These offerings necessitate a thorough assessment, potentially leading to divestment, restructuring, or a significant repositioning to find a viable niche.

- Example Scenario: A DNV GL advisory service for a highly regulated but stagnant sector, where client needs are met by numerous established players, could be a Dog if it fails to attract new clients and revenue streams are flat.

Dogs in DNV GL Group AS's BCG Matrix represent services with low market share and low growth potential, often found in mature or declining sectors. These offerings, such as basic inspection services in saturated markets or outdated training programs, consume resources without generating significant returns. For example, in 2024, DNV GL's services supporting legacy industrial equipment maintenance in sectors undergoing rapid technological change might be classified as Dogs, as these markets offer limited growth prospects and may not align with the company's focus on digital transformation and sustainability.

These underperforming offerings require careful strategic evaluation, potentially leading to divestment or a significant repositioning to find a viable niche. For instance, if a DNV GL digital solution for basic asset integrity management in a mature industry sees minimal uptake due to intense price competition, it could be classified as a Dog, as was seen with similar basic compliance software in 2023, which experienced growth rates below 3% with fragmented market share.

Question Marks

Advanced nuclear technologies, like Small Modular Reactors (SMRs), are poised for significant growth as the world pushes for cleaner energy solutions. DNV GL, a leader in assurance and risk management, recognizes this potential.

While DNV's established presence in traditional energy sectors is strong, its market share in the nascent SMR certification space is likely still developing. This signifies an opportunity for DNV to capture a larger portion of this emerging market.

To achieve market leadership in SMR certification, DNV will need to make strategic investments in expertise, technology, and market development. This focus is crucial to convert the high-growth potential of SMRs into tangible market share and revenue streams.

DNV is investing heavily in digital twin and AI-driven predictive maintenance technologies, recognizing their high-growth potential across various industries. These advanced solutions are designed to optimize operations and prevent failures before they occur.

While DNV has a strong foothold in maritime and energy sectors, its market share in applying these digital solutions to *new* or less established industrial markets is still building. This expansion requires significant capital to scale and establish dominance.

For instance, in 2024, the global predictive maintenance market was valued at approximately $11.2 billion and is projected to reach $50.4 billion by 2030, growing at a CAGR of 28.5%. DNV's efforts to capture a larger share in these emerging sectors, beyond its traditional strongholds, represent a strategic move into potentially high-reward but also high-investment areas.

The emerging hydrogen economy infrastructure certification represents a significant growth opportunity for DNV, though its current market share in this nascent field is still developing. As the global push for decarbonization accelerates, the demand for certified production facilities, storage solutions, and transportation networks is set to skyrocket.

DNV's strategic positioning in this high-growth sector is crucial. While the market is expanding rapidly, with significant investments being channeled into green hydrogen production and related infrastructure, DNV's role in certifying these new assets is still solidifying. For instance, by the end of 2023, global investment in clean hydrogen projects reached an estimated $200 billion, underscoring the immense market potential.

New Digital Platforms for Supply Chain Transparency (e.g., Blockchain)

DNV's Veracity platform and similar digital initiatives are positioned in a high-growth sector driven by the increasing demand for supply chain transparency and data assurance. These platforms leverage advanced technologies like blockchain to provide enhanced traceability and efficiency.

While these areas represent significant future potential, DNV's current market share in these specific platform-based solutions, particularly those utilizing emerging technologies, might be relatively nascent. This suggests a need for continued strategic investment to capture a larger portion of this evolving market.

- Market Growth: The global supply chain management market is projected to reach $40.06 billion by 2027, growing at a CAGR of 10.0% from 2020, indicating strong demand for transparency solutions.

- Blockchain Adoption: Blockchain in supply chain is expected to grow significantly, with estimates suggesting it could add $1.77 trillion in value by 2030.

- DNV's Position: Veracity, as a data platform, aims to tap into this growth, but its penetration in specific blockchain-enabled transparency solutions is still developing.

- Investment Needs: Significant R&D and market development investments are likely required for DNV to establish a leading position in these technologically advanced segments.

Certification and Advisory for Novel Food Technologies in Healthcare/Food & Beverage

DNV's expertise in food and beverage certification positions it well to capitalize on the burgeoning novel food technology sector. While current market share in areas like alternative proteins and cellular agriculture might be nascent, these represent high-growth opportunities. Investing in specialized certification and advisory services for these innovative segments, potentially mirroring DNV's approach to developing new service lines, could transform them into future Stars within the BCG matrix.

The global alternative protein market, a key area within novel food technologies, was valued at approximately USD 25.1 billion in 2023 and is projected to reach USD 119.1 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 25.1%. This rapid expansion presents a clear opportunity for DNV to establish a strong foothold. By offering robust certification and advisory services, DNV can build trust and credibility for these emerging technologies.

- Market Opportunity: The alternative protein market is experiencing exponential growth, offering significant potential for DNV's expansion.

- Strategic Investment: Developing specialized certification and advisory services for cellular agriculture and other novel food tech can create future market leaders.

- Competitive Advantage: Early investment can solidify DNV's position as a trusted certifier in a rapidly evolving and high-demand sector.

- Growth Projection: The market's projected CAGR of 25.1% underscores the urgency and potential return on investment for DNV's strategic focus.

DNV GL's expansion into advanced nuclear technologies like Small Modular Reactors (SMRs) represents a strategic move into a high-growth sector. While DNV has a strong foundation in traditional energy, its market share in SMR certification is still developing, indicating a significant opportunity. The company's investment in digital solutions like AI-driven predictive maintenance also targets high-growth markets, though establishing share beyond its core sectors requires substantial capital. Similarly, the burgeoning hydrogen economy and the demand for supply chain transparency through platforms like Veracity present substantial future potential, but require continued investment to secure leading positions.

The novel food technology sector, particularly alternative proteins, offers another avenue for DNV's growth. The rapid expansion of this market, with a projected CAGR of 25.1% for alternative proteins, underscores the need for DNV to develop specialized certification services. By investing early in these emerging areas, DNV can solidify its role as a trusted certifier and potentially transform these nascent markets into future Stars within its business portfolio.

| BCG Category | DNV GL Activity | Market Growth Potential | Current Market Share | Strategic Focus |

|---|---|---|---|---|

| Stars | Digital Twin & AI Predictive Maintenance (New Markets) | High | Developing | Aggressive Investment & Market Penetration |

| Question Marks | SMR Certification | High | Nascent | Strategic Investment & Expertise Development |

| Question Marks | Hydrogen Economy Certification | High | Developing | Solidify Position & Scale Services |

| Question Marks | Veracity Platform (Blockchain Solutions) | High | Nascent | R&D and Market Development Investment |

| Question Marks | Novel Food Technology Certification | High | Nascent | Develop Specialized Services & Build Trust |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining DNV GL's financial disclosures, industry growth forecasts, and comprehensive market trend analysis to ensure reliable, high-impact insights.