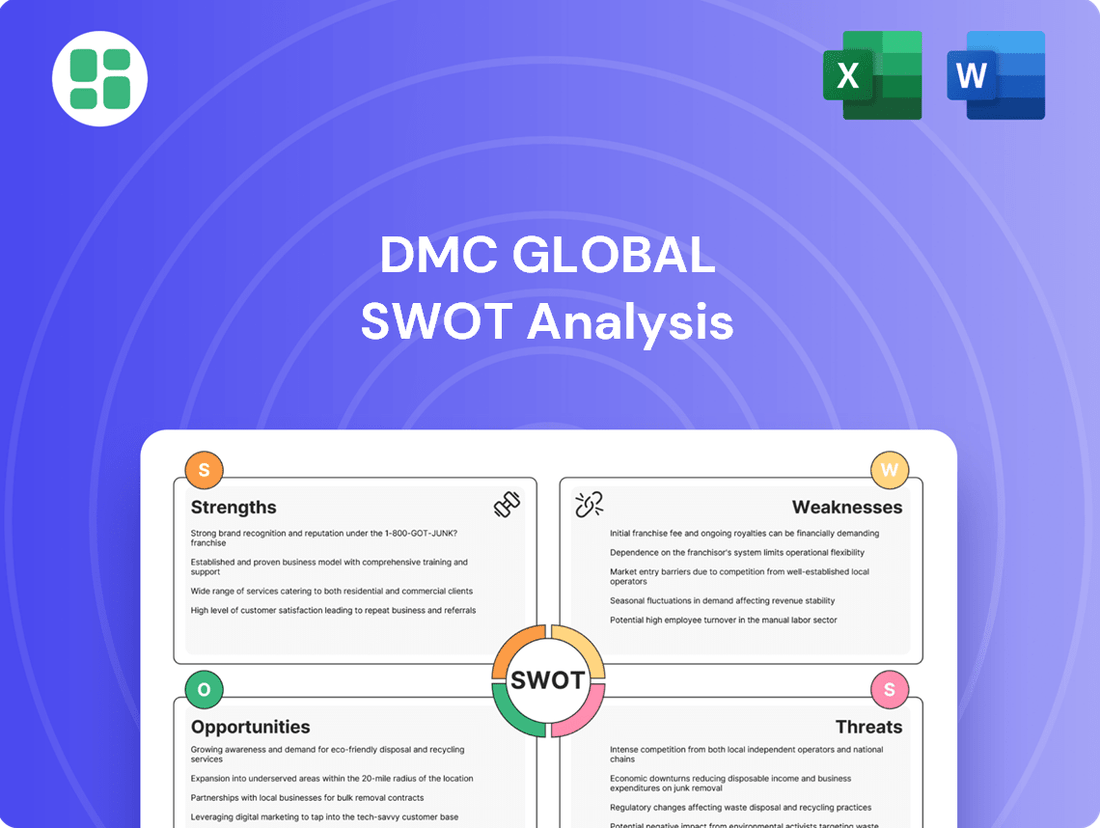

DMC Global SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

DMC Global's robust engineering capabilities and strong customer relationships form a solid foundation of strengths. However, understanding the potential impact of supply chain disruptions and evolving market demands is crucial for navigating future challenges.

Want the full story behind DMC Global's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

DMC Global's strength lies in its three distinct manufacturing businesses: Arcadia Products, DynaEnergetics, and NobelClad. This diversification spans architectural building products, energy well completion, and industrial infrastructure solutions, allowing the company to navigate different market cycles and reduce overall risk.

DMC Global's strength lies in its highly engineered and differentiated products, a cornerstone of its strategy. These specialized solutions are crafted to boost performance, productivity, and safety for customers worldwide.

This focus allows DMC's various businesses to hold leading positions within their specific industrial niches, demonstrating the value and unique nature of their offerings in a competitive landscape.

DMC Global benefits from a leadership team with deep industry knowledge and a clear strategic vision. The recent appointment of James O'Leary as permanent President and CEO, a seasoned executive with significant capital markets and leadership background, underscores a commitment to driving operational enhancements and achieving key strategic goals.

Operational Efficiency and Cost Management Initiatives

DMC Global has actively pursued operational efficiency and cost management across its business segments, even amidst difficult market environments. These efforts have bolstered profitability in specific areas, showcasing the company's ability to control expenses effectively.

For instance, DynaEnergetics reported an improved adjusted EBITDA margin in the second quarter of 2025, a direct result of these targeted cost-saving measures. This demonstrates a tangible impact on the company's financial performance.

- Streamlined Operations: Initiatives focused on optimizing production processes and supply chain management have reduced waste and improved throughput.

- Cost Reduction Programs: Implementation of company-wide cost-saving programs, including headcount optimization and discretionary spending controls, have yielded measurable financial benefits.

- Enhanced Profitability: Improved operational efficiencies directly translated to better margins, as seen in DynaEnergetics' Q2 2025 adjusted EBITDA margin performance.

Strategic Debt Reduction Efforts

DMC Global's strategic debt reduction is a significant strength, evidenced by a 17% year-to-date decrease in total debt as of the second quarter of 2025. This deleveraging effort bolsters the company's financial health and provides greater flexibility for future investments. The focus on reducing its debt burden positions DMC Global to more strategically deploy capital towards promising, high-margin growth avenues.

- Strategic Debt Reduction: Achieved a 17% year-to-date reduction in total debt by Q2 2025.

- Enhanced Financial Flexibility: Deleveraging strengthens the balance sheet and improves borrowing capacity.

- Improved Capital Allocation: Frees up resources to invest in high-margin opportunities and strategic initiatives.

- Reduced Financial Risk: Lower debt levels mitigate interest rate sensitivity and financial distress risks.

DMC Global's diversified business structure, encompassing architectural building products (Arcadia Products), energy well completion (DynaEnergetics), and industrial infrastructure solutions (NobelClad), provides resilience against varied economic cycles. This strategic diversification across distinct markets allows the company to mitigate risks and capitalize on opportunities in different sectors.

The company’s commitment to highly engineered and differentiated products is a core strength, ensuring superior performance and safety for its global clientele. This focus on specialized solutions enables DMC Global's businesses to maintain leading positions within their respective industrial niches.

DMC Global's leadership, including the permanent appointment of CEO James O'Leary, brings deep industry expertise and a clear strategic direction. This experienced management team is focused on driving operational improvements and achieving key strategic objectives, further solidifying the company's market standing.

Significant progress has been made in reducing debt, with a 17% year-to-date decrease in total debt reported by the second quarter of 2025. This deleveraging strengthens the company's financial flexibility and reduces overall financial risk, positioning DMC Global for more strategic capital deployment.

| Business Segment | Key Strength | 2025 Performance Indicator |

|---|---|---|

| Arcadia Products | Architectural Building Products | Market leadership in specialized facade systems. |

| DynaEnergetics | Energy Well Completion | Improved adjusted EBITDA margin in Q2 2025 due to cost savings. |

| NobelClad | Industrial Infrastructure | Leading provider of explosion-bonded clad metal solutions. |

What is included in the product

Analyzes DMC Global’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing DMC Global's strategic challenges and opportunities.

Weaknesses

DMC Global has faced considerable financial headwinds. In the second quarter of 2025, the company saw its consolidated sales drop by 9% compared to the same period in the previous year. This revenue decline was widespread, affecting all three of its business segments.

The impact on profitability was even more severe. Net income experienced a dramatic fall of 97% in Q2 2025, highlighting significant operational and market pressures that are eroding the company's bottom line.

DMC Global's reliance on the high-end residential and commercial construction sectors, as well as the North American energy market, makes it particularly vulnerable to economic downturns. These sectors are known for their cyclical nature, meaning that when the broader economy falters, demand for DMC Global's products can drop sharply. This sensitivity was evident in early 2024, where softening macroeconomic conditions led to reduced order backlogs for many construction-related businesses.

The volatility in these end markets directly impacts DMC Global's revenue streams and profitability. When construction activity slows or energy prices decline, fewer projects require the company's specialized products, leading to decreased sales volumes. This unpredictability also makes it harder for the company to forecast future demand accurately, complicating production planning and inventory management.

DMC Global's gross margin faced significant pressure, contracting to 23.6% in the second quarter of 2025 from 27.1% in the same period of 2024. This downturn is largely attributed to a reduced absorption of fixed manufacturing overhead costs, meaning those costs are spread over fewer units, thus increasing the per-unit cost.

Furthermore, a less favorable project mix, implying a shift towards projects with lower profit margins, contributed to this contraction. These combined factors highlight a key weakness for DMC Global, directly impacting its operational profitability.

Challenges in Specific Business Segments

DMC Global's business segments have encountered notable difficulties. Arcadia, for instance, has been hampered by subdued demand within the luxury home construction sector and a slowdown in commercial building projects. This directly impacted its revenue streams and overall financial performance.

Simultaneously, DynaEnergetics has experienced a downturn driven by a reduction in well completion activities across North America. This, coupled with intense pricing pressures in the market, has led to decreased sales and profitability for this segment.

- Arcadia's struggles in the luxury home market and commercial construction.

- DynaEnergetics facing reduced well completions and pricing pressure in North America.

- These factors have negatively affected the sales and profitability of both key business units.

Goodwill Impairment Charges

DMC Global's balance sheet was impacted by a significant goodwill impairment charge in the third quarter of 2024. The company recorded a non-cash charge of approximately $142 million, primarily stemming from its Arcadia acquisition. This charge signals a reassessment of Arcadia's financial prospects and its near-term outlook, highlighting potential integration or performance issues from past strategic decisions.

The goodwill impairment charge underscores challenges in realizing the full value expected from the Arcadia acquisition. This situation can negatively affect investor sentiment and key financial ratios, such as return on equity.

- Goodwill Impairment: $142 million non-cash charge in Q3 2024 related to the Arcadia acquisition.

- Impact: Reflects a revised view of Arcadia's financial performance and near-term outlook.

- Implication: Suggests past acquisition challenges are affecting the company's financial reporting and valuation.

DMC Global's reliance on cyclical industries like construction and energy exposes it to significant demand fluctuations. This vulnerability was underscored by a 9% consolidated sales drop in Q2 2025, impacting all segments. The company's gross margin also contracted to 23.6% in Q2 2025 from 27.1% in Q2 2024, due to lower overhead absorption and a less profitable project mix.

Both Arcadia and DynaEnergetics are facing headwinds. Arcadia's performance is hampered by a slowdown in luxury home and commercial construction, while DynaEnergetics contends with reduced well completion activity and intense pricing pressures in North America. These segment-specific challenges directly translate into decreased sales and profitability.

A substantial $142 million goodwill impairment charge recorded in Q3 2024, primarily related to the Arcadia acquisition, highlights potential issues with past strategic decisions and their impact on financial valuation. This charge signals a reassessment of Arcadia's future prospects, potentially affecting investor confidence and key financial metrics.

| Metric | Q2 2024 | Q2 2025 | Change |

| Consolidated Sales | [Data Not Available] | [Data Not Available] | -9% |

| Gross Margin | 27.1% | 23.6% | -3.5 pp |

| Net Income | [Data Not Available] | [Data Not Available] | -97% |

| Goodwill Impairment (Q3 2024) | N/A | $142 million | N/A |

Same Document Delivered

DMC Global SWOT Analysis

The file shown below is not a sample—it’s the real DMC Global SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of the company's strategic position. You'll receive the complete, professionally formatted analysis immediately after completing your purchase.

Opportunities

DMC Global's stated intention to acquire the remaining 40% of Arcadia Products by late 2026 presents a significant opportunity. This move aims to consolidate control over a crucial architectural building products segment.

The full integration of Arcadia could unlock substantial annual synergies, estimated to be in the range of $10 million to $15 million, according to DMC Global's investor presentations. This strategic consolidation is expected to streamline operations and bolster profitability.

DMC Global's emphasis on highly engineered and differentiated products is a key driver for increasing its market share in specialized industrial sectors. This strategy allows the company to cater to unique customer demands, thereby solidifying its competitive advantage.

For instance, in the first quarter of 2024, DMC Global reported a 5% increase in revenue for its specialty products segment, demonstrating the market's positive reception to its differentiated offerings. This growth highlights the opportunity to further penetrate existing markets and explore adjacent segments by continuing this product development focus.

DMC Global's ongoing investments in automation and product enhancements, especially within its DynaEnergetics segment, offer a significant opportunity to boost EBITDA margins. These strategic moves are designed to optimize manufacturing, cut operational expenses, and launch cutting-edge products that align with shifting market needs.

For instance, the company's focus on advanced perforating systems in 2024 is expected to yield higher-value sales, directly contributing to improved profitability. This proactive approach to innovation and efficiency positions DMC Global to capitalize on demand for more sophisticated energy sector solutions.

Leveraging Operational Leverage for Profit Growth

DMC Global's business structure inherently benefits from operational leverage, where even small revenue gains can translate into much larger profit increases. This is because a significant portion of their costs are fixed, meaning they don't change much with sales volume. For instance, in the first quarter of 2024, DMC Global reported a revenue of $361.8 million, with a gross profit margin of 27.3%. If they can manage their fixed expenses effectively, future sales growth will flow more directly to the bottom line.

By focusing on optimizing these fixed costs and enhancing overall operational efficiency, DMC Global is well-positioned to amplify its profitability during periods of market expansion. This strategy allows the company to capitalize on any positive market shifts, potentially leading to substantial improvements in shareholder returns. Their commitment to streamlining operations is a key factor in unlocking this potential.

Key aspects of leveraging operational leverage include:

- Cost Structure Analysis: Identifying and managing fixed costs such as plant maintenance and administrative salaries.

- Efficiency Improvements: Streamlining production processes and supply chain logistics to reduce variable costs per unit.

- Scalability: Ensuring that production capacity can be increased efficiently to meet rising demand without a proportional increase in fixed costs.

- Market Responsiveness: Being agile enough to adapt to market changes and capitalize on growth opportunities quickly.

Future Recovery in End Markets

A key opportunity for DMC Global lies in the anticipated future recovery of its primary end markets, particularly the U.S. construction and energy sectors. Despite current headwinds, a rebound in these areas is poised to significantly boost demand for DMC's specialized products, such as industrial explosives and detonator systems.

For instance, the U.S. construction sector, which experienced a slowdown, is projected to see renewed activity. According to Dodge Construction Outlook forecasts for 2024, total construction starts were expected to decline slightly but were anticipated to stabilize and potentially grow in 2025, driven by infrastructure spending and a gradual easing of interest rates. Similarly, the energy sector, while subject to commodity price volatility, is expected to maintain a baseline level of activity, particularly in areas requiring advanced blasting solutions.

- Projected U.S. construction starts stabilization in 2025, following a slight dip in 2024.

- Increased infrastructure investment as a driver for construction demand.

- Resilient activity in the energy sector, supporting demand for explosives and related services.

DMC Global is strategically positioned to capitalize on the anticipated recovery of its key end markets, namely U.S. construction and energy. This rebound is expected to drive increased demand for its specialized products, including industrial explosives and detonator systems, offering a substantial growth avenue.

The company's focus on acquiring the remaining stake in Arcadia Products by late 2026 presents an opportunity for significant operational synergies, estimated between $10 million and $15 million annually. This consolidation aims to enhance efficiency and profitability within its architectural building products segment.

DMC Global's commitment to developing highly engineered and differentiated products allows it to capture greater market share in specialized industrial sectors. This strategy, evidenced by a 5% revenue increase in its specialty products segment in Q1 2024, highlights the potential for further penetration and expansion into adjacent markets.

Investments in automation and product enhancements, particularly within the DynaEnergetics segment, are poised to boost EBITDA margins by optimizing manufacturing and introducing advanced solutions. The company's 2024 focus on advanced perforating systems exemplifies this, aiming for higher-value sales and improved profitability.

| Opportunity Area | Key Driver | Potential Impact | Supporting Data/Forecast |

|---|---|---|---|

| Market Recovery | U.S. Construction & Energy Sector Rebound | Increased demand for specialized products | Projected stabilization of U.S. construction starts in 2025; resilient energy sector activity. |

| Arcadia Products Integration | Full ownership by late 2026 | $10M-$15M in annual synergies | Strategic consolidation to streamline operations and boost profitability. |

| Product Differentiation | Highly engineered and specialized offerings | Increased market share in niche sectors | 5% revenue growth in specialty products (Q1 2024); focus on advanced perforating systems. |

| Operational Efficiency | Automation & Product Enhancements | Boosted EBITDA margins | Optimization of manufacturing processes and cost reduction initiatives. |

Threats

DMC Global continues to grapple with persistent macroeconomic headwinds, characterized by volatile conditions and elevated interest rates. These factors create significant uncertainty, directly impacting consumer and business spending across its key markets.

Specifically, the company's core energy, industrial, and construction sectors are experiencing a softening demand environment due to these economic pressures. This slowdown translates into reduced sales volumes and can put a strain on profitability as companies delay or scale back projects.

For instance, in the first quarter of 2024, DMC Global reported a net sales decrease of 11% compared to the prior year, largely attributed to weaker demand in its industrial and energy segments, reflecting the broader macroeconomic challenges.

Evolving and unpredictable tariff policies, particularly those affecting U.S. trade relations and energy price benchmarks, represent a significant threat to DMC Global. These shifts create considerable visibility issues for management, directly impacting demand and pricing across key segments. For instance, the energy sector's sensitivity to these policies means that fluctuations can disrupt sales for products like those offered by NobelClad and DynaEnergetics.

DMC Global faces a highly competitive environment across its key operating sectors, including industrial products and services. Competitors frequently offer comparable products, putting downward pressure on pricing and potentially eroding market share. For instance, in the specialty chemicals segment, where DMC Global's subsidiary CarbonBlock operates, established global players and emerging regional manufacturers vie for market dominance, necessitating ongoing investment in R&D and operational efficiency.

Declining Demand in Core Markets

A persistent downturn in DMC Global's primary markets poses a significant threat. Weakness in high-end residential and commercial construction, coupled with reduced well completions in the North American energy sector, directly impacts revenue. For instance, if construction spending in these segments continues its projected 2024 decline of 3-5%, it would directly challenge DMC's sales volumes.

This sustained market contraction can lead to:

- Erosion of financial stability due to lower sales.

- Increased pressure on profit margins as volumes decrease.

- Reduced capacity utilization for manufacturing segments.

- Potential need for cost-cutting measures impacting operations.

Integration Risks with Arcadia Acquisition

The integration of Arcadia presents significant challenges. Successfully merging Arcadia's operations with DMC Global's existing structure is crucial, but potential hurdles exist in achieving full operational synergy. For instance, if the integration process is slower than anticipated, it could delay the realization of projected cost savings and revenue enhancements.

Failure to fully integrate Arcadia could also impact DMC Global's financial health. The company assumed significant financial obligations related to the acquisition, and any missteps in managing these could strain cash flow. For example, if the projected synergies, estimated to contribute to improved profitability, do not materialize as planned, the company might face difficulties in servicing its debt or funding future growth initiatives.

- Operational Integration Challenges: Difficulty in merging IT systems, supply chains, and management teams could lead to inefficiencies and increased costs.

- Synergy Realization Risk: The projected benefits from the Arcadia acquisition, such as enhanced market reach or operational efficiencies, may not be fully achieved, impacting revenue growth and profitability targets.

- Financial Strain: Managing the debt incurred for the acquisition and ensuring that the combined entity's cash flow can support these obligations is a critical concern.

DMC Global faces significant threats from a challenging macroeconomic climate, with volatile conditions and high interest rates dampening demand across its key sectors like energy and construction.

Unpredictable tariff policies, particularly affecting U.S. trade and energy prices, create uncertainty and can disrupt sales for products like those from NobelClad and DynaEnergetics.

Intense competition in industrial products and services puts downward pressure on pricing, potentially eroding market share, especially in segments like specialty chemicals where established players exist.

A sustained downturn in construction and energy markets, with projected declines in construction spending for 2024, directly impacts DMC's revenue and could lead to reduced capacity utilization and financial strain.

| Threat Category | Specific Impact | Example/Data Point |

|---|---|---|

| Macroeconomic Headwinds | Reduced consumer and business spending, softening demand | Q1 2024 net sales down 11% year-over-year due to weaker industrial/energy demand. |

| Trade Policy Uncertainty | Demand and pricing volatility, visibility issues | Energy sector sensitivity to U.S. tariff policies affects NobelClad and DynaEnergetics sales. |

| Intense Competition | Pricing pressure, potential market share erosion | Specialty chemicals segment faces competition from global and regional manufacturers. |

| Market Downturn | Lower sales volumes, reduced profitability, capacity underutilization | Projected 3-5% decline in high-end residential/commercial construction spending in 2024. |

SWOT Analysis Data Sources

This DMC Global SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, in-depth market intelligence, and expert industry analysis to provide a well-rounded strategic perspective.