DMC Global PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

Navigate the complex external forces shaping DMC Global's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Gain a critical advantage by downloading the full report and arming yourself with actionable intelligence for strategic decision-making.

Political factors

Increased government spending on infrastructure, especially in the United States, directly benefits DMC Global's NobelClad segment, which supplies industrial infrastructure markets. The American Infrastructure Revitalization Act, for instance, aims to upgrade national transportation and water systems, creating a consistent demand for their specialized clad metal products.

Changes in energy policy, particularly in the United States, are a major factor for DMC Global's DynaEnergetics division. For instance, if there's a policy push to increase domestic oil and gas production, perhaps through more federal leases or relaxed environmental rules, this would likely boost demand for DynaEnergetics' well completion tools. In 2023, U.S. crude oil production reached an all-time high of approximately 12.9 million barrels per day, indicating a strong market for such products when supported by policy.

Conversely, a significant pivot towards renewable energy sources or the implementation of more stringent emissions regulations could dampen investment in traditional oil and gas exploration and production. This would naturally put pressure on DynaEnergetics' market. For example, if new policies favor solar or wind power, capital that might have gone into new oil wells could be redirected, impacting the sales of completion equipment.

Major economies, including the United States, have increasingly implemented tariffs and protectionist trade policies. For example, in 2024, the U.S. continued to review and adjust tariffs on goods from various countries, impacting sectors like steel and manufacturing. This directly affects DMC Global's supply chain and pricing by increasing the cost of imported components and raw materials.

Tariffs on key inputs such as steel and aluminum can significantly raise production costs for engineered products. This pressure on manufacturing expenses, especially in 2024, can erode profit margins if not effectively passed on to customers. The global trade environment's inherent uncertainty, fueled by these policies, also poses a risk to DMC Global's international sales volumes and the competitive positioning of its diverse business segments.

Geopolitical Tensions and Stability

Geopolitical tensions, like the ongoing conflicts in Eastern Europe and the Middle East, directly impact global supply chains and commodity prices, influencing DMC Global's operational costs and market demand. For instance, disruptions in energy supply routes can lead to significant price volatility for raw materials essential to DMC Global's manufacturing processes.

DMC Global's exposure to international energy and industrial markets means it faces risks from trade disputes and sanctions. These can hinder market access and increase operational complexities. For example, new tariffs or export restrictions imposed by major economies could affect the company's ability to sell its products in key regions.

- Supply Chain Disruptions: Events like the Red Sea shipping crisis in late 2023 and early 2024 led to increased transit times and costs for many global manufacturers, including those in sectors where DMC Global operates.

- Commodity Price Volatility: The price of oil, a key input for many industrial processes, saw significant fluctuations in 2024 due to geopolitical events, directly impacting production expenses.

- Trade Policy Uncertainty: Ongoing trade negotiations and potential shifts in trade agreements between major economic blocs create an unpredictable environment for international business operations.

Regulatory Environment for Manufacturing

The manufacturing sector is subject to a dynamic regulatory landscape. Governments worldwide are increasingly implementing industrial policies aimed at bolstering domestic production and fostering specialized industrial hubs. For a company like DMC Global, this means its operational strategies must remain adaptable to shifts in industrial policy, which can favor local manufacturing through incentives or create new competitive pressures from reshoring initiatives.

In 2024 and looking into 2025, several key trends are shaping this environment:

- Government Incentives for Reshoring: Many nations are offering tax credits, subsidies, and grants to encourage companies to bring manufacturing back onshore or to nearby regions (near-shoring). For instance, the US CHIPS and Science Act, enacted in 2022, provides significant funding for domestic semiconductor manufacturing, which could indirectly impact supply chains for various industrial components.

- Trade Policy and Tariffs: Evolving trade agreements and the potential for new tariffs can directly affect the cost of raw materials and finished goods, influencing DMC Global's global sourcing and distribution strategies.

- Environmental Regulations: Stricter environmental standards related to emissions, waste management, and energy efficiency are becoming more prevalent. Compliance with these regulations, such as the EU's proposed Carbon Border Adjustment Mechanism (CBAM), could necessitate investments in cleaner production technologies.

- Labor Laws and Standards: Changes in minimum wage laws, worker safety regulations, and labor union influence can impact operating costs and workforce management for manufacturers.

Government spending on infrastructure, particularly in the US, directly benefits DMC Global's NobelClad segment, with initiatives like the Infrastructure Revitalization Act driving demand for clad metal products. Changes in energy policy significantly impact DynaEnergetics; for example, increased federal leases for oil and gas production in 2024 would boost demand for their well completion tools, following 2023's record U.S. crude oil production of approximately 12.9 million barrels per day.

Trade policies, including tariffs implemented in 2024 by major economies, increase the cost of raw materials like steel for DMC Global, impacting production expenses and profit margins. Geopolitical tensions and trade disputes create supply chain disruptions and price volatility for essential commodities, affecting operational costs and market access for the company's diverse segments.

Governments are increasingly implementing industrial policies, such as incentives for reshoring and near-shoring, which require companies like DMC Global to adapt their operational strategies. Evolving environmental regulations and labor laws also influence manufacturing costs and compliance requirements, necessitating investments in cleaner technologies and adaptable workforce management.

| Political Factor | Impact on DMC Global | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Infrastructure Spending | Increased demand for NobelClad products. | US Infrastructure spending projected to grow, supporting industrial markets. |

| Energy Policy | Drives demand for DynaEnergetics' completion tools. | US crude oil production hit a record ~12.9 million bpd in 2023; policy shifts impact exploration investment. |

| Trade Policies & Tariffs | Higher raw material costs, potential impact on margins and sales. | Continued review and adjustment of tariffs on key inputs like steel in 2024. |

| Industrial Policy & Reshoring | Requires strategic adaptation to incentives and competitive pressures. | Government incentives for domestic manufacturing are a growing trend through 2025. |

What is included in the product

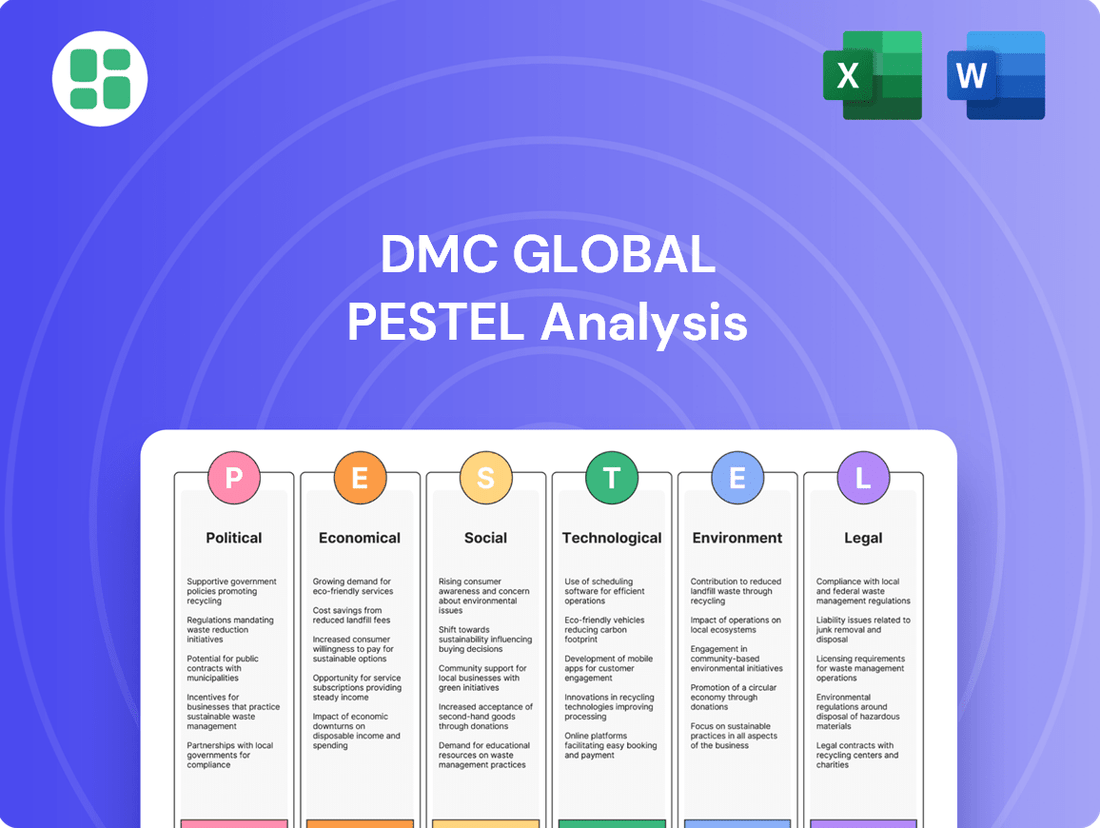

This comprehensive PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting DMC Global, providing a strategic overview of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining the identification and mitigation of external challenges.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear overview of the PESTLE factors impacting DMC Global.

Economic factors

Global economic growth is a key driver for DMC Global, directly impacting demand in its core markets like energy, industrial, and infrastructure. A healthy global economy, characterized by increasing GDP, typically translates to higher customer investment in new projects and essential maintenance, thereby boosting DMC Global's sales across all its segments.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, indicating a generally stable but somewhat restrained economic environment. This growth rate influences the capital expenditure cycles of DMC Global's customers, affecting their purchasing decisions for specialized products and services.

Conversely, any significant economic slowdown or recessionary pressures can lead to reduced capital spending by these customers. This directly impacts DMC Global's revenue streams and overall profitability, as companies tend to defer or cut back on investments during uncertain economic times.

DMC Global's DynaEnergetics segment is significantly impacted by the unpredictable nature of global energy markets, especially oil and gas prices. These price swings directly influence the spending habits of exploration and production companies, which in turn affects the demand for DynaEnergetics' well completion products.

Recent analyses indicate a softening in global energy markets, a trend that can pressure DynaEnergetics' pricing power and reduce overall unit sales. For instance, crude oil prices, which averaged around $78 per barrel in early 2024, experienced volatility, with some forecasts suggesting potential downward pressure due to increased supply and moderated demand growth.

The commercial and high-end residential construction markets are experiencing a slowdown, directly affecting DMC Global's Arcadia segment. For instance, in late 2023 and early 2024, many regions saw a dip in new commercial project starts and a cooling of the luxury housing sector.

This weaker demand translates into fewer orders for Arcadia's specialized window and door systems and other architectural components. In the first quarter of 2024, DMC Global reported that its architectural products segment faced headwinds due to this softer construction environment.

In response, DMC Global is strategically shifting its focus back to core commercial operations and implementing stringent cost control measures. This pivot aims to navigate the current volatility and improve profitability within the architectural products division.

Inflation and Cost of Materials

Inflationary pressures and the rising cost of raw materials, especially metals crucial for their engineered products, directly affect DMC Global's gross margins. For instance, the Producer Price Index for metals and metal products saw significant increases throughout 2023 and into early 2024, impacting input expenses.

While DMC Global focuses on manufacturing efficiency, these elevated input costs can squeeze profitability. This is particularly true if the company cannot fully pass these increases on through pricing adjustments or optimize its supply chain effectively to mitigate the impact.

- Rising Material Costs: DMC Global's reliance on metals means they are susceptible to commodity price volatility.

- Margin Pressure: Increased input costs can erode gross margins if not offset by price increases or cost savings.

- Pricing Strategy Importance: The ability to implement effective pricing strategies is key to maintaining profitability amidst inflation.

- Supply Chain Optimization: Streamlining the supply chain can help mitigate the impact of rising material expenses.

Interest Rates and Access to Capital

Changes in interest rates directly affect DMC Global's cost of capital and the financial feasibility of its customers' projects. For instance, if benchmark rates like the Federal Funds Rate increase, borrowing becomes more expensive, potentially slowing down investment in infrastructure and energy sectors that rely on significant capital outlay. This environment necessitates a strong focus on balance sheet management.

DMC Global's strategic emphasis on strengthening its balance sheet and optimizing its capital structure, including proactive debt management, becomes even more critical when interest rates are volatile or trending upward. This focus helps ensure the company can navigate higher borrowing costs and maintain financial flexibility for future growth opportunities.

- Interest Rate Environment: As of mid-2025, central banks globally are navigating a complex interest rate landscape, with many having implemented significant hikes in the preceding years to combat inflation. While some may be considering pauses or even gradual reductions, borrowing costs remain elevated compared to the low-rate environment of the early 2020s.

- Impact on Investment: Higher interest rates can lead to a slowdown in new project development within the energy and infrastructure sectors, as the cost of financing these large-scale ventures increases, impacting demand for DMC Global's products and services.

- DMC Global's Financial Strategy: DMC Global's commitment to deleveraging and maintaining a robust capital structure, as evidenced by its reported debt-to-equity ratios, positions it to better withstand periods of higher interest rates.

Global economic growth directly influences demand for DMC Global's products, with projections for 2024 indicating a 3.2% growth rate according to the IMF, suggesting a stable yet somewhat moderated market. This economic backdrop affects customer spending on projects and maintenance, impacting DMC Global's revenue across its energy, industrial, and infrastructure segments.

Inflationary pressures, particularly in metals, continue to affect DMC Global's input costs. For example, the Producer Price Index for metals saw increases through 2023 and into early 2024, potentially squeezing gross margins if cost increases cannot be fully passed on.

Interest rates remain a key consideration, with borrowing costs elevated compared to the early 2020s. This can slow down customer investment in capital-intensive projects, making DMC Global's focus on balance sheet strength and debt management crucial for financial flexibility.

| Economic Factor | 2024 Projection/Trend | Impact on DMC Global |

|---|---|---|

| Global GDP Growth | IMF projected 3.2% for 2024 | Influences customer capital expenditure and demand for products. |

| Inflation (Metals) | Elevated through 2023-early 2024 | Pressures gross margins due to increased input costs. |

| Interest Rates | Elevated compared to early 2020s | Can slow customer project investment, emphasizing balance sheet management. |

What You See Is What You Get

DMC Global PESTLE Analysis

The preview shown here is the exact DMC Global PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting DMC Global.

The content and structure shown in the preview is the same DMC Global PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

DMC Global's reliance on a skilled manufacturing and specialized engineering workforce means workforce availability is a critical sociological factor. The U.S. manufacturing sector, for instance, faced an estimated shortage of 2.1 million workers by 2030, as reported by the Manufacturing Institute in 2022, highlighting a persistent skills gap that could impact DMC Global's recruitment and operational costs.

This ongoing skills deficit in industrial fields presents a tangible challenge, potentially inflating labor expenses and constraining production output. To counter this, DMC Global might need to strategically invest in robust internal training and development programs, ensuring their workforce possesses the necessary competencies to maintain efficiency and competitive edge.

Societal expectations and regulatory emphasis on workplace safety and employee well-being are paramount for industrial companies like DMC Global. In 2024, the Occupational Safety and Health Administration (OSHA) continued to enforce stringent standards, with penalties for violations potentially reaching $15,625 per serious violation. Adhering to high safety standards is not only a legal requirement but also a social responsibility that affects employee morale, retention, and the company's reputation.

Investing in advanced safety protocols is essential for companies like DMC Global to mitigate risks and foster a positive work environment. Reports from the Bureau of Labor Statistics in late 2024 indicated that industries with robust safety programs saw a 15-20% reduction in lost-time injury cases compared to those with less emphasis on worker well-being.

DMC Global's manufacturing presence necessitates robust community engagement. In 2024, the company continued its focus on local impact, with its facilities contributing to job creation and local economies. For instance, its operations in regions like Colorado and Indiana support hundreds of direct and indirect jobs, fostering local economic development.

Responsible practices, such as prioritizing local procurement and actively managing environmental concerns, are crucial for DMC Global's social license to operate. This commitment not only strengthens community relations but also aligns with the company's broader sustainability objectives, aiming to minimize negative externalities and maximize positive contributions.

Demand for Sustainable Products and Practices

Societal awareness regarding sustainability is a powerful driver of consumer choice and investment strategy. As people become more conscious of environmental and social impacts, they increasingly favor companies that demonstrate responsible practices. This trend is particularly evident in sectors like infrastructure and energy, where there's a growing push for greener alternatives and more efficient operations.

DMC Global's product portfolio, which emphasizes enhanced performance, productivity, and safety, naturally aligns with these evolving demands. For instance, their solutions can contribute to more energy-efficient infrastructure projects, a key area of focus for governments and corporations alike. The company's ability to provide these types of solutions positions it favorably in a market increasingly prioritizing environmental stewardship.

Consider the following data points illustrating this trend:

- Global spending on renewable energy is projected to reach $2 trillion annually by 2030, reflecting a strong demand for sustainable solutions.

- In 2024, over 70% of consumers indicated they are willing to pay a premium for products from brands committed to sustainability.

- ESG (Environmental, Social, and Governance) investing saw significant inflows in 2023, with sustainable funds attracting substantial capital, signaling investor preference for responsible companies.

Diversity, Equity, and Inclusion (DEI) Initiatives

The increasing emphasis on diversity, equity, and inclusion (DEI) mirrors shifting societal norms and growing demands for corporate accountability. DMC Global's dedication to these principles, seen in its employee growth programs and efforts to cultivate an inclusive atmosphere, can significantly boost its ability to attract top talent, drive innovation, and solidify its brand image.

For instance, in 2024, companies with strong DEI programs reported an average of 19% higher innovation revenue compared to those with weaker programs. DMC Global's investment in DEI can therefore translate into tangible business benefits, fostering a more dynamic and creative workforce.

- Enhanced Talent Attraction: A strong DEI commitment makes DMC Global more appealing to a broader talent pool.

- Improved Innovation: Diverse teams are proven to be more innovative, leading to new product development and problem-solving.

- Stronger Corporate Reputation: Demonstrating a commitment to social responsibility positively impacts public perception and stakeholder trust.

- Increased Employee Engagement: Inclusive environments lead to higher morale and productivity among employees.

Societal expectations around ethical business practices and corporate responsibility continue to shape how companies like DMC Global operate. Consumers and investors alike are increasingly scrutinizing companies' social impact, demanding transparency and accountability. This trend is underscored by the growing influence of ESG (Environmental, Social, and Governance) factors in investment decisions, with sustainable funds attracting significant capital in 2023.

DMC Global's commitment to community engagement and responsible operations, such as job creation in its operating regions, directly addresses these societal demands. By fostering local economic development and prioritizing local procurement, the company strengthens its social license to operate and builds positive community relations, which are vital for long-term sustainability.

The increasing societal awareness and demand for sustainable products and practices are powerful market forces. DMC Global's product portfolio, designed for enhanced performance, productivity, and safety, aligns well with this shift, particularly in sectors like infrastructure where greener alternatives are sought. Global spending on renewable energy, projected to reach $2 trillion annually by 2030, exemplifies this demand for sustainable solutions.

Furthermore, diversity, equity, and inclusion (DEI) are becoming critical sociological factors, influencing talent attraction and innovation. Companies with robust DEI programs, like DMC Global's efforts in employee growth and inclusive atmospheres, report higher innovation revenue, with some studies showing up to a 19% increase in 2024. This focus not only enhances brand image but also fosters a more dynamic and productive workforce.

Technological factors

The increasing adoption of automation and smart manufacturing, driven by AI and robotics, offers substantial growth avenues for DMC Global. For instance, DynaEnergetics, a segment of DMC, has been actively integrating automation to boost its production capabilities.

These technological advancements are key to enhancing operational efficiency and cost reduction. In 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the scale of this trend and its potential impact on companies like DMC Global.

DMC Global's competitive edge is deeply rooted in its innovation within advanced materials and engineered solutions, especially through NobelClad's composite metal products. This focus on continuous research and development allows them to create high-performance materials that meet shifting industry demands.

For instance, in 2023, DMC Global reported that its NobelClad segment, which leverages these advanced materials, saw significant demand, contributing to the company's overall revenue growth. Their ability to tailor solutions for specific applications, such as in the oil and gas or chemical processing sectors, is a direct result of this technological investment.

DMC Global is positioned to benefit from the ongoing digital transformation, particularly through the Industrial Internet of Things (IIoT). This technology allows for real-time data collection from connected machinery, offering significant opportunities to enhance operational efficiency and service delivery across its diverse business segments.

By leveraging data-driven maintenance strategies, DMC Global can gain valuable insights for predictive maintenance. This proactive approach minimizes downtime and optimizes asset utilization. For instance, in 2024, the industrial IoT market was valued at approximately $246 billion, with projections indicating substantial growth, highlighting the increasing adoption of such technologies by forward-thinking companies.

New Energy Technologies

Advancements in new energy technologies are reshaping the energy landscape. Innovations like carbon capture and storage (CCS) and the scaling up of clean hydrogen production are not just creating new markets but also potentially altering demand for existing energy solutions. For instance, the global hydrogen market is projected to reach $250 billion by 2030, indicating significant growth potential for related technologies and infrastructure.

DMC Global's subsidiary, DynaEnergetics, currently focuses on the traditional oil and gas sector. However, the long-term strategic implications of the energy transition are considerable. As cleaner energy sources gain traction, the demand for specialized products used in conventional extraction methods could be impacted. Companies like DMC Global will need to monitor these shifts closely.

Consider these points regarding new energy technologies:

- Market Disruption: Emerging technologies can create entirely new revenue streams or render existing products obsolete.

- Investment Trends: Global investment in clean energy technologies reached an estimated $1.1 trillion in 2023, signaling a major shift in capital allocation.

- Technological Integration: The potential for integrating new energy solutions with existing infrastructure presents both challenges and opportunities for established players.

- Regulatory Impact: Government policies and incentives supporting new energy technologies, such as tax credits for hydrogen production, directly influence market viability.

Cybersecurity in Industrial Operations

As industrial operations increasingly rely on digital technologies, cybersecurity threats are a growing concern for companies like DMC Global. The interconnected nature of modern manufacturing means that a single breach could disrupt production, compromise sensitive data, and damage reputation. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved.

DMC Global must prioritize robust cybersecurity measures to safeguard its intellectual property, operational technology (OT) networks, and confidential customer information. This includes implementing multi-layered defenses and regularly updating security protocols to counter evolving threats. The company's commitment to security is vital for maintaining operational continuity and protecting its market position.

Investing in advanced technologies like AI-driven threat detection is becoming essential. These systems can proactively identify and neutralize potential cyberattacks before they cause significant damage. By bolstering its cybersecurity infrastructure, DMC Global can ensure the resilience of its operations and maintain the trust of its stakeholders in an increasingly digital landscape.

- Increased Vulnerability: Digitization of manufacturing processes expands the attack surface for cyber threats.

- Critical Asset Protection: Cybersecurity is paramount for safeguarding intellectual property and operational technology.

- AI-Driven Defense: Investing in AI for threat detection is crucial for proactive security.

- Stakeholder Trust: Strong cybersecurity practices are essential for maintaining confidence among investors and customers.

DMC Global's technological advantage is evident in its adoption of automation and advanced materials, particularly through its NobelClad and DynaEnergetics segments. The company is leveraging AI and robotics to enhance production efficiency, with the global industrial automation market projected to exceed $200 billion in 2024. Furthermore, investments in the Industrial Internet of Things (IIoT) are enabling data-driven insights for predictive maintenance, a critical factor in a market valued at approximately $246 billion in 2024.

| Technology Area | DMC Global Segment | Market Data Point (2024/2025 Projections) | Impact on DMC Global |

|---|---|---|---|

| Automation & Robotics | DynaEnergetics | Global industrial automation market > $200 billion (2024) | Enhanced production efficiency, cost reduction |

| Advanced Materials | NobelClad | Significant demand in 2023, contributing to revenue growth | High-performance solutions, tailored applications |

| Industrial IoT (IIoT) | Across segments | Global IIoT market ~ $246 billion (2024), with substantial growth | Predictive maintenance, optimized asset utilization |

| Cybersecurity | All operations | Global cost of cybercrime projected to reach $10.5 trillion annually by 2025 | Protection of IP, operational continuity, stakeholder trust |

Legal factors

DMC Global operates within a framework of rigorous environmental regulations, especially in its energy and industrial segments, covering aspects like emissions control, waste disposal, and the responsible use of resources. Failure to adhere to these mandates, which can include standards for CO2 capture or methane emission reduction, poses significant risks of penalties and jeopardizes essential operating permits.

The company must actively monitor and adapt to regulatory shifts, exemplified by the impact of legislation like the Inflation Reduction Act, which introduces new compliance requirements and opportunities for investment in green technologies.

DMC Global operates within a framework of stringent health and safety regulations, particularly impacting its manufacturing and industrial sectors. These legal mandates necessitate robust safety protocols and ongoing training for all employees worldwide, ensuring compliance and a secure work environment.

Failure to meet these health and safety standards can lead to severe consequences, including significant legal liabilities, costly fines, and irreparable damage to the company's reputation. For instance, in 2023, workplace injuries in the manufacturing sector resulted in an estimated $167 billion in direct and indirect costs in the United States alone, highlighting the financial risks of non-compliance.

DMC Global's extensive international operations mean navigating a complex landscape of trade laws. For instance, the USMCA agreement, which replaced NAFTA in 2020, significantly altered trade dynamics for companies operating between the United States, Mexico, and Canada, impacting tariffs and rules of origin for components used in manufacturing.

Fluctuations in global trade policy, such as the imposition of new tariffs or the escalation of trade disputes, directly affect DMC Global's cost of goods and market access. For example, the tariffs introduced on steel and aluminum imports in 2018 by the U.S. government had a ripple effect on manufacturing costs for many industries, including those that DMC Global serves.

Agile legal compliance and proactive strategic adjustments are crucial for DMC Global to mitigate risks associated with evolving international trade regulations. Staying abreast of agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which involves eleven Asia-Pacific nations, allows for better planning regarding market entry and supply chain optimization.

Intellectual Property Rights and Patents

Intellectual property rights and patents are foundational to DMC Global's market position, safeguarding its proprietary processes, engineered products, and innovative solutions. These legal protections are paramount for maintaining a competitive edge and preventing unauthorized use of their specialized technologies. For instance, in 2024, the global patent landscape saw continued growth, with innovation in materials science and manufacturing processes—areas directly relevant to DMC Global's operations—remaining robust. The ability to secure and enforce patents directly impacts market exclusivity and the return on investment for their research and development efforts.

Legal frameworks governing intellectual property are critical for DMC Global to deter infringement and preserve its market exclusivity for its specialized technologies. This includes navigating international patent laws and actively defending its IP portfolio against potential violations. The company's commitment to innovation is underscored by its patent filings, which contribute to its valuation and long-term strategic advantage. As of early 2025, many jurisdictions are enhancing their IP enforcement mechanisms, providing a more secure environment for companies like DMC Global to protect their technological advancements.

- Patent Protection: DMC Global relies on patents to shield its unique manufacturing processes and product designs, ensuring a competitive advantage.

- Market Exclusivity: Legal IP frameworks enable DMC Global to maintain exclusive rights to its innovations, preventing competitors from replicating its technologies.

- R&D Investment: The strength of its IP portfolio directly influences the company's ability to recoup significant investments in research and development.

- Global IP Landscape: DMC Global must stay abreast of evolving patent laws and enforcement trends across its international markets to effectively safeguard its intellectual assets.

Labor Laws and Employment Regulations

DMC Global navigates a complex web of labor laws and employment regulations across its international operations. These legal frameworks govern everything from minimum wage requirements and workplace safety standards to the rights of employees regarding collective bargaining and protection against discrimination. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay, while the Occupational Safety and Health Administration (OSHA) enforces workplace safety. Similarly, European Union directives, such as those concerning working time and equal treatment, significantly impact employment practices.

Compliance with these diverse regulations is critical for DMC Global to manage its global workforce effectively and avoid costly legal disputes. Failure to adhere to these laws can result in substantial fines, reputational damage, and operational disruptions. For example, in 2024, companies operating in the EU faced increased scrutiny on fair wage practices and worker protections, with specific directives like the Pay Transparency Directive coming into effect, requiring employers to provide more detailed information on pay.

- Wage and Hour Laws: DMC Global must ensure compliance with varying minimum wage laws, overtime regulations, and payment schedules across different jurisdictions. For example, the UK's National Living Wage increased in April 2024.

- Workplace Safety and Health: Adherence to occupational health and safety standards, such as those mandated by OSHA in the US or similar bodies globally, is paramount to prevent accidents and ensure employee well-being.

- Anti-Discrimination and Equal Opportunity: Laws prohibiting discrimination based on age, gender, race, religion, disability, and other protected characteristics are enforced globally, requiring robust HR policies.

- Collective Bargaining and Labor Relations: DMC Global must respect employees' rights to organize and engage in collective bargaining where such rights are legally protected, impacting negotiation processes and employee agreements.

DMC Global's operations are significantly shaped by environmental laws concerning emissions, waste, and resource use, with non-compliance risking penalties and permit loss. For instance, the U.S. Environmental Protection Agency (EPA) continues to enforce stringent air quality standards, impacting industrial processes. The company must also navigate evolving legislation like the Inflation Reduction Act, which incentivizes green technology investments and imposes new compliance burdens.

The company's adherence to health and safety regulations is critical, particularly in manufacturing. In 2023, workplace injuries in the U.S. manufacturing sector alone incurred an estimated $167 billion in costs, underscoring the financial risks of safety lapses. DMC Global's global presence necessitates compliance with diverse labor laws, including wage, hour, and anti-discrimination statutes, with non-compliance leading to fines and reputational damage. For example, the EU's Pay Transparency Directive, effective in 2024, mandates greater pay disclosure, impacting reporting requirements.

| Legal Factor | Impact on DMC Global | Example/Data Point (2023-2025) |

|---|---|---|

| Environmental Regulations | Compliance with emissions, waste, and resource use standards. Risk of fines and permit revocation. | U.S. EPA's continued enforcement of air quality standards. Inflation Reduction Act incentives for green tech. |

| Health and Safety Laws | Mandates robust safety protocols and training. Avoids legal liabilities and reputational damage. | U.S. manufacturing injuries cost an estimated $167 billion in 2023. |

| Labor Laws | Governs wages, working conditions, and employee rights across jurisdictions. | EU's 2024 Pay Transparency Directive increases pay disclosure requirements. |

| Intellectual Property Rights | Protects proprietary processes and products, ensuring market exclusivity and R&D recoupment. | Continued growth in global patent filings in materials science and manufacturing (2024). Enhanced IP enforcement mechanisms in many jurisdictions (early 2025). |

Environmental factors

Global and national climate change policies, including ambitious targets for carbon emission reductions and the implementation of carbon pricing mechanisms, are significantly reshaping the energy and industrial sectors. For instance, the European Union's Fit for 55 package aims to cut emissions by at least 55% by 2030 compared to 1990 levels, impacting businesses operating within or trading with the EU.

This regulatory landscape presents both challenges and opportunities for companies like DMC Global. There's increasing pressure to reduce their carbon footprint, whether through operational efficiency or by developing more sustainable products. For example, a growing number of corporate customers are setting their own net-zero targets, which directly influences their purchasing decisions, favoring suppliers with demonstrable low-carbon solutions.

DMC Global faces increasing pressure to adopt sustainable sourcing for its metal-based products due to growing global resource scarcity concerns. This means actively seeking out and integrating recycled content, aiming for a higher percentage of recycled aluminum and steel in their manufacturing processes. For instance, the global demand for metals like aluminum is projected to grow significantly, with some estimates suggesting a 30-40% increase by 2030, making responsible sourcing crucial for long-term cost stability and availability.

To counter potential material availability and cost fluctuations, DMC Global must optimize its material usage through advanced manufacturing techniques and explore alternative, more sustainable materials where feasible. Ensuring transparency and responsibility throughout their supply chains is also paramount. The increasing focus on Environmental, Social, and Governance (ESG) factors by investors means that companies like DMC Global are being scrutinized for their commitment to ethical and sustainable material procurement, with many institutional investors now divesting from companies with poor ESG ratings.

Environmental regulations and growing societal demand for sustainability are pushing businesses to adopt better waste management practices and embrace circular economy principles. DMC Global has a clear opportunity to gain an advantage by focusing on reducing waste in its manufacturing, making its products easier to recycle, and exploring options for refurbishment or reuse.

For instance, the European Union's Circular Economy Action Plan, updated in 2020, sets ambitious targets for waste reduction and resource efficiency, with further revisions anticipated by 2025. Companies that proactively integrate these principles into their operations, like investing in advanced recycling technologies or designing for disassembly, are likely to see improved resource utilization and potentially lower operational costs.

Water Usage and Conservation

DMC Global's manufacturing processes inherently require water, making water usage and conservation a critical environmental factor. As global water scarcity concerns intensify, particularly in regions where manufacturing hubs are located, stricter regulations on water withdrawal and discharge are anticipated. For instance, the World Resources Institute reported in 2023 that over 2 billion people live in countries experiencing high water stress, a number projected to rise significantly by 2050. This trend directly impacts industrial operations like DMC Global's, necessitating proactive strategies for water efficiency.

The company's commitment to sustainable practices will be increasingly scrutinized by stakeholders, including investors and consumers who prioritize environmental responsibility. Implementing advanced water-saving technologies, such as closed-loop systems and water recycling, is not only crucial for regulatory compliance but also for enhancing operational resilience and reducing costs. By investing in these solutions, DMC Global can mitigate risks associated with water availability and quality, ensuring long-term operational continuity.

- Water Scarcity Impact: Growing global water stress, affecting over 2 billion people as of 2023, poses a direct risk to water-intensive manufacturing.

- Regulatory Pressure: Expect increased regulations on water usage and discharge, requiring efficient water management practices.

- Technological Investment: Implementing water-saving technologies like recycling and closed-loop systems is vital for compliance and cost reduction.

- Stakeholder Expectations: Public and investor demand for environmental responsibility will drive the need for demonstrable water conservation efforts.

Impact of Energy Transition on Demand

The global shift towards renewable energy sources significantly influences demand for products serving the traditional fossil fuel industry. DMC Global's DynaEnergetics, which supplies the oil and gas sector, faces potential headwinds as the world increasingly prioritizes cleaner energy alternatives.

However, this transition also creates new avenues for growth. As investments pour into green energy infrastructure, companies like DMC Global might find opportunities in supplying components or services for these emerging sectors. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that renewable energy capacity additions are set to grow by over 30% in 2024 compared to 2023, reaching nearly 510 gigawatts globally. This substantial growth underscores the evolving energy landscape.

DMC Global must strategically assess how the accelerating energy transition, driven by climate concerns and technological advancements, will reshape long-term demand patterns for its core offerings. The company's ability to adapt and potentially diversify into supporting green energy initiatives will be crucial for sustained success.

- Energy Transition Impact: The global move away from fossil fuels presents a direct challenge to demand for products serving the oil and gas industry.

- Renewable Growth: Global renewable energy capacity additions were projected to exceed 510 GW in 2024, a significant increase from the previous year according to the IEA.

- Opportunity in Green Energy: The expansion of green energy infrastructure may offer new market opportunities for companies capable of adapting their product lines or services.

- Strategic Adaptation: DMC Global's long-term viability hinges on its capacity to navigate these shifts and potentially capitalize on emerging green energy markets.

Global climate policies are increasingly driving demand for sustainable materials and processes, impacting companies like DMC Global. The EU's Fit for 55 package, aiming for a 55% emission reduction by 2030, exemplifies this trend, influencing supply chains and product development.

DMC Global faces pressure to reduce its carbon footprint and embrace circular economy principles, as corporate customers set their own net-zero targets. This necessitates a focus on operational efficiency and the development of low-carbon solutions, aligning with growing investor scrutiny on ESG factors.

Resource scarcity and rising demand for metals, such as a projected 30-40% increase in aluminum demand by 2030, highlight the importance of sustainable sourcing and material efficiency for DMC Global. Investing in recycling technologies and exploring alternative materials are key strategies to mitigate cost fluctuations and ensure availability.

The accelerating energy transition, with renewable energy capacity additions projected to grow over 30% in 2024 according to the IEA, presents both challenges for fossil fuel-reliant segments and opportunities in green energy infrastructure for adaptable companies like DMC Global.

PESTLE Analysis Data Sources

Our DMC Global PESTLE Analysis is meticulously constructed using a blend of authoritative data from international organizations like the IMF and World Bank, alongside comprehensive industry reports and government publications. This ensures a robust understanding of political, economic, social, technological, environmental, and legal landscapes.