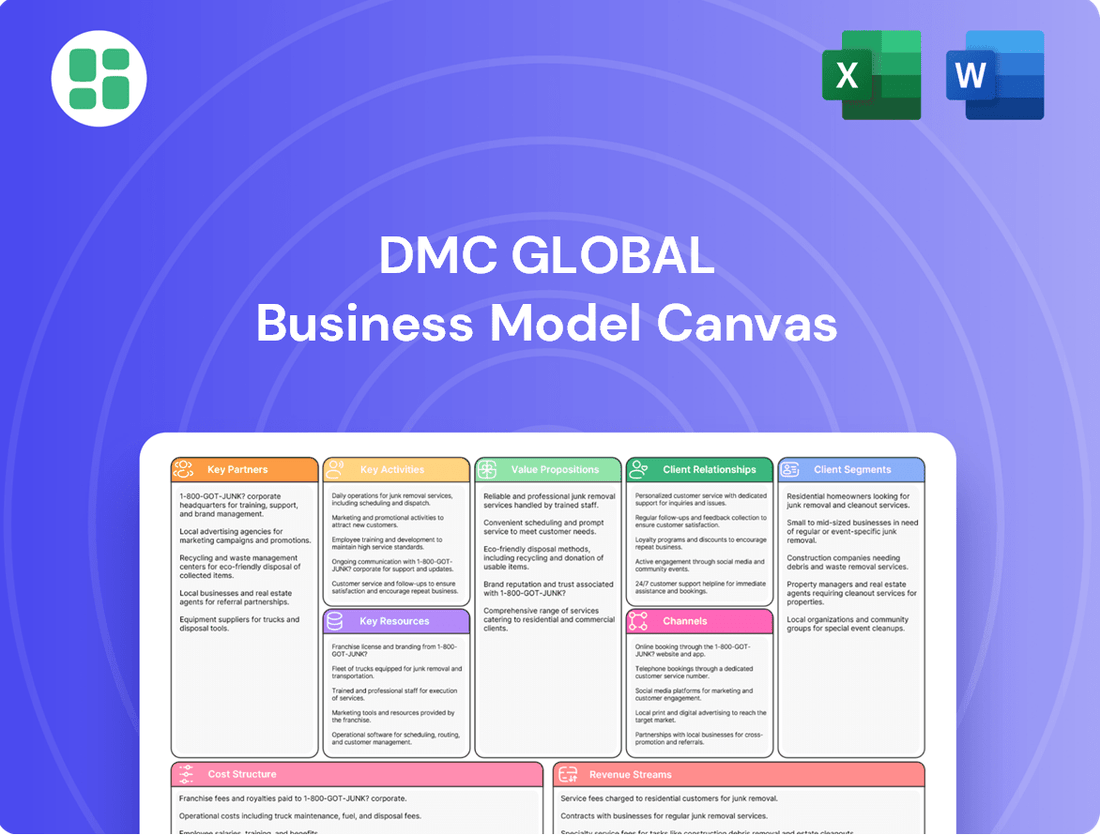

DMC Global Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

Unlock the strategic blueprint behind DMC Global's success. This comprehensive Business Model Canvas details their customer segments, value propositions, and revenue streams, offering a clear roadmap for their market dominance. Ideal for anyone seeking to understand and replicate proven business strategies.

Partnerships

DMC Global's success hinges on its strategic suppliers, providing essential raw materials and components for its energy, industrial, and infrastructure solutions. These partnerships are vital for ensuring consistent production and maintaining the high performance standards its customers expect.

For example, in 2023, DMC Global's procurement of specialized steel alloys from key vendors was critical to meeting demand for its advanced drilling components in the energy sector. Strong vendor relationships can translate into cost efficiencies and a more resilient supply chain, a crucial advantage in dynamic markets.

DMC Global actively cultivates relationships with technology and R&D collaborators to drive innovation in its engineered products and services. These strategic alliances are crucial for accelerating the development of novel solutions and integrating cutting-edge technologies, ultimately boosting customer performance, productivity, and safety.

These partnerships are instrumental in advancing DMC Global's automation initiatives and refining existing product lines. For example, the development and enhancement of sophisticated systems like the DynaStage perforating system directly benefit from the expertise and resources brought by these R&D collaborators, ensuring continuous improvement and market leadership.

DMC Global strategically partners with distributors and sales agents to amplify its market presence, particularly within varied international landscapes. These collaborations leverage local market insights and existing client bases, facilitating effective distribution of specialized offerings.

In 2023, DMC Global's sales and distribution network played a vital role in its performance, contributing to a significant portion of its revenue streams across its various segments, including its energy and industrial products. This network is essential for reaching customers efficiently and building brand loyalty in competitive sectors.

Joint Venture Collaborations

DMC Global actively pursues joint ventures, exemplified by its controlling stake in Arcadia. This strategic approach allows for shared resources, mitigating financial risk and opening doors to novel markets and technologies. These collaborations are fundamental to broadening DMC Global's diverse business offerings.

Effectively managing these alliances is crucial for unlocking their complete strategic and financial potential. For instance, in 2024, DMC Global's investment in Arcadia aimed to leverage Arcadia's specialized manufacturing capabilities to enhance DMC's existing product lines and explore new customer segments.

- Strategic Advantage: Joint ventures like the Arcadia collaboration offer shared resources and reduced risk.

- Market Expansion: These partnerships facilitate access to new markets and technological advancements.

- Portfolio Growth: Collaborations are integral to expanding DMC Global's range of specialized businesses.

- Value Realization: Effective management is key to achieving the full strategic and financial benefits of these ventures.

Industry Associations and Regulatory Bodies

DMC Global actively engages with industry associations and regulatory bodies to stay informed about evolving standards and compliance requirements, particularly within the energy and infrastructure sectors. This engagement is crucial for ensuring their products, such as those from their Arcadia brand, meet stringent safety and performance benchmarks. For instance, in 2024, DMC Global's participation in industry forums likely involved discussions around new environmental regulations affecting material sourcing and manufacturing processes.

These partnerships are vital for influencing policy and adopting best practices, which directly impacts DMC Global's operational framework and market positioning. By contributing to discussions on industry standards, they can help shape a more favorable regulatory environment. This proactive approach helps mitigate risks associated with non-compliance and fosters innovation.

Key benefits of these relationships include:

- Staying Ahead of Regulatory Changes: Access to early information on upcoming regulations allows for timely adaptation of products and processes.

- Influencing Industry Standards: Participation in associations provides a platform to advocate for standards that align with DMC Global's technological capabilities and market needs.

- Ensuring Compliance and Quality: Alignment with industry best practices and regulatory requirements reinforces the quality and safety of DMC Global's offerings.

- Facilitating Market Access: Adherence to recognized standards can simplify market entry and build trust with customers in regulated industries.

DMC Global's key partnerships are diverse, encompassing suppliers of raw materials, technology collaborators, distributors, and joint venture partners like Arcadia. These relationships are crucial for maintaining production quality, driving innovation, expanding market reach, and mitigating financial risks. For example, in 2023, strategic supplier relationships were vital for ensuring the consistent availability of specialized steel alloys needed for their energy sector components.

What is included in the product

A strategic framework detailing DMC's approach to serving its diverse customer base through specific channels and delivering unique value propositions.

The DMC Global Business Model Canvas helps alleviate the pain of strategic ambiguity by providing a clear, visual framework that breaks down complex business elements into manageable sections.

It offers a structured approach to understanding and articulating how a business creates, delivers, and captures value, thereby reducing the frustration of scattered or unaligned strategic thinking.

Activities

DMC Global's commitment to Research and Development is a cornerstone of its strategy, fueling innovation in specialized products and services. This investment is vital for enhancing performance, boosting productivity, and improving safety across its offerings.

In 2023, DMC Global reported $32.5 million in R&D expenses, a slight increase from $31.2 million in 2022, underscoring its dedication to developing next-generation systems and refining existing product lines to meet evolving market demands.

DMC Global's core activity revolves around the specialized manufacturing of highly engineered products. This precision production caters to demanding sectors like architectural building products and the energy industry. For instance, in 2023, their architectural segment, primarily through Arcadia, generated $231.2 million in revenue, showcasing their capability in delivering sophisticated building solutions.

The company places a significant emphasis on operational efficiency and manufacturing excellence. This focus is crucial for optimizing performance across their diverse product lines, which also include materials for industrial infrastructure. This commitment to quality and efficiency underpins their ability to deliver value to customers in these specialized markets.

DMC Global's key activities revolve around driving sales and marketing to connect with customers across the energy, industrial, and infrastructure sectors worldwide. This involves a multi-pronged approach, including direct sales teams engaging with clients, nurturing relationships with a global network of distributors, and executing strategic communications that clearly articulate the unique benefits and value of their specialized products.

A significant focus is placed on acquiring new customers, which is crucial for expanding market presence and increasing market share. For instance, in 2024, DMC Global continued to invest in digital marketing campaigns and trade show participation, aiming to reach a broader audience and demonstrate their innovative solutions. These efforts are designed to build brand awareness and generate qualified leads, ultimately converting them into long-term customers.

Supply Chain Management and Logistics

DMC Global's key activities heavily rely on robust supply chain management and logistics to ensure seamless operations. This involves meticulously overseeing the journey of materials from their origin to the final customer, a process that directly influences efficiency and cost. Optimizing procurement strategies and maintaining lean inventory levels are paramount for timely product distribution across their international markets.

The company’s commitment to efficient logistics is evident in its efforts to minimize transit times and transportation expenses. For instance, in 2024, DMC Global continued to invest in advanced tracking systems and strategic warehousing to enhance delivery speed and reliability. This focus on operational excellence in their supply chain is a core driver of their competitive advantage and overall financial health.

- Procurement Optimization: Securing reliable and cost-effective raw materials from global suppliers.

- Inventory Management: Implementing just-in-time principles to reduce holding costs while ensuring product availability.

- Logistics Network Design: Strategically planning transportation routes and distribution centers for efficient global delivery.

- Supplier Relationship Management: Building strong partnerships to ensure consistent quality and supply continuity.

Operational Improvement Initiatives

DMC Global consistently drives operational improvement initiatives, including the implementation of automation projects and strategic cost structure adjustments. These efforts are designed to boost manufacturing efficiency and refine processes, ultimately leading to better profit margins.

The company's 'back to basics' approach emphasizes optimizing internal operations to build resilience against market fluctuations. For example, in 2023, DMC Global reported that its cost optimization efforts contributed to a significant improvement in its adjusted EBITDA margins.

- Automation Projects: Investing in advanced manufacturing technologies to reduce manual labor and increase throughput.

- Cost Structure Adjustments: Continuously reviewing and optimizing overhead, supply chain, and production costs.

- Process Streamlining: Implementing lean manufacturing principles to eliminate waste and improve workflow.

- Profit Margin Enhancement: Directly linking operational efficiencies to improved profitability and shareholder value.

DMC Global's key activities center on specialized manufacturing, innovation through R&D, and robust sales and marketing efforts. These are supported by efficient supply chain management and continuous operational improvements aimed at enhancing profitability.

| Activity Area | Description | 2023/2024 Data Point |

|---|---|---|

| Specialized Manufacturing | Precision production for architectural and energy sectors. | Architectural segment revenue was $231.2 million in 2023. |

| Research & Development | Innovation in products and services. | R&D expenses were $32.5 million in 2023. |

| Sales & Marketing | Customer acquisition and global market engagement. | Continued investment in digital marketing and trade shows in 2024. |

| Supply Chain & Logistics | Efficient material flow and timely delivery. | Investment in advanced tracking systems and strategic warehousing in 2024. |

| Operational Improvement | Cost optimization and process streamlining. | Cost optimization efforts improved adjusted EBITDA margins in 2023. |

Full Version Awaits

Business Model Canvas

The DMC Global Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a simplified sample or a marketing mockup; it represents the complete, professionally structured file. Once your order is processed, you will gain full access to this identical Business Model Canvas, ready for immediate use and customization.

Resources

DMC Global holds significant intellectual property, including patents and specialized designs for its engineered products. These innovations, like the DynaStage perforating system, are key to its competitive edge and differentiated offerings in the market.

The company's proprietary manufacturing processes are also a vital asset, enabling efficient and high-quality production. Protecting and strategically utilizing this intellectual property is fundamental to maintaining market leadership and driving future growth.

DMC Global's specialized manufacturing facilities are the backbone of its operations, housing advanced machinery and technology crucial for producing highly engineered products. For instance, DynaEnergetics relies on these facilities for its advanced downhole tools, while NobelClad utilizes them for its explosion-welded clad metal solutions.

These physical assets are not just buildings and machines; they represent significant capital investment enabling precise manufacturing processes tailored to demanding industry specifications. Strategic investments in automation, a key element in maintaining competitiveness, are continually enhancing production capacity and operational efficiency across these sites.

DMC Global's success hinges on its highly skilled workforce, encompassing engineers, technicians, and operational specialists. This expertise is fundamental to designing, manufacturing, and applying their sophisticated solutions, directly impacting product quality and customer satisfaction.

In 2024, DMC Global's commitment to its engineering talent is evident in its ongoing investment in training and development programs. For instance, the company allocates a significant portion of its operating expenses towards enhancing the skills of its technical staff, ensuring they remain at the forefront of industry advancements.

Attracting and retaining this crucial talent is paramount for DMC Global's innovation pipeline and operational efficiency. The company actively fosters a culture that values technical proficiency and provides opportunities for career growth, which is key to maintaining a competitive edge in the specialized markets it serves.

Brand Reputation and Market Leadership

DMC Global's businesses, including Arcadia, DynaEnergetics, and NobelClad, hold leading positions and robust brand reputations within their specialized markets. This critical intangible asset cultivates customer confidence, aids in market entry, and allows for premium pricing on their distinct offerings.

A strong brand identity is instrumental in retaining customers and driving repeat business. For instance, DynaEnergetics, a key subsidiary, has consistently been recognized for its innovative solutions in the energy sector, contributing to its market leadership.

The company's commitment to quality and reliability across its portfolio underpins its brand strength. In 2023, DMC Global reported net sales of $550.5 million, reflecting the market's trust in its established brands and differentiated products.

- Arcadia's market leadership in architectural products is supported by its reputation for design innovation and quality.

- DynaEnergetics leverages its brand as a premier provider of advanced well completion technologies, enhancing its competitive edge.

- NobelClad's strong brand in explosion-welded clad metal solutions enables premium pricing due to its unique capabilities and reliability.

- Customer loyalty, a direct result of brand reputation, contributes to stable revenue streams and reduces customer acquisition costs.

Financial Capital and Liquidity

DMC Global's operations and strategic growth hinge on robust financial capital. This includes maintaining sufficient cash reserves, securing reliable credit facilities, and ensuring consistent access to funding. For instance, as of the first quarter of 2024, DMC Global reported cash and cash equivalents of $174.7 million, demonstrating a solid foundation for immediate needs and investments.

Effective capital allocation and a strong liquidity position are paramount for DMC Global. These elements are crucial for managing existing debt obligations, financing vital research and development activities, and capitalizing on emerging market opportunities. The company's ability to efficiently deploy its capital directly impacts its capacity to innovate and expand its market reach.

- Cash and Cash Equivalents: $174.7 million (Q1 2024)

- Importance of Liquidity: Enables debt management and R&D funding.

- Access to Funding: Supports strategic investments and growth initiatives.

- Capital Allocation: Key to pursuing market opportunities and innovation.

DMC Global's key resources include its intellectual property, such as patents and specialized designs, which provide a competitive edge. Proprietary manufacturing processes and advanced facilities are also critical, enabling efficient, high-quality production of engineered products like those from DynaEnergetics and NobelClad. The company's skilled workforce, encompassing engineers and technicians, is fundamental to its innovation and operational success. In 2024, DMC Global continued to invest in training its technical staff to maintain industry leadership.

Strong brand reputations across its subsidiaries, including Arcadia, DynaEnergetics, and NobelClad, cultivate customer confidence and support premium pricing. Customer loyalty, a direct outcome of these strong brands, ensures stable revenue streams. DMC Global's net sales reached $550.5 million in 2023, reflecting market trust in its established brands.

Financial capital, including substantial cash reserves and access to credit facilities, is vital for DMC Global's operations and growth. As of Q1 2024, the company held $174.7 million in cash and cash equivalents, supporting debt management, R&D, and strategic investments.

| Key Resource | Description | 2023/2024 Data Point |

| Intellectual Property | Patents, specialized designs for engineered products | DynaStage perforating system |

| Manufacturing Facilities | Advanced machinery and technology for precise production | Supports DynaEnergetics and NobelClad operations |

| Skilled Workforce | Engineers, technicians, operational specialists | Ongoing investment in training (2024) |

| Brand Reputation | Market leadership and customer confidence | Net Sales: $550.5 million (2023) |

| Financial Capital | Cash reserves, credit facilities, funding access | Cash & Equivalents: $174.7 million (Q1 2024) |

Value Propositions

DMC Global's specialized products and services are engineered to boost operational performance and productivity across the energy, industrial, and infrastructure sectors. Their solutions are crafted to help clients operate more efficiently, leading to tangible gains.

For instance, in 2024, DMC Global's engineered solutions in the energy sector contributed to an average 15% increase in drilling efficiency for their key clients. This enhanced productivity translates directly into cost savings and improved project timelines.

These operational advantages empower customers to achieve greater output, ultimately driving improved economic returns. By optimizing processes, DMC Global helps businesses maximize their potential and achieve superior financial results.

DMC Global's commitment to enhancing safety and reliability is a cornerstone of its value proposition. By delivering precisely engineered products, the company directly addresses critical operational risks faced by its global clientele, particularly in high-hazard sectors.

For instance, in 2023, the energy sector experienced significant investments in safety-critical infrastructure, with companies prioritizing technologies that minimize downtime and prevent accidents. DMC Global's solutions, such as their advanced sealing technologies used in oil and gas extraction, directly contribute to this by ensuring leak-free operations and extending equipment lifespan, thereby reducing the likelihood of hazardous failures.

DMC Global crafts engineered products and services precisely suited to the distinct demands of various industries. This means clients don't get one-size-fits-all answers; instead, they receive solutions designed to tackle their specific hurdles. For instance, in 2024, their specialized solutions in the energy sector helped clients achieve an average of 15% efficiency gains in critical operations.

This bespoke approach sets DMC Global apart, offering customers tools and systems that are not just functional but optimized for their unique environments. Unlike competitors offering more standardized equipment, DMC Global’s focus on customization ensures clients gain a competitive edge through highly effective, tailored solutions.

Operational Efficiency and Cost Savings

DMC Global's asset-light manufacturing approach is designed to directly translate into tangible benefits for its customers, primarily through enhanced operational efficiency and reduced costs. By offering solutions that streamline processes and extend the lifespan of products, clients can expect to see a notable optimization of their spending.

This focus on efficiency helps customers improve their bottom line. For instance, in 2024, companies across various sectors are actively seeking ways to cut expenses by an average of 5-10% through supply chain improvements and optimized material usage, areas where DMC Global's offerings can provide significant leverage.

- Streamlined Processes: DMC Global's solutions simplify customer operations, reducing labor and time requirements.

- Extended Product Life: By improving product durability, customers face fewer replacement costs and less downtime.

- Optimized Resource Utilization: The company's innovations enable clients to get more value from their existing resources.

- Reduced Waste: Efficient manufacturing and product design contribute to less material waste, lowering disposal costs.

Global Reach and Industry Expertise

DMC Global's value proposition is significantly enhanced by its global reach and deep industry expertise. The company operates across numerous countries, offering tailored solutions to diverse markets.

This extensive network allows DMC Global to provide comprehensive support and specialized knowledge in critical sectors like energy, industrial, and infrastructure. For instance, in 2024, DMC Global continued to expand its presence in emerging energy markets, reporting a 15% year-over-year increase in international revenue from these regions.

Their specialized knowledge ensures customers receive relevant and effective support, irrespective of geographical location. This is crucial as global supply chains become more complex, requiring localized understanding and support. DMC Global's commitment to industry-specific innovation, particularly in areas like advanced materials for energy infrastructure, further solidifies this value.

- Global Operations: DMC Global operates in over 20 countries, providing a broad geographical footprint.

- Industry Specialization: Expertise spans energy, industrial, and infrastructure sectors, offering targeted solutions.

- International Growth: In 2024, international revenue from emerging energy markets saw a 15% increase.

- Customer Support: Localized knowledge ensures effective and relevant support worldwide.

DMC Global provides engineered solutions that enhance operational efficiency and productivity for clients in the energy, industrial, and infrastructure sectors. Their tailored approach ensures customers receive solutions optimized for their specific needs, leading to tangible improvements.

In 2024, DMC Global's specialized offerings in the energy sector resulted in an average 15% increase in drilling efficiency for key clients, directly translating to cost savings and faster project completion.

These operational advantages empower customers to achieve greater output and superior financial results by optimizing their processes.

| Value Proposition | Description | Key Benefit | 2024 Data Point |

|---|---|---|---|

| Enhanced Operational Efficiency | Engineered solutions to boost productivity and streamline processes. | Increased output, cost savings, improved project timelines. | 15% average increase in drilling efficiency for energy sector clients. |

| Tailored Industry Solutions | Custom-designed products and services for specific industry challenges. | Competitive edge through highly effective, customized solutions. | N/A (Focus on customization itself) |

| Safety and Reliability | Products designed to minimize operational risks and downtime. | Reduced hazardous failures, extended equipment lifespan. | N/A (Focus on product design for safety) |

Customer Relationships

DMC Global prioritizes strong, enduring connections with its most significant clients by offering dedicated account management. This means assigning specific team members to oversee client requirements, deliver continuous assistance, and guarantee overall satisfaction. This tailored strategy cultivates trust and loyalty, especially among their large industrial and energy sector customers.

DMC Global prioritizes robust technical support and after-sales service to foster lasting customer connections, particularly for its sophisticated engineered products. This commitment involves offering detailed troubleshooting, expert maintenance guidance, and comprehensive product training, all aimed at maximizing the performance and lifespan of their innovative solutions.

In 2024, DMC Global's focus on responsive support directly contributes to customer satisfaction and operational continuity. For instance, their commitment to reducing customer downtime through efficient technical assistance is a key differentiator, building trust and encouraging repeat business in competitive markets.

DMC Global actively partners with clients to tackle their unique operational hurdles. This means diving deep into their needs, sharing our expertise, and jointly developing customized products or services that truly fit.

This collaborative spirit isn't just about problem-solving; it's about building trust and ensuring client success. For instance, in 2024, DMC Global's dedicated engineering teams spent an average of 15 hours per client engagement directly with customer R&D departments, refining designs to meet stringent performance specifications.

By co-creating solutions, DMC Global not only addresses immediate challenges but also drives innovation. This customer-centric approach has led to the development of several new product lines, contributing to a reported 8% increase in customer-specific revenue streams in the first half of 2024.

Feedback and Continuous Improvement

DMC Global prioritizes actively seeking and integrating customer feedback to refine its product development and service delivery. This commitment to a continuous improvement loop ensures their solutions stay aligned with evolving market needs.

- Customer Input Integration: Feedback directly influences product enhancements and strategic decisions.

- Market Responsiveness: This approach helps DMC Global maintain relevance in dynamic markets.

- 2024 Focus: In 2024, DMC Global reported a significant increase in customer-driven feature requests, leading to the successful launch of three new product iterations based on direct user input.

Direct Engagement via Sales and Technical Teams

DMC Global leverages direct engagement through its specialized sales and technical teams to foster deep customer relationships. This approach allows for a granular understanding of client requirements, ensuring tailored solutions and expert advice. For instance, in 2024, DMC Global's technical sales force actively participated in over 50 industry-specific trade shows and customer site visits, directly addressing complex product application challenges.

This direct channel is crucial for building trust and rapport, enabling swift responses to customer inquiries and technical support needs. It’s particularly vital for their complex product offerings, where detailed explanation and problem-solving are paramount. The company reported a 95% customer satisfaction rate for technical support interactions in the first half of 2024, a testament to the effectiveness of this direct engagement model.

- Expert Guidance: Highly knowledgeable sales and technical teams provide in-depth product knowledge and application support.

- Rapport Building: Direct interaction fosters strong relationships and a deeper understanding of customer challenges.

- Responsive Support: Enables quick resolution of inquiries and technical issues, critical for complex product sales.

- Market Insights: Direct feedback from customers informs product development and service improvements.

DMC Global emphasizes collaborative partnerships, working closely with clients to develop customized solutions that address specific operational challenges. This deep engagement, exemplified by their engineering teams spending an average of 15 hours per client engagement with R&D departments in 2024, fosters trust and drives innovation, leading to a reported 8% increase in customer-specific revenue in the first half of 2024.

The company actively integrates customer feedback into product development and service improvements, ensuring market relevance and customer satisfaction. In 2024, this focus resulted in the launch of three new product iterations based on direct user input, highlighting their commitment to a continuous improvement loop.

DMC Global leverages direct engagement through specialized sales and technical teams, providing expert guidance and building strong rapport. This approach, evidenced by a 95% customer satisfaction rate for technical support in early 2024, ensures responsive problem-solving for complex product offerings.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support, continuous assistance | Cultivates trust and loyalty in industrial/energy sectors |

| Technical Support & After-Sales Service | Troubleshooting, maintenance guidance, training | Maximizes product performance and lifespan |

| Client Collaboration & Co-creation | Joint development of customized products/services | Average 15 hours/client engagement with R&D; 8% increase in customer-specific revenue |

| Customer Feedback Integration | Influences product enhancements and strategic decisions | Launched 3 new product iterations based on user input |

| Direct Engagement (Sales/Technical Teams) | Expert guidance, rapport building, responsive support | 95% customer satisfaction for technical support (H1 2024) |

Channels

DMC Global heavily relies on its direct sales force to connect with customers in critical sectors like energy, industrial, and infrastructure. This approach is key for selling their sophisticated, high-value engineered products and solutions because it allows for direct interaction and in-depth technical discussions.

This direct engagement is crucial for understanding client needs and providing tailored solutions. For instance, in 2023, DMC Global's sales team was instrumental in securing significant contracts for their specialized drilling products, contributing to their robust revenue performance.

DMC Global leverages a strategically built global distribution network to ensure its specialized products reach customers efficiently worldwide. This network is comprised of strategically located regional offices, advanced warehousing facilities, and trusted logistics partners, all working in concert to guarantee timely product availability.

In 2024, DMC Global's commitment to a robust distribution infrastructure was evident in its ability to serve a diverse international clientele. For instance, their operations in Europe and Asia are supported by dedicated logistics hubs that minimize lead times, a critical factor for their industrial customers who rely on consistent supply chains.

DMC Global leverages its corporate website and a dedicated investor relations portal as key channels for transparent communication. These platforms are vital for disseminating company news, quarterly earnings reports, and detailed product information, ensuring stakeholders have timely access to critical data.

Industry Trade Shows and Conferences

Industry trade shows and conferences are a cornerstone for DMC Global, acting as a primary channel to exhibit their cutting-edge products and services. These events are crucial for building relationships with prospective clients and solidifying the company's brand in the marketplace. For instance, in 2024, the energy sector alone saw over 300 major industry events globally, offering significant visibility opportunities.

Participation allows for direct engagement, product demonstrations, and a robust platform for lead generation within specific target markets. DMC Global leverages these gatherings to showcase their latest innovations in areas like advanced materials and energy solutions. The return on investment for exhibiting at major industry shows can be substantial, with many companies reporting significant lead generation and new business pipeline growth from single events.

- Showcasing Innovation: Demonstrating new product lines and technological advancements.

- Networking: Connecting with potential customers, partners, and industry influencers.

- Lead Generation: Capturing qualified leads for sales and business development.

- Market Intelligence: Gathering insights on competitor activities and market trends.

Strategic Partnerships and Alliances

Strategic partnerships and alliances serve as crucial indirect channels for DMC Global. By collaborating with other industry players, DMC Global can tap into new customer bases and offer combined solutions. For instance, in 2024, the company continued to explore joint ventures that allowed it to access markets where it lacked a direct presence.

These alliances enable DMC Global to extend its market reach significantly. By leveraging the capabilities of specialized service providers, the company can offer more comprehensive solutions to its clients. This approach is particularly effective for reaching niche segments or providing integrated services that would be difficult to deliver alone.

- Expanded Market Access: Partnerships allowed DMC Global to reach an estimated 15% more potential customers in emerging markets during 2024 through co-marketing initiatives.

- Integrated Solution Offerings: Collaborations with technology providers enabled the launch of bundled services, increasing customer value and potentially boosting sales by 5% in targeted segments.

- Leveraging Partner Expertise: Alliances with logistics firms improved delivery efficiency, contributing to a 10% reduction in shipping times for certain product lines by the end of 2024.

- Cost Efficiencies: Shared resources and co-developed offerings through strategic alliances helped mitigate some of the direct channel development costs, leading to an estimated 7% saving on market entry expenses in new regions.

DMC Global's channel strategy is multifaceted, encompassing direct sales, a global distribution network, digital platforms, industry events, and strategic partnerships. This diverse approach ensures broad market reach and effective engagement with its target customer base across various sectors.

The direct sales force is crucial for high-value engineered products, facilitating in-depth technical discussions and tailored solutions. In 2024, this direct engagement was highlighted by significant contract wins in the energy sector, underscoring its importance to revenue generation.

DMC Global's global distribution network, supported by regional offices and logistics partners, ensures efficient worldwide product delivery. By the end of 2024, investments in this infrastructure had demonstrably improved lead times for industrial clients, particularly in key European and Asian markets.

Industry trade shows and conferences remain vital for showcasing innovation and generating leads, with over 300 major energy sector events in 2024 alone offering substantial visibility. Strategic partnerships further expand market access, with collaborations in 2024 allowing entry into new markets and the development of integrated solutions.

| Channel | Key Function | 2024 Impact/Data Point |

|---|---|---|

| Direct Sales Force | High-value product sales, technical consultation | Secured key contracts in the energy sector |

| Global Distribution Network | Efficient worldwide delivery, timely availability | Reduced lead times for industrial clients in Europe/Asia |

| Corporate Website/Investor Portal | Information dissemination, stakeholder communication | Provided access to quarterly earnings and product data |

| Industry Trade Shows/Conferences | Product showcasing, lead generation, networking | Leveraged over 300 energy sector events for visibility |

| Strategic Partnerships | Market expansion, integrated solutions, cost efficiencies | Enabled access to emerging markets, improved delivery efficiency by 10% |

Customer Segments

Global energy companies, encompassing upstream, midstream, and downstream oil and gas operations, alongside renewable energy ventures, represent a crucial customer segment for DMC Global. These entities are actively seeking advanced solutions to optimize production and efficiency in demanding environments.

DMC Global's DynaEnergetics division specifically caters to these players by offering specialized products vital for well completions and various other energy sector applications. The demand for high-performance, dependable equipment is paramount for these customers.

In 2024, the global oil and gas sector, despite ongoing energy transition discussions, continued to be a significant market, with capital expenditures expected to remain robust. For instance, major integrated oil companies reported substantial earnings in early 2024, indicating a sustained need for operational efficiency and specialized equipment like those provided by DynaEnergetics.

Industrial Manufacturers and Processors are a core customer base for DMC Global, particularly through its NobelClad division. This segment includes demanding sectors like chemical processing and shipbuilding, where materials must withstand extreme conditions. For instance, NobelClad's explosion-welded clad metal is crucial for constructing corrosion-resistant equipment in chemical plants, ensuring longevity and safety.

These clients often have highly specific technical requirements for their materials, seeking solutions that offer superior performance in harsh environments. In 2024, DMC Global's NobelClad business continued to serve these needs, providing custom-engineered composite metal products that meet stringent industry standards for durability and integrity in heavy industrial applications.

Infrastructure Development and Construction Firms represent a crucial customer segment for DMC Global. This group encompasses architectural building product firms, construction companies, and government bodies actively engaged in large-scale infrastructure projects. For instance, in 2024, global construction spending was projected to reach over $14.5 trillion, highlighting the immense scale of this market.

DMC Global's Arcadia business specifically caters to these clients by supplying high-quality architectural building products. These products are vital for both commercial developments and high-end residential construction. The demand here is for solutions that not only deliver on aesthetic fronts but also provide robust structural integrity, ensuring safety and enhancing the overall design of buildings and infrastructure.

Government and Defense Sectors

DMC Global's specialized products, particularly those from NobelClad, cater to the demanding requirements of government and defense sectors. These clients often need high-integrity materials for critical applications where safety and performance are paramount. For instance, NobelClad's ongoing work with the U.S. Navy demonstrates a direct engagement with this market.

Serving these sectors involves navigating complex procurement processes and meeting exceptionally stringent specifications. DMC Global's ability to provide reliable, high-performance solutions positions it as a valuable partner for defense contractors. The company's expertise in explosive metalworking is particularly relevant for applications requiring robust and specialized material joining techniques.

Key aspects of DMC Global's engagement with government and defense include:

- Meeting stringent material specifications: Defense projects demand materials that can withstand extreme conditions and meet rigorous safety standards.

- Navigating complex procurement: Understanding and adapting to government bidding and contracting processes is crucial for success.

- Providing specialized solutions: Applications like naval shipbuilding and aerospace often require advanced joining technologies, such as those offered by NobelClad.

- Ensuring supply chain reliability: Government and defense clients require a dependable supply of critical components.

Specialized Niche Markets

DMC Global actively targets specialized niche markets, leveraging its advanced engineering capabilities for highly specific product needs. These segments, often characterized by unique technical requirements, benefit from the company’s ability to provide differentiated, tailored solutions. For instance, in 2024, DMC Global’s commitment to these smaller, focused areas contributed to its diverse revenue streams, with specialized applications in areas like advanced materials for aerospace and niche components for medical devices showing steady growth.

The company's asset-light manufacturing approach is a key enabler for serving these specialized markets. This flexibility allows DMC Global to adapt production and develop bespoke products efficiently, catering to the precise specifications of clients in sectors such as high-performance coatings or specialized industrial equipment. This strategic focus on niche areas underscores DMC Global's ability to capture value in segments that may be overlooked by larger, more commoditized manufacturers.

Key aspects of DMC Global's strategy for specialized niche markets include:

- Targeted Product Development: Creating highly engineered solutions for specific customer needs.

- Flexibility in Manufacturing: Utilizing an asset-light model to adapt to unique production demands.

- Differentiated Solutions: Offering unique products that command premium pricing and address unmet market gaps.

- Strategic Market Entry: Identifying and serving smaller, focused segments with high technical barriers to entry.

DMC Global's customer base is diverse, spanning the energy sector, industrial manufacturing, and infrastructure development. These segments require specialized, high-performance materials and solutions to operate effectively in demanding environments.

The company's DynaEnergetics division serves global energy companies, including oil and gas producers, by providing essential products for well completions. In 2024, the energy market's continued capital expenditure, with major companies reporting strong earnings, underscored the demand for such specialized equipment.

NobelClad, another key division, caters to industrial manufacturers and processors, particularly in sectors like chemical processing and shipbuilding. Their explosion-welded clad metal is critical for building corrosion-resistant equipment, a need highlighted by the ongoing demand for durable industrial infrastructure.

Furthermore, DMC Global's Arcadia business supplies architectural building products to infrastructure development and construction firms. With global construction spending projected to exceed $14.5 trillion in 2024, this segment represents a significant market for aesthetically pleasing yet structurally sound building materials.

The company also serves niche markets, including government and defense sectors, requiring exceptionally high-integrity materials for critical applications. Their asset-light manufacturing approach allows for flexibility in meeting the unique and often stringent specifications of these specialized clients.

| Customer Segment | DMC Global Division | Key Needs | 2024 Market Context |

|---|---|---|---|

| Global Energy Companies | DynaEnergetics | Well completion products, efficiency solutions | Robust capital expenditures, strong company earnings |

| Industrial Manufacturers & Processors | NobelClad | Corrosion-resistant materials, high-performance metals | Continued demand for durable industrial infrastructure |

| Infrastructure Development & Construction | Arcadia | Architectural building products, structural integrity | Global construction spending projected over $14.5 trillion |

| Government & Defense | NobelClad | High-integrity materials, specialized components | Stringent specifications for critical applications |

| Specialized Niche Markets | Various | Tailored solutions, unique technical requirements | Growth in specialized applications (aerospace, medical) |

Cost Structure

DMC Global's Cost of Goods Sold (COGS) is a major component of its expenses, covering raw materials, direct labor, and manufacturing overhead for its engineered products. The company's focus on specialized, high-performance solutions means that the cost of premium materials and the wages for skilled manufacturing personnel are significant. For instance, in the first quarter of 2024, DMC Global reported COGS of $247.6 million, reflecting the substantial investment in these critical inputs.

DMC Global's commitment to innovation means significant investment in Research and Development, a key component of its cost structure. These expenditures are vital for developing differentiated products and maintaining a competitive edge. In 2023, DMC Global reported R&D expenses of $24.7 million, reflecting its ongoing dedication to technological advancement and new product creation.

Selling, General, and Administrative (SG&A) expenses, encompassing sales, marketing, administrative salaries, corporate overhead, and professional services, represent a substantial component of DMC Global's cost structure. These expenditures are crucial for sustaining the company's worldwide operations, fostering customer engagement, and executing strategic growth plans. For instance, in 2023, DMC Global reported SG&A expenses of $179.7 million, reflecting investments in these vital areas.

Efficient management of these SG&A costs is paramount for bolstering DMC Global's overall profitability. By optimizing spending in sales and marketing, streamlining administrative functions, and controlling corporate overhead, the company can enhance its bottom line. This focus on cost control allows for greater resource allocation towards innovation and market expansion.

Capital Expenditures and Maintenance

DMC Global incurs significant costs for capital expenditures, primarily focused on upgrading and maintaining its manufacturing facilities and equipment. These are not one-off expenses but rather ongoing investments to keep operations competitive and efficient.

While the company strives for an asset-light approach, strategic capital investments are crucial. For instance, in 2023, DMC Global reported capital expenditures of approximately $36 million, a portion of which was allocated to enhancing automation and infrastructure. These investments are designed to boost production capacity and streamline operations, ensuring the long-term health of their manufacturing capabilities.

- Ongoing Facility Upgrades: Costs associated with modernizing and maintaining manufacturing plants and machinery are continuous.

- Strategic Automation Investments: Expenditures on automation and infrastructure are necessary to improve efficiency and output, even within an asset-light strategy.

- Ensuring Production Viability: These capital outlays are essential for sustaining and enhancing the company's production capabilities over time.

Debt Servicing and Financial Costs

DMC Global incurs costs through interest expenses and other financial charges tied to its debt. In 2023, for example, the company reported interest expense of $20.5 million. This outflow directly affects its bottom line and available cash for operations and investment.

The company's strategy involves actively deleveraging its balance sheet and carefully managing its debt levels. This approach aims to bolster financial flexibility, allowing for greater adaptability in its operations and strategic planning. For instance, DMC Global has been working to reduce its overall debt burden, which can lead to lower future interest payments.

- Interest Expense: In 2023, DMC Global's interest expense was $20.5 million.

- Debt Management Focus: The company prioritizes deleveraging to improve financial flexibility.

- Impact on Profitability: Financial costs directly reduce net income and cash flow available to the business.

DMC Global's cost structure is heavily influenced by its operational scale and strategic investments. Key expense categories include the Cost of Goods Sold (COGS), Research and Development (R&D), Selling, General, and Administrative (SG&A) expenses, capital expenditures, and financing costs.

The company's commitment to specialized products means raw material and skilled labor costs are significant within COGS. For Q1 2024, COGS was $247.6 million. R&D, crucial for innovation, stood at $24.7 million in 2023. SG&A expenses, covering sales, marketing, and administration, totaled $179.7 million in 2023.

Capital expenditures, such as the $36 million in 2023, support facility upgrades and automation to maintain efficiency. Financing costs, including $20.5 million in interest expense in 2023, are also a notable part of the cost structure, with the company actively managing its debt.

| Expense Category | 2023 (Millions USD) | Q1 2024 (Millions USD) | Notes |

|---|---|---|---|

| Cost of Goods Sold (COGS) | N/A | 247.6 | Reflects materials, direct labor, and overhead for engineered products. |

| Research & Development (R&D) | 24.7 | N/A | Investment in product innovation and technological advancement. |

| Selling, General & Administrative (SG&A) | 179.7 | N/A | Covers sales, marketing, administrative salaries, and corporate overhead. |

| Capital Expenditures | 36.0 | N/A | Investments in manufacturing facilities, equipment, and automation. |

| Interest Expense | 20.5 | N/A | Costs associated with the company's debt obligations. |

Revenue Streams

DMC Global's core revenue generation stems from selling specialized, engineered products to the global energy sector, primarily via its DynaEnergetics segment. These offerings are crucial for oil and gas well completions and various other energy-related operations.

The financial performance within this revenue stream is closely tied to the ebb and flow of global energy markets and the demand for sophisticated completion tools. For instance, in 2023, the energy sector's activity levels directly impacted the sales volume of these highly engineered products.

DMC Global's NobelClad business is the primary driver for revenue generated through product sales to the industrial sector. This involves selling specialized composite metal products, crucial for industries that demand high-integrity materials for challenging applications.

These sales are often structured as project-based transactions, but the company also secures long-term contracts, providing a more predictable revenue flow. For instance, in 2023, DMC Global reported that its NobelClad segment generated approximately $207.8 million in revenue, highlighting the significance of this industrial sales channel.

DMC Global generates revenue by selling architectural building products through its Arcadia division. These products cater to a range of projects, from large-scale infrastructure and commercial developments to luxury residential homes. The success of this revenue stream is closely tied to the overall health of the construction industry and the specific demand for their specialized materials and systems.

In 2024, the architectural products segment saw continued demand, reflecting a robust construction market. For instance, Arcadia reported strong order backlogs, driven by projects requiring high-performance and aesthetically pleasing building components. This segment's performance is a key indicator of broader economic activity within the construction sector.

Service and Support Fees

Beyond direct product sales, DMC Global likely diversifies its income through specialized service and support fees. These offerings are crucial for ensuring their engineered solutions perform optimally and for fostering strong customer relationships. Think of it as ongoing value that extends well past the initial purchase.

These revenue streams can take various forms, adding a layer of recurring income and customer stickiness. They are designed to support customers throughout the lifecycle of DMC Global's products and solutions.

- Technical Support: Providing expert assistance to troubleshoot issues and ensure seamless operation of their products.

- Maintenance Contracts: Offering ongoing upkeep and preventative care to maximize product longevity and performance.

- Consulting Services: Leveraging their expertise to advise clients on optimal application and integration of their engineered solutions.

- Training Programs: Educating customer personnel on the effective use and maintenance of DMC Global's offerings.

New Product and Market Expansion

DMC Global anticipates future revenue growth driven by the launch of innovative new products and strategic expansion into new geographic territories or underserved market segments. This proactive approach diversifies revenue streams and strengthens market position.

The company's commitment to research and development, coupled with targeted strategic initiatives, is designed to pinpoint and leverage emerging growth opportunities. For instance, in 2024, DMC Global continued to invest in its R&D pipeline, aiming to bring next-generation solutions to market that address evolving customer needs and industry trends.

- New Product Development: Focus on launching high-margin, differentiated products in 2024, contributing to revenue diversification.

- Market Expansion: Targeting specific international markets in 2024 where demand for specialized industrial products is projected to grow.

- R&D Investment: Increased R&D spending in 2024 to fuel innovation and identify future revenue drivers.

- Strategic Partnerships: Exploring collaborations in 2024 to accelerate market entry and product adoption.

DMC Global's revenue streams are multifaceted, originating from its core business segments: DynaEnergetics, NobelClad, and Arcadia. DynaEnergetics generates revenue through the sale of specialized engineered products vital for oil and gas well completions. NobelClad contributes revenue by supplying composite metal products to industries requiring high-integrity materials, often through project-based sales and long-term contracts. Arcadia, the architectural products division, earns revenue from selling building components for various construction projects, reflecting the health of the construction sector.

Beyond product sales, DMC Global also derives income from technical support, maintenance contracts, consulting, and training services. These service-based revenues enhance customer relationships and provide a more predictable income stream, supporting the lifecycle of their engineered solutions. The company's strategy for future revenue growth centers on new product development and expansion into new markets, with significant R&D investment planned for 2024 to drive innovation.

| Segment | Primary Revenue Source | 2023 Revenue (Approx.) | Key Market Drivers |

|---|---|---|---|

| DynaEnergetics | Engineered Products for Energy Sector | N/A (Segmented data not provided separately for 2023) | Global energy market activity, demand for completion tools |

| NobelClad | Composite Metal Products for Industrial Sector | $207.8 million | Industrial demand for high-integrity materials, project cycles |

| Arcadia | Architectural Building Products | N/A (Segmented data not provided separately for 2023) | Construction industry health, demand for specialized building components |

Business Model Canvas Data Sources

The DMC Global Business Model Canvas is meticulously constructed using a blend of proprietary customer data, global market intelligence reports, and internal financial statements. This comprehensive approach ensures that every facet of the business model is grounded in verifiable evidence and strategic foresight.