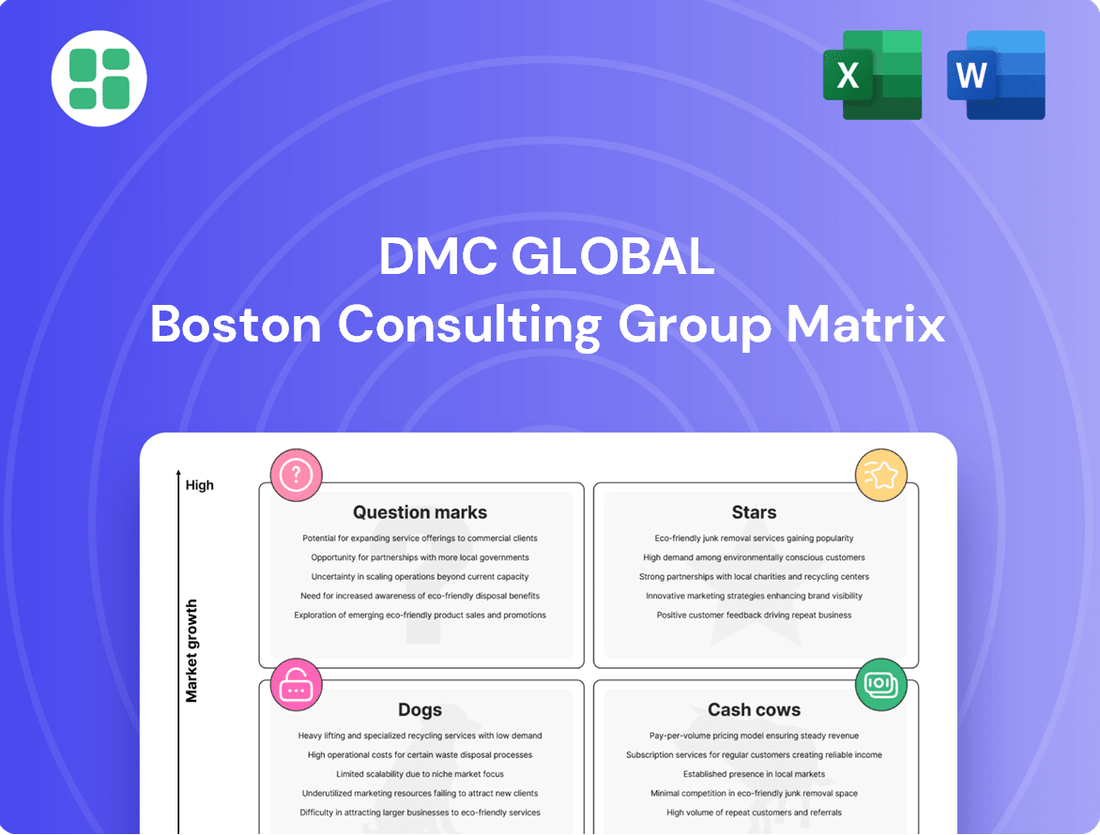

DMC Global Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

Unlock the strategic potential of DMC Global by understanding its product portfolio through the lens of the BCG Matrix. This powerful framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of market position and growth opportunities. Don't miss out on the actionable insights that can drive your business forward.

Dive deeper into DMC Global's strategic positioning with the complete BCG Matrix. This comprehensive report provides detailed quadrant analysis and data-driven recommendations, empowering you to make informed decisions about resource allocation and future investments. Purchase the full version for a clear roadmap to optimizing your product mix and achieving sustainable growth.

Stars

DynaEnergetics, a key player in DMC Global's portfolio, is strategically positioned within the perforating systems market. Their commitment to innovation, exemplified by the DS product line launched since 2015, addresses the evolving needs of the oil and gas industry. This focus on advanced technology is critical in a sector that, despite broader market challenges, sees a projected growth in the perforating gun segment, with North America anticipated to be a primary driver of this expansion.

NobelClad's exploration of clad products for concentrating solar power (CSP) facilities positions them within a burgeoning renewable energy sector. This strategic focus on CSP, a segment currently representing a modest portion of the market, signals DMC Global's ambition to capitalize on the projected growth in sustainable energy infrastructure.

The global push towards decarbonization is a significant tailwind for CSP. By 2024, the global CSP market was valued at approximately $3.8 billion, with projections indicating substantial growth driven by government incentives and the increasing need for reliable, dispatchable renewable power. NobelClad's investment here is a forward-looking play to establish a foothold in this high-potential, emerging technology.

Arcadia, within the DMC Global portfolio, is navigating a challenging construction market by strategically emphasizing its commercial exterior products, especially in the western and southwestern United States. This focus aims to bolster its standing in specific commercial sectors that show promise for growth.

By optimizing its operational costs and concentrating its resources, Arcadia is positioning itself to gain market share and improve profitability in these targeted regions. This strategic pivot is crucial for Arcadia's performance, especially considering the broader construction sector's headwinds.

DynaEnergetics' Manufacturing Automation Initiatives

DynaEnergetics is focusing on manufacturing automation and advanced product design to boost its adjusted EBITDA margins and operational efficiency. These strategic moves are designed to make their operations more cost-effective and elevate product quality, crucial for capturing market share in the perforating gun sector, which is experiencing modest growth.

These investments in operational enhancements are foundational for DynaEnergetics' sustained growth and profitability. For instance, DMC Global reported that in the first quarter of 2024, their adjusted EBITDA margin for the DynaEnergetics segment reached 18.7%, up from 16.2% in the same period of 2023, demonstrating the early impact of these initiatives.

- Manufacturing Automation: Investments are being made to streamline production processes at DynaEnergetics.

- Product Design Enhancements: Focus on innovating perforating gun technology to improve performance and reliability.

- Efficiency Gains: Automation is expected to reduce labor costs and increase throughput.

- Market Share Growth: Improved cost-effectiveness and product quality are key drivers for competitive advantage.

Engineered Solutions for Critical Infrastructure

DMC Global's strategic focus on engineered solutions for critical infrastructure is a key driver for future growth. As global infrastructure needs escalate, the company is well-positioned to capitalize on demand for highly specialized products and services. This emphasis suggests a commitment to investing in areas with significant potential for high-growth niches within the infrastructure sector.

The company's approach to critical infrastructure aligns with increasing global investment in this area. For instance, the U.S. Infrastructure Investment and Jobs Act, passed in 2021, allocated substantial funding towards improving roads, bridges, public transit, water pipes, and broadband internet. This trend is mirrored globally, creating a robust market for engineered solutions.

- Market Demand: Global infrastructure spending is projected to reach trillions of dollars in the coming years, driven by aging systems and new development needs.

- Specialized Solutions: DMC Global's expertise in engineered products allows it to address complex challenges within infrastructure projects, creating value beyond standard offerings.

- Growth Potential: By targeting high-potential niches within the infrastructure market, the company aims to achieve above-average growth and market share.

- Strategic Investments: Future capital allocation is likely to favor the development and expansion of these specialized infrastructure-focused capabilities.

DynaEnergetics, with its advanced perforating systems, operates in a segment of the oil and gas industry poised for modest growth. The company's focus on manufacturing automation and product design enhancements is driving improved operational efficiency and profitability. By Q1 2024, DynaEnergetics achieved an adjusted EBITDA margin of 18.7%, a notable increase from 16.2% in Q1 2023, underscoring the success of these strategic initiatives in a market segment that benefits from technological innovation.

| Segment | Key Focus | 2024 Performance Indicator | Market Trend |

|---|---|---|---|

| DynaEnergetics | Perforating Systems, Automation | Q1 2024 Adj. EBITDA Margin: 18.7% (vs. 16.2% in Q1 2023) | Modest growth in perforating gun segment, North America a key driver. |

| NobelClad | Clad Products for CSP | N/A (Emerging Market Focus) | Global CSP market valued at ~$3.8 billion in 2024, projected substantial growth. |

| Arcadia | Commercial Exterior Products | N/A (Strategic Market Share Focus) | Navigating challenging construction market, emphasizing growth in western/southwestern US. |

What is included in the product

This BCG Matrix analysis identifies DMC Global's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market share and growth.

The DMC Global BCG Matrix provides a clear, one-page overview of each business unit's position, relieving the pain of complex portfolio analysis.

Cash Cows

DynaEnergetics' Core Perforating Systems, a key component of DMC Global, has historically been a powerhouse, consistently contributing significantly to consolidated net sales. This strong market leadership in the energy sector highlights its established brand and extensive product portfolio, which continue to be robust cash generators.

Even with recent market headwinds, DynaEnergetics benefits from its well-developed sales, supply chain, and distribution infrastructure. These existing networks mean that maintaining its strong cash flow generation requires comparatively minimal new investment, reinforcing its position as a cash cow.

NobelClad's standard clad metal products, a cornerstone of DMC Global's portfolio, operate within mature industries like oil and gas, and chemical processing. This segment is a classic Cash Cow, consistently generating substantial revenue and profit for the company. In 2024, DMC Global reported that its NobelClad segment, which includes these clad metal products, generated approximately $300 million in revenue, showcasing its stable and significant contribution.

The mature market position for NobelClad's clad metals, coupled with its proprietary explosion-welding technology, allows for efficient production and high-quality output. This operational excellence translates into reliable and predictable cash flow, reinforcing its Cash Cow status. The company’s investment in these established product lines continues to yield strong returns with minimal need for further aggressive growth investment.

Arcadia's commercial division, a cornerstone of DMC Global, operates as a cash cow due to its established base in architectural framing systems, curtain walls, and entrances. This segment boasts a highly diversified and long-tenured customer base, providing a predictable revenue stream even amidst broader construction market fluctuations.

Despite potential headwinds in the overall construction sector, Arcadia's commercial division benefits from strong customer loyalty and an efficient manufacturing infrastructure. These factors contribute to its reliable cash generation, underscoring its position as a stable performer within the company's portfolio.

In 2024, DMC Global reported that its Arcadia segment continued to demonstrate resilience. The company highlighted that its focus on exceptional customer service and unwavering product quality were key drivers in maintaining market share and ensuring consistent cash flow from this division.

NobelClad's Global Manufacturing and Supply Network

NobelClad, a key player in DMC Global's portfolio, operates as a strong Cash Cow. Its manufacturing strength is anchored by facilities in Pennsylvania and Germany, enabling significant production capacity to serve a worldwide clientele.

This robust global manufacturing and supply network allows NobelClad to efficiently handle large-scale projects. For instance, in 2023, NobelClad secured a significant contract for a major petrochemical project in the Middle East, demonstrating its capability to deliver complex, high-volume orders across continents. This consistent order fulfillment is a direct contributor to its reliable cash generation.

- Global Reach: Manufacturing plants in Pennsylvania and Germany support a worldwide customer base.

- Project Capacity: Infrastructure enables efficient delivery of large-scale projects globally.

- Market Leadership: The established network underpins its leading position in specialized clad metals.

- Cash Generation: Consistent order fulfillment and reliable supply chain drive dependable cash flow.

DynaEnergetics' Established International Operations

DynaEnergetics' established international operations serve as a significant cash cow for DMC Global. Beyond its strong North American presence, the company actively operates in various international markets, creating a well-diversified revenue stream. This global footprint is crucial for stabilizing overall segment performance and cash flow, especially given the inherent volatility in the U.S. onshore market.

These international ventures benefit from existing infrastructure and established customer relationships, making them a consistent and reliable source of revenue. For instance, in 2023, DynaEnergetics reported that its international segments contributed significantly to its overall financial health, with specific regions showing robust growth despite broader market fluctuations. This diversification helps mitigate risks and ensures a steady cash inflow.

- Global Reach: DynaEnergetics operates in key international markets, broadening its revenue base.

- Revenue Stabilization: International operations offset U.S. market volatility, ensuring consistent cash flow.

- Leveraged Assets: Existing infrastructure and customer ties in global markets enhance revenue reliability.

- 2023 Performance: International segments demonstrated strong financial contributions, underscoring their cash cow status.

Cash Cows within DMC Global's portfolio represent established business segments or product lines that generate substantial and consistent profits with minimal need for further investment. These entities benefit from strong market positions and mature industries, ensuring a steady return on investment and contributing significantly to the company's overall financial stability.

NobelClad's standard clad metal products are a prime example, operating in stable sectors like oil and gas. In 2024, this segment generated approximately $300 million in revenue, highlighting its reliable cash generation capabilities. Similarly, Arcadia's commercial division, with its loyal customer base in architectural framing, consistently provides predictable revenue streams.

DynaEnergetics' international operations also function as a cash cow, leveraging existing infrastructure to offset market volatility and ensure steady cash inflow, as evidenced by their significant contributions to overall financial health in 2023.

| Segment | Role | Key Drivers | 2024 Revenue (Approx.) |

|---|---|---|---|

| NobelClad (Standard Clad Metal) | Cash Cow | Mature industries, proprietary technology | $300 million |

| Arcadia (Commercial Division) | Cash Cow | Diversified customer base, customer loyalty | N/A (Consistent Contribution) |

| DynaEnergetics (International Operations) | Cash Cow | Existing infrastructure, diversified markets | N/A (Significant Contribution in 2023) |

Preview = Final Product

DMC Global BCG Matrix

The DMC Global BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises—just a comprehensive, analysis-ready strategic tool. You can confidently use this preview to assess the quality and relevance of the report for your specific business needs, knowing the purchased version will be exactly the same. It's designed for immediate application in your strategic planning, providing clear insights into DMC Global's market position and product portfolio.

Dogs

Arcadia's high-end residential product line is currently struggling, largely due to persistently high interest rates and a general slowdown in the construction sector. This has led to a noticeable decline in sales for this segment.

The company is actively working to adjust its cost structure to better match the current market conditions, a process described as 'right-sizing'. This segment is consuming resources without generating sufficient returns, indicating it's a potential candidate for divestment or a significant reduction in focus.

Legacy DynaEnergetics Perforating Technologies likely reside in the Dogs quadrant of the BCG Matrix. These older, less differentiated perforating systems may be experiencing declining demand as the oil and gas industry increasingly adopts more advanced and efficient technologies. For instance, the market for conventional perforating guns might be shrinking as operators favor newer, faster, and more precise methods.

These legacy products could hold a low market share within a mature or even contracting segment of the energy sector. In 2024, the broader oilfield services market saw varied performance, with some segments experiencing pressure due to technological obsolescence and shifts in exploration and production strategies, which would impact older product lines.

Consequently, these legacy technologies likely generate minimal cash flow and represent capital that could be more effectively deployed into research and development for next-generation solutions or into higher-growth business units within DMC Global.

NobelClad's specialized clad metal products have been significantly impacted by recent tariff changes. These tariffs have directly led to a noticeable slowdown in new orders and a reduction in the company's overall order backlog, creating a challenging environment for these specific product lines.

The direct consequence of these tariffs is a squeeze on profitability for NobelClad's affected products. Furthermore, the uncertainty surrounding trade policy makes strategic investment for future growth in these areas difficult, potentially positioning them as low-growth, low-share assets within DMC Global's portfolio.

Underperforming Regional Markets (Arcadia)

Arcadia's performance, marked by a sales decline and EBITDA contraction, points to significant underperformance in certain regional markets. These areas likely struggle with low market share and intense local competition, or perhaps a slowdown in construction activity. For instance, in 2023, DMC Global's overall net sales were $562.2 million, a decrease from $613.8 million in 2022, indicating a broader trend that could be exacerbated by these specific underperforming regions.

DMC Global's strategic pivot towards its core commercial operations suggests a deliberate move away from these less productive segments. This focus aims to optimize resource allocation and enhance overall profitability.

- Sales Decline: DMC Global's net sales decreased by 8.4% from 2022 to 2023.

- EBITDA Contraction: While specific regional EBITDA figures are not publicly detailed, the overall EBITDA margin compression in 2023 compared to 2022 reflects challenges in less profitable segments.

- Strategic Shift: The company's focus on core commercial operations implies a divestment or de-emphasis on underperforming regional markets.

Commodity-Driven, Low-Margin DynaEnergetics Offerings

DynaEnergetics' commodity-driven offerings in U.S. markets are currently facing significant pricing pressure. This has led to a higher mix of lower-margin customers, impacting overall profitability. For instance, in 2024, the energy sector experienced volatile commodity prices, directly affecting the demand and pricing power for these types of products.

These products, while contributing to revenue, are characterized by poor profitability. This suggests a limited market share within more lucrative segments of the market. The company's focus on volume rather than value in these areas can be seen as a strategic challenge. In 2024, the average gross margin for commodity-exposed segments within the energy services sector saw a decline compared to previous years, reflecting this trend.

- Low Profitability: These offerings generate minimal profit, often barely covering costs.

- Cash Traps: They consume operational resources and capital without generating substantial returns.

- Intense Competition: The commodity-driven nature leads to fierce price competition, squeezing margins.

- Limited Market Share in Profitable Segments: The current product mix indicates a struggle to capture higher-margin business.

Products in the Dogs quadrant, like DynaEnergetics' legacy perforating technologies and certain NobelClad clad metal products, are characterized by low market share in slow-growing or declining industries. These segments often face challenges such as technological obsolescence or unfavorable trade policies, as seen with recent tariffs impacting NobelClad.

These offerings typically generate low profits and require significant investment to maintain, making them potential candidates for divestment or restructuring. For instance, DMC Global's overall net sales declined in 2023, highlighting the pressure on underperforming segments.

The strategic focus for these 'dog' products is often on minimizing cash outflow or exploring divestiture to reallocate capital to more promising areas of the business.

In 2024, the energy sector's volatility and technological shifts continued to pressure older oilfield technologies, impacting their market viability.

Question Marks

Arcadia's strategic expansion into new commercial geographies, such as the eastern U.S. or international markets, positions it as a potential 'Question Mark' within DMC Global's BCG Matrix. These ventures offer substantial growth potential for its architectural products, a sector that saw DMC Global's total revenue reach $1.3 billion in 2023, with the architectural products segment contributing significantly.

However, Arcadia's market share in these nascent regions is expected to be low initially, necessitating considerable investment to build brand awareness and distribution networks. This investment aligns with the characteristics of a Question Mark, where resources are allocated to capture future market share in promising but unproven territories.

DynaEnergetics' foray into digital wellsite solutions positions it within a rapidly expanding segment of the oil and gas industry, driven by the push for greater efficiency and data analytics. This strategic move aligns with broader industry trends where digitalization is paramount for informed decision-making.

As a new entrant or early developer in this specific digital niche, DynaEnergetics would likely hold a minimal market share. Significant investment would be necessary to establish a competitive presence and drive growth in this high-potential technology area.

NobelClad's proprietary explosion-welding technology holds promise for emerging green industries like advanced battery manufacturing and carbon capture systems. These sectors, while experiencing rapid growth, represent significant investment opportunities with potentially high future returns. For instance, the global green hydrogen market is projected to reach $123.4 billion by 2030, indicating substantial room for innovative material solutions.

Entering these nascent markets, however, necessitates substantial upfront investment in research and development, alongside dedicated market penetration strategies. This means initial profitability might be constrained due to high R&D expenditures and the need to build brand recognition in competitive new spaces. For example, companies developing new battery chemistries often spend hundreds of millions on R&D before seeing significant commercial returns.

Strategic Diversification into Adjacent Industrial Markets

Strategic diversification into adjacent industrial markets aligns with DMC Global's core mission of serving industrial and infrastructure sectors. This involves identifying and entering new markets where the company has limited current exposure but which exhibit strong growth potential. Such moves, while promising, necessitate significant initial capital outlay to establish a foothold and capture market share.

For example, if DMC Global were to explore expansion into the rapidly growing renewable energy component manufacturing sector, a market projected to see substantial growth through 2030, it would require substantial investment in specialized production facilities and research and development. This strategic pivot would aim to leverage existing manufacturing expertise while tapping into a new, high-demand area.

- Market Identification: Focus on industrial sectors with projected compound annual growth rates (CAGR) exceeding 5% in the next five years.

- Investment Requirements: Estimate upfront capital needs for new market entry, potentially ranging from $50 million to $200 million depending on the sector's intensity.

- Competitive Landscape: Analyze existing players and their market share to identify opportunities for differentiation and value creation.

- Synergistic Opportunities: Prioritize adjacent markets that can benefit from DMC Global's existing supply chains, technological capabilities, or customer relationships.

Investment in Advanced Materials Research

DMC Global's commitment to advanced materials research, particularly within its engineered products segment, positions it to potentially disrupt markets. While these research endeavors may currently represent a small market share, successful breakthroughs could propel them into high-growth 'Star' categories within the BCG matrix. This necessitates continued financial commitment to nurture these nascent innovations.

For instance, DMC Global's 2024 investments in areas like next-generation composites or specialized polymers could yield significant future returns. Such investments are critical for maintaining a competitive edge in rapidly evolving industries. The company’s strategic focus on differentiated offerings means that innovation in materials science is a core driver of its long-term value proposition.

- High-Growth Potential: Investment in advanced materials research aligns with DMC Global's strategy for differentiated businesses, aiming for future market leadership.

- Low Current Market Share: These research-intensive areas typically start with minimal market penetration, characteristic of question marks or early-stage stars.

- Transformation to Stars: Successful innovation can shift these segments into high-growth, high-market-share Stars, requiring ongoing capital allocation for scaling.

- Strategic Importance: Continued R&D funding is vital for DMC Global to maintain its competitive advantage and capitalize on emerging material science trends.

Question Marks in DMC Global's portfolio represent business units or ventures with low market share in high-growth industries. These require significant investment to develop and capture market share, with the potential to become Stars or fall into Dogs if unsuccessful. The company's strategic investments in areas like advanced materials and new geographic markets for architectural products exemplify this category. DMC Global's 2023 revenue of $1.3 billion underscores the scale of operations where such strategic bets are made.

| Business Unit/Venture | Industry Growth Potential | Current Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Arcadia (New Geographies) | High | Low | High | Star or Dog |

| DynaEnergetics (Digital Solutions) | High | Low | High | Star or Dog |

| NobelClad (Green Industries) | High | Low | High | Star or Dog |

| Strategic Diversification (Adjacent Markets) | High | Low | High | Star or Dog |

| Advanced Materials Research | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of financial disclosures, market research reports, and competitive intelligence to provide a robust strategic overview.