DMC Global Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMC Global Bundle

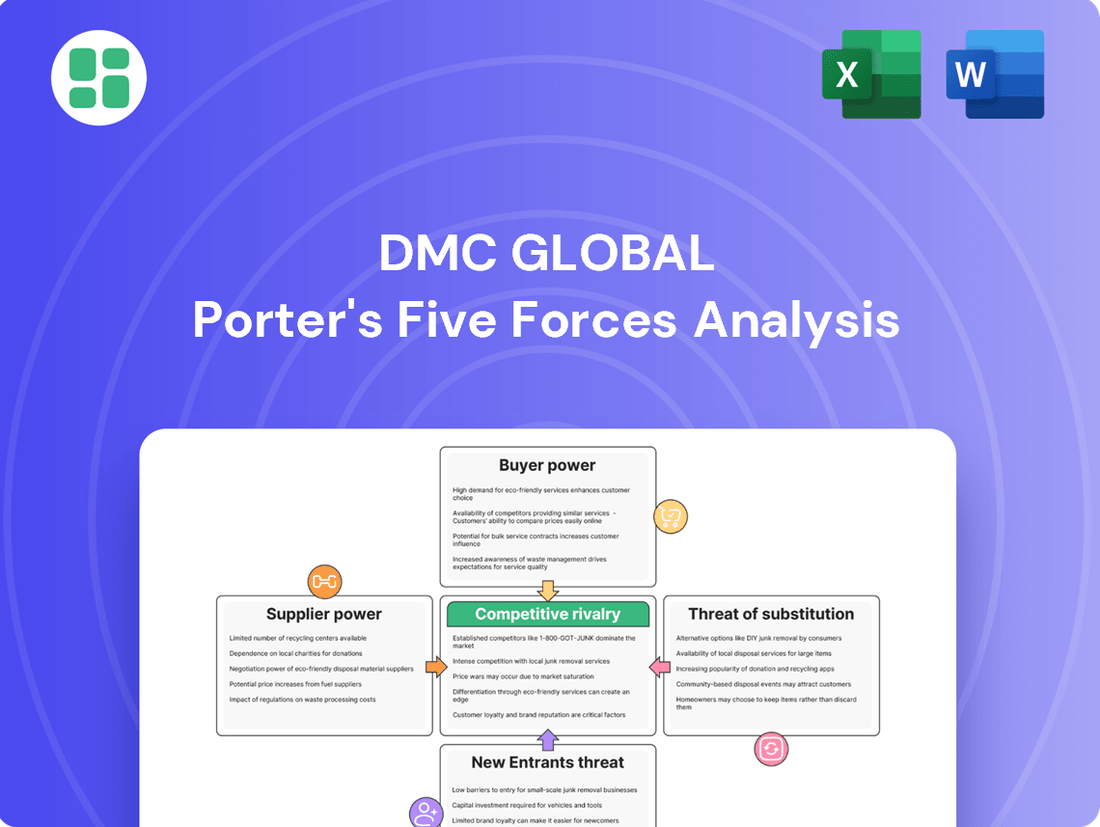

DMC Global faces moderate buyer power, as customers have some alternatives, but switching costs can be a deterrent. The threat of new entrants is also a significant factor, requiring constant innovation and cost management to maintain market share.

The complete report reveals the real forces shaping DMC Global’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for DMC Global is significantly influenced by supplier concentration and specialization. If DMC's key segments, such as DynaEnergetics and NobelClad, depend on highly specialized materials or components, and there are only a limited number of suppliers capable of providing these, those suppliers gain considerable leverage. This is particularly true when these specialized inputs are critical to DMC's engineered solutions.

DMC Global faces a significant challenge if switching suppliers involves substantial costs. For instance, if their specialized blasting services require highly engineered detonators, retooling production lines or requalifying new materials could easily run into hundreds of thousands, if not millions, of dollars. This makes it difficult for DMC to simply switch to a cheaper supplier without incurring these upfront expenses.

The threat of suppliers integrating forward into DMC Global's markets is a consideration, particularly if a key component supplier could realistically establish its own manufacturing or service operations. While DMC Global's specialized capabilities generally mitigate this, a supplier with significant investment and market insight might attempt to capture more value by moving into final product assembly or direct service provision.

Uniqueness of Inputs and Supplier Importance

The uniqueness of inputs significantly bolsters supplier bargaining power for DMC Global. When suppliers provide highly specialized raw materials or components that are difficult to substitute, they gain considerable leverage. For example, NobelClad's reliance on specific alloys for its clad metal products, or DynaEnergetics' need for specialized components in its perforating systems, means these suppliers hold more sway. This is particularly true if these inputs are critical to the performance and differentiation of DMC Global's end products.

The importance of these inputs to the final product's performance directly translates into increased supplier influence. If a supplier's material is essential for achieving a certain quality, efficiency, or unique feature in DMC Global's offerings, that supplier can command better terms. For instance, in 2023, DMC Global's NobelClad segment generated approximately $226.6 million in revenue, highlighting the commercial significance of its specialized clad metal products and, by extension, the critical nature of its input materials.

- Uniqueness of Inputs: Suppliers offering specialized materials or components not readily available elsewhere possess higher bargaining power.

- Criticality to Product Performance: Inputs vital for the performance and differentiation of DMC Global's products enhance supplier leverage.

- Supplier Importance to DMC Global: The reliance on specific suppliers for key technologies, such as those in NobelClad or DynaEnergetics, strengthens their position.

- Impact on Profitability: The cost and availability of these unique inputs can directly affect DMC Global's margins and competitive pricing.

Impact of Raw Material Volatility and Tariffs

Fluctuations in raw material prices and the imposition of tariffs can significantly shift the bargaining power of suppliers. When these costs rise, suppliers are often in a stronger position to pass them on to companies like DMC Global, directly impacting input costs and profit margins. For instance, recent reports highlight tariff uncertainty affecting segments such as NobelClad, which can empower material suppliers by increasing their leverage or directly escalating DMC Global's operational expenses.

This volatility creates a dynamic environment where suppliers can exert greater influence, particularly if they are concentrated or if the raw materials are critical and difficult to substitute. Companies must closely monitor global trade policies and commodity markets to mitigate these risks.

- Tariff Uncertainty: Trade policies can directly affect the cost of key materials, giving suppliers more pricing power.

- Raw Material Dependence: Reliance on specific, volatile raw materials increases supplier leverage.

- Cost Pass-Through: Suppliers can leverage market conditions to pass increased costs onto buyers like DMC Global.

The bargaining power of suppliers for DMC Global is amplified when inputs are unique and critical to product performance, as seen in its specialized segments like NobelClad and DynaEnergetics. For example, NobelClad's reliance on specific alloys for clad metal products means suppliers of these materials hold significant sway. This is further compounded by the difficulty and cost associated with switching suppliers, which can involve substantial retooling and requalification expenses, potentially running into hundreds of thousands of dollars.

| Factor | Impact on DMC Global | Example/Data Point |

|---|---|---|

| Uniqueness of Inputs | High leverage for suppliers | Specialized alloys for NobelClad |

| Switching Costs | Limits DMC Global's flexibility | Potential millions in retooling/requalification |

| Criticality to Performance | Suppliers can command better terms | Inputs vital for performance in DynaEnergetics |

| Tariff Uncertainty | Increases supplier pricing power | Impact on NobelClad's material costs |

What is included in the product

This analysis unpacks the competitive intensity within DMC Global's operating industries, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly navigate competitive landscapes and identify your strategic advantage with a visual, actionable breakdown of DMC Global's market pressures.

Customers Bargaining Power

DMC Global's customer base, particularly within the energy, industrial, and infrastructure sectors, often comprises major corporations and government bodies. The concentration of revenue from a few key clients significantly amplifies their bargaining leverage, enabling them to push for reduced pricing and more advantageous contract conditions.

Customers wield significant bargaining power when a plethora of substitute products or services are readily available. This allows them to switch suppliers with minimal cost or effort if they are unsatisfied with pricing or terms. For instance, in the industrial sector where DMC Global operates, while specialized solutions are valued, the existence of alternative, albeit less engineered, methods for achieving similar outcomes can empower buyers.

Customer price sensitivity is a significant factor impacting DMC Global, especially in mature markets where competition is fierce. When customers have many alternatives, they tend to shop around for the best deals, which naturally gives them more leverage. For instance, in 2023, the industrial manufacturing sector, a key market for DMC Global, saw increased price competition as companies focused on efficiency.

Threat of Backward Integration by Customers

The threat of backward integration by customers can significantly impact DMC Global's market position. If key customers possess the capability to manufacture DMC Global's specialized products or services internally, their leverage to negotiate lower prices or more favorable terms intensifies. This is particularly relevant for more commoditized offerings within DMC Global's portfolio, where the technical barriers to entry for customers might be lower.

For highly engineered or proprietary solutions, the likelihood of customer backward integration is generally reduced due to the specialized knowledge, capital investment, and established processes required. However, large-scale customers, especially those with substantial R&D and manufacturing capacity, might explore this option for standard components to gain greater control over their supply chain and costs. For instance, a major automotive manufacturer might consider in-house production of certain specialized fasteners if the volume justifies the investment and the technology is not overly complex.

- Customer Capability: Assess the technical and financial capacity of DMC Global's major customers to replicate its specialized product lines.

- Proprietary Nature: Evaluate the degree to which DMC Global's offerings are protected by patents, unique manufacturing processes, or specialized expertise.

- Customer Size and Volume: Consider whether the volume of business a customer provides is substantial enough to make backward integration economically viable for them.

- Industry Trends: Monitor broader industry shifts where customers are increasingly bringing manufacturing in-house for strategic components.

Product Differentiation and Importance to Customer's Business

The bargaining power of customers for DMC Global is significantly influenced by how unique their products are and how vital they are to a customer's operations. If DMC Global's offerings are easily substitutable or not central to a client's business, customers gain more leverage. For instance, if a customer can readily find similar components from competitors, they can demand lower prices or better terms.

Conversely, when DMC Global provides engineered solutions that demonstrably boost a customer's performance, efficiency, or safety, their bargaining power diminishes. A strong example would be a specialized component that directly improves a manufacturing line's output or reduces a critical failure rate. In 2023, companies that invested in advanced materials and custom solutions often saw improved operational metrics, making them less sensitive to price fluctuations and more reliant on the supplier's specialized capabilities.

- Product Differentiation: The less differentiated DMC Global's products are, the more power customers possess.

- Customer's Business Importance: If DMC Global's products are not critical to a customer's core operations, customer power increases.

- Performance Enhancement: When DMC Global's engineered solutions significantly improve customer performance, productivity, or safety, customer power is reduced.

- Market Trends: In 2023, industries prioritizing efficiency and safety demonstrated a greater willingness to pay for specialized solutions, thereby reducing their bargaining power with suppliers of such innovations.

DMC Global's customers, particularly large industrial clients, possess considerable bargaining power due to the availability of alternative suppliers and the potential for backward integration. This leverage is amplified when customers are price-sensitive or when DMC Global's offerings are not highly differentiated. For instance, in 2023, the industrial sector experienced heightened price competition, giving buyers more negotiating room.

The bargaining power of DMC Global's customers is directly tied to the uniqueness and criticality of its products. When solutions are easily substitutable or not essential to a client's operations, customers gain leverage, often demanding lower prices. Conversely, engineered solutions that demonstrably enhance customer performance, like those improving manufacturing efficiency, reduce customer power. In 2023, industries focused on operational gains showed less price sensitivity for specialized components.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2023) |

|---|---|---|

| Availability of Substitutes | Increases Power | Industrial sector saw increased price competition, offering customers more alternatives. |

| Backward Integration Potential | Increases Power | Large customers may consider in-house production of standard components to control costs. |

| Product Differentiation | Decreases Power (if high) | Highly engineered solutions that improve customer performance reduce their leverage. |

| Customer Price Sensitivity | Increases Power | Mature markets with fierce competition lead customers to seek the best deals. |

Full Version Awaits

DMC Global Porter's Five Forces Analysis

This preview displays the complete DMC Global Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can confidently expect this professionally formatted analysis to be ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

DMC Global's primary markets, including energy, industrial, and infrastructure, are generally considered mature. This maturity means growth rates are often more moderate and can be significantly influenced by broader economic cycles. For instance, the energy sector's performance is closely tied to global demand and commodity prices, which can lead to cyclical fluctuations in demand for DMC's products.

In mature industries, slower growth typically amplifies competitive rivalry. Companies often find themselves vying more aggressively for existing market share rather than capitalizing on rapidly expanding markets. This dynamic is evident in sectors where DMC Global operates, such as the energy and high-end residential construction markets, which have presented challenges due to their sensitivity to economic downturns and shifting demand patterns.

DMC Global operates in markets characterized by a significant number of competitors, ranging from large, diversified corporations to highly specialized niche players. This broad competitive landscape inherently fuels intense rivalry across its various business segments.

Within the energy sector, for instance, DMC Global faces direct competition from established entities like Core Laboratories and Oil States International. This presence of formidable rivals often translates into aggressive pricing strategies and heightened marketing expenditures as companies vie for market share and customer loyalty.

DMC Global's focus on differentiated products and engineered solutions aims to reduce competitive rivalry. However, the actual uniqueness and replicability of these offerings are key. If competitors can easily mimic these solutions, the advantage diminishes.

The level of customer switching costs significantly impacts rivalry. For instance, in the industrial sector, if a customer can easily switch from one supplier to another with minimal disruption or cost, the pressure to compete on price increases. This was evident in some segments of the industrial manufacturing market in 2024, where pricing pressures were reported due to readily available alternatives.

Exit Barriers for Competitors

High exit barriers can significantly impact competitive rivalry within DMC Global's operating segments. These barriers, such as specialized machinery or substantial investments in unique technology, make it costly for companies to leave the market, even if they are not profitable. This situation can force struggling competitors to remain active, potentially engaging in aggressive pricing to cover fixed costs and maintain operations.

For instance, in industries where specialized assets are prevalent, like certain manufacturing sectors, the resale value of these assets might be low, or they may have no alternative use. This locks companies into the existing market, intensifying competition. In 2023, some industrial manufacturing sub-sectors experienced prolonged periods of low profitability due to these entrenched players, as reported by industry analysis firms.

- Specialized Assets: High capital expenditure on unique equipment or facilities that have limited alternative uses.

- Long-Term Contracts: Commitments to suppliers or customers that are difficult and expensive to break.

- Sunk Costs: Investments in research and development, brand building, or market entry that cannot be recovered.

Strategic Commitments and Aggressiveness of Rivals

The strategic objectives and aggressiveness of competitors significantly shape the competitive rivalry within DMC Global's markets. If rivals are actively pursuing aggressive growth, engaging in price wars, or making substantial investments in new technologies, DMC Global faces intensified pressure to defend its market share and profitability.

For instance, in the industrial products sector, competitors like Dover Corporation have historically demonstrated aggressive acquisition strategies, aiming to consolidate market share and expand their product portfolios. This strategic commitment to growth can directly impact pricing dynamics and innovation cycles, forcing DMC Global to respond with its own strategic investments or cost-containment measures to remain competitive.

- Competitor Growth Strategies: Rivals pursuing aggressive expansion, such as through mergers and acquisitions, can alter market landscapes and increase competitive intensity for DMC Global.

- Price Wars: Competitors engaging in price-cutting strategies to gain market share can erode profit margins for all players, including DMC Global.

- Technological Investment: Significant R&D spending by competitors on new technologies can create disruptive threats, requiring DMC Global to invest similarly to avoid falling behind.

- Market Share Dynamics: In 2024, key competitors in the diversified industrial products space, like Illinois Tool Works, continued to focus on operational efficiency and market penetration, indicating a sustained competitive environment.

Competitive rivalry is a significant force within DMC Global's operating segments, driven by mature markets and a substantial number of competitors. This intensity is often exacerbated by aggressive strategies from rivals, such as price wars or strategic acquisitions, forcing DMC Global to focus on differentiation and cost management to maintain its market position.

The presence of established players like Core Laboratories in the energy sector, and diversified entities such as Dover Corporation in industrial products, highlights the competitive pressure. In 2024, market analysis indicated that companies like Illinois Tool Works continued to prioritize operational efficiency, contributing to a sustained competitive environment across the industrial products landscape.

Customer switching costs also play a crucial role; low switching costs in certain industrial segments in 2024 meant increased price competition. Furthermore, high exit barriers, like specialized assets with limited resale value, can keep less profitable firms active, intensifying rivalry and potentially impacting profit margins for all participants.

SSubstitutes Threaten

The threat of substitutes for DMC Global is significant, particularly when alternatives offer a compelling price-performance balance. In the energy sector, for instance, advancements in drilling and completion technologies could present less capital-intensive or more efficient alternatives to DMC's existing offerings. For example, the global oil and gas market, while experiencing fluctuations, saw significant investment in unconventional extraction methods, potentially creating substitute solutions for traditional well completion techniques.

Similarly, in the architectural products segment, innovative building materials or integrated systems that provide comparable or superior insulation, structural integrity, or aesthetic appeal at a lower cost pose a direct threat. The construction industry is constantly evolving, with a growing emphasis on sustainable and cost-effective materials, meaning new substitutes could emerge rapidly.

Customers' willingness to switch to substitutes for DMC Global's products hinges on several factors. These include how they perceive the value offered by alternatives, how easily they can adopt these substitutes, and any costs involved in making the switch. For instance, if a competitor offers a similar product with a significantly lower price point and minimal integration challenges, DMC Global might see a higher propensity for customers to substitute.

The threat of substitution can be substantial, even for products that seem specialized. If the perceived benefits of switching to an alternative, such as cost savings or improved performance, are greater than the costs associated with changing suppliers or processes, customers are more likely to explore and adopt those substitutes. This dynamic is crucial for DMC Global to monitor as it directly impacts market share and pricing power.

Rapid technological advancements in adjacent sectors pose a significant threat of substitution for DMC Global's offerings. For instance, breakthroughs in advanced materials science or novel manufacturing processes could yield alternative solutions that are more cost-effective or offer superior performance in applications currently served by DMC Global's products, such as specialized industrial components or energy infrastructure. Companies in the semiconductor or advanced composites industries, for example, are constantly innovating, and a leap in their respective fields could directly impact demand for traditional metal-based or engineered products.

Indirect Substitutes and Changing Industry Practices

Beyond direct product replacements, evolving industry practices can introduce potent substitutes for DMC Global's products. For instance, a significant shift in how energy infrastructure is built or maintained, perhaps favoring entirely new materials or digital solutions over traditional components, could diminish the need for DMC's specialized metal products. Consider the burgeoning trend towards modular construction in the building sector, which might streamline processes and reduce reliance on some of the fabricated components DMC currently supplies.

Furthermore, changes in construction techniques or the adoption of alternative energy sources can indirectly impact demand. If the global push towards renewable energy, like solar or wind, leads to different infrastructure requirements, it might bypass the need for certain steel-intensive components that DMC Global specializes in. For example, the increasing use of advanced composite materials in wind turbine blades or advanced insulation in energy-efficient buildings could represent a substitution threat by altering the fundamental material needs of these growing sectors.

The threat is amplified when these shifts are driven by cost-efficiency or regulatory mandates. For example, if new building codes prioritize lighter, more sustainable materials, this could present a substitution risk for traditional steel or metal components. By mid-2024, the global construction market was increasingly focused on sustainability, with reports indicating a growing preference for materials with a lower carbon footprint, a trend that could indirectly impact demand for traditional metal-based solutions.

- Shifting construction methodologies: Adoption of modular or pre-fabricated building techniques may reduce the need for on-site fabrication services.

- Alternative energy infrastructure: Growth in renewable energy sectors could favor different material science solutions, potentially bypassing traditional metal components.

- Material innovation: Increased use of advanced composites or novel alloys in infrastructure projects could displace conventional steel and metal products.

- Sustainability mandates: Evolving environmental regulations may drive demand towards lower-carbon footprint materials, posing a substitution risk for certain DMC Global offerings.

Regulatory or Environmental Shifts Favoring Substitutes

New environmental regulations or growing sustainability mandates can significantly boost the appeal of substitute products or processes. For instance, if stricter emissions standards are implemented, alternatives that offer lower environmental impact could become more attractive to customers, directly challenging DMC Global's existing offerings.

This shift could lead to increased adoption of these substitutes, potentially eroding DMC Global's market share. For example, a hypothetical scenario where a new carbon tax is introduced in 2024 could make energy-efficient alternatives to traditional industrial materials more cost-competitive.

Consider the following impacts:

- Increased customer demand for greener alternatives.

- Potential for higher pricing on compliant substitutes.

- Need for DMC Global to invest in sustainable R&D.

- Risk of losing market share to environmentally friendly competitors.

The threat of substitutes for DMC Global is influenced by the emergence of alternative materials and technologies that offer comparable or superior performance at a competitive price point. For example, the increasing adoption of advanced composites in the aerospace and automotive sectors, driven by their lightweight and high-strength properties, could represent a substitute for certain engineered metal products. In 2024, the global advanced composites market was projected to reach over $25 billion, indicating a significant and growing area of potential substitution.

Customer willingness to switch is also a key factor, often driven by cost savings, improved efficiency, or adherence to new regulatory standards. If alternative construction materials, such as engineered wood or high-performance plastics, become more cost-effective or meet evolving sustainability requirements, they could displace traditional metal components. The construction industry's focus on reducing embodied carbon in 2024 further amplified this trend, with many projects actively seeking lower-impact materials.

Technological advancements in adjacent industries can also introduce indirect substitutes. For instance, innovations in energy efficiency or digital infrastructure management might reduce the demand for certain physical components that DMC Global provides. The global push for digitalization in infrastructure projects, a trend gaining momentum throughout 2024, could lead to a greater reliance on software and integrated systems over discrete, hardware-based solutions.

The threat of substitutes is particularly pronounced when switching costs for customers are low, and the perceived benefits of the alternative are high. For example, if a new drilling fluid technology emerges that significantly reduces completion time and cost for oil and gas operations, it could directly substitute for existing methods that rely on DMC Global's specialized products. By mid-2024, the energy sector was actively exploring technologies aimed at optimizing extraction efficiency, a key driver for adopting innovative solutions.

| Industry Segment | Potential Substitute | Key Driver | Market Trend (2024 Focus) |

|---|---|---|---|

| Energy Infrastructure | Advanced Composites, Novel Alloys | Lightweighting, Corrosion Resistance | Increased investment in renewable energy infrastructure favoring specialized materials. |

| Architectural Products | Engineered Wood, High-Performance Plastics | Sustainability, Cost-Effectiveness | Growing demand for low-carbon footprint building materials and modular construction. |

| Industrial Components | Advanced Ceramics, 3D Printed Metals | High-Temperature Resistance, Customization | Industry 4.0 adoption driving demand for specialized, on-demand manufacturing solutions. |

Entrants Threaten

The energy, industrial, and infrastructure sectors, where DMC Global operates, demand substantial capital for manufacturing plants, specialized machinery, and ongoing research and development. For instance, building a new facility for producing specialized industrial components can easily cost tens to hundreds of millions of dollars, a significant hurdle for many aspiring companies.

DMC Global's existing, large-scale operations and integrated supply chains provide a distinct advantage. This established infrastructure allows them to achieve economies of scale, meaning they can produce goods at a lower per-unit cost than a smaller, newer competitor, making it harder for new entrants to compete on price.

DMC Global's strong emphasis on proprietary product technology and differentiation, particularly evident in its DynaEnergetics and NobelClad segments, presents a formidable barrier to new entrants. These highly engineered solutions, built on unique technological foundations, require substantial upfront investment in research and development for any competitor aiming to match or surpass DMC's capabilities.

For new companies trying to break into markets where DMC Global operates, getting access to established distribution channels and reliable supply chains presents a significant hurdle. Building these networks from scratch is often a costly and lengthy process, requiring substantial investment and time to gain traction.

DMC Global's existing, well-developed global distribution network and secure supply chain relationships offer a distinct competitive advantage. This infrastructure allows them to efficiently reach customers and manage their operations, making it harder for newcomers to compete on logistics and delivery speed.

Government Policy and Regulation

Government policy and regulation significantly impact the threat of new entrants for companies like DMC Global, particularly in its core markets of energy, industrial, and construction. Stringent environmental standards, such as those mandated by the EPA, and complex licensing requirements can create substantial hurdles for new companies aiming to enter these sectors. For instance, obtaining the necessary permits and demonstrating compliance with evolving emissions regulations can involve considerable time and capital investment, effectively raising the barrier to entry.

Compliance costs are a major deterrent. New entrants must absorb the expenses associated with meeting safety protocols, quality certifications, and environmental impact assessments. These upfront costs can be prohibitive, especially for smaller, less capitalized businesses. In 2024, the ongoing focus on sustainability and stricter carbon footprint regulations continues to add layers of complexity and expense for any new player in these industries.

- High Capital Requirements: Meeting regulatory standards often necessitates significant upfront investment in specialized equipment and compliance infrastructure.

- Licensing and Permitting Hurdles: Navigating the complex web of government approvals and licenses can be time-consuming and costly for new market participants.

- Evolving Regulatory Landscape: Changes in environmental and safety regulations, driven by policy shifts, require continuous adaptation and investment, posing a challenge for new entrants.

Brand Identity and Customer Loyalty

DMC Global benefits from strong brand identity and deep customer loyalty within its specialized markets, creating a significant barrier for potential new entrants. Years of consistent performance and reliable product delivery have fostered trust, particularly for engineered solutions where failure is not an option. For instance, in 2023, DMC Global's subsidiary, Arcadia, reported robust demand for its architectural products, underscoring the value of its established reputation.

New companies entering these niche sectors face the daunting task of replicating DMC Global's established brand equity and cultivating comparable customer relationships. This process is inherently time-consuming and capital-intensive, requiring substantial investment in marketing, sales, and product development to build credibility. The long lead times and rigorous qualification processes for many of DMC Global's engineered components further solidify this advantage.

- Brand Equity: DMC Global's brands are recognized for quality and reliability in their respective niches.

- Customer Loyalty: Long-standing relationships with key customers make switching difficult for buyers.

- Time and Investment: New entrants need significant time and capital to build comparable trust and market presence.

- Product Criticality: The engineered nature of many of DMC Global's products elevates the importance of proven performance, favoring established players.

The threat of new entrants for DMC Global is generally low, primarily due to high capital requirements and the need for specialized technology. Building new manufacturing facilities and acquiring advanced machinery can cost tens to hundreds of millions of dollars. Furthermore, DMC Global's proprietary technologies and established customer loyalty in its core energy, industrial, and infrastructure markets create significant barriers.

In 2024, stringent environmental regulations and complex licensing procedures continue to deter new players. For example, compliance with evolving emissions standards requires substantial ongoing investment. Additionally, the company's integrated supply chains and global distribution networks, developed over years, are difficult and costly for newcomers to replicate, further limiting the threat.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of establishing manufacturing and R&D facilities. | Significant financial hurdle, limiting the number of potential entrants. |

| Technology & IP | Proprietary product technology and patents. | Requires substantial R&D investment for competitors to match. |

| Regulation & Compliance | Strict environmental, safety, and licensing standards. | Increases upfront costs and time-to-market for new companies. |

| Brand & Customer Loyalty | Established reputation and strong customer relationships. | Makes it difficult for new entrants to gain market share and trust. |

Porter's Five Forces Analysis Data Sources

Our DMC Global Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available company filings, industry expert interviews, and reputable market research reports to capture the full competitive landscape.