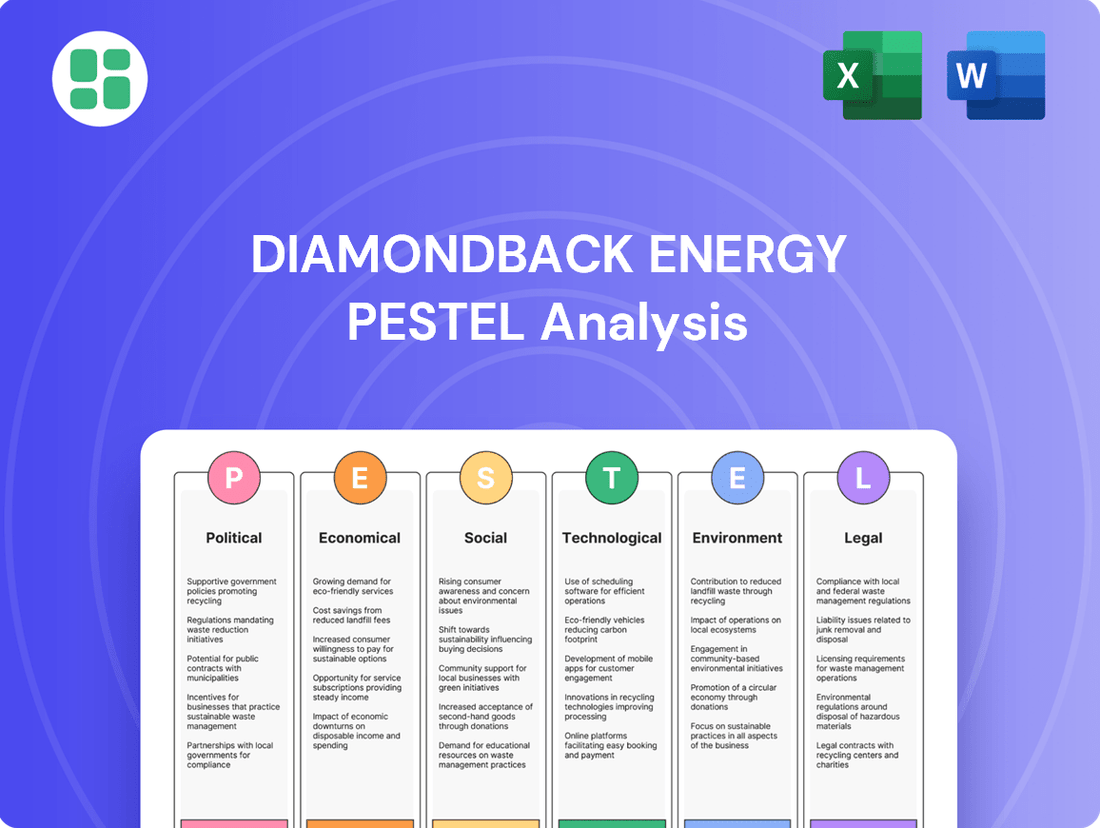

Diamondback Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diamondback Energy Bundle

Unlock the strategic advantages Diamondback Energy holds by understanding the political, economic, technological, environmental, and legal forces at play. Our expertly crafted PESTLE analysis dives deep into these external factors, revealing potential opportunities and threats. Don't just react to market shifts; anticipate them. Download the full PESTLE analysis now to gain a competitive edge and inform your investment decisions.

Political factors

Government energy policy, both at the federal and state levels, plays a crucial role in shaping Diamondback Energy's operational landscape. Shifts in policy priorities can directly impact areas like drilling permits and leasing on federal lands, influencing the company's capacity to expand its operations, particularly within the Permian Basin.

The U.S. federal government's approach to oil and gas production is a key consideration. For example, the Biden administration's focus on methane emission rules presents a regulatory challenge, while a potential shift towards deregulation under a future administration could alter the investment climate and long-term stability for companies like Diamondback.

International trade policies, particularly tariffs on essential materials like steel, directly influence Diamondback Energy's operational expenses. These tariffs can significantly inflate the cost of crucial components used in drilling operations.

For instance, the continuation of steel tariffs, which saw a notable increase under the Trump administration, is projected to raise casing costs by approximately 25% in 2025 when compared to 2024. This cost escalation directly impacts Diamondback's capital expenditure budgets and overall profitability.

Geopolitical stability significantly impacts global oil supply and prices, a critical factor for Diamondback Energy. Decisions by international oil cartels, such as OPEC+, directly influence these dynamics. For example, OPEC+'s production quotas can lead to either tighter or looser supply conditions, affecting crude oil prices and Diamondback's revenue streams.

In 2024, the market has seen continued volatility influenced by these geopolitical factors. While OPEC+ has largely maintained production targets, unexpected geopolitical events in key oil-producing regions can still disrupt supply chains. This uncertainty forces companies like Diamondback to remain agile in their investment and operational planning, balancing potential growth with the risk of price shocks.

Regulatory Environment and Enforcement

Diamondback Energy operates within a dynamic regulatory landscape, heavily influenced by agencies such as the Environmental Protection Agency (EPA) and various state-level bodies. The enforcement of existing environmental regulations and the potential introduction of new ones significantly shape the company's operational strategies and cost structures.

A key area of focus is methane emissions. The EPA's final rule on methane, while experiencing reconsideration and delays, signals a trend toward stricter controls. For Diamondback, this could translate into increased compliance expenses or necessitate investments in advanced technologies to meet these evolving standards. In 2023, the oil and gas sector faced heightened scrutiny regarding methane, with reports indicating significant efforts by companies to reduce leaks, though specific financial impacts on Diamondback related to this rule are still materializing as of mid-2024.

- Methane Emission Rules: Ongoing EPA rule developments present potential compliance cost increases or technology upgrade requirements for Diamondback.

- State Regulatory Influence: State agencies play a crucial role, often implementing regulations that can differ from federal mandates, adding complexity.

- Compliance Costs: Adhering to evolving environmental standards can impact operational budgets and capital expenditure plans.

- Technological Adaptation: The need to adopt new technologies to meet stricter emissions targets is a recurring theme in the sector.

Permitting and Licensing Processes

The efficiency and predictability of obtaining drilling permits and other necessary licenses from federal and state authorities are crucial for Diamondback Energy's operational continuity in 2024 and 2025. Delays or increased scrutiny in these processes can slow down development, impacting production targets and capital deployment.

For instance, while legislative efforts aim to streamline federal drilling permits, the actual implementation and state-level variations can still introduce significant variability. In 2023, the average time to obtain an onshore drilling permit in key U.S. shale plays could range from weeks to several months, depending on the specific jurisdiction and project complexity. This variability directly affects Diamondback's ability to execute its drilling plans and manage capital expenditures effectively.

- Permitting Timelines: Fluctuations in permit approval times directly impact project schedules and cost management for Diamondback.

- Regulatory Scrutiny: Increased environmental reviews or community engagement requirements can extend the permitting process.

- Legislative Impact: While federal efforts to expedite permits exist, state-specific regulations and their enforcement remain critical factors.

- Operational Impact: Delays in permitting can hinder Diamondback's ability to meet production growth targets and optimize capital allocation.

Government policies regarding oil and gas production, including leasing and permitting, directly influence Diamondback Energy's operational scope. The U.S. federal government's stance on emissions, like methane regulations, presents ongoing compliance considerations, while state-level regulations can introduce further operational complexities and cost variations.

International trade policies, such as tariffs on steel, can inflate operational expenses for Diamondback. For example, projected steel tariff impacts could increase casing costs by approximately 25% in 2025 compared to 2024, affecting capital expenditure. Geopolitical stability and decisions by entities like OPEC+ significantly sway global oil prices, impacting Diamondback's revenue streams and requiring agile strategic planning.

| Factor | Impact on Diamondback Energy | Data/Trend (2024-2025) |

| Federal Energy Policy | Affects leasing, drilling permits, and environmental regulations. | Continued focus on methane emission rules by the EPA. |

| State Regulations | Can differ from federal mandates, adding complexity. | State-specific permitting timelines vary, impacting project schedules. |

| Trade Tariffs | Increases operational costs for materials like steel. | Projected 25% increase in casing costs in 2025 due to tariffs. |

| Geopolitics/OPEC+ | Influences global oil supply and prices. | Market volatility persists; OPEC+ production quotas impact revenue. |

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Diamondback Energy, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides a comprehensive overview of how these global and regional dynamics create both challenges and strategic advantages for the company.

A concise PESTLE analysis for Diamondback Energy that highlights key external factors impacting the oil and gas industry, serving as a quick reference to alleviate concerns about market volatility and regulatory shifts during strategic planning.

Economic factors

Global and domestic oil and gas prices represent the most significant economic driver for Diamondback Energy. While Permian Basin production is projected to increase, the company's financial performance remains highly susceptible to commodity price volatility. Current oil prices, hovering around $80 per barrel for West Texas Intermediate (WTI) in early 2024, make the economic viability of some U.S. shale oil production less robust for substantial expansion compared to periods of higher pricing.

Diamondback Energy actively incorporates various price scenarios into its strategic planning, including analyses based on anticipated lower oil price ranges of $50 to $60 per barrel. This forward-looking approach acknowledges the inherent cyclicality of the energy markets and ensures the company is prepared for potential downturns in crude oil and natural gas prices, which directly impact revenue and profitability.

Diamondback Energy's access to capital and investor sentiment are crucial for funding operations and strategic moves. In 2024, the company has seen strong investor interest in its disciplined capital allocation, which prioritizes shareholder returns.

The company's 2025 capital budget is projected to be between $1.7 billion and $1.9 billion, a reduction from previous years, signaling a shift towards capital discipline and free cash flow generation. This aligns with a broader industry trend away from aggressive expansion and towards returning capital via dividends and share repurchases, a strategy that has been well-received by the market.

The cost of labor, essential equipment, and various services within the Permian Basin are direct determinants of Diamondback Energy's operational expenditures. These rising input costs can significantly impact the company's bottom line.

Despite Diamondback's successful implementation of technological advancements to boost efficiency, persistent inflationary pressures, especially evident in the rising costs of key materials like steel, pose a tangible threat to profit margins. For instance, the Producer Price Index for steel mill products saw a notable increase throughout 2024, impacting capital expenditure budgets.

Regional Economic Growth and Infrastructure

The Permian Basin, a key operational area for Diamondback Energy, experienced significant economic growth in 2024. This robust activity, fueled by oil and gas production, directly translates into job creation and infrastructure improvements within the region. The energy sector's contribution to the U.S. economy was substantial, with the Permian Basin alone generating an estimated $119 billion in 2024.

This economic strength underpins a stable operating environment for companies like Diamondback. The region’s economic vitality supported over 862,250 jobs in 2024, ensuring a readily available workforce and a strong local service sector. This infrastructure development and employment stability are crucial for Diamondback's ongoing operations and future expansion plans.

- Permian Basin Economic Contribution: Generated $119 billion for the U.S. economy in 2024.

- Job Support: Directly supported over 862,250 jobs in 2024.

- Infrastructure Development: Economic growth fuels necessary infrastructure improvements.

- Stable Operating Environment: Robust local economy ensures access to services and workforce.

Mergers, Acquisitions, and Consolidation

The energy sector, particularly in the Permian Basin, is seeing a significant wave of consolidation. Diamondback Energy's acquisition of Endeavor Energy Resources for approximately $26 billion in March 2024 is a prime example, highlighting the trend towards larger, more integrated operations. This consolidation allows companies to gain greater operational efficiencies and expand their access to valuable oil and gas reserves.

These mergers and acquisitions are driven by the pursuit of economies of scale and synergies. By combining operations, companies can optimize drilling schedules, reduce overhead costs, and potentially lower their per-barrel production expenses. This strategic move aims to enhance profitability and competitiveness in a dynamic market environment.

The impact of such consolidation extends to the competitive landscape, creating fewer, but larger, players. This can lead to:

- Increased operational efficiencies through shared infrastructure and optimized resource allocation.

- Enhanced inventory depth, providing a longer runway for production and development.

- Greater bargaining power with suppliers and service providers.

- Potential for reduced rig counts as companies consolidate drilling activities.

Commodity prices remain the primary economic determinant for Diamondback Energy, with WTI crude around $80 per barrel in early 2024 impacting expansion viability.

The company plans for lower price scenarios, factoring in $50-$60 per barrel to manage market cyclicality and ensure resilience against price downturns.

Diamondback's 2025 capital budget of $1.7-$1.9 billion reflects a strategic shift towards capital discipline and free cash flow generation, a trend favored by investors.

Rising input costs, such as steel, continue to pressure profit margins despite efficiency gains, with producer prices for steel mill products showing notable increases throughout 2024.

| Economic Factor | 2024/2025 Data Point | Impact on Diamondback Energy |

|---|---|---|

| Oil Prices (WTI) | ~$80/barrel (Early 2024) | Influences expansion viability and profitability; scenario planning includes $50-$60/barrel. |

| Capital Budget | $1.7-$1.9 billion (2025 Projection) | Indicates focus on capital discipline and free cash flow generation. |

| Input Costs (Steel) | Increasing throughout 2024 | Pressures profit margins despite efficiency improvements. |

| Permian Basin Economic Contribution | $119 billion (2024 Estimate) | Supports a stable operating environment and workforce availability. |

Full Version Awaits

Diamondback Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Diamondback Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a clear understanding of the external forces shaping Diamondback Energy's industry landscape and competitive positioning.

Sociological factors

The Permian Basin is grappling with a significant workforce availability issue, particularly concerning skilled labor for the oil and gas industry. This persistent talent gap means companies like Diamondback Energy face intense competition for qualified professionals.

Adding to this challenge, the rising cost of living, especially housing in key operational hubs such as Midland and Odessa, makes it increasingly difficult to attract and retain the necessary talent. For instance, average home prices in Midland saw a notable increase in 2024, impacting affordability for potential employees.

Diamondback Energy's ability to maintain positive community relations in West Texas is crucial for its social license to operate. The company actively addresses local concerns, such as the environmental impact of operations and strain on infrastructure, by investing in community improvement initiatives. For instance, in 2023, Diamondback reported contributing over $20 million to community development and charitable causes across its operating areas.

Public perception of fossil fuels is increasingly shaped by climate change concerns, directly impacting investor sentiment and regulatory landscapes for companies like Diamondback Energy. Surveys in 2024 indicate a growing majority of the public in developed nations believe climate change is a serious threat, pushing for faster energy transitions.

Diamondback's strategy reflects this shift, with the company emphasizing its commitment to producing the 'safest, cleanest barrels of oil possible' to align with evolving societal expectations and investor demands for more sustainable operations.

Health and Safety Standards

The societal expectation for robust health and safety standards in the energy sector directly impacts Diamondback Energy's operations and reputation. Companies are increasingly scrutinized for their commitment to protecting workers and the communities in which they operate.

Diamondback Energy demonstrates this commitment by integrating specific, measurable environmental and safety performance metrics into its short-term incentive compensation program. This approach directly links employee and executive rewards to achieving safety goals, fostering a culture of vigilance.

- Employee Safety Focus: Diamondback's incentive programs underscore the importance placed on minimizing workplace incidents and ensuring the well-being of its workforce.

- Performance Metrics: The inclusion of quantifiable safety metrics ensures accountability and drives continuous improvement in safety practices.

- Societal Expectations: Adherence to high safety standards is not just a regulatory requirement but a crucial element of corporate social responsibility, enhancing stakeholder trust.

Diversity, Equity, and Inclusion (DEI)

Diamondback Energy's commitment to Diversity, Equity, and Inclusion (DEI) is a significant sociological consideration. As societal expectations evolve, companies are increasingly scrutinized for their efforts to create equitable and inclusive work environments. This focus is particularly relevant in the competitive Permian Basin, where attracting and retaining top talent is crucial for operational success.

A strong DEI strategy can directly impact a company's ability to secure skilled labor. For instance, in 2023, the energy sector, including the Permian Basin, faced ongoing challenges in workforce availability. Companies with robust DEI initiatives often find themselves more appealing to a broader talent pool, potentially mitigating some of these labor shortages. This can translate into a more stable and experienced workforce, contributing to operational efficiency and innovation.

- Talent Attraction: Companies with strong DEI programs report higher applicant interest, especially among younger generations entering the workforce.

- Employee Retention: An inclusive culture fosters a sense of belonging, leading to lower turnover rates. In 2024, retention in the oil and gas industry remains a key performance indicator.

- Reputation Management: Positive public perception regarding DEI practices can enhance a company's social license to operate and attract investors focused on ESG (Environmental, Social, and Governance) factors.

Societal expectations regarding environmental stewardship and community engagement are paramount for Diamondback Energy. The company's proactive approach to addressing concerns about water usage and emissions in the Permian Basin, for example, is critical for maintaining its social license to operate. Public sentiment towards the energy industry, heavily influenced by climate change discourse, continues to push for cleaner operational practices.

Diamondback's commitment to Diversity, Equity, and Inclusion (DEI) is also a key sociological factor. In 2024, the energy sector is increasingly recognizing that strong DEI initiatives are essential for attracting and retaining a skilled workforce, particularly in talent-scarce regions like the Permian. Companies with robust DEI programs often report better employee retention rates, which is vital for operational stability.

| Sociological Factor | Impact on Diamondback Energy | 2023/2024 Data Point |

|---|---|---|

| Workforce Availability & Skills Gap | Intensified competition for qualified personnel in the Permian Basin. | Average home prices in Midland increased significantly in 2024, impacting affordability. |

| Community Relations & Social License | Need for investment in local initiatives to maintain operational approval. | Diamondback invested over $20 million in community development in 2023. |

| Public Perception of Fossil Fuels | Growing pressure for energy transition and sustainable practices from stakeholders. | Surveys in 2024 show a majority in developed nations view climate change as a serious threat. |

| Health & Safety Standards | Scrutiny on worker protection and community well-being. | Diamondback links executive compensation to safety performance metrics. |

| Diversity, Equity, and Inclusion (DEI) | Crucial for talent attraction and retention in a competitive market. | Companies with strong DEI initiatives report higher applicant interest and lower turnover in 2024. |

Technological factors

Diamondback Energy is heavily invested in advanced drilling and completion techniques. They utilize technologies such as extended lateral drilling, which can reach over 2 miles, and sophisticated hydraulic fracturing designs to maximize oil and gas recovery from each well. This focus on technological innovation has been a key driver in their operational success.

These cutting-edge methods, including optimized well spacing and advanced fracturing, directly translate to higher production volumes per well. For instance, Diamondback has reported that their latest vintage wells are achieving significantly higher initial production rates compared to earlier wells, demonstrating the effectiveness of these techniques.

The impact on capital efficiency is substantial. By achieving more output with fewer drilling rigs and shorter completion times, Diamondback can reduce its overall capital expenditure per barrel of oil equivalent. This efficiency is crucial in a volatile commodity market, allowing for more predictable and robust returns on investment.

Diamondback Energy is heavily investing in digitalization and data analytics to sharpen its operational edge. This focus on digital tools is key for tasks like real-time well monitoring and predictive maintenance, which aim to boost efficiency across their operations.

By leveraging advanced data analytics, Diamondback can refine its extraction methods, ultimately maximizing the recovery of valuable resources from its extensive Permian Basin asset base. For instance, in Q1 2024, the company reported a 13% increase in production year-over-year, partly attributed to these technological advancements.

Technological advancements in methane detection and reduction are paramount as environmental regulations tighten. Diamondback Energy is proactively addressing this by deploying Continuous Emissions Monitoring Systems (CEMs) across more than 90% of its operational oil production sites. This commitment underscores the growing importance of technology in managing greenhouse gas emissions within the energy sector.

Diamondback's engagement in initiatives such as the Oil & Gas Methane Partnership 2.0 further highlights its dedication to adopting best-in-class technologies for methane abatement. These partnerships facilitate the sharing of knowledge and best practices, driving innovation in emission control solutions. For instance, by mid-2024, the partnership reported a 20% reduction in methane intensity among its members, showcasing the tangible impact of such collaborative technological efforts.

Water Management and Recycling Innovations

Diamondback Energy's operations in the arid Permian Basin are heavily influenced by technological advancements in water management and recycling. These innovations are crucial for maintaining sustainable practices and mitigating environmental impact. The company's strategic investments in this area are already yielding significant results.

Diamondback has demonstrated a strong commitment to reducing its reliance on freshwater. A prime example is its investment in Deep Blue, a venture focused on produced water recycling. This initiative has proven highly effective, with Diamondback exceeding its 2025 water recycling rate target in 2023. This proactive approach not only conserves a vital resource but also positions the company favorably against increasing regulatory scrutiny and operational costs associated with water sourcing.

- Water Recycling Rate: Diamondback exceeded its 2025 water recycling goal in 2023.

- Strategic Investment: Investment in Deep Blue for produced water recycling.

- Permian Basin Focus: Critical for operations in an arid environment.

- Sustainability Driver: Reduces freshwater consumption and environmental footprint.

Electrification of Field Operations

The electrification of field operations, particularly in drilling and completion, represents a significant technological shift driven by the dual goals of emission reduction and cost efficiency. Diamondback Energy is actively participating in this trend, having converted two of its four existing frac fleets to electric power.

This strategic move not only reduces reliance on traditional diesel fuel but also leverages associated natural gas, a byproduct of their operations, as a cleaner energy source. Furthermore, Diamondback has engaged in collaborations focused on developing micro-grid solutions to power their extensive field activities, showcasing a commitment to innovative energy management.

- Reduced Emissions: Electrification directly lowers greenhouse gas emissions by displacing diesel consumption.

- Cost Savings: Utilizing associated natural gas and potentially more stable electricity pricing can lead to operational cost reductions.

- Fleet Conversion: Diamondback's conversion of two out of four frac fleets highlights tangible progress in adopting this technology.

- Micro-grid Development: Collaborations on micro-grids demonstrate a forward-thinking approach to powering remote field operations.

Diamondback Energy's adoption of advanced technologies, including extended lateral drilling and sophisticated hydraulic fracturing, significantly boosts oil and gas recovery per well. This technological edge directly translates to higher initial production rates, as evidenced by their latest well vintages outperforming older ones.

The company is also prioritizing digitalization and data analytics for real-time monitoring and predictive maintenance, aiming to enhance operational efficiency and resource recovery. For instance, Q1 2024 saw a 13% year-over-year production increase, partly driven by these tech investments.

Diamondback is actively implementing technologies to reduce methane emissions, deploying Continuous Emissions Monitoring Systems across over 90% of its oil production sites by mid-2024. This focus on environmental technology is crucial for meeting stricter regulations.

Furthermore, Diamondback has made substantial progress in water management, exceeding its 2025 water recycling targets in 2023 through strategic investments like Deep Blue, which is vital for operations in the arid Permian Basin.

| Technology Area | Diamondback's Action/Metric | Impact/Benefit | Data Point (2023/2024) |

|---|---|---|---|

| Drilling & Completion | Extended lateral drilling, advanced fracturing | Increased recovery, higher initial production rates | Latest vintage wells show significant improvement over earlier ones. |

| Digitalization & Data Analytics | Real-time monitoring, predictive maintenance | Enhanced operational efficiency, improved resource recovery | Q1 2024 production up 13% YoY, partly due to tech. |

| Emissions Reduction | Continuous Emissions Monitoring Systems (CEMS) | Reduced methane emissions, regulatory compliance | CEMS deployed at >90% of oil production sites by mid-2024. |

| Water Management | Produced water recycling (Deep Blue investment) | Reduced freshwater reliance, environmental sustainability | Exceeded 2025 water recycling goal in 2023. |

| Electrification | Electric frac fleet conversion | Lower emissions, potential cost savings | 2 of 4 existing frac fleets converted to electric power. |

Legal factors

Diamondback Energy operates under a stringent framework of federal and state environmental laws, impacting everything from air quality to waste disposal. Agencies like the Environmental Protection Agency (EPA) and various state environmental departments set the rules. For instance, the EPA's proposed methane emission standards for the oil and gas sector, alongside the Waste Emissions Charge, are critical compliance areas for companies like Diamondback. These regulations often require significant investment in new technologies and operational adjustments to meet evolving environmental targets.

Land use and permitting laws are critical for Diamondback Energy's operations. Regulations concerning land use, drilling permits, and leasing on both federal and state lands directly influence the company's ability to secure new reserves and expand its footprint in the Permian Basin. Navigating these legal frameworks is essential for growth.

Diamondback, like other Permian operators, faces potential operational challenges stemming from regulatory hurdles. Securing reliable discharge permits for water reuse, a key component of sustainable operations, can also present significant obstacles. For instance, in 2023, the average time to obtain a new drilling permit in Texas exceeded 30 days, a figure that can fluctuate based on specific county regulations and environmental reviews.

Hydraulic fracturing, or fracking, continues to navigate a complex regulatory landscape. While federal attempts at outright bans have largely been unsuccessful, the industry faces a patchwork of state-specific rules. These regulations significantly influence how companies like Diamondback Energy operate, dictating everything from the chemicals used and their disclosure to the very feasibility and cost of drilling new wells.

For instance, states like Colorado have implemented stricter rules regarding well spacing and methane emission controls, impacting operational efficiency. Conversely, Texas, a major hub for shale production, generally maintains more permissive regulations, though local ordinances can still pose challenges. Diamondback Energy, operating in key Permian Basin areas, must remain agile, adapting its strategies to comply with these diverse and evolving state mandates, which can add millions to project costs.

Worker Safety and Labor Laws

Diamondback Energy must strictly adhere to federal and state labor laws, particularly those concerning occupational safety and health, such as OSHA regulations. These laws are foundational, dictating everything from safe working conditions and mandatory employee training to incident reporting protocols. Failure to comply can result in significant legal penalties and operational disruptions.

The company's operational procedures are directly shaped by these legal mandates, impacting everything from equipment maintenance schedules to the personal protective equipment (PPE) required for field staff. For instance, OSHA's Process Safety Management (PSM) standard, applicable to facilities handling highly hazardous chemicals, necessitates rigorous hazard analyses and emergency planning, directly influencing how Diamondback manages its midstream assets.

- Compliance with OSHA standards: Diamondback's commitment to worker safety is directly tied to its adherence to OSHA's stringent requirements, which aim to prevent workplace injuries and illnesses.

- Impact on operational procedures: Labor laws, including those for safety and training, necessitate specific protocols for drilling, completion, and transportation activities, influencing cost structures and efficiency.

- Potential legal liabilities: Non-compliance can lead to substantial fines, lawsuits, and reputational damage, as seen in past industry incidents where companies faced millions in penalties for safety violations. For example, in 2023, several oil and gas companies faced significant fines for failing to meet safety and environmental regulations.

Corporate Governance and Reporting Requirements

Diamondback Energy, as a publicly traded entity, operates under rigorous corporate governance and financial reporting mandates from the Securities and Exchange Commission (SEC). This necessitates transparent disclosures regarding financial health, environmental, social, and governance (ESG) efforts, and identified risks, fostering accountability to investors and regulatory bodies.

These requirements ensure that Diamondback Energy provides timely and accurate information to the market. For instance, in its 2024 filings, the company detailed its executive compensation structures and board oversight mechanisms, aligning with SEC regulations aimed at promoting good corporate citizenship.

- SEC Filings: Diamondback Energy's adherence to SEC rules, including quarterly (10-Q) and annual (10-K) reports, is paramount for investor confidence.

- Transparency in Reporting: The company must clearly communicate its financial performance, operational updates, and sustainability progress, as seen in its 2024 ESG report which highlighted a 15% reduction in methane emissions intensity.

- Shareholder Accountability: Corporate governance structures are in place to ensure management is accountable to shareholders, with voting rights and proxy statements playing a key role in decision-making.

- Risk Disclosure: Diamondback Energy is obligated to disclose material risks, including those related to commodity price volatility and regulatory changes, as detailed in its 2025 risk factor disclosures.

Diamondback Energy operates within a complex web of federal and state legal frameworks that significantly shape its operations and strategic planning. Environmental regulations, such as those from the EPA and state agencies, dictate permissible emission levels and waste management practices, requiring substantial investment in compliance technologies. For example, in 2024, the company continued to adapt to evolving methane emission standards, which can add millions in operational costs.

Land use, permitting, and water rights are also critical legal considerations, directly impacting Diamondback's ability to acquire leases and develop new reserves. Securing necessary permits for drilling and water management can be time-consuming, with average new drilling permit times in Texas sometimes exceeding 30 days in 2023, influenced by local regulations.

Furthermore, adherence to labor laws, including OSHA safety standards, is paramount for worker protection and avoiding legal penalties. The company's commitment to safety protocols, such as those mandated by OSHA's Process Safety Management standard, directly influences operational procedures and risk management across its assets.

As a public company, Diamondback Energy is subject to SEC regulations for corporate governance and financial reporting, demanding transparency in its disclosures. This includes detailed reporting on executive compensation and ESG initiatives, as seen in its 2024 ESG report highlighting a 15% reduction in methane emissions intensity.

Environmental factors

The Permian Basin, Diamondback Energy's primary operational area, is characterized by significant water scarcity. This arid environment makes the responsible management of water resources a paramount environmental challenge for all oil and gas companies, including Diamondback.

Diamondback is proactively addressing this by heavily investing in water recycling and reuse programs. A key initiative is its joint venture with Deep Blue, which focuses on managing produced water, thereby substantially decreasing the reliance on freshwater sources for its hydraulic fracturing operations.

The oil and gas sector, including companies like Diamondback Energy, is a major contributor to greenhouse gas (GHG) emissions, with methane being a particularly potent concern for climate change. Diamondback has established significant goals to lower its Scope 1 GHG intensity and methane intensity, aiming for reductions of 50% and 60% respectively by 2030 compared to a 2017 baseline.

To achieve these targets, Diamondback is actively deploying Continuous Emissions Monitoring (CEMs) systems across its operations and collaborating with partners to reduce flaring and overall emissions. In 2023, the company reported a Scope 1 GHG intensity of 5.0 kg CO2e/boe and a methane intensity of 0.11%, demonstrating progress towards its ambitious objectives.

Oil and gas operations inherently carry risks for land use and biodiversity. Activities like drilling, pipeline construction, and infrastructure development can fragment habitats, degrade soil quality, and disrupt local ecosystems, potentially impacting species populations and their environments.

Diamondback Energy is actively working to reduce its environmental footprint. By concentrating drilling activities on centralized pads and employing efficient drilling techniques, the company aims to minimize the overall surface area disturbed by its operations, thereby mitigating potential negative impacts on land use and biodiversity.

Waste Management and Pollution Control

Diamondback Energy, like all oil and gas producers, faces significant environmental scrutiny regarding waste management. The sheer volume of produced water, drilling muds, and other byproducts necessitates sophisticated containment and disposal strategies to prevent soil and water contamination. In 2023, the Permian Basin, where Diamondback primarily operates, generated billions of barrels of produced water, a key challenge for the industry.

The industry, including Diamondback, is increasingly focused on the beneficial reuse of produced water. This initiative aims to reduce the environmental footprint associated with traditional disposal methods, particularly deep injection wells. These wells have faced increased regulatory attention and public concern due to their potential link to induced seismicity, a factor that could impact operational costs and public perception.

- Produced Water Generation: The Permian Basin alone saw the generation of over 10 billion barrels of produced water in 2023, highlighting the scale of the waste management challenge.

- Seismic Activity Concerns: Increased seismic events in regions with heavy injection well usage have led to stricter regulations and a drive for alternative disposal methods.

- Beneficial Reuse Focus: Companies are investing in technologies for treating and reusing produced water for operations like hydraulic fracturing, reducing reliance on injection.

- Regulatory Landscape: Evolving environmental regulations globally and within key operating regions directly influence waste management costs and operational strategies.

Energy Transition and Lower Carbon Economy

The global energy landscape is undeniably shifting towards lower-carbon solutions, a trend that presents both challenges and avenues for growth for companies like Diamondback Energy. While fossil fuels will continue to play a significant role in meeting energy needs for the foreseeable future, Diamondback is actively recalibrating its operational strategies to thrive within this evolving energy paradigm.

This adaptation involves not only optimizing existing oil and gas production but also exploring ways to produce these resources more efficiently and with a reduced environmental footprint. The company's commitment to providing cleaner barrels underscores its understanding of market demands and regulatory pressures shaping the energy transition.

- Global Energy Mix: Projections indicate that oil and gas will still constitute a substantial share of global energy demand through 2030 and beyond, despite the rise of renewables. For instance, the International Energy Agency (IEA) in its 2024 outlook suggested that oil demand could peak around 2030.

- Operational Efficiency: Diamondback is investing in technologies and practices aimed at reducing methane emissions and improving overall operational efficiency, thereby lowering the carbon intensity of its production.

- Strategic Adaptation: The company's strategy acknowledges the long-term trend of decarbonization and positions it to leverage its expertise in hydrocarbon production while remaining agile to future energy market developments.

Diamondback Energy operates in an environmentally sensitive region, the Permian Basin, facing challenges like water scarcity and the imperative for responsible waste management. The company is actively investing in water recycling and reuse, notably through its partnership with Deep Blue, to lessen freshwater dependency for hydraulic fracturing.

Addressing greenhouse gas emissions, Diamondback has set ambitious targets to cut its Scope 1 GHG intensity by 50% and methane intensity by 60% by 2030 from a 2017 baseline. These efforts are supported by the deployment of Continuous Emissions Monitoring systems and initiatives to reduce flaring, with 2023 data showing a Scope 1 GHG intensity of 5.0 kg CO2e/boe and a methane intensity of 0.11%.

The company also focuses on minimizing its land use impact through centralized drilling pads and efficient techniques, aiming to protect biodiversity. Furthermore, Diamondback is exploring beneficial reuse of produced water, a significant waste stream, to mitigate environmental risks associated with traditional disposal methods like deep injection wells, which have raised concerns about induced seismicity.

| Environmental Factor | Diamondback's Response/Data | Key Statistics/Targets |

|---|---|---|

| Water Scarcity & Management | Investment in water recycling/reuse, JV with Deep Blue | Reduced reliance on freshwater for fracturing |

| Greenhouse Gas Emissions | Deploying CEMs, reducing flaring | Target: 50% Scope 1 GHG intensity reduction by 2030 (vs. 2017) Target: 60% methane intensity reduction by 2030 (vs. 2017) 2023 Scope 1 GHG intensity: 5.0 kg CO2e/boe 2023 Methane intensity: 0.11% |

| Land Use & Biodiversity | Centralized drilling pads, efficient techniques | Minimizing surface area disturbance |

| Waste Management (Produced Water) | Focus on beneficial reuse, reducing injection well reliance | Permian Basin produced over 10 billion barrels in 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Diamondback Energy is built upon a robust foundation of data from official government agencies, reputable financial institutions, and leading industry publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the energy sector.