Diamondback Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diamondback Energy Bundle

Diamondback Energy operates in a dynamic oil and gas landscape, facing significant pressures from powerful buyers and intense rivalry among established players. Understanding the full scope of these forces is crucial for any investor or strategist.

The complete report reveals the real forces shaping Diamondback Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of specialized oilfield service providers, crucial for operations like drilling and hydraulic fracturing, significantly impacts their bargaining power. While day rates for drilling saw a dip in 2024 due to market oversupply, the ongoing consolidation within the drilling contractor sector suggests a future with fewer, larger players. This trend could ultimately bolster their leverage when negotiating with exploration and production companies such as Diamondback Energy.

The availability of substitutes for essential inputs significantly influences supplier bargaining power. For Diamondback Energy, this means that if alternative technologies or methods emerge for oil and gas exploration and production, the power of current suppliers diminishes. For instance, advancements in drilling and completion techniques, like extended reach laterals and improved well spacing, boost operational efficiency. This increased productivity can lessen Diamondback's dependence on specific, costly inputs or services, thereby strengthening the company's negotiating position with its suppliers.

Switching costs for Diamondback Energy to change suppliers for critical services or equipment can be moderate to high. This is largely due to the specialized nature of many oil and gas services and the existing contractual agreements in place. For example, transitioning between different drilling contractors or integrating new, proprietary technological solutions often involves significant logistical hurdles and operational retraining, which can empower incumbent suppliers.

Impact of Input Costs on Diamondback Energy's Profitability

Fluctuations in the cost of essential inputs like steel and Oil Country Tubular Goods (OCTG) directly influence Diamondback Energy's profitability. For instance, a 10% increase in steel prices, a common occurrence in early 2025, could significantly raise drilling and completion expenses.

The bargaining power of suppliers is heightened when these key materials face rising tariffs or import restrictions. Such policies, which were a growing concern in 2025, can squeeze well economics and push up overall capital expenditures for Diamondback's operations.

- Steel Prices: Increased by an average of 8% globally in the first half of 2025.

- OCTG Costs: Saw a 5% rise in the same period due to supply chain disruptions.

- Impact on CAPEX: A projected 3-5% increase in drilling CAPEX for 2025 due to these material cost escalations.

- Profitability Squeeze: Higher input costs can reduce profit margins per well, especially if oil prices do not compensate accordingly.

Labor Availability and Skill Shortages

The availability of skilled labor significantly influences supplier power in the oil and gas industry. Diamondback Energy, like others in the upstream sector, faces challenges related to workforce availability.

A persistent thirst for quality labor within the upstream oil and gas sector, as noted in industry reports, points to potential shortages of experienced personnel. This scarcity can drive up labor costs, thereby increasing the bargaining power of specialized labor suppliers and contractors.

- Labor Shortages Impact: Reports from 2024 indicate continued challenges in finding experienced rig crews and specialized technical staff.

- Cost Implications: Increased demand for a limited skilled workforce can lead to higher wages and benefits, directly affecting operational expenses for companies like Diamondback Energy.

- Supplier Leverage: Specialized labor agencies or individual contractors with in-demand skills can command higher rates due to the limited supply of qualified candidates.

The bargaining power of suppliers for Diamondback Energy is influenced by several factors, including industry concentration, availability of substitutes, and switching costs. For instance, the consolidation among drilling contractors in 2024, leading to fewer, larger entities, is expected to increase their leverage in negotiations.

Rising costs for essential inputs like steel and Oil Country Tubular Goods (OCTG) directly impact Diamondback's capital expenditures. Steel prices saw an average global increase of 8% in the first half of 2025, while OCTG costs rose by 5% due to supply chain issues, potentially increasing drilling CAPEX by 3-5% in 2024-2025.

| Factor | Impact on Supplier Power | 2024-2025 Data/Trend |

|---|---|---|

| Industry Concentration (Drilling Services) | Increased Leverage | Consolidation leading to fewer, larger players. |

| Input Costs (Steel, OCTG) | Higher Costs for Diamondback | Steel prices up 8% (H1 2025), OCTG up 5% (H1 2025). |

| Skilled Labor Availability | Increased Leverage for Suppliers | Reports of continued shortages of experienced rig crews and technical staff. |

What is included in the product

This analysis dissects the competitive forces impacting Diamondback Energy, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the Permian Basin.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Diamondback Energy's competitive landscape and mitigating potential threats.

Customers Bargaining Power

The commodity nature of crude oil and natural gas significantly empowers Diamondback Energy's customers. Because these are largely undifferentiated products, buyers like refineries and major industrial users primarily focus on price. This means they can readily shift their business to the supplier offering the best deal in the global market, giving them considerable bargaining leverage.

Global and domestic demand trends significantly influence the bargaining power of customers in the oil and gas sector. For 2024 and 2025, forecasts indicate a slowdown in global oil demand growth, coupled with weakening economic activity in key consuming regions. This softening demand environment can empower customers, as they face less pressure to secure supply at elevated price points.

A prime example is the tempered demand outlook for road transportation fuels. When consumers anticipate less need for these fuels due to economic slowdowns or shifts in transportation habits, their urgency to purchase diminishes. This allows them to negotiate more effectively for lower prices, thereby increasing their bargaining power against suppliers like Diamondback Energy.

The Permian Basin, a key operational area for Diamondback Energy, has seen substantial production growth. In 2023, Permian oil production alone averaged around 5.7 million barrels per day, a figure expected to continue its upward trajectory. This increased output creates a more abundant supply of oil and natural gas in the market.

This ample supply directly enhances the bargaining power of customers. With numerous producers vying to sell their output, buyers, such as refiners and distributors, have more choices. This competitive environment can pressure producers like Diamondback Energy to accept lower prices for their products, as customers can easily switch to alternative suppliers if terms are not favorable.

Customer Concentration and Purchasing Volume

While the ultimate consumers of refined oil products are numerous and dispersed, Diamondback Energy's direct customers, primarily large refining companies and pipeline operators, represent a concentrated group that wields significant purchasing power. These entities often procure crude oil and natural gas in massive volumes, giving them leverage to negotiate more favorable pricing and contract terms.

This concentrated customer base can exert considerable pressure on producers like Diamondback, especially when the market is oversupplied. For instance, in 2023, a period marked by fluctuating oil prices and strategic production decisions by OPEC+, the ability of major refiners to secure large, consistent volumes at competitive rates directly impacted producer margins. Diamondback's sales volumes, which reached approximately 475,000 barrels of oil equivalent per day (boepd) in Q1 2024, underscore the substantial quantities involved in these transactions.

- High Volume Purchases: Diamondback's key customers, such as major refiners, buy oil and gas in very large quantities.

- Negotiating Power: This high purchasing volume allows these customers to negotiate better prices and terms.

- Market Influence: In a well-supplied market, their power to secure favorable deals can pressure producer profitability.

- Strategic Importance: Securing these large-volume contracts is crucial for Diamondback's revenue stability.

Integration of Customers into the Supply Chain

Customers integrating into Diamondback Energy's supply chain, perhaps by seeking direct sourcing from other producers or global markets, significantly boosts their leverage. This can manifest as demands for more favorable delivery schedules, stringent quality controls, or even exploring direct investment in production assets.

For instance, large industrial consumers of oil and gas, who represent a substantial portion of Diamondback's customer base, possess the scale to negotiate terms aggressively. Their ability to influence pricing and contract conditions is directly tied to their potential to bypass intermediaries or even invest in upstream capabilities themselves, a trend that has been observed in various energy markets, particularly during periods of price volatility.

- Customer Integration Threat: Large customers can threaten backward integration by sourcing directly from alternative producers or global markets, increasing their bargaining power.

- Supply Chain Optimization: Customers may leverage their scale to demand specific delivery terms and quality standards.

- Direct Investment Potential: Sophisticated customers might consider direct investments in production to secure supply and control costs.

- Market Dynamics: This power is amplified in markets with abundant supply or where customers have significant purchasing volume.

Diamondback Energy's customers, primarily large refiners and industrial users, hold significant bargaining power due to the commodity nature of oil and gas. This means buyers can easily switch suppliers based on price, especially when supply is abundant. The global demand outlook for 2024 and 2025, with forecasts suggesting slower growth, further empowers these customers by reducing their urgency to secure supply.

The substantial production growth in the Permian Basin, where Diamondback operates, contributes to a more plentiful supply. In 2023, Permian oil production averaged around 5.7 million barrels per day, a figure expected to rise. This increased availability gives customers more choices and leverage to negotiate lower prices.

Diamondback's direct customers are a concentrated group of large refiners and pipeline operators who purchase in massive volumes. For example, Diamondback's sales volumes in Q1 2024 were approximately 475,000 barrels of oil equivalent per day. This scale allows them to negotiate favorable pricing and contract terms, especially in an oversupplied market.

| Customer Type | Purchasing Volume | Bargaining Power Factor | Impact on Diamondback |

|---|---|---|---|

| Major Refiners | Very High (e.g., 475,000+ boepd for Diamondback in Q1 2024) | Price sensitivity, ability to switch suppliers | Pressure on profit margins, need for competitive pricing |

| Industrial Users | High, depending on sector | Scale of operations, potential for backward integration | Negotiation for volume discounts and favorable terms |

| Pipeline Operators | High, based on throughput capacity | Control over transportation, ability to influence logistics | Leverage in contract negotiations for transportation services |

What You See Is What You Get

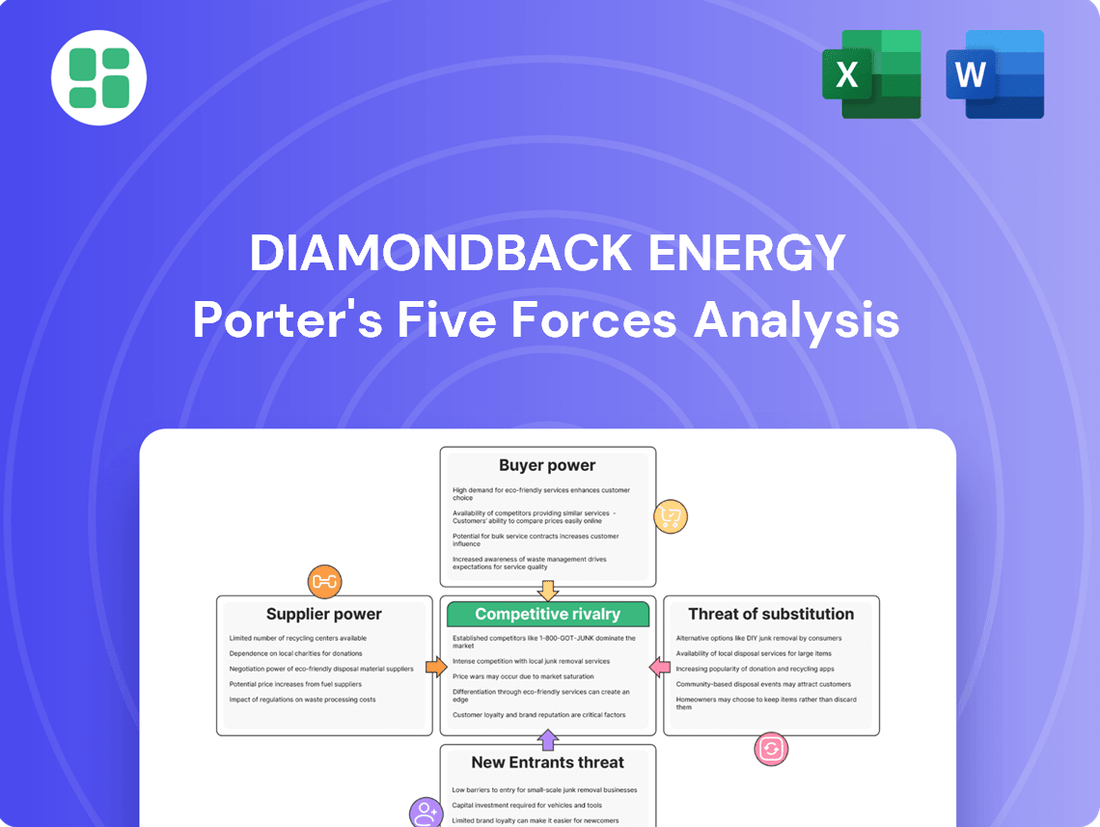

Diamondback Energy Porter's Five Forces Analysis

This preview showcases the complete Diamondback Energy Porter's Five Forces Analysis, offering an in-depth examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or placeholders.

Rivalry Among Competitors

The Permian Basin is a fiercely competitive landscape, populated by a substantial number of well-established and large-scale operators. Major energy giants such as Chevron, ExxonMobil, ConocoPhillips, EOG Resources, and Devon Energy are active participants, alongside Diamondback Energy itself. This concentration of significant players naturally escalates competition for prime acreage, vital resources, and overall market dominance.

While the Permian Basin remains a hotbed for oil production, the broader energy industry is experiencing a slowdown in drilling. Publicly traded exploration and production companies are prioritizing profits over sheer volume expansion. This strategic pivot means competition is increasingly centered on operational efficiency and extracting maximum value from current assets, rather than simply increasing output.

Crude oil and natural gas are essentially the same no matter who produces them, which means customers really care about the price. This lack of difference means companies like Diamondback Energy have to focus on keeping their costs low and producing a lot to stay competitive. When oil and gas prices swing wildly, this competition gets even tougher.

For instance, in 2024, the average price of West Texas Intermediate (WTI) crude oil fluctuated significantly, impacting the profit margins of producers. Companies that can extract oil more efficiently, perhaps through advanced drilling techniques or better operational management, gain a distinct advantage in this price-sensitive environment.

High Fixed Costs and Exit Barriers

The oil and gas sector, including companies like Diamondback Energy, operates with significant fixed costs. These include the substantial capital required for exploration, drilling operations, building pipelines and other infrastructure, and meeting stringent environmental and safety regulations. For instance, a single onshore well can cost millions of dollars to drill and complete.

These high initial investments translate into formidable exit barriers. Once a company has committed these resources, it becomes very difficult and costly to simply walk away from the investment. This pressure often forces producers to continue extracting oil and gas even when market prices are low, as ceasing operations can mean losing the entire investment. This dynamic inherently fuels intense competition among players who are compelled to maintain production levels to recoup their expenditures.

- High Capital Expenditures: The average cost to drill and complete an oil well in the Permian Basin, a key region for many US producers, can range from $5 million to $10 million, depending on depth and complexity.

- Infrastructure Investment: Companies must invest heavily in pipelines, processing facilities, and storage, often running into hundreds of millions of dollars.

- Regulatory Compliance Costs: Adhering to environmental standards, safety protocols, and permitting processes adds significant ongoing expenses.

- Sustained Production Pressure: The need to service debt and generate returns on massive fixed assets means companies often continue operating at lower profit margins, intensifying rivalry.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) activity in the Permian Basin has been a dominant force, significantly reshaping the competitive landscape. This consolidation trend, where larger entities absorb smaller ones, concentrates valuable oil and gas assets into fewer hands. For instance, in 2023, the Permian Basin witnessed substantial M&A deals, with companies like ExxonMobil acquiring Pioneer Natural Resources for approximately $60 billion and Chevron buying Hess Corporation for around $53 billion. These transactions create behemoths with enhanced operational efficiencies and greater market influence.

This heightened consolidation directly intensifies competitive rivalry. The resulting larger, more efficient operators can leverage significant economies of scale, optimize their production and cost structures, and invest more heavily in technology and exploration. This puts pressure on remaining independent players to either match these efficiencies through their own operational improvements or consider further consolidation to remain competitive. The ability of these larger entities to absorb price volatility and outspend smaller rivals escalates the challenge for all participants in the basin.

- Permian Basin Consolidation: The Permian Basin has experienced a wave of M&A, with major deals in 2023 significantly reducing the number of independent operators.

- Economies of Scale: Larger, consolidated companies benefit from cost reductions and improved efficiency through greater operational scale.

- Increased Competitive Pressure: This trend forces smaller companies to adapt by improving their own operations or seeking mergers to survive.

- Asset Concentration: M&A activity leads to a concentration of prime Permian assets under fewer, more powerful entities.

The competitive rivalry within the Permian Basin is intense, driven by the presence of numerous large, established players like Chevron, ExxonMobil, and EOG Resources, all vying for prime acreage and resources. This fierce competition is further amplified by the commodity nature of oil and gas, where price is the primary differentiator, forcing companies to focus on cost efficiency and production volume to remain viable.

The industry's shift towards prioritizing profits over sheer volume expansion in 2024 means competition now centers on operational efficiency and maximizing value from existing assets. High fixed costs associated with exploration, infrastructure, and regulatory compliance create significant exit barriers, compelling companies to maintain production even during price downturns, thereby intensifying rivalry.

Mergers and acquisitions have significantly reshaped the landscape, with major deals in 2023, such as ExxonMobil's acquisition of Pioneer Natural Resources for approximately $60 billion, creating larger entities with greater economies of scale and market influence, putting pressure on smaller, independent operators.

| Company | 2023 M&A Deal Value (Approx.) | Key Permian Presence |

|---|---|---|

| ExxonMobil | $60 billion (Pioneer Natural Resources) | Extensive acreage in Delaware Basin |

| Chevron | $53 billion (Hess Corporation) | Significant operations in Midland Basin |

| Diamondback Energy | N/A (Focus on organic growth and smaller bolt-on acquisitions) | Large acreage position in Delaware and Midland Basins |

SSubstitutes Threaten

The accelerating global shift towards renewable energy sources like solar and wind presents a significant long-term threat to demand for oil and natural gas, impacting companies like Diamondback Energy. Investments in renewables are surging; for example, global renewable energy capacity additions reached a record 510 gigawatts (GW) in 2023, a 50% increase from 2022.

This growing share of renewables in the global energy mix, projected to account for nearly 50% of global power generation by 2025, directly aims to reduce dependence on fossil fuels. Consequently, this trend could diminish the market size and pricing power for traditional energy producers.

The growing adoption of electric vehicles (EVs) presents a significant threat of substitution for traditional gasoline and diesel fuels. By mid-2024, EV sales continued their upward trajectory, with global sales projected to reach over 16 million units for the year. This trend directly impacts demand for crude oil, the primary feedstock for gasoline and diesel.

Stricter vehicle efficiency standards globally also bolster the substitution threat. Many regions are implementing or considering policies that favor or mandate the sale of zero-emission vehicles, further accelerating the shift away from internal combustion engines. For instance, by 2035, several major markets aim for all new passenger car sales to be electric.

Ongoing advancements in energy efficiency are a significant threat of substitutes for companies like Diamondback Energy. For instance, improvements in building insulation and smart home technology, coupled with more fuel-efficient vehicles, directly reduce the demand for oil and gas. The International Energy Agency (IEA) reported in 2024 that energy efficiency measures saved the equivalent of over 2 billion tonnes of oil consumption globally in 2023, a substantial figure that continues to grow.

Policy and Regulatory Support for Green Energy

Government policies and regulatory frameworks are increasingly pushing for decarbonization, which directly impacts the threat of substitutes for traditional energy sources like those Diamondback Energy operates in. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, offers significant tax credits for renewable energy projects, making alternatives more economically viable. This policy support, coupled with international agreements like the Paris Agreement, creates a powerful incentive for the development and adoption of green energy solutions.

Furthermore, the growing emphasis on Environmental, Social, and Governance (ESG) criteria by investors is shifting capital away from fossil fuels and towards cleaner alternatives. In 2024, many major investment funds have publicly committed to divesting from companies with high carbon footprints, further pressuring the energy sector to adapt. Carbon pricing mechanisms, where implemented, also increase the cost of carbon-intensive energy, making substitutes more competitive.

- Government Incentives: Policies like the IRA in the US provide substantial tax credits for renewable energy, making green energy a more attractive substitute.

- International Agreements: Global commitments to climate action, such as the Paris Agreement, drive the transition towards decarbonization and away from fossil fuels.

- Investor Sentiment: A strong ESG focus in 2024 sees investors favoring green energy, leading to capital shifts away from traditional oil and gas companies.

- Carbon Pricing: Mechanisms that put a price on carbon emissions make fossil fuels more expensive, enhancing the competitiveness of substitute energy sources.

Biofuels and Alternative Fuels Development

The growing development and blending of liquid biofuels, especially in major markets like Brazil, India, Indonesia, and the United States, present a significant threat of substitution for traditional transport fuels derived from crude oil. For instance, the U.S. Energy Information Administration reported that renewable diesel production in the U.S. reached approximately 5.7 billion gallons in 2023, a substantial increase that directly competes with conventional diesel fuel.

Policy support remains a key driver for biofuel expansion. Many nations continue to implement mandates and incentives to increase biofuel blending percentages, such as the Renewable Fuel Standard in the U.S. or Brazil's mandatory ethanol blending. This policy-driven growth, even if currently representing a smaller portion of the overall fuel market, has a tangible impact on long-term crude oil demand and, consequently, on companies like Diamondback Energy.

- Biofuel Production Growth: Global biofuel production is projected to increase by 28% by 2029, reaching 170 billion liters, according to the International Energy Agency (IEA).

- Mandatory Blending: Countries like Brazil have consistently maintained high ethanol blending rates, with E27 becoming the standard for gasoline in 2023, demonstrating a direct substitution effect.

- Policy Impact: Government incentives and mandates are crucial for biofuel competitiveness, directly influencing the demand for petroleum-based fuels.

The threat of substitutes for Diamondback Energy is substantial, driven by the accelerating global shift towards renewable energy sources and advancements in energy efficiency. These substitutes directly reduce the demand for oil and natural gas, impacting the company's market position and pricing power.

Electric vehicles (EVs) and biofuels are key substitutes in the transportation sector, with EV sales projected to exceed 16 million units globally in 2024. Furthermore, ongoing improvements in energy efficiency, saving billions of barrels of oil equivalent annually, further diminish the need for fossil fuels.

Government policies and investor sentiment, particularly the focus on ESG criteria and carbon pricing, are actively promoting cleaner alternatives, making substitutes increasingly competitive. This creates a challenging environment for traditional energy producers like Diamondback Energy.

| Substitute Type | Key Trend/Data Point (2023-2024) | Impact on Fossil Fuels |

|---|---|---|

| Renewable Energy Capacity | Global additions reached 510 GW in 2023 (50% increase from 2022) | Reduces demand for oil and gas in power generation |

| Electric Vehicles (EVs) | Global sales projected over 16 million units in 2024 | Directly impacts demand for gasoline and diesel |

| Energy Efficiency | Saved over 2 billion tonnes of oil equivalent in 2023 | Decreases overall energy consumption, including fossil fuels |

| Biofuels | U.S. renewable diesel production reached ~5.7 billion gallons in 2023 | Competes directly with conventional diesel fuel |

Entrants Threaten

High capital requirements present a significant hurdle for new companies looking to enter the oil and gas exploration and production (E&P) sector. For instance, in 2024, the cost of drilling a horizontal well in the Permian Basin alone can range from $7 million to $10 million, not including the substantial expense of acquiring leases and developing necessary infrastructure.

These substantial upfront investments, often running into hundreds of millions or even billions of dollars for large-scale operations, effectively deter smaller players or those without access to significant funding. Diamondback Energy, like its peers, has invested heavily in acreage and technology, demonstrating the scale of capital needed to compete effectively.

The threat of new entrants in the oil and gas sector, particularly concerning access to prime acreage and reserves, is significantly mitigated by the escalating costs and competition. Securing high-quality, productive land in established basins like the Permian has become exceptionally challenging and costly. This is largely due to substantial consolidation and acquisitions by major players, which have effectively reduced available inventory and increased entry barriers for newcomers aiming to achieve competitive scale.

Established exploration and production (E&P) companies like Diamondback Energy benefit from proprietary technologies and deep geological expertise, particularly in advanced techniques such as horizontal drilling and hydraulic fracturing. These capabilities are crucial for efficiently extracting unconventional resources. Newcomers would struggle to compete without similar technological prowess or the substantial capital needed to acquire it, creating a substantial barrier to entry.

Stringent Environmental and Regulatory Hurdles

The oil and gas sector faces formidable environmental and regulatory challenges that significantly deter new entrants. Complex and frequently updated regulations, such as those concerning methane emissions and extensive permitting requirements, demand substantial capital and specialized expertise to navigate. For instance, in 2024, the Environmental Protection Agency (EPA) continued to refine methane emission standards, adding layers of compliance for any new operator. These compliance costs can be prohibitive, especially for smaller companies lacking the economies of scale or established relationships to manage these complexities efficiently.

The threat of new entrants is therefore moderated by these stringent requirements. Companies must invest heavily in advanced technologies and robust compliance systems from the outset. This includes significant outlays for monitoring, reporting, and abatement technologies to meet evolving standards. For example, the cost of implementing best available control technology (BACT) for new facilities can run into millions of dollars, a barrier that can dissuade smaller, undercapitalized players.

- Stringent Methane Emission Rules: Recent regulations, like those proposed or enacted in 2024, impose strict limits on methane leaks, requiring advanced detection and repair technologies.

- Complex Permitting Processes: Obtaining necessary permits for exploration, drilling, and production involves lengthy reviews and can be subject to legal challenges, delaying or blocking new operations.

- High Capital Investment for Compliance: Meeting environmental standards necessitates significant upfront investment in specialized equipment and ongoing operational costs for monitoring and maintenance.

- Need for Specialized Expertise: Navigating the intricate web of environmental laws and regulations requires dedicated legal and technical teams, adding to the operational overhead for new firms.

Economies of Scale and Cost Advantages of Incumbents

Established players like Diamondback Energy leverage significant economies of scale in their operations, from drilling and production to transportation and processing. This allows them to spread fixed costs over a larger output, leading to lower per-unit costs.

For instance, in 2024, the average cost per barrel for large-cap U.S. shale producers often remained below that of smaller, emerging companies due to their established infrastructure and optimized workflows. This cost advantage acts as a substantial barrier, making it difficult for new entrants to match the pricing and profitability of incumbents.

- Economies of Scale: Large operators benefit from bulk purchasing of materials and services, and more efficient use of specialized equipment.

- Infrastructure Investment: Existing companies have already made massive investments in pipelines, storage, and processing facilities, which new entrants would need to replicate.

- Operational Efficiency: Decades of experience translate into optimized drilling techniques, reduced downtime, and better resource management, further lowering costs.

- Capital Access: Larger, established companies often have easier and cheaper access to capital markets, enabling them to fund operations and expansion more effectively than newer, less proven entities.

The threat of new entrants in the oil and gas sector is significantly low due to the immense capital required for operations. In 2024, the cost to drill a single horizontal well in the Permian Basin alone can range from $7 million to $10 million, excluding lease acquisition and infrastructure development.

Furthermore, established players like Diamondback Energy possess proprietary technologies and extensive geological expertise, particularly in advanced extraction methods. Newcomers would face considerable challenges in replicating these capabilities or acquiring the necessary technology without substantial financial backing.

Environmental regulations and complex permitting processes also act as substantial barriers. For instance, in 2024, evolving methane emission standards and extensive permitting requirements demand significant investment in compliance technologies and specialized expertise, making entry difficult for smaller, undercapitalized firms.

Economies of scale enjoyed by incumbents like Diamondback Energy further deter new entrants. Established companies benefit from lower per-unit costs due to bulk purchasing, existing infrastructure, and optimized operations, making it hard for new players to compete on price and profitability.

| Barrier Type | Description | 2024 Cost Example |

|---|---|---|

| Capital Requirements | High upfront investment for drilling and infrastructure. | $7M - $10M per horizontal well (Permian Basin) |

| Technology & Expertise | Need for advanced extraction techniques and geological knowledge. | Millions for proprietary software and specialized personnel. |

| Regulatory Compliance | Meeting environmental standards and permitting processes. | Millions for methane emission control technology and legal counsel. |

| Economies of Scale | Cost advantages from large-scale operations and existing infrastructure. | Lower per-barrel production costs for established operators. |

Porter's Five Forces Analysis Data Sources

Our Diamondback Energy Porter's Five Forces analysis is built upon a foundation of robust data, including SEC filings, annual reports, and investor presentations. We also incorporate insights from reputable industry research firms and financial news outlets to ensure a comprehensive understanding of the competitive landscape.