Diamondback Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diamondback Energy Bundle

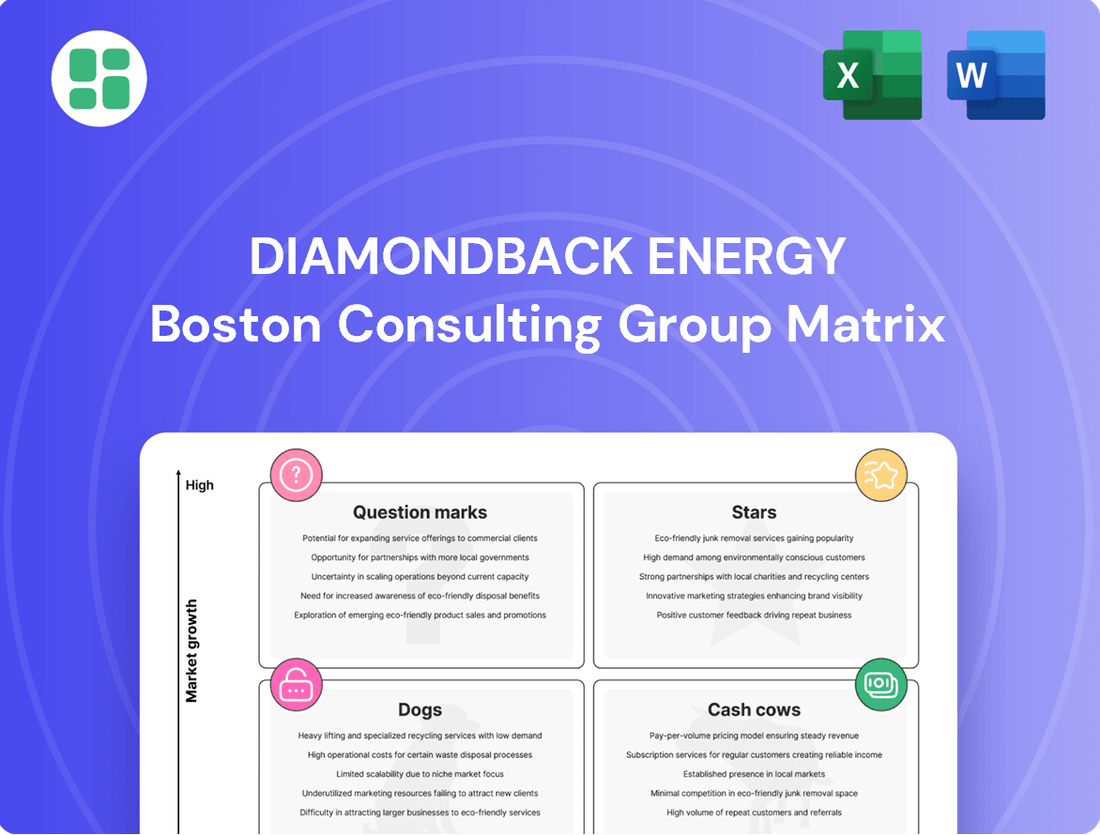

Curious about Diamondback Energy's strategic positioning? This glimpse into their BCG Matrix reveals the foundational understanding of their portfolio's market share and growth potential. But to truly unlock actionable insights and guide your investment decisions, you need the full picture.

Dive deeper into Diamondback Energy's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Diamondback Energy's dominant Permian Basin acreage, significantly expanded by the September 2024 Endeavor Energy Resources merger and the April 2025 Double Eagle IV acquisition, firmly places its core operations within the 'Star' category of the BCG Matrix. This strategic consolidation has resulted in an impressive approximately 722,000 net acres, establishing Diamondback as a premier operator in a region poised for substantial expansion.

The Permian Basin's critical role in driving U.S. oil and gas production growth through 2025 underscores the high-growth market aspect of this segment. This extensive, high-quality asset base in a thriving market environment validates its 'Star' classification, indicating strong potential for continued growth and market leadership.

Diamondback Energy's commitment to high-efficiency drilling and completions is a cornerstone of its competitive advantage. The company consistently achieves record-low cycle times, meaning it can drill and complete wells faster than ever before. For instance, in Q1 2024, Diamondback reported average cycle times of just 38 days, a significant improvement that directly translates to lower costs and quicker returns on investment.

These operational enhancements, including the ability to drill longer lateral wells, allow Diamondback to maximize resource extraction from each pad. By extending laterals, they can access more hydrocarbons with a single wellbore, thereby reducing the overall number of wells needed and further optimizing capital deployment. This focus on efficiency is crucial for maintaining a strong market share in the highly competitive Permian Basin.

The result of this operational prowess is Diamondback's ability to sustain or even grow production targets while simultaneously managing capital expenditures. In 2023, the company achieved an average production of 479 MBOE/d, demonstrating its capacity to deliver robust output. This capability underscores their leading operational expertise in a market that demands both efficiency and volume.

Diamondback Energy’s strategic acquisitions, including the significant multi-billion dollar deals for Endeavor Energy and Double Eagle IV, are designed to unlock substantial synergies. These integrations are projected to immediately bolster the company's portfolio with high-quality, adjacent drilling locations, enhancing their operational efficiency and market standing.

The core strategy behind these large-scale acquisitions is the consolidation of Tier One acreage. By bringing these newly acquired assets into Diamondback's proven operating model, the company aims to create a robust foundation for sustained, long-term growth and value creation.

Consistent Production Growth in Core Plays

Diamondback Energy's core operational areas, specifically the Spraberry and Wolfcamp formations in the Midland Basin and the Wolfcamp and Bone Spring formations in the Delaware Basin, are consistently driving robust production growth. This focus on highly prolific unconventional reservoirs underpins the company's ability to maintain significant output levels. The company's 2025 oil production guidance of 485-492 MBO/d, coupled with its Q2 2025 average oil production of 495.7 MBO/d, highlights its operational strength and execution capabilities in these key basins.

This sustained high-level production within these expanding basins is a clear indicator of Diamondback's strong market leadership and its capacity to capitalize on resource development.

- Midland Basin Focus: Spraberry and Wolfcamp formations are key production drivers.

- Delaware Basin Focus: Wolfcamp and Bone Spring formations contribute significantly to output.

- 2025 Oil Production Guidance: 485-492 MBO/d indicates continued growth.

- Q2 2025 Average Oil Production: 495.7 MBO/d demonstrates current operational strength.

Exploration of Secondary Zones

Diamondback Energy is strategically focusing on unlocking value from secondary zones within its established Permian Basin acreage. This internal exploration initiative is designed to maximize the potential of its existing footprint, ensuring a robust and high-quality drilling inventory. By developing these additional resource layers, Diamondback aims to enhance its production and market presence organically.

This approach allows Diamondback to efficiently grow its operations by leveraging its current infrastructure and geological understanding. The company's commitment to secondary zone development is a key component of its strategy to maintain a competitive edge and deliver sustained shareholder value. For instance, in the first quarter of 2024, Diamondback reported an average daily production of approximately 487,000 barrels of oil equivalent (BOE), a significant portion of which is attributable to optimized development across its extensive acreage.

- Focus on Secondary Zones: Diamondback is actively exploring and optimizing less-developed or previously bypassed zones within its existing Permian Basin assets.

- Internal Growth Engine: This strategy creates a continuous pipeline of high-potential drilling locations without the need for costly new acquisitions.

- Market Share Expansion: By tapping into these additional reserves, Diamondback effectively expands its production capacity and strengthens its position in the Permian.

- Q1 2024 Production: The company averaged around 487,000 BOE per day in early 2024, reflecting the success of its development strategies.

Diamondback Energy's substantial Permian Basin acreage, bolstered by recent strategic acquisitions, positions it squarely in the Stars category of the BCG Matrix. This classification signifies a high-growth market with a dominant market share, driven by the company's operational excellence and extensive, high-quality asset base.

The company's commitment to efficiency, evidenced by record-low cycle times and the development of longer lateral wells, directly contributes to its Star status. This focus on optimizing production from its core Permian assets, including secondary zone development, ensures continued growth and market leadership in a dynamic energy landscape.

Diamondback's 2025 oil production guidance of 485-492 MBO/d and its Q2 2025 average oil production of 495.7 MBO/d underscore its ability to consistently deliver strong output from its Star assets.

| BCG Category | Diamondback Energy's Position | Key Supporting Factors |

| Stars | Dominant Market Share in a High-Growth Market | Extensive Permian Basin acreage (~722,000 net acres post-merger), high-efficiency operations, strong production growth. |

| Market Growth (Permian Basin) | High | Critical role in U.S. oil and gas production expansion through 2025. |

| Diamondback's Market Share | High | Premier operator status due to strategic acquisitions and operational expertise. |

What is included in the product

Diamondback Energy's BCG Matrix analysis highlights strategic investment decisions for its portfolio.

It identifies which business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualizes Diamondback's portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Diamondback Energy's established Permian production base acts as a classic Cash Cow. These mature, high-volume wells, primarily in the Permian Basin, are incredibly efficient at generating substantial, consistent cash flow. In 2023, Diamondback reported a record adjusted EBITDA of $8.2 billion, a significant portion of which is attributable to these stable, long-lived assets.

Diamondback Energy's robust free cash flow generation is a hallmark of its Cash Cow status. The company reported a significant $4.0 billion in Adjusted Free Cash Flow for the full year 2024. This strong performance continued into the second quarter of 2025, with the company generating $1.2 billion in Adjusted Free Cash Flow.

This consistent and substantial cash flow, coupled with a disciplined approach to capital spending, provides Diamondback with the financial flexibility to manage its operations effectively. It allows the company to pay down debt, thereby strengthening its balance sheet, and also to return capital directly to its shareholders through dividends and buybacks. These steady cash inflows are precisely what define a mature, highly profitable business unit, offering a stable financial foundation.

Diamondback Energy's shareholder return program, which directs at least 50% of quarterly free cash flow to stockholders via dividends and buybacks, firmly places it in the Cash Cow category within the BCG Matrix. This commitment signifies a focus on leveraging established, high-performing assets to generate consistent cash for investor distribution, rather than prioritizing rapid expansion. For instance, in the second quarter of 2025, the company returned an impressive $691 million to its shareholders, underscoring the effectiveness of this mature asset monetization strategy.

Viper Energy Partners Majority Stake

Diamondback Energy's majority stake in Viper Energy Partners positions Viper as a quintessential Cash Cow. Viper's extensive royalty interests across prolific basins, particularly the Permian, generate consistent, low-cost cash flow with minimal capital expenditure. This structure allows Diamondback to leverage Viper's production without the direct operational burdens.

The stability of these royalty revenues is a key characteristic of a Cash Cow. In 2024, Viper Energy Partners continued to demonstrate this resilience, contributing significantly to Diamondback's overall financial health through its predictable income streams. This segment provides a vital source of funding for other strategic initiatives within Diamondback's broader portfolio.

- Stable Cash Flow: Viper's royalty interests provide a reliable and predictable income stream.

- Low Operational Expenditure: Royalty assets require minimal ongoing investment, enhancing profitability.

- Permian Exposure: Offers access to a highly productive basin without direct operational costs.

- Funding Source: Generates cash that can be reinvested or distributed.

Operational Cost Discipline

Diamondback Energy's operational cost discipline is a key driver of its Cash Cow status. The company achieved a Lease Operating Expense (LOE) of just $5.26 per barrel of oil equivalent (BOE) in the second quarter of 2025. This focus on lean operations translates directly into robust profit margins.

This low-cost structure is crucial for generating substantial free cash flow, even when oil prices experience volatility. The company's ability to keep its operating expenses down ensures that its high-market-share production remains highly profitable, a defining characteristic of a Cash Cow.

- Low Cash Operating Costs: Demonstrated by an LOE of $5.26/BOE in Q2 2025.

- High Profit Margins: Achieved through efficient operations on its significant production base.

- Consistent Free Cash Flow: A direct result of disciplined cost management.

- Resilience in Market Fluctuations: The lean structure allows for sustained profitability regardless of commodity price swings.

Diamondback Energy's established Permian production base, along with its majority stake in Viper Energy Partners, functions as a prime example of a Cash Cow. These assets are characterized by their mature, high-volume, and efficient generation of substantial, consistent cash flow with minimal capital reinvestment. Viper Energy Partners, specifically, provides a predictable income stream through its royalty interests, requiring very little ongoing investment.

| Metric | 2023 | 2024 (Full Year Est.) | Q2 2025 |

|---|---|---|---|

| Adjusted EBITDA | $8.2 billion | N/A | N/A |

| Adjusted Free Cash Flow | N/A | $4.0 billion | $1.2 billion |

| Lease Operating Expense (LOE) per BOE | N/A | N/A | $5.26 |

| Shareholder Returns (Q2 2025) | N/A | N/A | $691 million |

Delivered as Shown

Diamondback Energy BCG Matrix

The Diamondback Energy BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a professional, analysis-ready report designed for immediate strategic application.

Rest assured, the BCG Matrix report you are currently viewing is the exact final version that will be delivered to you after your purchase. It's a complete, professionally crafted document ready for your business planning and decision-making processes.

Dogs

Diamondback Energy has strategically divested non-core assets, aiming to shed at least $1.5 billion in properties. These sales typically involve assets with lower performance or those not central to the company's primary strategy, aligning them with the Dogs quadrant of the BCG Matrix due to their limited growth potential and market share within Diamondback's core operations.

Recent actions include the sale of a 10% stake in the BANGL pipeline and various non-operated assets in the Delaware Basin. Such divestitures allow Diamondback to focus capital and resources on its more promising, high-growth assets, thereby improving overall portfolio efficiency and shareholder returns.

Marginal or older producing wells, while not explicitly labeled as Dogs in Diamondback Energy's BCG Matrix, would represent assets that no longer meet the company's high capital efficiency standards. These wells typically have a low share of Diamondback's total production and very limited prospects for growth. For instance, during 2024, Diamondback continued its strategy of portfolio optimization, which inherently involves assessing and potentially divesting or decommissioning older, less productive assets that do not contribute significantly to returns.

Diamondback Energy's 27.5% stake in the Epic pipeline and associated water assets, acquired through the Endeavor purchase, is being divested, signaling these are non-core or 'Dog' assets within its portfolio.

While pipelines are generally considered valuable infrastructure, their classification as non-strategic suggests they do not sufficiently support Diamondback's core exploration and production (E&P) activities or are not generating adequate returns.

This divestiture is part of Diamondback's broader strategy to optimize its operational footprint and strengthen its balance sheet by reducing debt.

Underperforming Non-Operated Properties

Diamondback Energy's divestment of certain non-operated properties in the Delaware Basin for approximately $138 million in 2024 highlights assets with limited operational oversight and potentially lower returns. These types of assets, even within a strong market like the Delaware Basin, can be classified as 'Dogs' in a BCG Matrix if they don't significantly boost the company's market share or profitability. The strategic sale of these underperforming assets allows Diamondback to reallocate capital towards more promising and higher-yielding ventures.

- Divestment Value: Approximately $138 million from non-operated Delaware Basin properties.

- BCG Classification: These assets likely fall into the 'Dog' category due to low operational control and potentially lower returns.

- Strategic Rationale: Frees up capital for reinvestment in core, higher-performing assets.

Assets with Sub-Optimal Returns on Capital

Assets with sub-optimal returns on capital, particularly those that don't measure up to Diamondback's highly efficient core Permian operations, would fall into this category. The company's emphasis on free cash flow generation over sheer volume growth, especially in a market with ample supply, underscores its commitment to a stringent investment evaluation process. These types of assets can become capital drains, failing to generate adequate returns, and thus become prime candidates for divestment.

For instance, if Diamondback Energy were to acquire a smaller, less efficient asset outside its core Permian Basin, and that asset's return on invested capital (ROIC) consistently lagged behind the company's benchmark of, say, 20% ROIC in its Permian operations, it would be flagged. In 2024, Diamondback's focus on capital discipline meant that projects not meeting aggressive internal return hurdles were likely to be scrutinized for potential sale or reduced investment.

- Sub-optimal ROIC: Assets that consistently generate returns below Diamondback's target thresholds, such as its high-performing Permian assets.

- Capital Tie-up: Investments that lock up significant capital without producing commensurate financial results.

- Divestment Potential: Such assets are prime candidates for sale to free up capital for more productive uses.

- Strategic Alignment: Assets that do not align with the company's strategy of prioritizing free cash flow and capital efficiency.

Diamondback Energy's 'Dogs' are assets that exhibit low market share and limited growth potential within the company's portfolio, often characterized by sub-optimal returns or non-strategic alignment. The company's ongoing strategy of portfolio optimization, which includes divesting non-core or underperforming assets, directly addresses these 'Dog' classifications. These divestitures, such as the sale of non-operated properties or non-strategic pipeline stakes, aim to reallocate capital towards more profitable ventures and improve overall financial efficiency.

| Asset Type | BCG Classification | Rationale | Example Action (2024) | Approximate Value |

|---|---|---|---|---|

| Non-operated Delaware Basin Properties | Dog | Low operational control, potentially lower returns | Divested | $138 million |

| BANGL Pipeline Stake (10%) | Dog | Non-core, limited growth within E&P focus | Divested | N/A (Partial Stake) |

| Epic Pipeline Stake (27.5%) | Dog | Non-strategic, not supporting core E&P | Divested | N/A (Acquired via Endeavor) |

| Marginal Producing Wells | Dog | Low production, limited growth prospects, below capital efficiency standards | Potential divestment or decommissioning | N/A |

Question Marks

Diamondback Energy's recent acquisitions, notably the Endeavor and Double Eagle mergers, have significantly boosted its undeveloped acreage. The 407 locations acquired from Double Eagle, situated adjacent to Diamondback's core operations, are a prime example. These represent a substantial opportunity within a high-growth basin.

While these newly acquired assets hold considerable future potential, they currently function as question marks within the BCG matrix. Their market share is low because capital has not yet been deployed for their extensive development. The success of these undeveloped acres hinges on substantial future investment to transform them into producing, cash-generating assets.

Diamondback Energy's early-stage exploration in new zones, such as venturing into deeper or less-proven formations within the Permian Basin or entirely new geological areas, represents its '.' These initiatives hold substantial growth potential if they prove fruitful, but at present, they contribute minimally to the company's overall production volume and market share.

These exploratory efforts demand considerable initial capital outlay for detailed geological assessments and preliminary drilling campaigns to ascertain their economic feasibility. For instance, in 2024, Diamondback continued to invest in evaluating prospective acreage outside its core Delaware and Midland Basin positions, aiming to identify future growth engines.

Diamondback Energy's investments in decarbonization technologies, like their partnership with Verde Clean Fuels for lower-carbon gasoline, position them within the high-growth energy transition market. These ventures, while currently a minor revenue contributor, represent significant potential as the market for cleaner energy solutions expands.

The success of these initiatives, including the Deep Blue joint venture for water recycling, is intrinsically linked to technological advancements and broader market acceptance. This necessitates continued, substantial investment to navigate the evolving landscape and achieve commercial viability.

Application of New Drilling Technologies in Untested Areas

Applying novel drilling and completion technologies in untested geological areas presents a classic 'Question Mark' scenario for Diamondback Energy. While the company excels in optimizing existing plays, venturing into regions with less understood subsurface characteristics or into formations not yet thoroughly explored by Diamondback itself carries inherent risks. These initiatives, though potentially offering substantial future growth, currently lack a significant proven market share and demand considerable upfront investment and a steep learning curve.

For instance, if Diamondback were to pilot advanced hydraulic fracturing techniques in a newly acquired, geologically complex acreage in the Delaware Basin, this would fit the 'Question Mark' profile. Such a move, while potentially unlocking vast reserves, would require substantial capital expenditure and a period of intensive data gathering and adaptation. The success of these ventures is not guaranteed, but the potential payoff in terms of future production and market position could be transformative.

- High-Risk Exploration: Deployment of experimental drilling methods in areas with limited prior operational data.

- Uncertain Market Share: Initial low or non-existent proven production from these new ventures.

- Significant Capital Outlay: Substantial investment needed for technology adaptation and operational learning.

- Potential for Future Growth: High reward if new technologies prove successful in unlocking previously uneconomical reserves.

Strategic Shifts Towards Gas-Focused Development

Diamondback Energy's strategic positioning could see a shift towards its gas-rich assets. With natural gas prices climbing and a robust demand for Liquefied Natural Gas (LNG) exports, Diamondback might increase its focus on these areas within the Permian Basin, especially where its current gas production share is relatively lower. This strategic pivot represents a potential 'Question Mark' in the BCG matrix, as it offers new growth opportunities but necessitates targeted investment to capture a larger market share in the gas segment.

This strategic consideration is particularly relevant given market dynamics. For instance, the Henry Hub natural gas price averaged around $2.30 per million British thermal units (MMBtu) in 2023, a decrease from 2022's highs, but forward curves indicate potential strengthening. Diamondback's 2023 production mix showed a significant proportion of oil, but the company has also been actively managing its gas assets. A deliberate move to bolster its gas development could leverage this market trend.

- Strategic Focus: Increased emphasis on gas-rich acreage within the Permian.

- Market Opportunity: Rising natural gas prices and strong LNG export demand.

- BCG Matrix Implication: Potential 'Question Mark' due to investment requirements for growth.

- Investment Rationale: Unlocking new growth avenues by expanding market share in the gas commodity segment.

Diamondback Energy's undeveloped acreage, particularly following recent acquisitions like Endeavor and Double Eagle, represents significant potential but currently sits as a question mark in the BCG matrix. These assets have low market share because substantial capital hasn't yet been deployed for their full development. Their success hinges on future investment to transform them into producing, cash-generating entities.

The company's exploration into new geological zones or less-proven formations within basins like the Permian also falls into the question mark category. These efforts, while holding high growth potential, currently contribute minimally to overall production and market share, requiring considerable initial capital for assessment and preliminary drilling.

Diamondback's investments in decarbonization technologies, such as its partnership with Verde Clean Fuels, are also question marks. These ventures, though in a high-growth market, are minor revenue contributors now and necessitate continued investment to achieve commercial viability and market acceptance.

Diamondback Energy's strategic pivot towards its gas-rich assets, driven by rising natural gas prices and strong LNG export demand, also presents a question mark scenario. This requires targeted investment to capture a larger market share in the gas segment, despite the potential for new growth avenues.

| BCG Category | Diamondback Energy Examples | Key Characteristics | 2024/2025 Outlook |

| Question Marks | Undeveloped acreage (Endeavor, Double Eagle) | Low market share, high potential growth, requires significant investment. | Continued evaluation and phased development, dependent on capital allocation and market conditions. |

| Question Marks | New geological zone exploration | Minimal current production, high risk/reward, needs extensive upfront capital. | Ongoing geological studies and pilot drilling programs to assess economic viability. |

| Question Marks | Decarbonization technologies (Verde Clean Fuels) | Nascent revenue contribution, high growth market potential, requires R&D and market adoption. | Strategic partnerships and technology scaling to capture emerging clean energy demand. |

| Question Marks | Increased focus on gas assets | Opportunity in rising gas prices/LNG demand, requires targeted development for market share growth. | Potential capital reallocation towards gas infrastructure and exploration, monitoring market price trends. |

BCG Matrix Data Sources

Our Diamondback Energy BCG Matrix is informed by comprehensive financial disclosures, industry growth projections, and competitive landscape analysis to provide a robust strategic overview.