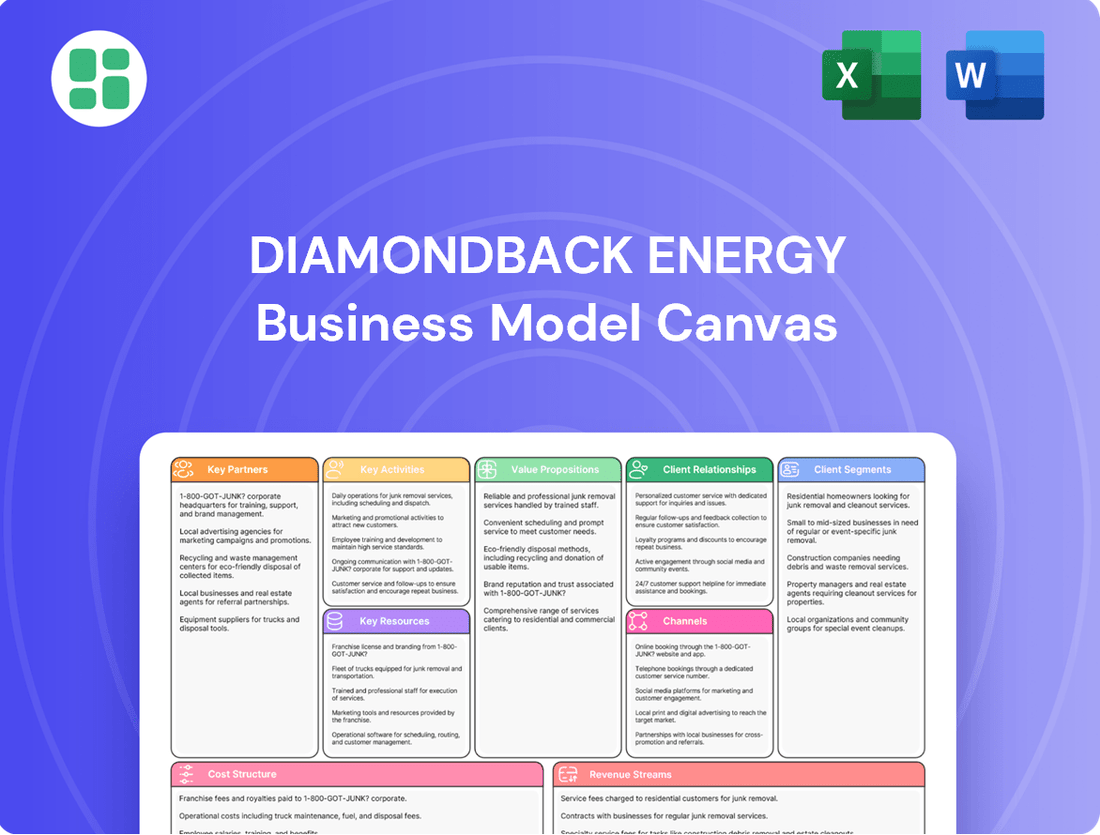

Diamondback Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diamondback Energy Bundle

Unlock the full strategic blueprint behind Diamondback Energy's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Diamondback Energy actively pursues strategic acquisitions to bolster its presence, notably through the significant merger with Endeavor Energy Resources. This move, alongside acquisitions like Double Eagle IV, directly expands its Permian Basin asset base and solidifies its market leadership.

These carefully chosen transactions are designed to significantly enhance the company's inventory depth and the overall quality of its reserves. The goal is to unlock substantial operational synergies and achieve greater economies of scale, ultimately driving improved efficiency and profitability.

Diamondback Energy actively pursues joint ventures to bolster its sustainability initiatives. A prime example is its partnership with Deep Blue, focused on enhancing water recycling and reuse within the Permian Basin. This collaboration is crucial for reducing the company's environmental footprint.

These strategic alliances are fundamental to Diamondback's commitment to responsible operational practices. By working with partners like Deep Blue, the company aims to achieve significant progress in water management, a key environmental concern in the energy sector.

Diamondback Energy collaborates with key technology and service providers to enhance its drilling, completion, and operational efficiency. These partnerships are crucial for accessing specialized expertise and innovative solutions.

A prime example is their partnership with VoltaGrid, which provides micro-grid solutions to electrify field operations. This collaboration is designed to significantly reduce operational costs and lower emissions, contributing to Diamondback's environmental goals.

Midstream and Transportation Partners

Diamondback Energy relies heavily on midstream and transportation partners to get its oil, natural gas, and natural gas liquids (NGLs) from the wellhead to customers. These relationships are vital for the company's operational efficiency and market access. For instance, in 2023, Diamondback continued to leverage a robust network of third-party midstream providers to manage its production volumes effectively.

These partnerships are essential for gathering, processing, and transporting the hydrocarbons produced. Without reliable midstream infrastructure, Diamondback's ability to monetize its reserves would be significantly hampered. The company's strategic planning often includes securing adequate transportation and processing capacity through these key alliances.

- Gathering Systems: Partnerships with midstream companies provide extensive gathering networks to collect crude oil and natural gas from Diamondback's wells.

- Processing Facilities: Access to NGL fractionation and natural gas processing plants is secured through these collaborations, ensuring products meet market specifications.

- Transportation Logistics: Agreements with pipeline operators and trucking companies facilitate the movement of finished products to refineries, petrochemical plants, and export terminals.

Financial Institutions and Investors

Diamondback Energy relies heavily on financial institutions for crucial funding. In 2024, the company continued to leverage credit facilities, term loans, and senior notes to finance its significant acquisition activity and ongoing capital expenditures in the Permian Basin. These partnerships are vital for maintaining operational momentum and executing strategic growth initiatives.

The company also cultivates strong relationships with both institutional and individual investors. This engagement is essential for equity financing, enabling Diamondback to raise capital for its ambitious plans and ensuring a stable shareholder base. These investor relationships also play a role in maintaining market liquidity for its stock.

- Credit Facilities: Access to revolving credit facilities provides flexibility for short-term funding needs and working capital management.

- Debt Offerings: Senior notes issuances are a primary method for securing long-term financing for major projects and acquisitions, such as the significant investments made in 2024.

- Equity Financing: Partnerships with investors allow for the issuance of new shares to fund growth, as demonstrated by equity components in major transactions throughout 2024.

- Market Liquidity: Maintaining strong investor relations helps ensure consistent trading volume and a fair market valuation for Diamondback's stock.

Diamondback Energy’s key partnerships are crucial for its operational success and strategic growth. These include vital collaborations with midstream and transportation providers, ensuring efficient movement of its oil and gas products. Furthermore, strong relationships with financial institutions and investors are fundamental for securing the capital needed for acquisitions and ongoing development.

The company also engages with technology and service providers to enhance operational efficiency and sustainability, exemplified by partnerships focused on micro-grid solutions and water recycling. These alliances are integral to Diamondback’s strategy of maximizing resource utilization and minimizing its environmental impact, particularly in the Permian Basin.

| Partner Type | Key Role | Example/Impact | 2024 Relevance |

| Midstream & Transportation | Gathering, processing, and transporting hydrocarbons | Ensures market access for crude oil, natural gas, and NGLs | Essential for monetizing increased production from acquisitions |

| Financial Institutions | Providing debt financing and credit facilities | Supports capital expenditures and strategic acquisitions | Crucial for funding the Endeavor Energy merger and related investments |

| Investors | Equity financing and market liquidity | Enables capital raising for growth initiatives | Maintains a stable shareholder base and supports stock valuation |

| Technology & Service Providers | Enhancing operational efficiency and sustainability | Access to specialized expertise and innovative solutions (e.g., VoltaGrid) | Aids in cost reduction and achieving environmental goals |

What is included in the product

A comprehensive business model canvas detailing Diamondback Energy's strategy, focusing on efficient Permian Basin oil and gas production, leveraging key partnerships and cost-effective operations to deliver shareholder value.

Diamondback Energy's Business Model Canvas offers a pain point reliever by providing a clear, one-page snapshot of their operational strategy, enabling quick identification of efficiencies and potential bottlenecks in oil and gas production.

Activities

Diamondback Energy's key activities revolve around the strategic acquisition and seamless integration of oil and natural gas assets, with a sharp focus on the prolific Permian Basin. This includes identifying promising unconventional reserves and bringing them into their operational fold efficiently.

A significant aspect of this is their aggressive growth through major acquisitions. For instance, the acquisition of Endeavor Energy, valued at approximately $26 billion, and Double Eagle IV, further solidify their position and operational capacity in the Permian. These moves are designed to expand their acreage, enhance production, and create significant synergies.

Diamondback Energy's core operations revolve around the sophisticated drilling, completion, and exploitation of oil and natural gas reserves. They leverage advanced techniques like horizontal drilling, particularly in prolific Permian Basin formations such as the Spraberry and Wolfcamp, to significantly boost hydrocarbon recovery rates.

In 2024, Diamondback continued to refine these processes. For instance, their average lateral length for new wells in the Permian Basin has steadily increased, demonstrating a commitment to maximizing reservoir contact. This focus on efficient exploitation is crucial for their ongoing production growth and cost management.

Diamondback Energy’s key activities center on the efficient and effective management of its producing assets. This involves overseeing the ongoing extraction of crude oil, natural gas, and natural gas liquids (NGLs) from its extensive portfolio of wells.

Optimizing well performance is crucial. This means employing advanced techniques to maximize output from each well, ensuring the company extracts the most value from its reserves. Maintaining the integrity and functionality of its vast infrastructure, including pipelines and processing facilities, is also a paramount activity to prevent downtime and ensure smooth operations.

Operational efficiency is a continuous focus. Diamondback implements technologies and best practices to minimize costs and maximize productivity. For instance, the company utilizes Continuous Emissions Monitoring Systems (CEMs) to enhance its environmental performance, demonstrating a commitment to responsible operations alongside production goals.

Capital Allocation and Shareholder Returns

Diamondback Energy strategically allocates capital to its core operations, including exploration and production drilling programs. This includes investments in midstream infrastructure to support its growing production base. Furthermore, capital is directed towards opportunistic acquisitions to enhance its asset portfolio and scale.

The company is committed to returning value to its shareholders. This is achieved through a combination of regular dividend payments and a robust share repurchase program. Diamondback aims to strike a balance between reinvesting in the business for future growth and providing direct returns to its investors.

- Capital Allocation Focus: Drilling programs, infrastructure development, and strategic acquisitions.

- Shareholder Returns: Dividends and share repurchase programs are key components.

- 2024 Dividend Snapshot: As of early 2024, Diamondback maintained a consistent dividend payout, reflecting its confidence in operational cash flow.

- Share Repurchase Activity: The company actively engaged in share buybacks throughout 2024, reducing outstanding shares and enhancing shareholder value.

Environmental, Social, and Governance (ESG) Initiatives

Diamondback Energy actively implements and reports on various sustainability practices. This includes significant efforts in water recycling, aiming to minimize freshwater usage in its operations. The company is also focused on reducing its greenhouse gas emissions, aligning with broader industry trends towards cleaner energy production.

Fostering a safe and healthy working environment is a core priority, with continuous investment in safety protocols and training programs. Diamondback integrates Environmental, Social, and Governance (ESG) metrics directly into its operational strategies and executive compensation structures. This approach is designed to incentivize and drive responsible development and performance across the organization.

- Water Recycling: Diamondback reported a water recycling rate of 80% for its Permian Basin operations in 2023, a key metric for environmental stewardship.

- Emissions Reduction: The company has set targets to reduce its Scope 1 and Scope 2 greenhouse gas emissions intensity, with specific reduction goals outlined in its sustainability reports.

- Safety: In 2023, Diamondback maintained a Total Recordable Incident Rate (TRIR) below the industry average, underscoring its commitment to workplace safety.

- ESG Integration: ESG performance is linked to executive compensation, creating a direct financial incentive for management to prioritize sustainable practices.

Diamondback Energy's key activities are centered on the efficient extraction and management of oil and natural gas, primarily in the Permian Basin. This includes sophisticated drilling and completion techniques, optimizing well performance, and maintaining extensive infrastructure. The company also focuses on strategic capital allocation for growth and shareholder returns.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Asset Acquisition & Integration | Acquiring and integrating oil and gas assets, particularly in the Permian Basin. | Continued focus on consolidating Permian acreage following major acquisitions. |

| Exploration & Production | Drilling, completing, and exploiting oil and natural gas reserves using advanced techniques. | Increased average lateral lengths for new wells in the Permian Basin, enhancing reservoir contact. |

| Operational Management | Overseeing ongoing extraction, optimizing well output, and maintaining infrastructure. | Implementing technologies for cost minimization and productivity maximization; utilization of CEMs for environmental performance. |

| Capital Allocation | Directing capital towards drilling programs, midstream infrastructure, and opportunistic acquisitions. | Significant capital expenditure planned for development projects and potential strategic transactions. |

| Shareholder Returns | Returning value through dividends and share repurchases. | Maintained consistent dividend payouts and actively engaged in share buyback programs throughout 2024. |

What You See Is What You Get

Business Model Canvas

The Diamondback Energy Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the file you'll download, offering full access to all sections and insights. You can be confident that the detailed analysis and strategic breakdown presented here is precisely what you'll own and can immediately utilize for your own business planning or research.

Resources

Diamondback Energy's core strength lies in its extensive acreage and proved reserves, primarily concentrated in the Permian Basin. This strategic land base, particularly in the prolific Spraberry and Wolfcamp formations, is the bedrock of its operations.

These unconventional, onshore oil and natural gas reserves are not just resources; they are the engine driving Diamondback's long-term production targets and growth trajectory. As of year-end 2023, Diamondback reported proved reserves of approximately 2.3 billion barrels of oil equivalent (BOE), with a significant portion attributable to these Permian assets.

Diamondback Energy's business model relies heavily on robust financial capital and ample liquidity. This includes significant cash reserves, which as of the first quarter of 2024, stood at approximately $750 million, providing immediate operational flexibility.

Access to substantial revolving credit facilities, totaling around $3 billion, offers a crucial backstop for funding ongoing operations, planned capital expenditures in the Permian Basin, and potential strategic growth opportunities.

Furthermore, the company's ability to tap into debt markets, demonstrated by recent successful debt offerings, ensures it can secure the necessary funds for large-scale projects and acquisitions, reinforcing its financial stability and capacity for expansion.

Diamondback Energy leverages proprietary and licensed technologies in horizontal drilling and hydraulic fracturing. This expertise is crucial for efficiently extracting oil and gas from challenging shale formations.

The company utilizes modern frac fleets and advanced operational efficiency tools to optimize hydrocarbon recovery. This focus on technological advancement directly impacts their cost structure and production volumes.

In 2024, Diamondback continued to invest in these advanced drilling and completion technologies, aiming to enhance well productivity and reduce per-barrel costs. Their commitment to innovation supports their strategy of maximizing returns from unconventional reservoirs.

Skilled Workforce and Management

Diamondback Energy’s success hinges on its highly skilled workforce, encompassing experienced geoscientists, engineers, and operational staff. This expertise is fundamental to optimizing exploration, development, and production, directly impacting efficiency and technological integration.

The management team's strategic acumen is equally vital, guiding decision-making and ensuring the company navigates the complexities of the energy sector effectively. Their leadership fosters innovation and drives operational excellence.

- Skilled Workforce: Diamondback reported approximately 1,000 employees in its 2023 annual report, a testament to the human capital driving its operations.

- Expertise in Operations: The company's geoscientists and engineers are critical for identifying and developing reserves, a core component of its business model.

- Management's Strategic Role: Experienced leadership ensures efficient capital allocation and strategic growth, particularly evident in their disciplined approach to acquisitions and development.

Infrastructure and Equipment

Diamondback Energy's infrastructure and equipment are foundational to its operations, encompassing ownership and access to vital assets like well sites, pipelines, and processing facilities. This extensive physical footprint, including drilling rigs, underpins the entire production lifecycle, from the initial extraction of oil and gas to its efficient transportation. The company's commitment to advanced monitoring systems, such as Continuous Emissions Monitoring (CEMs), further enhances operational efficiency and environmental compliance.

In 2024, Diamondback continued to invest in and optimize its infrastructure. For instance, the company's capital expenditures are allocated to maintaining and expanding these critical assets. This focus ensures reliable production and supports their strategic growth initiatives. The integration of technology within their infrastructure allows for real-time data analysis, enabling quicker decision-making and improved operational performance across their extensive Permian Basin acreage.

- Well Sites: Diamondback operates numerous well sites across its core acreage, which are the physical locations where drilling and production activities occur.

- Pipelines and Transportation: The company utilizes a network of pipelines for the efficient movement of crude oil, natural gas, and produced water, reducing reliance on more costly transportation methods.

- Processing Facilities: Ownership or access to midstream processing facilities is crucial for treating and preparing produced hydrocarbons for market.

- Drilling Rigs and Equipment: Diamondback maintains or contracts access to a fleet of modern drilling rigs and associated equipment, essential for exploration and development activities.

Diamondback's key resources are its vast Permian Basin acreage and substantial proved reserves, forming the foundation of its production capabilities. These assets, particularly in the Spraberry and Wolfcamp formations, are central to its operational strategy and long-term value generation.

The company's financial strength, including significant cash reserves and access to large credit facilities, provides the necessary liquidity and flexibility for ongoing operations and strategic investments. This robust financial backing is essential for funding capital expenditures and pursuing growth opportunities.

Diamondback's technological expertise in horizontal drilling and hydraulic fracturing, coupled with its skilled workforce and experienced management team, enables efficient resource extraction and operational optimization. This human and technological capital drives productivity and cost-effectiveness.

Crucial infrastructure, including well sites, pipelines, and processing facilities, supports the entire production lifecycle, ensuring efficient movement and preparation of hydrocarbons for market. Investment in these assets in 2024 continues to enhance operational performance and strategic growth.

| Key Resource | Description | 2023/2024 Data Point |

| Permian Basin Acreage & Reserves | Extensive land holdings and proved reserves in prolific formations. | Approx. 2.3 billion BOE proved reserves (YE 2023). |

| Financial Capital | Cash reserves and revolving credit facilities. | Approx. $750 million cash (Q1 2024); $3 billion revolving credit facility. |

| Technology & Expertise | Proprietary and licensed technologies for extraction; skilled workforce. | Ongoing investment in advanced drilling/completion tech in 2024; approx. 1,000 employees (2023). |

| Infrastructure | Well sites, pipelines, processing facilities, drilling equipment. | Continued investment and optimization of infrastructure in 2024. |

Value Propositions

Diamondback Energy is committed to producing oil and natural gas with exceptional efficiency and a strong emphasis on responsible practices. This involves meticulously developing its extensive asset base, prioritizing operational excellence at every stage.

The company's core objective is to extract the safest and cleanest barrels of oil possible, directly addressing global energy demand. This commitment is reflected in their operational strategies and ongoing investments in technology.

In 2024, Diamondback continued to demonstrate this commitment, achieving a production rate of approximately 490,000 barrels of oil equivalent per day (boepd) by the end of the first quarter. Their focus on cost management, with a capital budget of $1.9 to $2.1 billion for 2024, underscores their dedication to efficient resource utilization.

Diamondback Energy prioritizes boosting shareholder value by excelling in operations, pursuing strategic growth, and consistently returning capital through dividends and buybacks. This dedication to financial gains and strong free cash flow generation is a major attraction for investors.

In the first quarter of 2024, Diamondback Energy reported a significant increase in its capital returns to shareholders, distributing $732 million. This included $263 million in dividends and $469 million in share repurchases, underscoring their commitment to enhancing shareholder value.

Diamondback Energy boasts an exceptional inventory of drilling locations within the Permian Basin, a key advantage for its business model. This isn't just a large quantity; it's a high-quality reserve base, meaning the wells are expected to be more productive and cost-effective.

This deep bench of premium drilling inventory provides Diamondback with a significant competitive edge, ensuring a long-term outlook for production. For instance, as of the end of 2023, Diamondback reported over 1,700 net horizontal locations across its Permian assets, a testament to its extensive resource base.

The sheer scale and quality of this Permian inventory translate directly into a sustained growth runway. This allows the company to plan for years of development, capitalizing on favorable market conditions and optimizing its capital allocation for maximum returns.

Low-Cost Structure and Capital Efficiency

Diamondback Energy is laser-focused on keeping its operational costs as low as possible, consistently aiming for one of the lowest cost structures in the entire industry. This commitment translates directly into converting its proved reserves into cash flow with exceptional capital efficiency, meaning they get more bang for their buck on every dollar invested.

This operational discipline is a cornerstone of their strategy, allowing them to remain profitable and generate strong returns even when oil and gas prices are fluctuating wildly. For example, in the first quarter of 2024, Diamondback reported a production cost of $10.75 per barrel of oil equivalent (BOE), a figure that underscores their cost-conscious approach.

- Lowest Cost Structure: Diamondback actively manages its expenses to maintain a competitive edge in the Permian Basin.

- High Capital Efficiency: The company converts its asset base into cash flow with superior capital deployment.

- Profitability in Volatility: Their cost discipline ensures robust profitability regardless of commodity price swings.

- Operational Discipline: A consistent focus on efficient operations drives financial performance.

Commitment to Environmental Stewardship

Diamondback Energy showcases its dedication to environmental responsibility by setting aggressive goals for water recycling, emissions reduction, and maintaining high operational standards. This focus resonates strongly with investors and communities prioritizing sustainable energy practices.

For instance, in 2023, Diamondback reported achieving a 70% water recycling rate in its Permian Basin operations, a significant step towards minimizing freshwater usage. The company also aims to reduce its greenhouse gas intensity by 50% by 2030 compared to a 2019 baseline.

- Water Recycling: Aiming for over 70% water recycling in operations.

- Emissions Reduction: Targeting a 50% reduction in greenhouse gas intensity by 2030.

- Responsible Operations: Implementing best practices for environmental protection across all sites.

Diamondback's value proposition centers on delivering efficient, responsible energy production by leveraging its extensive Permian Basin asset base. The company prioritizes operational excellence and cost management to maximize shareholder returns through dividends and buybacks.

This commitment is evident in their substantial production volumes and disciplined capital allocation, ensuring consistent profitability and growth. Diamondback's focus on environmental stewardship further enhances its appeal to stakeholders.

| Metric | 2023 (Actual) | Q1 2024 (Actual) | 2024 (Guidance) |

|---|---|---|---|

| Production (boepd) | ~470,000 | ~490,000 | ~490,000 - 500,000 |

| Capital Expenditures (Billion USD) | $2.3 | $0.5 | $1.9 - $2.1 |

| Shareholder Returns (Billion USD) | $2.5 | $0.732 | N/A (Ongoing) |

Customer Relationships

Diamondback Energy prioritizes clear and open communication with its investors. They achieve this through quarterly earnings calls, live webcasts, and detailed investor presentations, making sure everyone stays updated on financial results and future plans.

This commitment to transparency ensures shareholders and industry analysts have timely access to information regarding Diamondback's financial health, operational progress, and strategic direction, fostering trust and informed decision-making.

For instance, in their Q1 2024 earnings call, Diamondback reported a net income of $703 million, or $3.52 per diluted share, highlighting their ongoing financial performance and providing concrete data for investor analysis.

Diamondback Energy cultivates robust shareholder relationships by consistently returning capital. In 2024, the company demonstrated this commitment through its base and variable dividend payouts and ongoing share repurchase initiatives, directly benefiting its investors.

Diamondback Energy actively fosters community engagement in its operational regions, aiming to be a valued local partner. This commitment translates into tangible contributions to local economies, supporting jobs and businesses. For example, in 2024, Diamondback's operational spending in the Permian Basin directly injected millions into local communities through wages, supplier contracts, and taxes.

Stakeholder Feedback Integration

Diamondback Energy actively integrates stakeholder feedback to refine its corporate responsibility initiatives. This means listening to investors, employees, and the communities where it operates to ensure its business practices are aligned with expectations and industry standards.

This continuous feedback loop is crucial for shaping Diamondback's approach to environmental, social, and governance (ESG) matters. For instance, in 2024, the company continued to enhance its transparency regarding operational impacts and community engagement programs based on direct input received.

- Investor Relations: Diamondback engages with its investors through various channels, including earnings calls and annual meetings, to understand their perspectives on ESG performance and long-term value creation.

- Employee Engagement: Internal surveys and feedback mechanisms help gauge employee sentiment on safety, diversity, and inclusion, informing the development of relevant programs and policies.

- Community Outreach: The company maintains dialogue with local communities through partnerships and direct engagement to address concerns and contribute positively to their development, as evidenced by its ongoing community investment projects.

- Industry Best Practices: Diamondback monitors and adapts to evolving industry standards and regulatory requirements, often influenced by broader stakeholder consensus on responsible energy development.

Direct Communication with Key Stakeholders

Diamondback Energy prioritizes direct communication with its key stakeholders, employing channels like letters to stockholders and specialized investor relations teams. This ensures that important updates, strategic decisions, and performance highlights are clearly conveyed to its significant financial decision-makers.

This personalized approach fosters robust relationships with investors. For instance, in 2024, Diamondback continued to emphasize transparent communication regarding its operational performance and strategic initiatives, aiming to build trust and confidence among its shareholder base.

- Direct Engagement: Utilizes investor relations teams for personalized communication.

- Information Dissemination: Leverages letters to stockholders for key updates.

- Strategic Clarity: Communicates strategic decisions and performance highlights directly.

- Relationship Building: Fosters strong connections with financial decision-makers through consistent outreach.

Diamondback Energy cultivates strong customer relationships, primarily with its investors, through consistent communication and capital returns. The company actively engages its shareholder base via earnings calls, webcasts, and direct outreach, ensuring transparency regarding financial performance and strategic direction. In 2024, Diamondback reinforced these relationships by returning significant capital through dividends and share repurchases, directly benefiting its investors.

| Relationship Aspect | 2024 Focus | Impact |

|---|---|---|

| Investor Communication | Quarterly earnings calls, webcasts, investor presentations | Enhanced transparency and informed decision-making for shareholders |

| Capital Returns | Dividend payouts and share repurchases | Direct financial benefit and confidence building for investors |

| Community Engagement | Local economic support, job creation, supplier contracts | Positive stakeholder relations in operational regions |

Channels

The Investor Relations website acts as Diamondback Energy's primary digital portal, offering a treasure trove of information for stakeholders. It's where you'll find everything from the latest press releases and SEC filings to detailed financial reports and crucial corporate governance documents. This accessibility is key for both existing shareholders and potential investors looking to understand the company's performance and structure.

Diamondback Energy leverages regular quarterly earnings conference calls and live webcasts as a crucial communication channel. This allows management to directly address financial results, operational achievements, and strategic forward-looking statements with the investment community. These sessions are vital for transparency and providing real-time insights.

The accessibility of these calls, often complemented by readily available replays, ensures a broad audience of analysts, individual investors, and financial professionals can engage with Diamondback's performance narrative. For instance, in their Q1 2024 earnings, the company reported a production increase and highlighted strong free cash flow generation, details thoroughly discussed during the accompanying webcast.

Diamondback Energy leverages press releases and news wires to disseminate crucial company information, including financial results and strategic updates. This channel ensures timely and widespread public awareness of key corporate developments, reaching investors and the broader market efficiently.

In 2024, companies in the energy sector, including Diamondback, have increasingly relied on these channels to communicate their performance and outlook. For instance, the dissemination of quarterly earnings reports through services like Business Wire or PR Newswire is a standard practice, providing investors with the data needed for their analysis.

SEC Filings (10-K, 10-Q, 8-K)

SEC filings like the 10-K and 10-Q are crucial for transparency, offering detailed financial and operational insights into Diamondback Energy. These mandatory reports allow sophisticated investors and analysts to thoroughly evaluate the company's performance and strategic direction. For instance, Diamondback Energy's 2023 10-K filing revealed a net income of $3.9 billion and total revenues of $9.8 billion, providing a clear financial snapshot.

These filings serve as a primary source for understanding a company's business model, risks, and management's outlook. They are essential for due diligence and valuation, enabling informed decision-making by stakeholders. The 8-K filing, used for reporting significant events, ensures timely disclosure of material information that could impact investor decisions.

- 10-K (Annual Report): Provides a comprehensive overview of Diamondback Energy's financial condition, results of operations, and risk factors.

- 10-Q (Quarterly Report): Offers updated financial information and operational highlights on a quarterly basis, tracking performance between annual reports.

- 8-K (Current Report): Discloses material events that shareholders should know about promptly, such as acquisitions or significant management changes.

Industry Conferences and Presentations

Diamondback Energy leverages industry conferences and investor presentations as a key channel to connect with a specialized audience of financial professionals and potential investors. These platforms offer a direct avenue for engagement, allowing the company to articulate its strategic vision and operational successes. For instance, in 2023, Diamondback presented at numerous events, including the EnerCom Denver conference, where management discussed their Permian Basin strategy and capital allocation priorities, aiming to attract and retain investor interest.

These interactions are crucial for building and maintaining investor confidence. By sharing updates on production, reserve growth, and financial performance, Diamondback can effectively communicate its value proposition. The company's participation in events like the IPTC (International Petroleum Technology Conference) also provides visibility within the broader energy sector, fostering relationships with peers and potential partners.

The insights gained from these engagements are invaluable. They allow Diamondback to gauge market sentiment and receive direct feedback, which can inform future strategic decisions. In 2024, the company continued this practice, participating in key investor days and industry forums to highlight its commitment to operational excellence and shareholder returns, reinforcing its position as a leading independent energy producer.

Key benefits of this channel include:

- Direct Investor Engagement: Facilitates communication with a concentrated group of financial stakeholders.

- Strategic Visibility: Showcases the company's operational performance and forward-looking plans.

- Market Feedback: Provides valuable insights into investor perceptions and market trends.

- Relationship Building: Strengthens ties with the financial community and industry peers.

Diamondback Energy utilizes its Investor Relations website, SEC filings, and earnings calls as primary channels for direct communication with investors and analysts. These platforms provide essential financial data, operational updates, and strategic insights, ensuring transparency and accessibility for informed decision-making.

Customer Segments

Institutional investors, including large investment funds, mutual funds, pension funds, and hedge funds, are key customers for Diamondback Energy. These entities are primarily interested in long-term growth and stable returns, making established energy producers like Diamondback attractive. For instance, as of the first quarter of 2024, Diamondback Energy reported a net income of $875 million, demonstrating financial strength that appeals to these sophisticated investors.

These institutional players meticulously analyze financial performance, reserve growth potential, and the company's capital allocation strategies. They seek companies with a proven track record and a clear vision for future development. Diamondback's commitment to returning capital to shareholders, evidenced by its dividend payouts and share repurchase programs, further solidifies its appeal to this segment.

Individual investors, encompassing both retail and high-net-worth individuals, form a key customer segment for Diamondback Energy. These investors are primarily driven by the prospect of receiving dividends, seeking capital appreciation, and gaining exposure to the dynamic energy sector. Their investment decisions are often informed by publicly available financial disclosures and the company's investor relations communications.

In 2024, Diamondback Energy continued to focus on returning capital to shareholders. For instance, the company's dividend payout policy aims to provide a stable income stream, a critical factor for many individual investors. The company's stock performance and its ability to generate consistent free cash flow are closely watched metrics by this segment, influencing their perception of value and future growth potential.

Diamondback Energy's energy market buyers primarily consist of refineries that process crude oil into gasoline, diesel, and other fuels. These industrial consumers rely on Diamondback's production as essential raw materials for their operations.

Natural gas utilities also form a significant customer segment, purchasing natural gas for distribution to residential, commercial, and industrial end-users. Chemical plants are another key buyer, utilizing crude oil, natural gas, and natural gas liquids (NGLs) as feedstocks for their manufacturing processes.

In 2024, the demand for refined products remained robust, with global oil demand projected to reach 102.7 million barrels per day by the end of the year, according to the International Energy Agency. This sustained demand directly benefits producers like Diamondback by creating a consistent market for their crude oil.

Similarly, the natural gas market saw continued strength, with U.S. dry natural gas production averaging 102.1 billion cubic feet per day in the first half of 2024. This indicates a healthy appetite for natural gas among utilities and industrial consumers.

Financial Analysts and Advisors

Financial analysts and advisors rely on Diamondback Energy for robust data to inform their recommendations. They scrutinize metrics like production volumes, reserve life, and cost structures to assess investment potential. For instance, in Q1 2024, Diamondback reported a production of 471,000 barrels of oil equivalent per day (BOE/d), a key figure for analysts evaluating operational scale and efficiency.

These professionals need insights into Diamondback's strategic moves, such as its acquisition activity and capital allocation plans. Understanding the financial implications of deals, like the proposed acquisition of Endeavor Energy Resources, is crucial for portfolio management. Analysts will be looking at how such a transaction impacts leverage ratios and future cash flow generation, especially given the projected $1.6 billion in synergies.

Key data points for financial analysts and advisors include:

- Production Levels: Tracking daily production volumes (e.g., 471,000 BOE/d in Q1 2024) to gauge operational output.

- Financial Health: Analyzing debt-to-equity ratios and cash flow statements to assess financial stability.

- Acquisition Impact: Evaluating the financial and strategic rationale behind major acquisitions, including projected synergies and integration costs.

- Shareholder Returns: Monitoring dividend payouts and share buyback programs as indicators of capital return strategy.

Local Communities and Regulatory Bodies

Diamondback Energy's operations directly impact the local communities where it drills, focusing on environmental stewardship, creating employment opportunities, and contributing to the local economy. In 2024, the company continued its commitment to these areas, with a significant portion of its workforce residing in the regions where it operates, fostering local economic growth through wages and local procurement.

Regulatory bodies, such as state environmental agencies and the EPA, are crucial partners, ensuring Diamondback adheres to stringent environmental protection and operational safety standards. The company actively engages with these entities to maintain compliance and promote responsible resource development, a key tenet of its business model.

- Community Engagement: Diamondback prioritizes local hiring and supports community initiatives, aiming to be a positive force in the areas it serves.

- Environmental Compliance: Adherence to all federal, state, and local environmental regulations is paramount, with continuous investment in technologies to minimize operational footprint.

- Economic Contribution: Through job creation and local spending, Diamondback aims to bolster the economic vitality of the communities where it operates.

- Stakeholder Relations: Maintaining open communication with local communities and regulatory bodies is essential for sustainable and responsible operations.

Diamondback Energy serves a diverse customer base, including institutional investors like mutual funds and pension funds seeking stable returns, and individual investors drawn to dividends and capital appreciation. The company's energy products are purchased by refineries for fuel production and by natural gas utilities for distribution. Additionally, financial analysts and advisors utilize Diamondback's data for investment recommendations, while local communities and regulatory bodies represent crucial stakeholders in its operational framework.

| Customer Segment | Primary Interest | Key Data Points (2024) |

| Institutional Investors | Long-term growth, stable returns | Net income ($875M in Q1 2024), reserve growth potential |

| Individual Investors | Dividends, capital appreciation | Dividend payout policy, stock performance |

| Refineries | Crude oil supply | Global oil demand (projected 102.7M bpd end of 2024) |

| Natural Gas Utilities | Natural gas supply | U.S. dry natural gas production (avg. 102.1 Bcf/d H1 2024) |

| Financial Analysts | Investment potential, strategic moves | Production levels (471K BOE/d in Q1 2024), acquisition synergies ($1.6B projected) |

| Local Communities | Economic opportunities, environmental stewardship | Local employment, community investment |

Cost Structure

Diamondback Energy dedicates a substantial portion of its capital budget to drilling and completing new wells. These expenditures encompass the costs associated with rig operations, skilled labor, essential equipment, and the specialized fracturing fluids needed to bring wells online. For 2024, Diamondback has projected capital expenditures in the range of $2.3 billion to $2.6 billion, with a significant portion allocated to these upstream activities.

Lease Operating Expenses (LOE) represent the ongoing costs of keeping Diamondback Energy's wells and related infrastructure running. This includes essential expenses like labor for field operations, electricity for pumps, routine repairs, and chemicals used in production. Efficiently managing these costs is absolutely vital for Diamondback to maintain healthy profit margins.

In 2024, Diamondback Energy reported LOE per barrel of oil equivalent (BOE) that remained competitive within the industry. For instance, their Q1 2024 LOE averaged around $6.50 per BOE, demonstrating a focus on operational efficiency. This figure is a key indicator of how effectively the company controls its day-to-day production expenses.

General and Administrative (G&A) expenses for Diamondback Energy encompass the costs of running its corporate operations. This includes salaries for executive and administrative teams, rent for corporate offices, legal fees, and accounting services. In 2023, Diamondback reported G&A expenses of approximately $338 million, demonstrating a focus on managing these overheads to maintain a competitive cost structure.

Production and Ad Valorem Taxes

Production and ad valorem taxes represent a significant direct cost for Diamondback Energy, directly tied to the volume of oil and gas extracted and the assessed value of its physical assets. These taxes are unavoidable expenses incurred from the moment hydrocarbons are produced and on the company's land and equipment.

For instance, in 2024, Diamondback Energy, like other producers, navigates a complex tax landscape. Ad valorem taxes, typically levied by local governments based on property value, can fluctuate with asset appraisals and local tax rates. Production taxes, often calculated as a percentage of revenue or a per-barrel fee, directly impact profitability on each unit sold.

- Ad Valorem Taxes: These are property taxes based on the assessed value of Diamondback's oil and gas properties, including wells, pipelines, and land.

- Production Taxes: These are levied on the volume of oil and gas produced, often as a percentage of gross or net revenue.

- Impact on Profitability: Both tax types directly reduce the net revenue generated from hydrocarbon sales, influencing operating margins.

- 2024 Considerations: Producers like Diamondback must factor in varying state and local tax rates, which can differ significantly across their operational areas.

Gathering, Processing, and Transportation (GPT) Expenses

Gathering, Processing, and Transportation (GPT) expenses represent a significant portion of Diamondback Energy's cost structure. These costs are directly tied to moving crude oil, natural gas, and natural gas liquids (NGLs) from where they are extracted at the wellhead through various midstream facilities, ultimately delivering them to market. These are fundamental costs to ensure the hydrocarbons produced are in a usable and saleable form.

For Diamondback Energy, these GPT expenses are critical for realizing revenue from their production. In 2024, the company has been actively managing these costs, which include fees for gathering pipelines, processing plants, and long-haul transportation via pipelines, rail, or truck. Effective management of these costs directly impacts the profitability of each barrel of oil or equivalent of natural gas produced.

- Gathering Costs: Expenses associated with moving hydrocarbons from the wellhead to a central point, often a processing facility.

- Processing Costs: Fees paid to third-party or company-owned facilities to separate crude oil from natural gas and NGLs, and to treat these products to meet market specifications.

- Transportation Costs: Expenditures for moving processed crude oil, natural gas, and NGLs via pipelines, railcars, or trucks to refineries, petrochemical plants, or export terminals.

- Midstream Infrastructure Investment: While not a direct operating expense, ongoing investment in and maintenance of gathering and transportation infrastructure also influences overall GPT cost efficiency.

Diamondback Energy's cost structure is heavily influenced by its upstream activities, including drilling and completion expenses, which represented a significant portion of its projected $2.3 billion to $2.6 billion capital expenditures for 2024. Lease Operating Expenses (LOE) are another critical component, with the company maintaining competitive figures, averaging around $6.50 per BOE in Q1 2024, reflecting operational efficiency. General and Administrative (G&A) costs, which totaled approximately $338 million in 2023, cover corporate overhead, while production and ad valorem taxes are direct costs tied to output and asset value, varying by location. Gathering, Processing, and Transportation (GPT) expenses are also substantial, encompassing the movement and preparation of hydrocarbons for market.

| Cost Category | 2023 Actual (Approx.) | 2024 Projection/Guidance | Key Components |

|---|---|---|---|

| Capital Expenditures | N/A | $2.3 - $2.6 billion | Drilling, completions, infrastructure |

| Lease Operating Expenses (LOE) | N/A | ~$6.50 per BOE (Q1 2024) | Labor, electricity, repairs, chemicals |

| General & Administrative (G&A) | $338 million | N/A | Salaries, rent, legal, accounting |

| Gathering, Processing, Transportation (GPT) | N/A | Ongoing management | Pipeline fees, processing, transport |

Revenue Streams

Crude oil sales represent Diamondback Energy's core revenue engine, stemming directly from the oil produced across its extensive Permian Basin holdings. The company's financial performance is intrinsically linked to the prevailing market price of crude oil and the sheer volume of barrels it successfully extracts and sells.

For the first quarter of 2024, Diamondback Energy reported average daily production of approximately 474,000 barrels of oil equivalent (BOE). This significant output directly fuels its crude oil sales revenue, with the average realized price for oil playing a critical role in the total amount generated.

Diamondback Energy generates revenue from selling natural gas, which is produced alongside its primary oil output. This co-product stream is crucial, as fluctuating natural gas prices and production volumes directly impact the company's overall financial performance.

In 2024, Diamondback Energy's strategic focus on optimizing its operations, including natural gas capture and marketing, contributed to its financial results. For instance, the company's commitment to efficient production means that even as oil is extracted, the associated natural gas is monetized, adding a valuable revenue stream.

Diamondback Energy generates income by selling natural gas liquids (NGLs), which are valuable byproducts extracted from raw natural gas. These NGLs, such as ethane, propane, and butane, represent a significant additional revenue stream beyond the sale of natural gas itself.

In 2024, the robust demand for NGLs, driven by petrochemical feedstock needs and energy consumption, contributed substantially to Diamondback's overall financial performance, underscoring the importance of this segment in their business model.

Sales of Purchased Oil

Diamondback Energy's revenue streams include the sale of purchased oil, a practice that can supplement income beyond its own extraction activities. This suggests a strategy of opportunistic trading or optimizing its supply chain by acquiring and reselling oil. For instance, in the first quarter of 2024, Diamondback reported total oil sales volumes that could include both produced and purchased oil, reflecting its operational flexibility.

This segment of their business model allows for potential arbitrage opportunities and enhances their ability to meet market demand. By engaging in the sale of purchased oil, Diamondback can effectively manage inventory and capitalize on price differentials. This diversification of revenue sources strengthens its financial resilience.

- Sale of Purchased Oil: A supplementary revenue stream generated by acquiring and reselling crude oil, distinct from its own production.

- Market Optimization: This activity allows Diamondback to capitalize on price fluctuations and manage inventory efficiently.

- Revenue Diversification: Contributes to overall financial stability by adding a revenue source not solely dependent on production levels.

Other Operating Income

Diamondback Energy's Other Operating Income encompasses miscellaneous revenue streams beyond its core oil and gas production. This can include gains from selling non-core assets, such as minor mineral interests or equipment no longer needed. In 2024, for instance, companies in the energy sector often saw such income from strategic divestitures to streamline operations.

Furthermore, this category can capture fees earned for providing services to other operators, like pipeline access or processing arrangements. These ancillary activities contribute to overall financial health without directly relating to the volume of hydrocarbons sold. For example, a company might generate income from allowing others to use its midstream infrastructure.

- Gains on Asset Sales: Income realized from the disposal of non-essential or underperforming assets.

- Service Fees: Revenue generated by offering operational or infrastructure services to third parties.

- Operational Adjustments: Income resulting from favorable accounting adjustments or reimbursements related to operations.

- Lease Income: Revenue from leasing out unused surface rights or mineral acreage.

Diamondback Energy's revenue streams are primarily driven by the sale of crude oil and natural gas, with natural gas liquids (NGLs) and other operating income providing diversification. The company's significant production volumes in the Permian Basin directly translate into substantial sales of these commodities.

In the first quarter of 2024, Diamondback Energy reported total revenue of approximately $2.0 billion, with crude oil sales forming the largest component. The average realized price for oil during this period was around $77.87 per barrel, highlighting the direct correlation between market prices and revenue generation.

Natural gas and NGL sales also contribute meaningfully to Diamondback's revenue. The company's production mix, which includes a substantial amount of associated gas and NGLs, allows it to capitalize on the value of these co-products, especially when market conditions are favorable for these hydrocarbons.

| Revenue Stream | Q1 2024 (Approximate) | Notes |

| Crude Oil Sales | $1.6 billion | Core revenue driver, dependent on production volume and market price. |

| Natural Gas Sales | $250 million | Generated from the sale of natural gas produced alongside oil. |

| Natural Gas Liquids (NGLs) Sales | $150 million | Revenue from selling extracted NGLs like ethane, propane, and butane. |

Business Model Canvas Data Sources

The Diamondback Energy Business Model Canvas is built upon a foundation of financial disclosures, industry analysis, and operational performance metrics. These data sources provide a comprehensive view of the company's strategic positioning and market dynamics.