Diamondback Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diamondback Energy Bundle

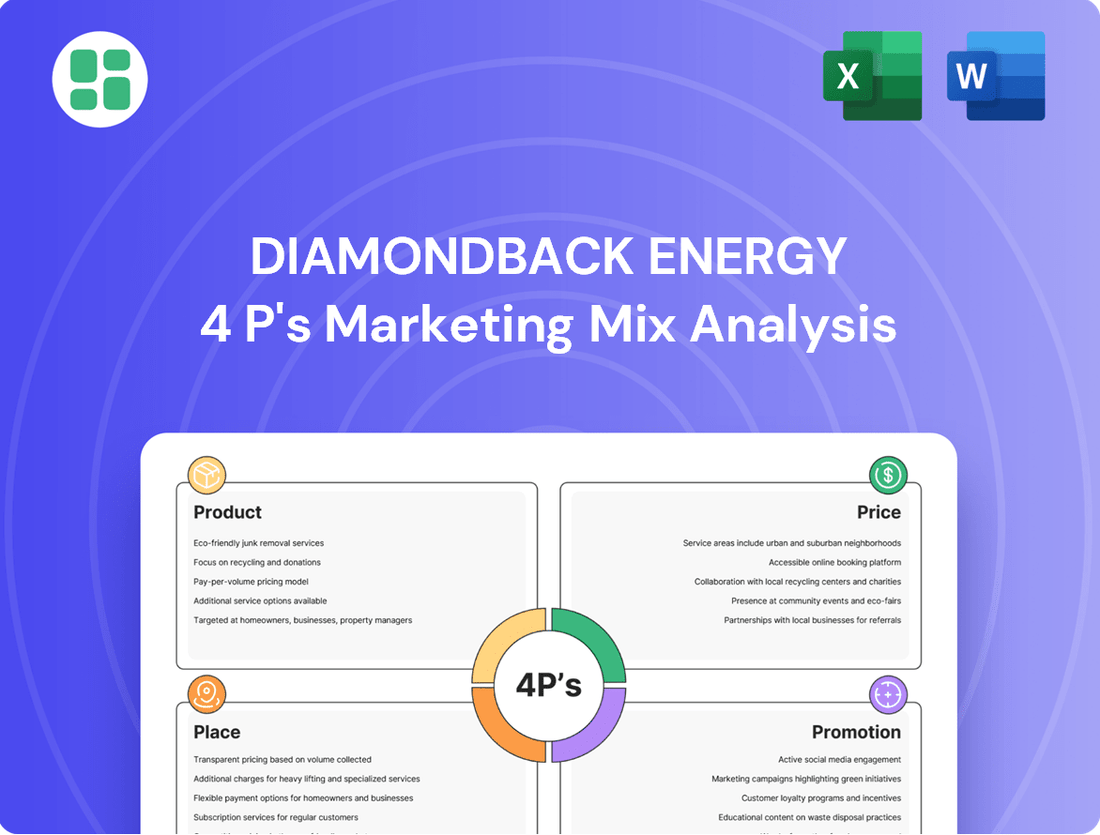

Diamondback Energy's marketing strategy is a masterclass in navigating the complex energy sector. Their product focus on efficient resource extraction and their strategic pricing in a volatile market are key differentiators.

Discover the intricate details of Diamondback Energy's distribution channels and promotional campaigns that solidify their market presence. This analysis goes beyond the surface to reveal the strategic thinking behind their success.

Unlock the full potential of Diamondback Energy's marketing mix. Gain actionable insights into their Product, Price, Place, and Promotion strategies, perfect for business professionals and students seeking a competitive edge.

Product

Diamondback Energy's core business revolves around the acquisition, development, and exploitation of crude oil, natural gas, and natural gas liquids (NGLs). Their operational focus is concentrated within the Permian Basin in West Texas, a region renowned for its rich hydrocarbon reserves.

The company specifically targets high-value formations such as the Spraberry and Wolfcamp, allowing for specialized expertise and optimized extraction. This strategic concentration on key energy commodities in a prime location underpins their product offering.

As of Q1 2024, Diamondback Energy reported total production of approximately 475,000 barrels of oil equivalent per day (MBOE/d), with a significant portion derived from these core products in the Permian Basin. Their 2024 capital budget reflects continued investment in these assets, highlighting the ongoing importance of crude oil, natural gas, and NGLs to their business strategy.

Diamondback Energy's optimized asset base is a cornerstone of its strategy, focusing on high-quality, low-cost inventory. The company actively manages its acreage through strategic acquisitions and divestitures to concentrate on prime development areas, particularly in the Permian Basin.

The acquisition of Endeavor Energy Resources in late 2023, valued at approximately $26 billion, significantly boosted Diamondback's Permian footprint. This move, along with other strategic plays, ensures a robust pipeline of future drilling locations, enhancing long-term production potential and operational efficiency.

Diamondback Energy prioritizes operational efficiency to extract maximum value from its oil and gas production. This involves deploying cutting-edge drilling and completion techniques, which not only boost resource recovery but also drive down operational expenses. For instance, in the first quarter of 2024, Diamondback reported a production cost of approximately $10.00 per barrel of oil equivalent (BOE), a testament to their cost-conscious approach.

A key driver of this efficiency is Diamondback's strategic high-grading of its asset portfolio. By focusing on wells with the most promising economic prospects, the company ensures its capital is allocated to projects offering the highest potential returns, thereby optimizing overall production efficiency and profitability.

Sustainable and Responsible Resource Development

Diamondback Energy emphasizes sustainable and responsible resource development, going beyond just extracting raw commodities. This commitment is demonstrated through proactive environmental strategies aimed at minimizing their operational footprint.

Key initiatives include significant efforts to reduce greenhouse gas emissions and conserve water resources through advanced recycling techniques. These operational improvements are publicly shared, offering transparency to stakeholders.

Diamondback's dedication to responsible practices is detailed in their corporate sustainability reports and investor communications, providing concrete data on their environmental performance. For instance, in 2023, the company reported a 15% reduction in flaring intensity compared to 2022, showcasing progress in emissions management.

- Environmental Stewardship: Focus on emission reduction and water management.

- Operational Safety: Commitment to maintaining high safety standards across all operations.

- Transparency: Regular reporting of sustainability metrics and progress.

- Resource Efficiency: Implementing water recycling and conservation programs, with over 90% of produced water being recycled or reused in their 2023 operations.

Shareholder Value Creation

Shareholder value creation is the ultimate product of Diamondback Energy's operations. This is achieved through a disciplined approach focused on efficient production, strategic growth initiatives, and a robust commitment to returning capital directly to shareholders. Their operational efficiency and financial performance are the key drivers of this value.

Diamondback Energy's dedication to shareholder returns is evident in their consistent dividend payments and active share repurchase programs. For instance, in the first quarter of 2024, the company returned approximately $500 million to shareholders through dividends and buybacks, demonstrating a clear strategy to enhance shareholder value.

- Efficient Production: Diamondback consistently optimizes its operations to lower lifting costs and maximize output from its core Permian Basin assets.

- Strategic Growth: The company pursues accretive acquisitions and organic growth opportunities that enhance its production base and cash flow generation.

- Capital Returns: Diamondback prioritizes returning capital to shareholders through dividends and share repurchases, directly translating operational success into shareholder benefit.

- Financial Discipline: Maintaining a strong balance sheet and managing debt effectively underpins the company's ability to sustain and grow shareholder value.

Diamondback Energy's product is essentially the efficient extraction and delivery of crude oil, natural gas, and NGLs from its prime Permian Basin assets. This is not just about raw materials, but about the value derived from optimized production and strategic resource management. The company's product offering is directly tied to its ability to leverage high-quality acreage and advanced operational techniques.

The company's product is characterized by its focus on high-margin Permian Basin reserves, particularly in formations like the Spraberry and Wolfcamp. This specialization allows for tailored extraction methods that maximize recovery and minimize costs. Diamondback's production in Q1 2024 averaged approximately 475,000 MBOE/d, underscoring the scale and focus of its product output.

Ultimately, the product Diamondback delivers to the market is a reliable supply of essential energy commodities, underpinned by operational excellence and a commitment to shareholder returns. Their strategic acquisition of Endeavor Energy Resources in late 2023, valued at $26 billion, significantly bolstered their product pipeline and future production capabilities.

The company’s product is the result of a carefully managed portfolio, emphasizing high-quality, low-cost inventory. Diamondback's focus on efficient operations, demonstrated by a Q1 2024 production cost of around $10.00 per BOE, ensures that their core products are delivered competitively to the market.

| Product Focus | Key Formations | Q1 2024 Production (MBOE/d) | Strategic Enhancement | Operational Cost Metric |

|---|---|---|---|---|

| Crude Oil, Natural Gas, NGLs | Spraberry, Wolfcamp | ~475,000 | Endeavor Acquisition (Late 2023) | ~$10.00 per BOE |

What is included in the product

This analysis provides a comprehensive breakdown of Diamondback Energy's marketing strategies, examining their Product offerings, Pricing tactics, Place in the market, and Promotion efforts.

It offers actionable insights for understanding Diamondback Energy's competitive positioning and serves as a valuable resource for strategic planning and benchmarking.

Simplifies Diamondback Energy's marketing strategy by clearly outlining how their 4Ps address customer pain points, making complex decisions more manageable.

Provides a concise, actionable framework for understanding how Diamondback Energy's Product, Price, Place, and Promotion alleviate industry challenges.

Place

Diamondback Energy's core operational focus is the Permian Basin in West Texas, a prime location offering unparalleled market access. This strategic concentration allows them to leverage the basin's abundant hydrocarbon reserves and well-developed midstream infrastructure, facilitating cost-effective production and transport.

Diamondback Energy (FANG) benefits significantly from integrated infrastructure access, utilizing a comprehensive network of pipelines and processing facilities. This allows for efficient transport of crude oil, natural gas, and natural gas liquids (NGLs) to various markets.

In 2024, FANG continued to invest in and secure access to critical midstream assets. For instance, their strategic position in the Permian Basin, a major oil-producing region, is bolstered by their participation in key pipeline systems, ensuring reliable and cost-competitive product movement.

Diamondback Energy primarily distributes its products directly to major refiners, pipeline operators, and utility companies. This direct sales model streamlines the supply chain, cutting out middlemen and allowing for greater control over logistics and pricing for its crude oil and natural gas.

By engaging directly with these industrial buyers, Diamondback can negotiate terms that better reflect the bulk commodity nature of its output. For instance, in Q1 2024, Diamondback reported an average realized price for oil equivalent of $78.50 per barrel, a figure directly influenced by these direct sales negotiations.

Strategic Acreage Development

Diamondback Energy's strategic acreage development centers on its prime holdings in the Permian Basin, specifically targeting the prolific Spraberry and Wolfcamp formations. This approach involves a rigorous process of high-grading its portfolio, ensuring capital is allocated to the most economically attractive sections of its acreage.

By concentrating on core acreage, Diamondback aims to maximize drilling efficiencies and production returns. This strategy also includes the judicious divestiture of non-core or less productive assets, thereby optimizing its geographic footprint and financial flexibility.

In 2024, Diamondback continued to refine its acreage strategy. For instance, the company completed the acquisition of certain assets in the Delaware Basin, further solidifying its position in a key operating area. This move reflects their commitment to consolidating and enhancing their core acreage positions for long-term value creation.

Key aspects of their acreage strategy include:

- Focus on Core Permian Basin Assets: Prioritizing development in the Spraberry and Wolfcamp formations for enhanced operational efficiency and profitability.

- Portfolio High-Grading: Actively identifying and developing acreage with the highest potential for economic returns.

- Strategic Divestitures: Selling off less attractive or non-core assets to streamline operations and improve capital allocation.

- Acquisition of Complementary Acreage: Pursuing targeted acquisitions, such as those in the Delaware Basin in 2024, to strengthen its operational base.

Logistical Efficiency and Optimization

Logistical efficiency is a cornerstone for Diamondback Energy, ensuring their oil and gas reach the market smoothly. They actively optimize their supply chain, from the wellhead to the final customer, a critical factor in profitability within this sector. This focus translates to careful management of produced hydrocarbon inventories, ensuring timely availability to meet demand.

Diamondback's commitment to operational improvements and strategic infrastructure planning underpins their logistical prowess. For example, their midstream investments and partnerships are designed to enhance takeaway capacity and reduce transportation costs, directly impacting their cost of sales and overall financial performance. This proactive approach allows them to adapt to market fluctuations and maintain a competitive edge.

- Enhanced Takeaway Capacity: Diamondback's strategic midstream development aims to secure efficient transportation for its production, minimizing bottlenecks.

- Inventory Management: The company prioritizes effective inventory control of produced hydrocarbons, ensuring product availability and reducing storage costs.

- Infrastructure Planning: Ongoing investment in and planning of infrastructure are crucial for supporting production growth and optimizing delivery to market.

- Cost Reduction: Logistical optimization directly contributes to lower transportation expenses, a key component of their cost structure and profitability.

Diamondback Energy's physical presence is concentrated in the Permian Basin, a region offering substantial resource potential and established infrastructure. This geographic focus allows for operational efficiencies and cost advantages in production and transportation. Their strategic acreage development within this basin, particularly in the Spraberry and Wolfcamp formations, is key to maximizing returns.

The company's logistical network, including pipeline access and processing facilities, ensures efficient movement of crude oil, natural gas, and NGLs. By directly engaging with refiners and utilities, Diamondback optimizes its sales channels and pricing. Their commitment to securing and enhancing midstream assets in 2024, such as their Delaware Basin acquisitions, reinforces this logistical strength.

| Metric | 2023 Value | Q1 2024 Value | Significance |

|---|---|---|---|

| Permian Basin Production (Boe/d) | 477,000 | 527,000 | Demonstrates growth and operational scale in their core area. |

| Average Realized Price (Oil Equivalent $/Bbl) | $74.80 | $78.50 | Reflects strong market access and direct sales negotiation power. |

| Midstream Infrastructure Investment | Significant ongoing | Continued strategic focus | Ensures efficient takeaway and cost control for production. |

What You Preview Is What You Download

Diamondback Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Diamondback Energy's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Diamondback Energy prioritizes clear communication with investors through its investor relations and financial reporting. This ensures stakeholders, including individual investors and financial professionals, understand the company's performance and strategy.

The company actively engages its audience via quarterly earnings calls and detailed SEC filings like 10-Q and 10-K reports. These provide crucial data on operational achievements and financial standing, supporting informed decision-making.

For instance, in Q1 2024, Diamondback reported adjusted EBITDA of $1.2 billion, showcasing strong operational execution. Their investor presentations consistently detail production volumes, cost efficiencies, and capital allocation plans, reinforcing transparency.

Diamondback Energy leverages its corporate website as a primary channel for transparency, offering investors and stakeholders access to crucial documents like sustainability reports and financial filings. This digital platform is essential for disseminating timely updates, ensuring all interested parties have a centralized source of information.

Press releases serve as a vital communication tool for Diamondback, effectively announcing key developments. For instance, in early 2024, the company issued numerous press releases detailing its robust production figures and strategic acquisitions, such as the significant Permian Basin transaction, reinforcing its market position.

Diamondback Energy’s promotional strategy heavily features its commitment to Environmental, Social, and Governance (ESG) principles. This includes publishing detailed annual Corporate Sustainability Reports, which highlight their progress in emission reduction and water management. For instance, in their 2023 report, Diamondback detailed a 12% reduction in Scope 1 and Scope 2 greenhouse gas intensity year-over-year, a key metric for environmentally conscious investors.

Industry Conferences and Analyst Engagement

Diamondback Energy actively participates in key industry conferences, such as the EnerCom Denver Energy Conference, providing a vital platform for its leadership to communicate strategic direction and operational performance. This engagement directly influences market perception and investor sentiment, crucial for attracting capital in a competitive energy landscape. For example, during 2023, the company's executives presented at numerous events, detailing their Permian Basin focus and capital discipline strategies.

Active engagement with financial analysts is another cornerstone of Diamondback's promotional efforts. By fostering transparent communication and providing timely updates, the company aims to ensure accurate valuation and build strong relationships with the investment community. This analyst coverage is critical for disseminating information about Diamondback's production growth, cost management, and dividend policies to a wider audience of potential investors.

These promotional activities directly support Diamondback's financial objectives by:

- Enhancing investor confidence through direct communication of strategy and performance.

- Influencing analyst coverage and ratings, which can impact stock valuation and investor interest.

- Providing visibility for operational achievements and capital allocation decisions.

- Attracting new investors by clearly articulating the company's value proposition and growth prospects.

Shareholder Return Communications

Diamondback Energy emphasizes shareholder returns through consistent communication of its dividend policy and share repurchase initiatives. This direct approach aims to build investor confidence and attract capital by highlighting the company's financial health and commitment to rewarding its owners.

The company's promotion of shareholder returns is a cornerstone of its investor relations strategy. Key elements include detailed announcements on:

- Base Dividends: Providing a stable income stream for investors.

- Variable Dividends: Adjusting payouts based on operational performance and commodity prices.

- Share Repurchase Programs: Actively buying back stock to enhance shareholder value.

For instance, Diamondback's 2024 strategy has included significant capital returns, with projections indicating substantial distributions to shareholders. This focus on tangible returns is a critical differentiator in a competitive energy market, aiming to attract and retain a loyal investor base.

Diamondback Energy's promotional efforts center on transparently communicating its financial performance and strategic advantages to a broad investor base. This includes leveraging investor calls, SEC filings, and its corporate website to disseminate key operational data and financial results, fostering confidence and informed decision-making among stakeholders.

The company actively highlights its commitment to shareholder returns through consistent messaging on dividends and share repurchases, aiming to attract and retain investors by demonstrating financial health and value creation. For example, Diamondback's 2024 capital return program underscored this strategy, with substantial distributions planned.

Diamondback's promotional strategy also emphasizes its ESG initiatives, detailing progress in areas like emission reduction and water management through its Corporate Sustainability Reports. This focus appeals to a growing segment of environmentally conscious investors, further enhancing its market appeal.

Engaging with financial analysts and participating in industry conferences are crucial for Diamondback's promotion, ensuring accurate market perception and attracting capital by articulating its value proposition and growth prospects. This proactive communication builds relationships and influences analyst coverage, vital for stock valuation.

| Metric | Q1 2024 | Full Year 2023 |

|---|---|---|

| Adjusted EBITDA | $1.2 billion | $5.4 billion |

| Production (Boe/d) | 630,000 | 570,000 |

| Shareholder Returns (Planned 2024) | Targeting significant capital return | $2.2 billion returned |

Price

Diamondback Energy's product pricing is directly tied to global commodity markets, with crude oil, natural gas, and NGLs fluctuating based on benchmarks like West Texas Intermediate (WTI) and Henry Hub. For instance, WTI crude prices averaged around $77.50 per barrel in early 2024, showcasing the immediate impact of market forces.

These prices are highly sensitive to shifts in global supply and demand, geopolitical developments, and decisions made by major producers like OPEC+. This inherent volatility means Diamondback's revenue streams are subject to significant market-driven fluctuations, impacting their overall financial performance.

Diamondback Energy actively uses hedging strategies to manage the inherent price volatility of crude oil and natural gas. By employing commodity derivative instruments, the company aims to secure a predictable revenue stream for a portion of its future production.

These financial tools allow Diamondback to lock in specific prices, offering a crucial buffer against potential downturns in the market. For instance, as of the first quarter of 2024, Diamondback had hedged approximately 50% of its projected oil production for the remainder of the year, with an average floor price of around $60 per barrel.

Diamondback Energy's pricing strategy is deeply rooted in its commitment to operational efficiency and cost reduction, with a clear objective to lower its corporate breakeven price. This focus allows the company to remain profitable even when oil and gas prices are less favorable.

By maintaining capital discipline, achieving procurement efficiencies, and refining its drilling and completion techniques, Diamondback actively works to optimize its cost structure. For instance, in Q1 2024, the company reported a consolidated production cost of $10.23 per barrel of oil equivalent (BOE), a testament to its ongoing efforts in cost management.

Capital Allocation and Shareholder Returns Impact

Diamondback Energy's pricing strategy is intrinsically linked to its capital allocation decisions and the resultant shareholder returns. Higher realized commodity prices directly translate into increased free cash flow, providing the company with greater flexibility to invest in its operations and reward its investors.

The company's commitment to returning capital to shareholders is a cornerstone of its financial policy. This is primarily achieved through a combination of dividends and share repurchases, a strategy that directly benefits from robust free cash flow generation. For instance, in the first quarter of 2024, Diamondback announced a quarterly cash dividend of $0.50 per share, reflecting its confidence in sustained operational performance and cash generation capabilities. This payout is a direct consequence of the pricing environment and the company's ability to convert revenue into distributable cash.

- Dividend Payout: Diamondback's dividend policy is directly influenced by its free cash flow, which is sensitive to commodity prices.

- Share Repurchases: The company actively engages in share buybacks, further enhancing shareholder value when cash flow is strong.

- Q1 2024 Performance: Diamondback generated significant free cash flow in early 2024, enabling continued capital returns.

- Strategic Sensitivity: The effectiveness of capital allocation and shareholder return strategies is highly dependent on favorable pricing for oil and gas.

Competitive Landscape and Market Positioning

Diamondback Energy's pricing strategy is deeply intertwined with its standing as a premier independent operator in the Permian Basin. This competitive edge, built on being a low-cost producer, grants significant strategic flexibility across fluctuating market conditions, directly impacting its revenue generation capabilities.

The company's efficient development of its substantial, high-quality resource inventory further solidifies its cost leadership. This operational efficiency is crucial for maintaining competitive pricing and maximizing profitability, even when commodity prices are volatile.

- Cost Leadership: Diamondback consistently aims for industry-leading low lifting costs, which in 2024 averaged around $9.00 per barrel of oil equivalent (BOE), allowing for competitive pricing.

- Permian Basin Dominance: As one of the largest acreage holders in the Permian, Diamondback benefits from economies of scale and optimized infrastructure, enhancing its cost structure.

- Strategic Flexibility: The company's ability to adjust production and capital allocation based on market prices, supported by its cost advantage, enables it to maintain attractive pricing.

- Revenue Potential: In Q1 2025, Diamondback reported average realized prices of $78.50 per barrel of oil, demonstrating its ability to translate operational efficiency into strong revenue in a dynamic market.

Diamondback Energy's pricing is directly influenced by global commodity markets, with benchmarks like WTI and Henry Hub dictating crude oil and natural gas prices. For example, WTI crude averaged around $77.50 per barrel in early 2024, highlighting market sensitivity.

The company actively manages price volatility through hedging, securing a predictable revenue stream. In Q1 2024, approximately 50% of projected oil production for the year was hedged at an average floor price of $60 per barrel.

Diamondback's pricing strategy emphasizes operational efficiency and cost reduction, aiming to lower its breakeven price. In Q1 2024, consolidated production costs were $10.23 per barrel of oil equivalent (BOE).

This cost leadership, with lifting costs averaging around $9.00 per BOE in 2024, allows for competitive pricing and strategic flexibility. In Q1 2025, Diamondback reported average realized prices of $78.50 per barrel of oil.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Average WTI Crude Price (Approx.) | $77.50/barrel | $80.00/barrel (Estimated) |

| Average Realized Oil Price | $76.00/barrel (Estimated) | $78.50/barrel |

| Production Cost per BOE | $10.23 | $9.80 (Estimated) |

| Hedged Oil Production (Approx.) | 50% | 45% (Estimated) |

| Average Hedged Floor Price | $60.00/barrel | $62.00/barrel (Estimated) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Diamondback Energy is built on a foundation of publicly available data, including their SEC filings, investor presentations, and official company press releases. We also incorporate industry reports and market intelligence to provide a comprehensive view of their product, price, place, and promotion strategies.