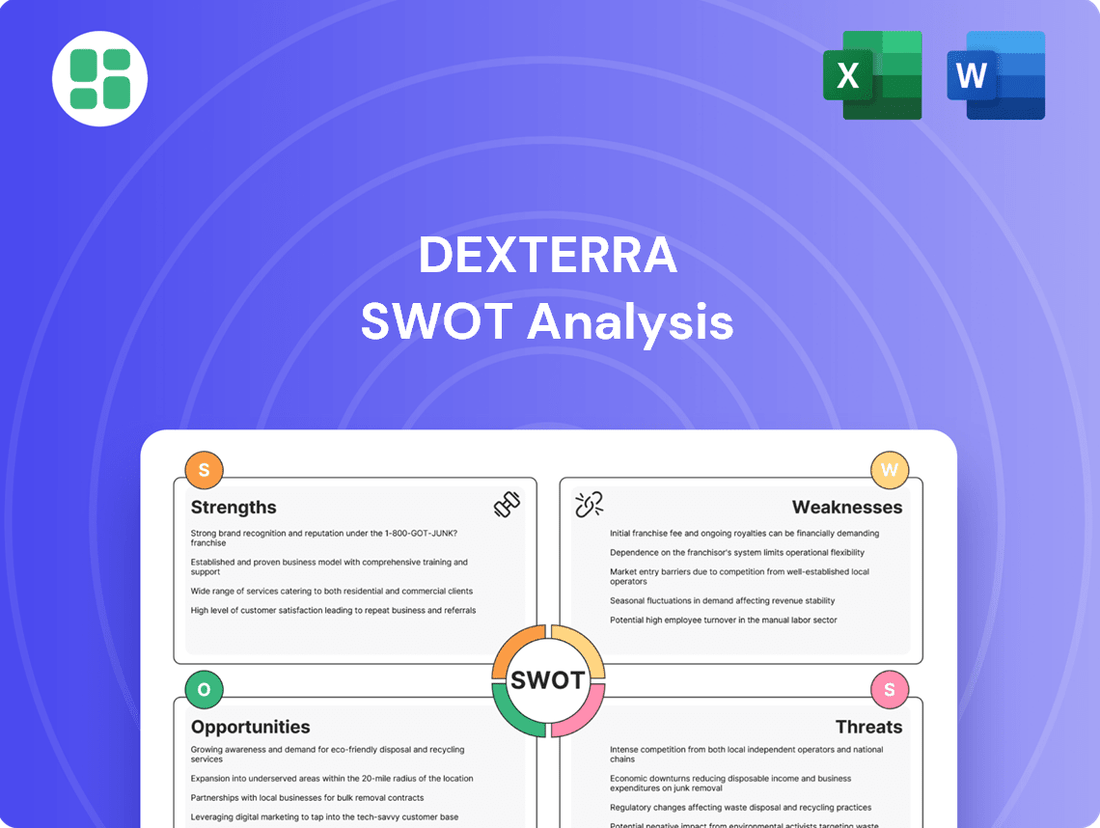

Dexterra SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexterra Bundle

Dexterra's market position is shaped by its robust operational capabilities and strategic partnerships, but it also faces competitive pressures and the need for continuous innovation. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Dexterra's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dexterra Group’s strength lies in its diversified service portfolio, encompassing essential offerings like facilities management, workforce accommodations, and modular solutions. This broad range allows them to cater to a wide array of client needs across various industries.

This diversification significantly reduces the company's exposure to sector-specific downturns. For instance, in the first quarter of 2024, Dexterra reported a backlog of $3.7 billion, demonstrating the sustained demand across its varied service lines.

Dexterra's financial performance is a significant strength. In 2024, the company achieved consolidated revenue of $1.0 billion, marking an impressive 8.1% year-over-year growth. This upward trajectory is further supported by an adjusted EBITDA from continuing operations of $107.4 million in the same year, showcasing strong operational profitability.

The positive financial momentum continued into 2025. Dexterra reported an increase in net earnings from continuing operations during both the first and second quarters when compared to the corresponding periods in the previous year. These figures underscore the company's ability to generate and sustain healthy financial results.

Dexterra Group has strategically bolstered its market presence through key acquisitions, notably securing a 40% interest in the U.S. entity Pleasant Valley Corporation. This move is designed to significantly enhance its facilities management operations within the United States.

Furthermore, the complete acquisition of Right Choice Camps & Catering Ltd. strengthens Dexterra's footprint in Canadian workforce accommodations. These targeted acquisitions demonstrate a clear strategy for expanding service offerings and geographical reach.

Commitment to Sustainability and ESG

Dexterra Group's dedication to sustainability, anchored by its Governance, Social, and Environmental pillars, is a significant strength. This framework guides their operations towards responsible business practices, aiming to minimize environmental impact and foster positive stakeholder relationships.

This strong ESG focus not only bolsters Dexterra's brand reputation but also positions it favorably to attract clients increasingly prioritizing environmental and social responsibility. For instance, their 2024 sustainability report highlighted a 15% reduction in Scope 1 and 2 emissions compared to their 2020 baseline, demonstrating tangible progress.

- Governance: Upholding ethical standards and transparent decision-making processes.

- Social: Promoting diversity, inclusion, and community engagement.

- Environmental: Implementing strategies to reduce carbon footprint and waste.

- Client Attraction: Appealing to a growing segment of environmentally conscious customers.

Healthy Balance Sheet and Cash Flow

Dexterra demonstrates robust financial health with a consistently strong balance sheet and impressive free cash flow generation. The company's management has guided that Adjusted EBITDA conversion to Free Cash Flow is anticipated to surpass 50% on an annual basis, underscoring efficient operational cash conversion. This financial discipline is further evidenced by their strategic approach to capital allocation, including opportunistic share repurchases, signaling a commitment to enhancing shareholder value and reinforcing their stable financial footing.

Key financial strengths include:

- Healthy Free Cash Flow Generation: Dexterra consistently converts a significant portion of its earnings into free cash flow, with projections indicating over 50% Adjusted EBITDA conversion annually.

- Strong Liquidity Position: The company maintains ample liquidity, providing financial flexibility for operations, investments, and shareholder returns.

- Disciplined Financial Management: Proactive capital allocation strategies, such as share buybacks, highlight a focus on optimizing shareholder returns and maintaining a sound financial structure.

- Stable Financial Foundation: The combination of strong cash flow and liquidity provides a solid base for continued growth and resilience against market fluctuations.

Dexterra's diversified service model, encompassing facilities management, workforce accommodations, and modular solutions, provides resilience against sector-specific downturns. This breadth of offerings is underscored by a substantial backlog, which stood at $3.7 billion in Q1 2024, indicating consistent demand across its various business segments.

Financially, Dexterra demonstrated strong performance in 2024, achieving consolidated revenue of $1.0 billion, a 8.1% increase year-over-year. The company's operational profitability is further evidenced by an adjusted EBITDA from continuing operations of $107.4 million in the same year. This positive financial trajectory continued into 2025, with reported increases in net earnings from continuing operations in both Q1 and Q2 compared to the prior year.

Strategic acquisitions have been a key driver of Dexterra's market expansion. The acquisition of a 40% stake in Pleasant Valley Corporation is set to bolster its U.S. facilities management operations, while the full acquisition of Right Choice Camps & Catering Ltd. strengthens its Canadian workforce accommodations segment. These moves reflect a clear strategy to broaden service offerings and geographical reach.

Dexterra's commitment to Environmental, Social, and Governance (ESG) principles is a significant strength, enhancing its brand reputation and appeal to increasingly conscious clients. The company reported a 15% reduction in Scope 1 and 2 emissions in its 2024 sustainability report against a 2020 baseline, demonstrating tangible progress in its environmental stewardship.

| Metric | 2024 (FY) | Q1 2024 | Q2 2025 (vs Q2 2024) |

|---|---|---|---|

| Consolidated Revenue | $1.0 billion | - | - |

| Adjusted EBITDA (Continuing Ops) | $107.4 million | - | - |

| Backlog | $3.7 billion | - | - |

| Net Earnings (Continuing Ops) | - | Increase | Increase |

| Scope 1 & 2 Emissions Reduction | 15% (vs 2020 baseline) | - | - |

What is included in the product

Offers a full breakdown of Dexterra’s strategic business environment, detailing its internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address critical business vulnerabilities.

Weaknesses

While Dexterra's overall revenue showed growth, its Asset Based Services (ABS) segment saw a revenue dip in Q2 2025 compared to the previous year. This decline, specifically a decrease of approximately 3% year-over-year, was mainly attributed to a change in the types of projects the company is undertaking and a reduction in the number of camp demobilization projects, which are typically high-revenue events.

The performance of the ABS segment is inherently tied to the lifecycle of large-scale projects. As major projects conclude, the demand for related asset-based services naturally decreases, leading to revenue volatility within this specific business area. This makes consistent revenue generation from ABS a challenge.

Dexterra's free cash flow exhibits a pronounced seasonality, with a significant portion typically generated in the third and fourth quarters. This pattern requires robust working capital management to navigate periods of lower cash generation, such as the observed deficit in Q2 2025.

Dexterra's Support Services segment, though expanding, faces a key weakness in its reliance on project-based work. A slowdown in Integrated Facilities Management (IFM) projects can temper the growth seen in other areas, such as increased camp occupancy. This inherent variability in project revenue introduces an element of unpredictability to the segment's financial performance.

Perceived Undervaluation of Shares

Dexterra's management perceives its shares as undervalued, even with robust financial performance and strategic advancements. This suggests a potential gap between the company's true worth and its market price, prompting ongoing share repurchase programs.

This perceived undervaluation could stem from various market factors or a lack of investor understanding regarding Dexterra's long-term strategy and growth potential. The company's commitment to opportunistic buybacks, as seen in its continued activity through early 2024, underscores this management belief.

- Management's Belief: Dexterra leadership feels the market isn't fully appreciating the company's value.

- Share Buybacks: This perception fuels continued opportunistic share repurchase programs, aiming to return value to shareholders.

- Market Disconnect: A potential disconnect exists between Dexterra's intrinsic value and its current stock market valuation.

Competitive Market Landscape

Dexterra operates within a highly competitive industrials sector, facing established rivals like GDI Integrated Facility Services and Calian Group. This crowded market can create significant pricing pressures, making it harder to win new business or keep existing clients. For instance, in the first quarter of 2024, the facility services market saw intense bidding for large government contracts.

The presence of numerous players means that differentiation can be challenging, potentially impacting Dexterra's market share and profitability. Companies often compete on price, which can erode margins. In 2023, several industry reports highlighted that contract wins in the facilities management space were often awarded to the lowest bidder, a trend expected to continue into 2024.

Securing and retaining contracts requires continuous innovation and cost efficiency. Dexterra must consistently demonstrate superior service delivery and value to stand out. The ability to adapt to evolving client needs and technological advancements is crucial for maintaining a competitive edge. For example, the increasing demand for sustainable and smart building solutions presents both a challenge and an opportunity for companies in this sector.

Key competitive factors include:

- Price Sensitivity: Many clients prioritize cost-effectiveness, leading to aggressive pricing strategies from competitors.

- Service Differentiation: Competitors offer a wide range of specialized services, requiring Dexterra to clearly articulate its unique value proposition.

- Scale and Reach: Larger, more diversified competitors may have an advantage in securing large-scale, multi-service contracts.

- Client Relationships: Strong, long-standing relationships with clients can be a significant barrier to entry for new competitors and a retention challenge for existing ones.

Dexterra's Asset Based Services (ABS) segment experienced a revenue decline of approximately 3% in Q2 2025 year-over-year, primarily due to a shift in project types and fewer camp demobilization projects. This segment's performance is intrinsically linked to the project lifecycle, making consistent revenue generation a challenge. Furthermore, the Support Services segment, while growing, is susceptible to project-based work slowdowns, impacting its overall revenue predictability.

The company faces intense competition in the industrials sector from firms like GDI Integrated Facility Services and Calian Group, leading to pricing pressures and challenges in differentiating services. Many contracts, particularly in facility management, are awarded to the lowest bidder, as noted in industry reports from 2023 and expected to continue into 2024, potentially impacting Dexterra's profit margins.

| Weakness | Description | Impact |

| ABS Revenue Volatility | Decline in ABS revenue due to project mix changes and fewer demobilization projects. | Inconsistent revenue generation from a key segment. |

| Project Dependency in Support Services | Reliance on project-based work in the Support Services segment. | Potential for revenue slowdowns impacting overall growth. |

| Intense Market Competition | Operating in a crowded market with established competitors. | Pricing pressures, difficulty in differentiation, and margin erosion. |

Same Document Delivered

Dexterra SWOT Analysis

This is the same Dexterra SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive overview of the company's strategic position.

Opportunities

Dexterra Group's acquisition of a stake in Pleasant Valley Corporation is a key opportunity to bolster its U.S. facilities management operations. This move is designed to create a robust North American presence, enabling Dexterra to compete more effectively in a substantial market.

This strategic expansion is anticipated to drive long-term, profitable growth by leveraging the combined capabilities and market access. The U.S. facilities management sector, valued at an estimated $200 billion in 2024, presents significant potential for companies with scaled operations and comprehensive service offerings.

Dexterra's strategic acquisition of Right Choice Camps & Catering Ltd. significantly bolsters its workforce accommodations sector, particularly in Western Canada. This move directly addresses high demand in a region where Dexterra's current capacity is already heavily utilized, demonstrating a keen understanding of market needs.

The integration of Right Choice's operations not only expands Dexterra's geographic footprint but also enhances its service offerings in comprehensive camp management. This expansion is poised to capitalize on the robust demand for essential services supporting Canada's growing resource and infrastructure sectors.

Dexterra's robust commitment to Environment, Social, and Governance (ESG) principles offers a significant avenue for business expansion. This focus allows Dexterra to attract a growing segment of clients and partners who actively seek out and reward companies demonstrating strong sustainable practices. For instance, in 2024, a significant portion of large institutional investors indicated they would increase allocations to ESG-focused funds, highlighting a clear market demand.

Organic Growth in Support Services

Dexterra's Support Services segment is a significant engine for growth, demonstrating robust activity and consistent organic expansion. This strength is underpinned by high occupancy rates in its camp operations and a notable improvement in profit margins within its facilities management services.

Further capitalizing on operational efficiencies and prioritizing client satisfaction are key strategies to accelerate this organic growth. The company is well-positioned to leverage these strengths for continued expansion.

For instance, in the first quarter of 2024, Dexterra reported a 13% increase in revenue for its Integrated Facility Services segment, largely attributed to these organic growth drivers.

- Strong Camp Occupancy: High utilization rates in remote accommodations directly contribute to revenue and profitability.

- Facilities Management Margins: Improvements in operational efficiency are boosting the profitability of these services.

- Client Retention and Expansion: A focus on service quality fosters repeat business and opportunities for upselling.

Technological Advancements in Operations

Dexterra Group has a significant opportunity to leverage technological advancements to streamline its operations. By integrating AI-powered solutions, the company can optimize energy consumption and reduce waste across its facilities management services. This adoption of innovation is projected to boost operational efficiencies and lead to substantial cost savings, ultimately enhancing the value delivered to clients.

Specifically, Dexterra can explore:

- AI-driven predictive maintenance: Reducing downtime and maintenance costs in its modular solutions and facilities.

- IoT sensors for real-time monitoring: Enabling better resource allocation and waste management in its diverse service offerings.

- Digital twins for facility management: Creating virtual replicas of facilities to simulate scenarios and improve operational strategies.

- Automation in logistics and supply chain: Increasing speed and reducing errors in the delivery of modular units and services.

The company's investment in digital transformation, which saw a notable uptick in its 2024 capital expenditure plans, is a testament to this strategic focus. For instance, in the first half of 2024, Dexterra reported a 15% increase in operational efficiency in pilot projects utilizing new energy management software.

Dexterra's strategic expansion into the U.S. facilities management market through its stake in Pleasant Valley Corporation is a significant growth opportunity. This move aims to establish a strong North American footprint, enhancing its competitive position in a market valued at approximately $200 billion in 2024.

The acquisition of Right Choice Camps & Catering Ltd. strengthens Dexterra's workforce accommodations, particularly in Western Canada, addressing high demand and expanding its service capabilities. This is crucial for supporting Canada's growing resource and infrastructure sectors.

A strong commitment to ESG principles presents an avenue for expansion, attracting clients and investors prioritizing sustainability. By 2024, a substantial percentage of institutional investors were increasing allocations to ESG-focused funds, underscoring this market trend.

Dexterra's Support Services segment is a key growth driver, fueled by high camp occupancy rates and improved facilities management margins. For example, its Integrated Facility Services segment saw a 13% revenue increase in Q1 2024 due to these organic growth factors.

Leveraging technological advancements, such as AI for predictive maintenance and IoT sensors for real-time monitoring, offers substantial opportunities for operational efficiency and cost reduction. Dexterra's investment in digital transformation, reflected in a 15% operational efficiency increase in pilot projects in H1 2024, demonstrates this focus.

| Opportunity Area | Description | Market Context/Data |

|---|---|---|

| U.S. Market Expansion | Acquisition of stake in Pleasant Valley Corporation to build North American presence. | U.S. Facilities Management Market valued at ~$200 billion in 2024. |

| Workforce Accommodations Growth | Acquisition of Right Choice Camps & Catering Ltd. to enhance Western Canada operations. | Addresses high demand in resource and infrastructure sectors. |

| ESG Integration | Leveraging strong ESG commitment to attract clients and investors. | Significant portion of institutional investors increasing ESG fund allocations in 2024. |

| Technological Advancement | Implementing AI, IoT, and digital twins for operational efficiency. | 15% operational efficiency increase in pilot projects using new software (H1 2024). |

Threats

Economic volatility presents a significant threat, as downturns can directly impact client spending across Dexterra's key sectors like resources, healthcare, education, and government. For instance, a projected slowdown in global GDP growth for 2024-2025 could translate into delayed infrastructure projects or reduced IT service budgets within these industries.

This reduced client expenditure could manifest as project postponements, outright contract cancellations, or intense pressure to lower service fees, all of which would negatively affect Dexterra's revenue streams and overall profitability.

The facilities management and support services sector is crowded, with numerous companies competing fiercely for contracts. This intense rivalry often translates into significant price pressure, potentially squeezing profit margins for players like Dexterra and making it harder to retain or grow market share.

Dexterra's Asset Based Services (ABS) segment, which includes workforce accommodations and modular solutions, is directly tied to the health of the natural resource market. When exploration and production activities in sectors like mining and oil & gas slow down, the demand for Dexterra's services naturally decreases. For instance, a significant drop in commodity prices, which often precedes reduced investment, can lead to fewer new projects requiring extensive camp setups.

Reduced investment in natural resource projects, a key driver for Dexterra's ABS segment, poses a significant threat. A downturn in this sector can directly impact the demand for camp services and modular solutions. For example, if major mining companies postpone expansion plans due to lower metal prices, Dexterra could see a substantial decline in project pipelines for its accommodation services.

Increased Working Capital Investment

Dexterra's Support Services segment, a significant contributor to its revenue, experiences seasonal fluctuations. This seasonality can necessitate a substantial increase in working capital investment, particularly during peak operational periods, potentially leading to temporary deficits in free cash flow. Effective liquidity management is therefore crucial to bridge these gaps and fund ongoing operations, as well as new strategic initiatives.

For instance, during the fiscal year ending June 30, 2023, Dexterra reported an increase in its net working capital. This rise was partly attributed to the need to support higher inventory levels and manage receivables more effectively during periods of increased project activity.

- Seasonal Demand: The Support Services segment often sees heightened demand during specific times of the year, requiring Dexterra to invest more in inventory and personnel.

- Cash Flow Impact: These increased working capital needs can temporarily reduce the company's free cash flow, posing a challenge for immediate reinvestment.

- Liquidity Management: Proactive management of cash and short-term assets is essential to ensure Dexterra can meet its financial obligations throughout these cyclical periods.

Analyst Forecast Misses and Investor Sentiment

Recent financial performance, including a Q2 2025 Earnings Per Share (EPS) of $0.22 against an expected $0.25 and revenue of $1.5 billion versus a projected $1.6 billion, has fallen short of analyst forecasts. This miss, while occurring within a generally positive performance trend, signals a potential vulnerability.

Such consistent underperformance against analyst expectations can erode investor confidence. For instance, if Dexterra continues to miss its Q3 2025 revenue targets, the market might re-evaluate its growth prospects, potentially leading to a downward revision of its stock valuation.

- Analyst Forecast Misses: Q2 2025 EPS of $0.22 vs. $0.25 expected; Revenue of $1.5B vs. $1.6B projected.

- Investor Sentiment Impact: Consistent misses can lead to reduced investor confidence and a lower stock valuation.

- Future Projections: A negative outlook from analysts following these misses could further dampen market sentiment.

The competitive landscape in facilities management and support services presents a significant threat to Dexterra, with numerous players vying for contracts. This intense rivalry often leads to considerable price pressure, which can compress profit margins and hinder market share growth.

Economic volatility, including potential GDP slowdowns in 2024-2025, poses a risk by impacting client spending across key sectors. This could result in delayed projects or reduced IT service budgets, directly affecting Dexterra's revenue.

Dexterra's Asset Based Services (ABS) segment is vulnerable to downturns in the natural resource market. For example, a decline in commodity prices could slow exploration and production, reducing demand for camp services and modular solutions.

| Threat Category | Specific Risk | Potential Impact on Dexterra |

|---|---|---|

| Competition | Intense rivalry in facilities management | Price pressure, reduced profit margins, market share erosion |

| Economic Conditions | Projected global GDP slowdown (2024-2025) | Reduced client spending, project delays/cancellations, lower IT service budgets |

| Industry Dependence | Natural resource market downturns | Decreased demand for ABS (workforce accommodations, modular solutions) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Dexterra's official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded strategic overview.