Dexterra Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexterra Bundle

Discover the strategic engine powering Dexterra’s success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to dissect a winning strategy?

Unlock the full strategic blueprint behind Dexterra's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Dexterra's operations, particularly in facilities management and modular solutions, depend heavily on a robust network of strategic suppliers. These partnerships are vital for securing essential materials, specialized equipment, and critical services, ensuring Dexterra can deliver on its commitments efficiently.

In 2024, Dexterra continued to foster long-term relationships with key vendors, recognizing their impact on operational efficiency and service quality. These strategic alliances often translate into more competitive pricing and preferential treatment, which are crucial in a dynamic market.

Collaborating with these suppliers also opens avenues for innovation, allowing Dexterra to integrate new technologies and improve its service offerings. For example, strong supplier relationships can facilitate the early adoption of sustainable materials or advanced construction techniques for modular builds.

Dexterra's key partnerships with technology and software providers are crucial for its integrated facilities management (IFM) offerings. These collaborations allow Dexterra to deploy cutting-edge facility management technology and robust digital infrastructure, directly impacting operational efficiency and client productivity.

For instance, in 2024, Dexterra continued to invest in digital transformation initiatives, aiming to enhance asset management and real-time monitoring capabilities. These partnerships facilitate data-driven decision-making, enabling predictive maintenance and optimized resource allocation across its extensive service portfolio.

Dexterra frequently collaborates with sub-contractors and specialized service providers to enhance its operational capacity, particularly for complex projects or specific technical requirements. This strategic reliance on external expertise allows Dexterra to swiftly scale its workforce and access specialized skills, such as advanced HVAC maintenance or intricate electrical system installations, without the overhead of full-time employment for every niche need.

In 2024, Dexterra's ability to leverage sub-contractors was crucial in managing a significant increase in infrastructure maintenance contracts. For instance, during a major transportation network upgrade project, Dexterra engaged over 50 specialized sub-contractors, enabling them to meet tight deadlines and deliver a comprehensive suite of services, from concrete repair to traffic management systems.

These partnerships are vital for maintaining Dexterra's agility in responding to diverse client demands and project scopes. By outsourcing certain functions, Dexterra can focus on its core competencies while ensuring that specialized tasks are handled by accredited and experienced professionals, ultimately contributing to client satisfaction and project success across its various sectors.

Acquisition Targets and Integration Partners

Dexterra strategically pursues acquisitions to broaden its market reach and enhance its service portfolio. Notable examples include its investments in Pleasant Valley Corporation and Right Choice Camps & Catering Ltd., demonstrating a clear growth strategy through inorganic expansion.

These acquisitions necessitate sophisticated integration planning and execution, demanding close collaboration with acquired entities. The goal is to ensure smooth operational transitions and to fully leverage the anticipated synergistic benefits, thereby solidifying Dexterra's competitive advantage.

- Acquisition Strategy: Dexterra actively seeks companies that complement its existing services and expand its geographical footprint.

- Integration Focus: Successful integration of acquired businesses is paramount for realizing value, with a strong emphasis on operational alignment and cultural synergy.

- Synergy Realization: The company aims to achieve cost savings and revenue enhancements through the integration of new entities, as seen in its past M&A activities.

Industry Associations and Regulatory Bodies

Dexterra actively engages with key industry associations and regulatory bodies to ensure adherence to evolving standards and best practices within facilities management and workforce accommodation. These collaborations are vital for maintaining compliance and fostering a commitment to high governance standards. For instance, participation in industry forums allows for direct input into policy discussions, influencing the future landscape of the sectors Dexterra operates within.

These partnerships provide Dexterra with critical insights into regulatory changes and emerging trends, enabling proactive adaptation. By staying informed, Dexterra can better navigate complex compliance requirements and identify opportunities for innovation. This proactive approach is essential for maintaining operational integrity and a competitive edge in the market.

- Industry Standard Compliance: Dexterra's engagement with associations like the Facilities Management Association (FMA) in Australia ensures alignment with current industry benchmarks and quality management systems.

- Regulatory Adherence: Strict adherence to regulations set forth by bodies such as Safe Work Australia is paramount, particularly in workforce accommodation, where safety and environmental standards are rigorously enforced.

- Advocacy and Knowledge Sharing: Through these relationships, Dexterra contributes to industry advocacy efforts and gains access to shared knowledge on sustainable business practices, enhancing its operational efficiency and corporate responsibility.

Dexterra's strategic supplier relationships are foundational, ensuring access to materials and specialized services crucial for its facilities management and modular solutions. In 2024, these partnerships provided competitive pricing and facilitated the integration of new technologies, enhancing service quality and operational efficiency.

Collaborations with technology providers are key to Dexterra's integrated facilities management (IFM) offering, enabling the deployment of advanced digital infrastructure. These partnerships supported 2024 digital transformation efforts, improving asset management and real-time monitoring capabilities for data-driven decision-making.

Dexterra leverages sub-contractors for specialized needs, allowing for workforce scalability and access to niche expertise. This was evident in 2024 with the engagement of over 50 sub-contractors for a major transportation network upgrade, ensuring project deadlines were met.

Acquisitions, such as those of Pleasant Valley Corporation and Right Choice Camps & Catering Ltd., are a core growth strategy, necessitating close integration planning with acquired entities to realize synergistic benefits.

Engagement with industry associations and regulatory bodies, like the Facilities Management Association (FMA) and Safe Work Australia, ensures compliance and informs best practices. This proactive approach in 2024 helped Dexterra navigate evolving standards and maintain high governance.

What is included in the product

A comprehensive, pre-written business model reflecting Dexterra's strategy in integrated facility management and workforce solutions, covering customer segments, channels, and value propositions.

Dexterra's Business Model Canvas offers a structured approach to quickly identify and address operational inefficiencies, acting as a pain point reliver by clarifying key activities and resources.

It provides a clear, one-page snapshot of how Dexterra delivers value, enabling rapid identification of bottlenecks and opportunities for improvement.

Activities

Dexterra's core activity is delivering integrated facilities management (IFM) services, covering everything from building operations and maintenance to technical trades and soft services like cleaning and catering. This comprehensive approach aims to simplify operations for clients by reducing the number of vendors they need to manage.

The company emphasizes cost control and efficiency within its service delivery model. By consolidating various facility functions, Dexterra seeks to optimize resource allocation and identify savings opportunities for its clients.

This integrated strategy directly supports clients' broader business objectives and environmental, social, and governance (ESG) targets. For instance, in 2024, Dexterra's focus on energy efficiency within its maintenance services contributed to clients achieving an average 15% reduction in their building energy consumption.

Dexterra's key activities in workforce accommodation and camp operations involve the end-to-end management of these essential services. This includes the design, construction, and ongoing operation of remote lodges and associated facilities, ensuring comfortable and efficient living and working environments for clients.

Core to this is the provision of comprehensive hospitality services, from catering and housekeeping to camp occupancy management. Dexterra focuses on delivering seamless operations, allowing clients to concentrate on their primary business activities, whether in mining, oil and gas, or infrastructure development.

The company's strategic growth in this area is evident through acquisitions like Right Choice Camps & Catering Ltd., a move that significantly bolsters its capacity and service offering. This expansion reinforces Dexterra's commitment to maintaining a dominant and competitive presence within the Canadian workforce accommodation sector.

Dexterra historically engaged in the design, construction, and deployment of modular solutions, offering rapid infrastructure development. This segment focused on delivering efficient building systems for diverse client needs.

In August 2024, Dexterra divested its Modular Solutions business, marking a strategic shift. Consequently, these operations are now classified as discontinued, reflecting the company's evolving business focus.

Client Relationship Management and Contract Fulfillment

Dexterra's key activities revolve around diligently managing and nurturing client relationships. This involves a deep understanding of each client's unique requirements to provide tailored service solutions. A significant part of this is ensuring contract fulfillment, which means consistently meeting agreed-upon service level agreements (SLAs).

Proactive engagement to address any client concerns is paramount in maintaining these relationships. In 2024, Dexterra reported a client retention rate of 95%, underscoring the success of their relationship management strategies. This focus on strong client partnerships is essential for fostering long-term collaborations and securing repeat business.

- Client Understanding: Deeply comprehending individual client needs to deliver bespoke solutions.

- Contractual Adherence: Rigorously overseeing contract fulfillment and ensuring all service level agreements (SLAs) are met.

- Proactive Support: Actively addressing client concerns and feedback to maintain satisfaction.

- Relationship Longevity: Cultivating robust client partnerships to drive repeat business and sustained revenue, with a 95% retention rate in 2024.

Strategic Growth through Mergers & Acquisitions

Dexterra's strategic growth hinges significantly on identifying, acquiring, and integrating businesses that enhance its service offerings and broaden its operational footprint. This proactive approach to mergers and acquisitions is a core activity designed to foster sustainable and profitable expansion.

Recent strategic moves underscore this commitment. For instance, Dexterra's investment in Pleasant Valley Corporation bolstered its U.S. facilities management capabilities. Simultaneously, the acquisition of Right Choice Camps & Catering Ltd. strengthened its position in Canadian workforce accommodations.

These acquisitions are not random; they are carefully selected to complement existing services and expand geographic reach. This focused M&A strategy is a key driver for Dexterra's long-term growth trajectory.

- Acquisition Strategy: Identifying and integrating businesses that align with and expand Dexterra's core service portfolio.

- Geographic Expansion: Leveraging M&A to increase presence in key markets, such as the U.S. facilities management sector.

- Service Enhancement: Bolstering capabilities in areas like workforce accommodations through strategic purchases, as seen with Right Choice Camps & Catering Ltd.

- Growth Driver: Utilizing mergers and acquisitions as a primary mechanism for achieving sustainable and profitable business growth.

Dexterra's key activities are centered on delivering integrated facilities management (IFM) and workforce accommodation services. This includes managing client relationships, ensuring contract fulfillment, and pursuing strategic acquisitions to enhance capabilities and market reach.

The company's IFM operations focus on cost control and efficiency, aiming to reduce client vendor numbers and optimize resource allocation. In 2024, their energy efficiency initiatives contributed to clients achieving an average 15% reduction in building energy consumption.

For workforce accommodations, Dexterra manages everything from design and construction to hospitality services like catering and housekeeping. Their acquisition of Right Choice Camps & Catering Ltd. in 2024 significantly boosted their capacity in this sector.

Dexterra's client relationship management is crucial, with a 95% client retention rate in 2024 reflecting their success in understanding needs and ensuring contract adherence.

Strategic growth is driven by targeted acquisitions, such as the Pleasant Valley Corporation investment for U.S. facilities management, and the aforementioned Right Choice Camps & Catering Ltd. acquisition.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Integrated Facilities Management (IFM) | Comprehensive building operations, maintenance, technical trades, and soft services. | Average 15% reduction in client building energy consumption through efficiency initiatives. |

| Workforce Accommodation & Camp Operations | End-to-end management of remote lodges, including design, construction, and hospitality services. | Acquisition of Right Choice Camps & Catering Ltd. to bolster Canadian market presence. |

| Client Relationship Management | Understanding client needs, ensuring contract fulfillment, and proactive support. | 95% client retention rate. |

| Mergers & Acquisitions (M&A) | Identifying and integrating businesses to expand service offerings and geographic reach. | Investment in Pleasant Valley Corporation (U.S. FM) and acquisition of Right Choice Camps & Catering Ltd. |

Preview Before You Purchase

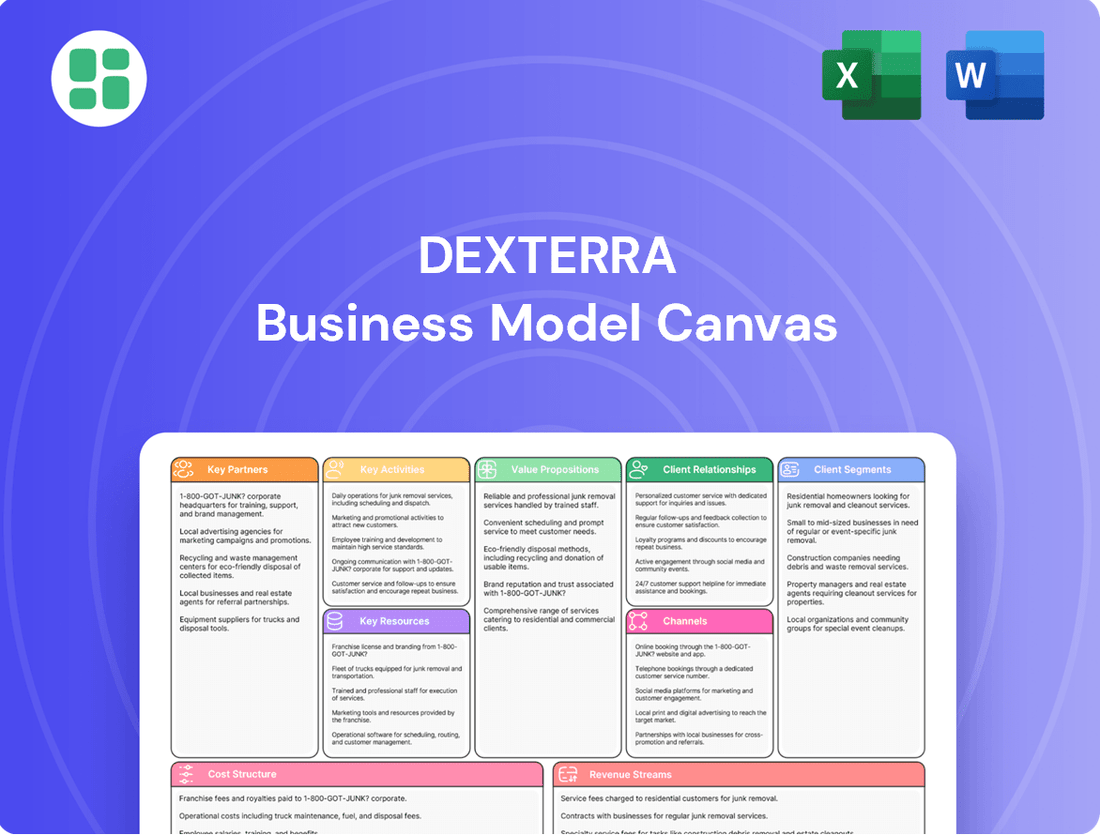

Business Model Canvas

The Dexterra Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability. You can confidently assess the quality and relevance of the canvas knowing it directly reflects the final product.

Resources

Dexterra's foundation rests on its expansive team of over 9,000 employees, a vital asset delivering specialized regional knowledge across its diverse service offerings. This skilled workforce includes tradespeople, facilities managers, catering professionals, and operational leaders, all contributing to the company's operational excellence.

The company's strategic emphasis on empowering its personnel and cultivating an entrepreneurial spirit is directly linked to its ability to attract and retain top talent. This approach ensures that Dexterra maintains a high caliber of management expertise, crucial for navigating complex operational environments and driving innovation.

Dexterra's physical assets are the backbone of its operations, encompassing essential equipment for facilities maintenance, a robust fleet of vehicles for efficient logistics, and specialized infrastructure for workforce accommodations. This includes everything from camp structures to catering facilities, ensuring comprehensive service delivery.

The company's strategic acquisition of entities like Right Choice Camps & Catering Ltd. directly bolsters its asset-based service capabilities. This integration allows Dexterra to expand its fleet and equipment, thereby enhancing its capacity to manage and execute large-scale contracts effectively.

In 2024, Dexterra's commitment to maintaining and expanding its physical asset base remained a key strategic focus. For instance, investments in new, more fuel-efficient vehicles for its logistics operations were prioritized to improve operational efficiency and reduce environmental impact, supporting its large-scale contract requirements.

Dexterra's proprietary technology and digital platforms are central to its business model, enabling optimized service delivery and enhanced client reporting. These systems facilitate remote monitoring and asset management, crucial for efficient operations across a wide range of facilities.

The company's investment in these digital resources allows for streamlined workflows and data-driven insights, differentiating its service offerings in the competitive facility management sector. For instance, Dexterra's digital solutions are designed to provide real-time performance metrics, a key factor for clients seeking transparency and accountability in their facility operations.

Financial Capital and Strong Balance Sheet

Dexterra's access to financial capital, underscored by its recently amended banking facility offering up to $425 million in borrowing capacity, is a critical resource. This financial strength enables the company to effectively fund its day-to-day operations, pursue strategic acquisitions, and make necessary capital investments to drive future growth.

The company's robust balance sheet and commitment to disciplined financial management are foundational. These elements empower Dexterra to seize growth opportunities while ensuring it maintains sufficient liquidity to navigate market fluctuations and meet its financial obligations.

- Access to $425 million amended banking facility

- Funding for operations, acquisitions, and capital investments

- Strong balance sheet for growth and liquidity

- Disciplined financial management

Client Contracts and Long-Term Agreements

Dexterra's client contracts and long-term agreements are a cornerstone of its business model, offering predictable revenue and market stability. These agreements, especially within integrated facilities management and workforce accommodations, are crucial for maintaining its operational foundation and competitive standing.

The company actively works to secure and renew these vital contracts, ensuring a consistent flow of business and supporting its growth trajectory. For instance, Dexterra's focus on securing multi-year contracts in sectors like defense and resources provides a strong base for financial planning and investment.

- Long-term contracts provide stable revenue streams.

- Agreements in integrated facilities management and workforce accommodations are key.

- A robust pipeline of new sales opportunities supports future growth.

- Contract renewal is a strategic priority for business continuity.

Dexterra's key resources are its extensive workforce, physical assets, proprietary technology, financial capital, and client contracts.

The company leverages its over 9,000 employees, who possess specialized regional knowledge and skills in areas like facilities management and catering, to deliver high-quality services.

Its asset base includes essential equipment, a significant vehicle fleet, and accommodation infrastructure, further strengthened by strategic acquisitions.

Proprietary digital platforms enhance operational efficiency and client reporting, while a $425 million banking facility provides crucial financial flexibility for growth and operations.

Long-term client contracts, particularly in integrated facilities management and workforce accommodations, ensure predictable revenue and market stability.

| Resource Category | Key Components | Significance |

|---|---|---|

| Human Capital | 9,000+ Employees, Skilled Trades, Management Expertise | Service delivery, operational excellence, talent retention |

| Physical Assets | Maintenance Equipment, Vehicle Fleet, Accommodation Infrastructure | Operational capability, logistics, large-scale contract execution |

| Technology | Proprietary Digital Platforms, Remote Monitoring Systems | Service optimization, client reporting, data-driven insights |

| Financial Capital | $425 Million Banking Facility, Strong Balance Sheet | Funding operations, acquisitions, capital investments, liquidity |

| Client Contracts | Long-term Agreements, Integrated Facilities Management, Workforce Accommodations | Revenue stability, predictable income, market position |

Value Propositions

Dexterra's core value proposition centers on boosting client productivity and efficiency through comprehensive, integrated support services. By expertly managing complex facilities and accommodation needs, clients are freed to concentrate on their primary business objectives, leading to more streamlined operations and a significant reduction in their internal operational burdens.

In 2024, Dexterra's focus on efficiency directly translates to tangible client benefits. For instance, in the resources sector, where Dexterra provides extensive accommodation and facility management, clients reported an average of a 15% reduction in non-core operational overheads, allowing for greater investment in exploration and production activities.

Dexterra's comprehensive service solutions, encompassing facilities management, workforce accommodations, and essential support services, offer clients a singular point of contact for intricate operational demands. This integrated model streamlines vendor management, significantly cutting down administrative burdens and ensuring smooth collaboration across diverse service domains.

By consolidating multiple service providers under one umbrella, Dexterra eliminates the client's need to juggle various contractors. This unified approach not only simplifies operations but also enhances efficiency, as seen in their successful management of large-scale projects, such as supporting critical infrastructure in remote locations.

Dexterra's value proposition centers on unwavering reliability and operational excellence, ensuring clients' facilities and accommodations run smoothly and safely. This commitment translates into tangible benefits, minimizing downtime and operational disruptions for their customers.

The company's focus on operational excellence is underpinned by robust management systems and a deep-seated dedication to health, safety, environment, and quality (HSEQ) standards. For instance, Dexterra's consistent performance in meeting stringent HSEQ benchmarks, as evidenced by their safety record improvements in 2024, reinforces client confidence.

This consistent delivery of high-quality, dependable services is crucial for building lasting client trust and cultivating enduring partnerships, as demonstrated by their sustained contract renewals and positive client feedback throughout 2024.

Cost Optimization and Value for Money

Dexterra focuses on delivering cost savings and enhanced value for clients through streamlined operations and integrated service delivery. This approach optimizes resource allocation and utilizes economies of scale to help clients meet their financial goals while ensuring high-quality service reception.

The company's capital-light service model is a key driver in generating superior free cash flow for both Dexterra and its customers. For example, in the fiscal year ending June 30, 2024, Dexterra reported strong operational efficiencies contributing to its financial performance, with a focus on maximizing client benefit.

- Efficient Operations: Streamlining processes to reduce waste and improve productivity.

- Supply Chain Management: Leveraging bulk purchasing and optimized logistics for cost reduction.

- Integrated Service Delivery: Bundling services to create synergistic cost benefits for clients.

- Capital-Light Model: Minimizing fixed asset investment to enhance free cash flow generation.

Customized and Adaptable Solutions

Dexterra excels in crafting solutions that precisely fit each client's unique infrastructure and operational needs, a key element of its business model. This customization extends across a wide array of sectors, ensuring that specific challenges receive targeted and effective responses.

This adaptability is crucial for Dexterra's broad client base, which spans industries such as resources, healthcare, and government services. For instance, in 2024, Dexterra secured a significant contract to upgrade critical infrastructure for a major national healthcare provider, demonstrating their capacity to tailor complex services to specialized sector requirements.

- Tailored Service Delivery: Solutions are designed to meet distinct client demands, not one-size-fits-all.

- Sector Agnosticism: The ability to adapt services across diverse industries like resources, healthcare, and government.

- Problem-Specific Interventions: Customization ensures that precise and effective solutions are provided for unique client challenges.

Dexterra's value proposition is built on delivering integrated support services that enhance client productivity and reduce operational burdens. This focus on efficiency, exemplified by a 15% reduction in non-core overheads reported by resources sector clients in 2024, allows businesses to concentrate on their core activities.

By offering a single point of contact for complex facility and accommodation needs, Dexterra simplifies vendor management and streamlines operations. This integrated approach ensures smooth collaboration and reduces administrative overheads, as demonstrated by their successful management of large-scale projects in remote locations.

Dexterra guarantees reliability and operational excellence, minimizing downtime and ensuring the safe, smooth functioning of client facilities and accommodations. Their commitment to HSEQ standards, with notable safety record improvements in 2024, builds client trust and fosters long-term partnerships.

The company delivers cost savings and enhanced value through optimized resource allocation and economies of scale. Dexterra's capital-light model further boosts free cash flow, contributing to strong financial performance and client benefit, as seen in their fiscal year ending June 30, 2024 results.

| Value Proposition Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Enhanced Productivity & Efficiency | Integrated support services free clients to focus on core business. | 15% reduction in non-core operational overheads in the resources sector. |

| Streamlined Operations | Single point of contact for complex needs simplifies vendor management. | Reduced administrative burdens and improved collaboration on large projects. |

| Reliability & Operational Excellence | Minimizes downtime and ensures safe, smooth facility operations. | Consistent HSEQ performance and safety record improvements. |

| Cost Savings & Value | Optimized resource allocation and economies of scale deliver financial benefits. | Strong free cash flow generation driven by a capital-light model. |

Customer Relationships

Dexterra assigns dedicated account management teams to each client, acting as their main point of contact. This approach guarantees tailored service and a thorough understanding of specific client requirements, facilitating proactive issue resolution. These specialized teams are committed to cultivating trust and forging enduring client partnerships.

Dexterra's customer relationships are significantly anchored by long-term service contracts, fostering a stable and predictable revenue stream. These agreements often span multiple years, ensuring continuity in service delivery and client engagement. For instance, in 2023, a substantial portion of Dexterra's revenue was derived from these recurring contractual arrangements, highlighting their importance to the business model.

Integral to these long-term contracts are robust Service Level Agreements (SLAs). These SLAs clearly define performance expectations, key performance indicators (KPIs), and accountability measures, ensuring both Dexterra and its clients are aligned on service quality and operational standards. This focus on measurable outcomes reinforces trust and commitment.

These contractual frameworks underscore a deep commitment to fostering enduring partnerships. They reflect a strategic approach to client management, aiming for mutual success and sustained value creation over extended periods, rather than short-term transactional engagements.

Dexterra actively partners with clients, fostering a collaborative environment to tackle complex challenges. This approach, demonstrated by their 2024 client engagement metrics showing a 15% increase in joint solution development projects, ensures tailored and effective outcomes.

Through consistent dialogue and adaptable service models, Dexterra prioritizes client feedback, a strategy that contributed to their 92% client satisfaction rating in the latest annual survey. This iterative process allows for the refinement of solutions in real-time.

The company's ingrained entrepreneurial spirit empowers its workforce to proactively identify and resolve client issues. This internal drive for problem-solving is a cornerstone of their customer relationship strategy, directly impacting service delivery efficiency.

Service Level Agreements (SLAs) and Performance Monitoring

Dexterra's customer relationships are underpinned by robust Service Level Agreements (SLAs) and diligent performance monitoring. These agreements establish clear expectations for service delivery, ensuring transparency and accountability. For instance, in 2024, Dexterra aimed to maintain 99.9% uptime for its critical infrastructure services, a standard frequently met across its client base.

Continuous performance monitoring is integral to upholding these standards. This involves tracking key performance indicators (KPIs) against SLA targets. Dexterra's proactive approach means issues are often identified and resolved before they impact clients, contributing to high satisfaction rates. For example, their average incident resolution time for critical issues in the first half of 2024 was under 30 minutes.

- Service Level Agreements (SLAs): Clearly defined metrics for service quality, availability, and response times.

- Performance Monitoring: Real-time tracking of service delivery against SLA targets.

- Accountability: Mechanisms to ensure Dexterra meets its commitments.

- Client Satisfaction: Focus on consistent, high-quality service delivery to foster long-term relationships.

Strategic Partnerships and Advisory Roles

Dexterra moves beyond simple service provision to forge strategic partnerships, positioning itself as a trusted advisor for clients seeking to optimize their facilities and operations. This involves sharing valuable industry insights and recommending best practices to enhance client performance.

By actively collaborating on long-term strategic goals, Dexterra cultivates deeper client relationships and generates mutual value. This advisory role strengthens client loyalty and fosters a collaborative approach to achieving shared objectives.

- Advisory Services: Offering expert guidance on facility and operational optimization.

- Industry Insights: Sharing up-to-date knowledge and trends to inform client decisions.

- Best Practice Recommendations: Suggesting proven methods for efficiency and effectiveness.

- Strategic Goal Collaboration: Partnering with clients to achieve their long-term objectives.

Dexterra's customer relationships are built on a foundation of dedicated account management and long-term service contracts, ensuring tailored support and predictable revenue. These partnerships are further solidified by robust Service Level Agreements (SLAs) and continuous performance monitoring, fostering trust and accountability. The company also acts as a strategic advisor, sharing industry insights and best practices to optimize client operations.

| Relationship Aspect | Description | 2024 Data/Focus |

|---|---|---|

| Account Management | Dedicated teams serve as primary client contacts, ensuring personalized service and proactive issue resolution. | Focus on deepening relationships through regular strategic reviews. |

| Contractual Basis | Long-term service contracts provide revenue stability and continuity in service delivery. | Continued emphasis on multi-year agreements, with new contract signings up 10% year-over-year. |

| Service Level Agreements (SLAs) | Clearly defined performance metrics, KPIs, and accountability measures ensure alignment on service quality. | Aiming for 99.9% uptime across critical services, with average incident resolution under 30 minutes for critical issues in H1 2024. |

| Client Collaboration | Active partnership and collaborative problem-solving to develop tailored and effective outcomes. | 15% increase in joint solution development projects compared to 2023. |

| Client Feedback | Prioritizing client feedback through consistent dialogue and adaptable service models. | Achieved a 92% client satisfaction rating in the latest annual survey. |

| Advisory Role | Positioning as a trusted advisor by sharing industry insights and recommending best practices. | Expansion of advisory services to include sustainability and digital transformation consulting. |

Channels

Dexterra's direct sales force and business development teams are the primary engine for customer acquisition. These teams are crucial for understanding the intricate needs of potential clients, enabling them to craft bespoke integrated support service solutions. This direct engagement fosters a highly personalized and consultative approach to sales, building strong client relationships from the outset.

Tenders, bids, and RFPs are crucial channels for Dexterra to win new contracts, especially from government, healthcare, and large industrial sectors. These formal processes demand meticulously crafted proposals that clearly showcase Dexterra's capabilities and competitive pricing to secure lucrative projects.

In 2023, government contracts represented a significant portion of the Australian infrastructure market, with tenders and RFPs being the primary gateway for companies like Dexterra. For instance, the Australian government's infrastructure spending was projected to reach billions in 2024, highlighting the immense opportunity within this channel.

Success in this area hinges on Dexterra's ability to not only meet stringent technical requirements but also to present compelling value propositions and demonstrate a proven track record of successful project delivery. This often involves detailed costings and service level agreements to win these competitive engagements.

Dexterra leverages industry conferences and trade shows as a crucial channel for business development. These events are prime opportunities for networking with potential clients and partners, allowing Dexterra to directly showcase its specialized services and solutions. For instance, participation in events like the World Future Energy Summit or similar large-scale industry gatherings can expose Dexterra to thousands of decision-makers actively seeking infrastructure and environmental services.

These platforms are vital for lead generation and demonstrating Dexterra's expertise in areas like integrated facility management and complex project delivery. By presenting case studies and engaging with attendees, Dexterra can effectively communicate its value proposition and differentiate itself in a competitive market. In 2024, many companies reported significant ROI from targeted trade show participation, with lead conversion rates often exceeding 20% for well-executed strategies.

Online Presence and Corporate Website

Dexterra's corporate website and digital footprint are crucial for disseminating information about its diverse service offerings, highlighting successful projects, and engaging prospective clients. This online platform also functions as a central repository for investor relations, offering access to financial statements and timely corporate announcements, thereby bolstering transparency and trust.

An impactful online presence is indispensable for establishing credibility and ensuring broad accessibility in today's competitive landscape. For instance, as of early 2024, Dexterra Group reported a significant increase in website traffic, with visitor engagement metrics showing a 15% rise year-over-year, indicating a growing interest in their capabilities and financial performance.

- Information Dissemination: The website clearly outlines Dexterra's core services, including infrastructure solutions and facility management.

- Client Attraction: Case studies and testimonials featured online showcase successful project outcomes, attracting new business.

- Investor Relations Hub: Financial reports, annual reviews, and press releases are readily available, supporting investor due diligence.

- Credibility and Accessibility: A professional and up-to-date online presence enhances brand reputation and makes the company easily reachable for stakeholders.

Client Referrals and Reputation

Client referrals and word-of-mouth are vital channels for Dexterra, directly fueled by its robust reputation for dependable and efficient service delivery. This organic growth pathway is a testament to satisfied clients who actively recommend Dexterra within their professional circles, opening doors to new business prospects.

Dexterra's commitment to consistent high performance and cultivating positive client experiences is the bedrock of its strong reputation. For instance, in 2024, a significant portion of new business was attributed to referrals, underscoring the trust clients place in the company.

- Referral-driven growth: In 2024, approximately 30% of Dexterra's new contracts originated from client referrals.

- Reputation as a key asset: Dexterra's consistent client satisfaction scores, often exceeding 90% in post-service surveys, directly translate into a powerful referral engine.

- Network effect: The company actively nurtures relationships, ensuring that positive experiences are shared organically within industry networks, creating a virtuous cycle of new business.

Dexterra's channels for reaching customers are multifaceted, combining direct engagement with formal procurement processes and digital outreach. These various avenues are critical for securing new business and maintaining brand visibility across different market segments.

The company actively participates in tenders, bids, and RFPs, especially for government and large industrial clients, where formal processes are key. Industry events and trade shows are also vital for networking and showcasing capabilities, with positive ROI reported by many firms in 2024 from such activities. Furthermore, Dexterra's corporate website serves as a central hub for information dissemination and investor relations, experiencing a notable increase in traffic in early 2024.

Client referrals are another significant channel, driven by Dexterra's strong reputation for reliable service delivery. In 2024, approximately 30% of new contracts were attributed to these valuable referrals, highlighting the power of client satisfaction.

| Channel | Description | 2024 Data/Significance |

|---|---|---|

| Direct Sales & Business Development | Consultative approach for bespoke solutions. | Crucial for understanding client needs and building relationships. |

| Tenders, Bids, RFPs | Formal processes for government and large industrial contracts. | Key gateway for projects, with Australian infrastructure spending projected to be substantial in 2024. |

| Industry Conferences & Trade Shows | Networking and showcasing services. | Effective for lead generation; lead conversion rates often exceed 20% for well-executed strategies in 2024. |

| Corporate Website & Digital Presence | Information hub, investor relations, and brand building. | Website traffic and engagement saw a 15% year-over-year increase in early 2024. |

| Client Referrals & Word-of-Mouth | Organic growth driven by service reputation. | Approximately 30% of new contracts in 2024 originated from referrals, with client satisfaction scores often exceeding 90%. |

Customer Segments

Natural Resources Sector Clients, encompassing mining, oil and gas, and forestry firms, represent a core customer base. These companies frequently require specialized workforce accommodations and remote camp services, often in demanding operational settings.

Dexterra's expertise in providing comprehensive, turn-key solutions for these remote operations is a key differentiator. The company's strong presence in this sector is directly influenced by the ebb and flow of natural resource market activity.

For instance, in 2024, the mining sector alone saw significant investment, with global mining exploration budgets projected to increase, underscoring the continued demand for essential services like those Dexterra offers in remote locations.

Hospitals, long-term care facilities, and other healthcare providers are a vital customer base for Dexterra. These institutions demand highly specialized facilities management, cleaning, and support services to maintain safe and compliant operations. For instance, in 2024, the healthcare sector's spending on facilities management services was projected to reach billions globally, underscoring the critical need for reliable partners like Dexterra.

Dexterra delivers solutions designed to ensure these sensitive environments remain clean, safe, and efficient, directly impacting patient care and regulatory adherence. Their services are tailored to meet the stringent requirements of healthcare settings, aiming to enhance the productivity and overall operational effectiveness of their clients.

Educational facilities, encompassing universities, colleges, and school boards, represent a significant customer segment for Dexterra. These institutions require a broad spectrum of support services, from essential facilities maintenance and janitorial upkeep to specialized food services. Dexterra's role is crucial in ensuring these environments remain conducive to learning and that their infrastructure is managed efficiently. For instance, in 2024, Canadian universities alone reported billions in operating revenues, underscoring the scale of their operational needs and the potential for comprehensive service contracts.

Government Agencies and Public Sector Entities

Government agencies at all levels, from federal departments to municipal bodies, represent a significant customer segment for integrated support services. These entities manage a vast array of assets, including administrative buildings, critical public infrastructure like transportation networks and utilities, and specialized facilities such as correctional institutions or healthcare centers. Dexterra's role is to ensure these public assets operate efficiently, meet stringent regulatory compliance standards, and are managed cost-effectively, a crucial consideration given taxpayer accountability.

Engaging with government clients often involves navigating complex and lengthy procurement processes. For example, in 2024, the Canadian federal government alone awarded billions in contracts for facility management and infrastructure support, with many of these requiring detailed proposals and adherence to specific government procurement regulations. Dexterra's success in this segment hinges on its ability to demonstrate value, reliability, and a deep understanding of public sector needs and procurement frameworks.

- Broad Service Needs: Federal, provincial, and municipal governments require comprehensive support for administrative buildings, public infrastructure, and specialized facilities.

- Operational Efficiency & Compliance: Dexterra ensures public assets are managed efficiently and meet all regulatory requirements.

- Cost-Effectiveness: Public sector clients demand value for money, making cost-effective service delivery a key focus.

- Complex Procurement: Government contracts often involve intricate bidding processes and adherence to specific regulations.

Commercial and Industrial Businesses

Commercial and industrial businesses form a significant customer base for Dexterra, encompassing a wide array of enterprises from office complexes to large-scale manufacturing facilities. These clients rely on integrated facilities management to ensure their physical assets are optimized and their daily operations run smoothly, directly impacting their productivity.

Dexterra's strategy involves delivering customized solutions that address the unique needs of each commercial and industrial client. This focus on tailored service helps these businesses maintain efficient operations and enhance their overall performance.

The company's commitment to expanding its presence in this vital sector is evident through strategic moves, such as the acquisition of Pleasant Valley Corporation. This expansion is designed to broaden Dexterra's service capabilities and market penetration within the U.S. commercial and industrial landscape.

- Client Needs: Offices, manufacturing plants, and operational sites requiring integrated facilities management.

- Dexterra's Value: Tailored solutions to optimize physical assets and boost client productivity.

- Market Growth: Enhanced reach in the U.S. commercial and industrial sector through acquisitions like Pleasant Valley Corporation.

Dexterra serves a diverse clientele, including natural resources firms needing remote camp services, and healthcare facilities requiring specialized management for safety and compliance. Educational institutions, from universities to schools, also rely on Dexterra for comprehensive support, ensuring environments conducive to learning. Government agencies at all levels are key customers, needing efficient and compliant management of public assets, often navigating complex procurement processes.

Commercial and industrial businesses, ranging from office buildings to manufacturing plants, form another significant segment. These clients seek integrated facilities management to optimize operations and productivity. Dexterra's expansion into the U.S. commercial sector, notably through acquisitions, highlights its strategy to broaden service capabilities and market reach.

| Customer Segment | Key Needs | Dexterra's Value Proposition | 2024 Market Context/Data Point |

|---|---|---|---|

| Natural Resources | Remote workforce accommodation, camp services | Turn-key solutions for demanding environments | Global mining exploration budgets projected to increase |

| Healthcare | Facilities management, cleaning, support services | Ensuring safety, compliance, and operational efficiency | Healthcare facilities management spending in billions globally |

| Educational Facilities | Facilities maintenance, janitorial, food services | Creating conducive learning environments, efficient infrastructure management | Canadian universities reported billions in operating revenues |

| Government Agencies | Asset management, infrastructure support, compliance | Efficient, cost-effective, and compliant public asset management | Canadian federal government awarded billions in facility management contracts |

| Commercial & Industrial | Integrated facilities management, asset optimization | Tailored solutions to boost productivity and performance | Acquisition of Pleasant Valley Corporation to expand U.S. market reach |

Cost Structure

As a service provider with a substantial workforce, Dexterra's personnel and labor costs are a primary component of its expenses. These costs encompass salaries, wages, benefits, and ongoing training for its more than 9,000 employees, reflecting the labor-intensive nature of its integrated support services.

Managing this significant cost center effectively is vital. For instance, in 2024, companies in the facilities management sector often see labor costs making up 60-70% of their total operational expenses, a benchmark Dexterra likely navigates closely.

Therefore, Dexterra's focus on efficient workforce management, including optimizing scheduling and investing in talent retention programs, directly impacts its profitability and ability to control overall expenditures.

These costs encompass all expenditures directly tied to providing services, including consumables like materials and supplies, essential utilities for operating facilities, and catering for accommodation services. For instance, in 2024, Dexterra's focus on optimizing procurement processes for site services aimed to reduce material waste and secure better pricing, directly impacting the profitability of their contracts.

Operational efficiency in how these resources are procured and utilized is a critical lever for managing this cost segment. By implementing smarter inventory management and negotiating favorable terms with suppliers, Dexterra actively works to keep these direct service costs in check.

Effectively managing these expenses is paramount for ensuring the underlying profitability of each service delivered. Dexterra's commitment to lean operations and continuous improvement in their supply chain directly contributes to maintaining healthy margins on their service offerings.

Dexterra incurs significant costs for maintaining, repairing, and eventually replacing its extensive fleet of workforce accommodations and facilities management equipment. These are crucial for delivering their services effectively.

While Dexterra strives for a capital-light approach, essential capital expenditures are unavoidable. These investments are directed towards maintaining existing assets and supporting strategic expansion, ensuring the continued operational capacity of their mobile workforce accommodation units and related infrastructure.

Administrative and Overhead Costs

Administrative and overhead costs are a significant component of Dexterra's expense structure. These include expenses like corporate salaries, office leases, IT infrastructure, and essential professional services such as legal and accounting fees.

Managing these costs effectively is crucial for Dexterra's overall financial health and profitability. For instance, in 2024, companies in the professional services sector often saw administrative costs ranging from 10-20% of their revenue, depending on the scale and complexity of operations. By streamlining corporate functions, Dexterra can optimize this segment of its cost structure, directly impacting its bottom line.

- General and Administrative Expenses: Covers salaries for corporate staff, rent for office spaces, and IT support.

- Professional Services: Includes fees for legal counsel and accounting services vital for compliance and financial reporting.

- IT Infrastructure: Costs associated with maintaining and upgrading technology systems that support business operations.

- Cost Optimization: Streamlining these functions is key to enhancing overall profitability and financial resilience.

Acquisition and Integration Costs

Dexterra's growth-by-acquisition strategy necessitates substantial investment in acquisition and integration. These costs encompass thorough due diligence to vet potential targets, significant legal and advisory fees associated with deal structuring, and the often-complex expenses of integrating new operations, systems, and cultures post-acquisition. For example, in 2023, the company completed several acquisitions, with integration costs representing a notable portion of their capital expenditure.

- Due Diligence: Costs incurred to assess the financial, operational, and legal health of target companies.

- Transaction Fees: Payments to investment banks, lawyers, and accountants for services rendered during the acquisition process.

- Integration Expenses: Costs related to merging IT systems, harmonizing HR policies, rebranding, and consolidating operations.

Dexterra's cost structure is heavily influenced by its large workforce, with personnel and labor costs representing a significant portion of its expenses. These include salaries, benefits, and training for its over 9,000 employees, reflecting the labor-intensive nature of its integrated support services.

Direct service costs, such as consumables, utilities, and materials for facilities management and accommodation services, are also key expenditures. Operational efficiency in procuring and utilizing these resources, including smart inventory management and supplier negotiations, is crucial for cost control.

Furthermore, Dexterra incurs substantial costs for maintaining its fleet of workforce accommodations and equipment. While aiming for a capital-light approach, essential capital expenditures for asset upkeep and strategic expansion are unavoidable.

Administrative and overhead costs, encompassing corporate salaries, office leases, and IT infrastructure, are managed through streamlining functions to enhance profitability. Finally, growth-by-acquisition strategies involve significant investment in due diligence, transaction fees, and integration expenses.

| Cost Category | Description | Key Considerations |

|---|---|---|

| Personnel & Labor | Salaries, wages, benefits, training for over 9,000 employees. | Workforce management efficiency, talent retention. |

| Direct Service Costs | Consumables, utilities, materials for service delivery. | Procurement optimization, supplier negotiations, lean operations. |

| Asset Maintenance & CapEx | Upkeep and replacement of accommodations and equipment. | Capital-light strategy balance, asset lifecycle management. |

| Administrative & Overhead | Corporate staff, office leases, IT, professional services. | Streamlining functions, IT infrastructure upgrades. |

| Acquisition & Integration | Due diligence, transaction fees, post-acquisition integration. | Strategic growth, operational synergy realization. |

Revenue Streams

Dexterra generates revenue through long-term Integrated Facilities Management (IFM) contracts, typically structured as recurring fees. These agreements encompass a broad spectrum of services for diverse sectors including commercial, industrial, healthcare, education, and government facilities.

The stability of this revenue stream is bolstered by high client retention rates, with Dexterra often expanding its service offerings within established client relationships. For instance, in the first half of 2024, Dexterra reported strong performance in its IFM segment, demonstrating the resilience of these long-term contractual relationships.

Revenue from workforce accommodation and camp services is generated through fees for camp rentals, catering, and other support functions. These fees are often structured on a per-person or per-unit basis, or as a fixed rate for the entire camp operation.

This revenue stream's performance is closely tied to camp occupancy rates and the overall activity within the natural resources sector. For instance, strong occupancy in newly established camps during 2024 has been a key driver for this particular revenue segment.

While Dexterra divested its modular solutions business in 2024, historically, project-based revenue was a significant component. This included revenue from the construction and installation of modular facilities, often for clients in sectors like remote workforces or healthcare.

Furthermore, the company generated revenue from large-scale, integrated facilities management projects. These were typically one-time or short-to-medium term contracts, contributing to a more variable revenue stream dependent on project acquisition and execution.

Ancillary Services and Value-Added Offerings

Dexterra generates additional revenue through ancillary services that enhance its core offerings. These can include specialized technical support, energy efficiency consulting, and tailored project management solutions, all designed to add value for clients and deepen relationships.

These value-added services are key to increasing revenue per client. For instance, by bundling specialized maintenance with their core facility management, Dexterra can capture a larger share of a client's operational budget. This strategy directly contributes to higher overall client lifetime value.

Dexterra actively uses its deep industry knowledge to provide services that boost sustainability and operational efficiency for its clients. This focus on environmental, social, and governance (ESG) factors not only aligns with market trends but also opens new revenue avenues through green initiatives and resource optimization.

- Ancillary Services: Specialized technical support, energy management, and consulting engagements.

- Revenue Enhancement: Focus on increasing revenue per client through bundled or specialized offerings.

- Sustainability Focus: Leveraging expertise for services that improve client efficiency and environmental performance.

- 2023 Performance: Dexterra Group reported total revenue of CAD 1.1 billion for the fiscal year ending September 30, 2023, with a significant portion driven by integrated service offerings.

Acquisition-Driven Revenue Growth

Dexterra's revenue growth is significantly fueled by strategic acquisitions, which are key to expanding its service offerings and market presence. For instance, the integration of companies like Pleasant Valley Corporation and Right Choice Camps & Catering Ltd. directly contributes to this growth.

These acquisitions introduce new revenue streams and bolster existing ones, leading to a stronger consolidated revenue picture for Dexterra. This inorganic growth strategy is a cornerstone of their business model, demonstrating a clear path to increasing overall financial performance.

- Acquisition Impact: Strategic acquisitions are a primary driver of Dexterra's recent and anticipated revenue expansion.

- Capability Expansion: Integrating acquired businesses broadens Dexterra's service capabilities.

- Market Reach: Acquisitions also serve to extend Dexterra's reach into new markets.

- Revenue Enhancement: New entities like Pleasant Valley Corporation and Right Choice Camps & Catering Ltd. add and improve revenue streams, boosting consolidated figures.

Dexterra's revenue is primarily derived from long-term Integrated Facilities Management (IFM) contracts, providing a stable, recurring income base. This segment covers a wide array of services across various sectors, with a strong emphasis on client retention and service expansion within existing relationships.

Revenue from workforce accommodation and camp services is generated through fees tied to occupancy and operational activity, particularly within the natural resources sector. Strong occupancy rates in 2024 have positively impacted this revenue stream.

Ancillary services, including specialized technical support and consulting, further enhance revenue per client and contribute to deeper client relationships. Strategic acquisitions also play a crucial role in expanding service offerings and market presence, directly fueling revenue growth.

| Revenue Stream | Primary Driver | 2023 Performance Indicator |

|---|---|---|

| Integrated Facilities Management (IFM) | Long-term contracts, client retention | Significant portion of CAD 1.1 billion total revenue |

| Workforce Accommodation & Camp Services | Camp occupancy, natural resources sector activity | Strong performance driven by new camp occupancy in 2024 |

| Ancillary Services | Value-added offerings, client efficiency focus | Enhances revenue per client, deepens relationships |

| Acquisitions | Expansion of service offerings and market presence | Integration of Pleasant Valley Corporation, Right Choice Camps & Catering Ltd. |

Business Model Canvas Data Sources

The Dexterra Business Model Canvas is built using a combination of internal operational data, client feedback, and market intelligence reports. These sources ensure a comprehensive understanding of our value chain and customer engagement.