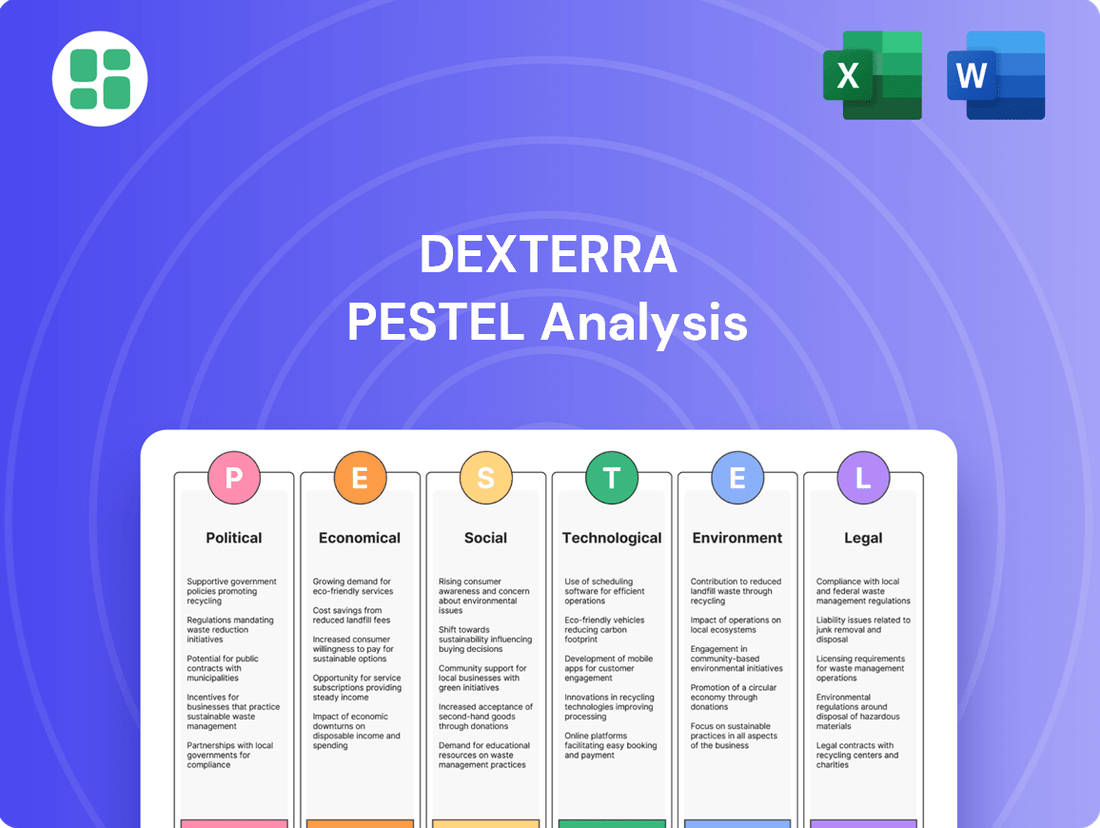

Dexterra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexterra Bundle

Unlock critical insights into the external forces shaping Dexterra's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions. Gain a competitive advantage by understanding these dynamics. Download the full report now for actionable intelligence.

Political factors

Dexterra Group's reliance on government contracts means its revenue is directly tied to public spending priorities. For instance, a shift in the Australian federal budget towards infrastructure projects, like those seen in the 2024-25 budget with significant allocations to transport and regional development, could boost demand for Dexterra's facility management and asset services in those sectors. Conversely, austerity measures or reprioritization away from areas like social housing or public education could negatively impact contract pipelines.

The political landscape's stability is also a key determinant for Dexterra, particularly concerning its involvement in public-private partnerships (PPPs). A stable political environment fosters confidence in long-term infrastructure and service delivery agreements, crucial for companies like Dexterra that often operate under multi-year contracts. Uncertainty or frequent policy changes can deter investment in PPPs, making it harder for Dexterra to secure and maintain these vital revenue streams.

Regulatory frameworks governing government procurement and service delivery are paramount. Dexterra must navigate evolving compliance requirements and tender processes. For example, new environmental regulations or standards for service provision in the healthcare or defence sectors could necessitate operational adjustments and investments, impacting profitability and contract competitiveness. Staying abreast of these changes is critical for maintaining its market position.

Government regulations, including zoning laws, building codes, and operational licenses, significantly shape Dexterra's operations in facilities management, workforce accommodations, and modular construction. For instance, changes in building codes for modular units, which are becoming increasingly prevalent in projects like those supporting the energy sector, could require costly redesigns or material substitutions.

Dexterra's ability to secure and maintain operational licenses across various jurisdictions is critical. In 2024, the Canadian federal government continued to emphasize infrastructure development, which often involves navigating a complex web of provincial and municipal regulations for construction and service provision. Non-compliance can lead to project delays and penalties, impacting overall profitability.

Anticipating and adapting to evolving regulatory landscapes is a key strategic imperative for Dexterra. For example, new environmental regulations concerning waste management in construction or energy efficiency standards for modular buildings, which saw increased adoption in 2024 for remote work sites, could present both challenges and opportunities for innovation and market differentiation.

Policies targeting specific industries Dexterra serves, like mining and healthcare, significantly shape its operational landscape. For example, the Australian government's continued focus on critical minerals, with initiatives like the Critical Minerals Strategy aiming to boost domestic production, could drive demand for Dexterra's remote workforce accommodation and services in the resource sector throughout 2024 and 2025.

Conversely, shifts in healthcare funding or regulatory frameworks, such as potential changes to aged care facility management standards in Australia, could present both opportunities for new contracts and challenges in adapting existing service models. Dexterra's strategic planning will need to closely monitor these sector-specific directives to capitalize on emerging opportunities and mitigate potential risks.

Trade & International Relations

While Dexterra's operations are largely domestic, global trade policies and international relations can indirectly influence its business. Changes in trade agreements or tariffs can impact the profitability and investment decisions of its clients, particularly in the resource sector, which is a significant user of Dexterra's services. For instance, a slowdown in global commodity demand due to trade disputes could reduce capital expenditure by mining companies, affecting Dexterra's project pipeline.

Geopolitical stability plays a crucial role, as it directly correlates with commodity prices and foreign investment in resource-rich regions. Disruptions to international trade routes or increased protectionism can lead to supply chain vulnerabilities, potentially affecting the cost and availability of materials and equipment that Dexterra utilizes or that its clients rely on. In 2024, ongoing geopolitical tensions in various regions continue to highlight the importance of supply chain resilience for companies like Dexterra.

- Impact on Client Industries: Trade policies affecting commodity prices, such as iron ore or coal, directly influence the capital expenditure budgets of mining clients, a key sector for Dexterra.

- Supply Chain Dynamics: Global trade disruptions, as seen with shipping container availability and costs in late 2023 and early 2024, can increase project costs for Dexterra and its clients.

- Investment Climate: International relations and trade agreements influence foreign direct investment into Australia's resource sector, impacting the overall demand for infrastructure and support services provided by Dexterra.

Procurement Policies

Government procurement policies significantly shape Dexterra's operational landscape, particularly for public sector contracts. These policies dictate the tendering processes, emphasizing transparency, fairness, and specific award criteria. For instance, in 2024, the Australian government continued to prioritize local content, with initiatives aimed at bolstering domestic industries, which directly impacts companies like Dexterra bidding for infrastructure projects.

The criteria for awarding contracts, which increasingly include factors like sustainability and social value, can influence Dexterra's competitiveness. A strong focus on these elements in government tenders means Dexterra must align its strategies and service offerings with these evolving standards to enhance its chances of winning bids. This adaptability is crucial for sustained growth in the public sector market.

Dexterra's success in securing new projects is directly tied to its ability to navigate and adapt to these procurement standards. For example, upcoming infrastructure spending in Canada, projected to reach billions in 2025, will be heavily influenced by federal and provincial procurement guidelines that may favor companies demonstrating strong ESG (Environmental, Social, and Governance) performance.

- Government Tendering: Policies dictate fairness and transparency in awarding public contracts.

- Local Content Emphasis: Initiatives in 2024 across various nations, including Australia, prioritize domestic industries.

- Sustainability Criteria: Evolving standards increasingly favor companies with strong ESG performance, impacting bid success.

- Market Adaptation: Dexterra must align strategies with evolving procurement standards for growth, anticipating increased infrastructure spending in 2025.

Government spending priorities significantly influence Dexterra's revenue streams, with infrastructure and defence contracts being key drivers. Australia's 2024-25 budget, for instance, allocated substantial funds to transport and regional development, potentially boosting demand for Dexterra's services in these areas. Political stability is also crucial, as it underpins confidence in long-term public-private partnerships, a vital segment for Dexterra's contract pipeline.

Regulatory frameworks, including procurement policies and compliance requirements, directly shape Dexterra's operational landscape. Evolving standards for environmental impact and social value in government tenders necessitate continuous adaptation. For example, upcoming infrastructure projects in Canada, expected to see significant investment in 2025, will be governed by procurement guidelines that may increasingly favor companies with strong ESG credentials.

Sector-specific government policies can create both opportunities and challenges. The Australian government's focus on critical minerals, for example, is likely to increase demand for Dexterra's remote workforce accommodation and services in the resources sector through 2024-2025. Conversely, changes in healthcare funding or aged care facility management standards could require Dexterra to adjust its service models.

| Political Factor | Impact on Dexterra | 2024/2025 Relevance |

| Government Spending Priorities | Directly affects contract volume and revenue. | Increased infrastructure spending in Australia and Canada expected. |

| Political Stability | Influences confidence in long-term PPPs. | Crucial for securing multi-year service agreements. |

| Regulatory Frameworks | Dictates compliance, procurement, and operational standards. | Emphasis on ESG and local content in tenders is growing. |

| Sector-Specific Policies | Creates opportunities or challenges in key industries. | Critical minerals focus boosts resource sector demand; healthcare policy shifts require adaptation. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Dexterra, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions with specific relevance to its operating landscape.

Provides a concise overview of external factors impacting Dexterra, simplifying complex market dynamics for strategic decision-making.

Economic factors

Economic growth is a significant driver for Dexterra Group. As economies expand, there's typically a greater need for infrastructure, facility management, and resource extraction services, directly boosting demand for Dexterra's offerings. For instance, strong GDP growth in Australia and Canada, key markets for Dexterra, generally translates to more robust client spending on their services.

Conversely, economic slowdowns or recessions pose challenges. During downturns, clients often cut back on discretionary spending, leading to reduced project pipelines, delayed investments, and pressure on contract pricing for companies like Dexterra. The resource sector, a vital client base for Dexterra, is particularly susceptible to commodity price fluctuations and global economic sentiment.

In 2024, forecasts for global economic growth, while varied, generally anticipate a moderate pace. For example, the International Monetary Fund (IMF) projected global GDP growth around 3.2% for 2024. This level of growth suggests a generally supportive, though not booming, environment for Dexterra's diverse service lines.

Inflationary pressures, especially concerning labor, materials, and energy, directly affect Dexterra's operational expenses. For instance, the Canadian CPI saw a notable increase, reaching 4.3% year-over-year in April 2024, highlighting the broad impact of rising costs across various sectors.

As a service-oriented entity, Dexterra faces a direct challenge where escalating wages and input prices can shrink profit margins. This is particularly true if the company cannot adequately adjust its contracts or implement sufficient operational efficiencies to offset these increases.

Dexterra's capacity to transfer these heightened costs to its clients is a crucial determinant of its financial resilience during periods of elevated inflation. Successfully navigating this dynamic is key to maintaining profitability and operational stability.

Interest rate fluctuations directly impact Dexterra's capital expenditure decisions. For instance, if the Bank of Canada's overnight rate, which influences prime lending rates, were to increase significantly in 2024 or 2025, Dexterra's borrowing costs for new modular construction facilities or equipment upgrades would rise. This increased cost of capital could make expansion projects less attractive, potentially moderating the pace of growth.

Furthermore, prevailing interest rates influence Dexterra's clients' investment capacity and willingness. Higher rates, such as those seen in late 2023 and projected into 2024 by many economists, often translate to higher financing costs for clients undertaking large infrastructure or building projects. This can lead to a slowdown in new project initiations, thereby reducing the demand for Dexterra's specialized services.

Labor Market & Wage Trends

The availability and cost of skilled labor are critical economic considerations for Dexterra, particularly in its facilities management and modular construction segments. For instance, in Australia, the unemployment rate remained low, hovering around 4.0% in early 2024, indicating a tight labor market that can pressure wages. This scarcity of skilled workers directly impacts Dexterra's operational costs and its capacity to deliver services effectively.

Significant wage increases, a trend observed across many sectors due to inflation and demand, can notably inflate Dexterra's operating expenses. As of late 2023 and early 2024, wage price indexes in Australia showed consistent growth, with the annual wage price index increasing by 4.1% in the year to December 2023. This necessitates proactive strategies from Dexterra to maintain competitive compensation packages.

To counter these pressures and ensure a consistent talent pipeline, Dexterra must actively monitor labor market trends. This includes understanding regional skill demands and adapting its recruitment and retention strategies. Key areas for Dexterra to focus on include:

- Monitoring Australian unemployment rates and wage growth trends.

- Assessing the availability of specific skilled trades relevant to facilities management and construction.

- Benchmarking compensation against industry averages to attract and retain qualified personnel.

- Investing in training and development to upskill existing employees and mitigate external labor shortages.

Client Industry Performance

Dexterra's revenue is intrinsically linked to the economic health of its core client sectors: resources, healthcare, education, and government. For instance, robust commodity prices in 2024 have driven increased activity in the resources sector, translating to higher demand for Dexterra's remote workforce accommodation and operational services.

The healthcare industry, a significant revenue driver, has seen continued investment. In Australia, healthcare spending was projected to reach approximately AUD 134.4 billion in 2023-24, indicating a stable environment for facilities management contracts.

Government and education sectors also provide a baseline of consistent demand. Government infrastructure spending plans and ongoing needs for facility maintenance in educational institutions offer predictable contract flows, even amidst broader economic fluctuations.

- Resources Sector: High commodity prices in 2024 are stimulating project development, boosting demand for accommodation and support services.

- Healthcare Sector: Projected Australian healthcare spending of AUD 134.4 billion for 2023-24 underscores the sector's stability and consistent need for facilities management.

- Education Sector: Ongoing requirements for maintenance and upgrades in schools and universities provide a steady stream of contract opportunities.

- Government Sector: Planned infrastructure investments and essential service delivery ensure continued demand for Dexterra's operational support.

Economic growth directly influences Dexterra's demand, with strong GDP in Australia and Canada boosting client spending. Conversely, economic slowdowns can reduce project pipelines and put pressure on pricing, especially in the sensitive resource sector.

Inflationary pressures, particularly on wages and materials, impact Dexterra's operational costs, with Canadian CPI at 4.3% year-over-year in April 2024 highlighting this challenge. The company's ability to pass these costs to clients is crucial for maintaining profit margins.

Interest rate hikes, like those seen in late 2023 and into 2024, increase Dexterra's borrowing costs and can dampen client investment in projects, potentially slowing demand for services.

A tight labor market, exemplified by Australia's low unemployment rate around 4.0% in early 2024, pressures wages and affects Dexterra's operational expenses, necessitating strategic talent management.

| Economic Factor | Impact on Dexterra | Supporting Data/Trend |

| GDP Growth | Increased demand for services | Moderate global growth projected around 3.2% for 2024 (IMF) |

| Inflation | Higher operational costs, potential margin squeeze | Canadian CPI at 4.3% (YoY April 2024); Australian Wage Price Index up 4.1% (Dec 2023) |

| Interest Rates | Increased borrowing costs, reduced client investment | Rates elevated in late 2023/early 2024 influencing financing costs |

| Labor Market | Wage pressures, potential talent shortages | Australian unemployment around 4.0% (early 2024) |

What You See Is What You Get

Dexterra PESTLE Analysis

The preview shown here is the exact Dexterra PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers all key external factors impacting Dexterra, providing valuable insights for strategic planning. You can trust that the detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences is precisely what you'll download.

Sociological factors

Changes in population demographics, like an aging workforce in many developed nations, directly affect the availability of skilled labor for companies like Dexterra. For instance, in the UK, the proportion of workers aged 50 and over in the workforce has been steadily increasing, reaching approximately 27% in early 2024, which can create both opportunities and challenges for recruitment in sectors like facilities management and construction.

Dexterra's reliance on a diverse workforce for its core services—facilities management, catering, and construction—means that shifts in migration patterns are also crucial. In 2023, net migration figures in Australia, a key market for Dexterra, remained high, potentially easing labor shortages in certain areas but also requiring careful management of cultural integration and skill-matching within the workforce.

Understanding these demographic trends is vital for Dexterra's recruitment strategies. Ensuring a stable talent pipeline requires proactive planning to address potential skill gaps, whether through targeted training programs or by adapting recruitment approaches to attract a broader range of candidates, including younger generations and those from different backgrounds.

Societal focus on health and safety has intensified, particularly following the COVID-19 pandemic, raising client expectations for pristine and secure environments. Dexterra, as a key player in integrated support services, must proactively evolve its procedures and service portfolios to align with these heightened standards, which can also unlock avenues for premium service offerings. For instance, in 2023, the Australian construction industry reported a 10% decrease in serious injury frequency rates, reflecting a broader trend towards improved safety practices that Dexterra must embody.

A robust safety culture is paramount for fostering client trust and ensuring adherence to regulatory frameworks. Dexterra's commitment to safety, evidenced by its adherence to ISO 45001 standards, directly impacts its competitive positioning. In 2024, companies with demonstrably strong safety records often secure preferential contracts, as clients increasingly prioritize partners who minimize operational risks and uphold ethical operational standards.

The rise of remote and hybrid work models significantly impacts accommodation needs, pushing demand for more comfortable and amenity-rich living spaces. For instance, in 2024, a significant portion of the workforce, estimated to be over 30% in many developed economies, continued to embrace flexible work arrangements, directly influencing the types of facilities clients seek for their project sites.

This shift necessitates that providers like Dexterra adapt their modular solutions to incorporate features that support well-being and productivity, such as better internet connectivity, private workspaces, and recreational areas. The expectation for higher quality living conditions is becoming a standard, not a luxury, for attracting and retaining skilled labor in remote project locations.

Social Values & Corporate Responsibility

Societal expectations for corporate social responsibility (CSR) and ethical business practices are significantly shaping client choices and employee attraction in 2024 and 2025. Consumers and potential employees are increasingly looking beyond product quality and profitability to assess a company's broader impact. This heightened scrutiny covers everything from environmental stewardship to fair labor practices and genuine community engagement.

Companies are under a microscope, with their social impact, labor conditions, and community involvement being key differentiators. For instance, a 2024 survey indicated that over 60% of millennials consider a company's social and environmental impact when making purchasing decisions. This trend is expected to grow as Gen Z enters the workforce and consumer base in larger numbers.

Dexterra's dedication to responsible operations, fostering diversity, and actively participating in community initiatives directly addresses these evolving social values. This commitment can substantially bolster its brand reputation, making it more attractive to a growing segment of socially conscious clients and top-tier talent. In 2025, companies demonstrating strong CSR are projected to see a 5-10% higher employee retention rate and a 3-5% increase in customer loyalty compared to peers with weaker social performance.

- Growing Consumer Demand for Ethical Practices: By 2025, an estimated 70% of consumers will prioritize brands with demonstrable commitments to sustainability and ethical labor.

- Talent Acquisition Advantage: Companies with strong CSR programs are expected to attract 25% more job applications from university graduates in 2024-2025.

- Brand Reputation Enhancement: Positive social impact initiatives can lead to a 15% improvement in brand perception among key stakeholders.

- Risk Mitigation: Proactive engagement in social responsibility helps mitigate reputational risks associated with labor disputes or environmental concerns.

Urbanization & Regional Development

Urbanization trends significantly influence Dexterra's service demand. For instance, Canada saw its urban population reach 87.7% by 2023, a figure projected to climb, increasing the need for facilities management in commercial and institutional buildings within these growing centers. This growth necessitates robust infrastructure and maintenance services, areas where Dexterra operates.

Simultaneously, regional development, particularly in resource-rich remote areas, presents a distinct demand for Dexterra's specialized services. As of early 2024, Canada's resource sector, including mining and energy, continues to expand in less populated regions, driving the need for workforce accommodation and integrated camp services. Dexterra's expertise in managing remote operations directly addresses this demand.

- Urban Population Growth: Canada's urban population was approximately 37 million in 2023, with projections indicating continued growth, boosting demand for urban facilities management.

- Resource Sector Activity: The Canadian resource sector, a key driver of regional development, maintained significant investment levels into 2024, supporting demand for remote workforce solutions.

- Infrastructure Needs: Growing urban and remote populations require enhanced infrastructure, including maintenance and operational support, aligning with Dexterra's service offerings.

- Strategic Market Focus: Understanding these geographical shifts allows Dexterra to strategically allocate resources and expand its market presence in high-demand urban and remote development zones.

Societal expectations for corporate social responsibility (CSR) and ethical business practices are significantly shaping client choices and employee attraction in 2024 and 2025. Consumers and potential employees are increasingly looking beyond product quality and profitability to assess a company's broader impact, with over 60% of millennials considering a company's social and environmental impact when making purchasing decisions in 2024.

Dexterra's dedication to responsible operations, fostering diversity, and actively participating in community initiatives directly addresses these evolving social values, bolstering its brand reputation. Companies demonstrating strong CSR are projected to see a 5-10% higher employee retention rate in 2025 compared to peers with weaker social performance.

| Societal Factor | Impact on Dexterra | Supporting Data (2024-2025) |

|---|---|---|

| Corporate Social Responsibility (CSR) | Enhances brand reputation, attracts talent and clients | 60%+ millennials consider social/environmental impact (2024); 5-10% higher employee retention for strong CSR (2025) |

| Health and Safety Standards | Drives demand for premium services, ensures client trust | 10% decrease in serious injury frequency rates in Australian construction (2023); preferential contracts for strong safety records (2024) |

| Workforce Demographics | Affects labor availability and recruitment strategies | ~27% of UK workforce aged 50+ (early 2024); high net migration in Australia (2023) |

| Remote/Hybrid Work Models | Influences demand for quality accommodation and facilities | 30%+ workforce in developed economies embrace flexible work (2024) |

Technological factors

Automation and smart building tech, including IoT and AI, are revolutionizing facilities management. These advancements optimize energy use, enable predictive maintenance, and boost overall operational efficiency. For instance, smart sensors can monitor equipment health, flagging potential issues before they cause downtime, a critical aspect for companies like Dexterra managing large portfolios.

Dexterra can harness these technologies to deliver superior, cost-efficient, and data-driven services. By integrating AI for predictive maintenance, they can reduce unexpected repair costs, which in 2024 are a significant concern for facility budgets. This not only enhances client productivity but also directly lowers operational expenses, making Dexterra's offerings more attractive in a competitive market.

Staying ahead means investing in these technological frontiers. The global smart building market is projected to reach over $100 billion by 2025, indicating a strong demand for these solutions. Dexterra’s commitment to adopting and integrating these innovations will be crucial for its continued growth and market leadership.

Advancements in modular construction are significantly boosting efficiency. Innovations in pre-fabrication techniques, new materials, and digital design tools are making it faster, better, and more affordable to build with modular components. For Dexterra, this means their modular solutions can be more streamlined and tailored to specific client needs across sectors like healthcare and remote workforce housing.

The modular construction market is projected for substantial growth. For instance, the global modular construction market size was valued at approximately USD 101.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching an estimated USD 168.7 billion by 2030. Dexterra's ability to leverage these technological leaps in speed, quality, and cost-effectiveness will be key to maintaining its competitive edge and capturing a larger share of this expanding market.

Dexterra leverages advanced data analytics to transform its service delivery from reactive to proactive. By analyzing vast datasets from building systems and equipment, the company gains predictive insights into potential maintenance issues.

This predictive capability allows Dexterra to anticipate needs, optimize the deployment of technicians and resources, and significantly reduce unexpected downtime for its clients. For instance, in 2024, a pilot program utilizing predictive maintenance on HVAC systems in a major commercial portfolio resulted in a 15% reduction in emergency service calls and a 10% improvement in energy efficiency.

The data-driven approach not only enhances operational efficiency but also directly contributes to improved service quality and heightened client satisfaction. Dexterra's investment in these technologies positions it to offer more reliable and cost-effective facility management solutions in the competitive 2025 market.

Digital Transformation & Connectivity

Digital transformation is reshaping industries, with enhanced connectivity and integrated digital platforms fundamentally altering how companies like Dexterra manage operations and engage with clients. This shift necessitates robust digital systems for everything from project oversight to client communication, aiming to boost efficiency and transparency.

Implementing these advanced digital solutions directly translates to improved project management, streamlined supply chain logistics, and more responsive client interactions. For instance, the global digital transformation market was projected to reach $1.5 trillion in 2024, highlighting the significant investment in these technologies across sectors.

- Enhanced Connectivity: 5G rollout and widespread internet access enable real-time data flow for better operational control.

- Integrated Platforms: Digital tools for project management and client portals improve collaboration and service delivery.

- Data-Driven Decisions: Analytics from digital systems inform strategic planning and resource allocation.

- Cybersecurity Focus: Investment in secure digital infrastructure is paramount to protect sensitive operational and client data.

Cybersecurity & Data Privacy

Dexterra's increasing reliance on digital platforms and the sensitive client data it handles makes cybersecurity and data privacy absolutely critical. Protecting this information from evolving cyber threats is paramount to maintaining client trust and avoiding costly legal penalties. For instance, the Australian Cyber Security Centre reported a significant increase in ransomware attacks in 2024, highlighting the persistent threat landscape.

Ensuring compliance with stringent data protection regulations, such as the Australian Privacy Principles, is a non-negotiable aspect of operations. Failure to do so can result in substantial fines and reputational damage. Dexterra must invest in and continuously update its cybersecurity infrastructure to safeguard against breaches.

Key considerations for Dexterra include:

- Implementing multi-factor authentication for all user accounts.

- Conducting regular vulnerability assessments and penetration testing.

- Providing ongoing cybersecurity awareness training for all employees.

- Developing and testing a comprehensive incident response plan.

Technological advancements are fundamentally reshaping the facilities management landscape, with automation and smart building technologies like IoT and AI driving significant operational efficiencies. These innovations are key to optimizing energy consumption, enabling predictive maintenance, and enhancing overall service delivery, which is crucial for companies managing extensive property portfolios.

Dexterra can leverage these technologies to provide superior, cost-effective, and data-driven services, reducing unexpected repair costs and improving client productivity. The global smart building market's projected growth to over $100 billion by 2025 underscores the demand for these solutions, making Dexterra's commitment to innovation vital for market leadership.

The company's utilization of advanced data analytics allows for a proactive approach to maintenance, anticipating issues before they arise. This predictive capability, as demonstrated by a 2024 pilot program reducing emergency calls by 15%, directly enhances operational efficiency and client satisfaction.

Dexterra's adoption of digital transformation, including integrated platforms and enhanced connectivity, streamlines operations and client engagement. The global digital transformation market's projected $1.5 trillion valuation in 2024 highlights the widespread investment in these efficiency-boosting solutions.

| Technology Area | Impact on Dexterra | Market Trend/Data (2024-2025) |

|---|---|---|

| Automation & Smart Building Tech (IoT, AI) | Optimized energy use, predictive maintenance, increased operational efficiency. | Global smart building market projected >$100 billion by 2025. |

| Modular Construction | Faster, more affordable, and tailored building solutions. | Global modular construction market valued at ~$101.4 billion in 2023, expected CAGR of 6.7% (2024-2030). |

| Data Analytics & Predictive Maintenance | Proactive issue identification, optimized resource deployment, reduced downtime. | Pilot program in 2024 showed 15% reduction in emergency calls and 10% energy efficiency improvement. |

| Digital Transformation & Connectivity | Improved project management, streamlined supply chains, enhanced client interaction. | Global digital transformation market projected $1.5 trillion in 2024. |

Legal factors

Dexterra Group, a major employer, navigates a dense landscape of labor laws. These include stipulations on minimum wage, working hours, and crucial workplace safety standards. For instance, in Australia, where Dexterra has a significant presence, the Fair Work Act 2009 sets out many of these employment conditions.

Evolving labor legislation directly influences Dexterra's operational expenses and its approach to managing its extensive workforce. For example, recent discussions around increasing minimum wages in various Australian states could add to labor costs, requiring strategic adjustments in budgeting and resource allocation. Staying compliant is paramount to avoiding legal challenges and maintaining smooth operations.

The potential for unionization and collective bargaining agreements also shapes Dexterra's employee relations. Understanding and adhering to regulations surrounding these processes is vital for fostering a stable and productive working environment. This is particularly relevant given the diverse nature of Dexterra's service offerings, which often involve large teams operating across different sectors.

Dexterra operates under stringent health and safety legislation, a critical factor given its work in high-risk sectors like construction and industrial services. Compliance with occupational health and safety (OHS) regulations is non-negotiable, impacting everything from site management to employee training. For instance, in 2024, workplace safety incidents across the Australian construction industry saw a slight decrease, but the focus remains on proactive measures and continuous improvement to meet and exceed legal requirements and prevent costly penalties.

Dexterra's operations, particularly in waste management and site remediation, are heavily influenced by environmental regulations. For instance, in 2024, the Canadian government continued to implement stricter rules around landfill emissions and hazardous waste disposal, impacting how Dexterra manages its projects. Failure to comply with permits for water usage and waste handling could lead to significant penalties, potentially affecting their operational licenses and profitability.

The company must remain agile to adapt to evolving environmental legislation. For example, the increasing focus on carbon pricing mechanisms across various jurisdictions in 2024 and 2025 could directly influence Dexterra's energy consumption and transportation costs. Stricter waste mandates, such as those being considered for increased recycling rates, will necessitate adjustments in their waste management strategies and potentially increase operational expenditures.

Contract Law & Procurement Regulations

Dexterra's core business relies heavily on contracts, making contract law and procurement regulations critical. Navigating the complexities of service agreements, public tenders, and dispute resolution is paramount for successful operations. For instance, in Australia, the Commonwealth Procurement Rules (CPRs) and state-level equivalents govern how government entities procure goods and services, directly impacting Dexterra's ability to secure public sector contracts.

Changes in these legal frameworks can significantly influence Dexterra's business development and risk profile. For example, updates to tender evaluation criteria or new compliance requirements can alter competitive landscapes and increase administrative burdens. In 2023, government contract awards in Australia saw significant activity, with infrastructure and defense sectors being major areas of focus, highlighting the importance of understanding evolving procurement landscapes for companies like Dexterra.

- Contractual Compliance: Adherence to service level agreements (SLAs) and master service agreements (MSAs) is fundamental to maintaining client relationships and avoiding penalties.

- Procurement Process Navigation: Expertise in public tendering processes, including understanding evaluation criteria and submission requirements, is crucial for winning government contracts.

- Dispute Resolution: Knowledge of legal mechanisms for resolving contractual disputes ensures efficient and cost-effective outcomes.

- Regulatory Adaptation: Proactive monitoring and adaptation to changes in contract law and government procurement policies mitigate legal and financial risks.

Data Privacy & Protection Laws

Dexterra's operations, increasingly digital, necessitate strict adherence to data privacy and protection laws. For instance, in Canada, compliance with the Personal Information Protection and Electronic Documents Act (PIPEDA) and provincial equivalents is paramount. This involves careful management of how client and employee data is collected, stored, used, and secured. Failure to comply can lead to significant legal penalties and reputational damage.

The company must invest in robust data governance frameworks and advanced cybersecurity measures. These are not merely best practices but legal imperatives to safeguard sensitive information. For example, the Canadian government continues to update its privacy legislation, with ongoing discussions around potential enhancements to PIPEDA in 2024 and 2025, reflecting a global trend towards stronger data protection. Dexterra's proactive approach to these regulations is crucial for maintaining trust and avoiding litigation.

- PIPEDA Compliance: Ensuring all data handling practices align with Canada's federal privacy law.

- Provincial Data Laws: Adhering to specific data protection regulations in provinces where Dexterra operates.

- Data Governance Investment: Allocating resources for policies and procedures governing data lifecycle management.

- Cybersecurity Measures: Implementing and maintaining strong security protocols to protect against data breaches.

Dexterra must navigate a complex web of legal frameworks governing its operations, from labor and safety to environmental protection and data privacy. Staying abreast of evolving legislation, such as updates to Australia's Fair Work Act or Canada's PIPEDA, is crucial for compliance and risk mitigation. For instance, in 2024, Australian workplace safety regulations saw continued emphasis on proactive measures, impacting companies like Dexterra in high-risk sectors.

Contractual compliance and adept navigation of procurement processes, particularly in the public sector, are vital for securing and maintaining business. Changes in government procurement rules in 2023, for example, highlighted the need for Dexterra to remain agile. The company's commitment to data privacy laws, like PIPEDA, is also a legal imperative, requiring robust governance and cybersecurity investments to avoid penalties and maintain stakeholder trust.

Environmental factors

Increasing governmental and societal focus on climate change mitigation directly impacts Dexterra's operations. For instance, in Australia, the Albanese government has legislated a target of reducing greenhouse gas emissions by 43% below 2005 levels by 2030, with a net-zero target by 2050. This creates both challenges and opportunities for Dexterra in its service delivery.

Policies aimed at reducing greenhouse gas emissions, such as carbon pricing mechanisms or stricter energy efficiency standards for buildings, can influence operational costs and the demand for Dexterra's sustainable solutions. In 2023, the Australian government continued to refine its carbon market mechanisms, impacting energy-intensive industries that Dexterra serves.

Dexterra must proactively assess and manage its carbon footprint across its extensive facilities and diverse service offerings. This involves evaluating emissions from its fleet, energy consumption in its managed properties, and the lifecycle impact of materials used in its projects, aligning with the growing expectation for corporate environmental responsibility.

Stricter environmental regulations are increasingly shaping how companies like Dexterra manage waste. For instance, in 2024, the UK government continued to push for higher recycling rates, with targets aiming for 65% of municipal waste to be recycled by 2035. This directly impacts Dexterra's facilities management operations, requiring more robust waste reduction, recycling, and responsible disposal strategies for its clients.

Client demands for enhanced waste management are also on the rise, with many organizations prioritizing sustainability. This trend is evident in the growing number of corporate sustainability reports highlighting waste reduction initiatives. By adopting circular economy principles, such as using modular components designed for disassembly or incorporating recycled materials in its construction projects, Dexterra can bolster its environmental credentials and attract clients committed to eco-friendly practices.

Growing concerns over resource scarcity, especially for water and energy, are pushing companies like Dexterra to adopt more efficient operational methods in facilities management and modular construction. This trend directly fuels the demand for solutions that minimize consumption.

Dexterra is well-positioned to address this by offering services such as implementing energy-efficient building systems or water conservation strategies for its clients. For instance, the global water scarcity issue is projected to affect 5 billion people by 2050, highlighting the urgency for such solutions.

By providing these efficiency-focused services, Dexterra not only helps clients meet sustainability goals but also unlocks significant cost savings. This focus on resource efficiency can serve as a key differentiator, offering a competitive edge in the market.

Biodiversity & Land Use Impact

Dexterra’s operations, especially those involving land development for workforce accommodations or modular construction in remote regions, face significant environmental scrutiny regarding biodiversity and land use. The company must navigate stringent regulations designed to protect natural habitats and ecosystems.

Compliance with environmental impact assessments is paramount. For instance, in 2024, projects in Canada, where Dexterra operates, often require detailed studies on species at risk and their habitats before development can commence, influencing project timelines and costs.

Responsible land use planning is essential for Dexterra’s sustainable development initiatives. This includes minimizing habitat fragmentation and ensuring that construction activities do not negatively impact local biodiversity.

- Biodiversity Protection: Dexterra must adhere to regulations protecting endangered species and sensitive ecosystems, impacting site selection and construction methods.

- Environmental Impact Assessments (EIAs): Rigorous EIAs are mandatory for land development projects, often requiring extensive data collection on flora and fauna.

- Sustainable Land Management: The company's commitment to responsible land use planning directly influences its social license to operate and long-term environmental stewardship.

- Regulatory Compliance: Failure to comply with environmental legislation can result in significant fines and project delays, underscoring the financial implications of land use decisions.

ESG Reporting & Stakeholder Pressure

The demand for detailed ESG reporting is intensifying, impacting Dexterra's operational transparency and strategic choices. Investors, clients, and the broader public are pushing for greater accountability, making robust ESG disclosures a critical factor in business success. For instance, by the end of 2024, a significant majority of S&P 500 companies were expected to provide some form of ESG data, reflecting this growing trend.

Demonstrating strong environmental performance is now a key differentiator for attracting investment and securing new contracts. Dexterra's commitment to sustainability initiatives and transparent reporting on environmental metrics directly influences its access to capital and its competitive edge in the market. Companies with superior ESG ratings often experience lower costs of capital.

- Investor Scrutiny: Institutional investors are increasingly integrating ESG factors into their due diligence, with global sustainable investment assets projected to exceed $50 trillion by 2025, influencing capital allocation decisions.

- Client Demands: Major clients are incorporating ESG criteria into their procurement processes, requiring suppliers like Dexterra to demonstrate strong environmental and social governance.

- Public Perception: Public awareness of environmental issues is driving consumer and community expectations, pressuring companies to adopt and report on sustainable practices.

Growing governmental and societal focus on climate change is directly influencing Dexterra's operations and strategic direction. Australia's legislated target of reducing greenhouse gas emissions by 43% below 2005 levels by 2030, with a net-zero goal by 2050, presents both challenges and opportunities for the company's service delivery. Stricter environmental regulations, such as those pushing for higher recycling rates in the UK, are also reshaping waste management practices within Dexterra's facilities management contracts, necessitating more robust waste reduction and recycling strategies.

Concerns over resource scarcity, particularly water and energy, are driving demand for more efficient operational methods. Dexterra is positioned to meet this by offering services like energy-efficient building systems and water conservation strategies, addressing the global water scarcity issue projected to affect 5 billion people by 2050. Furthermore, environmental impact assessments are crucial for land development projects, with Canadian regulations in 2024 requiring detailed studies on species at risk, influencing project timelines and costs.

The increasing demand for ESG reporting impacts Dexterra's transparency and choices, with a significant majority of S&P 500 companies expected to provide ESG data by the end of 2024. Strong environmental performance is a key differentiator, with global sustainable investment assets projected to exceed $50 trillion by 2025, affecting capital allocation and client procurement processes. Companies with superior ESG ratings often benefit from lower costs of capital.

| Environmental Factor | Impact on Dexterra | Relevant Data/Target |

| Climate Change Mitigation | Operational adjustments, demand for sustainable solutions | Australia: 43% GHG reduction target by 2030 |

| Waste Management | Need for robust reduction, recycling, and disposal strategies | UK: Target of 65% municipal waste recycling by 2035 |

| Resource Scarcity | Increased demand for efficiency services (energy, water) | Global: 5 billion people affected by water scarcity by 2050 |

| Biodiversity & Land Use | Scrutiny on land development, compliance with EIAs | Canada (2024): EIA requirements for species at risk |

| ESG Reporting & Investor Scrutiny | Increased transparency, impact on capital access and client acquisition | Global Sustainable Investment: Projected >$50 trillion by 2025 |

PESTLE Analysis Data Sources

Our Dexterra PESTLE analysis is built on a robust foundation of data, drawing from official government publications, reputable economic forecasting agencies, and leading industry research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in credible, up-to-date information.