Dexterra Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexterra Bundle

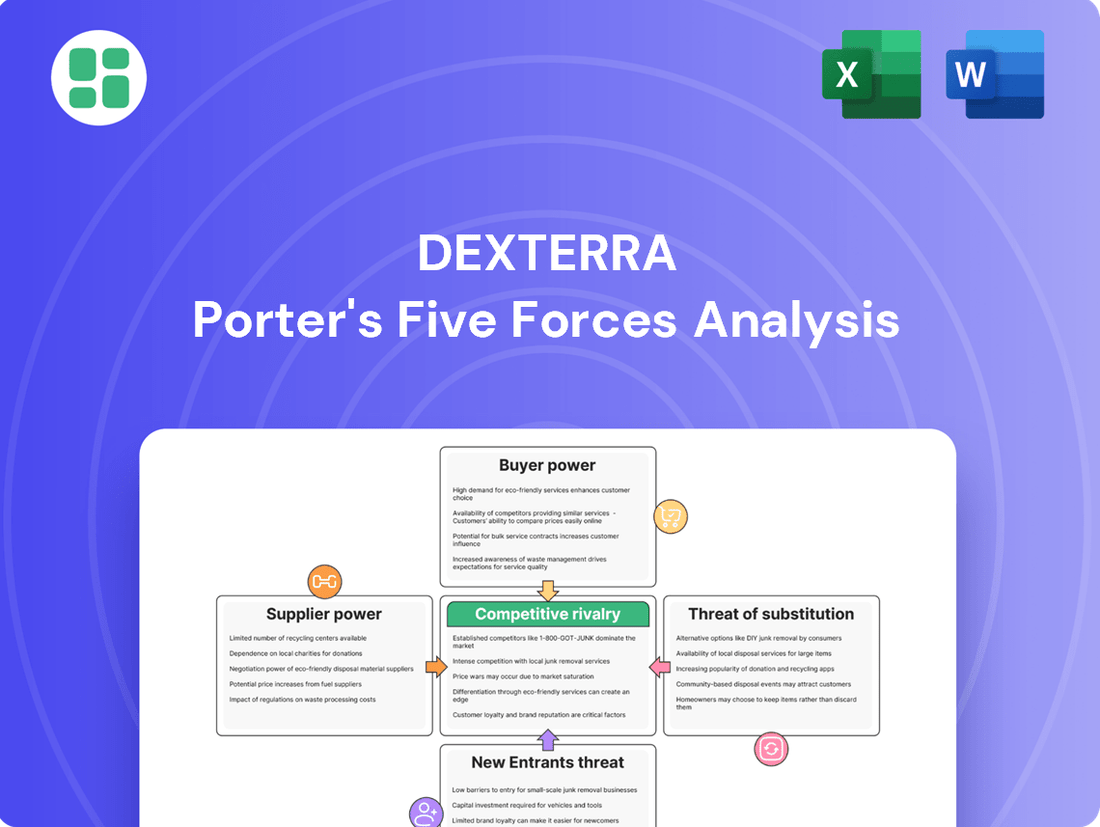

A Porter's Five Forces analysis for Dexterra reveals the intense competition within the facility management and integrated business services sector. Understanding the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry is crucial for navigating this landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dexterra’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Dexterra is significantly influenced by the concentration and uniqueness of its input sources. For specialized labor, such as skilled trades in facilities management or catering staff for remote accommodations, a limited pool of qualified individuals can give those suppliers leverage. Similarly, if Dexterra relies on a few providers for specific building materials used in its modular solutions or unique advanced technology systems, these suppliers gain considerable power.

In 2024, the ongoing demand for skilled trades in the construction and facilities management sectors, exacerbated by labor shortages in many regions, likely intensified supplier power for Dexterra's specialized labor needs. For instance, reports from industry bodies in late 2023 and early 2024 highlighted a persistent deficit in tradespeople, potentially leading to higher wage demands from labor providers. This situation underscores the importance of Dexterra's strategies to diversify its supplier base and cultivate enduring partnerships to counterbalance this supplier strength.

Dexterra faces potential supplier power due to the significant switching costs involved for its clients. These costs can include the expense and time required for retraining staff on new operational systems or reconfiguring established supply chains for essential construction materials. For instance, if a client needs to transition from Dexterra’s integrated facility management services to another provider, they might incur substantial costs in onboarding new personnel and integrating different technology platforms.

The threat of suppliers integrating forward into Dexterra's business operations, such as a major catering supplier moving into full camp management, could significantly shift the power dynamic. While this risk is typically lower in specialized service sectors, it remains a consideration, especially for suppliers of more commoditized goods or services used by Dexterra.

Importance of Dexterra to Suppliers

Dexterra's significance to its suppliers plays a crucial role in determining their bargaining power. If Dexterra constitutes a substantial portion of a supplier's annual revenue, that supplier's leverage is considerably weakened. They would likely be reluctant to jeopardize this key relationship by demanding unfavorable terms, fearing the loss of a major client.

Conversely, if Dexterra represents only a small fraction of a supplier's overall business, the supplier gains more power. In such scenarios, suppliers are less dependent on Dexterra and can more readily push for better pricing or contract conditions, knowing that losing Dexterra as a client would have minimal impact on their financial performance.

For instance, consider a supplier of specialized cleaning chemicals. If Dexterra accounts for 40% of their sales, the supplier has less power. However, if Dexterra is only 5% of their sales, the supplier can afford to be more assertive.

- Supplier Dependence: The extent to which a supplier relies on Dexterra for its revenue directly influences its bargaining power.

- Revenue Concentration: Suppliers with a high concentration of revenue from Dexterra are less likely to exert strong bargaining power.

- Client Size Impact: Dexterra's position as a large or small customer for its suppliers significantly shapes the negotiation dynamic.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences Dexterra's bargaining power with its suppliers. For instance, the rise of prefabricated components in modular construction can lessen the dependence on traditional on-site labor suppliers. However, Dexterra divested its modular solutions business in August 2024, potentially altering its exposure to this specific substitute.

In 2024, the construction industry continued to explore innovative materials and methods. The adoption rate of prefabrication and off-site construction, a key substitute for traditional labor-intensive methods, was projected to grow. For example, some market reports indicated a potential CAGR of over 6% for the global modular construction market leading up to 2025, suggesting increasing availability of such alternatives.

- Reduced Reliance: The availability of alternative inputs, like advanced building materials or digital construction technologies, can reduce Dexterra's dependence on specific traditional suppliers.

- Impact of Divestment: Dexterra's August 2024 sale of its modular solutions business means it may have less direct control or influence over the supply chain for modular components, a key substitute.

- Market Trends: The growing acceptance and innovation in areas like 3D printing in construction or advanced composite materials present future substitutes that could further shift supplier power dynamics.

Dexterra's suppliers hold considerable bargaining power when they are concentrated, possess unique or highly differentiated inputs, or face low switching costs for Dexterra's clients. In 2024, persistent labor shortages in skilled trades, a key input for facilities management, amplified this power, as evidenced by rising wage demands from labor providers. Furthermore, if Dexterra represents a small portion of a supplier's revenue, that supplier can exert greater pressure on terms, knowing their reliance on Dexterra is minimal.

| Factor | Impact on Dexterra's Supplier Bargaining Power | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | High concentration = High power | Limited number of providers for specialized catering or remote accommodation services. |

| Input Uniqueness/Differentiation | Unique inputs = High power | Proprietary technology systems or specialized building materials for construction projects. |

| Switching Costs for Clients | High switching costs = High power | Significant expenses for clients to retrain staff or reconfigure supply chains if changing providers. |

| Supplier Dependence on Dexterra | Low dependence = High power | Suppliers whose revenue from Dexterra is a small percentage of their total. |

| Availability of Substitutes | Few substitutes = High power | Limited alternative sources for essential materials or skilled labor. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Dexterra's operational environment.

Instantly visualize competitive intensity across all five forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Dexterra's customer concentration is a key factor in its bargaining power. The company serves a diverse range of clients, including major players in natural resources, government agencies, and healthcare networks. A significant portion of Dexterra's revenue often comes from a limited number of large contracts, meaning these clients can wield considerable influence over pricing and service delivery.

Dexterra's clients face varying degrees of difficulty when considering a switch to a competitor or bringing services in-house. For instance, clients utilizing Dexterra's integrated facility management systems, which are often deeply embedded within their operational workflows, would likely incur significant costs and disruptions to transition to a new provider. This integration acts as a substantial barrier, reducing the bargaining power of these customers.

Conversely, for clients with less integrated service agreements, the ease of switching can be considerably higher. If Dexterra's services are largely commoditized and easily replicable by competitors, or if contracts are short-term and lack significant customization, customers gain more leverage. This increased flexibility allows them to more readily explore alternative service providers, thereby amplifying their bargaining power.

Customer price sensitivity is a significant factor for Dexterra, especially in competitive bidding for large contracts. In 2024, the Canadian facility management market remains highly competitive, with numerous players vying for market share. This environment often compels companies like Dexterra to compete aggressively on cost to secure business, directly impacting profit margins.

Threat of Backward Integration by Customers

Customers, particularly large organizations, possess the potential to bring services in-house, thereby reducing their reliance on Dexterra. This threat of backward integration is amplified when clients have the financial and operational capacity to develop their own facilities management teams or manage workforce accommodations internally, especially for less specialized functions.

The in-house model remains a significant force within the Canadian facility management sector, indicating that clients are already accustomed to and capable of managing these services themselves. For instance, many large corporations in Canada maintain substantial internal departments for property maintenance and operational support, controlling a notable share of the market.

- Significant Client Resources: Large enterprises often have the capital and expertise to establish internal capabilities, bypassing external providers like Dexterra for core services.

- Control over Operations: Bringing services in-house allows clients greater direct control over quality, costs, and operational flexibility.

- Market Share of In-House Models: The established presence of in-house facilities management in Canada highlights client feasibility and willingness to self-manage these functions.

Information Availability and Transparency

Customers today have unprecedented access to information regarding service offerings, pricing, and competitor performance. This heightened transparency, fueled by online reviews and comparison platforms, significantly boosts their bargaining power. For instance, by easily comparing Dexterra's service packages and pricing against competitors, clients can identify discrepancies and negotiate more favorable terms.

The increased availability of market data allows customers to understand industry benchmarks and the value proposition of different providers more clearly. This knowledge empowers them to demand better quality, more competitive pricing, or customized solutions, directly impacting Dexterra's ability to dictate terms.

Dexterra's robust financial standing, evidenced by its consistent revenue growth, and its strategic acquisitions, such as the acquisition of Programmed in 2023 for approximately AUD 150 million, can paradoxically strengthen its position. While customers gain more information, Dexterra's scale and financial health can allow it to absorb some of these demands or leverage its market presence to maintain its pricing structure.

- Information Accessibility: Customers can readily access detailed service comparisons and pricing structures online.

- Negotiation Leverage: Greater transparency empowers customers to negotiate more effectively on price and service terms.

- Competitive Benchmarking: Customers can easily benchmark Dexterra's offerings against industry peers.

- Dexterra's Counterbalance: Strong financial performance and strategic growth can help Dexterra mitigate some customer bargaining power.

Dexterra's customers, particularly those with integrated service needs, face high switching costs, limiting their bargaining power. However, for commoditized services or shorter contracts, customers can more easily switch providers, increasing their leverage. The threat of clients bringing services in-house also remains a factor, especially given the prevalence of such models in Canada.

In 2024, the Canadian facility management market's competitiveness means customers are highly price-sensitive, pushing Dexterra to offer competitive pricing. Enhanced information accessibility allows clients to benchmark services and negotiate better terms, though Dexterra's financial strength and strategic acquisitions can help it manage this pressure.

| Factor | Customer Bargaining Power Impact | Dexterra's Position |

|---|---|---|

| Switching Costs (Integrated Services) | Low | Strong |

| Switching Costs (Commoditized Services) | High | Weak |

| Threat of In-House Services | Moderate to High | Moderate |

| Price Sensitivity (2024 Canadian Market) | High | Challenged |

| Information Accessibility | High | Mitigated by Scale |

What You See Is What You Get

Dexterra Porter's Five Forces Analysis

This preview displays the complete Dexterra Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file. This means you'll receive the same in-depth strategic insights without any placeholders or sample content, ready for immediate use.

Rivalry Among Competitors

Dexterra operates in a competitive landscape characterized by a substantial number of active players. These competitors range from large, diversified corporations with broad service offerings to smaller, specialized regional firms focusing on niche segments within integrated support services, facilities management, and workforce accommodations.

In Canada and the U.S. markets, the sheer volume of competitors means that no single entity, including Dexterra, holds a dominant market share. This fragmentation is a key feature of the industry, with many companies vying for contracts across various sectors.

The relative size of these competitors varies significantly. While some global giants may have greater financial resources and a wider geographic reach, many successful regional players possess deep local market knowledge and strong client relationships, posing a consistent challenge to larger entities like Dexterra.

The markets Dexterra operates within are experiencing robust growth. For instance, the Canadian facility management sector is anticipated to expand significantly, with the outsourced services segment projected to achieve a strong compound annual growth rate (CAGR) between 2025 and 2030. This upward trend suggests an expanding market, creating opportunities but also intensifying competition as more players vie for a larger share of this growing pie.

Dexterra's ability to differentiate its integrated services hinges on its focus on client productivity and efficiency. By offering tailored solutions that genuinely improve how clients operate, Dexterra can stand out from competitors who may offer more commoditized services. This strategic emphasis on value-added outcomes, rather than just service delivery, can significantly lessen the pressure of price-based competition.

In 2024, the market for integrated facility management services, where Dexterra operates, saw continued demand for specialized expertise. Companies are increasingly looking for partners who can demonstrate tangible improvements in operational costs and output. Dexterra's commitment to innovation in service delivery, evidenced by its investment in technology to enhance service monitoring and reporting, directly addresses this need, allowing for premium pricing and stronger client loyalty.

Exit Barriers

Dexterra faces significant exit barriers in the facility management and integrated asset management sectors. High asset specificity, where specialized equipment and infrastructure are required, makes it difficult and costly for competitors to redeploy or sell assets if they decide to leave the market. This can trap capital and prolong competition, even when market conditions are unfavorable.

Long-term contracts are another major factor. Many facility management agreements, especially those with government entities or large corporations, span multiple years. Exiting these contracts prematurely often incurs substantial penalties, effectively locking competitors into ongoing operations and discouraging departure.

Dexterra's strategic acquisition of Pleasant Valley Corporation in 2024, aimed at bolstering its U.S. facility management capabilities, further illustrates the industry's consolidation trend, which can increase exit barriers for smaller, less integrated players. The capital investment required to maintain and upgrade specialized fleets and technology also acts as a deterrent to exiting.

- High Asset Specificity: Specialized machinery and infrastructure are costly to divest.

- Long-Term Contracts: Significant penalties for early termination lock companies in.

- Capital Investment: Ongoing costs for fleet and technology upgrades deter exits.

- Industry Consolidation: Acquisitions like Dexterra's Pleasant Valley deal can raise the bar for smaller competitors.

Cost Structure and Fixed Costs

Industries with a significant proportion of fixed costs, such as those requiring substantial upfront investment in equipment or infrastructure, often see heightened competitive rivalry. Companies in these sectors may engage in aggressive price competition to ensure their fixed overheads are covered, particularly when demand softens. This dynamic can lead to lower profit margins across the board.

Dexterra's strategic focus on a capital-light, scalable model suggests a conscious effort to mitigate the impact of high fixed costs. This approach aims to reduce the burden of fixed overheads, potentially allowing for greater flexibility in pricing and a stronger competitive position, especially compared to rivals with more asset-intensive operations.

- High Fixed Costs Drive Price Wars: Sectors with substantial fixed costs, like infrastructure maintenance or specialized equipment, often experience intense price competition as firms attempt to cover their overheads, as seen in many construction and facility management segments.

- Dexterra's Capital-Light Strategy: Dexterra aims for a business model that minimizes fixed asset ownership, focusing instead on operational efficiency and service delivery, which can lead to a lower fixed cost base compared to traditional asset-heavy competitors.

- Impact on Profitability: A lower proportion of fixed costs can provide Dexterra with more pricing flexibility and potentially higher margins, especially during economic downturns when competitors with high fixed costs are forced to cut prices to remain operational.

Competitive rivalry within Dexterra's operating environment is intense due to a large number of competitors, ranging from global corporations to specialized regional firms. The Canadian facility management market, for instance, is projected for significant growth, with the outsourced services segment expected to see a strong CAGR between 2025 and 2030, fueling further competition as more players vie for market share.

Dexterra differentiates itself by focusing on client productivity and efficiency through tailored, value-added solutions, moving beyond commoditized service offerings. This strategy aims to reduce price-based competition, especially as companies in 2024 increasingly seek tangible operational cost improvements, a need Dexterra addresses through technological investments in service monitoring.

High fixed costs in sectors like infrastructure maintenance can lead to aggressive price competition to cover overheads. Dexterra's capital-light, scalable model aims to mitigate this by minimizing fixed asset ownership, potentially offering greater pricing flexibility and stronger margins compared to asset-heavy rivals.

| Metric | 2024 Data/Projection | Impact on Rivalry |

|---|---|---|

| Number of Competitors | Substantial, fragmented market | High rivalry, price sensitivity |

| Canadian Facility Management Market Growth (2025-2030 CAGR) | Strong projected growth | Increased competition for market share |

| Dexterra's Differentiation Strategy | Focus on client productivity/efficiency | Mitigates direct price competition |

| Fixed Cost Intensity | Varies by service segment | Can drive price wars in asset-heavy areas |

SSubstitutes Threaten

The threat of substitutes for Dexterra's services hinges on the price-performance trade-off. For facilities management, clients might consider bringing services in-house if they perceive cost savings or better control, though this often sacrifices specialized expertise and efficiency. Similarly, for workforce accommodations, traditional hotels or private rentals are substitutes, but they typically lack the integrated, tailored solutions Dexterra offers for remote sites.

Outsourcing these functions is increasingly favored by businesses seeking to leverage specialized skills, reduce operational complexity, and mitigate risks associated with managing non-core activities. This trend is supported by market data showing a growing demand for integrated facility management solutions, with the global market projected to reach over $2 trillion by 2028, indicating a strong preference for external expertise over in-house execution.

Customers might switch to alternatives if they perceive a lower cost or better performance. For instance, if a competitor offers a facility management solution that is 15% cheaper and demonstrates comparable service quality, Dexterra could see a shift in demand. Brand loyalty plays a role, but strong price incentives or demonstrably superior features in substitutes can overcome this.

The perceived risk of switching is also a factor. If customers believe changing providers will disrupt operations or introduce unforeseen problems, they are less likely to switch. However, readily available information and positive reviews of alternative providers can mitigate this perceived risk, making substitution more appealing.

The growing focus on sustainability in the facility management sector, particularly in 2024, is a significant driver for substitutes. Companies are increasingly seeking providers with strong environmental, social, and governance (ESG) credentials. This trend could empower specialized, green-focused facility management firms to attract Dexterra's clients if they can offer demonstrably more sustainable solutions.

Clients might consider developing their own in-house capabilities for services like cleaning, maintenance, or catering, rather than outsourcing to Dexterra. This threat is particularly relevant for clients with the necessary resources and scale to manage these functions internally.

While the outsourced facility management market is expanding, with global revenues projected to reach over $1.5 trillion by 2027 according to some industry forecasts, the in-house model still holds a significant share. For instance, many large corporations maintain dedicated internal teams for critical operational services, reducing their reliance on external providers like Dexterra.

Technological Advancements Enabling Substitutes

Technological advancements are a significant threat to Dexterra, as they can empower clients to manage their facility needs more independently or through alternative service models. For instance, the rise of smart building systems, the Internet of Things (IoT), and AI-driven facility management software allows for greater automation and predictive maintenance, potentially reducing the reliance on traditional outsourced services.

These technologies can enable clients to gain more control over their operational efficiency and service quality. In 2023, the global smart building market was valued at approximately $80 billion, with projections indicating substantial growth. This indicates a strong trend towards integrated technological solutions that could bypass established service providers.

The increasing sophistication of these platforms means that clients might opt for in-house management or engage specialized, technology-focused providers. This shift could fragment the market and present Dexterra with new competitors who leverage technology as their primary differentiator.

- Smart Building Systems: Offer integrated control over HVAC, lighting, and security, allowing for self-management.

- IoT in Facilities: Enables real-time data collection for predictive maintenance, reducing the need for reactive service calls.

- AI-Driven Software: Optimizes resource allocation and operational workflows, potentially lowering costs for clients.

- Client Independence: Technological empowerment can lead clients to internalize functions previously outsourced to companies like Dexterra.

Regulatory or Policy Changes

Regulatory and policy shifts can significantly impact the threat of substitutes for companies like Dexterra, particularly in sectors like facility management and workforce accommodation. For instance, evolving labor laws could make employing staff directly more appealing than outsourcing certain functions, thereby creating a substitute for Dexterra's service offerings. In 2024, there's a growing trend of governments exploring policies to enhance worker protections and potentially increase the cost of contingent labor, which could indirectly favor in-house solutions.

Furthermore, government incentives or mandates related to specific types of housing or accommodation can divert demand from traditional workforce camps. This means that if policies favor smaller, decentralized living arrangements or specific sustainable building practices, these could emerge as viable substitutes for Dexterra's large-scale camp management services. Environmental, Social, and Governance (ESG) regulations are also becoming a critical factor in vendor selection, with many clients prioritizing suppliers who demonstrate strong sustainability credentials, potentially favoring substitutes that inherently align better with these evolving criteria.

- Labor Law Evolution: Changes in employment regulations could increase the attractiveness of direct hiring over outsourced services, impacting Dexterra's market position.

- Accommodation Policy Shifts: Government incentives for alternative housing models might reduce demand for traditional workforce camps.

- ESG Mandates: Increasing emphasis on ESG compliance in procurement processes can favor substitute providers with stronger sustainability profiles.

The threat of substitutes for Dexterra is moderate, primarily driven by clients considering in-house operations or alternative service providers. For instance, in 2024, many companies are re-evaluating their outsourcing strategies, with some bringing essential services back in-house to gain greater control or achieve perceived cost savings, despite potential trade-offs in specialized expertise. However, the complexity and scale of services Dexterra offers, particularly in remote workforce accommodation and integrated facility management, often make direct substitution challenging without significant investment and operational changes.

Technological advancements, such as smart building systems and AI-driven facility management software, are emerging as potential substitutes. These technologies can empower clients to manage their facilities more autonomously, potentially reducing reliance on traditional outsourced providers. The global smart building market, valued at approximately $80 billion in 2023, is expected to grow significantly, indicating a trend toward integrated technological solutions that could bypass established service providers.

Regulatory shifts, particularly concerning labor laws and ESG mandates, also influence the threat of substitutes. Evolving worker protection policies in 2024 might make direct employment more attractive for certain functions, creating an indirect substitute for outsourced services. Furthermore, government incentives for alternative housing models could impact demand for large-scale workforce camps, favoring more decentralized or specialized accommodation solutions.

| Service Area | Potential Substitutes | Key Differentiating Factors for Dexterra | Threat Level |

|---|---|---|---|

| Facilities Management | In-house management, specialized cleaning/maintenance firms | Integrated solutions, economies of scale, specialized expertise | Moderate |

| Workforce Accommodations | Traditional hotels, private rentals, smaller decentralized housing | On-site integrated services, remote site expertise, custom solutions | Moderate |

| Technology Integration | Client-owned smart building systems, AI-driven software | Managed service approach, operational efficiency gains | Emerging |

Entrants Threaten

Entering Dexterra's core markets, such as integrated support services, facilities management, and workforce accommodations, demands substantial financial investment. Companies need significant capital for essential infrastructure, specialized equipment, and building robust operational capabilities from the ground up. This high initial outlay serves as a considerable barrier to entry for potential new competitors.

For instance, Dexterra's strategic acquisitions in recent years underscore the scale of financial commitment involved in expanding market presence and operational capacity. These moves, often involving multi-million dollar transactions, highlight the capital-intensive nature of consolidating and growing within these sectors, making it challenging for smaller or less capitalized entities to compete effectively.

Dexterra benefits significantly from economies of scale and scope. Its large operational footprint and diversified service portfolio, spanning facility management, integrated resource management, and workforce solutions, allow it to spread fixed costs across a broader revenue base. This inherently provides cost advantages over smaller, more specialized competitors. For instance, in 2023, Dexterra reported total revenue of $1.1 billion, demonstrating its substantial market presence.

New entrants would find it challenging to match Dexterra's cost efficiencies. Achieving comparable economies of scale requires substantial upfront investment in infrastructure, technology, and personnel, which can be a significant barrier. Furthermore, Dexterra's capital-light, scalable model for support services enables it to adapt quickly and efficiently to market demands without massive capital outlays, a flexibility that new, less established players often lack.

New companies entering Dexterra's market face significant hurdles in securing essential distribution channels and building trust with clients. Established players like Dexterra have cultivated long-standing relationships, making it difficult for newcomers to gain access, particularly with large corporate or government contracts. This is evident as Dexterra reported a strong pipeline of new sales opportunities, indicating the ongoing reliance on its existing client base and established procurement routes.

Government Policy and Regulation

Government policy and regulation significantly influence the threat of new entrants. Stricter energy-performance mandates and evolving ESG reporting requirements, for instance, can reshape industry spending and create opportunities for agile new players possessing specialized compliance knowledge.

Regulatory hurdles and licensing requirements can act as substantial barriers. For example, in the construction and infrastructure services sector, where Dexterra operates, obtaining the necessary certifications and permits can be a lengthy and costly process. In 2024, the Australian government continued to emphasize net-zero emissions targets, which translates to more stringent building codes and environmental impact assessments, potentially favoring firms adept at navigating these regulations.

- Increased Compliance Costs: New entrants may face higher initial costs to meet evolving regulatory standards, such as those related to sustainability and safety.

- Licensing and Permitting: Obtaining the necessary licenses and permits can be a significant barrier, especially in highly regulated industries like utilities or defense contracting.

- Government Incentives: Conversely, government incentives for innovation or specific technologies can lower barriers and encourage new entrants with relevant expertise.

- Policy Uncertainty: Fluctuations in government policy can create uncertainty, deterring potential new entrants who prefer stable operating environments.

Brand Loyalty and Differentiation

Dexterra has cultivated significant brand loyalty through its consistent delivery of reliable and safe integrated solutions. This reputation, built over years of operation, makes it challenging for new entrants to quickly establish a comparable level of trust with clients. The company's emphasis on best-in-class client solutions further solidifies its market position, creating a substantial hurdle for potential competitors seeking to gain market share.

The difficulty for new entrants is amplified by Dexterra's established track record and the inherent switching costs for clients who rely on their specialized services. Building a brand synonymous with quality and dependability in the integrated facility management sector requires substantial time and investment, resources that nascent companies may struggle to muster against an incumbent like Dexterra.

- Brand Strength: Dexterra's established reputation for reliability and safety acts as a significant barrier.

- Differentiation: The company's focus on integrated and best-in-class client solutions is difficult to replicate.

- Switching Costs: Clients often face considerable costs or disruption when switching providers for essential services.

- Market Entry Barrier: The combination of brand loyalty and service differentiation makes it hard for new companies to compete effectively.

The threat of new entrants into Dexterra's markets is generally moderate to low, primarily due to significant capital requirements and established brand loyalty. New companies would need substantial financial backing to compete with Dexterra's scale and operational capabilities. For example, Dexterra's 2023 revenue of $1.1 billion highlights its market dominance, making it difficult for smaller players to achieve similar economies of scale.

Regulatory environments and the need for specialized licenses also pose considerable barriers, particularly with evolving standards like those for net-zero emissions, which were a continued focus for the Australian government in 2024. Furthermore, Dexterra's strong client relationships and the associated switching costs create a formidable challenge for newcomers seeking to establish a foothold and build trust in sectors like integrated facility management.

| Barrier Type | Description | Impact on New Entrants | Dexterra's Advantage | Example Data/Context |

|---|---|---|---|---|

| Capital Requirements | High initial investment for infrastructure and equipment. | Significant hurdle for less capitalized firms. | Leverages economies of scale and scope. | 2023 Revenue: $1.1 billion |

| Brand Loyalty & Switching Costs | Established trust and client relationships. | Difficult to gain market access and displace incumbents. | Strong reputation for reliability and safety. | Strong pipeline of new sales opportunities (2024). |

| Regulatory & Licensing | Complex permits and compliance with evolving standards. | Time-consuming and costly to navigate. | Expertise in navigating industry-specific regulations. | Australian net-zero targets influencing building codes (2024). |

Porter's Five Forces Analysis Data Sources

Our Dexterra Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research reports to capture competitive dynamics.