Dexterra Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dexterra Bundle

Unlock the strategic potential of Dexterra's product portfolio with our comprehensive BCG Matrix. Understand precisely where each offering fits—whether it's a high-growth Star, a stable Cash Cow, a resource-draining Dog, or a promising Question Mark. Purchase the full report to gain actionable insights and a clear roadmap for optimizing your investments and driving future success.

Stars

Dexterra's strategic investment in Pleasant Valley Corporation (PVC) for US$58.3 million, with an option to acquire the remaining 60%, positions its Integrated Facilities Management (IFM) services in the U.S. healthcare and commercial sector as a potential Star. This move, effective July 31, 2025, aims to significantly expand Dexterra's service capabilities and geographic reach across North America, reflecting high growth prospects.

PVC's established annual revenues of approximately US$175 million and its client base, which includes Fortune 500 companies in commercial and industrial segments, immediately enhance Dexterra's market share in a rapidly expanding industry. This acquisition is a clear indicator of Dexterra's aggressive strategy to capture a larger portion of the U.S. facility management market, which is experiencing robust demand.

Dexterra's Support Services segment is demonstrating strong performance, with Q1 2025 profit margins reaching 9.5%, a notable jump from 8.2% in Q1 2024. This growth is directly linked to an increased volume of high-margin project work within their service offerings.

The strategic focus on these lucrative project engagements is a key driver for Dexterra, indicating a successful shift towards more value-added services. This positions the Support Services segment as a potential cash cow within the company's broader portfolio.

Dexterra's Workforce Accommodations, Forestry and Energy Services (WAFES) segment, with its specialized camp operations, is a star performer within its BCG Matrix. This segment is a significant revenue generator, bringing in approximately $500 million annually.

The strength of WAFES is further bolstered by its diversification, with 10-20% of its revenue stemming from the mining sector and the rest from infrastructure projects. This balanced approach provides stability, further enhanced by consistently high camp occupancy rates, often exceeding 90% in peak periods.

The robust demand for large-scale mining and infrastructure projects, a trend expected to continue through 2024 and beyond, solidifies WAFES's position. These specialized accommodation solutions are therefore classified as a high-growth, high-market share offering, indicating strong future potential.

Growth in Post-Secondary Education Facilities Management

Dexterra's Integrated Facilities Management (IFM) segment has experienced robust growth, with significant revenue and EBITDA increases attributed to securing new contracts within the post-secondary education sector. This performance highlights the company's effective strategy in capturing market share within this specific client segment.

The company's emphasis on acquiring new business in post-secondary education points to a deliberate and strategic allocation of resources towards a market demonstrating considerable potential. This focus is a key driver of Dexterra's overall IFM expansion.

- IFM Revenue Growth: Dexterra reported a substantial increase in IFM revenue in 2024, largely fueled by new agreements with educational institutions.

- EBITDA Performance: The company's EBITDA within the IFM division also saw a healthy uplift, reflecting improved operational efficiency and profitability from these new contracts.

- Market Penetration: The success in the post-secondary education market signifies strong penetration and a growing presence in serving universities and colleges.

- Strategic Focus: New contract wins in this sector underscore a strategic commitment to capitalize on the expanding needs of educational facilities management.

Technology Integration in Facilities Management (e.g., Smart Building Tech)

Dexterra is actively integrating advanced technologies like data analytics, AI, and IoT devices into its facilities management operations. This strategic move is designed to boost efficiency and provide a distinct competitive edge in the market. By leveraging these innovations, Dexterra aims to capture a larger market share by offering superior, tech-driven solutions.

The company's commitment to innovation positions its technology-enabled facilities management offerings as a potential Star within the BCG matrix. This is driven by the expectation that these advanced solutions will attract more clients and increase revenue in a growing market segment. For example, smart building technology adoption in commercial real estate is projected to grow significantly, with the global smart building market expected to reach USD 100.7 billion by 2027, indicating a strong demand for such integrated services.

- Data Analytics: Enabling predictive maintenance and optimizing resource allocation.

- AI Integration: Enhancing building performance and tenant experience through intelligent automation.

- IoT Devices: Facilitating real-time monitoring and control of building systems, such as HVAC and lighting.

- Mobile Cloud Solutions: Streamlining work order management and technician dispatch for improved service delivery.

Dexterra's Workforce Accommodations, Forestry and Energy Services (WAFES) segment is a prime example of a Star in the BCG Matrix. It generates substantial revenue, around $500 million annually, and benefits from high market share due to its specialized camp operations. The segment's diversification across mining and infrastructure projects, coupled with consistently high occupancy rates exceeding 90%, ensures its strong performance.

The robust demand for large-scale mining and infrastructure projects, a trend expected to continue through 2024 and beyond, solidifies WAFES's position as a high-growth, high-market share offering. This segment is a significant revenue generator, indicating strong future potential and continued growth.

Dexterra's strategic investment in Pleasant Valley Corporation (PVC) for US$58.3 million, with an option to acquire the remaining 60%, positions its Integrated Facilities Management (IFM) services in the U.S. healthcare and commercial sector as a potential Star. This move, effective July 31, 2025, aims to significantly expand Dexterra's service capabilities and geographic reach across North America, reflecting high growth prospects.

PVC's established annual revenues of approximately US$175 million and its client base, which includes Fortune 500 companies in commercial and industrial segments, immediately enhance Dexterra's market share in a rapidly expanding industry. This acquisition is a clear indicator of Dexterra's aggressive strategy to capture a larger portion of the U.S. facility management market, which is experiencing robust demand.

| Segment | Market Growth | Market Share | Description |

|---|---|---|---|

| WAFES | High | High | Specialized camp operations for mining and infrastructure; strong revenue ($500M annually), high occupancy (>90%). |

| IFM (U.S. Healthcare/Commercial via PVC) | High | High (projected) | Strategic acquisition of PVC for US$58.3M; aims to expand North American reach; PVC has US$175M revenue. |

| Technology-Enabled IFM | High | High (projected) | Integration of data analytics, AI, IoT; aims to boost efficiency and market share in a growing market. |

What is included in the product

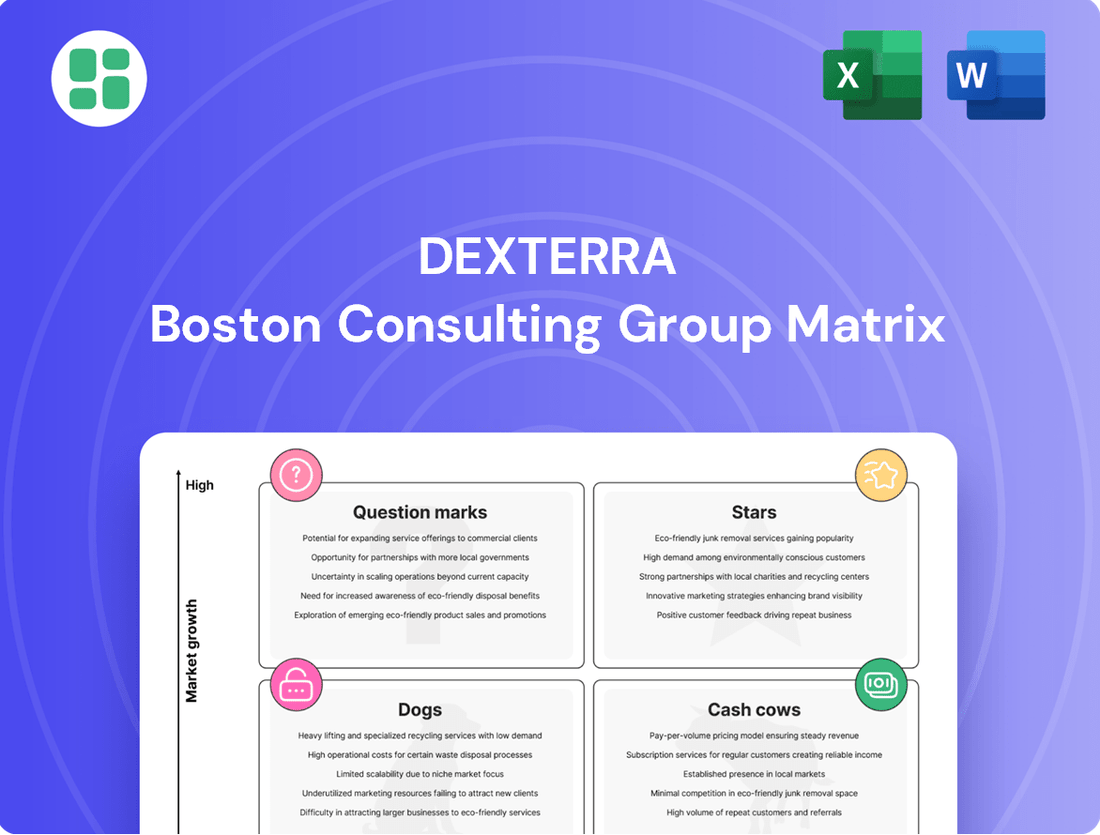

This analysis categorizes Dexterra's business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear BCG Matrix visually clarifies where each Dexterra business unit stands, alleviating the pain of strategic uncertainty.

Cash Cows

Dexterra's core Integrated Facilities Management (IFM) operations in Canada, distinct from its recent U.S. ventures, are a prime example of a cash cow. This segment boasts a significant market share within Canada, underpinned by a robust base of long-term contracts with both public and private sector clients.

These established IFM services generate consistent, predictable revenue streams, a hallmark of a mature business. The emphasis for this division is on optimizing operational efficiency and maintaining strong profitability, rather than pursuing aggressive expansion, fitting the classic cash cow profile within the BCG matrix.

Dexterra's workforce accommodations in the established oil and gas sector are a prime example of a cash cow. This segment consistently generates substantial revenue due to long-standing contracts and the ongoing operational needs of mature oil and gas projects.

The reliability of this revenue stream is further underscored by the segment's strong profitability, as indicated by its impressive Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margins. For instance, Dexterra reported an Adjusted EBITDA margin of 20.1% for its Integrated Services segment in Q1 2024, a significant portion of which is driven by these established oil and gas operations.

Dexterra's Asset Based Services (ABS) segment, especially with its stable camp asset utilization, firmly fits the cash cow quadrant of the BCG matrix. This means it generates more cash than it needs to operate and grow, providing a reliable income stream.

While the ABS segment might see some ups and downs in revenue due to seasonality, its Adjusted EBITDA margins remain robust, showcasing excellent profitability. For instance, in the first half of 2024, Dexterra reported that its ABS segment continued to be a significant contributor to overall financial performance, with margins demonstrating the efficiency of their asset deployment.

This consistent cash generation from ABS is crucial. It acts as a financial engine, enabling Dexterra to invest in or support other business units that may be in different stages of the BCG matrix, such as question marks or stars, allowing for strategic resource allocation across the company.

Long-Term Government Contracts for Support Services

Dexterra's long-term government contracts for support services are positioned as cash cows within the BCG matrix. These agreements, often spanning multiple years, offer a consistent and reliable revenue source, benefiting from the essential nature of the services provided. For instance, in 2024, government spending on infrastructure and facility management services, areas Dexterra operates in, remained robust, underscoring the stability of these contracts. The company's strategy here centers on optimizing operational efficiency and ensuring contract renewals to maintain profitability, rather than pursuing rapid growth.

- Predictable Revenue: Long-term government contracts provide a stable and predictable income stream, crucial for cash cow status.

- Stable Demand: The essential nature of support services ensures consistent demand, minimizing market volatility risks.

- Operational Efficiency Focus: Success relies on cost-effective service delivery and maintaining strong client relationships for contract longevity.

- Low Growth, High Share: These segments typically exhibit low market growth but represent a significant market share for Dexterra, generating substantial cash flow.

Routine Operations and Maintenance Services

Dexterra's Routine Operations and Maintenance Services for built assets and infrastructure, a core component of their Support Services, are positioned as a significant cash cow. These offerings provide a consistent and dependable revenue stream, benefiting from established client relationships and mature operational efficiencies.

These services are characterized by their essential nature to clients, ensuring the ongoing functionality of critical assets. This indispensability translates into a stable demand, even in slower economic periods. For instance, in 2024, Dexterra's extensive portfolio of long-term contracts across various sectors, including government and commercial, underscores the predictable revenue generated by these maintenance activities.

- Stable Revenue Generation: Routine operations and maintenance services contribute a predictable and consistent income, crucial for funding other business segments.

- Low Growth, High Profitability: While not experiencing rapid expansion, these mature services typically boast healthy profit margins due to optimized processes and established infrastructure.

- Client Retention: The essential nature of these services fosters strong client loyalty and long-term partnerships, minimizing customer acquisition costs.

- Operational Efficiency: Years of experience have refined operational workflows, leading to cost-effective service delivery and reliable performance metrics.

Dexterra's established Integrated Facilities Management (IFM) operations in Canada, particularly those with long-term government contracts, are classic cash cows. These segments benefit from stable demand and high market share, generating consistent revenue with a focus on operational efficiency rather than aggressive expansion.

Similarly, workforce accommodations for the mature oil and gas sector and the Asset Based Services (ABS) segment, especially camp utilization, act as significant cash cows. These areas demonstrate strong profitability, as evidenced by robust Adjusted EBITDA margins, such as the 20.1% reported for Integrated Services in Q1 2024, providing crucial financial support for other business units.

| Segment | BCG Classification | Key Characteristics | Financial Indicator (Example) |

|---|---|---|---|

| Canadian IFM (Govt. Contracts) | Cash Cow | Stable demand, high market share, predictable revenue | Consistent revenue generation |

| Workforce Accommodations (Oil & Gas) | Cash Cow | Long-term contracts, ongoing operational needs, high profitability | Strong Adjusted EBITDA margins |

| Asset Based Services (Camp Utilization) | Cash Cow | Stable asset utilization, reliable income stream, robust margins | Profitable operations |

What You’re Viewing Is Included

Dexterra BCG Matrix

The Dexterra BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report, designed for strategic clarity, will be immediately available for your use without any alterations or demo content. You can confidently expect the full, professionally formatted BCG Matrix analysis to be delivered directly to you, ready for immediate application in your business planning and decision-making processes.

Dogs

Dexterra's former Modular Solutions Business was clearly a Dog in the BCG Matrix. This segment was explicitly identified as underperforming, with the company reporting an Adjusted EBITDA loss of $6.1 million in 2023, primarily driven by rework and remediation expenses.

The finalization of its sale on August 30, 2024, confirms its status as a low-growth, low-market share segment. Dexterra divested this business to enhance overall profitability and sharpen its focus on its core service offerings, demonstrating a strategic move to shed underperforming assets.

Access matting services, a component of Asset Based Services, saw a revenue decrease in the first quarter of 2025. This dip was primarily attributed to adverse cold weather conditions that significantly reduced demand for these services.

While this seasonal fluctuation is expected, a continuous and heavy dependence on weather-sensitive services, especially those with prolonged low-demand periods, poses a risk. Such a scenario could lead to its classification as a Dog within the BCG matrix if capital remains tied up in assets yielding inconsistent returns without strategic mitigation.

Legacy contracts with low profit margins at Dexterra represent a significant concern. These agreements, often established years ago, may not have kept pace with inflation or incorporated operational improvements, resulting in consistently thin profit margins. For instance, if a contract signed in 2019 for $100,000 had a 5% profit margin ($5,000), and costs have risen by 15% by 2024, the same $100,000 revenue might now yield a profit closer to $0, or even a loss, depending on cost structures.

Underperforming Regional Service Units

Underperforming Regional Service Units within Dexterra might represent the Dogs in the BCG Matrix. These are operational branches that consistently miss their profitability goals and struggle to capture substantial local market share, even when situated within broader, more successful company segments. They can become a drain on company resources, consuming overhead and management focus without yielding proportionate returns to the overall enterprise.

For instance, consider a hypothetical regional unit in the Canadian prairies that, in 2024, reported a negative EBITDA margin of -5% compared to the company average of 12%. Despite efforts, its market share in its specific service area remained stagnant at 3%, far below the national average of 15% for similar units. This unit's revenue growth was also a mere 1% year-over-year, significantly lagging behind the company's overall growth of 8%.

- Low Profitability: A regional unit might exhibit consistently negative or significantly below-average profit margins, for example, a regional maintenance division reporting a 2% net profit margin in 2024 while the company's overall net profit margin was 9%.

- Stagnant Market Share: These units often show little to no growth in their local market presence. A specific regional construction services branch might have held a 5% market share in its territory for the past three years, failing to gain traction against competitors.

- Resource Consumption: Despite poor performance, these units still require investment in management, infrastructure, and operational costs. In 2024, an underperforming regional logistics hub might have incurred $5 million in operating expenses with only $4 million in generated revenue.

- Limited Growth Potential: The underlying market dynamics or the unit's operational inefficiencies may severely limit its future prospects for significant expansion or improved profitability.

Services Highly Dependent on Volatile Commodity Prices

Services within Dexterra that are heavily reliant on volatile commodity prices, without strong protective measures like hedging or adaptable contracts, could be classified as Dogs in the BCG matrix. These operations face significant uncertainty in both demand and earnings. For instance, if a significant portion of Dexterra's revenue in 2024 was tied to services for oil extraction, and oil prices experienced sharp declines, those specific services would likely fall into the Dog category.

These types of services struggle to generate consistent profits, making them a drag on overall company performance. Their unpredictable nature means they are unlikely to become reliable sources of cash flow for the business in the long run. Consider the impact of fluctuating natural gas prices in early 2024 on companies providing services primarily to that sector; a similar scenario could affect Dexterra's Dog quadrant.

- Exposure to Commodity Price Swings: Services directly linked to commodities like oil, gas, or certain metals are inherently vulnerable to market volatility.

- Lack of Hedging or Contractual Flexibility: Without strategies to mitigate price risk or contracts that allow for price adjustments, profitability can be severely impacted.

- Unpredictable Demand and Profitability: These services experience fluctuating demand and inconsistent earnings, hindering their potential for growth and stability.

- Potential for Negative Cash Flow: In periods of low commodity prices, these Dog services may consume more resources than they generate, impacting overall financial health.

Dogs in Dexterra's BCG matrix represent business segments with low market share and low growth potential. These are typically underperforming units or services that consume resources without generating significant returns. Identifying and managing these Dogs is crucial for optimizing resource allocation and improving overall company profitability.

The divestiture of the Modular Solutions Business in August 2024, which reported a $6.1 million Adjusted EBITDA loss in 2023, exemplifies Dexterra's strategy to exit Dog segments. This move aims to streamline operations and focus on more promising areas of the business.

Access matting services experienced a revenue decline in Q1 2025 due to adverse weather, highlighting how external factors can temporarily push even potentially viable segments into a Dog-like position if not managed proactively. Legacy contracts with low profit margins also pose a risk, as they may fail to cover rising costs, turning potentially profitable services into Dogs.

Underperforming regional service units, such as a hypothetical prairie unit with a -5% EBITDA margin and 3% market share in 2024, also fit the Dog profile. These units drain resources and management attention, hindering overall company performance.

| Segment/Service | Market Share (2024) | Growth Rate (2024) | EBITDA Margin (2024) | BCG Classification |

|---|---|---|---|---|

| Modular Solutions Business (Divested) | Low | Low/Negative | Negative | Dog |

| Access Matting Services | Variable (Weather Dependent) | Volatile | Variable | Potential Dog (if persistent) |

| Legacy Low-Margin Contracts | N/A (Contractual) | N/A (Contractual) | Very Low/Negative | Dog |

| Underperforming Regional Units (Hypothetical) | 3% | 1% | -5% | Dog |

Question Marks

Dexterra's recent acquisition of U.S. Integrated Facilities Management (IFM) contracts, bolstered by its investment in Pleasant Valley Corporation (PVC) and the appointment of a new U.S. President, signals a strategic push into a burgeoning market. The U.S. IFM sector is projected to reach $200 billion by 2027, indicating significant growth potential.

Despite this ambitious expansion, Dexterra's current footprint in the vast U.S. IFM market remains modest, necessitating considerable capital outlay to capture substantial market share. This positions these new IFM contracts as question marks within the BCG matrix, requiring careful monitoring and strategic investment to determine their future success.

Expansion into new, untapped geographic markets, such as Dexterra's strategic focus on the U.S., would place them in the "Question Marks" category of the BCG Matrix. These markets represent high growth potential but currently hold a low market share for Dexterra.

Significant investment is required to build brand awareness and gain traction in these nascent territories. For instance, Dexterra's U.S. expansion efforts in 2024 involve substantial capital allocation towards sales infrastructure and marketing campaigns to establish a foothold.

Dexterra recognizes the significant shift towards data analytics and artificial intelligence in facility management, actively pursuing smart building technologies. This strategic focus on advanced digital and AI-driven solutions positions them to capitalize on a high-growth market. However, these innovative offerings currently represent a small portion of Dexterra's overall market share, demanding substantial investment in research and development alongside robust marketing efforts to drive adoption.

Strategic Partnerships for Emerging Service Offerings

Dexterra's strategic partnerships for emerging service offerings would be categorized as Stars or Question Marks in the BCG Matrix, depending on their current market position and growth potential. These ventures are high-growth by nature but involve significant uncertainty regarding market adoption and Dexterra's ability to gain substantial market share, demanding careful resource allocation.

For instance, if Dexterra partnered with a renewable energy technology firm in 2024 to offer integrated solar and battery storage solutions for commercial clients, this would likely be a Question Mark. The market for such integrated services is rapidly expanding, but the competitive landscape is also intensifying, with many players vying for dominance. Dexterra's success hinges on its ability to quickly establish a strong foothold and differentiate its offering.

- Emerging Service Focus: Partnerships targeting nascent markets like AI-driven predictive maintenance or advanced cybersecurity solutions for critical infrastructure.

- High Growth, High Uncertainty: These areas promise substantial revenue growth but face significant risks related to technological evolution and customer acceptance. For example, the global market for AI in infrastructure management was projected to reach over $2 billion by 2025, indicating strong growth but also a dynamic and evolving field.

- Resource Allocation Challenge: Dexterra must carefully balance investment in these new ventures against its established, cash-generating core businesses to avoid overstretching its resources.

- Market Share Ambition: The goal is to capture significant market share in these new segments, transforming them into future Stars or Cash Cows for the company.

Diversification into New Industries or Client Verticals

Diversifying into entirely new industries or client verticals for Dexterra would represent a Stars or Question Marks on the BCG Matrix, depending on the growth potential and Dexterra's current market share within those new areas. These ventures would aim for high-growth sectors, demanding substantial capital for developing new capabilities, establishing client trust, and gaining traction from scratch.

- High Investment, High Risk: Significant upfront investment is necessary to acquire new skills, build brand recognition, and penetrate unfamiliar markets.

- Potential for High Returns: Success in these new, high-growth areas could lead to substantial future revenue streams and market leadership.

- Example Scenario: If Dexterra, primarily a facilities management company, were to enter the burgeoning renewable energy installation sector, it would require substantial investment in specialized training, equipment, and certifications.

- Market Dynamics: For instance, the global renewable energy market was projected to reach over $1.9 trillion by 2023, offering significant growth opportunities but also intense competition from established players.

Question Marks in Dexterra's BCG Matrix represent business units or ventures with low market share in high-growth industries. These require significant investment to increase market share and potentially become Stars. Without substantial investment, they risk becoming Dogs.

Dexterra's expansion into the U.S. IFM market exemplifies a Question Mark. While the U.S. IFM sector is projected for robust growth, Dexterra's current market share is minimal, necessitating considerable capital for market penetration and brand building. For example, Dexterra allocated significant capital in 2024 towards establishing its U.S. sales infrastructure and marketing initiatives to gain traction.

Similarly, investments in emerging technologies like AI-driven predictive maintenance for facilities fall into the Question Mark category. The market for these advanced solutions is expanding rapidly, with global AI in infrastructure management projected to exceed $2 billion by 2025, but Dexterra's current share is small, demanding R&D and marketing investment to drive adoption and capture market share.

Strategic partnerships for new service offerings, such as integrated solar and battery storage solutions, also represent Question Marks. These ventures operate in high-growth areas but face intense competition and uncertainty regarding market acceptance and Dexterra's ability to secure a dominant position.

BCG Matrix Data Sources

Our Dexterra BCG Matrix is built on comprehensive market data, incorporating financial disclosures, industry benchmarks, and growth forecasts to provide actionable strategic insights.