Descente SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descente Bundle

Descente's strong brand reputation and innovative product design are key strengths, but the company faces challenges from intense competition and evolving consumer trends. Understanding these dynamics is crucial for anyone looking to invest or strategize within the performance apparel market.

Want the full story behind Descente’s market position, potential growth drivers, and competitive landscape? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Descente stands out due to its commitment to advanced product innovation, deeply rooted in its philosophy of 'functional beauty.' This approach seamlessly blends high performance with aesthetic appeal, aiming to boost both athletic capability and user confidence.

The brand's dedication to R&D is evident in its 2024-2025 ski collections, which incorporate cutting-edge technologies like the S.I.O. minimum pattern and Breathing System. Furthermore, the new .EX Collection showcases an adaptive design approach to address evolving climate conditions, highlighting Descente's forward-thinking product development.

The upcoming operation of the renovated Mizusawa Factory in 2025 underscores Descente's ongoing investment in its manufacturing capabilities and technological advancements. This strategic focus on innovation and quality reinforces its premium brand positioning and provides a significant competitive advantage in the market.

Descente boasts a robust brand portfolio, encompassing not only its flagship namesake but also popular names like Le coq Sportif, Umbro, Arena, and Marmot. This multi-brand approach effectively broadens its market appeal and diversifies revenue streams.

The company's strategic equity-method affiliation with ANTA Sports Products Limited has been particularly impactful in China, significantly enhancing its market penetration and sales capabilities in that crucial region. This partnership is a key driver of Descente's international growth.

Descente has demonstrated strong performance in established markets such as South Korea and China, signaling a healthy demand for its diverse product offerings. The company is actively pursuing expansion into new territories, including Europe, the United States, and Southeast Asia, aiming to replicate its success in these growing markets.

Descente's strategic pivot to a direct-to-consumer (DTC) model is a significant strength, evidenced by the Descente brand's DTC ratio hitting 57% by December 2024. This focus on direct sales, supported by investments in flagship stores like DESCENTE GOLF COMPLEX GINZA, is designed to boost profitability through increased full-price sales and deeper customer relationships.

The company's commitment to DTC is further underscored by its ambitious target of a 60-70% company-wide DTC ratio, with plans to elevate the Descente brand's DTC sales ratio to an impressive 80-90% by fiscal 2026. This aggressive expansion into DTC channels allows Descente to capture more margin and gain valuable direct consumer insights.

Successful Rebranding and Market Recovery in Key Regions

Descente has demonstrated remarkable resilience, successfully navigating the challenges presented by the boycott in South Korea and the evolving golf market. The company's strategic rebranding efforts have paid off, leading to a significant recovery in its market value within South Korea.

This revitalization is further evidenced by the business growth of its Umbro brand, which has contributed to Descente achieving record-high profits. Specifically, Descente reported a net profit of ¥18.1 billion for fiscal 2023, a substantial increase from ¥7.7 billion in fiscal 2022, underscoring the effectiveness of its market recovery strategies.

- Brand Revitalization: Descente's strategic rebranding has successfully re-established its strong market presence in South Korea.

- Umbro Growth: The Umbro brand has experienced notable business expansion, contributing to overall company performance.

- Record Profits: Descente achieved record-high profits in fiscal 2023, with net profit reaching ¥18.1 billion.

- Market Adaptability: The company's ability to adapt to regional market dynamics and overcome boycotts highlights its strategic agility.

Commitment to Sustainability

Descente's commitment to sustainability is a significant strength, underscored by their 'Design that Sustain' initiative and the 'RE:DESCENTE' clothing recycling program launched in May 2025. This proactive approach integrates eco-friendly materials, such as KAMITO, and optimizes production to reduce water usage and carbon emissions, embodying reduce, recycle, and reuse principles.

This dedication to environmental responsibility not only bolsters Descente's brand image but also resonates strongly with the increasing consumer preference for sustainable goods. For instance, a 2024 survey indicated that 72% of consumers consider sustainability when making purchasing decisions, a trend that benefits companies like Descente with clear eco-conscious strategies.

- 'Design that Sustain' Initiative: Focuses on eco-friendly materials and optimized production.

- 'RE:DESCENTE' Program: Launched in May 2025 for clothing recycling.

- Consumer Alignment: Meets growing demand for sustainable products, with 72% of consumers prioritizing sustainability in 2024.

- Brand Reputation: Enhances brand image through demonstrable environmental responsibility.

Descente's dedication to cutting-edge product development, exemplified by its S.I.O. minimum pattern and Breathing System in 2024-2025 ski lines, is a core strength. The upcoming Mizusawa Factory renovation in 2025 further solidifies its manufacturing prowess and commitment to quality, reinforcing its premium market positioning.

The company's strategic shift to a direct-to-consumer (DTC) model, with the Descente brand's DTC ratio reaching 57% by December 2024 and a target of 80-90% by fiscal 2026, allows for higher margins and direct customer engagement.

Descente has shown impressive market adaptability, successfully recovering from regional boycotts and achieving record profits of ¥18.1 billion in fiscal 2023, boosted by the growth of brands like Umbro.

Its sustainability initiatives, including the 'RE:DESCENTE' recycling program launched in May 2025 and the use of eco-friendly materials, align with the 72% of consumers prioritizing sustainability in 2024, enhancing brand reputation.

| Strength Category | Key Aspect | Supporting Data/Initiative |

|---|---|---|

| Product Innovation | Advanced Technologies | S.I.O. minimum pattern, Breathing System (2024-2025 ski collections) |

| Manufacturing Excellence | Factory Renovation | Mizusawa Factory renovation (2025) |

| Sales Strategy | Direct-to-Consumer (DTC) | Descente brand DTC ratio: 57% (Dec 2024); Target 80-90% (FY2026) |

| Financial Performance | Profitability | Record net profit: ¥18.1 billion (FY2023) |

| Sustainability | Eco-conscious Programs | 'RE:DESCENTE' recycling program (May 2025); Consumer preference: 72% (2024) |

What is included in the product

Analyzes Descente’s competitive position through key internal and external factors, highlighting its brand strength and market expansion opportunities alongside potential production cost increases and competitive pressures.

Provides a clear, actionable framework for identifying and addressing Descente's strategic challenges.

Weaknesses

Descente's deep specialization in high-performance athletic apparel, especially skiwear, means its appeal might not be as wide as broader sportswear brands. This focus on specific sports like skiing, running, and training makes the company more vulnerable to seasonal shifts and trends within those niches.

For instance, while the global ski apparel market is projected to reach approximately $13.5 billion by 2027, Descente's significant reliance on this segment exposes it to potential downturns if participation in winter sports declines. Expanding into new markets without compromising its established reputation for quality and performance presents a significant hurdle.

Descente contends with formidable global sportswear giants like Nike, Adidas, and Under Armour, brands with significantly larger marketing war chests and extensive global distribution channels. This intense rivalry, particularly pronounced in the lucrative ski apparel sector where Descente holds strong ground, makes it challenging to expand market share and enhance brand recognition against these established players.

Descente's reliance on a premium pricing strategy, while bolstering its high-performance image, can restrict its appeal to a broader market segment. This approach makes the company susceptible to economic slowdowns where consumers may shift to less expensive options, a trend observed in the 2023 global luxury goods market which saw a slowdown in growth compared to prior years.

Sustaining this premium positioning necessitates ongoing investment in product innovation and robust brand communication to justify the higher cost. For instance, Descente's continued investment in R&D, as seen in their performance apparel advancements, is crucial for maintaining this perceived value against competitors offering similar functionality at lower price points.

Privatization and Delisting from Stock Exchange

Descente's privatization and delisting from the Tokyo Stock Exchange's Prime Market on January 24, 2025, following ITOCHU Corp's tender offer, presents a significant weakness. This transition, while intended to boost corporate value and decision-making by easing information disclosure, simultaneously removes the discipline and transparency of public market oversight. The loss of this scrutiny could potentially hinder independent growth strategies.

The delisting also curtails Descente's access to public equity markets for future financing needs. This limitation could restrict its ability to fund ambitious expansion projects or R&D initiatives independently, making it more reliant on internal cash flow or debt financing. For instance, in fiscal year 2024, Descente reported net sales of ¥100.3 billion, highlighting the scale of operations that might require external capital for significant growth.

- Reduced public accountability: The absence of regular public reporting and shareholder engagement can lessen the pressure to meet short-term performance targets, but also removes a key mechanism for identifying and addressing potential issues early.

- Limited access to capital: Privatization eliminates the option of raising funds through issuing new shares, potentially constraining future investment capacity compared to publicly traded peers.

- Potential for slower innovation: Without the constant drive for public market approval, the pace of strategic shifts or investments in potentially disruptive, long-term projects might be affected.

Limited Domestic Production in Japan

Descente's reliance on overseas manufacturing presents a significant vulnerability. In 2023, less than 10% of Descente's apparel sold in Japan was actually produced domestically. This limited in-country production leaves the company susceptible to global supply chain disruptions, currency exchange rate volatility, and potential geopolitical instability affecting its manufacturing partners.

While Descente is strategically investing in its Mizusawa Factory to produce premium items like its renowned Mizusawa Down jackets, this focus on high-value, lower-volume goods doesn't offset the broader reliance on imported finished products. This imbalance means that a substantial portion of its sales volume remains exposed to external economic and political factors.

- Reduced Domestic Production: Less than 10% of Descente's apparel sold in Japan is manufactured within the country as of 2023.

- Supply Chain Risks: Heavy dependence on imported goods heightens exposure to disruptions from global logistics issues.

- Currency Fluctuations: Overseas production exposes Descente to potential losses from unfavorable shifts in exchange rates.

- Geopolitical Vulnerabilities: International manufacturing operations can be impacted by trade policies and political tensions.

Descente's heavy reliance on overseas manufacturing, with less than 10% of its Japanese sales originating from domestic production in 2023, exposes it to significant supply chain risks and currency fluctuations. This dependence means that global logistics issues, trade policy shifts, and unfavorable exchange rate movements can directly impact its cost of goods and product availability. While the company is investing in its Mizusawa Factory for premium items, the overall volume remains vulnerable to external factors.

The company's privatization and delisting from the Tokyo Stock Exchange's Prime Market on January 24, 2025, removes the transparency and accountability of public oversight. This transition, while intended to streamline decision-making, curtails access to public equity markets for future financing, potentially limiting its capacity for large-scale expansion or R&D initiatives. Descente's fiscal year 2024 net sales were ¥100.3 billion, indicating the substantial capital needs for growth that may now be harder to meet externally.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Overseas Manufacturing Dependence | Low domestic production (<10% in Japan for 2023) | Vulnerability to supply chain disruptions, currency volatility, geopolitical risks | Global logistics issues can delay inventory; Yen depreciation against USD increases import costs. |

| Privatization & Delisting | Loss of public market oversight and access to equity financing | Reduced transparency, potential constraint on future investment capacity | Delisted Jan 24, 2025; FY2024 Net Sales ¥100.3 billion highlights scale of capital needs. |

| Intense Competition | Facing global sportswear giants with larger resources | Difficulty in expanding market share and brand recognition | Brands like Nike and Adidas have significantly larger marketing budgets and distribution networks. |

| Premium Pricing Strategy | Higher price point limits broader market appeal | Susceptibility to economic downturns and consumer shifts to lower-cost alternatives | Global luxury goods market slowdown in 2023 illustrates this vulnerability. |

Preview Before You Purchase

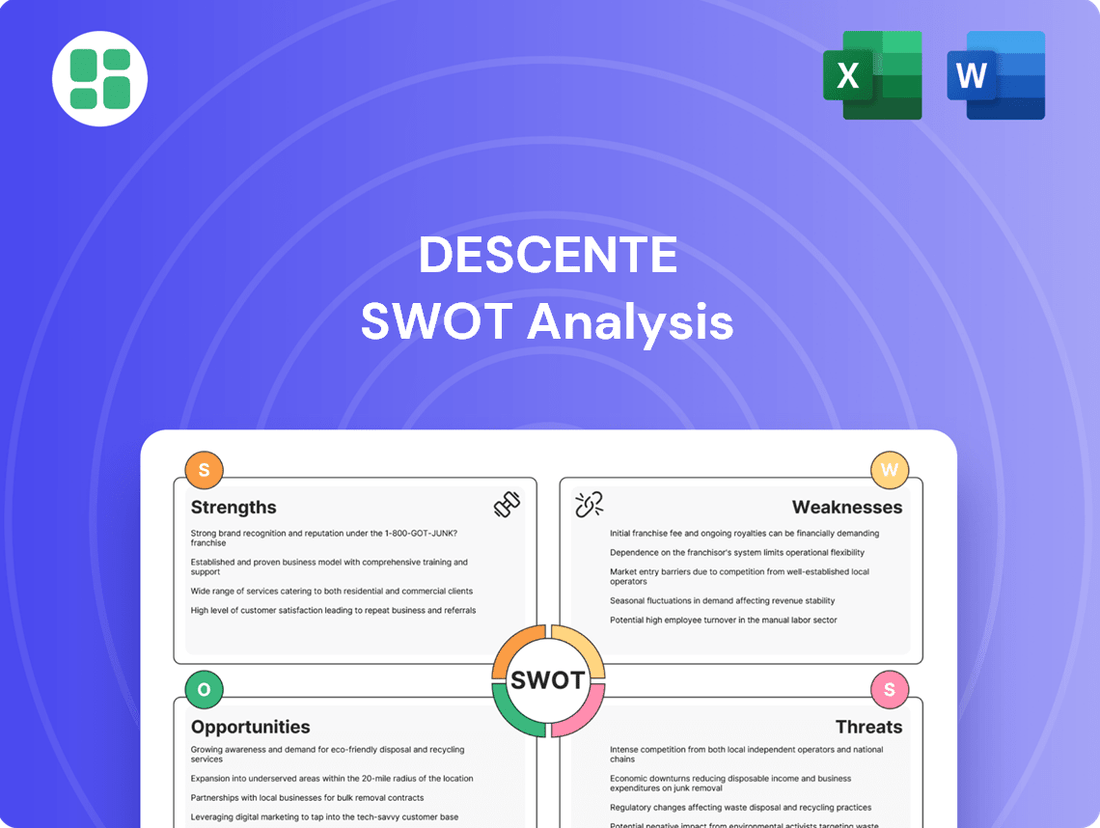

Descente SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Descente SWOT analysis, ensuring transparency and quality. Purchase unlocks the full, detailed report for your strategic planning needs.

Opportunities

Descente's strategic pivot towards Direct-to-Consumer (DTC) channels offers a substantial growth avenue, aiming to boost profitability and solidify brand identity. This involves expanding its owned retail footprint and bolstering its online presence.

By increasing the DTC sales ratio, Descente can capture higher gross margins and gain direct access to crucial customer data, enabling more personalized marketing and product development. The company has set an ambitious target of achieving an 80-90% DTC ratio for the Descente brand by fiscal year 2026, signaling a clear commitment to this strategy.

Descente can significantly expand its reach by leaning into the rapidly growing athleisure and lifestyle apparel markets. This strategic move allows the brand to attract a broader consumer base, moving beyond its core performance-oriented customers to embrace the everyday comfort and style sought by many. The global athleisure market was valued at over $300 billion in 2024 and is projected to continue its strong growth trajectory.

By developing and promoting more casual, lifestyle-focused collections, Descente can tap into this lucrative segment. Collaborations with influential lifestyle brands, such as the partnership with JJJJound observed in the 2024-2025 period, are crucial for enhancing brand perception and extending its appeal to fashion-conscious consumers.

Descente's successful partnership with ANTA Sports Products Limited has already cemented its premium status in China, paving the way for significant expansion. This existing foothold provides a strong foundation for further growth across the broader Asia-Pacific region, a market demonstrating increasing demand for high-quality athletic wear. The global ski apparel market, anticipated to grow steadily, further underscores the potential for Descente to capitalize on geographic market expansion.

Leveraging Sustainability Initiatives for Brand Differentiation

Descente's commitment to sustainability, highlighted by its 'Design that Sustain' and 'RE:DESCENTE' initiatives, offers a significant opportunity for brand differentiation. This focus on eco-friendly materials, efficient production, and recycling programs resonates with a growing segment of environmentally aware consumers, potentially boosting brand loyalty and unlocking new market opportunities.

The company's proactive stance on sustainability can be a powerful marketing tool. For instance, in 2023, global consumer spending on sustainable products saw a notable increase, with studies indicating that 60% of consumers are willing to pay more for brands with strong environmental commitments. Descente's initiatives directly address this trend.

- Eco-friendly materials: Utilizing recycled polyester and organic cotton in apparel lines.

- Optimized production: Reducing water and energy consumption in manufacturing processes.

- Recycling programs: Implementing take-back schemes for old garments to promote circularity.

- Brand messaging: Clearly communicating these efforts to consumers to build trust and appeal.

Strategic Collaborations and Athlete Endorsements

Descente can leverage strategic collaborations and athlete endorsements to enhance its market presence. The continuation and expansion of partnerships with elite athletes, exemplified by the Marco Odermatt capsule collection introduced in 2024, serve as a powerful avenue to elevate brand visibility and solidify Descente's reputation for high-performance athletic wear.

These alliances offer more than just marketing mileage; they are crucial for gathering direct feedback that informs product innovation, effectively associating the brand with peak athletic performance and resonating with a broad spectrum of sports aficionados.

- Brand Visibility: Collaborations with athletes like Marco Odermatt directly increase brand exposure among target demographics.

- Product Development Insights: Athlete feedback from partnerships directly influences and improves product design and functionality.

- Market Positioning: Aligning with top athletes reinforces Descente's image as a premium, performance-oriented brand.

Expanding into the burgeoning athleisure and lifestyle markets presents a significant opportunity for Descente to broaden its customer base beyond performance athletes. Tapping into this segment, which saw global valuations exceeding $300 billion in 2024, allows the brand to appeal to consumers seeking comfort and style for everyday wear.

Strategic collaborations, such as the one with JJJJound in the 2024-2025 period, are key to enhancing brand perception and reaching fashion-forward audiences. Furthermore, Descente's established presence in China through its partnership with ANTA Sports provides a robust platform for expansion across the Asia-Pacific region, capitalizing on the growing demand for premium athletic apparel.

The company's commitment to sustainability, through initiatives like 'Design that Sustain' and 'RE:DESCENTE', offers a distinct competitive advantage. With consumers increasingly prioritizing eco-conscious brands, Descente's focus on recycled materials and efficient production, supported by data showing 60% of consumers willing to pay more for sustainable products, can foster loyalty and attract new market segments.

Leveraging athlete endorsements, like the Marco Odermatt capsule collection in 2024, is another avenue for strengthening brand visibility and reinforcing its premium, performance-driven image. These partnerships also provide valuable product development insights, ensuring Descente remains at the forefront of athletic innovation.

Threats

The global sportswear market, valued at approximately $180 billion in 2024, is intensely competitive, featuring established giants and agile newcomers. This saturation pressures brands like Descente, potentially triggering price wars and eroding profit margins. For instance, in 2024, major competitors such as Nike and Adidas continued aggressive marketing campaigns, requiring significant investment from all players to maintain visibility.

Emerging brands, particularly in athleisure and specialized sports segments, are further fragmenting the market, demanding constant innovation from Descente. This dynamic necessitates substantial R&D and marketing outlays to differentiate offerings, as seen with the increasing focus on sustainable materials and digital integration by competitors throughout 2024 and into 2025.

Descente, as a premium sportswear brand, faces a significant threat from economic downturns, which directly impact consumer discretionary spending. During periods of economic contraction, consumers are more likely to cut back on non-essential purchases, including high-priced athletic apparel. For instance, the International Monetary Fund (IMF) projected global economic growth to slow in 2024 and 2025, indicating a potentially challenging environment for luxury goods and premium brands.

This shift in consumer behavior could lead to reduced sales volumes and pressure on profit margins for Descente. Consumers may opt for more budget-friendly alternatives from competitors, especially if they perceive less value in premium pricing during financially uncertain times. This sensitivity to economic cycles is a critical factor for the brand to monitor.

The sportswear sector is notoriously fickle, with fashion trends and what consumers want changing at a breakneck pace. This includes the ongoing popularity of athleisure wear and specific style preferences that can emerge quickly.

Even though Descente is known for its performance gear, how stylish and on-trend its products look is really important for attracting a wider customer base. For example, in 2024, the athleisure market continued its strong growth, with many consumers prioritizing comfort and versatility in their apparel choices, impacting traditional sportswear demand.

If Descente can't keep up with these shifting tastes, it could see a drop in sales and end up with too much stock that nobody wants. This rapid evolution means that staying relevant requires constant monitoring and agile product development to avoid falling behind competitors who are quicker to adapt.

Supply Chain Disruptions and Raw Material Volatility

Descente faces significant threats from supply chain disruptions and the volatility of raw material prices. Given its reliance on specialized fabrics and a global manufacturing footprint, the company is susceptible to events that can halt or slow production. For instance, in 2023, the apparel industry experienced widespread shipping delays and increased freight costs, impacting inventory management and delivery timelines for many brands.

Rising costs for key materials, such as high-performance synthetic fibers, directly affect Descente's cost of goods sold. Geopolitical instability can exacerbate these issues, leading to potential shortages or price spikes. For example, disruptions in key textile-producing regions in Asia could significantly impact Descente's ability to secure necessary materials, thereby affecting production schedules and potentially leading to higher prices for consumers.

- Increased Material Costs: Global commodity prices for synthetic fibers, a core component in many of Descente's performance apparel lines, saw an average increase of 8-12% in 2023 compared to 2022.

- Logistics Challenges: Shipping container rates, while fluctuating, remained elevated in early 2024 compared to pre-pandemic levels, adding an average of 15% to inbound logistics costs for many apparel manufacturers.

- Geopolitical Risks: Trade tensions and regional conflicts can disrupt established supply routes, potentially creating a 10-20% lead time extension for critical components if alternative sourcing is required.

Impact of Climate Change on Winter Sports Industry

Descente's significant footprint in the skiwear sector exposes it directly to the escalating threats posed by climate change. Factors like shorter winter seasons, diminished snowfall, and the closure of more ski resorts directly impact the viability of winter sports. For instance, a 2023 report indicated that by 2050, many European ski resorts could face significant snow scarcity, with some at lower altitudes becoming unviable. This environmental shift can lead to a substantial decrease in participation in winter sports, consequently reducing the demand for high-quality ski apparel and equipment, which forms a core part of Descente's revenue. While Descente is actively developing collections tailored for evolving environmental conditions, the overarching trend represents a persistent, long-term challenge to its core market.

The intense competition within the global sportswear market, projected to reach $195 billion by 2025, poses a significant threat to Descente. Competitors like Nike and Adidas continue to invest heavily in marketing and innovation, forcing Descente to allocate substantial resources to maintain brand visibility and market share. This competitive pressure can lead to price wars, potentially impacting profit margins.

Shifting consumer preferences, particularly the enduring popularity of athleisure and the rapid evolution of fashion trends, present another challenge. Descente must continuously adapt its product lines to remain stylish and relevant, requiring agile R&D and quick product development cycles to avoid inventory obsolescence and sales declines.

Economic volatility, as indicated by a projected global economic growth slowdown in 2024 and 2025 by the IMF, directly impacts discretionary spending. Consumers may reduce purchases of premium-priced athletic wear, opting for more budget-friendly alternatives, which could pressure Descente's sales volumes and profitability.

Supply chain disruptions and rising raw material costs, exacerbated by geopolitical instability, are critical threats. Increased costs for synthetic fibers and elevated logistics expenses, averaging 15% higher for inbound costs in early 2024 compared to pre-pandemic levels, directly impact Descente's cost of goods sold and production timelines.

Climate change poses a long-term threat, particularly to Descente's significant skiwear segment. Shorter winter seasons and reduced snowfall in key markets, with some European ski resorts facing significant snow scarcity by 2050, could decrease participation in winter sports and, consequently, demand for specialized ski apparel.

| Threat Category | Specific Threat | Impact on Descente | 2024/2025 Data Point |

|---|---|---|---|

| Market Competition | Intense competition from established and emerging brands | Pressure on pricing, reduced profit margins, need for increased marketing spend | Global sportswear market projected to reach $195 billion by 2025. |

| Consumer Trends | Rapidly changing fashion trends and athleisure popularity | Risk of product obsolescence, need for agile product development, potential sales decline | Athleisure market continued strong growth in 2024. |

| Economic Factors | Economic downturns and reduced discretionary spending | Lower sales volumes, potential shift to lower-priced competitors | IMF projected global economic growth slowdown for 2024-2025. |

| Supply Chain | Material cost increases and logistics challenges | Higher cost of goods sold, potential production delays, increased operational costs | Inbound logistics costs averaged 15% higher in early 2024 vs. pre-pandemic. |

| Environmental Factors | Climate change impacting winter sports | Reduced demand for skiwear, potential decline in core revenue segment | Many European ski resorts may face snow scarcity by 2050. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Descente's official financial statements, comprehensive market research reports, and insights from industry analysts. These sources provide a clear picture of the company's performance, competitive landscape, and future potential.