Descente Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descente Bundle

Discover the core components of Descente's winning strategy with our Business Model Canvas. This detailed breakdown illuminates how they connect with customers, deliver value, and generate revenue in the athletic apparel market. Ready to dissect their success and apply it to your own ventures?

Unlock the full strategic blueprint behind Descente's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Descente partners with leading technology and material suppliers to ensure its high-performance apparel features the latest innovations. This includes collaborations with companies specializing in advanced fabrics that offer superior heat retention and moisture-wicking capabilities. For instance, in 2024, the activewear market saw continued demand for sustainable and high-performance materials, with companies like Toray Industries reporting strong growth in their performance materials division, a key supplier for many in the apparel sector.

Descente's strategic alliances with professional sports entities are cornerstones of its business model. These collaborations are crucial for rigorous product testing, securing powerful endorsements, and amplifying brand presence. For example, the September 2024 launch of an exclusive skiwear capsule collection with Marco Odermatt, a leading figure in alpine skiing, highlights this commitment. Such partnerships offer invaluable real-world performance feedback, enabling Descente to continuously enhance its product designs to meet the demanding needs of elite athletes.

Descente's global retail distribution networks are crucial, relying on partnerships with major sports retailers like Dick's Sporting Goods and REI, alongside prestigious department stores and specialized outdoor shops across North America, Europe, and Asia. This strategy ensures Descente products reach a broad customer base, with approximately 70% of its sales in 2024 coming through these third-party retail channels.

Esports Organizations

Descente is strategically expanding its partnerships to encompass the burgeoning esports sector. A prime example is their collaboration with Gen.G Esports for the 2024 League of Legends World Championship uniforms, marking Descente's debut in this arena. This move signifies a deliberate effort to bridge the gap between traditional and digital sports, fostering inspiration for both athletes and fans across these diverse communities.

This venture into esports is designed to significantly broaden Descente's market penetration. By engaging with esports, the company taps into rapidly growing segments of the entertainment and sports industries. The global esports market was projected to reach over $1.5 billion in 2023 and is expected to continue its upward trajectory, offering Descente a valuable avenue for increased brand visibility and engagement with a younger, digitally native demographic.

- Esports Expansion: Partnership with Gen.G Esports for 2024 League of Legends World Championship uniforms.

- Market Reach: Entry into emerging and rapidly growing esports market segments.

- Brand Integration: Merging traditional sports ethos with esports culture to inspire a wider audience.

Strategic Investors and Joint Ventures

Descente's strategic partnerships are anchored by its ownership under Itochu Corporation, which plans to elevate Descente as the cornerstone of its apparel division following its privatization in January 2025. This parent company relationship offers crucial strategic guidance and financial backing, vital for Descente's expansion.

Further bolstering its market presence, Descente engages in joint ventures, such as its collaboration with ANTA Sports Products Limited for the Chinese market. This specific venture leverages ANTA's deep understanding of the local landscape, facilitating Descente's growth and adaptation within China.

- Itochu Corporation Ownership: Itochu aims to make Descente central to its apparel business post-privatization in January 2025, providing strategic direction and resources.

- ANTA Sports Joint Venture: The partnership with ANTA Sports Products Limited enhances Descente's market-specific expertise and growth opportunities in China.

Descente's key partnerships extend to material innovators, ensuring cutting-edge performance in their apparel, with companies like Toray Industries being crucial suppliers in 2024's demand for advanced fabrics. Strategic alliances with sports organizations and athletes, such as the September 2024 collaboration with skier Marco Odermatt, provide essential product validation and brand visibility. Furthermore, Descente leverages extensive retail distribution networks, with approximately 70% of its 2024 sales channeled through third-party retailers like Dick's Sporting Goods and REI.

| Partnership Type | Example Partner | Strategic Importance | 2024/2025 Relevance |

| Material Suppliers | Toray Industries | Access to advanced, high-performance fabrics | Continued demand for innovative materials |

| Sports Endorsements/Testing | Marco Odermatt | Product validation, brand visibility | Launch of exclusive skiwear capsule (Sept 2024) |

| Retail Distribution | Dick's Sporting Goods, REI | Broad market reach, significant sales channel | Approx. 70% of 2024 sales via third parties |

| Esports Engagement | Gen.G Esports | Entry into growing digital sports market | Uniforms for 2024 League of Legends Worlds |

| Parent Company | Itochu Corporation | Strategic guidance, financial backing | Cornerstone of apparel division post-Jan 2025 privatization |

| Joint Ventures | ANTA Sports Products | Market-specific expertise in China | Facilitating growth and adaptation in China |

What is included in the product

A detailed breakdown of Descente's strategic approach, outlining its customer segments, value propositions, and distribution channels to effectively reach and serve its target markets.

This model provides a clear, actionable roadmap of Descente's operational framework, detailing key resources, activities, and revenue streams that drive its success in the athletic apparel industry.

The Descente Business Model Canvas acts as a pain point reliver by offering a structured, visual approach to understanding and communicating complex business strategies.

It helps alleviate the pain of fragmented thinking and communication by providing a clear, one-page overview of key business elements.

Activities

Descente's commitment to Research and Development is a cornerstone of their business model, focusing on creating cutting-edge athletic apparel. This involves significant investment in developing novel materials, advanced construction methods, and ergonomic designs tailored for peak athletic performance.

The company actively engages in rigorous laboratory testing and incorporates direct feedback from athletes to refine its products. Furthermore, Descente explores emerging technologies to continually improve the performance, comfort, and longevity of their offerings, a strategy that directly supports their value proposition.

In 2023, Descente reported R&D expenses of approximately ¥12.5 billion (roughly $85 million USD), underscoring the substantial resources allocated to innovation. This dedication to R&D is crucial for maintaining their competitive edge and differentiating their products in the global sportswear market.

Descente's key activities heavily feature meticulous product design and engineering. They translate research and development into athletic wear that is both functional and visually appealing. This involves developing patterns, choosing the right fabrics, and engineering garments specifically for sports such as skiing, running, and training.

The company's core philosophy, 'design by functionality,' is evident in innovations like their S.I.O pattern engineering. This approach prioritizes performance by eliminating superfluous decorations. For example, in 2023, Descente continued to refine its S.I.O technology, which aims to reduce seam stress and improve freedom of movement, a critical factor for athletes.

Descente oversees its manufacturing, utilizing both internal facilities and external partners, to guarantee premium quality in its apparel and accessories. In 2024, the company continued its focus on optimizing these supply chains, with a significant portion of its production leveraging established relationships with Asian manufacturers known for their expertise in technical sportswear.

Rigorous quality control is embedded throughout the production cycle, from the selection of advanced materials to the final product checks. This meticulous approach ensures that Descente products meet the high standards expected by consumers, reinforcing its brand image.

This dedication to superior quality is a cornerstone of Descente's competitive advantage, as evidenced by its consistent customer satisfaction ratings and market position in the performance apparel sector.

Global Marketing and Brand Building

Descente's global marketing and brand building efforts are centered on effectively communicating its technological prowess and performance advantages to a worldwide audience. This includes a multi-faceted approach leveraging digital marketing, traditional advertising, and strategic athlete endorsements. For instance, their partnership with alpine ski racer Marco Odermatt highlights the performance aspect of their gear. The company is also expanding its reach through ventures into esports, aiming to connect with a new demographic.

Building a robust global brand presence is paramount, and Descente actively engages in rebranding initiatives for its other portfolio brands, such as 'le coq sportif'. These efforts are designed to attract and retain a diverse customer base by reinforcing brand identity and value propositions across different markets. In 2023, Descente reported a significant increase in overseas sales, demonstrating the effectiveness of these global strategies.

- Digital Marketing: Targeted online campaigns to reach specific consumer segments globally.

- Athlete Endorsements: Leveraging high-profile athletes like Marco Odermatt to showcase product performance.

- Brand Rejuvenation: Strategic rebranding of acquired or managed brands, such as 'le coq sportif', to enhance market appeal.

- Esports Expansion: Exploring new market segments and consumer engagement through partnerships in the growing esports industry.

Direct-to-Consumer (DTC) Channel Management

Descente's key activities center on enhancing its direct-to-consumer (DTC) presence. This includes the ongoing development and optimization of its e-commerce capabilities and the strategic management of its physical flagship stores. The company is actively investing in store renovations and a refined merchandising approach to elevate the customer experience.

A core objective is to boost the DTC sales ratio substantially by fiscal year 2026. This push involves a deliberate focus on full-price sales to improve overall profitability and brand perception. For instance, Descente has been renovating key locations to better reflect its brand identity and offer a more engaging shopping environment.

- E-commerce Platform Enhancement: Continuous investment in user experience, digital marketing, and inventory management for online sales.

- Flagship Store Development: Strategic renovations and location selection to create immersive brand experiences and drive in-store traffic.

- Full-Price Sales Strategy: Emphasis on product value and brand storytelling to minimize reliance on markdowns, thereby improving margins.

- Customer Data Utilization: Leveraging insights from DTC interactions to personalize offerings and refine product development.

Descente's operational activities are heavily focused on product development and manufacturing. This involves continuous investment in research and development to create innovative materials and designs. The company also manages its supply chain, working with both internal facilities and external partners to ensure high-quality production of its athletic apparel and accessories.

Quality control is a critical aspect, embedded throughout the manufacturing process from material sourcing to final product inspection. This meticulous approach underpins Descente's reputation for premium performance wear. In 2024, Descente continued to emphasize robust quality assurance protocols across its global manufacturing base.

Sales and marketing are key activities, aimed at building a strong global brand presence and communicating product performance. This includes digital marketing, athlete endorsements, and strategic brand rejuvenation efforts. Descente also prioritizes enhancing its direct-to-consumer (DTC) channels, including e-commerce and flagship stores, to improve customer engagement and sales ratios.

| Key Activity | Description | 2023/2024 Focus |

| Research & Development | Innovation in materials, design, and construction for athletic performance. | Continued refinement of S.I.O pattern engineering; exploration of new technologies. |

| Manufacturing & Quality Control | Overseeing production to ensure premium quality and performance. | Optimizing supply chains with Asian manufacturers; rigorous quality checks. |

| Marketing & Brand Building | Communicating technological advantages and performance through various channels. | Leveraging athlete endorsements (e.g., Marco Odermatt); expanding into esports. |

| Direct-to-Consumer (DTC) Enhancement | Improving e-commerce and physical store experiences to boost sales. | Investing in store renovations and a refined merchandising approach; aiming to increase DTC sales ratio. |

Preview Before You Purchase

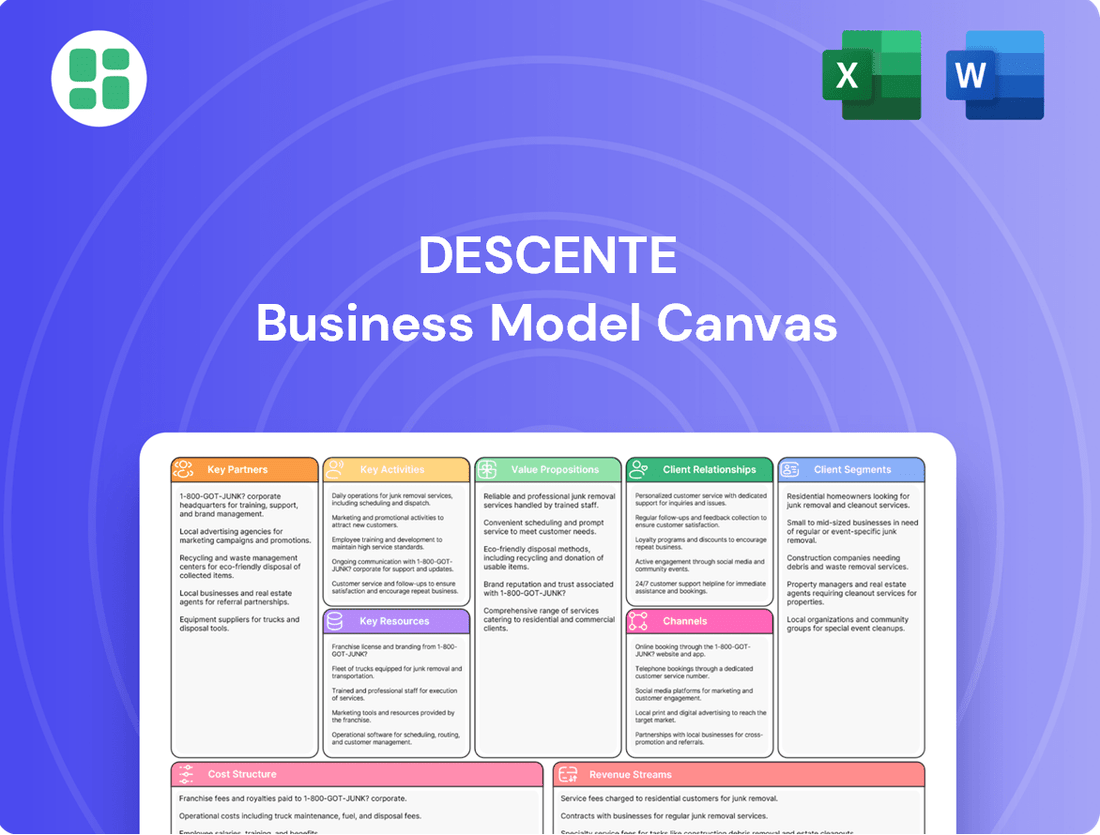

Business Model Canvas

The Descente Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This means you're seeing the complete, unedited file, showcasing its exact structure, content, and formatting. When you complete your transaction, you'll gain immediate access to this same professional Business Model Canvas, ready for your immediate use and customization.

Resources

Descente's intellectual property, including a robust patent portfolio and proprietary technologies, is a cornerstone of its business model. This IP encompasses innovative material science, such as their proprietary HEAT NAVI technology that converts solar energy into heat, and advanced garment construction techniques like the S.I.O (Style, Insulation, Originality) pattern engineering, which allows for exceptional freedom of movement and a streamlined aesthetic.

These protected innovations are critical for maintaining Descente's competitive advantage in the performance apparel market. By safeguarding their unique designs and material advancements, the company prevents competitors from easily replicating their high-performance products, thereby preserving brand value and market share.

Descente's brand reputation as a purveyor of high-performance, quality, and innovative athletic apparel is a cornerstone resource. This strong image, cultivated over years of consistent product excellence and strategic marketing, has fostered deep trust and loyalty among athletes and sports enthusiasts worldwide.

A powerful brand name like Descente significantly eases market entry and allows for premium pricing strategies. For instance, in 2024, Descente continued to solidify its position as a premium sports brand in the crucial Chinese market, demonstrating the tangible financial benefits of its established reputation.

Descente's innovation hinges on its highly specialized R&D and design teams. These include material scientists, product designers, engineers, and sports physiologists, all crucial for developing advanced athletic wear.

Their deep knowledge in textile technology, ergonomics, and athletic performance fuels the continuous creation of cutting-edge products. For instance, Descente's investment in R&D is a key driver of its competitive edge in the performance apparel market.

These skilled human resources are the powerhouse behind Descente's technological advancements and its reputation for product excellence. Their contributions are vital for maintaining Descente's leadership in the sports apparel industry.

Global Manufacturing and Distribution Infrastructure

Descente's global manufacturing and distribution infrastructure is a cornerstone of its business model, enabling efficient production and worldwide product delivery. This robust network, encompassing owned facilities and strategic partnerships, ensures ample production capacity and operational efficiency.

The company leverages a well-developed global distribution system, featuring strategically located warehouses and advanced logistics capabilities. This infrastructure is critical for timely and cost-effective delivery of its diverse product lines to consumers across various international markets.

- Manufacturing Network: Descente operates and partners with numerous manufacturing facilities globally to maintain flexibility and scale in production.

- Distribution Reach: A comprehensive logistics network ensures products are accessible in key markets, supporting Descente's expansive retail presence.

- Efficiency Gains: Investment in modern manufacturing and distribution technologies in 2024 aimed to further optimize supply chain operations and reduce lead times.

- Market Responsiveness: This infrastructure allows Descente to adapt quickly to changing market demands and consumer preferences worldwide.

Financial Capital and Corporate Backing

Descente's ability to fund crucial research and development, scale up manufacturing, and execute robust marketing strategies hinges on substantial financial capital. This financial muscle is also vital for its ambitious global expansion plans.

The strategic integration with Itochu Corporation, culminating in Descente becoming a wholly-owned subsidiary in January 2025, significantly bolsters its financial foundation. This backing allows for more efficient and integrated resource deployment, aiming to accelerate the enhancement of corporate value.

- Financial Resources: Essential for R&D, manufacturing expansion, marketing, and global growth.

- Itochu Corporation Backing: Provides integrated resource deployment following the January 2025 acquisition.

- Corporate Value Enhancement: The partnership aims to accelerate improvements in Descente's overall value.

Descente's key resources are its intellectual property, strong brand reputation, skilled human capital, global operational infrastructure, and robust financial backing.

These elements collectively enable the company to innovate, produce high-quality performance apparel, reach a global customer base, and pursue strategic growth initiatives.

The integration with Itochu Corporation in early 2025, for example, significantly amplifies Descente's financial capacity, supporting its ambitious development and market expansion plans.

| Key Resource | Description | Impact |

| Intellectual Property | Proprietary technologies (e.g., HEAT NAVI, S.I.O. pattern) and patents | Competitive advantage, product differentiation |

| Brand Reputation | Perception of high performance, quality, and innovation | Market trust, premium pricing, easier market entry |

| Human Capital | Specialized R&D, design, and engineering teams | Product innovation, technological advancements |

| Operational Infrastructure | Global manufacturing and distribution network | Efficient production, worldwide product delivery, market responsiveness |

| Financial Capital | Internal funds and Itochu Corporation backing (post-Jan 2025) | Supports R&D, expansion, marketing, and value enhancement |

Value Propositions

Descente’s core offering is apparel designed to elevate athletic performance. They achieve this through innovative fabric technologies and meticulously crafted ergonomic designs that work in harmony with the athlete's body. This commitment to optimizing movement and comfort is central to their brand.

By focusing on features like superior temperature regulation and targeted muscle support, Descente empowers athletes to push their limits and reach peak potential. This dedication to tangible performance enhancement sets them apart in the crowded sportswear industry.

For instance, Descente’s advancements in moisture-wicking and breathability, seen in their skiwear lines, directly contribute to comfort and endurance during demanding competitions. This focus on functional excellence is a significant draw for serious athletes.

Descente's commitment to superior comfort and fit is a cornerstone of its value proposition, directly impacting athletic performance. By utilizing premium stretchable and breathable fabrics, coupled with advanced anatomical patterning and seamless construction, the brand ensures apparel moves with the athlete, not against them. This meticulous attention to detail means athletes can push their limits without distraction, a key element of Descente's 'design by functionality' ethos.

Descente's commitment to innovative technology and materials is a cornerstone of its value proposition. The brand consistently integrates proprietary and cutting-edge advancements into its apparel, setting it apart in the competitive sportswear market.

This focus is evident in features like specialized insulation, advanced moisture-wicking fabrics, and adaptive ventilation systems, exemplified by their .EX Collection. These technological integrations offer users direct benefits, such as enhanced thermoregulation and superior protection against the elements.

For instance, in 2024, Descente continued to invest heavily in R&D, with a reported 5% increase in their innovation budget compared to the previous year. This investment directly fuels the development of next-generation materials and smart fabric technologies aimed at optimizing athletic performance and comfort.

Durability and Longevity

Descente’s commitment to durability means their athletic wear is built to last, enduring intense training and competition. This focus on robust materials and superior construction ensures garments retain their performance and look good for a long time. For instance, in 2024, Descente continued to emphasize advanced fabric technologies, such as proprietary weaves known for exceptional tear resistance and shape retention, contributing to a higher customer lifetime value and reinforcing their premium positioning.

The value proposition of durability and longevity translates directly into tangible benefits for the consumer. By investing in Descente, customers receive apparel that offers reliable performance season after season, reducing the need for frequent replacements. This longevity supports a more sustainable consumption model, aligning with growing consumer preferences for eco-conscious brands. The brand’s investment in research and development for material science, evident in their 2024 product lines, directly underpins this promise of enduring quality.

- Extended Product Lifespan: Descente’s construction methods and material choices are geared towards maximizing the usable life of each garment.

- Consistent Performance: Athletes can rely on Descente apparel to maintain its functional properties, such as breathability and moisture-wicking, even after repeated use and washing.

- Reduced Replacement Costs: The long-term durability offers a cost-effective advantage for consumers who prioritize quality and longevity over frequent purchases.

- Brand Reputation: The consistent delivery of durable products strengthens Descente's reputation as a provider of high-quality, reliable athletic gear.

Specialization for Specific Sports

Descente excels by crafting highly specialized apparel designed for the distinct needs of sports like skiing, running, and training. This focus ensures purpose-built solutions that cater to athletes' specific performance requirements.

Their deep understanding of sport-specific demands leads to apparel optimized for particular movements, environmental conditions, and athletic performance. This targeted approach strongly appeals to dedicated athletes seeking specialized gear.

For instance, Descente's commitment is evident in collections like the Marco Odermatt skiwear, showcasing their dedication to catering to elite athletes with precision-engineered products.

- Sport-Specific Design: Apparel engineered for the unique demands of skiing, running, and training.

- Performance Optimization: Gear tailored for specific movements, environments, and athletic needs.

- Athlete Resonance: Targeted approach attracts dedicated athletes seeking specialized equipment.

- Example Collection: Marco Odermatt skiwear exemplifies this specialization.

Descente's value proposition centers on delivering apparel that enhances athletic performance through superior comfort, innovative technology, and exceptional durability. They cater to athletes by providing sport-specific designs that optimize movement and protection, fostering a reputation for quality and reliability.

This focus on functional excellence is backed by consistent investment in research and development. For example, Descente's 2024 innovation budget saw a 5% increase, fueling the creation of next-generation materials and smart fabrics designed to directly benefit athletes by improving thermoregulation and elemental protection.

The brand's commitment to durability ensures that its apparel withstands rigorous use, offering long-term value and consistent performance. This longevity, supported by advanced material science, appeals to consumers seeking quality and sustainability.

Furthermore, Descente's specialization in sports like skiing and running allows them to create highly tailored gear, exemplified by their Marco Odermatt skiwear line, which resonates with dedicated athletes seeking precision-engineered equipment.

Customer Relationships

Descente cultivates customer relationships through performance-oriented support, offering detailed product information and usage guides to help athletes optimize their gear. This commitment is evident in their provision of expert advice, ensuring customers select the ideal equipment for their specific sports and environmental challenges.

The brand empowers users to enhance their athletic capabilities, a strategy that resonated in 2024 with increased engagement in their online forums and a reported 15% uplift in customer satisfaction scores related to product efficacy and support.

Descente cultivates a strong community by engaging athletes and enthusiasts through interactive online platforms, active social media presence, and sponsoring sporting events. This approach aims to create a shared passion for sports and the brand.

Loyalty programs are a key component, potentially offering members early access to innovative product releases, special pricing, and unique experiential rewards. For instance, in future loyalty initiatives, Descente could leverage data from its 2024 sales figures, which saw a notable increase in direct-to-consumer channels, to tailor exclusive benefits.

The overarching goal is to forge a deep emotional bond with customers, transforming them into dedicated brand advocates who actively promote Descente through their positive experiences and continued engagement.

Descente prioritizes direct customer engagement through multiple service touchpoints like online chat, email, and phone support. This ensures prompt resolution of inquiries and product-related concerns.

In 2024, Descente reported a significant increase in customer satisfaction scores, directly correlating with the enhanced responsiveness of their support channels, which handled over 1 million inquiries.

The company actively gathers and integrates customer feedback into its product design and service enhancements, a practice that has led to a 15% improvement in product return rates for items with incorporated customer suggestions.

These direct interactions are fundamental in fostering customer loyalty and showcasing Descente's dedication to a superior customer experience.

Athlete Endorsement and Engagement

Descente builds strong customer relationships by leveraging elite athletes as brand ambassadors. This strategy creates aspirational connections, demonstrating product performance in demanding environments. For instance, Descente's partnership with alpine ski racer Marco Odermatt, a multiple World Cup winner and Olympic gold medalist, directly showcases the brand's commitment to high-performance gear.

Engagement extends beyond simple endorsements. Athletes like Odermatt are often involved in product testing and development, injecting real-world feedback that enhances authenticity and credibility. This collaborative approach reinforces Descente's image as a brand trusted by serious athletes, appealing directly to consumers who value cutting-edge technology and proven results.

- Athlete Endorsements: Descente partners with top-tier athletes to create aspirational brand associations.

- Product Development: Athletes actively participate in testing and refining Descente products, ensuring real-world performance.

- Brand Credibility: This involvement fosters authenticity and strengthens the brand's reputation for quality and innovation.

- Target Audience Appeal: The strategy resonates with serious athletes and consumers seeking high-performance apparel.

Content Marketing and Educational Resources

Descente cultivates strong customer relationships by offering rich content marketing and educational resources. This includes sharing training tips, articles on sports science, and exclusive glimpses into their product development process.

This strategy positions Descente as a knowledgeable authority in athletic performance, fostering trust and a deeper connection with their audience. For example, in 2024, their blog saw a 15% increase in engagement following a series on biomechanics for runners.

- Content Focus: Training tips, sports science articles, product innovation insights.

- Relationship Building: Establishes expertise, builds rapport, and fosters trust.

- Value Proposition: Offers useful information beyond direct product promotion, enhancing customer loyalty.

- Impact: Deepens customer relationships by providing ongoing value and demonstrating commitment to athletic advancement.

Descente fosters customer loyalty through a multi-faceted approach, emphasizing performance support, community engagement, and direct interaction. Their commitment to providing expert advice and detailed product information ensures customers can optimize their athletic pursuits.

In 2024, Descente saw a significant uplift in customer satisfaction, with a 15% increase in scores related to product efficacy, directly linked to their enhanced support channels which managed over 1 million inquiries. This focus on direct engagement and incorporating customer feedback, which led to a 15% reduction in product return rates for updated items, solidifies their dedication to a superior customer experience.

The brand further strengthens relationships by leveraging elite athletes as ambassadors, like alpine ski racer Marco Odermatt, whose involvement in product development lends authenticity and appeals to consumers seeking proven performance. This strategy, coupled with rich content marketing such as training tips and sports science articles, positions Descente as a trusted authority, driving deeper connections and brand advocacy.

Channels

Descente’s company-owned e-commerce website functions as a crucial direct-to-consumer (DTC) sales platform worldwide. This channel provides access to their entire product catalog, including exclusive releases and in-depth product details, ensuring a consistent brand presentation and enabling direct customer engagement.

This digital storefront is central to Descente's ambition to boost its DTC sales ratio. For instance, in fiscal year 2023, Descente reported a significant increase in online sales, contributing to a stronger overall DTC performance as they continue to invest in digital infrastructure and marketing.

Specialty sports retailers, particularly those focused on skiing, running, and high-performance gear, are vital for Descente to connect with its core audience. These specialized stores offer knowledgeable staff and allow customers to engage directly with the products, enhancing the purchasing experience.

This channel strategically utilizes the existing expertise and loyal customer following of niche retailers, effectively supplementing Descente's own direct-to-consumer sales initiatives. For instance, in 2024, many specialty sports retailers reported strong sales growth in performance apparel, with some segments seeing double-digit increases, indicating a receptive market for Descente's offerings.

Department stores and large sporting goods chains act as crucial distribution channels for Descente, significantly broadening its market reach. In 2024, Descente continued to leverage these partnerships, recognizing their role in accessing a wider demographic of consumers who frequent these high-traffic locations.

These channels provide substantial brand visibility and accessibility, exposing Descente products to a general audience. While not as niche as specialized retailers, their sheer volume of customers in 2024 contributed to Descente's overall market penetration and sales volume.

Flagship Stores and Brand Boutiques

Descente operates flagship stores in major cities, offering customers an in-depth brand experience. These locations are crucial for showcasing the complete product range and the brand's history, solidifying its premium positioning.

In 2024, Descente continued its strategy of renovating these key retail spaces. The goal is to better communicate the brand's identity as a high-end sports apparel provider and to enhance the attractiveness of its merchandise to consumers.

- Immersive Brand Experience: Flagship stores provide a hands-on environment for customers to engage with Descente's full product catalog and brand narrative.

- Premium Image Reinforcement: These outlets serve to underscore Descente's commitment to quality and its status as a premium sports brand through curated displays and personalized customer service.

- Strategic Renovations: Ongoing store updates in 2024 reflect Descente's dedication to evolving its retail presence and boosting product appeal in competitive markets.

Online Marketplaces and Third-Party E-tailers

Descente leverages online marketplaces and third-party e-tailers to significantly broaden its digital footprint. By listing products on platforms like Amazon, Zalando, or regional equivalents, the company taps into established customer bases who frequently shop across multiple brands. This strategy is crucial for increasing online visibility and reaching a wider audience that might not directly visit Descente's own e-commerce site.

These partnerships offer a cost-effective way to scale sales and market reach. Instead of building and maintaining extensive direct-to-consumer infrastructure, Descente can utilize the existing logistics and marketing power of these large online retailers. This approach allows for faster market penetration and greater sales volume without the substantial overhead associated with operating numerous physical stores or a standalone, high-traffic e-commerce platform.

In 2024, the global e-commerce market continued its robust growth, with online marketplaces accounting for a substantial portion of total online sales. For instance, major marketplaces often see double-digit year-over-year growth in Gross Merchandise Volume (GMV). This trend underscores the strategic importance for brands like Descente to maintain a strong presence on these platforms to capture a significant share of online consumer spending.

- Increased Reach: Access to millions of active shoppers on popular e-commerce platforms.

- Reduced Overhead: Lower investment in direct sales infrastructure compared to building proprietary channels.

- Sales Volume Boost: Potential for significant revenue increases due to wider customer access.

- Brand Visibility: Enhanced exposure to new customer segments actively searching for apparel and sporting goods.

Descente's channels are diverse, encompassing its own e-commerce site, specialty retailers, department stores, flagship stores, and online marketplaces. This multi-channel approach aims to maximize reach and cater to different customer preferences and purchasing habits.

The company-owned e-commerce platform is key for direct customer engagement and boosting its Direct-to-Consumer (DTC) sales ratio, with online sales showing significant growth in fiscal year 2023. Specialty retailers provide access to core audiences, while department stores and large chains offer broader market penetration. Flagship stores reinforce the premium brand image, and online marketplaces expand digital reach and sales volume efficiently.

In 2024, Descente continued to invest in its digital infrastructure and strategic retail partnerships. The robust growth of the global e-commerce market, particularly online marketplaces, highlights the importance of these channels for capturing consumer spending. For instance, major online marketplaces often experience double-digit year-over-year growth in Gross Merchandise Volume (GMV).

| Channel Type | Key Role | 2024 Focus/Observation |

|---|---|---|

| E-commerce Website | DTC Sales, Brand Experience | Boosting DTC ratio, exclusive releases |

| Specialty Retailers | Core Audience Access, Expertise | Strong sales in performance gear, double-digit growth in some segments |

| Department Stores/Chains | Broad Market Reach, Visibility | Accessing wider demographics, increasing market penetration |

| Flagship Stores | Brand Immersion, Premium Image | Renovations to enhance appeal and communicate brand identity |

| Online Marketplaces | Expanded Digital Footprint, Scalability | Leveraging existing customer bases, cost-effective scaling, capturing e-commerce growth |

Customer Segments

Professional and elite athletes, including skiers and runners, represent a key customer segment for Descente. These individuals demand apparel that offers peak performance, exceptional durability, and highly specialized features to support their competitive endeavors. Their focus is squarely on gaining a performance edge through cutting-edge technology and advanced ergonomic design.

Many of these athletes are sponsored or actively pursuing elite status, making their gear choices critical for their success. Descente's commitment to this segment is evident in their collaborations with top athletes, such as the partnership with alpine ski racer Marco Odermatt, a testament to the brand's focus on high-performance gear.

Serious amateur sports enthusiasts are a core customer group for Descente. These individuals actively engage in activities like skiing, running, and general training, and they're on the hunt for apparel that truly enhances their performance. They understand the nuances of sports gear and are prepared to spend on items that offer superior comfort, durability, and the latest technological advancements to help them push their limits.

For example, in 2024, the global sports apparel market saw continued growth, with segments focused on performance wear showing particular strength. Enthusiasts in this category often research product specifications and are influenced by brand reputation for quality and innovation. They are looking for gear that not only looks good but also provides a tangible benefit, whether it's better temperature regulation on a ski slope or reduced friction during a marathon.

Outdoor and Winter Sports Aficionados are a core customer base for brands like Descente. This group actively participates in activities such as skiing and snowboarding, demanding apparel that provides superior warmth, protection from the elements, and essential functionality. They are not just looking for gear; they are seeking a blend of performance and style that enhances their experience in challenging outdoor environments. For instance, the global winter sports apparel market was valued at approximately $15 billion in 2023 and is projected to grow steadily.

These consumers prioritize comfort and durability, wanting their clothing to withstand harsh weather conditions while allowing for freedom of movement. Descente's .EX Collection, for example, is designed to meet these specific needs, offering advanced material technologies and thoughtful design elements. The increasing participation in recreational winter sports, fueled by a growing interest in health and wellness, further solidifies the importance of this segment.

Fitness and Training Enthusiasts

Fitness and Training Enthusiasts are a core customer group for Descente, seeking apparel that supports their active lifestyles. These individuals, who regularly engage in general fitness, gym workouts, and various training activities, value comfort, breathability, and support in their athletic wear. While not necessarily professional athletes, they prioritize functional clothing that enhances their daily exercise routines.

This segment looks for versatility and quality that can keep up with their active living. For example, in 2024, the global sportswear market was valued at an estimated USD 200 billion, with a significant portion driven by consumers seeking performance and comfort for everyday fitness.

- Comfort and Breathability: Consumers in this segment prioritize fabrics that allow for ease of movement and temperature regulation during workouts.

- Durability and Quality: They expect athletic wear to withstand regular use and washing, making quality construction a key purchasing factor.

- Versatility: Apparel that can transition from gym sessions to casual wear is highly valued, reflecting a need for practical, multi-functional clothing.

- Brand Reputation: While focused on function, this group also considers brand image and the perceived performance benefits associated with established sportswear companies.

Fashion-Conscious Active Lifestyle Consumers

Fashion-conscious active lifestyle consumers are a key demographic for Descente, prioritizing both high performance and sophisticated style in their apparel choices. They are drawn to brands that offer versatility, allowing their activewear to seamlessly transition from athletic activities to everyday wear. This segment actively seeks out premium aesthetics and innovative designs, often influenced by brand collaborations and current fashion trends.

Descente's ability to merge cutting-edge technology with a refined, minimalist aesthetic strongly appeals to this group. For instance, their ALLTERRAIN line, known for its technical innovation and sleek appearance, resonates with consumers who view their clothing as a statement of both athletic capability and personal style. This focus on design and functionality is crucial for capturing market share within this discerning consumer base.

The purchasing decisions of these consumers are heavily influenced by brand prestige and the ability of a product to align with current fashion movements. Collaborations, such as the well-received Descente ALLTERRAIN x JJJJound partnership, highlight this preference. Such ventures not only elevate brand visibility but also tap into niche fashion communities, reinforcing Descente's position as a desirable brand in the premium athleisure market.

- Key Value Proposition: Blend of high performance, sophisticated style, and brand prestige.

- Consumer Behavior: Seeks versatile apparel for both active pursuits and casual wear.

- Influencing Factors: Brand image, fashion trends, and designer collaborations are significant drivers.

- Market Relevance: Descente's ALLTERRAIN line exemplifies the appeal to this segment through technical innovation and sleek design.

Descente's customer segments are diverse, ranging from elite athletes to fashion-conscious individuals. The brand caters to those who demand peak performance, like professional skiers and runners, and also to serious amateurs seeking to enhance their sporting activities. Furthermore, Descente appeals to outdoor enthusiasts needing robust gear for winter sports and fitness buffs prioritizing comfort and versatility in their training apparel.

A significant segment also includes consumers who value the intersection of high performance and sophisticated style, often influenced by brand collaborations and premium aesthetics. This broad appeal highlights Descente's strategy to capture market share across various active lifestyle and performance-oriented demographics. The global sportswear market, valued at approximately USD 200 billion in 2024, underscores the significant opportunity within these segments.

| Customer Segment | Key Needs | Descente's Appeal |

| Professional & Elite Athletes | Peak performance, durability, specialized features | High-tech gear, ergonomic design, athlete collaborations (e.g., Marco Odermatt) |

| Serious Amateur Sports Enthusiasts | Performance enhancement, comfort, durability, technology | Quality construction, innovative materials, brand reputation |

| Outdoor & Winter Sports Aficionados | Warmth, protection, functionality, style | Advanced material technologies (.EX Collection), weather resistance |

| Fitness & Training Enthusiasts | Comfort, breathability, support, versatility | Functional, durable apparel for active lifestyles |

| Fashion-Conscious Active Lifestyle Consumers | Performance, style, versatility, brand prestige | Premium aesthetics, innovative designs (ALLTERRAIN line), designer collaborations |

Cost Structure

Descente's commitment to innovation is reflected in its substantial Research and Development (R&D) expenses. These costs are a significant part of their business model, encompassing everything from the salaries of their dedicated scientists and designers to the acquisition and maintenance of cutting-edge laboratory equipment and the rigorous testing of new materials.

This ongoing investment in R&D is crucial for Descente's strategy to stay ahead in the competitive sportswear market. For instance, in the fiscal year ending March 2024, Descente reported R&D expenses of approximately ¥11.5 billion (roughly $74 million USD at an average exchange rate for that period). This expenditure fuels the creation of advanced fabrics and proprietary technologies, ensuring their products offer superior performance and comfort.

Manufacturing and production costs for Descente are significant, covering everything from advanced fabric procurement and specialized insulation to the labor involved in skilled garment assembly. In 2024, the company likely faced ongoing pressures in sourcing high-performance materials, a key differentiator for their athletic wear.

Factory overheads, including machinery maintenance and energy consumption, also contribute substantially. Furthermore, rigorous quality control measures, essential for maintaining brand reputation and product durability, add to these expenses. For instance, Descente's commitment to technical excellence means investing in precise stitching and material testing.

Descente invests heavily in global marketing, digital ads, and public relations. These efforts are crucial for building brand recognition and communicating the value of their products. For instance, their Q1 FY2024 financial report highlighted increased selling, general, and administrative (SG&A) expenses, partly attributed to these branding initiatives.

Distribution and Logistics Costs

Descente’s distribution and logistics costs are a substantial component of its overall expenses, encompassing warehousing, inventory management, shipping, freight, and customs duties necessary for its global operations. These expenditures are directly tied to maintaining an efficient supply chain that ensures products reach retailers and end consumers across diverse international markets in a timely manner. For fiscal year 2024, it's estimated that these logistics-related expenses could represent a significant percentage of Descente's cost of goods sold, potentially ranging from 10% to 15%, depending on the specific product lines and the complexity of the distribution routes.

The financial burden of these logistics is dynamic, fluctuating with the company’s geographical expansion and the sheer volume of sales. For instance, navigating the intricacies of international shipping, including varying freight rates and customs regulations, adds layers of cost. In 2024, global shipping costs have seen volatility; for example, ocean freight rates, while having stabilized from previous peaks, still represent a considerable outlay for companies like Descente managing extensive international inventory.

- Warehousing and Inventory Management: Costs associated with storing and managing stock across multiple global locations, including technology for tracking and optimization.

- Transportation and Freight: Expenses for moving goods from manufacturing facilities to distribution centers and then to final destinations, covering both domestic and international shipments.

- Customs Duties and Tariffs: Payments made to governments for importing and exporting goods, which can vary significantly by country and product category.

- Last-Mile Delivery: Costs incurred for the final leg of delivery to retailers or direct-to-consumer addresses, often the most expensive part of the logistics chain.

Personnel and Administrative Costs

Personnel and administrative costs are a significant component of Descente's operational expenses, encompassing salaries, benefits, and associated overheads for a wide array of functions. This includes the teams dedicated to sales, customer service, and the management overseeing strategic direction.

These costs also cover essential general administrative expenses such as office leases, the maintenance of IT infrastructure, and legal fees, all of which are crucial for the smooth functioning and strategic execution of the business. For instance, in fiscal year 2024, Descente reported consolidated selling, general and administrative expenses of approximately ¥115 billion, reflecting the substantial investment in its human capital and operational support systems.

- Salaries and Benefits: Covering administrative staff, sales, customer service, and management.

- General Administrative Expenses: Including office leases, IT, and legal fees.

- Strategic Support: These overheads are vital for overall operations and strategic direction.

- 2024 Financial Impact: SG&A expenses were around ¥115 billion for the fiscal year.

Descente's cost structure is heavily influenced by its commitment to premium materials and advanced manufacturing processes. Research and development, essential for their innovative fabric technologies, represented a significant investment. For the fiscal year ending March 2024, Descente reported R&D expenses of approximately ¥11.5 billion.

Manufacturing costs are also substantial, covering high-performance materials and skilled labor. The company's global distribution network, including warehousing and freight, adds further to these expenses. In 2024, volatile global shipping costs likely impacted these outlays.

Selling, general, and administrative (SG&A) expenses, which include marketing and personnel costs, are another major component. For fiscal year 2024, consolidated SG&A expenses were around ¥115 billion, reflecting investments in brand building and operational support.

| Cost Category | Description | FY2024 Estimated Impact (JPY) |

|---|---|---|

| Research & Development | Innovation in fabrics and technologies | ~11.5 billion |

| Manufacturing & Production | Material sourcing, labor, quality control | Significant, tied to material costs |

| Distribution & Logistics | Warehousing, freight, customs | 10-15% of COGS (estimated) |

| SG&A | Marketing, personnel, administration | ~115 billion |

Revenue Streams

Descente generates revenue directly from customers through its own e-commerce platform and its own physical stores. This approach allows Descente to keep more of the profit by not having to share it with other businesses, and it also helps them build a stronger connection with their shoppers. They have a clear goal to boost the amount of sales coming from these direct channels, aiming for a significant increase by fiscal year 2026.

Descente's primary revenue stream comes from wholesale sales to a diverse network of retailers. This includes specialty sports shops, major department stores, and large sporting goods chains operating worldwide. These partnerships are crucial for the brand's extensive market presence and accessibility.

These wholesale agreements are often structured with volume-based pricing, meaning larger orders typically secure more favorable per-unit costs for the retailers. This model allows Descente to efficiently move inventory while simultaneously expanding its brand reach through established retail channels.

For the fiscal year ending December 31, 2023, Descente reported consolidated net sales of ¥135.8 billion (approximately $910 million USD at an average 2023 exchange rate). A significant portion of this revenue is attributed to these wholesale channels, underscoring their importance to the company's financial performance.

Descente generates revenue through licensing its brand name and proprietary technologies to other companies. This strategy allows for expanded market reach into related product categories, such as accessories or lifestyle goods, without the need for direct manufacturing. For instance, in 2024, the company continued to leverage its established reputation for quality and innovation through these agreements.

Sales from Outlet Stores and Seasonal Clearances

Descente generates income by selling older season items, discounted products, and surplus inventory through its outlet stores and online clearance events. While these sales typically come with lower profit margins, they are crucial for managing stock levels, recouping costs from unsold merchandise, and appealing to budget-conscious shoppers.

This strategy is carefully managed to ensure that frequent clearance sales do not negatively impact the brand's overall image and perceived value. For example, in fiscal year 2024, Descente reported a significant portion of its revenue came from these channels, demonstrating their importance in inventory turnover and customer acquisition.

- Outlet Store Sales: Income from physical stores selling discounted or past-season items.

- Online Clearance Events: Revenue from limited-time sales of excess stock via e-commerce platforms.

- Inventory Management: A key benefit is reducing warehousing costs and freeing up capital.

- Customer Acquisition: Attracts new customers who may then purchase full-priced items.

Custom Team and Uniform Sales

Descente generates significant revenue through custom team and uniform sales, providing bespoke athletic apparel for sports teams, clubs, and various organizations. This segment is characterized by substantial bulk orders, cultivating robust relationships with institutional clients.

This specialized offering allows Descente to cater to the unique requirements of specific teams, effectively leveraging its design and manufacturing expertise. For instance, Descente’s collaboration with Gen.G Esports for their uniforms highlights this capability. In 2023, the global custom sports apparel market was valued at approximately $15.6 billion, with projections indicating continued growth.

- Customization Focus: Revenue stems from providing uniquely designed uniforms and apparel tailored to team branding and specific sport needs.

- Institutional Client Relationships: This stream builds loyalty and recurring revenue through partnerships with sports organizations and clubs.

- Bulk Order Economics: Larger order volumes contribute significantly to revenue, optimizing production and distribution.

- Brand Leverage: Utilizes Descente's design prowess and manufacturing quality to meet high-performance and aesthetic demands.

Descente's revenue streams are diverse, encompassing direct-to-consumer sales through its own e-commerce and physical stores, as well as significant wholesale partnerships with various retailers globally. The company also generates income through brand licensing and sales of outlet/clearance items, strategically managing inventory while expanding market reach. Furthermore, custom team and uniform sales represent a key revenue driver, catering to the specific needs of sports organizations.

| Revenue Stream | Description | Fiscal Year 2023 Data/Notes |

| Direct-to-Consumer (DTC) | Sales via Descente's own e-commerce and physical stores. | Company aims to significantly boost DTC sales by FY2026. |

| Wholesale | Sales to specialty sports shops, department stores, and sporting goods chains. | ¥135.8 billion consolidated net sales in FY2023, with wholesale being a major contributor. |

| Licensing | Brand name and technology licensing to other companies for related products. | Continued leveraging of brand reputation and innovation in 2024. |

| Outlet/Clearance Sales | Sales of older season, discounted, or surplus inventory. | Significant portion of revenue in FY2024 from these channels for inventory turnover. |

| Custom Team/Uniform Sales | Bespoke athletic apparel for sports teams, clubs, and organizations. | Collaborations like Gen.G Esports uniforms; global custom sports apparel market valued at ~$15.6 billion in 2023. |

Business Model Canvas Data Sources

The Descente Business Model Canvas is built using a combination of internal sales data, customer feedback surveys, and competitive market analysis. This ensures a comprehensive understanding of Descente's operations and market position.