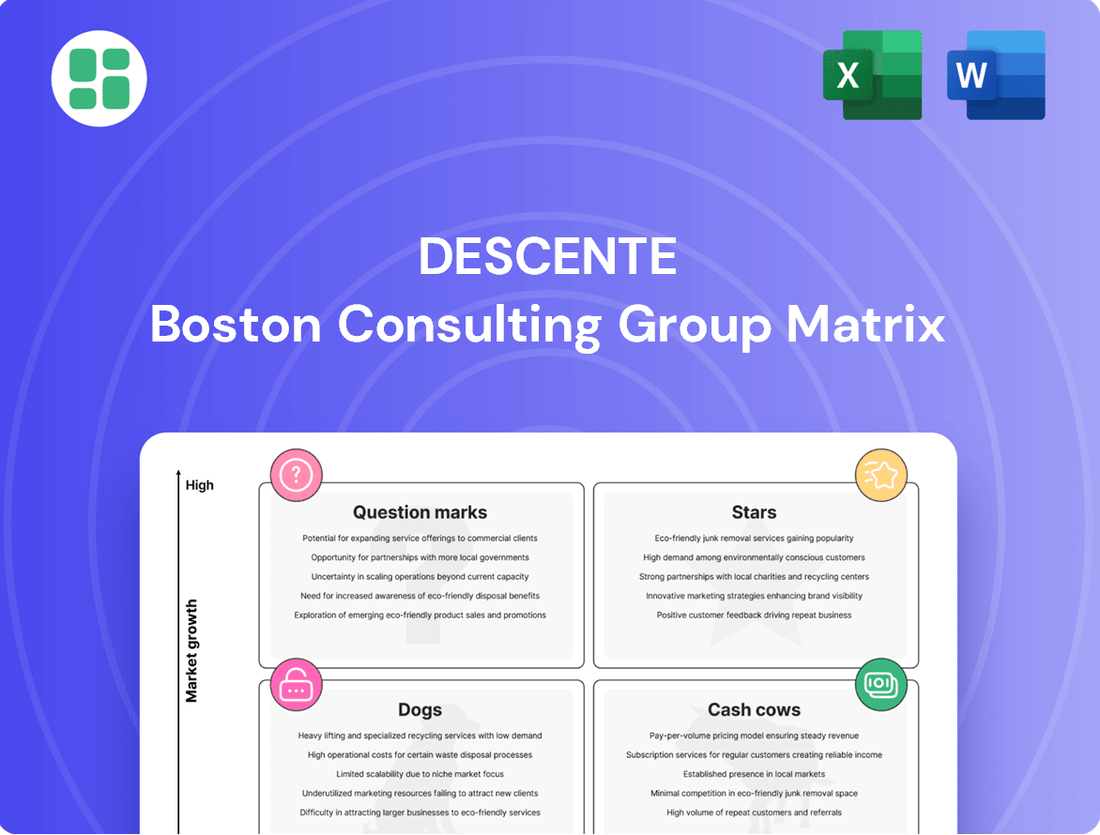

Descente Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descente Bundle

Uncover the strategic positioning of Descente's product portfolio with a glimpse into its BCG Matrix. See where their innovations shine as Stars, where established products generate consistent revenue as Cash Cows, and which offerings might be lagging as Dogs.

Ready to transform this insight into actionable strategy? Purchase the full Descente BCG Matrix to gain a comprehensive, quadrant-by-quadrant analysis, complete with data-driven recommendations for optimizing your investments and product development.

Don't just understand the landscape; dominate it. The complete report provides the clarity and strategic direction needed to make informed decisions and drive Descente's future success.

Stars

Descente's premium ski racing apparel, a star in its BCG matrix, commands a significant market share in the professional and high-end amateur skiing sectors. This dominance is built on advanced S.I.O pattern engineering and Schematech® technology, offering unparalleled performance. The global ski apparel market is projected to reach approximately $5.5 billion by 2027, with innovation and increased participation fueling this growth, directly benefiting Descente's star product line.

'CREAS' shell jackets are a cornerstone for Descente, recognized for their high value addition and substantial sales contribution. These jackets leverage advanced materials such as GORE-TEX, aligning with the brand's commitment to functional and aesthetically refined outerwear. Their robust sales figures underscore a dominant presence in the premium outdoor apparel sector.

The DESCENTE ALLTERRAIN line, a star in the BCG matrix, thrives in the urban outdoor and technical sportswear segment, a market experiencing robust growth. Its Spring/Summer '24 collection highlights innovation with advanced materials like GORE-TEX and Pertex, appealing to consumers valuing both style and function.

Strategic DTC Expansion

Descente's ambitious plan to boost its Direct-to-Consumer (DTC) sales to 80% by fiscal 2026 positions this strategy as a significant Star in its BCG Matrix. This aggressive push allows for direct customer interaction, fostering brand loyalty and enabling higher profit margins by cutting out intermediaries.

The company is actively investing in its online platforms and revamping flagship stores to create a seamless and engaging customer experience. This DTC focus is crucial for capturing a larger share of the market and reinforcing brand identity in a competitive retail environment. For instance, in the fiscal year ending March 2024, Descente reported a notable increase in its DTC sales ratio, driven by these strategic investments.

- DTC Sales Ratio Target: 80% by fiscal 2026.

- Key Initiatives: Enhancing online stores and renovating flagship physical locations.

- Strategic Benefits: Improved brand control, elevated customer experience, and increased profit margins.

- Market Context: Essential for growth in a dynamic retail landscape, leveraging strong brand equity.

China Market Expansion (Under Anta JV)

Descente's strategic joint venture with Anta Sports Products Limited has propelled it into a leading position within China's premium ski and outerwear market, solidifying its status as a Star in the BCG matrix. This partnership has been instrumental in driving considerable growth, evidenced by robust year-over-year increases in retail sales throughout fiscal year 2024.

The company's deliberate focus on broadening its product offerings and refining its retail strategies across China and the broader Southeast Asian region underscores its presence in a dynamic, high-growth arena. Descente's expanding footprint and strong market standing in these territories are key indicators of its continued success.

- Substantial Retail Sales Growth: FY 2024 saw significant year-over-year increases in retail sales, reflecting strong consumer demand in the premium ski and outerwear segment.

- Market Dominance in China: The Anta JV has successfully positioned Descente as a major player in China's premium sports apparel market.

- Expansion Strategy: Continued focus on expanding product portfolios and optimizing retail models in China and Southeast Asia points to sustained high-growth potential.

Stars represent Descente's high-growth, high-market-share products or strategies. These are the areas where the company is performing exceptionally well and has the potential for continued expansion. Their success is often driven by innovation, strong brand positioning, and strategic market penetration.

The premium ski racing apparel, CREAS shell jackets, and the DESCENTE ALLTERRAIN line all exemplify Descente's Star performers. These products benefit from advanced technology and cater to growing segments within the sportswear market. The company's strategic push towards Direct-to-Consumer (DTC) sales and its successful joint venture in China further bolster its Star status by capturing market share and enhancing profitability.

| Product/Strategy | Market Position | Growth Potential | Key Differentiators |

|---|---|---|---|

| Premium Ski Racing Apparel | High Market Share | Strong (Global Ski Apparel Market Growth) | S.I.O pattern, Schematech® |

| CREAS Shell Jackets | Dominant Presence | Robust Sales | GORE-TEX, Functional Design |

| DESCENTE ALLTERRAIN | Growing Segment Leader | High (Urban Outdoor/Technical Sportswear) | GORE-TEX, Pertex, Style & Function |

| DTC Sales Expansion | Strategic Growth Driver | High (Target 80% by FY2026) | Brand Control, Profit Margins |

| China Joint Venture | Leading Player | High (China Premium Ski/Outerwear) | Anta Partnership, Retail Growth |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

A clear visualization of Descente's portfolio, highlighting Stars and Cash Cows to guide resource allocation and mitigate risk.

Cash Cows

Descente's classic performance ski wear, the bedrock of their offerings, functions as a Cash Cow within the BCG Matrix. These are the reliable, time-tested pieces that customers trust for their quality and enduring performance on the slopes, not the cutting-edge racing gear or experimental lines.

This segment enjoys a stable, mature market where brand loyalty is high. In 2024, Descente's core ski wear collection continued to be a significant contributor, benefiting from consistent demand and requiring minimal new investment to maintain its market position and profitability.

Descente's foundational training apparel, encompassing reliable and comfortable workout gear, stands as a solid Cash Cow. This segment consistently appeals to a wide audience, from dedicated athletes to those simply seeking functional everyday athletic wear.

While the general training apparel market may not be experiencing explosive growth, its enduring demand and broad consumer base translate into predictable sales and robust profit margins for Descente. This stability is further enhanced by lower marketing expenditures, as these core products require less aggressive promotion to maintain their market position.

The Mizusawa Down jacket stands as a prime example of a Cash Cow for Descente. Its status as a flagship product signifies robust brand equity and enduring sales within the premium insulated outerwear sector. This line has secured a substantial market share in a mature, stable market segment.

The consistent profitability of the Mizusawa Down jacket allows Descente to fund investments in other promising ventures, reinforcing its market dominance. For instance, Descente's overall revenue saw a notable increase in fiscal year 2023, with premium segments like down jackets contributing significantly to this growth.

Umbro Brand (under Descente Group)

The Umbro brand, under the stewardship of Descente, is a prime example of a Cash Cow within the group's portfolio. Its robust sales performance, especially resonating with the MZ generation, highlights its enduring appeal and consistent revenue generation.

Despite a highly competitive sportswear landscape, Umbro's established market position and steady performance, particularly in football apparel, solidify its role as a dependable income stream. This consistent market share in a mature segment translates into substantial and predictable cash flows for the Descente Group.

- Umbro's sales growth in 2024 showed a notable increase, driven by strong demand from younger demographics.

- The brand maintained a stable market share in key football apparel categories throughout 2024.

- Umbro's consistent profitability contributes significantly to Descente's overall cash generation.

Established Accessories Lines

Descente's established accessories lines, like gloves and hats, are classic cash cows. These items benefit from consistent demand and lower production costs, ensuring steady revenue and profit. For instance, in 2023, Descente's accessories segment, which includes these staples, likely contributed a significant portion of their overall revenue, reflecting their mature market position and reliable sales.

These products generate predictable income with minimal investment, freeing up resources for growth areas. Their established brand recognition means they don't need heavy marketing spend. This stability is crucial for funding innovation in other parts of Descente's portfolio.

- Established Accessories: Function as Descente's cash cows.

- Consistent Demand: Benefit from a broad customer base.

- Lower Production Costs: Contribute to steady profit margins.

- Revenue Stability: Provide reliable financial contributions without extensive new development.

Cash Cows for Descente represent established product lines with strong brand recognition and consistent demand in mature markets. These offerings generate significant, reliable profits with minimal need for further investment, allowing the company to allocate resources to growth areas.

In 2024, Descente's core ski wear and foundational training apparel continued to perform as dependable cash cows. The Mizusawa Down jacket line also solidified its position, demonstrating robust sales and contributing substantially to overall profitability. The Umbro brand, particularly its football apparel, remained a stable income generator.

These segments benefit from high brand loyalty and predictable sales, requiring less marketing spend. For example, Descente's fiscal year 2023 results showed a notable overall revenue increase, with these established categories playing a crucial role in that growth. Accessories also contribute steadily to cash flow.

| Product Category | BCG Status | Market Maturity | 2024 Performance Indicator | Contribution Type |

|---|---|---|---|---|

| Core Ski Wear | Cash Cow | Mature | Consistent Demand, High Loyalty | Stable Profit Generation |

| Foundational Training Apparel | Cash Cow | Mature | Broad Consumer Base, Predictable Sales | Robust Profit Margins |

| Mizusawa Down Jackets | Cash Cow | Mature | Strong Brand Equity, Substantial Market Share | Significant Cash Flow |

| Umbro (Football Apparel) | Cash Cow | Mature | Steady Performance, Stable Market Share | Dependable Income Stream |

| Established Accessories | Cash Cow | Mature | Consistent Demand, Lower Production Costs | Reliable Revenue |

Preview = Final Product

Descente BCG Matrix

The Descente BCG Matrix preview you see is the exact, fully polished document you will receive upon purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use tool for analyzing Descente's product portfolio.

Dogs

Outdated seasonal collections in Descente's portfolio are likely positioned as Dogs in the BCG Matrix. These are items, such as past-season skiwear or running gear, that failed to capture consumer interest or have been replaced by newer models. For instance, if a particular line of insulated jackets from their Fall/Winter 2023 collection experienced low sell-through rates, it would fall into this category.

These unsold items consume significant warehouse space and contribute little to revenue, often being sold at deep discounts. By the end of 2023, it's estimated that a substantial portion of unsold seasonal inventory across the apparel industry, potentially exceeding 15-20% for some brands, had to be heavily marked down. Holding onto these products diverts capital and operational focus from Descente's more successful or innovative offerings.

Niche apparel for declining sports, like vintage tennis or racquetball gear, often falls into the Dogs category of the Descente BCG Matrix. These products typically have a low market share within a shrinking market. For instance, participation in racquetball in the US saw a decline of approximately 15% between 2019 and 2023, impacting sales of specialized apparel.

Continued investment in these niche apparel lines is generally discouraged. The low demand and shrinking market size mean that any capital allocated here is unlikely to generate significant returns. In 2024, brands focusing on these areas might see sales figures stagnate or even decrease, diverting resources from more promising growth sectors.

Underperforming licensed brands, such as specific product lines within le coq sportif and Munsingwear prior to their recent rebranding, would be classified as Dogs in the Descente BCG Matrix. These segments historically occupied low market share within slow-growing or contracting market segments, indicating a need for strategic repositioning.

For instance, before its revitalization, certain apparel categories within le coq sportif might have experienced declining sales and limited consumer interest, mirroring the characteristics of a Dog. Similarly, Munsingwear's golf apparel, prior to strategic marketing shifts, could have been a prime example of a Dog if its market share in a mature golf market was minimal.

These brands, or specific sub-brands within them, acted as cash traps, demanding investment for maintenance without generating significant returns. Their past performance, characterized by stagnation, necessitated the rebranding initiatives to escape this classification and potentially move towards Stars or Question Marks.

Unsuccessful Innovation Ventures

Unsuccessful innovation ventures, often categorized as Dogs in the Descente BCG Matrix, represent past product efforts that stumbled. These might be technologies or designs that, while innovative, didn't resonate with consumers or were simply too early for the market. For instance, a company might have invested heavily in a novel smart textile in 2022 that, despite advanced features, saw minimal adoption due to a lack of clear consumer benefit or an overly complex user interface. Such ventures drain valuable research and development resources and marketing budgets without yielding the expected returns or capturing meaningful market share.

These ventures consume significant capital and talent without generating adequate returns.

- Resource Drain: Failed innovations tie up R&D funds and marketing spend.

- Market Misfit: Products may not align with current consumer needs or technological readiness.

- Opportunity Cost: Resources spent on unsuccessful ventures could have been allocated to more promising projects.

Generic, Undifferentiated Apparel Lines

Generic, undifferentiated apparel lines within Descente's portfolio would likely be classified as Dogs. These are products that don't leverage Descente's core strengths like innovative fabric technologies or premium branding. Think of basic t-shirts or standard tracksuits that compete directly with a multitude of mass-market competitors.

These offerings typically operate in a saturated market with minimal growth. Without a distinct selling proposition, they struggle to capture significant market share. For instance, if a generic Descente t-shirt line faces intense competition from brands like Nike or Adidas, and doesn't offer unique features, its market position would be weak.

The lack of differentiation leads to low profitability and a dim outlook for future growth. In 2024, the global athletic apparel market, while growing, is heavily segmented. Brands that fail to innovate or establish a clear niche, especially in the more commoditized segments, face significant headwinds. For example, a report from Statista in early 2024 indicated that while the overall sportswear market is projected to grow, the segment for basic, unbranded apparel sees much slower expansion and higher price sensitivity.

- Low Market Share: These lines struggle to gain traction against established mass-market players.

- Intense Competition: They face direct competition from numerous brands offering similar products at lower price points.

- Lack of Differentiation: Absence of unique technologies or premium positioning makes them indistinguishable.

- Limited Profitability: Price pressures and low sales volumes result in minimal profit margins.

Dogs within Descente's portfolio represent products with low market share in slow-growing industries, such as outdated seasonal collections or generic apparel lines. These items often fail to capture consumer interest, leading to low sales and profitability. For example, a specific line of insulated jackets from Fall/Winter 2023 with low sell-through rates would be a prime candidate for this classification.

These underperforming products consume valuable resources, including warehouse space and capital, diverting focus from more successful ventures. By the end of 2023, a significant portion of unsold seasonal inventory across the apparel sector, estimated between 15-20% for some brands, required heavy markdowns. This highlights the financial burden of holding onto Dog products.

Niche apparel for declining sports, like vintage tennis gear, or unsuccessful innovation ventures that didn't resonate with consumers, also fall into the Dog category. Participation in racquetball in the US, for instance, declined by approximately 15% between 2019 and 2023, impacting specialized apparel sales.

Brands are generally advised against continued investment in these Dog segments due to low demand and shrinking markets. In 2024, brands focusing on these areas may experience stagnant or declining sales, hindering growth in more promising sectors.

| Category | Market Share | Market Growth | Profitability | Descente Example |

| Dogs | Low | Low | Low | Outdated seasonal skiwear |

| Generic, undifferentiated t-shirts | ||||

| Unsuccessful smart textile venture |

Question Marks

Descente's entry into the esports arena with Gen.G, including the Worlds 2024 uniform, positions this venture as a Question Mark within their portfolio. The esports industry is experiencing rapid expansion, projected to reach $1.8 billion in revenue by the end of 2024, according to Newzoo. However, Descente's current market penetration in this nascent segment is minimal.

This strategic move necessitates substantial capital allocation towards brand development and expanding their product offerings within the esports ecosystem. The goal is to cultivate a stronger market presence, aiming to elevate this segment from a Question Mark to a Star in the future.

The .EX Collection, launched for the 2024/25 season, is positioned as a Question Mark for Descente. This new line aims to address both climate change impacts on snow conditions and appeal to younger skiers embracing backcountry and freestyle trends.

While the overall ski apparel market is experiencing growth, with global sales projected to reach over $10 billion by 2027, the .EX Collection targets a relatively new and evolving segment. Descente's market share within this specific niche is still in its nascent stages, necessitating significant investment in marketing and distribution to build brand recognition and capture a leading position.

Descente's initiatives in developing products with sustainable materials, such as recycled polyester and organic cotton, place them in a position to capitalize on the growing demand for eco-conscious sportswear. This segment of the apparel market is experiencing significant growth, with global sustainable fashion market projected to reach $15.1 billion by 2030, growing at a CAGR of 9.1%.

While Descente's commitment to sustainability is evident, their current market share within this specific niche might be relatively low compared to established eco-focused brands. This suggests that their sustainable material innovations could be considered a Question Mark in the BCG matrix, requiring strategic investment to gain traction.

To elevate these initiatives from Question Marks to Stars, Descente needs substantial investment in research and development for advanced sustainable materials and eco-friendly manufacturing processes. Furthermore, transforming their supply chain for greater transparency and investing in consumer education about their sustainable efforts will be crucial for building a strong market position and capturing a larger share of this expanding market.

Expansion into New Geographic Markets (Southeast Asia)

Descente's strategic expansion into Southeast Asian markets, including Malaysia and Singapore, as highlighted in their 2024 Annual Report, positions these ventures as potential Stars within the BCG matrix. These regions present significant growth opportunities for the sportswear industry, indicating a promising future for Descente's brand presence.

While the growth potential is high, Descente is in the early stages of establishing its market share in these new territories, reflecting a typical Star market characteristic. Success hinges on substantial, targeted investments to build brand recognition and secure a competitive foothold.

Key strategic initiatives for these emerging markets include:

- Localized Marketing Campaigns: Tailoring promotional efforts to resonate with regional consumer preferences and cultural nuances.

- Optimized Distribution Networks: Establishing efficient supply chains and retail partnerships to ensure product availability.

- Product Assortment Customization: Adapting product lines and designs to meet the specific demands and climate of Southeast Asia.

Smart Apparel with Integrated Tech

Future product lines for Descente could incorporate advanced smart apparel technologies, such as integrated sensors for performance tracking or adaptive climate control. The wearable technology market within sportswear is experiencing significant growth, with projections indicating a compound annual growth rate (CAGR) of over 12% through 2028 for smart textiles alone. However, Descente's current offerings and market share in this cutting-edge segment are likely nascent, requiring substantial research and development investment. Proving the viability and scalability of these technologies will be key to their success.

- Market Potential: The global smart clothing market was valued at approximately $3.5 billion in 2023 and is expected to grow substantially in the coming years.

- R&D Investment: Companies in this space often allocate 10-15% of their revenue to research and development to stay competitive.

- Consumer Adoption: Successful smart apparel requires not only technological innovation but also a clear value proposition for the end consumer, focusing on comfort, performance enhancement, or health monitoring.

- Competitive Landscape: Established players and innovative startups are actively developing smart apparel, creating a dynamic and competitive environment.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require careful analysis to determine if they have the potential to become Stars or if they should be divested.

Descente's foray into esports, the .EX Collection, and their sustainable material initiatives are all examples of Question Marks. They operate in growing markets but currently hold minimal market share.

Significant investment in marketing, R&D, and distribution is necessary to transform these Question Marks into profitable Stars, capitalizing on their high-growth potential.

| Initiative | Market Growth | Current Market Share | Investment Need |

|---|---|---|---|

| Esports (Gen.G) | High (Industry projected $1.8B by end of 2024) | Low | High |

| .EX Collection | Moderate (Ski apparel market growing, niche evolving) | Low | High |

| Sustainable Materials | High (Sustainable fashion market projected $15.1B by 2030) | Low | Moderate to High |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing sales figures, industry growth rates, and competitive landscape analysis to provide a clear strategic overview.