Descente Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descente Bundle

Descente's position within the competitive apparel landscape is shaped by a complex interplay of forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

The complete report reveals the real forces shaping Descente’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The sportswear industry's supplier base for advanced materials and specialized components is moderately concentrated. This means suppliers of high-performance fabrics, for instance, hold a degree of leverage. In 2024, the global technical textiles market, crucial for sportswear, was valued at approximately $55 billion, indicating a significant market for these specialized inputs.

Descente's commitment to innovative technologies and functional products necessitates a reliance on suppliers capable of delivering cutting-edge materials. This specialization can amplify the bargaining power of these key suppliers, particularly when their products are unique or protected by patents, potentially impacting Descente's cost structure.

Switching costs for Descente can be moderate, especially when dealing with suppliers of highly specialized or proprietary materials essential for their performance-driven apparel. While a broad range of textile suppliers exists, transitioning away from long-standing partners for advanced fabrics necessitates investment in new testing protocols and can lead to temporary supply chain disruptions, thereby strengthening the leverage of current specialized providers.

Suppliers providing unique, patented, or technologically advanced materials, like specialized moisture-wicking or temperature-regulating fabrics, wield considerable power over Descente. The company's focus on performance enhancement through these advanced materials makes it reliant on suppliers capable of delivering these distinct components.

Descente's commitment to athletic performance through cutting-edge materials means its ability to innovate and differentiate its products is directly tied to the capabilities of its suppliers. This dependency grants suppliers a stronger negotiating position.

The market for advanced sports materials is characterized by rapid technological progress, which in turn drives up the production costs associated with these complex, high-performance fabrics. For instance, specialized synthetic fibers can cost significantly more to produce than standard textiles.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Descente's business, meaning they start producing and selling finished sportswear themselves, is generally quite low. Most material suppliers, like textile mills or chemical producers, simply don't have the brand name, the stores, or the advertising savvy to go head-to-head with established sportswear giants like Descente. Their expertise lies in making the raw materials, not in creating and marketing consumer apparel brands. For example, in 2024, the global textile market was valued at over $1 trillion, but the vast majority of this revenue came from the production of fabrics and yarns, not from brands that directly sold to consumers.

While the overall risk is low, there's a slight possibility that very large chemical or textile companies could decide to move into producing specialized components or even finished goods. These conglomerates, with their significant resources, might develop the capabilities to gain more control over their supply chain by venturing into areas closer to the end consumer. However, this remains a niche concern rather than a widespread threat across the industry.

- Low Brand Recognition: Suppliers typically lack the consumer-facing brand equity necessary to compete directly with established sportswear labels.

- Limited Distribution Networks: Most material producers do not possess the retail infrastructure or e-commerce capabilities to reach end consumers effectively.

- Absence of Marketing Expertise: The skills required for consumer marketing and brand building are generally outside the core competencies of raw material suppliers.

- Focus on Core Competencies: The primary business of textile and chemical suppliers remains material production, not the development and sale of finished apparel.

Importance of Descente to Suppliers

Descente's status as a prominent Japanese sportswear brand with a global reach makes it a valuable customer for its suppliers, especially those providing specialized, high-performance materials. The prospect of losing Descente as a client can represent a significant financial impact for a supplier, thereby moderating their overall bargaining power during negotiations.

However, the bargaining power of suppliers can shift dramatically when they offer highly unique or proprietary inputs. In such scenarios, Descente's reliance on these specific materials can grant those suppliers considerable leverage. For instance, if a supplier holds patents on advanced waterproof-breathable fabrics critical to Descente's premium outdoor lines, their ability to dictate terms increases substantially.

In 2024, the sportswear industry continued to see demand for innovative materials. Suppliers who could consistently deliver on performance, sustainability, and unique technological advantages found themselves in a stronger negotiating position with brands like Descente. The ability to secure exclusive supply agreements for such materials would further bolster a supplier's importance and, consequently, their bargaining power.

- Supplier Dependence: Descente's global presence and reputation make it a key customer, potentially limiting supplier bargaining power due to the risk of losing this significant contract.

- Uniqueness of Inputs: Suppliers providing highly specialized or patented materials, essential for Descente's product differentiation, can wield considerable influence.

- Market Dynamics (2024): The ongoing demand for advanced and sustainable materials in sportswear in 2024 empowered suppliers offering such innovations, strengthening their negotiating stance with brands like Descente.

Suppliers of specialized, high-performance materials possess significant bargaining power over Descente due to the company's reliance on these unique inputs for product differentiation. This power is amplified when suppliers offer patented technologies or materials with limited alternatives, as seen in the advanced fabric market. While Descente's global standing makes it a valuable client, the critical nature of certain materials can shift negotiations in favor of the supplier.

| Factor | Impact on Descente | Supporting Data (2024 Estimates) |

|---|---|---|

| Supplier Concentration | Moderate; specialized suppliers have leverage. | Global technical textiles market valued at ~$55 billion. |

| Uniqueness of Inputs | High; patented/advanced materials increase supplier power. | Demand for innovative, sustainable sportswear materials remains strong. |

| Switching Costs | Moderate; transitioning from specialized suppliers is complex. | New testing protocols and potential supply chain disruptions increase reliance. |

| Threat of Forward Integration | Low; suppliers lack brand and distribution expertise. | Consumer apparel market dominated by established brands. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Descente's position in the athletic apparel industry.

Effortlessly visualize competitive intensity with a dynamic, interactive five forces chart, transforming complex analysis into actionable insights.

Customers Bargaining Power

Customer price sensitivity in the athletic apparel market is a key factor influencing Descente's bargaining power. While some consumers, particularly those seeking high-performance gear, are willing to pay more for advanced technology and quality, the broader market includes many price-conscious shoppers. For instance, the global sportswear market was valued at approximately $200 billion in 2023, with a significant portion driven by value-oriented consumers.

This price consciousness becomes more potent for Descente when its products are perceived as less differentiated or when competitive alternatives, including fast fashion brands and the growing resale market, offer similar aesthetics at lower price points. The secondhand apparel market, for example, is projected to grow significantly, further increasing consumer options and potentially dampening price premiums for established brands.

The athletic wear market in 2024 is characterized by an overwhelming number of brands, from global giants like Nike and Adidas to emerging direct-to-consumer labels. This sheer volume of choice significantly amplifies customer bargaining power. For instance, the global sportswear market was valued at approximately $195.5 billion in 2023 and is projected to reach $304.5 billion by 2030, indicating intense competition and a wide selection for consumers.

Furthermore, the increasing trend of athleisure, where athletic wear is seamlessly integrated into everyday fashion, means consumers have even more alternatives. They can choose from specialized sportswear, fast-fashion casual wear, or even vintage clothing for their needs, often without incurring substantial switching costs. This flexibility allows customers to readily compare prices, quality, and styles across a broad spectrum of offerings, pushing brands to offer competitive value.

Customers today are remarkably well-informed, readily accessing details on product features, materials used, and a brand's overall reputation. This knowledge empowers them to meticulously compare options and make more discerning choices, directly influencing their purchasing decisions. For instance, in 2024, online reviews and detailed product specifications have become primary decision-making tools for a significant portion of apparel shoppers.

While Descente is actively cultivating brand loyalty through its commitment to high-quality, innovative products, the market remains dynamic. Consumers are increasingly willing to explore and adopt new brands and emerging products, especially those offering perceived value or unique selling propositions. This openness means that even established brands must continually earn customer trust and preference.

The expansion of direct-to-consumer (DTC) channels, a strategy Descente is embracing, offers a powerful avenue for direct customer engagement. These channels facilitate immediate feedback loops and foster a more profound brand connection, which can, in turn, help to temper the inherent bargaining power of customers by building stronger relationships and brand affinity.

Switching Costs for Customers

Switching costs for customers in the sportswear industry are typically low. This means consumers can readily shift their purchases between brands without facing significant financial penalties or functional disruptions. For instance, a customer looking for new running shoes can easily try a different brand if they are dissatisfied with their current choice, perhaps finding a better price or a more appealing design.

This low barrier to switching directly amplifies the bargaining power of customers. When it's easy to change suppliers, customers have more leverage to demand better prices, higher quality, or improved service. In 2024, the sportswear market saw continued intense competition, with brands like Nike and Adidas frequently offering promotions and new product lines to retain and attract customers, a direct reflection of this customer power.

- Low Financial Commitment: Customers rarely incur substantial fees or investments when switching sportswear brands.

- Ease of Access to Alternatives: The sportswear market is saturated with numerous brands offering similar products, making alternatives readily available.

- Minimal Functional Disruption: Changing from one athletic apparel or footwear brand to another doesn't require customers to learn new systems or adapt to different functionalities.

- Brand Loyalty vs. Price Sensitivity: While some brand loyalty exists, price and perceived value often drive purchasing decisions, especially for casual sportswear consumers.

Concentration of Customers

Descente's broad global reach across diverse sports segments, from skiing to golf, means its individual customer base is highly fragmented. This lack of significant customer concentration inherently limits the bargaining power of any single buyer or small group of buyers. For instance, in 2024, Descente's direct-to-consumer sales, while growing, still represent a smaller portion of their overall revenue compared to wholesale, indicating a wide distribution network rather than reliance on a few large individual purchasers.

However, the bargaining power shifts when considering business-to-business customers. Large, influential retail chains or major sporting goods distributors can wield considerable leverage due to the volume of Descente products they carry. These entities can negotiate terms, pricing, and promotional support, impacting Descente's margins and market access. The concentration of sales through a few key wholesale partners in major markets like Japan and Korea in 2024 underscores this dynamic.

- Fragmented Individual Customer Base: Descente's appeal to a wide array of athletes and enthusiasts globally prevents any single consumer from having significant influence.

- Wholesale Channel Power: Large retail partners and distributors represent a more concentrated customer segment, capable of exerting greater bargaining power due to order volume.

- Geographic Sales Distribution: In 2024, a notable percentage of Descente's revenue was generated through wholesale channels in key Asian markets, highlighting the importance of managing relationships with these larger buyers.

Customers in the athletic apparel market possess significant bargaining power due to low switching costs and a wide array of readily available alternatives. The sheer volume of brands, from global giants to emerging labels, means consumers can easily compare prices and features, pushing companies like Descente to offer competitive value. For instance, the global sportswear market was valued at approximately $195.5 billion in 2023, highlighting the intense competition consumers face.

This power is amplified by informed consumers who readily access product details and reviews, enabling them to make discerning choices. While Descente builds loyalty through quality, the market's openness to new brands means continuous effort is needed to retain customer preference. The growth of direct-to-consumer channels, embraced by Descente, helps foster stronger brand connections, potentially mitigating some of this customer leverage.

The bargaining power of customers is further influenced by their low financial commitment when switching brands, as there are rarely significant penalties. This ease of transition allows customers to demand better pricing and quality. In 2024, the sportswear market continued to see aggressive promotions from major players, a clear indication of this customer influence.

Descente's fragmented individual customer base limits the power of any single buyer, as their global reach spans diverse sports and enthusiasts. However, large wholesale partners and distributors represent a more concentrated customer segment with considerable leverage due to order volumes. In 2024, a significant portion of Descente's revenue was derived from these key wholesale channels in major Asian markets, underscoring their importance.

| Factor | Impact on Descente | 2024 Market Context |

| Low Switching Costs | Amplifies customer power to demand better terms. | Customers can easily shift between brands offering similar athletic wear. |

| Availability of Alternatives | Increases competition and price pressure. | The sportswear market is saturated, with numerous brands and product options. |

| Informed Consumers | Empowers customers to compare and choose based on detailed information. | Online reviews and product specifications are key decision-making tools for shoppers. |

| Wholesale Channel Concentration | Grants significant leverage to large retail partners and distributors. | Key wholesale partners in Asian markets represented a substantial revenue source for Descente in 2024. |

What You See Is What You Get

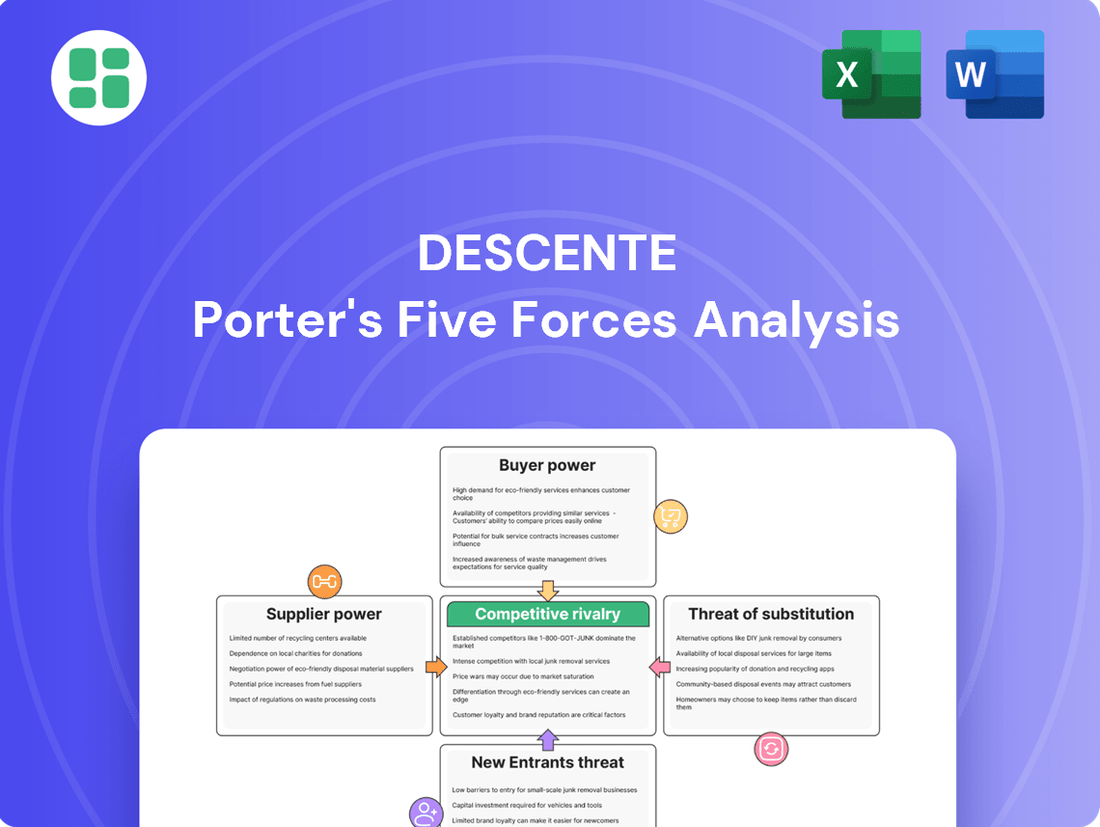

Descente Porter's Five Forces Analysis

This preview showcases the complete Descente Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the athletic apparel industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies and full readiness for your strategic planning.

Rivalry Among Competitors

The global sportswear market is a crowded arena, featuring a vast array of both local and international competitors. Major global brands such as Nike, Adidas, Puma, and Under Armour dominate, but they are joined by a multitude of specialized niche brands catering to specific sports or consumer preferences. This fragmentation means Descente constantly navigates a complex competitive landscape.

Descente's competitive rivalry is significantly shaped by these established multi-brand conglomerates, which possess substantial resources for marketing, research and development, and distribution. Beyond these giants, emerging challenger brands are also making inroads, often by focusing on innovative designs, sustainable practices, or specific athletic communities, further intensifying the pressure on Descente.

In 2024, the sportswear industry continues to see significant investment and expansion. For instance, the global sportswear market size was valued at approximately USD 200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2030, indicating ongoing robust competition and market opportunities.

The sportswear industry is robust, with the global market anticipated to exceed USD 385 billion by 2025. This sustained expansion, however, is showing signs of moderation.

Growth is projected to decelerate from 7% between 2021 and 2024 to an estimated 6% for the period of 2024 to 2029. This slight slowdown in the overall growth rate can heighten competitive pressures as companies vie more intensely for market share.

Descente's competitive landscape is heavily shaped by product differentiation, particularly through advancements in technology, materials, and design. The company actively pursues innovation in these areas, aiming to provide superior performance for athletes and active individuals.

Significant investment in research and development is a hallmark of this sector, leading to features like advanced moisture-wicking fabrics and intelligent temperature regulation systems. For instance, Descente's proprietary Heat Navi technology aims to convert infrared rays into heat, a key differentiator in winter sportswear.

While such innovation can create temporary competitive advantages, the rapid pace of imitation in the apparel industry means these benefits can be short-lived. Companies must constantly innovate to stay ahead, as competitors quickly adopt and adapt successful technologies.

Brand Identity and Marketing Intensity

Sportswear brands pour significant resources into marketing, sponsorships, and brand building to forge strong identities and foster customer loyalty. This intense marketing activity creates a barrier to entry for new players and intensifies rivalry among established ones, as companies constantly vie for consumer attention and market share.

Descente, for instance, leverages its reputation for high-performance and premium positioning, utilizing sponsorships and targeted marketing campaigns to differentiate itself in a highly competitive landscape. In 2023, the global sportswear market was valued at approximately $200 billion, with marketing and advertising accounting for a substantial portion of operational expenses for leading brands.

- Brand Investment: Major sportswear companies often allocate over 10% of their revenue to marketing and advertising.

- Sponsorship Impact: Athlete and team endorsements, like those Descente engages in, can significantly boost brand visibility and credibility.

- Emotional Connection: Successfully linking a brand to aspirational lifestyles or peak performance resonates deeply with consumers, driving engagement.

- Market Saturation: The sheer volume of marketing messages means brands must be highly innovative to cut through the noise and capture consumer interest.

Exit Barriers

Exit barriers in the sportswear sector are often substantial, stemming from considerable investments in specialized manufacturing plants and extensive global supply chains. For instance, a company like Nike, which heavily relies on its proprietary manufacturing technologies and vast distribution networks, would face significant costs and operational disruptions if it decided to exit.

The need to liquidate specialized machinery and manage existing inventory, often in large volumes, further complicates an exit. Consider the challenge of selling off advanced textile machinery or disposing of thousands of pairs of unsold athletic shoes.

Furthermore, brand equity and customer loyalty represent significant intangible assets that are difficult to divest. A brand like Adidas has cultivated decades of consumer trust and recognition, making a clean break from its established market presence and workforce incredibly challenging and costly.

- High Capital Investment: Significant upfront costs in factories, equipment, and R&D create a substantial hurdle for exiting firms.

- Inventory Management: Disposing of unsold goods, especially seasonal or trend-driven items, can lead to substantial losses.

- Brand Equity and Reputation: The value built in a brand is hard to transfer or sell, making a complete exit difficult without significant reputational damage.

- Employee and Stakeholder Relations: Managing workforce layoffs and contractual obligations with suppliers or distributors adds complexity and cost to exiting the market.

Competitive rivalry within the sportswear industry is intense, driven by a mix of global giants and niche players. The market's projected growth, though moderating, still fuels aggressive competition as companies fight for market share. This rivalry is further amplified by the constant need for product innovation and significant marketing investments.

Descente must continually innovate in materials and design, like its Heat Navi technology, to stay ahead. However, the rapid pace of imitation means these advantages are often short-lived. Brands also invest heavily in marketing and sponsorships, creating a noisy environment where cutting through the clutter is paramount for capturing consumer attention.

The sportswear market is expected to reach over $385 billion by 2025, with growth rates projected to slow from 7% (2021-2024) to 6% (2024-2029). This slight deceleration intensifies competition as firms seek to maintain or increase their slice of the market. For example, major brands often dedicate over 10% of revenue to marketing and advertising efforts.

| Key Competitive Factors | Impact on Descente | Industry Data (2024/2025 Projections) |

| Market Saturation & Growth Rate | High rivalry due to numerous competitors vying for market share as growth moderates. | Global sportswear market projected to exceed $385 billion by 2025; growth slowing from 7% to 6%. |

| Product Innovation & Differentiation | Necessity to invest in R&D (e.g., Heat Navi) to create unique selling propositions, though imitation is rapid. | Significant R&D spending by major players to develop advanced materials and technologies. |

| Marketing & Brand Building | Substantial investment required for sponsorships and advertising to build brand loyalty and visibility. | Leading brands allocate over 10% of revenue to marketing; market valued at approx. $200 billion in 2023. |

SSubstitutes Threaten

The rise of athleisure presents a significant threat of substitution for Descente. Over 70% of U.S. consumers now wear activewear as everyday clothing, blurring the lines between athletic and casual apparel. This widespread adoption means consumers can easily opt for versatile, non-specialized clothing for many activities previously requiring dedicated gear.

The growing appeal of a wide array of fitness and wellness pursuits, including yoga, Pilates, and home-based exercise routines, presents a significant threat of substitutes for traditional athletic apparel brands like Descente. These alternative activities often require less specialized or costly attire, potentially diminishing the perceived value of premium athletic wear.

For instance, in 2024, the global online fitness market saw substantial growth, with many individuals opting for subscription services offering guided workouts accessible from home. This trend means consumers might see less need to purchase high-performance gear, opting instead for comfortable, everyday clothing for these activities, thereby impacting demand for Descente's specialized offerings.

The burgeoning secondhand and discount market presents a substantial threat to premium athletic apparel brands like Descente. The proliferation of online resale platforms, such as Depop and Poshmark, has made it easier than ever for consumers to access pre-owned athletic wear at significantly lower price points. In 2023, the global secondhand apparel market was valued at approximately $177 billion, with projections indicating continued robust growth, further intensifying competition for new product sales.

Furthermore, the availability of cheaper, non-premium alternatives, including counterfeit products, directly siphons off potential customers. Budget-conscious consumers, and increasingly, those motivated by sustainability, may opt for pre-owned athletic clothing or lower-cost imitations rather than investing in new, high-performance apparel. This trend is particularly concerning for brands like Descente, which rely on perceived quality and brand prestige to justify their premium pricing.

Technological Advancements in Other Apparel

Technological advancements in everyday apparel present a significant threat of substitution for specialized athletic wear brands like Descente. Innovations in fabric technology are creating alternative clothing solutions that mimic the performance benefits of traditional athletic gear, such as superior moisture-wicking and temperature regulation. For instance, the global smart textiles market, which includes these advanced materials, was valued at approximately $3.7 billion in 2023 and is projected to grow substantially, indicating a broader adoption of such technologies beyond niche athletic applications.

As these high-performance materials become more accessible and integrated into mainstream fashion and casual wear, the perceived need for dedicated athletic apparel diminishes. Consumers may opt for versatile, technologically advanced casual clothing that can also serve their fitness needs, thereby reducing the demand for specialized athletic brands. This trend is supported by the increasing consumer interest in athleisure wear, blurring the lines between performance and everyday clothing.

The threat is amplified by the potential for these new materials to offer comparable or even superior comfort and functionality at competitive price points. This could lead to a significant shift in consumer purchasing habits, where the unique selling propositions of athletic brands are challenged by the widespread availability of advanced, multi-purpose apparel. For example, the development of new synthetic fibers with enhanced breathability and durability could be adopted by a wide range of apparel manufacturers, not just those focused on sports.

Key considerations regarding this threat include:

- Fabric Innovation: The continuous development of new technical fabrics that offer moisture-wicking, stretch, and durability.

- Market Accessibility: The increasing availability and affordability of these advanced materials across various apparel segments.

- Consumer Perception: The growing acceptance of non-athletic wear for fitness activities due to improved material performance.

- Brand Differentiation: The challenge for athletic brands to maintain a distinct advantage as performance features become commonplace in general apparel.

Changing Consumer Preferences

Consumer preferences are in constant flux, with a growing emphasis on comfort, versatility, and sustainability impacting how people choose apparel. For Descente, a brand known for its high-performance gear, this presents a significant threat of substitutes.

If consumers increasingly favor more general-purpose clothing over specialized athletic wear, Descente's core products face direct competition from less technical alternatives. This shift can be seen in the broader market trends where athleisure wear, designed for both athletic and casual use, has surged in popularity. For instance, the global athleisure market was valued at approximately $321 billion in 2023 and is projected to grow significantly, indicating a strong consumer pull towards versatile apparel.

- Shifting Demand: A move towards comfort and versatility means consumers might opt for less specialized, more adaptable clothing, bypassing brands like Descente that focus on performance-specific garments.

- Sustainability Focus: Growing consumer demand for eco-friendly and ethically produced clothing could lead consumers to substitute traditional performance wear with sustainable alternatives, even if they offer slightly different functionalities.

- Market Diversification: The rise of brands offering affordable, stylish, and comfortable athleisure wear directly challenges Descente's premium positioning in the high-performance segment.

The threat of substitutes for Descente arises from the increasing availability of versatile, everyday apparel that can also serve athletic purposes. This trend is fueled by advancements in fabric technology and a growing consumer preference for comfort and athleisure wear. The secondhand market also offers a more affordable alternative, directly impacting demand for new, premium athletic gear.

The global athleisure market's significant growth, reaching approximately $321 billion in 2023, underscores this shift. Consumers are increasingly choosing comfortable, adaptable clothing that bridges the gap between athletic and casual wear. This means Descente faces competition not only from other athletic brands but also from a wide array of fashion-focused apparel that incorporates performance-like features.

| Threat Category | Description | Market Data/Impact |

|---|---|---|

| Athleisure Wear | Clothing designed for both athletic and casual use. | Global market valued at ~$321 billion in 2023, indicating strong consumer preference for versatile apparel. |

| Fabric Innovation | Advanced materials offering moisture-wicking, stretch, and durability in everyday clothing. | Global smart textiles market valued at ~$3.7 billion in 2023, showing increasing integration of performance features into mainstream apparel. |

| Secondhand Market | Resale platforms offering pre-owned athletic wear at lower prices. | Global secondhand apparel market valued at ~$177 billion in 2023, providing a cost-effective substitute for new purchases. |

Entrants Threaten

Entering the competitive high-performance sportswear arena demands significant financial muscle. Companies need to allocate substantial capital towards cutting-edge research and development, state-of-the-art manufacturing, extensive marketing campaigns, and building robust global distribution networks. For instance, Descente, a key player, demonstrably invests in innovation, maintaining its own dedicated research and development facilities to stay ahead.

These considerable upfront financial commitments serve as a formidable barrier, effectively deterring many potential new entrants from even attempting to challenge established brands. The sheer scale of investment required to match existing infrastructure and brand recognition makes market entry a high-risk, capital-intensive endeavor.

The sportswear industry is a crowded space, heavily influenced by brands that have spent decades building strong customer relationships. Think of giants like Nike and Adidas; they've cultivated immense brand loyalty and recognition, making it tough for newcomers to break in.

For any new company entering this market, the biggest hurdle is convincing consumers to switch from brands they already trust and love. Building a reputable brand image and earning that trust takes significant time and investment, often requiring substantial marketing efforts to even get noticed.

In 2024, the sportswear market continues to be dominated by these established players. For instance, Nike's global revenue alone was reported to be over $51 billion in fiscal year 2024, showcasing the sheer scale and entrenched customer base that new entrants must contend with.

Newcomers face a significant challenge in securing access to established distribution channels. For a company like Descente, which has cultivated strong relationships with retailers and e-commerce platforms globally, this presents a substantial barrier. Building these networks from the ground up demands considerable capital and a lengthy timeframe, often proving prohibitive for emerging competitors.

Technological and R&D Expertise

The threat of new entrants in the high-performance sportswear sector is significantly influenced by the need for technological and R&D expertise. Success in this market requires continuous innovation in materials science and product design. For instance, companies like Descente demonstrate this through their focus on advanced materials and ergonomic designs, reflecting substantial investment in specialized knowledge.

New players must commit considerable resources to research and development to create proprietary technologies and functional advantages that can challenge established brands. Without this, they risk being unable to offer differentiated products. In 2023, the global sportswear market was valued at approximately $204 billion, with a significant portion driven by innovation in performance-enhancing apparel and footwear.

- High R&D Investment: New entrants must allocate substantial capital to R&D to develop unique material technologies and design innovations.

- Technological Barriers: Established brands often possess patents and proprietary knowledge, creating significant hurdles for newcomers.

- Material Science Advancement: Continuous breakthroughs in fabrics, such as moisture-wicking, temperature regulation, and lightweight durability, are critical competitive differentiators.

- Ergonomic Design Expertise: Understanding biomechanics and athletic movement to create optimized apparel requires specialized design talent.

Economies of Scale

Existing large-scale sportswear manufacturers, like Nike and Adidas, leverage significant economies of scale. This allows them to achieve lower per-unit production costs through bulk purchasing of raw materials and optimized manufacturing processes. For instance, in 2024, major players continued to benefit from these efficiencies, which are critical in a price-sensitive market.

New entrants, by contrast, would likely start with smaller production volumes. This inherently leads to higher per-unit costs for materials, labor, and overhead. The inability to match the cost structure of established firms presents a substantial barrier, making it challenging to compete effectively on price from the outset.

- Economies of scale in production

- Lower per-unit costs for established players

- Higher initial costs for new entrants

- Price competition disadvantage for newcomers

The threat of new entrants in the sportswear market is significantly mitigated by high capital requirements for R&D, manufacturing, and marketing. Established brands like Nike and Adidas, with revenues exceeding $51 billion in fiscal year 2024 for Nike alone, have built immense brand loyalty and distribution networks that are difficult and costly for newcomers to replicate.

New companies must overcome substantial technological barriers, including patents and proprietary knowledge in material science and ergonomic design, to compete effectively. The global sportswear market, valued at approximately $204 billion in 2023, is driven by continuous innovation, demanding significant investment in R&D from any potential entrant.

Economies of scale enjoyed by established players, leading to lower per-unit production costs, create a price disadvantage for new entrants operating at smaller volumes. This cost structure further solidifies the barriers to entry in this competitive landscape.

| Factor | Impact on New Entrants | Example Data (2024/2023) |

|---|---|---|

| Capital Requirements | Very High (R&D, Manufacturing, Marketing) | Nike Revenue FY24: >$51 Billion |

| Brand Loyalty & Recognition | High Barrier | Established brands have decades of customer trust. |

| Technological Expertise | High Barrier (Patents, Proprietary Knowledge) | Global Sportswear Market Value (2023): ~$204 Billion (driven by innovation) |

| Distribution Channels | Difficult to Access | Requires significant investment to build global networks. |

| Economies of Scale | Disadvantage (Higher per-unit costs) | Established players benefit from bulk purchasing and optimized production. |

Porter's Five Forces Analysis Data Sources

Our Descente Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Descente's annual reports, financial statements, and investor presentations. We also leverage industry-specific market research reports and competitor analysis from reputable sources to provide a thorough understanding of the competitive landscape.