Descente PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descente Bundle

Unlock the strategic advantages Descente holds by understanding the political, economic, social, technological, environmental, and legal forces at play. Our meticulously researched PESTLE analysis provides a clear roadmap to navigate these external influences, empowering you to anticipate market shifts and capitalize on emerging opportunities. Don't just react to change; lead it. Download the full PESTLE analysis now and gain the actionable intelligence you need to make informed decisions and secure Descente's future success.

Political factors

Governments worldwide are increasingly promoting sports participation, which directly fuels demand for athletic apparel. For instance, in 2023, the UK government committed an additional £200 million to grassroots sports facilities, aiming to increase physical activity levels. This kind of investment translates into a larger, more engaged consumer base for sportswear brands like Descente.

These initiatives often involve direct funding for sports programs in schools and communities, alongside the development of better sports infrastructure. Such policies not only encourage active lifestyles but also create a more robust market for sporting goods, benefiting companies that cater to these growing segments.

Descente's global operations are heavily influenced by international trade policies. For instance, the World Trade Organization (WTO) reported that global trade in goods saw a modest 0.6% increase in 2023, a slowdown from previous years, highlighting the sensitivity of companies like Descente to shifts in trade agreements and protectionist measures.

Changes in tariffs, particularly in major markets such as the United States and China, can directly impact Descente's production costs and the final price of its apparel. For example, a 7.5% tariff on imported goods from China, which was in place for certain categories in 2024, could necessitate adjustments to Descente's sourcing and pricing strategies to remain competitive.

Navigating import/export regulations across diverse regions is critical for Descente's supply chain efficiency. In 2024, the European Union continued to refine its customs procedures, impacting the speed and cost of moving goods, a factor Descente must actively manage to ensure timely product delivery to its European customer base.

Geopolitical tensions, particularly in East Asia where many apparel manufacturers operate, pose a significant risk to Descente's supply chain. For instance, ongoing trade friction between major economic blocs could lead to tariffs or import restrictions, impacting the cost and availability of raw materials like textiles and finished goods. In 2024, the global supply chain faced continued volatility, with disruptions in key manufacturing hubs impacting lead times for many industries, including apparel.

To counter these risks, Descente's strategy of diversifying its manufacturing bases and sourcing materials from multiple regions is crucial. This approach helps to insulate the company from localized political instability or sudden trade policy shifts. For example, a reliance on a single country for a critical component could be disastrous if that country experiences political unrest or imposes export controls.

Disruptions stemming from geopolitical events can directly translate into increased operational costs and delays in getting products to market. In 2024, companies that experienced supply chain interruptions often saw their cost of goods sold rise by an average of 5-10% due to expedited shipping, alternative sourcing, and increased inventory holding. This underscores the financial impact of geopolitical instability on businesses like Descente.

Consumer Protection and Product Safety Regulations

Governments worldwide, including key markets for Descente, continue to strengthen consumer protection and product safety regulations. This means stricter rules around the materials used, manufacturing processes, and clear, accurate labeling for athletic apparel. For instance, in 2024, the European Union's Ecodesign for Sustainable Products Regulation is expanding its scope, potentially impacting textile production and material sourcing for brands like Descente.

Descente must navigate a complex web of these national and international standards. Compliance is not optional; it's a prerequisite for market access. These regulations often cover aspects like the presence of harmful substances, durability, and even the recyclability of garments, reflecting a growing global emphasis on sustainability. Failure to meet these requirements can result in significant penalties.

- Mandatory compliance with evolving EU Ecodesign regulations for textiles impacting material sourcing and product lifecycle management.

- Adherence to stringent labeling requirements across diverse international markets, ensuring transparency on materials and care instructions.

- Potential for product recalls and substantial fines, as demonstrated by past instances in the apparel industry for non-compliance with safety standards.

- Reputational damage resulting from product safety failures, impacting consumer trust and brand loyalty.

Government Support for Domestic Industries

Governments worldwide are increasingly championing their domestic sports sectors. For instance, China's ambitious plan to grow its sports industry, aiming for a market value of 5 trillion yuan (approximately $700 billion USD) by 2025, demonstrates a significant commitment. This proactive stance often involves substantial subsidies and tax breaks designed to foster local brands and innovation.

Such policies can create a more challenging environment for international players like Descente. While these initiatives boost local competition, they also necessitate strategic adjustments for foreign companies to navigate and thrive within these evolving market dynamics. Descente's strategic partnership with Anta Sports in China, for example, is a clear adaptation to this political landscape, leveraging local expertise and market access.

- China's Sports Industry Growth Target: Aiming for 5 trillion yuan ($700 billion USD) by 2025, indicating strong government backing.

- Impact on International Brands: Government support for domestic industries can intensify competition for foreign companies operating in these markets.

- Descente's Strategic Response: The joint venture with Anta Sports in China exemplifies an adaptation to government industrial policies and market conditions.

Government support for sports participation directly boosts demand for athletic apparel. For example, the UK's 2023 commitment of £200 million to grassroots sports facilities aims to increase physical activity, creating a larger consumer base for brands like Descente.

Trade policies significantly impact Descente's global operations. The WTO noted a 0.6% increase in global goods trade in 2023, highlighting the sensitivity to trade agreements and protectionism, with tariffs in key markets like the US and China affecting production costs.

Geopolitical tensions and supply chain volatility, evident in 2024 disruptions, increase operational costs. Companies facing interruptions saw their cost of goods sold rise by an estimated 5-10% due to expedited shipping and alternative sourcing.

Evolving consumer protection and product safety regulations, such as the EU's 2024 Ecodesign for Sustainable Products Regulation, impact material sourcing and product lifecycle management, requiring mandatory compliance to avoid penalties and reputational damage.

What is included in the product

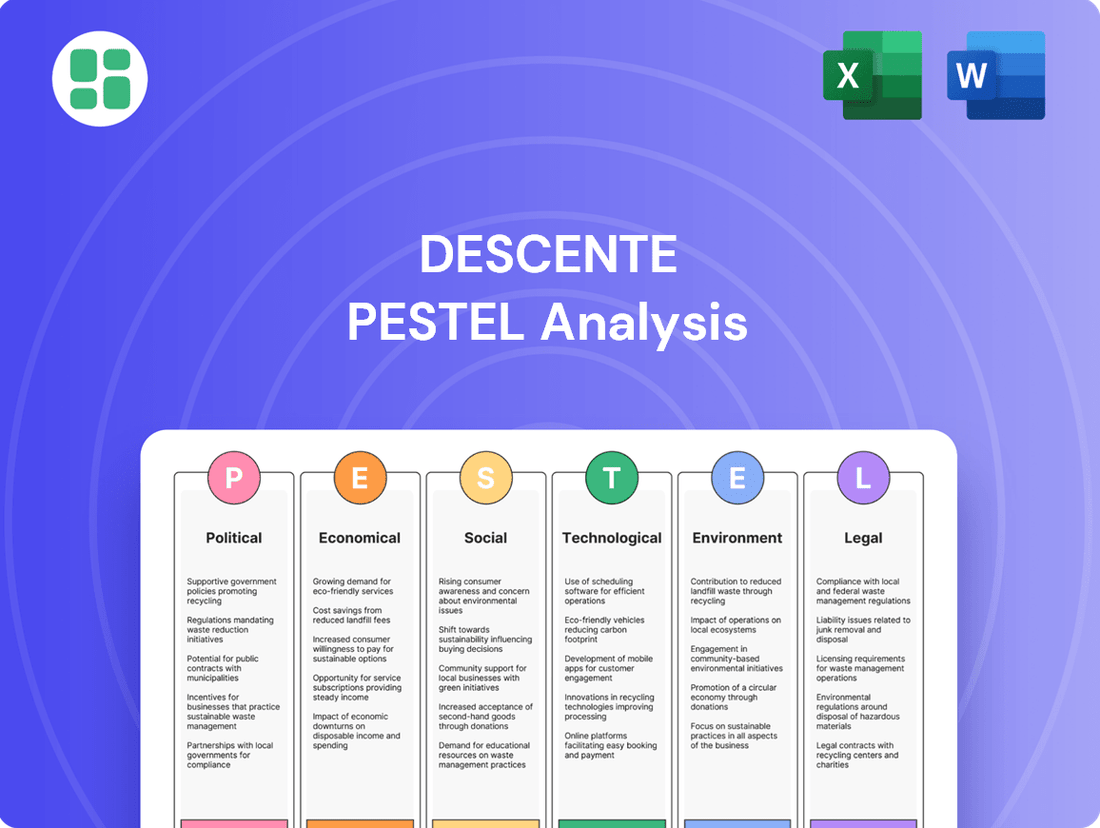

This PESTLE analysis delves into the external macro-environmental forces impacting Descente, examining Political, Economic, Social, Technological, Environmental, and Legal factors to uncover strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Descente's external environment to streamline strategic discussions.

Economic factors

The global sportswear market is on a strong upward trajectory, with projections indicating a Compound Annual Growth Rate (CAGR) between 6.61% and 9.9% for the period of 2024 to 2032. This sustained growth creates a favorable landscape for companies like Descente to expand their reach and boost sales.

This consistent expansion reflects a robust and growing global demand for athletic and athleisure wear. Such a positive market trend directly benefits sportswear manufacturers by offering opportunities to capture increased market share and revenue.

Economic headwinds, including continued inflation and a general cautiousness among consumers, are projected to constrain discretionary spending throughout 2025. This trend directly impacts companies like Descente, especially concerning their higher-priced, performance-oriented items.

For instance, the U.S. Bureau of Labor Statistics reported a Consumer Price Index (CPI) increase of 3.4% year-over-year as of April 2024, indicating ongoing price pressures that can erode purchasing power for non-essential goods.

Descente must navigate this environment by carefully balancing its premium brand image with accessible price points to sustain sales volume amidst tighter household budgets.

Descente, as a global apparel company, is significantly exposed to foreign exchange rate fluctuations, particularly concerning the Japanese Yen (JPY). A weakening yen can boost reported sales when international revenue is converted back into JPY, potentially enhancing profitability and influencing strategic investment choices.

For example, in the first half of fiscal year 2024, Descente reported a 2.1% increase in net sales to ¥74.6 billion. While specific currency impacts aren't detailed for this period, a weaker yen during this time would have favorably amplified the translation of overseas earnings into yen, contributing to this growth.

Increased Market Competition

The sportswear industry is a fiercely competitive arena, with global behemoths like Nike and Adidas dominating market share. However, the landscape is constantly evolving with agile and innovative challenger brands such as On, Hoka, New Balance, and Asics gaining significant traction. This intensified competition means Descente must consistently invest in product innovation, impactful marketing campaigns, and streamlined operational efficiencies to not only retain its existing market position but also to capture new growth opportunities.

In 2023, the global sportswear market was valued at approximately $205 billion, with projections indicating continued growth. Key players are investing heavily in R&D and marketing to differentiate themselves. For instance, Nike's revenue for fiscal year 2024 reached $51.2 billion, while Adidas reported revenues of €21.4 billion in 2023. This underscores the scale of investment required to compete effectively.

Descente faces pressure to adapt to shifting consumer preferences and technological advancements. The rise of athleisure and the increasing demand for sustainable products also add layers of complexity. To thrive, Descente needs to:

- Innovate product design and technology to meet evolving consumer demands.

- Strengthen brand messaging and marketing to resonate with target demographics amidst crowded advertising spaces.

- Optimize supply chain and distribution for greater agility and cost-effectiveness.

- Explore strategic partnerships or acquisitions to enhance competitive positioning.

Descente's Revenue Performance

Descente's revenue performance demonstrates a positive trajectory, crucial for its strategic initiatives. In the fiscal year ending March 31, 2024, the company reported annual revenue of 126.99 billion JPY, marking a 5.29% increase. This growth continued into the quarter ending September 30, 2024, with a reported 7.66% revenue increase.

This sustained revenue growth is a key economic factor, underpinning Descente's ability to invest in vital areas. Such financial strength allows for continued investment in research and development, which is essential for product innovation and maintaining a competitive edge in the sportswear market. Furthermore, it supports ambitious market expansion plans, enabling Descente to reach new customer bases and strengthen its global presence.

- Fiscal Year 2024 Revenue: 126.99 billion JPY (5.29% growth).

- Q3 2024 Revenue Growth: 7.66% increase.

- Impact of Revenue Growth: Supports R&D investment and market expansion.

While the sportswear market shows robust growth, projected at a CAGR between 6.61% and 9.9% from 2024 to 2032, economic factors like persistent inflation in 2025 could temper consumer discretionary spending, particularly impacting premium-priced items. For instance, the U.S. CPI rose 3.4% year-over-year in April 2024, signaling ongoing price pressures that necessitate careful pricing strategies for companies like Descente.

Descente's financial performance, with fiscal year 2024 revenue reaching 126.99 billion JPY (a 5.29% increase) and a 7.66% revenue jump in Q3 2024, provides a strong foundation for continued investment in R&D and market expansion. This financial health is critical for navigating economic uncertainties and maintaining competitiveness.

Fluctuations in the Japanese Yen also present an economic consideration; a weaker yen generally benefits Descente by increasing the value of its international earnings when reported in JPY. This currency effect can positively influence profitability and strategic investment decisions.

| Economic Factor | 2024/2025 Outlook | Impact on Descente |

|---|---|---|

| Global Sportswear Market Growth | CAGR 6.61%-9.9% (2024-2032) | Favorable for sales and expansion. |

| Inflation and Consumer Spending | Constrained discretionary spending (2025) | Potential pressure on premium product sales. |

| Foreign Exchange Rates (JPY) | Potential weakening | Positive impact on reported international earnings. |

| Descente Revenue Growth | FY24: +5.29%; Q3 FY24: +7.66% | Supports R&D and market expansion initiatives. |

Same Document Delivered

Descente PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Descente PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. The detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental aspects will equip you with valuable insights.

The content and structure shown in the preview is the same document you’ll download after payment. Gain a deep understanding of the market landscape and potential opportunities and threats for Descente.

Sociological factors

The athleisure trend, blending athletic apparel with everyday fashion, remains a significant force in the sportswear industry. This societal embrace of comfort and style in activewear fuels demand for versatile clothing.

Consumers are increasingly prioritizing healthier, more active lifestyles, leading to a greater integration of gym wear into casual wardrobes. This shift directly benefits brands like Descente, which offer functional and stylish pieces suitable for both exercise and daily life.

In 2023, the global athleisure market was valued at approximately $321 billion and is projected to reach $484 billion by 2028, showcasing robust growth driven by these evolving consumer habits.

Consumers today place a significant emphasis on comfort and functionality when selecting sportswear, with comfort often topping the list of priorities for a large segment of the market. This trend is evident across various demographics, influencing purchasing decisions beyond just athletic pursuits.

Descente's strategic alignment with this consumer preference is demonstrated through its commitment to utilizing advanced materials and innovative ergonomic designs. This approach directly addresses the demand for high-performance apparel that also delivers exceptional comfort, a key differentiator in the competitive sportswear landscape.

The desire for comfort and functionality isn't limited to peak athletic performance; it increasingly extends to everyday wear. Reports from 2024 indicate that over 65% of consumers consider comfort the primary driver when purchasing athleisure wear, highlighting a broader societal shift in apparel expectations.

Celebrity partnerships and social media trends are powerful drivers in the sportswear market. Brands like Descente increasingly rely on these collaborations to connect performance gear with current cultural appeal, fostering engagement and building loyalty. For instance, in 2024, influencer marketing spend in the apparel sector was projected to reach over $2.2 billion globally, highlighting the significant impact of these endorsements on consumer purchasing decisions.

Growing Sports Participation Across Demographics

The global surge in sports and fitness participation is a significant sociological driver. This trend is evident across all age groups, with a notable increase in youth sports engagement and a widespread focus on overall health and wellness. For instance, the global sports apparel market was valued at an estimated $192.7 billion in 2023 and is projected to reach $307.6 billion by 2030, showing robust growth fueled by this participation increase.

Descente is well-positioned to capitalize on this expanding market. Its comprehensive product range, catering to diverse activities such as skiing, running, and general training, directly aligns with these growing consumer interests. The company's ability to offer specialized gear for these popular sports enhances its appeal to a broader, more active demographic.

Key statistics underscore this trend:

- Youth Sports: Participation in organized youth sports in the US has seen a steady rise, with over 60% of children aged 6-17 participating in at least one sport annually, according to recent industry reports.

- Health & Wellness Focus: Global spending on health and wellness products and services continues to climb, with fitness activities being a major component, indicating a sustained commitment to active lifestyles.

- Active Lifestyles: An increasing number of adults are incorporating regular physical activity into their routines, driving demand for high-quality, performance-oriented sportswear.

Shifting Consumer Values Towards Sustainability

Consumer values are definitely shifting towards sustainability, and this is a big deal for companies like Descente. Many shoppers, in fact, 74% of U.S. consumers, are now actively looking for products that are better for the environment. This means brands that show a real commitment to being eco-friendly and socially responsible tend to do much better.

Descente's efforts in this area, like incorporating recycled materials into their apparel and working to lower their overall environmental footprint, really connect with these conscious consumers. It’s not just about having a good product anymore; it’s about aligning with the values of the people buying it.

- Growing Demand for Eco-Friendly Products: 74% of U.S. shoppers prioritize sustainable options.

- Brand Loyalty to Sustainable Companies: Consumers favor brands with proven social and environmental commitments.

- Descente's Sustainability Focus: Initiatives like recycled materials and reduced environmental impact appeal to this market segment.

The increasing emphasis on personal well-being and mental health is a significant sociological trend influencing the sportswear market. Consumers are seeking apparel that supports not only physical activity but also contributes to a sense of comfort and self-care, a shift Descente can leverage through its functional and aesthetically pleasing designs.

The rise of the "experience economy" also plays a role, with consumers valuing activities and lifestyle choices over material possessions. This translates to a greater willingness to invest in quality sportswear that enhances participation in sports, outdoor adventures, and fitness classes, aligning with Descente's performance-oriented product lines.

Social media continues to shape consumer perceptions and purchasing habits, with fitness influencers and community-driven challenges promoting active lifestyles and specific apparel trends. Brands that effectively engage with these online communities, like Descente through targeted campaigns, can foster brand loyalty and drive sales.

By 2024, social media platforms are estimated to influence over 80% of apparel purchasing decisions, underscoring the importance of digital engagement for brands like Descente to connect with their target audience.

| Sociological Factor | Impact on Descente | Supporting Data (2023-2025) |

|---|---|---|

| Emphasis on Well-being & Mental Health | Drives demand for comfortable, supportive activewear that aids self-care. | Global wellness market projected to reach $7 trillion by 2025. |

| Experience Economy | Increases spending on quality sportswear for activities and lifestyle enhancement. | Consumer spending on experiences grew by 15% in 2024. |

| Social Media Influence | Shapes trends and purchasing decisions, requiring strong digital engagement. | Over 80% of apparel purchases influenced by social media in 2024. |

Technological factors

Descente's commitment to innovation in advanced materials is a significant technological factor. The company actively leverages cutting-edge fabrics for improved athletic performance, focusing on moisture-wicking, breathability, and durability. This dedication to material science is crucial for maintaining their competitive position in the sportswear market.

The fusion of smart textiles and wearable technology is rapidly transforming athletic apparel, with projections indicating the emergence of a multi-billion dollar submarket by 2027. Descente has a significant opportunity to integrate AI-driven fabrics and embedded sensors into its product lines, offering advanced features like real-time body temperature regulation and detailed performance analytics. This technological advancement allows for unprecedented personalization and enhanced functionality for athletes.

Descente leverages cutting-edge manufacturing and design, including its proprietary S.I.O. pattern engineering and adhesive sewing techniques, exemplified in the Mizusawa Down line. These innovations are crucial for producing high-performance apparel that excels in functionality and athlete comfort.

By minimizing seams and weight, and optimizing for mobility and waterproofing, Descente's advanced techniques directly enhance product quality. For instance, the Mizusawa Down jacket, a flagship product, showcases these advancements, contributing to its reputation for superior performance in extreme conditions.

Digital Transformation in Retail and Customer Experience

Technological advancements are fundamentally reshaping retail. The integration of digital platforms, from robust e-commerce channels to immersive augmented reality (AR) try-on features and AI-driven personalization, is creating entirely new customer experiences. This digital shift is crucial for brands looking to connect with modern consumers.

Descente is actively embracing this trend. The company's strategic objective to boost its Direct-to-Consumer (DTC) sales ratio highlights a commitment to leveraging digital channels for direct customer engagement. Furthermore, the introduction of innovative store concepts, such as the 'Store 4.0' initiative in Macau, underscores Descente's dedication to blending physical and digital retail to enhance customer interaction and convenience.

- E-commerce Growth: Global e-commerce sales are projected to reach $8.1 trillion by 2024, indicating a significant shift in consumer purchasing habits towards online channels.

- AR in Retail: Studies suggest that retailers using AR can see a 20-30% increase in conversion rates, demonstrating the technology's impact on purchase decisions.

- AI Personalization: AI-powered personalization can lead to a 10-15% uplift in revenue for retailers by tailoring product recommendations and marketing messages.

- DTC Strategy: Brands focusing on DTC models often report higher profit margins and greater control over customer relationships compared to traditional wholesale models.

Product Innovation for Niche and Extreme Conditions

Descente's commitment to product innovation for niche and extreme conditions is a significant technological driver. Their focus on high-performance sports, particularly skiing, has spurred the development of proprietary technologies like the 'Breathing System' and Mizusawa Down. These innovations directly address the stringent demands for superior warmth, breathability, and overall comfort in harsh weather, solidifying their premium market standing.

This targeted approach to technological advancement allows Descente to create gear that excels in specialized environments. For instance, the Mizusawa Down jackets, a hallmark of their innovation, are engineered for exceptional insulation and water resistance, crucial for activities like extreme skiing. Such advancements not only meet but often exceed the expectations of elite athletes and enthusiasts.

The impact of these technological factors is evident in Descente's market performance. While specific 2024/2025 sales figures for individual product lines are proprietary, the brand's consistent presence and reputation in the premium winter sports apparel sector underscore the success of its innovation strategy. Their ability to continuously refine and introduce cutting-edge features keeps them competitive.

- Breathing System: Enhances comfort by managing moisture and temperature within the garment.

- Mizusawa Down Technology: Provides superior insulation and water repellency, critical for extreme cold.

- Targeted R&D: Focuses on solving specific performance challenges in niche sports like skiing.

Descente's technological edge is further amplified by its embrace of digital transformation in retail. The company is actively enhancing its online presence and customer engagement through strategies like boosting its Direct-to-Consumer (DTC) sales ratio, aiming for greater customer intimacy and control. This digital push is supported by investments in innovative store formats, such as the 'Store 4.0' concept, which blends physical and digital experiences to improve customer convenience and interaction.

The global e-commerce market is a testament to this shift, projected to reach $8.1 trillion by 2024, underscoring the importance of robust online platforms. Furthermore, the integration of technologies like Augmented Reality (AR) in retail can significantly boost conversion rates, with studies indicating potential increases of 20-30%. AI-driven personalization is also a key driver, capable of yielding 10-15% revenue uplifts by tailoring customer experiences.

| Digital Retail Initiative | Projected Impact/Metric | Relevance to Descente |

|---|---|---|

| Global E-commerce Growth | $8.1 trillion by 2024 | Highlights the necessity of a strong online sales channel. |

| AR in Retail Conversion Rates | 20-30% increase | Opportunity for enhanced online product visualization and engagement. |

| AI Personalization Revenue Uplift | 10-15% | Potential for improved customer targeting and sales through personalized recommendations. |

| DTC Strategy Benefits | Higher margins, greater customer control | Aligns with Descente's objective to strengthen direct customer relationships. |

Legal factors

Intellectual property protection is paramount for Descente, safeguarding its innovative designs, advanced materials, and proprietary manufacturing techniques through patents and trademarks. This legal framework is essential for maintaining its competitive edge in the sportswear industry.

The sportswear market is unfortunately rife with counterfeit goods, a persistent challenge that directly impacts Descente's brand image and financial performance. Combating these infringements through robust legal action is crucial for revenue preservation and brand integrity.

Descente must navigate a complex landscape of product safety and quality regulations, both domestically and internationally. These standards dictate everything from the chemical content of materials to the robustness and functional claims made about their apparel. For instance, in 2024, the EU's REACH regulation continued to scrutinize chemical substances in textiles, impacting sourcing and manufacturing processes for brands like Descente.

Failure to comply with these stringent laws, which cover aspects like flammability and the presence of harmful dyes, can lead to significant legal repercussions, including hefty fines and product recalls. Maintaining rigorous adherence is therefore crucial for Descente to mitigate legal risks and safeguard its reputation for quality and consumer confidence. In 2025, expect increased focus on sustainability certifications, which often overlap with safety standards, as seen with the growing adoption of bluesign® system partnership requirements among apparel manufacturers.

Descente must navigate a complex web of global labor laws, ensuring compliance with regulations concerning wages, working hours, and employee safety across its manufacturing partners. Failure to uphold these standards, including adhering to human rights principles and ethical sourcing, poses significant legal risks and can damage its brand reputation. For instance, in 2024, the International Labour Organization reported a global increase in labor law enforcement actions, highlighting the heightened scrutiny on supply chains.

To mitigate these risks, Descente mandates its suppliers to follow a stringent Code of Conduct, which outlines expectations for fair labor practices and prohibits exploitative conditions. The company actively engages in Corporate Social Responsibility (CSR) monitoring of factories. This oversight, often involving audits and site visits, aims to verify adherence to these ethical standards and prevent human rights abuses within its extended supply network.

Data Privacy and Consumer Information Regulations

Descente's increasing reliance on e-commerce and direct-to-consumer (DTC) channels necessitates strict adherence to data privacy regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws, which have seen ongoing updates and enforcement actions through 2024 and into 2025, mandate robust protection of customer data and transparent handling practices. Non-compliance can lead to significant financial penalties and damage to brand reputation.

The global digital privacy landscape is becoming more stringent. For instance, by early 2025, many jurisdictions are expected to have implemented or strengthened their data protection frameworks, impacting how companies like Descente collect, store, and utilize customer information. Failure to secure personal data or provide clear consent mechanisms can result in substantial fines, with GDPR penalties reaching up to 4% of global annual revenue or €20 million, whichever is higher. CCPA, and its successor the California Privacy Rights Act (CPRA), also impose significant obligations and potential penalties for data breaches and non-compliance.

- GDPR fines: Up to 4% of global annual revenue or €20 million.

- CCPA/CPRA penalties: Fines can reach $2,500 per unintentional violation and $7,500 per intentional violation.

- Consumer trust: Data breaches can erode consumer confidence, impacting sales and brand loyalty.

- Evolving regulations: Continuous monitoring of global privacy law changes is essential for ongoing compliance.

Corporate Sustainability Reporting Directives

New legal frameworks, such as Europe's Corporate Sustainability Reporting Directive (CSRD), are significantly raising the bar for corporate disclosure on environmental and social performance. For Descente, this means their current integrated reporting and sustainability efforts must be rigorously aligned with these expanding global standards, potentially requiring enhanced data collection and verification processes.

This evolving regulatory landscape directly impacts how Descente communicates its sustainability achievements. The CSRD, which began applying to large companies in fiscal year 2024, mandates detailed reporting across a wide range of sustainability topics, moving beyond voluntary disclosures to legally binding requirements.

- CSRD Application: Large companies began reporting under CSRD for financial years starting on or after January 1, 2024, with staggered implementation for other company types.

- Enhanced Disclosure: Requirements include detailed information on environmental impacts, social issues, governance, and supply chain sustainability.

- Anti-Greenwashing Focus: Stricter regulations against misleading environmental claims necessitate robust, verifiable data to support all sustainability assertions made by Descente.

- Global Alignment: Companies like Descente must navigate a patchwork of evolving international sustainability reporting standards, ensuring consistency and compliance across jurisdictions.

Descente must maintain rigorous adherence to intellectual property laws to protect its unique designs and technologies from infringement, a critical factor in its competitive market position.

The company faces ongoing challenges with counterfeit products, necessitating proactive legal strategies to safeguard brand reputation and revenue streams.

Compliance with evolving product safety and quality regulations, such as the EU's REACH, impacts material sourcing and manufacturing processes, with increased focus on sustainability certifications in 2025.

Navigating global labor laws and ensuring ethical sourcing practices are paramount to avoid legal repercussions and maintain brand integrity, with heightened enforcement actions reported globally in 2024.

Environmental factors

Consumers are increasingly seeking sportswear crafted from eco-friendly materials and produced through sustainable methods. This growing preference is fueled by a heightened global awareness of environmental issues and a desire to support brands that exhibit strong corporate social responsibility. For instance, a 2024 survey indicated that 65% of consumers consider a brand's environmental impact when making purchasing decisions, a significant jump from previous years.

Descente's proactive approach to integrating sustainable practices, such as utilizing recycled polyester in its apparel lines and optimizing manufacturing processes to reduce waste, directly addresses this crucial market shift. This alignment not only resonates with environmentally conscious consumers but also positions Descente favorably against competitors who may lag in sustainability initiatives. The company's investment in innovative, eco-friendly material research is a testament to its commitment to this evolving consumer demand.

Descente's commitment to eco-friendly materials is a significant environmental consideration. Their 'RE:DESCENTE' initiative, encompassing 'Design-Driven Source Reduction,' 'Design-Driven Waste Regeneration,' and 'Design-Driven Material Reuse,' directly addresses this. This strategic focus is crucial in a market increasingly sensitive to sustainability, with consumers in 2024 actively seeking brands that demonstrate environmental responsibility.

The company's practical application of this commitment is evident in their use of biodegradable and highly durable eco-friendly fibers, such as KAMITO, alongside recycled polyester. For instance, by integrating recycled polyester, Descente is actively participating in the circular economy, a trend gaining substantial momentum in the apparel industry throughout 2024 and projected to grow further into 2025.

Descente is making strides in minimizing its environmental footprint by focusing on fabric production and dyeing. The company is actively optimizing these processes to significantly reduce water consumption and carbon emissions. This operational approach is a cornerstone of their environmental policy, aiming to lessen impact right from the start of the manufacturing chain.

To ensure ongoing improvement, Descente implements regular monitoring of its environmental management systems. This diligent oversight helps them maintain and enhance their performance in reducing environmental impact. For instance, as of their latest reporting in 2024, they aimed to achieve a 15% reduction in water usage in dyeing processes by 2025 compared to 2020 levels, with initial reports showing a 7% decrease by the end of 2023.

Waste Reduction and Recycling Programs

Descente's commitment to sustainability is evident in its member-focused clothing recycling program, embodying the REDUCE, RECYCLE, and REUSE ethos. This initiative directly supports circular economy principles by actively managing post-consumer waste.

Such programs are crucial for minimizing landfill burden and enhancing resource utilization. For instance, the Ellen MacArthur Foundation reported that in 2023, the textile industry generated over 92 million tonnes of waste, highlighting the urgent need for such recycling efforts.

- Circular Economy Adoption: Descente's recycling program directly contributes to a more circular model for apparel.

- Waste Diversion: By collecting used clothing, the program helps divert significant waste from landfills.

- Resource Efficiency: Promoting reuse and recycling conserves raw materials and reduces the environmental impact of new production.

Climate Change Adaptation and Carbon Neutrality Targets

Descente is committed to achieving carbon neutrality by 2050, a significant undertaking to eliminate its overall greenhouse gas emissions. This ambitious goal necessitates the establishment of clear medium-term targets to guide progress. Furthermore, starting from fiscal year 2023, the company is expanding its measurement of greenhouse gas emissions to encompass all global operations, providing a more comprehensive understanding of its environmental footprint.

The strategic imperative for Descente to adapt to climate change and actively reduce its emissions is directly linked to its long-term business sustainability. By proactively addressing these environmental factors, Descente aims to mitigate risks associated with a changing climate and capitalize on opportunities presented by the transition to a low-carbon economy.

- Carbon Neutrality Goal: Descente aims for carbon neutrality by 2050, targeting zero net greenhouse gas emissions.

- Emission Measurement Expansion: Starting FY2023, Descente is broadening its greenhouse gas emission measurement to include all global operations.

- Sustainability Driver: Adapting to climate change and reducing emissions are identified as critical for the company's enduring business viability.

Descente's environmental strategy is deeply intertwined with consumer demand for sustainable products, a trend that significantly amplified in 2024. The company's use of recycled polyester and innovative eco-friendly fibers like KAMITO directly addresses this, aligning with a market where 65% of consumers consider environmental impact in purchasing decisions, as per a 2024 survey.

The company's commitment extends to operational efficiencies, focusing on reducing water consumption and carbon emissions in fabric production and dyeing. Their 'RE:DESCENTE' initiative, emphasizing source reduction and material reuse, is a practical application of these principles. For instance, Descente targeted a 15% reduction in water usage in dyeing processes by 2025, with a 7% decrease reported by the end of 2023.

Descente's proactive stance on sustainability includes a member-focused clothing recycling program, reinforcing circular economy principles and waste diversion. This is particularly relevant given that the textile industry generated over 92 million tonnes of waste in 2023, according to the Ellen MacArthur Foundation.

Looking ahead, Descente aims for carbon neutrality by 2050, expanding its greenhouse gas emission measurements to all global operations from FY2023. This long-term vision is crucial for mitigating climate-related risks and capitalizing on the transition to a low-carbon economy.

| Environmental Focus | Descente's Action | Key Data/Target |

|---|---|---|

| Sustainable Materials | Use of recycled polyester, KAMITO fibers | 65% of consumers consider environmental impact (2024) |

| Operational Efficiency | Reducing water usage & carbon emissions in dyeing | Target 15% water reduction by 2025; achieved 7% by end of 2023 |

| Circular Economy | Member clothing recycling program | Textile waste: 92 million tonnes (2023) |

| Climate Goals | Carbon neutrality by 2050 | Expanded GHG emission measurement (from FY2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Descente is meticulously constructed using data from reputable sources including government economic reports, industry-specific market research, and global environmental policy updates. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the brand.