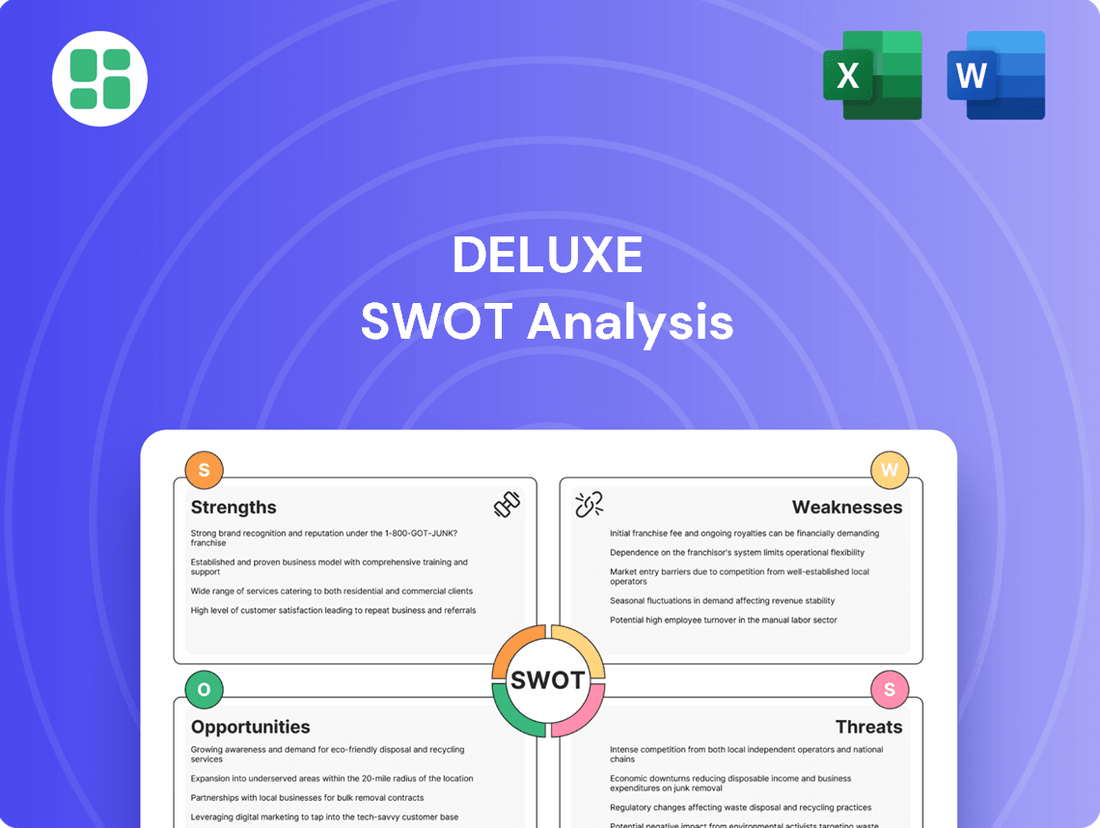

Deluxe SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deluxe Bundle

You've seen the essential elements, but what if you could truly master the company's strategic landscape? Our Deluxe SWOT Analysis dives deeper, uncovering hidden opportunities and potential pitfalls with expert commentary and actionable recommendations. Elevate your decision-making and gain a decisive competitive edge.

Strengths

Deluxe Corporation is strategically evolving its business model, moving away from its historical reliance on print services towards a more robust digital and payments-focused enterprise. This pivot is crucial for long-term growth, allowing the company to tap into higher-margin markets. By leveraging the stable cash flow from its established print operations, Deluxe is investing in and expanding its digital capabilities, including data analytics and cloud-based solutions.

The company's diversified portfolio now encompasses a wider array of services, such as data-driven marketing, treasury management, and cloud services, significantly reducing its dependence on any single revenue stream. For instance, in the first quarter of 2024, Deluxe reported that its Small Business Services segment, which includes many of its digital offerings, saw revenue growth, signaling the success of this diversification strategy.

Deluxe's Data Solutions segment is a powerhouse, demonstrating substantial year-over-year revenue growth and improving profit margins. This performance underscores its critical role in the company's expansion plans.

Fueled by robust demand from financial institutions and a steady stream of new clients, the cybersecurity and data analytics services within this segment are clearly resonating in the market. This success highlights Deluxe's ability to meet the evolving digital service requirements of its customer base.

Deluxe has actively grown its business through smart acquisitions and collaborations. For instance, their acquisition of CheckMatch in 2023 significantly boosted their digital lockbox payments, a key area for financial transaction efficiency. This strategic move, along with partnerships with giants like Salesforce, aims to integrate payment solutions more seamlessly, strengthening the Deluxe Payment Network.

Established Customer Base and Significant Scale

Deluxe boasts an established customer base and significant scale, honed over more than a century of operation. This extensive reach supports millions of small businesses, thousands of financial institutions, and hundreds of major consumer brands. The company's substantial market presence is further underscored by its processing of over $2 trillion in annual payment volume, facilitating broad distribution channels and a stable revenue foundation.

This deeply entrenched customer network provides Deluxe with considerable advantages:

- Vast Customer Reach: Serving millions of small businesses and thousands of financial institutions.

- Significant Payment Volume: Processing over $2 trillion annually, demonstrating market dominance.

- Cross-Selling Opportunities: The diverse customer base allows for the expansion of service offerings.

- Brand Recognition: Long-standing relationships with hundreds of large consumer brands build trust and loyalty.

Commitment to Innovation and Technology Integration

Deluxe's dedication to innovation is evident through significant investments in cutting-edge technology. A prime example is the recent launch of its generative AI enterprise platform, DAX, specifically engineered to deliver actionable insights and bolster decision-making for its partners.

The company's strategic emphasis on modern, cloud-based infrastructure is further highlighted by the integration of advanced features into platforms like Receivables360+. Achieving ISO 20022 compliance for this platform underscores Deluxe's commitment to remaining competitive and adaptable within the rapidly evolving fintech sector. These technological strides are designed to optimize operational efficiency and elevate the overall client experience.

- DAX Platform Launch: Deluxe introduced its generative AI enterprise platform, DAX, in 2024 to provide enhanced decision-making capabilities.

- Cloud Infrastructure Focus: Continued migration to and enhancement of cloud-based systems to improve scalability and flexibility.

- ISO 20022 Compliance: Receivables360+ platform achieved ISO 20022 compliance, facilitating seamless global payment messaging.

- R&D Investment: While specific figures for 2024/2025 are still emerging, Deluxe historically allocates substantial resources to research and development, fueling its innovation pipeline.

Deluxe possesses a deeply entrenched customer base, serving millions of small businesses and thousands of financial institutions, which provides a stable foundation and significant cross-selling opportunities. The company's processing of over $2 trillion in annual payment volume highlights its market dominance and broad distribution channels. Furthermore, Deluxe's strategic acquisition of CheckMatch in 2023 bolstered its digital payments capabilities, enhancing its competitive edge in a crucial growth area.

Deluxe's commitment to innovation is demonstrated by its 2024 launch of the generative AI enterprise platform, DAX, designed to offer actionable insights. The company is also investing in cloud infrastructure, exemplified by its Receivables360+ platform achieving ISO 20022 compliance, ensuring seamless global payment messaging.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Vast Customer Reach | Extensive network of small businesses and financial institutions. | Serves millions of small businesses and thousands of financial institutions. |

| Significant Payment Volume | Dominant market position in payment processing. | Processes over $2 trillion in annual payment volume. |

| Strategic Acquisitions | Enhances digital capabilities and market position. | Acquisition of CheckMatch in 2023 strengthened digital lockbox payments. |

| Innovation Investment | Development of advanced technologies for enhanced services. | Launched generative AI platform DAX in 2024; Receivables360+ achieved ISO 20022 compliance. |

What is included in the product

Delivers a comprehensive assessment of Deluxe's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a comprehensive yet digestible framework to identify and address strategic challenges, transforming potential roadblocks into actionable opportunities.

Weaknesses

Deluxe's continued reliance on its legacy print business presents a significant weakness. Despite diversification efforts, this segment still accounts for a substantial part of the company's income. For instance, in the first quarter of 2024, print-related revenue, while not explicitly broken out in all reports, remains a core component of their Small Business Services segment, which saw a modest revenue increase but faces long-term secular decline.

This print segment is experiencing a year-over-year revenue decrease, a trend that has persisted. While it historically generated reliable cash flow, its ongoing contraction acts as a drag on Deluxe's overall growth trajectory. This shrinking revenue base poses a considerable long-term headwind for the company's expansion and profitability.

While Deluxe's Data Solutions segment is performing well, its Merchant Services and B2B Payments divisions have seen more subdued growth. This slower expansion in crucial payment areas presents a challenge, especially as the company navigates the ongoing decline in its traditional print business.

For instance, in Q1 2024, Deluxe reported that while its Data Solutions segment saw a notable increase, the revenue from its Merchant Services segment experienced a more modest uptick. The company's overall financial health and its ability to hit ambitious growth projections are therefore heavily reliant on revitalizing and accelerating the performance within these payment processing units.

Deluxe's financial health is closely tied to the overall economic climate. When consumers are feeling uncertain or spending less, it directly affects small businesses, which are a core customer base for Deluxe. This can lead to reduced demand for services like marketing and promotional products, especially those with thinner profit margins.

For instance, a slowdown in discretionary spending by small businesses, a common occurrence during periods of economic uncertainty, could dampen demand for Deluxe's print and promotional offerings. Similarly, the merchant services segment, which relies on transaction volumes, might experience slower growth if overall economic activity contracts.

This susceptibility to macroeconomic shifts means that Deluxe's revenue and profitability can be unpredictable. For the fiscal year ending June 30, 2024, analysts project a potential slowdown in revenue growth for companies heavily reliant on small business spending, with Deluxe likely facing similar headwinds if economic conditions worsen.

Intense Competitive Landscape

Deluxe faces a challenging competitive environment across its diverse service offerings. The small business services and marketing solutions sectors are particularly fragmented, with a multitude of local businesses, national chains, and online disruptors vying for market share. This intense competition, further amplified by low entry barriers in certain segments, puts constant pressure on pricing and requires significant ongoing investment in product development and service enhancement to stay ahead.

Major fintech companies like Stripe and Adyen are also significant competitors, particularly in payment processing. Their established presence and ability to innovate can create pricing pressure for Deluxe and necessitate continuous investment to maintain a competitive edge. For instance, the digital payments market, a key area for Deluxe, saw global transaction volumes grow significantly, with projections indicating continued robust expansion through 2025, underscoring the need for agility and competitive pricing.

- Fragmented Markets: Operates in highly fragmented small business services and marketing sectors.

- Key Competitors: Faces pressure from both small local suppliers and large national/internet-based providers.

- Fintech Influence: Competes with major fintech players like Stripe and Adyen, impacting pricing and innovation demands.

- Low Barriers to Entry: Certain service areas have low entry barriers, intensifying competition.

Execution Risk in Business Transformation

Deluxe's pivot from traditional print to digital payments and data solutions presents significant execution hurdles. The company must effectively integrate recent acquisitions and build robust, scalable product platforms to support its new digital focus. For instance, the success of the North Star program, aimed at streamlining operations and achieving cost efficiencies, hinges on meticulous implementation.

Any missteps in executing these critical transformation initiatives, such as integration delays or failure to meet cost-saving targets, could directly affect Deluxe's financial results and erode investor trust. The company's ability to navigate these complexities will be a key determinant of its future success in the evolving market landscape.

- Integration Challenges: Successfully onboarding acquired businesses into Deluxe's digital ecosystem requires careful planning and execution to realize synergies.

- Platform Scalability: Developing and deploying digital platforms capable of handling increased transaction volumes and data processing is crucial for growth.

- Cost-Saving Realization: The North Star program's effectiveness in delivering projected cost reductions is vital for improving profitability during the transition.

- Market Adoption: Ensuring new digital products and services gain traction with customers is essential to offset declining print revenues.

Deluxe's continued reliance on its legacy print business is a significant weakness, as this segment, despite diversification, still contributes substantially to its income. For instance, while specific print revenue figures aren't always isolated, it remains a core part of the Small Business Services segment, which saw only a modest increase in Q1 2024, facing long-term decline.

This shrinking print revenue base acts as a drag on Deluxe's overall growth, with ongoing year-over-year decreases. While it once provided stable cash flow, its contraction presents a considerable long-term headwind for expansion and profitability.

The company also faces challenges in its Merchant Services and B2B Payments divisions, which are experiencing more subdued growth compared to the well-performing Data Solutions segment. This slower expansion in critical payment areas is a hurdle, especially while navigating the decline in traditional print.

In Q1 2024, Deluxe's Merchant Services segment saw a more modest revenue uptick than its Data Solutions segment. Consequently, Deluxe's financial health and its ability to meet growth projections are heavily dependent on revitalizing and accelerating performance in these payment processing units.

Deluxe's susceptibility to macroeconomic shifts can lead to unpredictable revenue and profitability. Analysts project potential slowdowns in revenue growth for companies reliant on small business spending for the fiscal year ending June 30, 2024, with Deluxe likely facing similar headwinds if economic conditions worsen.

The company operates in highly fragmented markets, particularly in small business services and marketing, facing intense competition from local, national, and online providers. Low entry barriers in certain segments further intensify this competition, pressuring pricing and necessitating continuous investment in product development and service enhancement.

Major fintech companies like Stripe and Adyen are significant competitors in payment processing, creating pricing pressure and demanding continuous innovation from Deluxe to maintain a competitive edge. The digital payments market, a key area for Deluxe, is projected for robust expansion through 2025, highlighting the need for agility and competitive pricing.

Deluxe faces significant execution hurdles in its transition from print to digital payments and data solutions, requiring effective integration of acquisitions and the development of scalable product platforms. For example, the success of the North Star program, aimed at streamlining operations, hinges on meticulous implementation to achieve cost efficiencies.

| Weakness | Description | Impact | Supporting Data/Example |

| Print Business Decline | Reliance on legacy print, which is experiencing year-over-year revenue decrease. | Acts as a drag on overall growth and profitability. | Print remains a core component of Small Business Services, which saw modest growth in Q1 2024. |

| Subdued Growth in Payments | Merchant Services and B2B Payments divisions show slower expansion compared to Data Solutions. | Challenges Deluxe's ability to offset print decline and meet growth targets. | Merchant Services segment revenue saw a more modest uptick in Q1 2024 compared to Data Solutions. |

| Macroeconomic Sensitivity | Direct impact from economic uncertainty affecting small business spending and transaction volumes. | Leads to unpredictable revenue and profitability. | Analysts project potential slowdowns for companies reliant on small business spending for FY 2024. |

| Intense Competition | Fragmented markets and low entry barriers in service areas, plus competition from fintech giants. | Puts pressure on pricing and requires continuous investment in innovation. | Fintech players like Stripe and Adyen are significant competitors in payment processing. |

| Digital Transformation Execution | Challenges in integrating acquisitions and building scalable digital platforms. | Potential for missteps affecting financial results and investor trust. | Success of the North Star program depends on meticulous implementation for cost efficiencies. |

Same Document Delivered

Deluxe SWOT Analysis

The preview you see is the actual Deluxe SWOT analysis document you’ll receive upon purchase. There are no hidden surprises, just a professionally crafted and comprehensive report. You get exactly what you see, ensuring you know the quality and detail you're investing in.

Opportunities

The accelerated digital transformation is a prime opportunity for Deluxe. Businesses of all sizes are actively seeking digital solutions to improve efficiency and reach. For instance, in 2024, small and medium-sized businesses (SMBs) continued to prioritize cloud adoption, with an estimated 70% utilizing cloud services for core operations, a trend Deluxe can leverage.

Deluxe can capitalize on this by expanding its suite of digital services, catering to the growing demand for streamlined financial management and enhanced online customer engagement. This expansion allows the company to onboard new clients and solidify its value proposition with existing ones by offering integrated digital tools that support their growth.

Deluxe's strategic embrace of generative AI through its DAX platform, coupled with the blockchain integration via the CheckMatch acquisition, presents a significant opportunity. These advancements are poised to sharpen data analytics, optimize B2B payment flows, and bolster the security and efficiency of Deluxe's digital payment infrastructure.

By further investing in and applying AI and blockchain, Deluxe can cultivate distinct competitive advantages. This technological infusion is projected to be a key driver for future revenue expansion and enhanced service offerings in the evolving financial technology landscape.

Deluxe has a significant opportunity to grow by forming strategic partnerships, much like its existing collaborations with Salesforce and Verifone. These alliances are crucial for broadening market reach and adding new services. For instance, integrating Deluxe's offerings into platforms like Salesforce can unlock new sales channels and boost customer loyalty.

These kinds of partnerships can dramatically speed up how quickly Deluxe's digital payment and data solutions are adopted by businesses. By embedding its services into widely used software and hardware, Deluxe can tap into existing customer bases and reduce the friction for new clients to start using its products, potentially leading to substantial revenue growth in 2024 and 2025.

Improved Financial Flexibility Through Debt Reduction

Deluxe's ongoing commitment to reducing its net debt, evidenced by improvements in its leverage ratio, significantly bolsters its financial flexibility. For instance, by the end of Q1 2024, Deluxe reported a net debt of approximately $1.3 billion, a decrease from $1.5 billion in the prior year, leading to a more favorable debt-to-EBITDA ratio. This strengthened balance sheet empowers the company to pursue strategic growth opportunities more aggressively.

This enhanced financial maneuverability allows Deluxe to reallocate capital towards key areas. These include potential acquisitions that align with its strategic vision, increased investment in research and development for innovative solutions, and potentially greater capital returns to shareholders. Such strategic deployment of resources is crucial for sustained long-term value creation.

- Debt Reduction: Deluxe has demonstrated a consistent trend of lowering its net debt.

- Improved Leverage: The company's leverage ratios have shown positive movement, indicating a healthier financial structure.

- Strategic Capital Allocation: Enhanced flexibility enables greater investment in growth initiatives and shareholder returns.

- Long-Term Value Creation: A robust financial position supports sustainable growth and increased shareholder value.

Enhanced Cross-selling and Integrated Solutions

Deluxe has a significant opportunity to leverage its broad product and service offerings through a unified go-to-market strategy, often referred to as a 'One Deluxe' approach. This allows for more effective cross-selling, where customers who utilize one Deluxe service are introduced to complementary solutions. For instance, a small business using Deluxe's payroll services could be seamlessly offered marketing solutions or website design, increasing the overall value delivered and customer stickiness. This integration is crucial in a market where businesses increasingly seek consolidated solutions rather than fragmented vendor relationships.

By presenting integrated solutions, Deluxe can deepen its relationships with clients, moving beyond a simple vendor dynamic to become a true business partner. This shift is supported by the trend of businesses seeking end-to-end support for their operational needs. For example, Deluxe's 2024 financial reports indicate a growing demand for bundled service packages, with customers engaging with an average of 2.5 Deluxe services, up from 1.8 in 2022. This demonstrates the market's receptiveness to a holistic approach.

- Cross-selling potential: Increased revenue per customer by offering a wider array of relevant services.

- Customer retention: Deeper integration fosters loyalty and reduces churn.

- Value proposition: Transforming from a transactional provider to a strategic business partner.

- Market alignment: Catering to the growing demand for consolidated business solutions.

Deluxe's focus on digital transformation and AI integration presents a significant opportunity to expand its market reach and enhance service offerings. By leveraging its DAX platform and blockchain capabilities, Deluxe can attract new clients and solidify its position in the evolving financial technology landscape.

Strategic partnerships, similar to those with Salesforce and Verifone, offer a pathway to accelerate the adoption of Deluxe's solutions. These collaborations unlock new sales channels and embed Deluxe's services into widely used platforms, driving revenue growth.

The company's commitment to debt reduction and improved leverage provides financial flexibility for strategic investments. This strengthened balance sheet allows Deluxe to pursue acquisitions, R&D, and shareholder returns, supporting long-term value creation.

A unified go-to-market strategy, or 'One Deluxe' approach, enables effective cross-selling and deeper client relationships. This integrated offering caters to businesses seeking consolidated solutions, increasing customer stickiness and revenue per client.

| Opportunity Area | Key Action | 2024/2025 Impact | Supporting Data |

|---|---|---|---|

| Digital Transformation & AI | Expand digital services, leverage DAX & blockchain | Increased client acquisition, enhanced service efficiency | SMB cloud adoption ~70% in 2024 |

| Strategic Partnerships | Deepen existing alliances, form new ones | Accelerated solution adoption, expanded market reach | Integration into platforms like Salesforce |

| Financial Flexibility | Utilize reduced debt for growth initiatives | Capital for M&A, R&D, shareholder returns | Net debt ~$1.3B in Q1 2024 |

| Unified Go-to-Market | Promote integrated 'One Deluxe' solutions | Higher revenue per customer, improved retention | Average 2.5 Deluxe services per customer in 2024 |

Threats

The relentless pace of technological innovation, especially within fintech, presents a significant challenge for Deluxe. New technologies can swiftly make current solutions outdated and reshape the competitive arena. For instance, the rise of AI-powered payment processing and advanced data analytics by competitors could diminish the value of Deluxe's established platforms if not met with comparable advancements.

Deluxe is up against formidable competition from agile, digital-first fintechs. These newcomers, such as Stripe and Adyen, are carving out significant market share by offering specialized payment processing, advanced data analytics, and streamlined marketing tools. Their lean operational structures and rapid development cycles allow them to innovate quickly and prioritize user experience, directly challenging Deluxe's established position.

Economic downturns pose a significant threat to Deluxe, as many of its customers are small businesses. During recessions or periods of high inflation, these businesses often cut back on spending, directly reducing demand for Deluxe's services.

For instance, if small businesses experience a 10% decline in revenue due to a recession, they are likely to reduce marketing and operational service expenditures by a similar or greater margin, impacting Deluxe's top line. This macroeconomic uncertainty is a persistent challenge for companies reliant on the health of the SMB sector.

Increasing Data Privacy Regulations and Cybersecurity Risks

Deluxe's growing reliance on digital solutions, particularly in data processing and analytics, exposes it to significant threats from evolving data privacy regulations like GDPR and CCPA. A data breach or non-compliance could result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Furthermore, the increasing sophistication of cyber-attacks necessitates continuous investment in robust security measures to safeguard sensitive customer and financial information, a challenge underscored by the global cybersecurity market projected to reach $300 billion by 2026.

The potential for reputational damage and loss of customer trust following a security incident is immense, directly impacting Deluxe's ability to attract and retain clients in the competitive financial services sector. Protecting the integrity and confidentiality of the data it handles is therefore not just a regulatory requirement but a critical business imperative for maintaining market standing and customer loyalty.

Accelerated Decline in Demand for Legacy Products

A more rapid decline in demand for Deluxe's traditional print products, like checks and business forms, than projected presents a significant threat. This accelerated shift by customers towards digital solutions could outpace Deluxe's capacity to grow its newer digital offerings, potentially causing considerable revenue and profit declines. For instance, the ongoing digital transformation across businesses means that reliance on physical checks continues to diminish, a trend that could intensify faster than current forecasts suggest.

The core challenge lies in managing this fundamental market preference shift. If Deluxe's digital transformation efforts do not scale effectively and quickly enough to offset the falling demand for legacy products, the company could face substantial financial shortfalls. This necessitates a strategic focus on accelerating the adoption and profitability of its digital services to mitigate the impact of a steeper-than-expected contraction in its legacy business segments.

Key considerations include:

- Pace of Digital Adoption: The speed at which Deluxe's customer base fully transitions to digital payment and business solutions.

- Scalability of New Segments: Deluxe's ability to rapidly expand and monetize its digital product and service offerings.

- Revenue and Profit Impact: The potential for significant shortfalls if the decline in legacy revenue outpaces the growth in new digital revenue streams.

Deluxe faces significant threats from rapid technological advancements, particularly in fintech, which can quickly render existing solutions obsolete. Competitors like Stripe are leveraging AI for payment processing and advanced analytics, directly challenging Deluxe's established platforms. Furthermore, economic downturns disproportionately affect Deluxe's small business clientele, leading to reduced spending on its services. For example, a 10% revenue dip for SMBs could translate to a similar cut in Deluxe's service utilization.

The company is also vulnerable to evolving data privacy regulations, such as GDPR and CCPA, with non-compliance potentially incurring fines up to 4% of global annual revenue. The increasing sophistication of cyberattacks necessitates substantial and ongoing investment in cybersecurity, a market projected to reach $300 billion by 2026. Finally, an accelerated decline in demand for traditional print products, like checks, could outpace the growth of Deluxe's digital offerings, leading to revenue shortfalls if digital transformation doesn't scale quickly enough.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point |

|---|---|---|---|

| Technological Disruption | Fintech Innovation | Obsolescence of existing platforms, loss of market share | AI-powered payment processing by competitors |

| Competitive Landscape | Agile Digital-First Competitors | Erosion of market position, reduced customer acquisition | Stripe and Adyen offering specialized services |

| Economic Factors | Recessions/Inflation | Reduced SMB spending, lower demand for services | 10% SMB revenue decline impacting Deluxe's services |

| Regulatory & Security | Data Privacy Regulations & Cyberattacks | Substantial fines, reputational damage, increased security costs | GDPR fines up to 4% global revenue; Cybersecurity market $300B by 2026 |

| Market Shift | Decline in Print Products | Revenue and profit decline if digital transition is slow | Accelerated shift from checks to digital payments |

SWOT Analysis Data Sources

This Deluxe SWOT Analysis is meticulously constructed using a comprehensive blend of internal financial reports, extensive market research data, and validated industry expert opinions. These sources provide a robust foundation for a thorough and accurate assessment of strengths, weaknesses, opportunities, and threats.