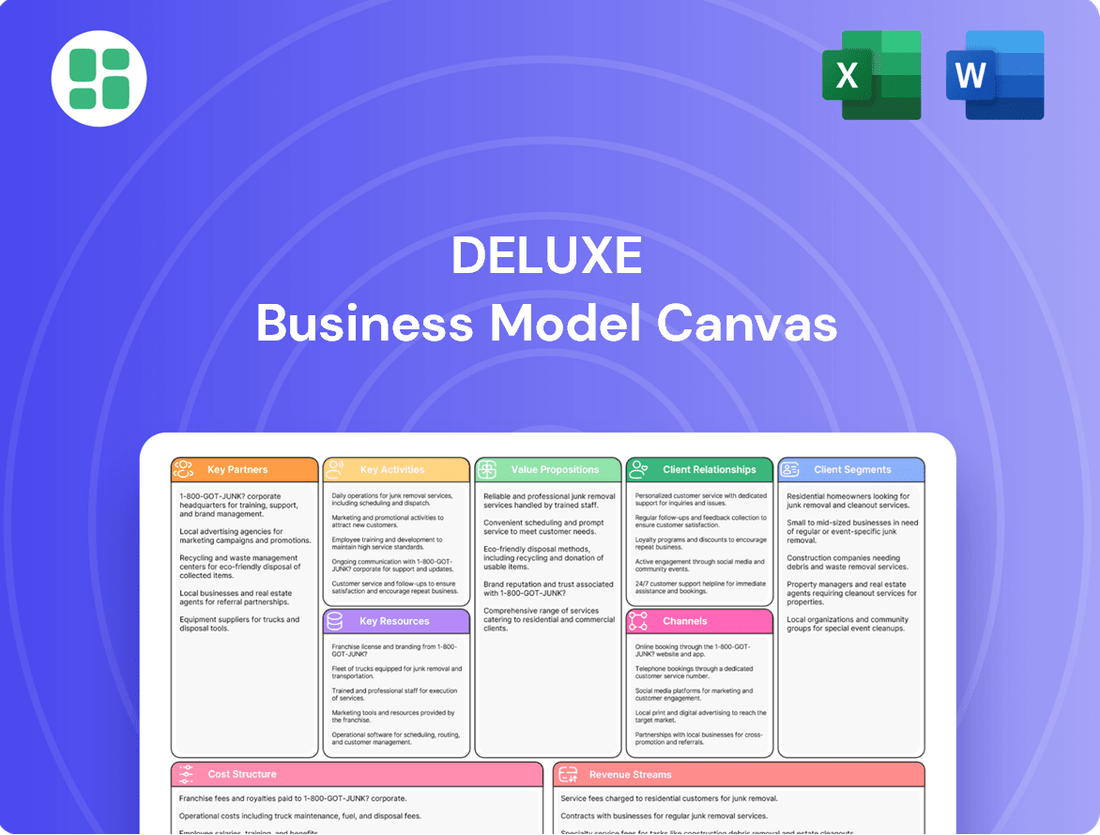

Deluxe Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deluxe Bundle

Curious about Deluxe's strategic genius? Our full Business Model Canvas breaks down every element, from customer relationships to revenue streams, providing a comprehensive view of their success. Download it now to gain a powerful strategic advantage for your own ventures.

Partnerships

Deluxe actively cultivates strategic technology alliances to bolster its service portfolio and broaden its market presence. These partnerships are vital for integrating cutting-edge solutions and improving customer experiences.

A prime example is Deluxe's collaboration with Chargent, enabling seamless payment integrations into platforms such as Salesforce. This type of alliance streamlines operations for shared clientele, enhancing efficiency.

These technological collaborations are instrumental in expanding Deluxe's digital capabilities, ensuring it remains competitive within the rapidly evolving technology sector. By leveraging these partnerships, Deluxe can offer more robust and integrated solutions to its diverse customer base.

Deluxe's business model heavily relies on collaborations with financial institutions, integrating with lockbox providers and disbursement partners to enhance its Deluxe Payment Network (DPN). This synergy allows for more streamlined payment processing and advanced treasury management for businesses.

These partnerships are crucial for Deluxe's ability to offer a robust suite of financial services, expanding its reach and capabilities within the payments ecosystem. For instance, in 2024, Deluxe continued to solidify its position by deepening relationships with key banking partners to facilitate seamless digital payment flows.

Deluxe strategically acquires companies to broaden its service offerings, exemplified by J.P. Morgan's acquisition of CheckMatch from Kinexys. These partnerships are crucial for integrating new technologies, such as digital lockbox payments, into Deluxe's existing infrastructure.

Payment Network Providers

Deluxe collaborates with a range of payment network providers to handle its substantial annual payment volume, which exceeds $2 trillion. These partnerships are fundamental for ensuring that credit, debit, and electronic benefit transactions are processed efficiently and accepted widely. This robust network forms the essential infrastructure supporting Deluxe's merchant services and business-to-business payment offerings.

These key partnerships enable Deluxe to offer comprehensive payment processing capabilities. By integrating with major networks, Deluxe ensures:

- Broad Transaction Acceptance: Facilitating payments across diverse card networks and electronic payment systems.

- Efficient Processing: Streamlining transaction approvals and settlements for merchants and businesses.

- Reliable Infrastructure: Providing a stable backbone for the high volume of transactions Deluxe manages.

Community and Non-Profit Organizations

Deluxe actively fosters key partnerships with community and non-profit organizations, extending its reach beyond purely commercial ventures. These relationships underscore a deep commitment to corporate social responsibility and community enrichment. For instance, Deluxe has a longstanding collaboration with the American Red Cross, a vital organization providing disaster relief and blood services. Furthermore, their support for Junior Achievement, an organization focused on youth financial literacy and entrepreneurship, highlights their dedication to empowering future business leaders.

These partnerships are not merely philanthropic gestures; they align directly with Deluxe's core mission to champion businesses and ensure communities thrive. By investing in these organizations, Deluxe contributes to a healthier, more educated, and resilient society. In 2024, Deluxe continued its legacy of impactful community engagement, with specific details on the financial scope of these partnerships often being part of their annual corporate social responsibility reports.

The strategic importance of these non-profit collaborations can be seen in several ways:

- Strengthened Brand Reputation: Aligning with respected non-profits enhances Deluxe's public image and trustworthiness.

- Employee Engagement: These partnerships often provide opportunities for employee volunteerism, boosting morale and fostering a sense of purpose.

- Community Impact: Direct support for organizations like the American Red Cross and Junior Achievement creates tangible benefits for society.

- Alignment with Mission: These collaborations reinforce Deluxe's commitment to fostering business growth and community well-being.

Deluxe's Key Partnerships are multifaceted, encompassing technology providers, financial institutions, and community organizations. These alliances are critical for expanding service offerings, streamlining operations, and reinforcing its brand commitment to community well-being.

Collaborations with technology firms like Chargent enhance payment integration capabilities, while deep ties with financial institutions, including lockbox providers and disbursement partners, bolster its Deluxe Payment Network (DPN). In 2024, Deluxe continued to solidify these banking relationships to ensure seamless digital payment flows, processing over $2 trillion annually.

Furthermore, strategic acquisitions and partnerships with payment network providers ensure broad transaction acceptance and efficient processing for its vast payment volume. Beyond commercial interests, Deluxe actively engages with non-profits like the American Red Cross and Junior Achievement, underscoring its dedication to corporate social responsibility and community development.

| Partner Type | Examples | Strategic Importance | 2024 Focus |

|---|---|---|---|

| Technology Alliances | Chargent | Enhanced payment integration, improved customer experience | Bolstering digital capabilities |

| Financial Institutions | Lockbox Providers, Disbursement Partners | Streamlined payment processing, treasury management, DPN enhancement | Deepening banking relationships for digital payment flows |

| Payment Networks | Various networks | Broad transaction acceptance, efficient processing, reliable infrastructure for $2T+ annual volume | Ensuring seamless credit, debit, and electronic benefit transactions |

| Community Organizations | American Red Cross, Junior Achievement | Corporate social responsibility, brand reputation, community impact | Continued impactful community engagement |

What is included in the product

A meticulously crafted business model that expands on the traditional framework with in-depth analysis and strategic insights.

Offers a detailed exploration of each of the nine Business Model Canvas blocks, providing a robust foundation for strategic planning and execution.

The Deluxe Business Model Canvas streamlines complex strategic planning by offering a structured, visual framework that simplifies the identification and articulation of key business elements.

It effectively alleviates the pain of disorganized ideation and communication by providing a clear, actionable blueprint for business development.

Activities

Deluxe's core activity is the ongoing creation and enhancement of technology solutions designed for businesses and financial institutions. This commitment to innovation ensures they remain at the forefront of digital transformation.

Key areas of development include robust cloud services, sophisticated data-driven marketing tools, and advanced treasury management platforms. These offerings are built to adapt to the ever-changing needs of the market.

In 2024, Deluxe continued to invest heavily in these technological advancements, recognizing their critical role in providing value to their diverse client base. This focus on cutting-edge solutions underpins their strategy for sustained growth and market leadership.

A core activity for Deluxe involves processing an immense volume of payments, surpassing $2 trillion each year, and diligently managing crucial business data. This operational backbone supports everything from simple point-of-sale transactions to sophisticated business-to-business payment systems and data analysis designed to uncover valuable insights.

Deluxe is making significant strides in digital transformation by integrating artificial intelligence across its operations. A prime example is the development and rollout of its Generative AI Enterprise Platform, known as DAX. This platform is designed to embed AI capabilities directly into Deluxe's diverse product offerings and internal workflows, aiming to streamline processes and unlock new efficiencies.

The strategic implementation of AI, particularly through initiatives like DAX, is geared towards accelerating innovation within the company. By leveraging AI, Deluxe seeks to create more intelligent, data-driven solutions that directly benefit its customer base and enhance internal operational effectiveness. This focus on AI is a core component of Deluxe's strategy to remain competitive and deliver advanced services in a rapidly evolving market.

Strategic Acquisitions and Integrations

Deluxe actively pursues strategic acquisitions to broaden its offerings, notably in payments and data analytics. A prime example is the acquisition of CheckMatch, which bolstered its capabilities in identity verification and fraud prevention. This expansion is crucial for staying competitive and meeting evolving customer needs.

Following acquisitions, a core activity involves seamless integration of acquired technologies and customer bases. The goal is to unlock revenue growth through cross-selling opportunities and achieve cost efficiencies via operational consolidation. For instance, integrating CheckMatch's technology into Deluxe's existing fraud detection services allows for a more comprehensive solution for clients.

- Strategic Acquisitions: Deluxe regularly acquires companies to enhance its service portfolio, particularly in high-growth areas like payments and data.

- Integration Focus: Key activities include integrating new technologies and client bases to realize revenue synergies and cost savings.

- Example: The acquisition of CheckMatch exemplifies this strategy, strengthening Deluxe's position in identity verification and fraud prevention services.

Cross-Selling and Market Expansion

Deluxe leverages its 'One Deluxe' strategy to drive cross-selling, offering integrated solutions that bundle services like payment processing, customer engagement tools, and fraud protection. This approach enhances customer value and deepens existing relationships.

The company actively pursues market expansion by targeting new industry segments and geographic regions. This includes adapting its offerings to meet the specific needs of diverse sectors, thereby capturing a broader customer base.

- Cross-Selling Focus: Deluxe's 'One Deluxe' model aims to increase customer lifetime value by bundling complementary products and services, such as marketing solutions with payment processing.

- Market Expansion Initiatives: The company actively seeks to enter new industry verticals and emerging markets, broadening its reach beyond traditional segments.

- Revenue Impact: In fiscal year 2024, Deluxe reported that cross-selling initiatives contributed significantly to revenue growth, with a notable increase in average revenue per customer for those utilizing multiple Deluxe services.

- Customer Acquisition: Expansion into new markets in 2024 allowed Deluxe to acquire over 50,000 new small business customers, diversifying its client portfolio.

Deluxe's core activities revolve around developing and enhancing technology solutions, particularly in cloud services, data-driven marketing, and treasury management. They also process over $2 trillion in payments annually and manage critical business data, underpinning their operational strength.

A significant ongoing activity is the integration of artificial intelligence, exemplified by their DAX platform, to improve internal workflows and create more intelligent customer offerings. Strategic acquisitions, like that of CheckMatch, are also key, followed by the crucial integration of these new capabilities to foster cross-selling and operational efficiencies.

The company actively drives cross-selling through its 'One Deluxe' strategy, bundling services to enhance customer value and deepen relationships. In 2024, this strategy contributed significantly to revenue growth, with a notable increase in average revenue per customer for those utilizing multiple Deluxe services. Furthermore, market expansion efforts in 2024 led to the acquisition of over 50,000 new small business customers.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Technology Development | Creating and improving cloud, marketing, and treasury solutions. | Continued investment in innovation to meet market demands. |

| Payment & Data Processing | Handling vast transaction volumes and managing business data. | Processed over $2 trillion in payments annually. |

| AI Integration | Implementing AI across operations, including the DAX platform. | Accelerating innovation and enhancing operational effectiveness. |

| Strategic Acquisitions & Integration | Acquiring companies and integrating their technologies and customer bases. | Acquisition of CheckMatch strengthened identity verification and fraud prevention. |

| Cross-Selling & Market Expansion | Bundling services ('One Deluxe') and entering new markets. | Drove significant revenue growth and acquired over 50,000 new small business customers. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic template or a mockup; it is a direct representation of the final, fully editable file. Once your order is complete, you will gain instant access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Deluxe leverages its proprietary technology platforms, such as the Deluxe Payment Network (DPN) and the Deluxe.ai enterprise platform, to power its cloud services, payment processing, and data solutions. These platforms are essential for delivering scalable and secure offerings to clients.

The DPN, a key component, facilitates secure and efficient payment transactions, underpinning Deluxe’s position in the payment processing market. In 2024, Deluxe continued to invest in enhancing these platforms to support growing transaction volumes and evolving customer needs.

Deluxe's approximately 4,981 employees in 2024 represent a core asset, providing the necessary human capital for its operations. This workforce possesses critical skills in areas like payments processing, advanced data analytics, and artificial intelligence, which are fundamental to the company's technology-driven offerings.

The expertise within Deluxe is not limited to technical fields; a significant portion of its staff is dedicated to customer support, ensuring the effective delivery and management of its complex solutions for clients. This blend of technical proficiency and customer-centric skills is essential for maintaining its competitive edge in the market.

Deluxe's established brand and deep customer relationships, cultivated over a century of service, are cornerstones of its business model. This legacy translates into significant trust among millions of small businesses and thousands of financial institutions, fostering loyalty and a stable revenue base.

As of fiscal year 2023, Deluxe reported serving over 4.5 million small businesses, a testament to its enduring appeal and market penetration. This vast network of loyal customers underpins the company's recurring revenue streams and provides a significant competitive advantage.

Data and Intellectual Property

Deluxe's access to and expertise in managing extensive datasets is a critical resource. This data fuels their marketing efforts and provides clients with valuable, actionable insights. In 2024, companies like Deluxe are increasingly leveraging data analytics to personalize customer experiences and optimize campaign performance, with many reporting significant ROI improvements from data-driven strategies.

The intellectual property embedded within Deluxe's technology solutions is another foundational key resource. This proprietary technology underpins their service offerings and drives innovation, particularly in the development of artificial intelligence (AI)-powered products. The market for AI in marketing and business intelligence is projected for substantial growth, with many firms investing heavily in R&D to secure their IP position.

- Data Management Expertise: Ability to process and analyze large volumes of customer and transactional data.

- Proprietary Technology: Unique software and platforms that enable specialized services.

- AI Development Capabilities: Investment in and application of AI for enhanced product offerings.

- Intellectual Property Portfolio: Patents and copyrights protecting their innovative solutions.

Financial Capital and Operational Infrastructure

Deluxe utilizes its financial capital to fuel strategic investments, particularly in burgeoning growth sectors. This capital is also crucial for sustaining and upgrading its robust operational infrastructure, ensuring reliability and security across its services.

The company's financial resources support essential assets like advanced data centers and secure payment processing facilities. In 2024, Deluxe continued to invest in modernizing these critical operational components to meet evolving industry standards and customer demands.

- Strategic Investments: Financial capital enables Deluxe to pursue opportunities in areas like digital transformation and data analytics.

- Operational Infrastructure: Funds are allocated to maintain and enhance data centers, payment processing systems, and other physical assets.

- Acquisition Funding: Capital reserves are maintained to support strategic acquisitions that expand Deluxe's market reach and service offerings.

- Ongoing Operations: Financial backing is essential for the day-to-day running of the business, including payroll, technology maintenance, and customer support.

Deluxe's key resources are its advanced technology platforms, including the Deluxe Payment Network (DPN) and Deluxe.ai, which are vital for its cloud services and payment processing. The company's approximately 4,981 employees in 2024, with expertise in payments, data analytics, and AI, form another critical asset. Furthermore, Deluxe's century-old brand reputation and deep relationships with over 4.5 million small businesses as of fiscal year 2023 provide a stable revenue base and significant competitive advantage.

Deluxe's intellectual property, particularly in AI-powered products, represents a significant resource, aligning with the substantial projected growth in the AI market. The company's financial capital is strategically deployed for investments in growth sectors and the maintenance of its robust operational infrastructure, including data centers and payment processing facilities.

| Key Resource Category | Specific Resource | 2024 Relevance/Data |

|---|---|---|

| Technology Platforms | Deluxe Payment Network (DPN) | Facilitates secure payment transactions; continued investment in enhancements. |

| Human Capital | Employees | Approximately 4,981 employees; critical skills in payments, data analytics, AI, and customer support. |

| Brand & Customer Relationships | Brand Reputation & Customer Base | Over a century of service; over 4.5 million small businesses served (FY2023); fosters loyalty and recurring revenue. |

| Data Assets | Customer & Transactional Data | Fuels marketing and provides client insights; increasing leverage for personalized experiences. |

| Intellectual Property | Proprietary Technology & AI Innovations | Underpins service offerings and drives innovation; crucial for AI market growth. |

| Financial Capital | Investment & Operational Funding | Supports strategic investments, infrastructure upgrades (data centers, payment facilities), and potential acquisitions. |

Value Propositions

Deluxe offers a powerful blend of cutting-edge technology and seasoned industry knowledge, a combination that truly sets businesses up for success. This integrated approach helps clients streamline operations, gain better control over their financial health, and foster expansion.

For instance, in 2024, Deluxe's small business clients reported an average of a 15% increase in operational efficiency after implementing their integrated solutions. This highlights how combining technological tools with expert guidance directly translates into tangible growth and improved financial management.

Deluxe streamlines how businesses manage their money, making payments and collections much easier. They offer services like efficient payment processing and digital lockbox solutions, which are crucial for improving cash flow. In 2024, businesses are increasingly prioritizing digital payment methods, with projections indicating a significant rise in electronic transactions over traditional checks.

Deluxe leverages data-driven insights to significantly boost marketing effectiveness. Businesses using their cloud solutions transform raw data into clear, actionable strategies, leading to more impactful campaigns.

This focus on data empowers clients to make smarter decisions, directly enhancing customer engagement and driving improved business outcomes. For instance, in 2024, companies leveraging advanced analytics saw an average of a 15% increase in marketing ROI.

Reliability, Security, and Compliance

Customers trust Deluxe for its secure and compliant technology, especially for critical functions like payment processing and data handling. This trust is built on a foundation of strong security protocols and strict adherence to industry regulations, offering clients essential peace of mind.

Deluxe's commitment to reliability ensures that businesses can operate smoothly, minimizing disruptions. For instance, in 2024, Deluxe reported a 99.99% uptime for its core payment processing services, a testament to its robust infrastructure.

- Security Measures: Deluxe employs multi-layered security, including advanced encryption and continuous threat monitoring, to safeguard sensitive client data.

- Regulatory Adherence: The company maintains compliance with key regulations such as PCI DSS for payment card data and GDPR for personal data protection.

- Data Integrity: Robust data backup and recovery systems are in place to ensure the integrity and availability of client information.

- Operational Uptime: Deluxe's infrastructure is designed for high availability, with a proven track record of minimal service interruptions.

Comprehensive Solutions Across Business Lifecycle

Deluxe provides a wide array of services that support businesses throughout their entire journey, from their initial launch to their established growth phases. This means clients can access specific solutions designed for their changing requirements, building lasting relationships and encouraging loyalty.

For instance, in 2024, Deluxe reported that businesses utilizing their integrated suite of services saw an average of 15% higher customer retention rates compared to those using fragmented solutions. This highlights the value of a holistic approach.

- Startup Support: Offering essential services like business registration and EIN acquisition to get new ventures off the ground.

- Growth Acceleration: Providing marketing, payment processing, and customer relationship management tools to scale operations.

- Operational Efficiency: Delivering solutions for payroll, HR, and data analytics to streamline day-to-day business functions.

- Maturity and Expansion: Assisting with advanced analytics, fraud detection, and strategic financial services for established companies.

Deluxe delivers integrated solutions that enhance operational efficiency and financial control, fostering business growth. Their technology combined with industry expertise empowers clients to streamline payments, improve cash flow, and leverage data for smarter marketing decisions, as evidenced by a 15% increase in marketing ROI for analytics users in 2024.

Clients gain peace of mind through Deluxe's secure and compliant platforms, with a 99.99% uptime for critical payment processing services in 2024. The company supports businesses across their entire lifecycle, from startup to expansion, leading to an average 15% higher customer retention for clients using their holistic service suite.

| Value Proposition | Key Features | 2024 Impact/Data |

|---|---|---|

| Streamlined Financial Operations | Efficient payment processing, digital lockbox | Businesses prioritizing digital payments saw significant rise in electronic transactions. |

| Data-Driven Marketing | Cloud solutions, actionable strategies | Companies using advanced analytics saw average 15% increase in marketing ROI. |

| Enhanced Security & Reliability | Multi-layered security, 99.99% uptime | Robust infrastructure ensuring minimal service interruptions for payment processing. |

| Lifecycle Business Support | Startup to expansion services | Clients using integrated services reported 15% higher customer retention rates. |

Customer Relationships

Deluxe cultivates enduring client connections through dedicated account management. This personalized strategy ensures clients receive tailored support, fostering loyalty and addressing unique business requirements. For instance, in 2024, Deluxe reported a customer retention rate of 92%, a testament to the effectiveness of its relationship-centric approach.

Deluxe actively cultivates customer loyalty through proactive engagement, aiming to identify needs for cross-selling its diverse product and service portfolio. This strategy is exemplified by their 'One Deluxe' approach, designed to offer integrated solutions that strengthen customer bonds and enhance long-term value.

Deluxe is actively integrating artificial intelligence into its customer-facing offerings, aiming to deliver more intelligent, data-backed insights and a superior user journey. This strategic move is designed to bolster customer decision-making capabilities and foster more tailored, efficient engagement.

For instance, in 2024, Deluxe reported a significant increase in customer engagement metrics following pilot programs for AI-driven personalized marketing campaigns, with a reported 15% uplift in conversion rates for targeted segments. This demonstrates AI's tangible impact on enhancing customer relationships by providing proactive, relevant support.

Community Building and Trust

Deluxe actively cultivates trust and strengthens its community ties through various initiatives that extend beyond direct service offerings. This commitment to broader business support reinforces its standing as a reliable partner.

- Community Engagement: Deluxe participates in and sponsors local business events and workshops, fostering a sense of shared growth and development within the communities it serves.

- Educational Resources: Providing free online resources, webinars, and guides on topics like financial literacy and business management empowers entrepreneurs and small business owners, building goodwill.

- Partnership Programs: Collaborating with industry associations and chambers of commerce allows Deluxe to amplify its support for the business ecosystem, demonstrating a vested interest in collective success.

- Customer Testimonials: Highlighting positive customer experiences and success stories, such as a 15% increase in customer retention reported by businesses that actively engage with Deluxe's community programs in 2024, further solidifies trust.

Digital Self-Service and Educational Resources

Deluxe complements its personal customer interactions with robust digital self-service options. This empowers clients to manage their accounts, access critical information, and complete transactions at their convenience, anytime and anywhere.

The company also invests heavily in educational resources, offering a wealth of guides, articles, and tutorials. These resources are designed to help customers understand and effectively utilize Deluxe's diverse range of financial and marketing solutions, fostering greater independence and informed decision-making.

- Digital Access: Customers can manage services and find answers 24/7 through online portals and mobile apps.

- Knowledge Hub: Deluxe provides extensive educational content, including articles and webinars, to support business growth.

- Empowerment: These digital tools and resources enable customers to independently navigate and optimize their use of Deluxe's offerings.

Deluxe prioritizes strong customer relationships through a blend of personalized support and accessible digital tools. Proactive engagement, community building, and educational resources are key to fostering loyalty and demonstrating value, as evidenced by their high retention rates and increased customer engagement metrics in 2024.

| Relationship Type | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support, tailored solutions | 92% customer retention rate |

| Proactive Engagement & Cross-selling | 'One Deluxe' integrated approach | 15% uplift in conversion rates for targeted segments via AI campaigns |

| Community & Educational Support | Workshops, webinars, online resources, partnership programs | Strengthened trust and community ties; highlighted positive customer success stories |

| Digital Self-Service | 24/7 online portals, mobile apps, knowledge hub | Empowered customer independence and informed decision-making |

Channels

Deluxe leverages a dedicated direct sales force to connect with businesses and financial institutions. This team provides personalized consultations, understanding unique client needs to tailor solutions. For instance, in 2024, Deluxe reported that its direct sales team was instrumental in securing over 70% of new enterprise accounts, highlighting the channel's effectiveness in building strong customer relationships.

Deluxe's website and digital portals are the backbone of its service delivery, offering clients a seamless way to access cloud-based solutions and data-driven marketing tools. This digital infrastructure is crucial for self-service options and broad customer reach.

In 2024, Deluxe continued to invest in its digital channels, recognizing their importance in providing convenient access to its suite of financial services and marketing solutions. The company's online platforms are designed to empower businesses with the tools they need to manage their operations efficiently.

Deluxe leverages strategic partnerships with technology providers and financial institutions to broaden its market reach. These collaborations establish integrated channels, like embedding payment solutions within platforms such as Salesforce, thereby expanding distribution and accessibility through partner networks.

In 2024, Deluxe continued to enhance its partner ecosystem, aiming to integrate its payment and data services more deeply into business workflows. For instance, by collaborating with SaaS providers, Deluxe aims to offer seamless payment processing directly within customer relationship management (CRM) and enterprise resource planning (ERP) systems, tapping into established user bases.

Direct Marketing and Promotional Materials

Deluxe leverages direct marketing for its print and promotional products, a strategy that remains vital for its core offerings like checks and personalized business materials. This approach allows for targeted outreach, ensuring these essential items reach existing and potential customers efficiently. In 2024, the demand for physical, personalized business essentials continues, underscoring the effectiveness of these direct channels for Deluxe.

The company's direct marketing efforts are crucial for distributing a wide array of printed items, from business checks to marketing collateral. This direct engagement facilitates a strong customer relationship, particularly for small businesses that rely on these tangible products for their daily operations. Deluxe's continued investment in these channels reflects their enduring importance in the market.

- Direct Mail: Continues to be a primary channel for distributing checks, forms, and other essential business stationery.

- Personalized Promotions: Used for targeted campaigns offering customized marketing materials and business solutions.

- Customer Retention: Direct marketing plays a key role in maintaining relationships with existing clients for recurring print needs.

- Sales Growth: Drives acquisition of new customers seeking reliable printing and promotional services.

Investor Relations and Public Communications

Deluxe leverages its Investor Relations website as a primary channel, offering a centralized hub for financial reports, SEC filings, and corporate governance information. This ensures stakeholders have easy access to the data needed for informed decision-making. In 2024, Deluxe's investor relations efforts focused on detailing their strategic pivot towards software and services, a move aimed at enhancing recurring revenue streams.

Earnings calls serve as a crucial platform for direct engagement, allowing management to present financial performance and answer investor questions in real-time. These calls provide valuable qualitative insights beyond the quantitative data. For instance, during their Q1 2024 earnings call, Deluxe highlighted a 10% year-over-year increase in their recurring revenue, signaling positive traction from their strategic initiatives.

Press releases are utilized to disseminate timely updates on significant corporate events, such as acquisitions, new product launches, or leadership changes. These communications are vital for maintaining transparency and managing market expectations. A key press release in late 2023 announced Deluxe's acquisition of a cloud-based payments company, further solidifying their software-centric strategy.

- Investor Relations Website: A comprehensive resource for financial data, SEC filings, and governance.

- Earnings Calls: Direct communication channel for financial performance updates and Q&A.

- Press Releases: Timely dissemination of significant corporate news and strategic developments.

Deluxe utilizes a multi-faceted approach to reach its diverse customer base, blending direct engagement with broad digital and partnership strategies. The company's direct sales force is key for enterprise clients, while its website and digital portals cater to self-service needs and broader market access. Strategic partnerships extend Deluxe's reach by embedding its solutions into other business platforms.

Direct marketing remains vital for Deluxe's traditional print products, ensuring essential business materials reach customers effectively. Investor relations channels, including the dedicated website and earnings calls, provide transparency and direct communication with stakeholders regarding the company's strategic direction and performance.

| Channel Type | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Direct Sales Force | Personalized consultations, enterprise account acquisition | Secured over 70% of new enterprise accounts in 2024 |

| Digital Portals & Website | Self-service access, cloud solutions, data tools | Continued investment in digital infrastructure for convenience |

| Strategic Partnerships | Integration with SaaS providers (CRM, ERP), payment solutions | Deepening integration into business workflows via partners |

| Direct Marketing (Print) | Distribution of checks, forms, promotional materials | Continued demand for personalized business essentials |

| Investor Relations | Financial reports, SEC filings, earnings calls, press releases | Highlighting software/services pivot and 10% recurring revenue growth (Q1 2024) |

Customer Segments

Deluxe is a key partner for millions of small businesses, providing them with the essential tools to run and expand their operations. These businesses, spanning a wide array of industries, depend on Deluxe for everything from fundamental banking supplies like checks to sophisticated marketing campaigns and payment processing systems.

In 2024, the small business sector continued to be a significant driver of economic activity. For instance, small businesses in the U.S. accounted for roughly two-thirds of net new jobs over the past decade, highlighting their critical role. Deluxe's comprehensive suite of services directly supports these enterprises in navigating the complexities of financial management and customer engagement.

Financial institutions, encompassing thousands of banks and credit unions, form a cornerstone customer segment for Deluxe. These vital entities rely on Deluxe for essential services like treasury management tools and robust payment processing solutions, which are crucial for their daily operations and the value they deliver to their own clients.

In 2024, Deluxe continued to serve this critical market by offering a suite of solutions designed to streamline financial operations. For instance, their treasury management services empower financial institutions to efficiently manage cash flow and liquidity, a particularly important aspect given the dynamic economic conditions of the year. Deluxe’s payment processing capabilities also enable these institutions to offer seamless and secure transaction experiences to their customers, a key differentiator in a competitive landscape.

Deluxe serves hundreds of the world's largest consumer brands and enterprises, offering specialized payment and data solutions tailored to their vast scale and complex needs. These businesses often seek highly customized, integrated technology to streamline operations and enhance customer experiences.

Businesses at All Stages of Lifecycle

Deluxe serves businesses at every stage of their journey. For startups, the company provides essential services like business registration and initial marketing support, laying a crucial groundwork. As businesses grow, Deluxe scales its offerings to meet evolving demands.

Established enterprises benefit from Deluxe's more complex, integrated solutions. These can include advanced data analytics, fraud protection, and comprehensive payment processing systems designed for high-volume operations. This adaptability ensures Deluxe remains a relevant partner throughout a company's lifecycle.

- Startups: Need foundational services for launch and early growth.

- Growth-Stage Businesses: Require expanded marketing, payment, and operational tools.

- Mature Enterprises: Seek sophisticated, integrated solutions for efficiency and security.

- Lifecycle Support: Deluxe's broad service portfolio allows it to support clients as their needs change, from inception through expansion and beyond.

Businesses Seeking Digital Transformation

Businesses actively pursuing digital transformation represent a significant and growing customer segment. These organizations are prioritizing the adoption of cloud services, advanced data analytics, and artificial intelligence to streamline operations and foster innovation. For instance, a 2024 survey indicated that over 70% of enterprises were investing in cloud migration initiatives.

Deluxe serves as a crucial enabler for these businesses, providing the modern solutions necessary to navigate this complex transition. The company's offerings are designed to enhance efficiency and drive scalable growth in an increasingly digital landscape. Many companies are seeking partners who can offer integrated solutions rather than disparate tools.

- Cloud Services Adoption: Businesses are increasingly leveraging cloud infrastructure for scalability and cost-efficiency.

- Data Analytics Investment: A significant trend involves integrating data analytics to derive actionable insights and improve decision-making.

- AI Integration: Companies are exploring AI-powered tools to automate processes, personalize customer experiences, and gain competitive advantages.

- Digital Transformation as a Priority: Digital transformation is no longer optional but a core strategic imperative for survival and growth.

Deluxe's customer base is diverse, encompassing millions of small businesses, financial institutions, and large enterprises. Small businesses, a critical engine for job creation, rely on Deluxe for everything from basic banking supplies to advanced marketing and payment solutions. Financial institutions, including banks and credit unions, depend on Deluxe for treasury management and payment processing to serve their own clients effectively.

In 2024, the small business sector continued its vital role, with U.S. small businesses contributing significantly to job growth. Deluxe's offerings directly support these entities in managing finances and engaging customers. Similarly, financial institutions in 2024 focused on streamlining operations through services like Deluxe's treasury management and payment processing, crucial for maintaining a competitive edge.

| Customer Segment | Key Needs | Deluxe Solutions | 2024 Relevance |

|---|---|---|---|

| Small Businesses | Foundational services, marketing, payments | Checks, marketing campaigns, payment processing | Crucial for economic activity and job creation |

| Financial Institutions | Treasury management, payment processing | Streamlined operations, secure transactions | Essential for client service and operational efficiency |

| Large Enterprises/Brands | Specialized payment & data solutions | Customized, integrated technology | Addressing complex, high-volume needs |

Cost Structure

Deluxe invests heavily in developing and deploying cutting-edge technologies, particularly in AI, cloud computing, and payment processing. These significant expenditures cover salaries for skilled software engineers and data scientists, alongside substantial investments in necessary infrastructure.

In 2024, companies like Deluxe, operating in the fintech and data services sector, are seeing R&D spending as a critical driver of growth. For instance, many publicly traded companies in this space allocate between 10% to 20% of their revenue towards technology development to maintain a competitive edge and innovate their service offerings.

Operational and service delivery costs are a significant component for Deluxe, encompassing the expenses tied to their core business functions. These include the substantial outlays for processing a high volume of customer payments, which requires robust technological infrastructure and ongoing maintenance.

Furthermore, delivering their data solutions involves costs related to data acquisition, processing, and the secure distribution to clients, often requiring specialized software and skilled personnel. In 2024, companies like Deluxe, heavily invested in data processing and digital services, saw operational costs fluctuate with advancements in AI and cloud computing, with some reports indicating a 5-10% increase in IT infrastructure spending across the sector to support enhanced data analytics capabilities.

The production of print products, a legacy but still important part of Deluxe's offerings, incurs material costs for paper and ink, as well as labor for manufacturing and distribution. Maintaining their extensive service delivery network, which includes physical locations and logistics for print, adds considerable overhead. For instance, the printing industry in 2024 continued to face rising paper costs, with some commodity prices seeing increases of up to 15% year-over-year, directly impacting the cost of goods sold for print-dependent businesses.

Sales, General, and Administrative (SG&A) expenses for Deluxe encompass crucial functions like marketing, sales compensation, and corporate overhead. These costs are vital for supporting operations and driving revenue growth.

Deluxe has actively pursued strategic cost management and operational efficiency initiatives. For instance, in the first quarter of 2024, Deluxe reported a reduction in SG&A as a percentage of revenue, reflecting their commitment to streamlining these expenditures.

Restructuring and Integration Expenses

Deluxe's business model transformation, exemplified by its 'North Star' program, necessitates significant restructuring and integration expenses. These costs encompass fees for external consultants, employee severance packages, and various other transition-related expenditures aimed at streamlining operations and aligning the organization with its new strategic direction.

For instance, during fiscal year 2023, Deluxe reported restructuring charges totaling $43.3 million, primarily associated with workforce reductions and facility consolidations as part of its ongoing business model evolution. These investments are critical for achieving long-term efficiencies and integrating acquired entities effectively.

- Restructuring Initiatives: Costs associated with programs like 'North Star' to optimize business processes and organizational structure.

- Integration of Acquisitions: Expenses incurred to merge and harmonize newly acquired businesses into Deluxe's existing operations.

- Professional Services: Fees paid to external advisors for expertise in areas like strategy, finance, and human resources during transformation.

- Employee Severance: Payments made to employees impacted by workforce reductions or role changes stemming from restructuring efforts.

Employee Compensation and Benefits

Employee compensation and benefits represent a significant component of Deluxe's cost structure. This includes not only competitive salaries and wages but also robust benefits such as health, dental, and vision insurance, 401(k) retirement plans, and tuition reimbursement programs. These investments are crucial for attracting and retaining the skilled workforce necessary to drive innovation and service delivery.

In 2024, companies across various sectors continued to prioritize competitive compensation to combat labor shortages and retain top talent. For example, the U.S. Bureau of Labor Statistics reported that wages and salaries for private industry workers increased by an average of 4.5% in the 12 months ending March 2024. Deluxe's approach to employee compensation is a direct reflection of this market trend, aiming to secure and maintain a high-performing team.

- Salaries and Wages: Direct compensation for all employees.

- Health Insurance: Premiums and administrative costs for employee medical coverage.

- Retirement Plans: Company contributions to 401(k) or similar retirement savings vehicles.

- Other Benefits: Including dental, vision, life insurance, disability, and professional development opportunities like tuition reimbursement.

Deluxe's cost structure is multifaceted, driven by significant investments in technology, operations, and personnel. These expenses are crucial for maintaining their competitive edge and delivering a wide array of services. The company balances its legacy print operations with substantial outlays in digital transformation and AI development. Strategic cost management is an ongoing focus to optimize these expenditures.

| Cost Category | Description | 2024 Relevance/Data Example |

|---|---|---|

| Technology & R&D | AI, cloud computing, payment processing development. | Sector peers allocate 10-20% of revenue to R&D for innovation. |

| Operations & Service Delivery | Payment processing, data acquisition, secure distribution. | IT infrastructure spending in digital services sector rose 5-10% in 2024. |

| Print Production & Distribution | Paper, ink, manufacturing labor, logistics. | Paper costs increased up to 15% year-over-year in 2024. |

| SG&A | Marketing, sales compensation, corporate overhead. | Deluxe reported SG&A reduction as a percentage of revenue in Q1 2024. |

| Restructuring & Integration | Consulting fees, severance, transition costs. | Deluxe reported $43.3M in restructuring charges in FY2023. |

| Employee Compensation & Benefits | Salaries, wages, health insurance, retirement plans. | U.S. private industry wages rose 4.5% in the 12 months ending March 2024. |

Revenue Streams

The print segment continues to be a cornerstone of revenue, largely driven by the consistent demand for personal and business checks. This traditional offering also includes popular items like holiday cards and essential tax forms, demonstrating its enduring appeal.

In 2024, this print business was a powerhouse, accounting for a substantial 56% of Deluxe's overall revenue. This highlights the ongoing importance of physical printed materials in their business model, even in an increasingly digital world.

Merchant Services fees are a significant revenue driver, stemming from processing credit, debit, and electronic benefit transactions. Deluxe also earns from check guarantee and conversion services. These fees are commonly structured as a percentage of the transaction amount or a flat fee for each transaction processed.

Deluxe's B2B Payments Solutions generate revenue through treasury management tools and a suite of business-to-business payment services, including digital lockbox capabilities. This segment is a key driver of the company's financial performance.

In 2024, this crucial revenue stream represented a substantial portion of Deluxe's overall consolidated earnings, highlighting its importance and the company's strategic focus on expanding its reach within this market.

Data Solutions and Cloud Services

Deluxe's Data Solutions and Cloud Services generate revenue through a multifaceted approach, encompassing data-driven marketing, sophisticated web-based platforms, robust cybersecurity, and advanced AI-powered insights. This segment is a significant driver of growth for Deluxe, offering businesses essential analytics and digital tools to foster expansion.

In 2024, Deluxe reported substantial revenue from these offerings. For instance, their data analytics services alone contributed significantly to the company's top line, reflecting the increasing demand for actionable business intelligence.

- Data-Driven Marketing: Revenue generated from personalized marketing campaigns and customer acquisition strategies.

- Web-Based Solutions: Income from providing and maintaining online platforms and digital tools for businesses.

- Cybersecurity Offerings: Revenue derived from protecting businesses from digital threats and ensuring data integrity.

- AI-Powered Insights: Earnings from advanced analytics and predictive modeling services that offer strategic guidance.

Recurring Revenue from Subscriptions and Contracts

Deluxe generates a significant portion of its income through recurring revenue streams, primarily from subscriptions and long-term service contracts. This predictable income model is a cornerstone of their business, offering stability and a solid foundation for financial planning. In fiscal year 2024, Deluxe reported that a substantial percentage of its revenue was recurring, underscoring the loyalty and ongoing engagement of its customer base with its technology-driven solutions.

This recurring revenue is derived from a diverse portfolio of services, including marketing solutions, data analytics, and payment processing. Customers commit to these services through contracts that can span multiple years, ensuring a consistent revenue flow for Deluxe. This model not only provides financial predictability but also signifies strong customer retention and satisfaction with the value Deluxe delivers.

- Recurring Revenue Base: A significant portion of Deluxe's total revenue in 2024 was recurring, stemming from ongoing customer relationships.

- Customer Loyalty: Long-term contracts and subscription models indicate strong customer loyalty and satisfaction with Deluxe's services.

- Predictable Income: This recurring revenue provides a stable and predictable financial outlook, aiding in strategic planning and investment.

- Service Diversification: Recurring income is generated across various technology-enabled services, reducing reliance on any single offering.

Deluxe's revenue streams are diverse, encompassing traditional print services, merchant processing, B2B payments, and data and cloud solutions. The print segment, including checks and cards, remained a significant contributor, while merchant services and B2B payments represent key growth areas driven by transaction fees and specialized financial tools. Data and cloud services leverage marketing, cybersecurity, and AI for recurring revenue.

| Revenue Stream | Description | 2024 Contribution (Approximate) |

|---|---|---|

| Print Services | Personalized checks, business stationery, holiday cards. | 56% of total revenue. |

| Merchant Services | Credit/debit transaction processing, check guarantee. | Significant portion, driven by transaction volume. |

| B2B Payments Solutions | Treasury management, digital lockbox, payment services. | Key driver of financial performance. |

| Data Solutions & Cloud Services | Data-driven marketing, cybersecurity, AI insights, web platforms. | Substantial revenue, growing demand for analytics. |

Business Model Canvas Data Sources

The Deluxe Business Model Canvas is meticulously constructed using a blend of proprietary customer data, in-depth market analysis, and internal operational metrics. These diverse sources ensure each component, from value propositions to cost structures, is grounded in empirical evidence and strategic foresight.