Deluxe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deluxe Bundle

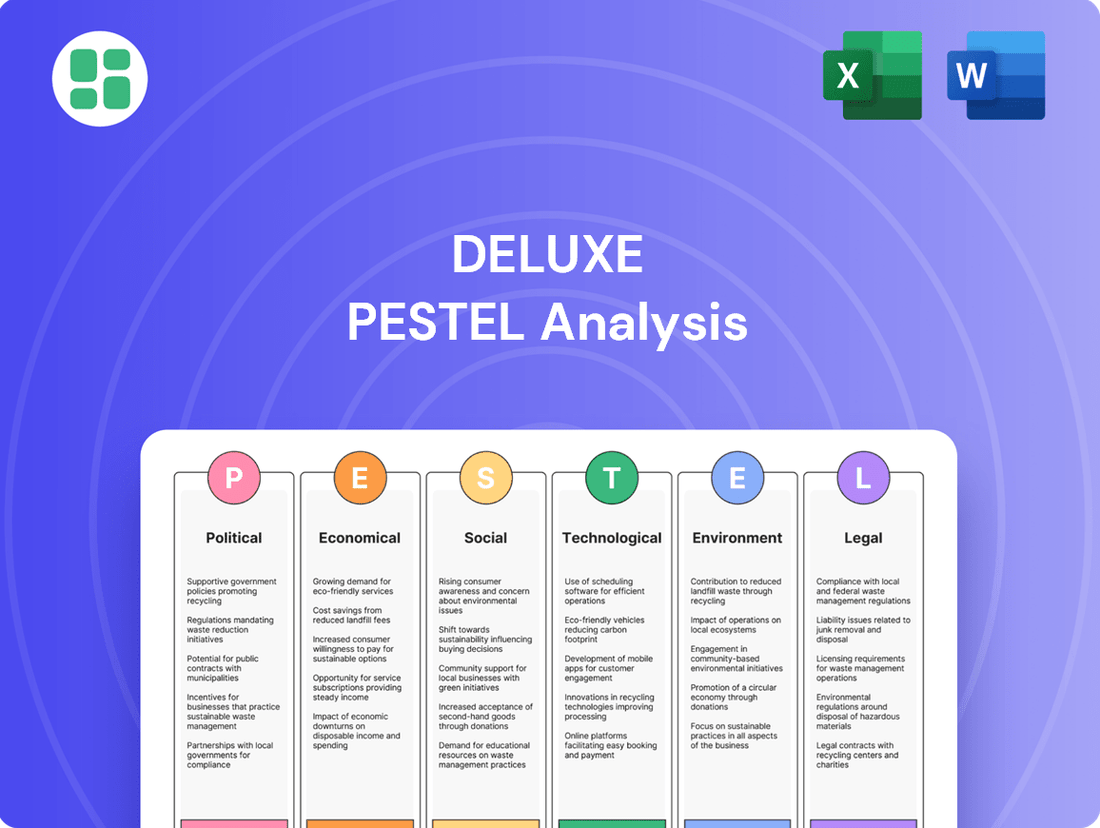

Uncover the intricate web of external forces shaping Deluxe's trajectory with our comprehensive PESTLE analysis. Gain a strategic advantage by understanding the political, economic, social, technological, legal, and environmental factors impacting the company. Equip yourself with actionable insights to navigate market complexities and drive informed decision-making. Download the full PESTLE analysis now for unparalleled clarity and a competitive edge.

Political factors

Deluxe Corporation, a key player in providing technology solutions for financial institutions, navigates a landscape heavily shaped by government regulations. These rules, covering areas like data privacy and consumer protection, are constantly evolving. For instance, the ongoing discussions around potential updates to the Gramm-Leach-Bliley Act (GLBA) in the US, which governs financial institutions' handling of nonpublic personal information, highlight the dynamic nature of compliance. Failure to adhere to these mandates, such as those related to the secure processing of financial transactions, can lead to significant penalties and operational disruptions.

Data privacy regulations are a significant political factor for Deluxe. With laws like the California Consumer Privacy Act (CCPA) and the European Union's General Data Protection Regulation (GDPR) setting stringent standards, Deluxe must prioritize robust data protection measures. These regulations directly impact how Deluxe collects, stores, and utilizes customer data, particularly for its marketing and cloud-based services.

The company's ability to comply with evolving data privacy laws is crucial. For instance, the CCPA, fully effective since January 1, 2023, grants California consumers rights over their personal information, requiring businesses like Deluxe to be transparent about data collection and usage. Failure to adhere to these mandates can result in substantial fines; under CCPA, penalties can reach $2,500 per unintentional violation and $7,500 per intentional violation.

Adapting to these legal frameworks necessitates ongoing investment in compliance infrastructure and employee training. Deluxe's commitment to secure data handling not only mitigates legal risks but also builds trust with its customer base, which is vital for its data-centric business models. The global trend towards stronger data protection suggests this will remain a key compliance area for years to come.

Deluxe's operations across the United States, Canada, and Europe mean its international business is significantly influenced by evolving trade policies. For instance, shifts in agreements like the USMCA or potential new tariffs on goods or services could directly affect Deluxe's operational costs and its ability to expand into new geographical markets. This global presence necessitates constant monitoring of geopolitical developments and trade regulations.

Government Spending on Digital Transformation

Governments worldwide are significantly increasing their spending on digital transformation initiatives. For instance, the United States government allocated $1.7 billion in fiscal year 2023 to modernize federal IT infrastructure, with a substantial portion directed towards cloud adoption and cybersecurity. This trend creates a fertile ground for companies like Deluxe, especially within its cloud services and treasury management segments.

The drive to enhance public services through digital means often translates into increased demand for sophisticated financial technology solutions. As governments aim to streamline operations and improve citizen engagement, they are investing in platforms that offer secure and efficient treasury management and cloud-based services. Deluxe's expertise in these areas positions it to capitalize on this growing market. For example, the EU's Digital Decade policy aims to have 75% of businesses use cloud computing services by 2030, indicating a broader European push that could benefit Deluxe.

- Increased government investment in digital infrastructure modernization.

- Growing demand for cloud services and treasury management solutions in public sectors.

- Opportunities for Deluxe to offer its expertise in financial technology to government entities.

- Potential for revenue growth driven by digital transformation projects in public administration.

Taxation Policies on Technology Companies

Fluctuations in corporate taxation policies, particularly those affecting technology and financial services, directly influence Deluxe's profitability and investment decisions. For instance, the US federal corporate tax rate, which stood at 21% in 2024, can significantly alter net income.

Favorable tax incentives, such as research and development credits, could stimulate Deluxe's innovation and expansion efforts. Conversely, an increase in tax burdens, like potential future adjustments to digital services taxes in various jurisdictions, might compel adjustments in financial planning and operational cost management.

- Tax Rate Impact: A 1% change in the corporate tax rate can affect Deluxe's bottom line by millions of dollars annually.

- R&D Credits: The availability and terms of R&D tax credits in key markets like the US and Europe directly influence investment in new product development.

- International Tax Landscape: Evolving international tax agreements and potential global minimum tax initiatives could reshape Deluxe's global tax strategy.

- Digital Services Taxes: The implementation or expansion of digital services taxes in countries where Deluxe operates could increase operating expenses.

Government stability and policy continuity are crucial for Deluxe's long-term planning. For example, the upcoming 2024 US Presidential election and its potential impact on regulatory frameworks for financial technology and data privacy create an environment of careful observation for the company. Political shifts can lead to changes in trade agreements, tax policies, and government spending priorities, all of which directly affect Deluxe's operational costs and market opportunities.

The increasing focus on cybersecurity by governments worldwide presents both challenges and opportunities for Deluxe. For instance, the US Cybersecurity and Infrastructure Security Agency (CISA) continues to issue guidance and directives aimed at strengthening critical infrastructure security, including the financial sector. Deluxe must ensure its solutions meet these evolving standards, potentially driving demand for its security-focused offerings.

Government initiatives promoting digital transformation in public services are a significant driver for Deluxe. Countries are investing heavily; for example, the UK's National Cyber Security Centre actively supports businesses in adopting secure digital practices. Deluxe's expertise in cloud and treasury management solutions positions it to benefit from these public sector digital modernization efforts, as governments seek to improve efficiency and citizen services through technology.

What is included in the product

The Deluxe PESTLE Analysis provides a comprehensive examination of external macro-environmental influences across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The Deluxe PESTLE Analysis offers a structured framework, transforming complex external factors into actionable insights that alleviate the pain of strategic uncertainty.

Economic factors

Interest rate fluctuations significantly impact Deluxe's financial health. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as it did through much of 2024, Deluxe's borrowing costs for expansion or operations will remain elevated. This can also deter clients, especially small businesses, from investing in new capital or services, potentially dampening demand for Deluxe's offerings.

Conversely, a scenario where interest rates decline, perhaps to a range like 4.50%-4.75% by late 2024 or into 2025, would likely stimulate economic activity. Lower borrowing costs could encourage Deluxe's clients to increase their capital expenditures, thereby boosting demand for Deluxe's products and services. This environment generally supports growth-oriented investments.

The overall economic climate significantly influences Deluxe's customer base. During periods of economic expansion, small businesses and financial institutions are more likely to invest in marketing and technology solutions, boosting Deluxe's revenue streams. For instance, the U.S. saw a GDP growth of approximately 2.5% in 2024, indicating a generally favorable environment for business investment.

Conversely, economic downturns can negatively impact Deluxe. Recessions often lead to reduced discretionary spending by businesses, potentially causing them to cut back on services like those Deluxe offers or seek cheaper alternatives. A projected slowdown in global GDP growth for 2025, with some forecasts suggesting rates below 2%, could present headwinds for Deluxe if businesses tighten their belts.

Inflationary pressures directly impact Deluxe's operational costs. For its print segment, this means higher expenses for raw materials like paper and ink, as well as increased labor wages to keep pace with the rising cost of living. The U.S. Producer Price Index for printing and related support activities saw a notable increase in early 2024, reflecting these material cost hikes.

Similarly, Deluxe's cloud services are susceptible to rising energy costs, a critical input for data centers. As global energy prices remain volatile, these increased operational expenses can directly affect the profitability of its digital offerings. For instance, the average cost of electricity for commercial users in the U.S. experienced a significant uptick in late 2023 and early 2024.

While Deluxe has historically demonstrated strong cost management capabilities, sustained inflation presents a challenge to maintaining healthy profit margins. If price increases on its services cannot fully compensate for these rising input costs, or if efficiency gains don't keep pace, profit margins could be compressed. The company's ability to strategically adjust pricing and implement further operational efficiencies will be crucial in navigating these persistent inflationary headwinds throughout 2024 and into 2025.

Currency Exchange Rates

Currency exchange rates are a significant consideration for Deluxe, given its operations in Canada and Europe. Fluctuations in these rates can directly affect the reported value of international revenues and expenses when translated back into U.S. dollars. For example, a strengthening U.S. dollar against the Canadian dollar or the Euro would decrease the reported USD value of earnings from those regions.

This volatility necessitates strategic financial hedging and robust management of international financial exposures. Companies like Deluxe often utilize financial instruments to mitigate the risk associated with currency movements, aiming to stabilize reported earnings and cash flows.

- Impact on Revenue: A stronger USD in 2024 could reduce the reported USD value of Deluxe's Canadian and European sales.

- Cost Management: Conversely, a weaker USD might increase the cost of goods or services sourced internationally.

- Hedging Strategies: Deluxe likely employs forward contracts or currency options to lock in exchange rates for future transactions.

- 2024 Exchange Rate Trends: The U.S. Dollar Index (DXY) saw fluctuations throughout 2024, impacting companies with significant international operations. For instance, the USD strengthened against the Euro in early 2024 before experiencing some volatility.

Small Business and Consumer Spending Trends

Deluxe's business thrives on the spending habits of small businesses and consumers. In 2024, consumer spending showed resilience, with retail sales projected to grow by 3.0% year-over-year, indicating a steady demand for payment processing and marketing services. The ongoing shift to digital channels is a significant tailwind.

The increasing adoption of digital payments directly benefits Deluxe. For instance, in the first quarter of 2025, small businesses reported a 15% increase in transactions processed through online platforms, highlighting the growing need for Deluxe's integrated payment solutions. This trend is expected to continue as e-commerce penetration deepens.

- Consumer spending growth: Retail sales are anticipated to increase by approximately 3.0% in 2024.

- Digital payment adoption: Small businesses saw a 15% rise in online transaction processing in Q1 2025.

- E-commerce expansion: The continued growth of online retail fuels demand for Deluxe's digital marketing and payment tools.

Economic factors significantly shape Deluxe's operating environment. Interest rate policies, such as the Federal Reserve's target range of 5.25%-5.50% in 2024, influence borrowing costs and client investment decisions. Robust GDP growth, like the estimated 2.5% in the U.S. for 2024, generally supports business spending, while projected slower global growth for 2025 could pose challenges.

Inflation directly impacts Deluxe's costs, increasing expenses for raw materials like paper and energy for its cloud services. For instance, U.S. commercial electricity costs saw a notable rise in late 2023 and early 2024. Currency exchange rate volatility, particularly between the USD, Canadian Dollar, and Euro, affects the reported value of international revenues and expenses.

Consumer spending, projected to grow by 3.0% in 2024, and the increasing adoption of digital payments, evidenced by a 15% rise in online transaction processing for small businesses in Q1 2025, present significant opportunities for Deluxe's digital marketing and payment solutions.

| Economic Factor | 2024/2025 Data Point | Impact on Deluxe |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (through much of 2024) | Elevated borrowing costs, potential dampening of client investment. |

| U.S. GDP Growth | ~2.5% (projected for 2024) | Generally favorable for business investment and demand. |

| Global GDP Growth | Projected below 2% for 2025 | Potential headwinds due to tightened business spending. |

| U.S. Producer Price Index (Printing) | Notable increase in early 2024 | Higher raw material costs for print segment. |

| U.S. Commercial Electricity Costs | Significant uptick late 2023/early 2024 | Increased operational expenses for cloud services. |

| U.S. Dollar Index (DXY) | Fluctuated throughout 2024 | Affects reported value of international sales and costs. |

| U.S. Retail Sales Growth | ~3.0% (projected for 2024) | Supports demand for payment processing and marketing services. |

| Small Business Online Transactions | 15% increase in Q1 2025 | Growing demand for Deluxe's digital payment solutions. |

Preview the Actual Deliverable

Deluxe PESTLE Analysis

The Deluxe PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of your industry's landscape.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors.

Sociological factors

Societal shifts are profoundly impacting how businesses operate, with digital adoption and payment preferences at the forefront. Consumers and businesses alike are increasingly favoring electronic transactions over traditional methods like checks. This ongoing trend necessitates strategic adaptation for companies like Deluxe, which has historically relied on check processing.

The move towards digital payments is not just a preference; it's becoming the norm. For instance, in 2023, the U.S. saw a significant increase in digital payment volumes, with projections indicating continued growth through 2025. Deluxe is actively responding by diversifying its offerings to include a broader range of payments and data solutions, recognizing that this pivot is essential for maintaining its competitive edge and ensuring future relevance in a rapidly evolving financial landscape.

The increasing influx of Gen Z and younger Millennials into the workforce, who are inherently digital natives, is significantly reshaping the demand for business software. These generations expect seamless, intuitive digital experiences, similar to what they use in their personal lives, driving a need for user-friendly cloud services and integrated treasury management platforms.

For Deluxe, this demographic shift means its success hinges on offering solutions that resonate with a tech-savvy clientele. In 2024, companies are prioritizing vendors that offer not just functionality but also a superior user experience, making Deluxe's investment in accessible, modern digital tools a critical factor in client acquisition and retention.

The surge in e-commerce, amplified by the pandemic, has fundamentally reshaped consumer behavior and business operations. Globally, e-commerce sales are projected to reach $7.4 trillion by 2025, up from an estimated $5.7 trillion in 2023, highlighting a significant shift towards digital marketplaces. This trend demands advanced digital marketing, secure payment gateways, and scalable cloud infrastructure.

Deluxe is well-positioned to capitalize on this evolution by offering integrated solutions that support businesses navigating the online landscape. Their expertise in data analytics and digital transformation services can empower companies to enhance customer engagement, streamline online transactions, and optimize their digital presence, thereby fostering growth in the burgeoning e-commerce sector.

Societal Expectations for Data Security and Privacy

Societal expectations for data security and privacy have intensified, directly impacting companies like Deluxe. As awareness of data breaches grows, consumers and businesses alike demand robust protection of their sensitive information. This heightened concern translates into a critical need for companies to demonstrate strong data handling practices to maintain trust.

For Deluxe, which often handles financial and personal data for its clients, this societal shift is paramount. A recent survey indicated that 85% of consumers consider data privacy a significant factor when choosing a service provider. Failure to meet these expectations can lead to substantial client attrition and hinder new customer acquisition efforts, particularly within the financial services sector where trust is foundational.

- Increased consumer demand for transparency in data usage.

- Heightened regulatory scrutiny following high-profile data breaches globally.

- Direct correlation between perceived data security and customer loyalty.

- Growing market for privacy-enhancing technologies and services.

Emphasis on Financial Literacy and Digital Inclusion

Societal emphasis on financial literacy and digital inclusion is a key driver for Deluxe's growth. Initiatives aimed at boosting these areas can significantly broaden Deluxe's potential customer base, especially among small businesses and underserved communities looking to digitize their financial management. For instance, the U.S. Department of the Treasury's Financial Literacy and Education Commission continues to promote programs that enhance financial capabilities, which directly benefits companies like Deluxe offering digital financial tools.

Deluxe's suite of solutions is well-positioned to empower these businesses. By providing accessible digital platforms for invoicing, payments, and financial reporting, Deluxe can help small businesses navigate the complexities of the modern digital economy. This is particularly relevant as small businesses are increasingly adopting digital tools; a 2024 report indicated that over 70% of small businesses in the U.S. now utilize cloud-based accounting software, a trend Deluxe actively supports.

- Increased adoption of digital financial tools by small businesses, driven by financial literacy campaigns.

- Expansion of Deluxe's market reach into previously underserved communities through digital inclusion efforts.

- Empowerment of small businesses to manage finances effectively in the digital era, fostering economic growth.

- Alignment of Deluxe's offerings with national strategies to improve financial well-being and digital access.

Societal trends highlight a growing preference for digital interactions and a demand for enhanced data security. Consumers and businesses are increasingly moving away from paper-based transactions, favoring electronic payments and cloud-based services. This shift, coupled with heightened awareness around data privacy, necessitates that companies like Deluxe adapt their offerings and operational practices to meet evolving expectations.

The demographic shift towards younger generations, who are digital natives, is also a significant factor. These groups expect intuitive, seamless digital experiences, influencing the design and functionality of business software. Deluxe's ability to provide user-friendly, modern digital tools is crucial for attracting and retaining this growing segment of the market.

The surge in e-commerce continues to reshape consumer behavior, driving demand for integrated digital solutions. Businesses need robust support for online transactions, digital marketing, and secure payment processing. Deluxe's expertise in data analytics and digital transformation services positions it to assist companies in navigating this evolving landscape and optimizing their online presence.

Societal emphasis on financial literacy and digital inclusion presents an opportunity for Deluxe to expand its reach. By offering accessible digital financial tools, Deluxe can empower small businesses and underserved communities to better manage their finances. This aligns with broader national efforts to improve financial well-being and digital access, creating a favorable market environment.

Technological factors

Deluxe is actively integrating advanced AI, machine learning, and data analytics into its core offerings, particularly in data-driven marketing and cloud services. This allows them to deliver highly targeted insights and optimize campaign performance for their clients, a crucial differentiator in today's market.

The company's commitment to innovation in these areas is evident with recent investments and the launch of a generative AI enterprise platform. This strategic move underscores the necessity of staying at the forefront of technological advancements to maintain a competitive edge and provide clients with state-of-the-art solutions.

The cloud computing landscape continues its rapid evolution, with significant strides in scalability, security, and cost-effectiveness. These advancements directly shape Deluxe's ability to enhance its cloud services, offering more robust and agile solutions.

By staying ahead of these technological shifts, Deluxe can better meet the dynamic needs of its clients, particularly financial institutions that demand high performance and unwavering reliability. For instance, the global cloud computing market was valued at approximately $610 billion in 2023 and is projected to grow substantially, underscoring the importance of continuous infrastructure investment.

Deluxe faces an ever-growing challenge from cybersecurity threats, given its role in managing sensitive financial and business information for its clients. The company must continually invest in robust security protocols to safeguard this data.

In 2024, the global average cost of a data breach reached $4.73 million, underscoring the significant financial and reputational risks Deluxe mitigates through its cybersecurity investments. Maintaining client trust and adhering to stringent regulatory mandates, such as GDPR and CCPA, are critical functions directly supported by these advanced security measures.

Development of New Payment Technologies

The financial landscape is rapidly evolving with new payment technologies. Real-time payment systems, for instance, are becoming increasingly prevalent, allowing for instant fund transfers. In 2023, the global real-time payments market was valued at approximately $15.5 billion and is projected to grow significantly, reaching an estimated $40.7 billion by 2030, according to some market analyses. This necessitates that Deluxe continuously updates its payment processing solutions to remain competitive and cater to the demand for faster transactions.

Blockchain technology and mobile payment solutions also represent significant technological shifts. Mobile payments are already deeply integrated into daily commerce, with global mobile payment transaction value expected to exceed $2.5 trillion in 2024. Deluxe must therefore ensure its offerings can seamlessly integrate with or leverage these advancements, such as exploring blockchain for enhanced security and efficiency in treasury management, or expanding its mobile payment capabilities.

These technological advancements create both opportunities and challenges. Deluxe can capitalize on these trends by offering innovative, secure, and user-friendly payment solutions. However, failure to adapt could lead to a loss of market share as competitors embrace these new technologies. The company's strategic response to these developments will be critical for its future success in the payments sector.

Pace of Digital Transformation Adoption

The rapid pace at which small and medium-sized businesses (SMBs) and financial institutions are embracing digital transformation directly impacts the demand for Deluxe's technology-driven services. For instance, a 2024 report indicated that 75% of SMBs planned to increase their digital spending in the next 18 months, highlighting a significant market opportunity for companies like Deluxe offering digital solutions.

Deluxe's prosperity is intrinsically linked to its capacity to assist clients in navigating their digital evolution. This involves providing user-friendly and cohesive tools that simplify complex processes, thereby fostering greater adoption and reliance on Deluxe's offerings.

Factors influencing this adoption rate include:

- SMB Digital Maturity: The current level of digital integration within SMB operations.

- Financial Sector Modernization: The ongoing efforts by financial institutions to upgrade their technological infrastructure.

- Customer Demand for Digital Services: The increasing expectation from end-customers for seamless digital interactions with businesses and financial providers.

Deluxe's technological strategy centers on leveraging AI, machine learning, and cloud computing to enhance its data-driven marketing and payment solutions. This focus is critical as the global cloud computing market was valued at approximately $610 billion in 2023, with continuous growth expected.

The company must also prioritize robust cybersecurity measures, especially since the average cost of a data breach in 2024 reached $4.73 million, impacting client trust and regulatory compliance.

Emerging payment technologies like real-time payments, which saw global market value around $15.5 billion in 2023, and mobile payments, with transaction values projected to exceed $2.5 trillion in 2024, necessitate Deluxe's adaptation to maintain competitiveness.

The increasing digital transformation among SMBs, with 75% planning to boost digital spending in 2024-2025, presents a significant opportunity for Deluxe to provide integrated digital tools.

| Technology Area | 2023/2024 Data Point | Implication for Deluxe |

|---|---|---|

| Cloud Computing Market | ~$610 billion (2023) | Enhances Deluxe's ability to offer scalable and agile solutions. |

| Average Data Breach Cost | $4.73 million (2024) | Highlights the need for continuous investment in cybersecurity. |

| Real-Time Payments Market | ~$15.5 billion (2023) | Requires Deluxe to update payment processing for faster transactions. |

| Mobile Payment Transactions | >$2.5 trillion (2024 projection) | Necessitates seamless integration of mobile payment capabilities. |

| SMB Digital Spending Intent | 75% planning increase (2024-2025) | Creates demand for Deluxe's digital transformation services. |

Legal factors

Deluxe must meticulously adhere to evolving data protection regulations, such as the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) in the U.S. These laws significantly impact Deluxe's ability to collect, process, and utilize customer data for its marketing and cloud-based services, necessitating strong data governance and transparent consent mechanisms.

Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. In 2024, companies are increasingly investing in privacy-enhancing technologies and data anonymization techniques to balance data utility with regulatory compliance.

Deluxe, as a key player serving financial institutions, operates under rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This legal framework mandates that Deluxe's treasury management and payment processing solutions must actively support client compliance efforts. For example, financial institutions globally are investing heavily in these areas; in 2024, the global AML software market was valued at approximately $3.5 billion and is projected to grow significantly.

Non-compliance with these evolving legal requirements carries substantial risks for Deluxe and its clients. Penalties can include hefty fines, operational restrictions, and severe damage to brand reputation, impacting market trust and future business opportunities. The Financial Crimes Enforcement Network (FinCEN) in the U.S., for instance, levied over $2.5 billion in civil penalties in 2023 for AML violations alone.

Deluxe's intellectual property, encompassing its software, algorithms, and unique technologies, forms a cornerstone of its competitive edge. The company actively safeguards these assets through robust patent, copyright, and trademark enforcement. For instance, in fiscal year 2024, Deluxe continued to invest in R&D, a key driver for new IP, with a focus on AI-powered solutions for fraud detection and payment processing.

Effective management of software licensing agreements is also paramount, particularly for Deluxe's cloud-based offerings and its expanding suite of digital solutions. These agreements ensure revenue streams and control over the use of proprietary technology, a critical factor as the company navigates the evolving digital landscape and its associated regulatory frameworks.

Consumer Protection Laws

Deluxe's extensive marketing and online service offerings, including digital advertising and customer data management, fall under a complex web of consumer protection laws. These regulations, such as the Federal Trade Commission (FTC) Act in the US, govern truth in advertising, prohibit deceptive practices, and mandate clear online disclosures, impacting how Deluxe presents its services and handles customer information.

Adherence to these legal frameworks is crucial for maintaining consumer trust and avoiding costly litigation. For instance, the FTC reported over 2.1 million consumer complaints in 2023, with a significant portion related to deceptive advertising and online scams, highlighting the risks of non-compliance.

Key areas of focus for Deluxe would include:

- Data Privacy Compliance: Ensuring adherence to regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which grant consumers rights over their personal data.

- Truthful Advertising: Maintaining accuracy and avoiding misleading claims in all marketing materials, especially for financial and business services where trust is paramount.

- Online Disclosure Requirements: Providing clear and conspicuous information regarding terms of service, fees, and data usage policies on all digital platforms.

- Combating Unfair Business Practices: Implementing robust internal controls to prevent any practices that could be deemed unfair or abusive to consumers.

Antitrust Regulations in Tech and Financial Sectors

Antitrust regulations are a critical legal factor for Deluxe, particularly within the tech and financial sectors. As a company operating in a consolidating industry, Deluxe must ensure that its mergers, acquisitions, and strategic partnerships do not violate competition laws. For instance, the U.S. Department of Justice and the Federal Trade Commission actively scrutinize large tech mergers, with a growing focus on how these deals impact market competition and consumer choice.

The increasing scrutiny on Big Tech's market power by regulators globally means Deluxe must be exceptionally cautious. Any move that could be perceived as stifling competition or creating monopolistic practices, especially in areas like payment processing or data analytics, will face rigorous review. In 2023, regulators worldwide initiated numerous investigations and lawsuits against major technology firms concerning alleged anti-competitive behavior, setting a precedent for stricter enforcement.

- Increased regulatory focus on market dominance in tech-driven financial services.

- Mergers and acquisitions require thorough antitrust compliance checks to avoid stifling competition.

- Potential for fines and divestitures if anti-competitive practices are identified.

- Global trend towards stricter enforcement of antitrust laws in digital markets.

Deluxe must navigate a complex legal landscape concerning data privacy and consumer protection, including regulations like GDPR and CCPA. These laws dictate how customer data is collected and used, requiring robust data governance and clear consent. Failure to comply can lead to significant fines, with GDPR penalties potentially reaching 4% of global annual turnover.

The company is also bound by stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, essential for its treasury and payment solutions. The global AML software market was valued at approximately $3.5 billion in 2024, reflecting the importance of compliance. Non-compliance risks hefty fines and reputational damage, as seen with FinCEN levying over $2.5 billion in penalties in 2023 for AML violations.

Intellectual property protection is vital, with Deluxe investing in R&D for AI-powered solutions in fiscal year 2024 to drive new IP. Furthermore, consumer protection laws, such as the FTC Act, govern advertising practices and online disclosures, impacting how Deluxe markets its services and manages customer information. The FTC received over 2.1 million consumer complaints in 2023, highlighting the need for adherence.

Antitrust regulations demand careful attention, particularly regarding mergers and acquisitions in the tech and financial sectors. Regulators globally, including the U.S. Department of Justice and FTC, are increasing scrutiny on market dominance. Numerous investigations into alleged anti-competitive behavior by major tech firms in 2023 underscore the need for Deluxe to avoid practices that stifle competition.

Environmental factors

Customers and investors increasingly expect companies to embrace sustainability, pushing for greener IT solutions and eco-conscious operations. This trend directly impacts Deluxe, especially given its print heritage and data center infrastructure, creating a need to actively shrink its environmental impact and showcase its commitment to corporate social responsibility.

Deluxe's cloud-based services are heavily dependent on data centers, which are substantial energy consumers. This reliance places the company under growing pressure to address the energy efficiency and carbon footprint associated with these critical operations.

In 2024, the global data center industry's energy consumption was estimated to be around 200-300 terawatt-hours (TWh), a figure projected to increase significantly. Deluxe's commitment to sustainability will involve substantial investments in renewable energy sources, such as solar and wind power, to offset its operational energy demands and reduce its environmental impact.

Furthermore, optimizing data center infrastructure through advanced cooling technologies and more efficient hardware is a crucial environmental strategy for Deluxe. Industry benchmarks in 2025 indicate that Power Usage Effectiveness (PUE) ratios below 1.2 are considered best-in-class for energy efficiency, a target Deluxe will likely strive for.

The lifecycle of technological hardware, both within Deluxe's operations and for its clients, inevitably generates electronic waste (e-waste). This presents a significant environmental challenge, as improper disposal can lead to the release of hazardous materials into the environment. For instance, in 2024, global e-waste generation was projected to exceed 61 million metric tons, highlighting the scale of this issue.

Addressing this requires Deluxe to implement responsible e-waste management strategies. This includes robust programs for proper disposal, prioritizing recycling initiatives, and actively encouraging the sustainable procurement of hardware. By focusing on these areas, Deluxe can mitigate environmental impact and align with growing regulatory pressures and consumer expectations for corporate environmental responsibility.

Climate Change Impact on Business Continuity

Climate change presents indirect operational risks for Deluxe, impacting business continuity. Extreme weather events, such as those experienced globally throughout 2024 and projected for 2025, can disrupt the physical infrastructure Deluxe relies on, including data centers and transportation networks. This necessitates robust disaster recovery and business continuity planning.

Supply chain disruptions are another key concern. For instance, the increasing frequency of severe weather events in regions vital for technology component manufacturing could lead to delays or increased costs for hardware upgrades, indirectly affecting Deluxe's service delivery. Building resilience into these extended supply chains is crucial for maintaining uninterrupted operations.

Furthermore, the operational stability of Deluxe's clients is also susceptible to climate-related impacts. Disruptions to their businesses, whether through direct physical damage or broader economic consequences, can affect their ability to utilize Deluxe's services. This underscores the importance of Deluxe's own operational resilience and its ability to support clients through challenging periods.

- Infrastructure Vulnerability: Increased risk of power outages and network disruptions due to extreme weather events, impacting data center uptime.

- Supply Chain Volatility: Potential for delays and cost increases in acquiring essential hardware due to climate-induced disruptions in manufacturing regions.

- Client Operational Risk: Indirect impact on Deluxe's revenue if client businesses face significant disruptions from climate change effects.

- Resilience Investment: Ongoing need to invest in cloud service redundancy and robust operational continuity plans to mitigate these risks.

Corporate Social Responsibility (CSR) Expectations

Deluxe is experiencing heightened scrutiny from investors, employees, and the general public concerning its Corporate Social Responsibility (CSR), particularly its environmental impact. For instance, in 2024, a significant portion of institutional investors, estimated at over 70%, consider ESG (Environmental, Social, and Governance) factors when making investment decisions, a trend that directly influences companies like Deluxe. Meeting these evolving expectations is becoming crucial for maintaining a positive corporate image and fostering strong relationships with all stakeholders.

Demonstrating a genuine commitment to environmental sustainability and providing transparent reporting on these efforts can significantly bolster Deluxe's brand reputation. In 2025, surveys indicate that consumers are increasingly likely to choose brands that align with their environmental values, with studies showing up to 60% of consumers willing to pay more for sustainable products. This translates to a tangible benefit for Deluxe, potentially driving customer loyalty and market share.

Effective CSR initiatives can also be a powerful tool for attracting and retaining talent. By 2024, a substantial percentage of the workforce, particularly younger generations, prioritize working for companies with strong ethical and environmental commitments. Deluxe's proactive approach to environmental stewardship can therefore enhance its appeal as an employer, contributing to a more engaged and motivated workforce.

The company's CSR performance, especially regarding environmental factors, directly impacts its stakeholder relations. Deluxe's ability to clearly communicate its environmental goals and progress, such as reducing its carbon footprint by a targeted 15% by 2027, can foster trust and goodwill. This transparency is vital for navigating the complex landscape of corporate accountability and ensuring long-term business viability.

Deluxe's environmental strategy must address its significant energy consumption, particularly from data centers, aiming for efficiency improvements. The company also faces the challenge of managing e-waste, necessitating robust recycling and responsible disposal programs to meet growing stakeholder expectations for sustainability.

Climate change poses indirect risks through potential disruptions to infrastructure and supply chains, requiring Deluxe to invest in resilience and continuity planning. Demonstrating strong environmental, social, and governance (ESG) performance is crucial for attracting investment, retaining customers, and securing talent in 2025.

| Environmental Factor | Impact on Deluxe | 2024/2025 Data/Trend |

|---|---|---|

| Energy Consumption & Carbon Footprint | Data center operations are major energy consumers; need to reduce carbon emissions. | Global data center energy consumption estimated at 200-300 TWh in 2024. Best-in-class PUE ratios < 1.2 in 2025. |

| Electronic Waste (E-waste) | Hardware lifecycle generates e-waste; requires responsible management. | Global e-waste projected to exceed 61 million metric tons in 2024. |

| Climate Change Impacts | Risk of infrastructure disruption (power outages, network issues) and supply chain volatility. | Increasing frequency of extreme weather events globally in 2024 and projected for 2025. |

| Corporate Social Responsibility (CSR) & Stakeholder Expectations | Investor, customer, and employee demand for sustainability impacts brand reputation and talent acquisition. | Over 70% of institutional investors consider ESG factors in 2024. Up to 60% of consumers willing to pay more for sustainable products in 2025. |

PESTLE Analysis Data Sources

Our Deluxe PESTLE Analysis is meticulously constructed using a blend of authoritative global economic databases, comprehensive government policy updates, and cutting-edge technology trend forecasts. This ensures every insight into the political, economic, social, technological, legal, and environmental landscape is both accurate and highly relevant.