Deluxe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deluxe Bundle

Deluxe faces significant competitive pressures, from the bargaining power of its buyers to the constant threat of new entrants disrupting its market share. Understanding these dynamics is crucial for any business operating in or looking to enter Deluxe's industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Deluxe’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Deluxe Corporation's dependence on technology and cloud infrastructure suppliers, such as AWS, Microsoft Azure, and Google Cloud, grants these providers substantial bargaining power. As Deluxe increasingly adopts cloud-based services and data-centric solutions, its reliance on these dominant hyperscalers intensifies, allowing them to exert influence over pricing and contract stipulations.

For specialized software components and advanced AI technologies, suppliers can wield significant power. This stems from the proprietary nature of their offerings and the deep expertise needed to develop and maintain them. Deluxe's strategic push into AI and blockchain, for instance, requires collaborations with firms at the forefront of these fields. This reliance on niche providers can translate into higher procurement costs and a potential dependence on specific vendors for critical technological advancements.

Data providers, particularly those with unique or extensive datasets vital for marketing and analytics, can wield significant bargaining power. The quality and exclusivity of this data are paramount for Deluxe's data solutions, potentially restricting the availability of comparable alternatives and thus strengthening supplier leverage.

Supplier Power 4

In Deluxe's traditional print operations, the bargaining power of suppliers for raw materials like paper and ink, as well as printing equipment makers, is relatively subdued. This is largely because these markets are more commoditized, meaning there are many suppliers to choose from, and the cost of switching is not prohibitively high.

Furthermore, the ongoing decline in revenue from the legacy print segment significantly diminishes the leverage suppliers hold over Deluxe. As this business area shrinks, suppliers have less influence because the overall demand from Deluxe in this segment is decreasing, making them more eager to secure the remaining business.

- Supplier Power in Print: Generally low due to commoditized markets and multiple vendors for paper, ink, and equipment.

- Impact of Declining Print Revenue: Further reduces supplier leverage as overall demand from Deluxe in this segment wanes.

- Digital Segment Shift: The growth in digital services offers Deluxe more negotiating power against suppliers in those newer areas.

Supplier Power 5

The availability of skilled IT talent, especially in high-demand fields like AI, cybersecurity, and cloud architecture, significantly influences supplier power within the labor market. A scarcity of these professionals can lead to increased labor expenses and hinder Deluxe's capacity for innovation and service delivery.

For instance, in 2024, the demand for AI specialists continued to outpace supply, with some reports indicating that the average salary for an AI engineer could range from $120,000 to $180,000 annually, depending on experience and location. This upward pressure on wages directly impacts a company's operating costs.

Deluxe's reliance on specialized IT skills means that suppliers of this talent—the individuals themselves—hold considerable bargaining power. This is particularly true when specific skill sets are not readily available or when there's intense competition for qualified candidates.

- High Demand for Specialized IT Skills: Fields like artificial intelligence, machine learning, and advanced cybersecurity are experiencing critical talent shortages globally.

- Wage Inflation in IT Sector: In 2024, the IT sector continued to see robust wage growth, with specialized roles experiencing increases of 10-15% year-over-year in many advanced economies.

- Impact on Innovation and Service Delivery: A lack of skilled IT personnel can delay product development cycles and compromise the quality or efficiency of customer-facing services.

- Geographic Concentration of Talent: Talent pools for cutting-edge IT skills are often concentrated in specific tech hubs, creating regional competition and further empowering suppliers in those areas.

Deluxe's strategic shift toward digital services, particularly in areas like AI and cloud infrastructure, means suppliers in these sectors hold significant leverage. Companies like AWS, Microsoft Azure, and Google Cloud, which are critical for Deluxe's operations, can dictate terms due to their dominant market positions and the specialized nature of their offerings.

The scarcity of specialized IT talent, such as AI engineers and cybersecurity experts, further empowers individual suppliers and staffing agencies. In 2024, the demand for these skills continued to outstrip supply, with average salaries for experienced AI engineers often exceeding $150,000 annually, increasing Deluxe's labor costs.

Conversely, suppliers in Deluxe's legacy print segment, like paper and ink manufacturers, have diminished bargaining power. This is due to the commoditized nature of these markets and the declining revenue from Deluxe's print operations, which reduces overall demand and supplier influence.

| Supplier Type | Bargaining Power | Reasoning | 2024 Data Point |

| Cloud Infrastructure (AWS, Azure, Google) | High | Dominant market share, specialized services, high switching costs | Cloud spending by businesses globally was projected to increase by over 20% in 2024. |

| Specialized AI/Tech Software | High | Proprietary technology, deep expertise, limited alternatives | Investment in AI startups reached record levels in early 2024, driving up the cost of specialized solutions. |

| Data Providers (Unique Datasets) | High | Exclusivity and quality of data, critical for analytics | The market for big data and business analytics was expected to grow by 12-14% in 2024. |

| IT Talent (AI, Cybersecurity) | High | Talent scarcity, high demand, specialized skills | Average salaries for senior AI engineers in major tech hubs saw year-over-year increases of 10-15% in 2024. |

| Print Materials (Paper, Ink) | Low | Commoditized market, numerous suppliers, low switching costs | Global paper prices remained relatively stable in 2024, with some regional increases due to supply chain factors. |

What is included in the product

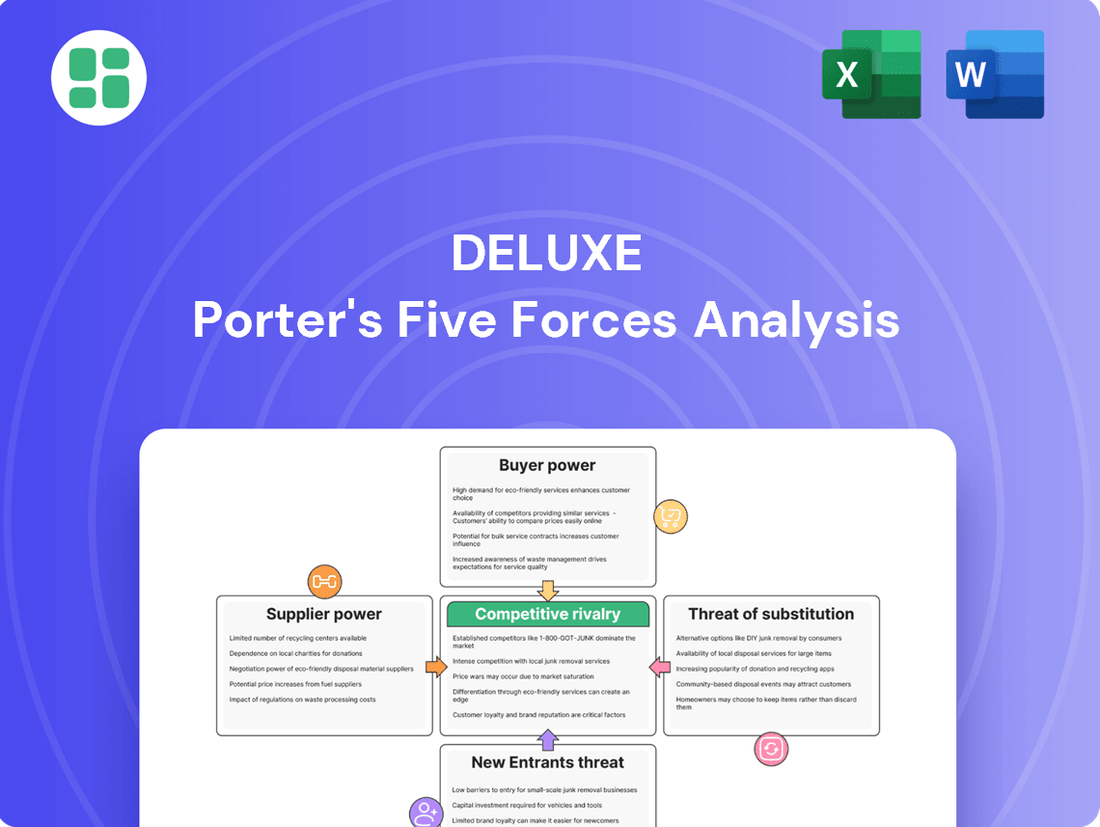

A comprehensive examination of the five forces shaping Deluxe's industry, providing strategic insights into competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.

Effortlessly identify and mitigate competitive threats with a comprehensive, yet easily digestible, breakdown of each Porter's Five Force.

Customers Bargaining Power

Deluxe serves a broad spectrum of customers, from millions of small businesses to thousands of financial institutions and major consumer brands. This diversity means the bargaining power of customers isn't uniform across the board. For instance, while individual small businesses might have limited sway, their collective purchasing decisions can significantly impact Deluxe's demand.

Financial institutions and large enterprises, as major clients for treasury management and B2B payment solutions, wield significant bargaining power. These clients, due to their substantial contract values and intricate requirements, can negotiate for tailored solutions, aggressive pricing, and robust service level agreements. For instance, in 2024, large corporate clients often represent over 60% of a treasury management provider's revenue, giving them considerable leverage.

Deluxe's bargaining power of customers is influenced by the growing landscape of B2B technology providers. The rise of specialized fintechs and marketing technology companies provides businesses with a wider array of choices, directly increasing their leverage. This means customers can more readily switch to competitors offering better value or more customized solutions, putting pressure on Deluxe to remain competitive.

Buyer Power 4

Customers wield significant influence, particularly as they increasingly favor digital self-serve options and integrated solutions for smoother, more efficient interactions. This trend empowers buyers, as they can more easily switch between providers offering superior digital experiences.

Deluxe's success hinges on its ability to adapt to these evolving customer expectations. Continuous innovation and the integration of its product and service portfolio are crucial to retaining customers and preventing churn in this competitive landscape.

- Customer Preference Shift: A significant portion of customers, particularly small businesses, are actively seeking digital-first solutions. For instance, in 2024, surveys indicated that over 70% of small businesses prioritize online account management and digital support.

- Demand for Integration: Buyers are increasingly looking for bundled services that simplify their operations. Deluxe's ability to offer integrated payment processing, marketing tools, and business management software enhances customer loyalty by reducing the need for multiple vendor relationships.

- Price Sensitivity and Alternatives: While not explicitly stated for Deluxe, broader market trends show that increased availability of digital alternatives can lead to greater price sensitivity among customers. If competitors offer comparable digital self-serve solutions at lower price points, Deluxe faces pressure to match or demonstrate superior value.

- Impact on Deluxe's Strategy: To counter this buyer power, Deluxe must invest in user-friendly digital platforms and ensure seamless integration across its offerings, thereby increasing switching costs and customer retention.

Buyer Power 5

Buyer power is influenced by how easy or difficult it is for customers to switch to a competitor. For Deluxe, particularly in its B2B Payments division, the complexity and cost of migrating integrated payment and treasury management systems can significantly limit customer leverage. This 'stickiness' creates a strong competitive moat.

In 2024, businesses often face substantial integration challenges when changing financial service providers. For instance, switching from a deeply embedded treasury management system could involve significant IT resources, data migration complexities, and retraining of staff, making it a costly and time-consuming endeavor. This inertia inherently strengthens Deluxe's position by reducing the perceived viability of alternatives for many clients.

- High Switching Costs: The integration of Deluxe's payment and treasury solutions creates significant operational dependencies for businesses, raising the cost and effort required to switch providers.

- Customer Lock-in: Once a business is deeply embedded with Deluxe's systems, the 'stickiness' of these solutions acts as a natural barrier to customer departure, thereby diminishing their bargaining power.

- B2B Payments Focus: This dynamic is particularly pronounced in Deluxe's B2B Payments segment, where the specialized nature of the services amplifies the impact of switching costs on customer leverage.

Deluxe's customer base is diverse, ranging from millions of small businesses to large financial institutions, each with varying levels of bargaining power. While individual small businesses may have limited influence, their collective purchasing decisions are significant. Large enterprise clients, however, represent a substantial portion of revenue, granting them considerable leverage to negotiate tailored solutions and competitive pricing, especially in the B2B Payments sector.

| Customer Segment | Bargaining Power Factors | Impact on Deluxe |

|---|---|---|

| Small Businesses | Low individual power, high collective power | Influences overall demand, sensitive to digital self-serve options |

| Financial Institutions & Large Enterprises | High power due to large contract values and complex needs | Negotiate tailored solutions, aggressive pricing, and robust SLAs |

| B2B Payments Clients | High power due to significant switching costs and integration complexity | Customer lock-in due to system dependencies, reducing leverage |

Preview the Actual Deliverable

Deluxe Porter's Five Forces Analysis

The preview you are seeing is the complete and professionally formatted Deluxe Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. This means you can be confident that the in-depth analysis of competitive forces, including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors, is exactly what you'll get. There are no placeholders or sample sections; this is the full, ready-to-use deliverable for your strategic planning needs.

Rivalry Among Competitors

The B2B technology solutions market, where Deluxe operates across marketing, cloud, and treasury management, is intensely competitive. This sector is populated by a multitude of companies vying for market share, making it a challenging environment for any single player.

Deluxe encounters significant rivalry from established financial technology giants such as Fiserv and Jack Henry, both of which possess extensive resources and deep market penetration. Simultaneously, the company must contend with nimble, digital-native startups that often introduce innovative solutions and disruptive business models, further intensifying the competitive landscape.

Competitive rivalry in Deluxe's cloud services sector is fierce, with giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dominating the landscape. These hyperscalers offer a vast array of services, creating significant pressure on smaller players. For instance, in 2023, AWS held approximately 31% of the global cloud infrastructure market, followed by Azure with around 24%, and Google Cloud with about 11%, showcasing their substantial market power.

In the marketing technology sector, competitive rivalry is intense, fueled by a relentless pace of innovation, particularly the integration of artificial intelligence for enhanced personalization and advanced analytics. Deluxe faces a crowded field of competitors, including numerous marketing automation platforms, customer relationship management (CRM) providers, and specialized data analytics firms, all vying for market share.

The marketing technology market is characterized by rapid product development cycles and a constant need to adapt to evolving customer expectations and technological advancements. For instance, in 2023, global spending on marketing technology was projected to reach over $121 billion, highlighting the significant investment and competition within the space. This environment necessitates continuous investment in R&D for companies like Deluxe to maintain a competitive edge.

Competitive Rivalry 4

The treasury management and B2B payments sectors are characterized by intense competition. Traditional banks, established payment processors, and agile fintech startups are all vying for market share. These players are increasingly leveraging advanced technologies, including blockchain, to offer more efficient and real-time payment solutions. This technological push, coupled with the inherent demand for speed and cost-effectiveness in business transactions, significantly heightens the rivalry.

In 2024, the global B2B payments market was valued at approximately $9.5 trillion, with significant growth projected. This massive market size naturally attracts a wide array of competitors. Fintechs, in particular, are disrupting the space by offering specialized solutions that often bypass the legacy systems of traditional banks.

Key competitive dynamics include:

- Technological Innovation: Fintechs are at the forefront, introducing solutions like AI-powered fraud detection and instant payment platforms.

- Customer Experience: Companies are differentiating themselves by offering seamless, user-friendly interfaces and superior customer support.

- Pricing and Fees: Competitive pricing models are crucial, especially as businesses seek to optimize their operational costs.

- Regulatory Compliance: Navigating complex financial regulations is a constant challenge and a barrier to entry for new players.

Competitive Rivalry 5

Deluxe faces intense competition as it pivots from its traditional print services to digital solutions. This shift places it in direct contention with established tech companies and agile startups vying for dominance in rapidly evolving markets. Success hinges on Deluxe's capacity to effectively cross-sell and seamlessly integrate its expanding portfolio of digital offerings, a crucial differentiator in this crowded landscape.

The digital transformation necessitates a robust competitive strategy, particularly in areas like small business services and fraud prevention. For instance, in the small business sector, Deluxe competes with a multitude of providers offering everything from website creation to marketing automation. The company's 2023 annual report highlights increased investment in its digital segments, reflecting the strategic importance of gaining traction against well-entrenched digital players.

- Market Saturation: Digital solutions for small businesses, including payment processing and marketing tools, are highly competitive with numerous providers.

- Technological Pace: Rapid advancements in AI and data analytics create a dynamic environment where companies must constantly innovate.

- Integration Capabilities: Deluxe's ability to bundle and integrate various digital services is key to standing out from competitors offering more specialized solutions.

- Customer Acquisition Costs: Acquiring new customers in the digital space can be expensive due to aggressive marketing by competitors.

Deluxe operates in highly competitive markets, facing pressure from both established giants and agile startups across its B2B technology solutions, cloud services, marketing technology, and treasury management sectors. The intensity of this rivalry is driven by rapid technological innovation, particularly in AI, and a constant need to adapt to evolving customer expectations and market demands.

In 2024, the global B2B payments market was valued at approximately $9.5 trillion, underscoring the massive scale and fierce competition within this segment. Fintech companies are particularly disruptive, offering specialized and often more efficient solutions compared to traditional financial institutions. This dynamic necessitates continuous investment in research and development for companies like Deluxe to maintain their competitive edge and capture market share.

| Sector | Key Competitors | Competitive Dynamics |

|---|---|---|

| B2B Technology Solutions | Fiserv, Jack Henry, Digital-native startups | Resource disparity, disruptive business models |

| Cloud Services | AWS, Microsoft Azure, Google Cloud | Hyperscaler dominance, extensive service offerings |

| Marketing Technology | Marketing automation platforms, CRM providers, data analytics firms | AI integration, rapid product cycles, evolving customer expectations |

| Treasury Management & B2B Payments | Traditional banks, payment processors, fintech startups | Technological adoption (e.g., blockchain), demand for speed and cost-efficiency |

SSubstitutes Threaten

The threat of substitutes for Deluxe's data-driven marketing and cloud services is notable, particularly from large enterprises with significant IT capabilities. These companies may choose to develop proprietary, in-house solutions or utilize readily available open-source software, bypassing the need for external vendors like Deluxe. For instance, in 2024, many large corporations continued to invest heavily in their digital transformation, with IT spending projected to reach over $5 trillion globally, indicating a strong internal capacity to build custom platforms.

In treasury management, traditional banks still provide essential services that can stand in for specialized fintech offerings, especially for smaller enterprises or those with simpler requirements. For instance, many small businesses continue to rely on their existing banking relationships for basic cash management, payment processing, and liquidity services, often finding these adequate for their needs.

Furthermore, manual processes or established accounting software can act as rudimentary substitutes for advanced treasury solutions. While less efficient, these methods are often familiar and require no additional investment, making them a viable option for businesses prioritizing cost savings over enhanced functionality. In 2024, an estimated 30% of small businesses still primarily use manual or basic accounting software for their financial operations, indicating the persistent presence of these substitutes.

The threat of substitutes is significant for Deluxe, particularly due to the declining use of physical checks. Digital payment methods, including ACH, wire transfers, and various electronic platforms, directly replace Deluxe's traditional check printing business. For instance, in 2023, the volume of checks processed continued its downward trend, with electronic payments representing an ever-larger share of transactions.

Deluxe has proactively addressed this by investing in and digitizing its payment network. This strategic shift aims to capture a portion of the growing electronic payments market, thereby mitigating the impact of declining check volumes. Their acquisition of various fintech companies in recent years underscores this commitment to evolving beyond their print-centric origins.

4

The threat of substitutes for Deluxe's offerings is significant, particularly for small businesses. General-purpose software and readily available online tools can often fulfill basic operational needs at a lower cost, even if they lack the integration and depth of Deluxe's specialized solutions.

For instance, many small businesses might opt for free or low-cost accounting software instead of a comprehensive financial management suite. Similarly, simple online form builders can replace some of the document creation and management functionalities Deluxe provides. While these substitutes may not offer the same level of sophistication or security, their accessibility and affordability make them a compelling alternative for businesses with simpler requirements.

In 2024, the market for accessible digital tools continued to expand. Many cloud-based productivity suites, for example, offer integrated document creation, basic data management, and communication features that can chip away at the demand for more specialized, integrated platforms. This trend is driven by a desire for cost-efficiency and ease of use, especially among startups and small to medium-sized enterprises.

Here are some key substitute categories:

- General Productivity Suites: Platforms like Microsoft 365 or Google Workspace offer document creation, spreadsheet capabilities, and basic data organization that can substitute for certain Deluxe offerings.

- Online Form and Survey Tools: Services such as SurveyMonkey or Google Forms can replace simpler data collection and form-filling functionalities.

- Basic Accounting Software: Many small businesses utilize affordable or freemium accounting applications that handle core financial tasks, reducing reliance on more integrated solutions.

- Direct-to-Consumer Printing Services: For personalized marketing materials, some businesses might bypass specialized platforms and use online print shops directly.

5

The threat of substitutes for Deluxe's services is growing, particularly with the emergence of integrated platforms. These 'super apps' are starting to bundle various business functions, potentially offering a one-stop shop that could replace the need for specialized solutions like those Deluxe provides. This consolidation trend highlights a significant challenge for companies relying on distinct service offerings.

For instance, many small businesses have traditionally relied on separate providers for payment processing, payroll, and customer relationship management. However, platforms like Square, which expanded its offerings significantly in 2023 and 2024 to include payroll and marketing tools, represent a direct substitute. By offering a more comprehensive suite, these platforms can attract customers seeking simplicity and cost-effectiveness, thereby reducing the demand for individual Deluxe services.

This shift underscores the importance for Deluxe to adapt and potentially integrate its own services or partner with other providers to offer more holistic solutions. Failure to do so could see customers migrating to these all-in-one platforms. The market is increasingly favoring convenience and integration, making standalone services more vulnerable.

- Rise of Super Apps: Platforms consolidating multiple business services (e.g., payments, payroll, marketing) pose a direct substitute threat.

- Customer Demand for Integration: Businesses increasingly prefer single providers for efficiency and cost savings.

- Competitive Landscape: Companies like Square have actively expanded their service portfolios, directly challenging specialized providers.

- Strategic Imperative: Deluxe must consider service integration or partnerships to counter this substitution trend.

The threat of substitutes for Deluxe's offerings is significant, especially as businesses seek cost-effective and integrated solutions. Many small and medium-sized businesses (SMBs) are increasingly turning to general-purpose software and readily available online tools that can fulfill basic operational needs at a lower price point, even if they lack the specialized depth of Deluxe's platforms.

For instance, in 2024, the market for accessible digital tools continued its robust expansion, with cloud-based productivity suites offering integrated document creation and basic data management. These tools can chip away at demand for more specialized platforms, driven by a desire for cost-efficiency and ease of use, particularly among startups and SMBs.

The rise of consolidated platforms, often termed 'super apps,' presents a direct substitute challenge. These platforms bundle various business functions, offering a single point of contact that can replace the need for specialized, individual services. Companies like Square, which expanded its offerings to include payroll and marketing in 2023 and 2024, exemplify this trend, attracting customers seeking simplicity and cost-effectiveness.

| Substitute Category | Examples | Impact on Deluxe | 2024 Market Trend |

|---|---|---|---|

| General Productivity Suites | Microsoft 365, Google Workspace | Replaces basic document creation and data organization | Continued growth in adoption by SMBs |

| Online Form & Survey Tools | SurveyMonkey, Google Forms | Substitutes for simpler data collection | High accessibility and low cost |

| Basic Accounting Software | QuickBooks (basic tiers), Xero (basic tiers) | Addresses core financial tasks for smaller businesses | Significant market share among startups |

| Consolidated Business Platforms ('Super Apps') | Square, Shopify (with integrated services) | Offers bundled payments, payroll, marketing, etc. | Increasing customer preference for integrated solutions |

Entrants Threaten

The threat of new entrants in the B2B financial services and technology space is generally moderate to high. This is largely due to the significant capital required to build and maintain the necessary technology infrastructure and development capabilities. For instance, establishing a secure and scalable cloud-based payment processing system can easily run into millions of dollars in upfront investment.

The threat of new entrants for Deluxe, particularly within the financial services sector, is significantly mitigated by the heavy burden of regulatory compliance. New players must navigate complex frameworks such as Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which demand substantial investment in legal expertise and robust operational systems. For instance, the cost of compliance alone can be a substantial hurdle, with many financial institutions dedicating millions annually to meet these requirements.

The threat of new entrants for Deluxe is relatively low, primarily due to the significant capital and time required to establish trust and build robust customer relationships, particularly within the financial services sector. Deluxe's century-long history, dating back to 1905, has allowed it to cultivate deep-seated relationships with banks and large corporations, creating a substantial barrier to entry for newcomers. For instance, in 2023, Deluxe reported that over 4,500 financial institutions relied on its services, underscoring the entrenched nature of its client base.

4

The threat of new entrants for Deluxe is moderate, largely due to the significant barriers to entry in the data solutions market. Access to proprietary data and advanced analytics capabilities are paramount for success in Deluxe's core business. Aspiring competitors would need to invest heavily in acquiring or developing substantial data assets, a process that is both time-consuming and capital-intensive.

Developing sophisticated data infrastructure and analytics platforms requires considerable technical expertise and financial resources, often exceeding what a startup can readily muster. For instance, building a data processing and analysis capability comparable to Deluxe's would likely involve multi-million dollar investments in technology and specialized personnel.

Furthermore, established customer relationships and brand loyalty in the financial services sector are difficult for newcomers to overcome. Deluxe's long-standing presence and trusted reputation provide a significant competitive advantage. New entrants would face the challenge of building trust and demonstrating value to a market accustomed to reliable, high-quality data providers.

Key barriers include:

- High capital investment for data acquisition and technology infrastructure.

- Need for specialized data science and analytics talent.

- Established customer relationships and brand loyalty.

- Regulatory compliance and data privacy requirements.

5

Despite existing barriers like established brand loyalty and regulatory hurdles, the threat of new entrants in the financial services sector is evolving. Rapid advancements in AI and cloud computing are significantly lowering the technical entry bar for nimble startups. These agile fintechs can carve out niches by offering specialized, innovative, and cost-effective solutions, directly challenging incumbents.

Consider the surge in AI-powered wealth management platforms. For instance, in 2024, the global robo-advisor market was projected to reach over $2.5 trillion in assets under management, indicating a strong appetite for tech-driven financial advice. Startups leveraging these technologies can bypass the need for extensive physical infrastructure, a traditional barrier, allowing them to compete on agility and specialized service delivery.

- Lowered Technical Barriers: AI and cloud computing reduce the upfront investment in technology for new financial service providers.

- Niche Specialization: Startups can focus on specific customer segments or services, offering tailored solutions that larger institutions may overlook.

- Cost-Effectiveness: Lean operating models enabled by technology allow new entrants to offer competitive pricing.

- Agility and Innovation: Startups can adapt quickly to market changes and introduce novel products or services more readily than established players.

The threat of new entrants for Deluxe is moderate, influenced by the evolving technological landscape. While established relationships and regulatory hurdles remain, advancements in AI and cloud computing are lowering entry barriers for agile fintechs. These startups can offer specialized, cost-effective solutions, challenging incumbents by leveraging new technologies to bypass traditional infrastructure needs.

| Factor | Impact on Deluxe | Supporting Data/Example |

|---|---|---|

| Capital Investment | High barrier for traditional infrastructure | Building secure payment systems can cost millions. |

| Regulatory Compliance | Significant barrier | AML/KYC compliance costs millions annually for financial institutions. |

| Customer Relationships & Trust | Strong barrier for Deluxe | Over 4,500 financial institutions relied on Deluxe in 2023. |

| Technological Advancements (AI/Cloud) | Lowering barriers for new entrants | Robo-advisor market projected to exceed $2.5 trillion in AUM in 2024. |

Porter's Five Forces Analysis Data Sources

Our Deluxe Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary market research, extensive financial databases like FactSet and Refinitiv, and in-depth industry expert interviews.