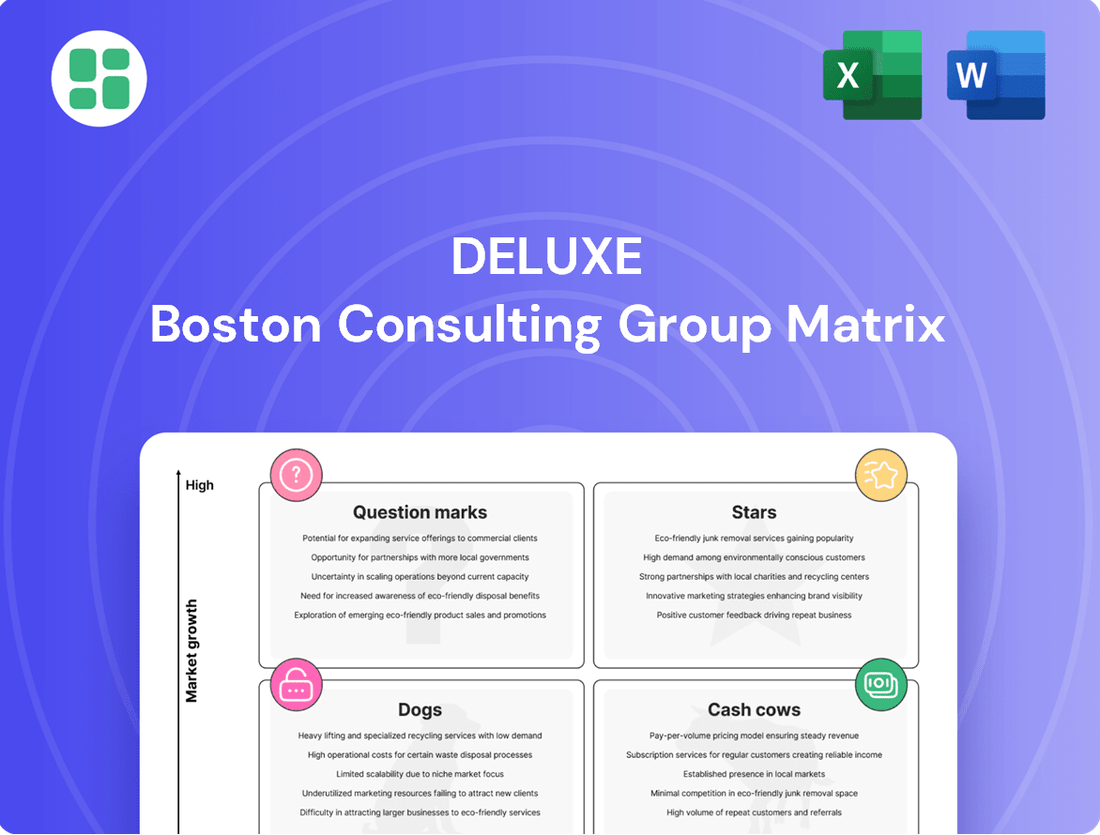

Deluxe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deluxe Bundle

Unlock the full potential of strategic portfolio management with the Deluxe BCG Matrix. This comprehensive tool not only categorizes your products into Stars, Cash Cows, Dogs, and Question Marks but also provides actionable insights for each quadrant. Don't settle for a glimpse; invest in the complete Deluxe BCG Matrix to receive a detailed breakdown, data-driven recommendations, and a clear roadmap for optimizing your business strategy and maximizing profitability.

Stars

Deluxe's Data Solutions segment is a clear star in their BCG matrix, boasting a remarkable 29.3% year-over-year revenue increase in Q1 2025, hitting $77.2 million. This robust growth is fueled by their extensive data assets and advanced AI capabilities, which are crucial for optimizing marketing campaigns in today's data-centric world.

The company’s strategic focus on expanding this segment into new industry verticals underscores its high growth potential. This expansion indicates a commitment to capturing a larger share of the burgeoning market for data-driven marketing solutions.

The Merchant Services segment, particularly its digital payments processing, is a key growth engine for Deluxe. The company saw notable revenue increases in this area during Q3 2024, and projections indicate mid-single-digit growth by the end of 2025. This performance underscores Deluxe's successful transition towards electronic payment solutions, tapping into a rapidly expanding market.

This strategic focus on digital payments aligns with broader industry trends and Deluxe's own evolution. The 2021 acquisition of First American Payment Systems was instrumental, significantly enhancing Deluxe's capacity to serve the digital payments sector. This move has solidified Deluxe's position as a competitive force in the increasingly vital digital payments ecosystem.

Deluxe's B2B Payments solutions, especially its digital offerings like the R360+ platform, are on an upward trajectory. This segment is expected to see mid-single-digit growth by the end of 2025, reflecting a strong recovery.

The market for B2B payments is rapidly digitizing, and Deluxe is well-positioned to capitalize on this trend by addressing complex payment challenges with its software and payment solutions. The company's strategy includes strengthening its digital presence through strategic alliances and integrating new platforms.

Generative AI Enterprise Platform (DAX)

Deluxe's introduction of the Generative AI Enterprise Platform, DAX, in May 2025 marks a significant strategic move. This platform is specifically designed to bolster partner support and elevate customer service through advanced AI capabilities.

This innovation places Deluxe in a prime position within the burgeoning AI sector, a market experiencing rapid expansion and offering substantial growth prospects. The company's commitment to AI leadership is evident in this new offering.

Early recognition for the DAX platform indicates a positive market reception, suggesting strong potential for future adoption and revenue generation. For example, industry analysts in early 2025 projected the AI market to grow by over 30% annually through 2028.

- DAX Launch: May 2025

- Primary Function: Enhance partner support and customer service

- Market Positioning: Forefront of AI innovation in its industry

- Growth Indicator: Early recognition and strong initial market reception

Cloud-Native Data Platform

Deluxe's investment in a cloud-native data platform within its Data Solutions segment is a key driver of its robust year-over-year growth. This platform is designed to deliver sophisticated data analytics and cybersecurity services, catering to the increasing market need for secure, cloud-based data solutions. This strategic move is intended to significantly boost the company's expansion within the data sector.

- Strategic Investment: Deluxe's launch of a cloud-native data platform underscores its commitment to innovation and growth in the data solutions market.

- Market Demand: The platform addresses the escalating demand for advanced data analytics and robust cybersecurity, crucial in today's digital landscape.

- Growth Accelerator: This technological advancement is positioned to accelerate Deluxe's trajectory in the competitive data space, supporting its strong financial performance.

Deluxe's Data Solutions segment is a prime example of a Star in the BCG matrix. Its impressive 29.3% year-over-year revenue increase in Q1 2025, reaching $77.2 million, highlights its strong market position and growth potential. The segment's success is attributed to its comprehensive data assets and advanced AI capabilities, which are vital for modern marketing optimization.

The company's strategic expansion of this segment into new industry verticals further solidifies its Star status. This move indicates a clear intent to capture a larger share of the rapidly expanding market for data-driven solutions.

| Segment | BCG Category | Q1 2025 Revenue | YoY Growth | Key Drivers |

|---|---|---|---|---|

| Data Solutions | Star | $77.2 million | 29.3% | Advanced AI, extensive data assets, cloud-native platform |

What is included in the product

An extended BCG Matrix that provides a deeper dive into each product's strategic position and potential.

The Deluxe BCG Matrix provides a clear, visual overview of your portfolio, instantly relieving the pain of strategic uncertainty.

Cash Cows

Deluxe's legacy check printing business, despite a secular decline in volume, continues to be a substantial cash cow. In 2024, this segment accounted for a significant 33.1% of the company's total revenue, demonstrating its enduring financial contribution.

The profitability of this mature segment is robust, with adjusted EBITDA margins hovering around 31-31.2% as of Q1 2025. Deluxe effectively utilizes these consistent cash flows to fuel growth initiatives and investments in its more dynamic payments and data services divisions.

Traditional business forms and accessories, a segment closely tied to check printing, represent a mature but still significant revenue source for Deluxe. Despite a low single-digit decline, this area benefits from a vast installed base, ensuring consistent profitability.

Deluxe's established, non-digital treasury management solutions are indeed cash cows. These offerings, deeply entrenched with financial institutions and businesses, provide consistent revenue streams due to their high market share in areas like cash visibility and financial controls. While Deluxe invests in cloud solutions, these traditional products continue to be a significant and reliable generator of cash flow.

Promotional Products (Traditional)

Certain traditional promotional products, primarily within the Print segment, represent a source of consistent, though not rapidly expanding, revenue. These items leverage a loyal customer base and the operational advantages of existing print capabilities.

Despite some softening in demand for less essential, shorter-term promotional items, these core products continue to bolster the segment’s profitability. For instance, in 2024, the promotional products sector, a significant part of the broader print industry, demonstrated resilience, with many established businesses reporting stable revenue streams from recurring orders.

- Stable Revenue: Traditional promotional items provide a predictable income, often from repeat clients.

- Established Infrastructure: Existing print facilities and supply chains reduce operational costs and enhance efficiency.

- Healthy Margins: Despite low growth, these products contribute positively to overall profitability due to efficient operations.

- Market Resilience: Core promotional products continue to perform well even when discretionary spending within the segment faces headwinds.

Remote Deposit Capture Services

Remote Deposit Capture (RDC) services, a key component of Deluxe's B2B Payments segment, are a prime example of a Cash Cow. While not experiencing rapid expansion, this mature service boasts extensive adoption among businesses seeking efficient payment processing. Its utility translates into predictable, transaction-based revenue streams, making it a reliable generator of consistent cash flow for Deluxe.

The enduring demand for RDC stems from its ability to streamline financial operations for businesses. This translates into a steady income for Deluxe, requiring minimal incremental investment to maintain its market position. For instance, in 2024, Deluxe continued to see robust utilization of its RDC solutions, contributing significantly to the stability of its B2B Payments revenue, which is a key indicator of its Cash Cow status.

- Mature Market Position: RDC has achieved widespread acceptance, indicating a stable, albeit not high-growth, market.

- Consistent Revenue Generation: Transaction-based fees provide a reliable and predictable income stream for Deluxe.

- Low Investment Requirement: As an established service, RDC requires minimal new capital expenditure for ongoing operations or incremental growth.

- Strategic Importance: RDC supports Deluxe's broader B2B Payments ecosystem, retaining existing clients and facilitating cross-selling opportunities.

Cash Cows within Deluxe's portfolio represent mature, high-market-share businesses that generate substantial and consistent cash flow with minimal investment. These segments, while not experiencing rapid growth, are crucial for funding innovation and supporting other business units. Their stability is a hallmark of their value.

Deluxe's legacy check printing and related traditional business forms are prime examples of cash cows. In 2024, check printing alone represented a significant portion of revenue, and segments like treasury management solutions and Remote Deposit Capture (RDC) continue to provide predictable, transaction-based income with robust margins, often exceeding 30% adjusted EBITDA.

These established offerings benefit from existing infrastructure and loyal customer bases, requiring low incremental investment to maintain their market position. This allows Deluxe to reliably generate cash to reinvest in growth areas.

| Business Segment | 2024 Revenue Contribution (Approx.) | Adjusted EBITDA Margin (Q1 2025 Approx.) | Cash Flow Generation |

|---|---|---|---|

| Check Printing | 33.1% | 31-31.2% | High and Stable |

| Traditional Business Forms | Significant | Strong | Consistent |

| Treasury Management Solutions | High Market Share | Healthy | Predictable |

| Remote Deposit Capture (RDC) | Robust Utilization | Strong | Transaction-Based |

Delivered as Shown

Deluxe BCG Matrix

The preview you see is the exact, fully formatted Deluxe BCG Matrix document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive, analysis-ready tool designed for immediate strategic application.

Dogs

The declining volume of checks beyond essential business use is categorized as a 'Dog' within the Deluxe BCG Matrix. Consumer check usage is projected to fall to a mere 2.5% of all U.S. consumer payments by 2025, highlighting a significant secular decline.

Deluxe recognizes this trend and strategically leverages the cash flow generated from this segment to invest in more promising growth areas. Continued investment in rapidly shrinking, non-strategic sub-segments would be an inefficient allocation of resources.

The company's approach is to manage this decline effectively, focusing on maintaining profitability rather than pursuing growth in this area. This ensures that resources are directed towards more strategic and sustainable business initiatives.

Deluxe has strategically divested smaller business units that no longer fit its core strategy, primarily focusing on payments and data services. These divested segments, likely acquired previously, exhibited low market share and limited growth potential.

These businesses were essentially "dogs" in the BCG matrix, draining resources and offering minimal returns, thus hindering the company's overall performance and strategic focus.

For instance, in 2023, Deluxe completed the divestiture of its direct-to-consumer business, which represented a smaller portion of its overall revenue and was not central to its growth ambitions in the payments sector.

Deluxe's history includes many acquisitions, some of which likely ended up with small market shares in slow or shrinking industries. These non-strategic businesses, if not properly integrated or refocused, would land in the Dogs category of the BCG matrix. They would struggle to produce substantial cash or growth.

The company's current leadership has been actively working to streamline this portfolio. For instance, in 2023, Deluxe completed the divestiture of its Operations division, a move that aligns with this strategy of focusing on core, higher-growth areas and shedding underperforming assets.

Certain Discretionary Branded Promotional Products

Certain discretionary branded promotional products, particularly those with shorter sales cycles, are experiencing a notable downturn. This softness in demand directly translates to revenue declines within these specific product categories.

These offerings typically hold a low market share within their respective niches. Furthermore, they are highly vulnerable to economic fluctuations that affect both consumer and business spending on non-essential items.

Within the broader Print segment, these particular products function as Dogs. This classification stems from their combination of low market growth and persistent challenges in gaining significant market share.

- Demand Softness: The market for shorter-cycle discretionary branded promotional products is facing ongoing weakness.

- Revenue Impact: This softness is directly causing revenue declines in these specific product lines.

- Market Position: These products likely possess a low market share within their niche segments.

- Economic Sensitivity: They are susceptible to macroeconomic uncertainties that impact discretionary spending.

Redundant or Inefficient Operational Infrastructure

Deluxe's 'North Star Initiative' highlights the presence of redundant or inefficient operational infrastructure, a classic 'Dog' in the BCG Matrix context. This initiative involved consolidating real estate and standardizing business line operating systems, directly addressing the inefficiencies of a fragmented and outdated infrastructure.

This legacy infrastructure, while not a product, acted as a 'Dog' by draining capital and resources without generating proportional returns or fostering competitive advantage. For instance, in 2023, Deluxe reported significant investments in its technology modernization efforts, aiming to streamline operations and reduce the costs associated with maintaining disparate systems.

The necessity for substantial restructuring underscores the resource drain. Such inefficiencies can manifest in various ways:

- Higher IT maintenance costs: Supporting multiple legacy systems is inherently more expensive than managing a unified platform.

- Reduced operational agility: Inconsistent systems hinder quick adaptation to market changes or new business opportunities.

- Data silos and integration challenges: Fragmented infrastructure often leads to difficulties in accessing and analyzing comprehensive business data, impacting strategic decision-making.

- Employee productivity impact: Navigating outdated or complex systems can slow down workflows and reduce overall employee efficiency.

The 'Dogs' in Deluxe's portfolio represent segments with low market share in slow-growing or declining industries. These include the shrinking consumer check market, where usage is projected to be a mere 2.5% of U.S. consumer payments by 2025, and certain discretionary promotional products experiencing demand softness. Deluxe strategically manages these segments for cash flow rather than growth, often divesting them to focus on core, higher-potential areas.

| Segment | Market Share | Market Growth | Strategic Approach |

|---|---|---|---|

| Consumer Checks | Low (declining) | Negative | Cash generation, managed decline |

| Discretionary Promotional Products | Low | Slow/Negative | Divestment, focus on core |

| Legacy Infrastructure | N/A (internal) | N/A (inefficient) | Consolidation, modernization |

Question Marks

Deluxe's new generative AI offerings, beyond the established DAX platform, would initially be categorized as Question Marks in the BCG Matrix. These are unproven ventures with significant potential but currently low market share. For instance, if Deluxe were to launch a new AI-powered content creation tool in 2024, it would likely face intense competition from established players and startups, resulting in a small initial market penetration.

The generative AI market is experiencing rapid growth, with global spending projected to reach hundreds of billions of dollars by 2025. However, for any new, unproven Deluxe offering in this space, market share would be minimal until significant market adoption occurs. This necessitates substantial investment in marketing and product development to build brand awareness and capture a meaningful slice of the market.

Deluxe is actively developing intelligent, cloud-based treasury management tools, positioning them as a forward-thinking player. However, these innovative solutions are still in their nascent stages of widespread adoption when contrasted with established, on-premise treasury systems.

While the overall cloud treasury market is experiencing robust growth, Deluxe's current market share within these emerging cloud-native offerings may be relatively modest. This reflects the early-stage nature of these specific products and the competitive landscape.

To solidify its leadership in this segment, Deluxe will need to make substantial investments in targeted marketing campaigns and customer education. The goal is to drive adoption and effectively convert users from traditional treasury management methods to their advanced cloud-based platforms.

Deluxe's strategic push into new industry verticals for its Data Solutions business, moving beyond financial institutions, positions these specialized services as question marks in the BCG Matrix. While the data analytics market itself is experiencing robust growth, projected to reach over $100 billion globally by 2025, Deluxe's entry into nascent, specialized segments within these new verticals means it will likely have a low initial market share.

This low market share, coupled with the high growth potential inherent in specialized data analytics for emerging sectors, firmly places these new offerings in the question mark quadrant. For instance, the demand for AI-driven customer analytics in retail is surging, but Deluxe would be a new entrant facing established players.

Significant strategic investment will be crucial for Deluxe to nurture these question mark offerings. The company must allocate resources for research and development, sales and marketing tailored to specific industry needs, and potentially acquisitions to quickly gain traction and expertise in these new domains, aiming to eventually shift them to stars.

Strategic Partnerships for Payments Expansion

Deluxe is actively pursuing strategic partnerships, exemplified by its collaborations with Square 9 and TowneBank, to accelerate the expansion of its digital payment solutions and enhance market reach. These alliances are designed to tap into new distribution channels, offering significant growth potential.

While these ventures represent a strategic move towards high-growth areas, their initial market share and direct revenue impact may be modest, reflecting their nascent stage. The success of these partnerships will be contingent on robust execution and the successful adoption of Deluxe's offerings through these newly established channels.

- Strategic Alliances: Partnerships with entities like Square 9 and TowneBank aim to broaden Deluxe's digital payment footprint.

- Growth Potential: These collaborations unlock new distribution avenues, presenting opportunities for substantial market penetration.

- Early Stage Impact: Initial market share and revenue contributions from these partnerships are expected to be low as they mature.

- Execution is Key: The ultimate success will depend on effectively leveraging these channels to drive adoption and revenue.

Integrated Software Channel in Merchant Services

Deluxe is strategically investing in an integrated software channel for its Merchant Services, aiming to solidify its standing and expand within the electronic payments sector. This move is designed to tap into the burgeoning market for seamless payment integrations.

The company's focus on this channel positions it within the 'Question Mark' quadrant of the BCG matrix. This is because while integrated payment solutions represent a high-growth area, Deluxe's new channel begins with a relatively small market share, facing intense competition.

Key considerations for Deluxe's integrated software channel include:

- Market Growth: The integrated payments market is experiencing significant expansion, with projections indicating continued strong growth through 2025 and beyond, driven by demand for streamlined customer experiences. For example, the global integrated payments market was valued at approximately $11.5 billion in 2023 and is expected to grow at a CAGR of over 15% in the coming years.

- Low Market Share: As a new entrant or underdeveloped segment, Deluxe's integrated software channel currently holds a modest portion of the market, necessitating substantial investment to gain traction.

- Competitive Landscape: The market is populated by established players and agile fintech companies, requiring Deluxe to differentiate its offering through innovation and superior service.

- Investment Requirement: Significant capital and resources will be needed for development, marketing, and sales to scale this channel effectively and achieve a dominant market position.

Question Marks in Deluxe's portfolio represent new ventures with high growth potential but currently low market share. These are areas where Deluxe is investing significant resources to build future market leadership. Successfully nurturing these offerings is critical for long-term growth and market positioning.

Deluxe's generative AI offerings, new cloud treasury management tools, and specialized data solutions for new verticals all fall into this category. While the markets they operate in are expanding rapidly, Deluxe's current penetration is modest, requiring substantial investment to gain traction and compete effectively.

Strategic partnerships and the development of an integrated software channel for Merchant Services also exemplify Question Marks. These initiatives aim to tap into high-growth areas, but their initial market share and revenue impact are limited, emphasizing the need for strong execution and market development.

| Deluxe Offering | Market Growth Potential | Current Market Share | Strategic Focus |

| Generative AI | Very High (hundreds of billions by 2025) | Low | Product Development, Marketing |

| Cloud Treasury Management | High | Modest | Customer Education, Targeted Marketing |

| Specialized Data Solutions (New Verticals) | High (over $100 billion for data analytics by 2025) | Low | R&D, Sales & Marketing, Potential Acquisitions |

| Strategic Partnerships (e.g., Square 9) | High | Low | Channel Expansion, Adoption Driving |

| Integrated Software Channel (Merchant Services) | High (integrated payments market ~$11.5B in 2023, >15% CAGR) | Low | Development, Marketing, Sales |

BCG Matrix Data Sources

Our Deluxe BCG Matrix leverages comprehensive market data, including financial reports, sales figures, competitor analysis, and industry growth projections, to provide a robust strategic overview.