Delta Galil SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Galil Bundle

Delta Galil's robust brand portfolio and global manufacturing capabilities present significant strengths, while the fast-paced fashion industry and supply chain disruptions pose notable threats. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Delta Galil's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Delta Galil's strength lies in its extensive and diverse brand portfolio, encompassing both owned labels and popular licensed brands like Calvin Klein and Tommy Hilfiger. This multi-brand strategy, spanning intimate wear, activewear, and sleepwear, diversifies revenue streams and mitigates risks associated with any single brand's performance. The company reported net sales of $2.4 billion for the fiscal year ending December 31, 2023, demonstrating the scale and market acceptance of its broad brand offerings.

The company's global reach is another significant advantage, with operations and distribution networks spanning Israel, Europe, Asia, and the Americas. This international presence allows Delta Galil to tap into various markets effectively, adapting to regional consumer preferences and economic conditions. For instance, its significant presence in North America and Europe contributed substantially to its 2023 revenue, highlighting the success of its global operational strategy.

Delta Galil has showcased impressive financial strength, achieving record sales and enhanced profitability. In 2024, the company reported full-year sales exceeding $2.0 billion, marking a 10% year-over-year rise. This upward trend continued into the first quarter of 2025, with sales climbing 11% to a new record of $498.7 million.

Delta Galil's dedication to innovation is a significant strength, consistently channeling over 2.5% of its annual sales back into research and development and design. This investment fuels the creation of proprietary and sustainable fabrics, alongside cutting-edge designs and manufacturing techniques.

The company's leadership in seamless technology, a testament to its advanced manufacturing capabilities, provides a distinct competitive advantage. This technological prowess enables Delta Galil to develop high-performance, sustainable solutions such as Real Cool Cotton and 720° Stretch, enhancing product appeal and market differentiation.

Vertically Integrated Global Manufacturing Footprint

Delta Galil's vertically integrated global manufacturing footprint, spanning locations like Israel, Bulgaria, Turkey, Egypt, Thailand, and Jordan, provides significant operational advantages. This allows for enhanced flexibility and efficiency in production, directly impacting their ability to meet diverse market demands swiftly.

The strategic placement of these facilities enables Delta Galil to adapt to shifting global trade dynamics. For instance, the company can strategically reallocate production to countries with favorable tariff structures, such as Egypt, to mitigate risks associated with geopolitical tensions and optimize overall cost management. This adaptability is crucial in today's volatile global market.

- Global Reach: Manufacturing presence in Israel, Bulgaria, Turkey, Egypt, Thailand, and Jordan.

- Supply Chain Control: Vertical integration allows for greater oversight and efficiency from raw materials to finished goods.

- Risk Mitigation: Ability to shift production to lower-tariff regions, reducing exposure to trade disputes and geopolitical instability.

- Cost Optimization: Strategic location of facilities helps in managing production costs effectively.

Commitment to Sustainability and Ethical Practices

Delta Galil demonstrates a robust commitment to sustainability and ethical operations, a key strength in today's market. The company has set ambitious goals, aiming for 100% sustainable cotton and recycled polyester usage by 2025, reflecting a proactive approach to environmental responsibility. This focus extends to their production processes, incorporating eco-friendly materials and innovative technologies such as waterless dyeing, which significantly cuts down on water usage, waste, and carbon emissions.

Further bolstering its ethical standing, Delta Galil actively upholds fair labor practices. Its membership in the Fair Labor Association underscores this dedication, aligning the company with growing consumer preferences for ethically sourced and produced goods. This commitment is not just about compliance; it's about building trust and brand loyalty in an increasingly conscious marketplace.

- Target Achievement: On track to meet 100% sustainable cotton and recycled polyester usage by 2025.

- Environmental Innovation: Investment in waterless dyeing technology and eco-friendly materials.

- Ethical Labor: Membership in the Fair Labor Association ensures adherence to fair labor standards.

- Market Alignment: Responds to increasing consumer demand for ethically and sustainably produced apparel.

Delta Galil's diverse brand portfolio, including owned and licensed labels, provides significant revenue diversification. Its global operational presence across continents allows it to capitalize on various market opportunities, as evidenced by its substantial contribution to 2023 revenue from North America and Europe.

The company exhibits strong financial performance, with 2024 sales exceeding $2.0 billion, a 10% increase year-over-year. This growth momentum continued into Q1 2025, with sales reaching a record $498.7 million, an 11% rise.

Delta Galil's commitment to innovation is demonstrated by reinvesting over 2.5% of annual sales into R&D, focusing on proprietary fabrics and advanced manufacturing techniques like its leading seamless technology.

Its vertically integrated global manufacturing footprint offers flexibility and efficiency, enabling swift adaptation to market demands and strategic shifts in production to optimize costs and mitigate geopolitical risks.

The company's strong focus on sustainability, targeting 100% sustainable cotton and recycled polyester by 2025, coupled with ethical labor practices evidenced by its Fair Labor Association membership, aligns with increasing consumer demand for responsible apparel.

What is included in the product

Delivers a strategic overview of Delta Galil’s internal and external business factors, highlighting its strengths in brand portfolio and operational efficiency against market challenges and competitive threats.

Offers a clear, actionable framework to identify and address Delta Galil's core challenges and leverage its strengths for improved market performance.

Weaknesses

Delta Galil's operations are significantly vulnerable to shifts in U.S. tariff policies. The company has openly acknowledged that evolving trade regulations and the imposition of new tariffs present a substantial hurdle, prompting them to withdraw their fiscal year 2025 financial guidance.

A considerable portion of Delta Galil's income, roughly 30% of its current revenue, is directly exposed to these tariffs. Projections indicate a potential annual operating income impact of up to $20 million in 2025 due to these trade measures.

This reliance on the stability of international trade relations introduces substantial financial unpredictability. Consequently, Delta Galil is compelled to explore strategic adaptations, such as relocating manufacturing facilities to mitigate the effects of these trade policies.

Delta Galil's gross margin saw a dip in Q1 2025, reaching 40.6% compared to 42.3% in the same period of 2024, despite achieving record sales.

This contraction in profitability was largely driven by increased freight expenses, adverse currency fluctuations, and a reduction in export subsidies impacting their Egyptian manufacturing facilities.

Sustained pressure on these margins, even with robust sales figures, poses a risk to the company's overall financial health and ability to translate top-line growth into bottom-line success.

Delta Galil's extensive global supply chain exposes it to the unpredictable swings in international freight expenses and currency values. These external economic forces can significantly impact the company's bottom line, as seen in the Q1 2025 gross margin decline, where these factors were noted as key detractors.

For instance, a 10% increase in shipping costs, combined with unfavorable currency movements, could directly reduce profit margins by a noticeable percentage. Effectively mitigating these volatile costs is therefore paramount for Delta Galil's ongoing financial health and its ability to maintain stable profitability amidst global economic fluctuations.

Intense Competition in the Apparel Market

The apparel market, especially in activewear and intimate apparel, is incredibly crowded. Giants like Nike, Adidas, and Lululemon set a high bar, demanding constant innovation from players like Delta Galil to stand out.

Delta Galil faces significant pressure to differentiate its offerings in a landscape where major competitors pour vast resources into research, development, marketing, and building strong brand recognition.

- Market Saturation: The activewear and intimate apparel sectors are highly saturated, making it challenging for any single brand to capture substantial market share without significant differentiation.

- Brand Dominance: Global powerhouses like Nike and Adidas command significant market share and consumer loyalty, often through extensive marketing campaigns and product innovation pipelines.

- Price Sensitivity: While brand loyalty exists, consumers can also be price-sensitive, creating a dynamic where Delta Galil must balance premium offerings with competitive pricing strategies.

Potential Impact of Consumer Spending Pullback

Reports from early 2025 indicate a noticeable slowdown in consumer spending across apparel, accessories, and footwear sectors. This trend is impacting various demographics, suggesting a broader economic sentiment shift.

While Delta Galil has demonstrated sales growth, a prolonged period of consumer caution could challenge its revenue streams. The company might face pressure on sales volumes and its ability to maintain current pricing, especially for its branded offerings, as consumers increasingly opt for more budget-friendly options or discount retailers.

- Consumer Spending Trends: Early 2025 data shows a general decline in discretionary spending on apparel and footwear.

- Market Shift: Consumers are increasingly favoring lower-cost alternatives and off-price channels.

- Potential Impact on Delta Galil: A sustained pullback could affect sales volume and pricing power for branded products.

Delta Galil's profitability is susceptible to increased operational costs, including freight and currency fluctuations. The company's Q1 2025 gross margin fell to 40.6% from 42.3% in Q1 2024, attributed to these factors and reduced export subsidies in Egypt.

The company's extensive global supply chain makes it vulnerable to these external economic pressures. A hypothetical 10% rise in shipping costs, coupled with adverse currency movements, could significantly erode profit margins.

The highly competitive activewear and intimate apparel markets present a challenge for Delta Galil. Dominant players like Nike and Adidas invest heavily in innovation and marketing, requiring Delta Galil to constantly differentiate its products to maintain market presence.

Early 2025 data indicates a slowdown in consumer spending on apparel and footwear. This trend could impact Delta Galil's sales volumes and pricing power, particularly for its branded items, as consumers shift towards more budget-friendly options.

| Financial Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Gross Margin | 42.3% | 40.6% | -1.7 pp |

| Revenue | Record High | Record High | N/A |

Preview the Actual Deliverable

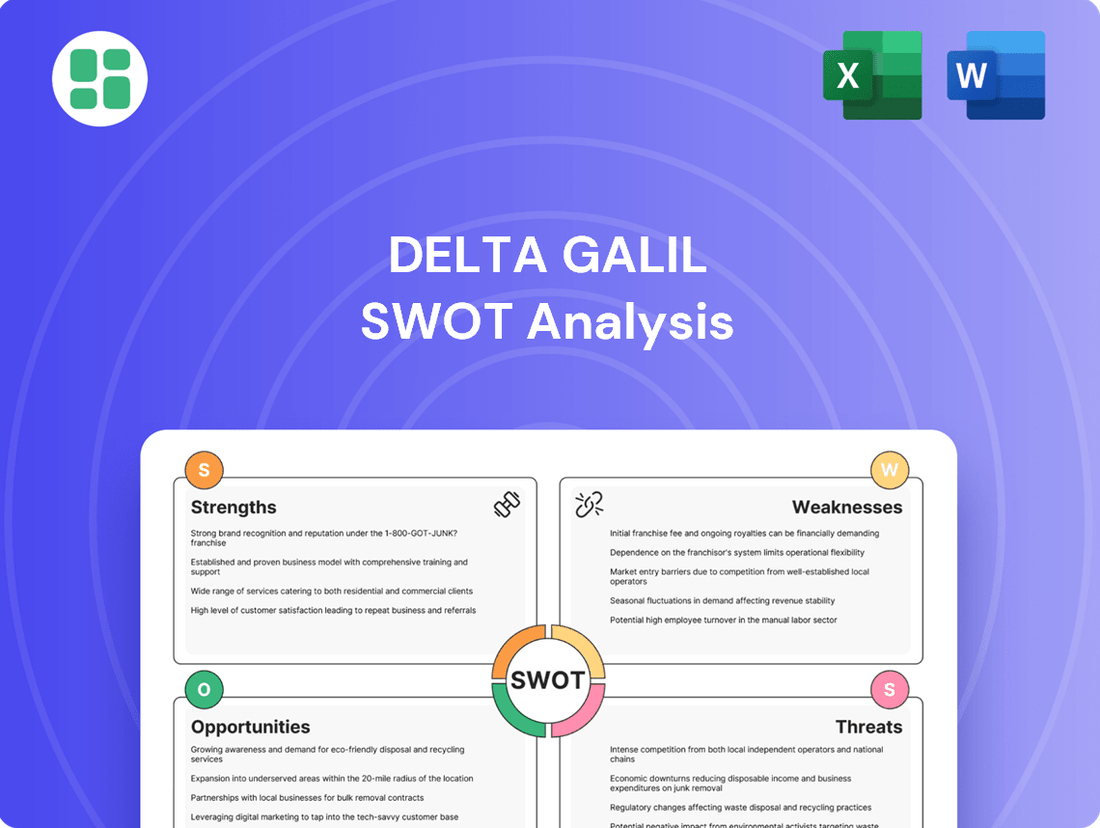

Delta Galil SWOT Analysis

This is the actual Delta Galil SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report, ensuring you know exactly what you're getting.

The preview below is taken directly from the full Delta Galil SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete understanding of the company's strategic position.

This is a real excerpt from the complete Delta Galil SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

Delta Galil's online sales are a significant growth engine, with its own brands experiencing a robust 21% increase in Q1 2025. This momentum is expected to continue, with projections indicating 21-22% growth for the full year 2024.

Further investment in e-commerce infrastructure, including enhanced digital marketing strategies and innovative virtual try-on technologies, is a key opportunity. This aligns with the broader market trend where online apparel sales are anticipated to capture a substantial share of the total market by 2026.

Delta Galil's dedication to sustainability, including its goals for 100% sustainable cotton and recycled polyester by 2025, taps into a growing consumer preference for eco-conscious fashion. This commitment is a prime opportunity to boost brand image and foster consumer loyalty.

By actively marketing its sustainable practices, such as ethical sourcing and reduced environmental impact, Delta Galil can significantly differentiate itself in a crowded marketplace. This transparency builds trust and appeals to a wider, more values-driven customer base.

Ongoing global supply chain disruptions and geopolitical uncertainties present a significant opportunity for Delta Galil to enhance its manufacturing diversification and embrace nearshoring. By strategically expanding production in low-tariff regions such as Egypt and Vietnam, the company can build a more resilient supply chain.

Furthermore, exploring nearshoring options, bringing production closer to key consumer markets, allows Delta Galil to improve supply chain agility and reduce lead times. This strategic shift can significantly mitigate risks associated with fluctuating international trade policies and tariffs, bolstering operational efficiency.

Growth in Activewear and Athleisure Market

The global activewear market is experiencing robust expansion, with projections indicating a compound annual growth rate of 5.9% through 2034. This sector is expected to reach a valuation exceeding $517 billion in 2024, reflecting a sustained consumer shift towards health, wellness, and the integration of athletic apparel into everyday wardrobes.

Delta Galil is strategically positioned to capitalize on this trend. Its established expertise in activewear, combined with ongoing innovation in smart and high-tech fabric technologies, provides a distinct advantage. The company’s ability to develop advanced materials that enhance performance and comfort directly addresses the evolving demands of consumers within this dynamic market.

- Market Expansion: Global activewear market projected to grow at a CAGR of 5.9% until 2034.

- Current Valuation: Estimated market size of over $517 billion in 2024.

- Key Drivers: Increased focus on health, wellness, and the athleisure trend.

- Delta Galil's Advantage: Strong presence and innovation in smart/high-tech fabrics.

Strategic Partnerships and New Category Development

Delta Galil's strategic focus on expanding its global licenses and cultivating new brands, coupled with developing novel product categories alongside its key retail partners, presents a significant avenue for growth. This approach, as seen in their ongoing efforts, aims to boost both sales volume and profit margins.

By actively pursuing strategic brand collaborations and pinpointing untapped market opportunities, often referred to as 'white space', Delta Galil can broaden its product portfolio. For instance, in 2023, the company reported a revenue of $2.3 billion, demonstrating its substantial market presence.

These partnerships allow Delta Galil to enter previously unaddressed market segments and effectively leverage its established innovation capabilities. The company's commitment to this strategy is crucial for driving sustained future expansion and enhancing its competitive edge in the apparel industry.

- Strategic Brand Alliances: Delta Galil aims to strengthen its position through collaborations with established and emerging brands, expanding its reach and product diversity.

- New Category Penetration: The company is actively exploring and developing new product categories with its main customers, aiming to capture new consumer demand and increase revenue streams.

- White Space Identification: A key part of their strategy involves identifying underserved market segments, allowing for the introduction of innovative products and services.

- Leveraging Innovation: Delta Galil intends to utilize its robust innovation platform to support the development and launch of these new offerings, ensuring they meet evolving market needs.

Delta Galil's strong online sales growth, with its own brands up 21% in Q1 2025 and projected 21-22% for the full year 2024, presents a significant opportunity. Continued investment in e-commerce, including digital marketing and virtual try-on tech, will capitalize on the growing online apparel market. The company's commitment to sustainability, aiming for 100% sustainable cotton and recycled polyester by 2025, appeals to eco-conscious consumers and enhances brand loyalty.

Diversifying manufacturing and nearshoring to regions like Egypt and Vietnam offers a chance to build a more resilient supply chain, mitigating risks from global disruptions and trade policy shifts. The booming activewear market, valued over $517 billion in 2024 and growing at a 5.9% CAGR, is another key opportunity, especially with Delta Galil's expertise in high-tech fabrics.

Expanding global licenses and developing new product categories with retail partners, alongside identifying untapped market segments, are strategic growth avenues. In 2023, Delta Galil achieved $2.3 billion in revenue, showcasing its capacity to leverage innovation and partnerships for broader market penetration.

Threats

The primary and most immediate threat to Delta Galil stems from the ongoing unpredictability and implementation of new US import tariffs. These policies directly impacted the company's Q1 2025 performance, forcing the withdrawal of its annual guidance. For instance, the imposition of tariffs can significantly increase sourcing costs.

Such increased costs can translate into higher retail prices for consumers, potentially dampening demand and impacting overall sales volumes. This creates a challenging environment for maintaining competitive pricing and profit margins.

The apparel sector, including companies like Delta Galil, continues to grapple with escalating operating expenses. These include significant jumps in freight charges and upward pressure on wages in key manufacturing hubs, alongside broader inflationary trends impacting raw materials and energy. For instance, Delta Galil reported a decline in its gross margin in Q1 2025, directly attributable to these cost increases.

These persistent cost pressures pose a substantial threat to profitability, potentially squeezing margins even with diligent cost-saving measures. While Delta Galil is actively pursuing cost-reduction strategies, the overarching economic environment and its impact on input costs remain a critical external factor that could continue to challenge the company's financial performance.

Delta Galil faces significant threats from ongoing supply chain disruptions, exacerbated by geopolitical tensions. Issues with raw material sourcing, labor shortages, and logistics bottlenecks are widespread in the global fashion industry. For instance, the Red Sea crisis in early 2024 significantly impacted shipping routes, leading to extended transit times and increased freight costs for many apparel companies.

These challenges directly affect Delta Galil's operational efficiency, potentially causing production delays and making it harder to secure necessary materials. The Ukraine-Russia war also continues to influence energy prices and certain raw material availability, adding another layer of complexity to global sourcing strategies for companies like Delta Galil.

Shifting Consumer Behavior and Market Saturation

Consumers are increasingly prioritizing value, leading them to seek out more affordable options and a growing interest in the secondhand apparel market. This trend, combined with a projected slowdown in consumer spending in early 2025, presents a significant challenge for Delta Galil. Market saturation in several apparel segments further exacerbates this, potentially impacting sales of higher-priced or branded items.

Delta Galil must remain agile in its pricing and product development to address these evolving consumer preferences. The company's ability to adapt its strategies will be crucial for maintaining its competitive edge in a dynamic retail landscape.

- Value-Seeking Consumers: A significant portion of consumers are actively seeking lower-priced alternatives, impacting demand for premium offerings.

- Secondhand Market Growth: The resale apparel market is expanding, offering consumers more budget-friendly choices.

- Slowing Spending Forecasts: Projections for early 2025 indicate a potential dip in overall consumer spending, affecting discretionary purchases like apparel.

- Market Saturation Risks: Overcrowded product categories can limit Delta Galil's ability to gain market share and drive revenue growth.

Increased Scrutiny on Supply Chain Transparency and Ethical Labor

Growing global demand for supply chain transparency, particularly concerning ethical labor practices, presents a significant threat. The Uyghur Forced Labor Prevention Act (UFLPA), enacted in 2022, and similar legislation worldwide, are increasing scrutiny and enforcement, requiring companies like Delta Galil to demonstrate robust visibility over their entire supply chain. For instance, U.S. Customs and Border Protection has detained shipments suspected of being produced with forced labor, impacting companies across various industries.

Delta Galil's extensive global manufacturing network, encompassing both owned facilities and third-party suppliers, makes maintaining absolute oversight challenging. Any identified or even alleged instances of unethical labor practices, such as forced labor or poor working conditions, within this complex network could result in severe reputational damage and potential legal penalties, affecting consumer trust and market access.

- Increased Regulatory Enforcement: The UFLPA and similar international regulations are actively being enforced, leading to potential import detentions and supply chain disruptions for non-compliant companies.

- Reputational Risk: Public and consumer awareness of ethical sourcing is high, making any perceived lapse in labor standards a significant threat to brand image and customer loyalty.

- Supply Chain Complexity: Delta Galil's reliance on a vast network of global suppliers necessitates continuous monitoring and auditing to ensure compliance with evolving ethical labor standards.

The company faces significant threats from increasing competition and market saturation in key segments, which could pressure pricing and market share. Furthermore, evolving consumer preferences towards sustainability and ethical production require substantial investment in supply chain adjustments and material innovation, potentially impacting short-term profitability.

The ongoing volatility in global currency exchange rates presents another challenge, directly affecting the cost of imported materials and the repatriated profits from international sales. For instance, a strengthening US dollar in late 2024 could make Delta Galil's exports more expensive for foreign buyers.

Delta Galil's reliance on a global supply chain makes it vulnerable to geopolitical instability and trade policy shifts beyond tariffs, such as export restrictions or sanctions that could disrupt sourcing or market access. The company's 2024 financial reports highlighted increased logistics costs due to these broader global uncertainties.

SWOT Analysis Data Sources

This analysis is built upon a foundation of comprehensive data, including Delta Galil's official financial reports, detailed market research, and insights from industry experts to provide a robust and accurate SWOT assessment.