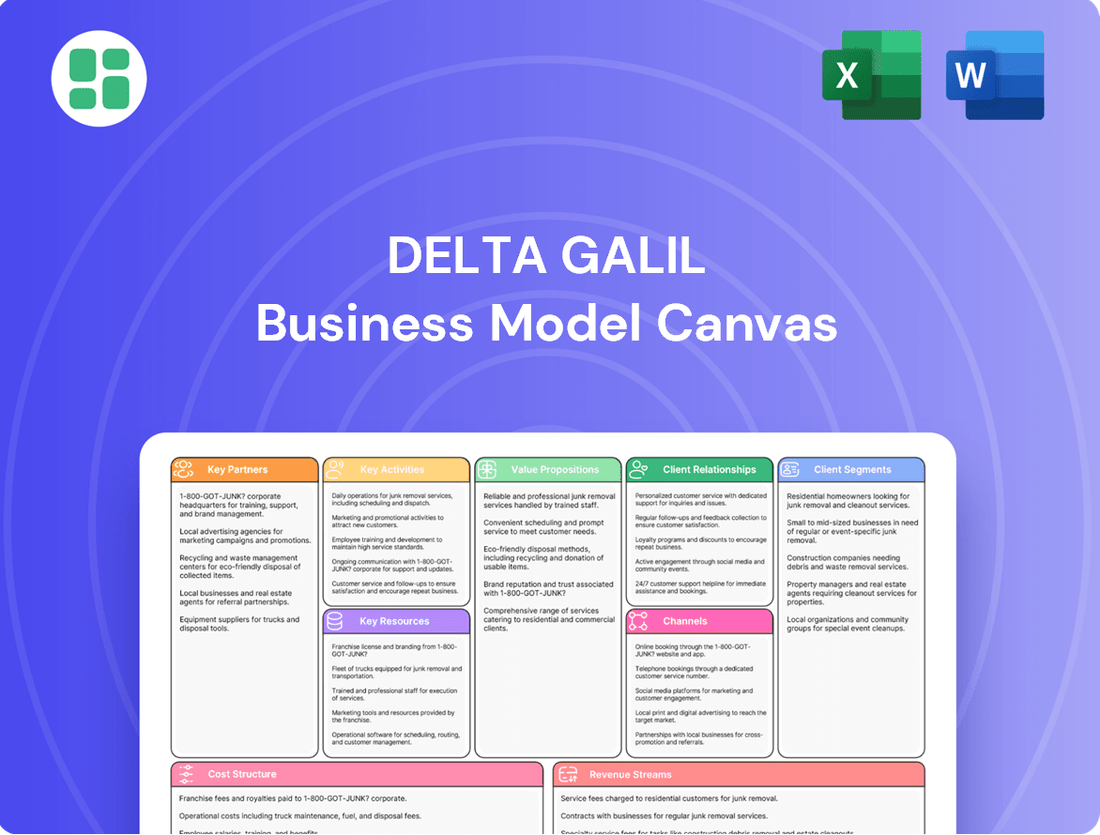

Delta Galil Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Galil Bundle

Unlock the strategic secrets behind Delta Galil's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear roadmap for their industry dominance. Dive into the full analysis to understand how they consistently innovate and deliver value.

Partnerships

Delta Galil's strategic brand licensees are a cornerstone of its business model. The company collaborates with iconic names such as Calvin Klein, Tommy Hilfiger, Columbia, and Adidas, among others, to design, produce, and distribute apparel. This strategy unlocks access to a vast customer base already familiar with these beloved brands.

In 2024, these licensing agreements continue to be a significant driver of Delta Galil's revenue and market penetration. By leveraging the established equity of these global brands, Delta Galil can efficiently expand its product offerings into new categories and geographical regions, demonstrating a consistent ability to adapt and grow within the competitive apparel industry.

Delta Galil actively partners with major global retailers, designing and manufacturing private label apparel. This strategic collaboration allows them to offer end-to-end solutions, from concept to production, specifically tailored to each retailer's unique requirements and brand identity.

These collaborations are crucial for strengthening the retailers' market presence by producing high-quality goods under their own established brands. For instance, in 2023, private label sales represented a significant portion of the apparel industry's growth, with major retailers leveraging these partnerships to enhance their private label offerings and capture consumer loyalty.

Delta Galil’s manufacturing and supply chain partners are the backbone of its global operations. The company leverages a vast network of factories and suppliers worldwide, including its own facilities in strategic, low-tariff locations like Egypt. This global footprint is essential for cost optimization and efficient production.

These partnerships are critical for maintaining flexibility and speed in meeting diverse customer demands. In 2024, Delta Galil continued to emphasize these relationships to navigate complex trade policies and ensure a resilient supply chain, allowing for timely delivery of products across its many markets.

Technology and Innovation Partners

Delta Galil actively seeks technology and innovation partners to drive advancements in its product lines, especially within the intimate and activewear sectors. This strategic approach focuses on integrating cutting-edge technologies to improve performance and functionality. For instance, collaborations might focus on developing smart textiles or advanced material science applications that enhance comfort and athletic capabilities.

The company’s commitment to innovation is evident in its pursuit of partners who can provide unique technological solutions. This allows Delta Galil to stay ahead of market trends and create differentiated products. A key area of focus is leveraging digital technologies for enhanced design, manufacturing, and supply chain efficiency. For example, in 2024, Delta Galil continued to explore partnerships in areas like AI-driven design and advanced material testing to accelerate product development cycles.

These partnerships are crucial for Delta Galil's strategy to maintain a competitive advantage and develop next-generation apparel. By collaborating with technology leaders, the company can access specialized expertise and resources that might not be available internally. This synergy fosters the creation of high-tech apparel that meets the evolving demands of consumers for performance, sustainability, and integrated technology.

Key areas for these technology partnerships include:

- Development of smart fabrics with integrated sensors for health and fitness monitoring.

- Advancements in sustainable material sourcing and eco-friendly production technologies.

- Integration of digital design tools and virtual prototyping for faster product iteration.

- Exploration of new manufacturing techniques, such as 3D printing for customized apparel components.

Joint Ventures (e.g., Reliance Retail in India)

Delta Galil strategically forms joint ventures to tap into new, high-growth markets. A prime example is its 50/50 partnership with Reliance Retail in India, a move designed to accelerate market entry and expansion. This collaboration allows Delta Galil to leverage Reliance Retail's vast distribution capabilities and deep understanding of the Indian consumer landscape.

These joint ventures are crucial for tailoring product development to meet specific local consumer demands, ensuring relevance and market penetration. By combining Delta Galil's expertise in apparel manufacturing and design with its partner's market access, the company can effectively navigate diverse retail environments.

- Market Expansion: Entry into rapidly growing markets like India through strategic alliances.

- Local Product Development: Adapting product offerings to suit specific regional consumer preferences.

- Leveraging Distribution: Utilizing partners' extensive networks for efficient product reach.

- Risk Mitigation: Sharing investment and operational risks in new territories.

Delta Galil's key partnerships are diverse, encompassing strategic brand licensees like Calvin Klein and Columbia, major global retailers for private label development, and crucial manufacturing and supply chain partners. The company also actively pursues technology and innovation collaborations to enhance product lines, particularly in intimate and activewear, and forms joint ventures for market expansion, such as its significant partnership with Reliance Retail in India.

These collaborations are vital for revenue generation, market penetration, and product differentiation. For example, in 2024, Delta Galil continued to leverage its extensive network of over 200 partners globally to ensure supply chain resilience and cost efficiency, while its joint venture in India aimed to capture a substantial share of that burgeoning market.

| Partnership Type | Key Examples | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Brand Licensing | Calvin Klein, Tommy Hilfiger, Columbia, Adidas | Access to established customer bases, market reach | Continued revenue driver, product category expansion |

| Retailer Collaborations (Private Label) | Major global retailers | End-to-end apparel solutions, retailer brand strengthening | Enhancing private label offerings, consumer loyalty |

| Manufacturing & Supply Chain | Global network of factories, own facilities (e.g., Egypt) | Cost optimization, production efficiency, flexibility | Navigating trade policies, ensuring supply chain resilience |

| Technology & Innovation | AI design, advanced material testing partners | Product advancement, performance enhancement, differentiation | Accelerating product development, smart textiles |

| Joint Ventures | Reliance Retail (India) | New market entry, accelerated expansion, local adaptation | Capturing high-growth market share, leveraging distribution |

What is included in the product

A comprehensive, pre-written business model tailored to Delta Galil's strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for informed decision-making.

Delta Galil's Business Model Canvas offers a clear, one-page snapshot of their operations, simplifying complex strategies for easier understanding and adaptation.

It acts as a pain point reliever by providing a structured, digestible format that streamlines strategic discussions and internal alignment.

Activities

Delta Galil's core strength lies in its comprehensive apparel design and development process. This covers a wide array of product categories, from intimate apparel and activewear to socks, sleepwear, and leisurewear, catering to both its own brands and private label clients.

The company actively engages in creating innovative designs and sourcing suitable materials, a critical step in bringing new apparel concepts to life. This includes a focus on developing new product categories that resonate with current market trends and evolving consumer tastes.

In 2023, Delta Galil reported net sales of $2.3 billion, with a significant portion driven by these design and development capabilities that allow them to adapt to diverse market demands and maintain a competitive edge.

Delta Galil Industries operates a vast global manufacturing network, with factories strategically positioned across diverse regions to maximize efficiency and profitability. This extensive footprint allows for optimized production cycles and cost management.

Key activities encompass the entire garment production process, from the initial stages of knitting and cutting fabric to the final sewing and finishing. The company prioritizes maintaining high-quality standards throughout these operations.

In 2023, Delta Galil reported that its manufacturing segment, which includes its extensive production facilities, generated a significant portion of its revenue, highlighting the critical role of these operations. The company consistently aims to optimize production volumes to meet global demand effectively.

Delta Galil's key activity in branded and private label marketing and sales is multifaceted, encompassing the promotion and distribution of its diverse portfolio. This includes nurturing its wholly-owned brands like Schiesser, 7 For All Mankind, and Splendid, alongside managing sales for licensed brands. The company strategically develops marketing campaigns and maintains brand integrity across all touchpoints to drive consumer engagement and sales.

In 2023, Delta Galil reported significant revenue from its branded and private label segments, highlighting the effectiveness of its sales strategies. The company's direct-to-consumer (DTC) channels, including e-commerce platforms and its own retail stores, continue to grow, complementing its robust wholesale relationships with major retailers worldwide. This dual approach allows for broader market reach and diversified revenue streams.

Supply Chain Management and Logistics

Delta Galil's supply chain management and logistics are central to its operations, encompassing the sourcing of raw materials like cotton and polyester, coordinating production in numerous factories globally, and ensuring timely delivery of apparel to retailers worldwide. This intricate network requires constant attention to efficiency and cost management.

Navigating the complexities of global logistics is a significant undertaking. The company must contend with fluctuating freight costs, which can impact profitability, and the ever-present challenge of tariffs and trade regulations in different markets. For instance, in 2024, global shipping costs saw volatility, with some routes experiencing increases due to geopolitical events and demand shifts.

- Global Sourcing: Procuring raw materials from diverse international suppliers to ensure quality and competitive pricing.

- Production Coordination: Managing manufacturing processes across a network of owned and outsourced facilities in various countries.

- Distribution Network: Overseeing the warehousing and transportation of finished goods to distribution centers and retail partners across continents.

- Logistics Optimization: Continuously seeking ways to reduce transit times and shipping expenses while mitigating risks associated with international trade.

Innovation and Sustainability Initiatives

Delta Galil actively invests in research and development to drive innovation in textiles, focusing on sustainable materials and eco-friendly production processes. This commitment extends to adopting industry-leading practices and aligning with global sustainability targets, including the UN Sustainable Development Goals.

In 2024, the company continued to prioritize these initiatives, with R&D spending playing a crucial role in developing next-generation fabrics and manufacturing techniques. These efforts aim to reduce environmental impact across the value chain.

- Material Innovation: Development of recycled and bio-based fibers.

- Process Optimization: Implementation of water-saving dyeing and finishing techniques.

- Circular Economy: Exploration of product end-of-life solutions and waste reduction.

- Partnerships: Collaboration with technology providers and research institutions to accelerate sustainable advancements.

Delta Galil's key activities revolve around managing its extensive global manufacturing network and sophisticated supply chain. This involves coordinating production across numerous facilities and ensuring the efficient flow of raw materials and finished goods. The company actively seeks to optimize logistics to reduce transit times and shipping costs, a critical factor given the volatility in global shipping rates, which saw fluctuations in 2024 due to various economic and geopolitical factors.

| Key Activity | Description | 2023 Data/2024 Trend |

|---|---|---|

| Global Sourcing | Procuring raw materials from diverse international suppliers. | Focus on sustainable and recycled materials is increasing. |

| Production Coordination | Managing manufacturing across owned and outsourced facilities. | Operates a vast global network to maximize efficiency. |

| Distribution Network | Overseeing warehousing and transportation of finished goods. | Ensures timely delivery to retail partners worldwide. |

| Logistics Optimization | Reducing transit times and shipping expenses. | Navigating volatile freight costs in 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are precisely as you see them, ensuring no surprises. You'll gain full access to this comprehensive analysis of Delta Galil's business strategy, ready for your immediate use.

Resources

Delta Galil's owned and licensed brand portfolio is a cornerstone of its business model, encompassing prestigious names like 7 For All Mankind, Schiesser, and Splendid. This diverse collection fuels significant revenue streams and cultivates strong customer loyalty through established market recognition.

The company also leverages its licensing agreements with globally recognized brands such as Calvin Klein, Tommy Hilfiger, and Adidas. In 2024, this strategic brand management contributed to Delta Galil's robust financial performance, with its brands consistently driving sales growth across various product categories.

Delta Galil's global manufacturing facilities and infrastructure, spanning locations like Israel, Egypt, Turkey, Vietnam, and the Czech Republic, represent a core physical asset. This widespread network is crucial for their operational efficiency and market responsiveness.

In 2024, Delta Galil continued to leverage its approximately 30 manufacturing sites worldwide. This extensive infrastructure allows for diversified sourcing and production, mitigating risks and optimizing costs. Their presence in key regions, including Asia and Europe, facilitates proximity to major consumer markets.

Delta Galil's skilled workforce, encompassing designers, developers, and manufacturing experts, is a cornerstone of its business model. This talent pool is directly responsible for the company's innovation in apparel, its robust design capabilities, and its commitment to operational excellence.

The expertise of these individuals in apparel design, technical production processes, and staying ahead of market trends is absolutely critical to Delta Galil's sustained success. For instance, in 2023, the company highlighted its investment in talent development, recognizing that its people are key to maintaining a competitive edge in the fast-paced fashion industry.

Financial Capital and Strong Balance Sheet

Delta Galil's financial capital is a cornerstone of its business model, enabling robust operations and strategic expansion. The company's strong balance sheet, bolstered by significant equity and substantial cash reserves, provides the necessary foundation for sustained growth and investment. This financial strength is critical for navigating market dynamics and pursuing new opportunities.

In 2024, Delta Galil reported record sales surpassing $2 billion, a clear indicator of its market penetration and operational efficiency. This financial performance directly translates into enhanced financial capital, offering flexibility and resilience. The company's ability to generate strong revenues underpins its capacity to reinvest in its business and maintain a healthy financial structure.

- Record Sales: Exceeded $2 billion in 2024, demonstrating strong market demand and effective sales strategies.

- Strong Balance Sheet: Characterized by substantial equity and ample cash reserves, providing financial stability.

- Investment Capacity: Financial resources support investments in growth initiatives, operational enhancements, and strategic acquisitions.

- Financial Flexibility: The robust capital position allows Delta Galil to respond effectively to market opportunities and challenges.

Proprietary Technology and Innovation Platform

Delta Galil's proprietary technology and innovation platform is central to its business model, enabling the development of advanced apparel solutions. This platform houses unique technologies and processes focused on creating seamless garments and integrating sustainable practices. For instance, in 2023, the company continued to invest in its innovation capabilities, aiming to enhance product performance and consumer comfort.

This technological advantage translates directly into the creation of high-quality, comfortable, and distinctive products that set Delta Galil apart in the market. The company's commitment to innovation is reflected in its ongoing efforts to develop new fabric technologies and manufacturing techniques. In early 2024, Delta Galil highlighted its focus on digital transformation within its innovation pipeline, seeking to accelerate product development cycles.

Key aspects of Delta Galil's proprietary technology and innovation platform include:

- Proprietary Seamless Technology: Enabling the production of comfortable, durable, and aesthetically pleasing apparel with fewer seams, enhancing wearability and reducing material waste.

- Sustainable Innovation Processes: Integrating eco-friendly materials and manufacturing methods, such as water-saving dyeing techniques and recycled fabric utilization, aligning with growing consumer demand for sustainable fashion.

- In-house R&D Capabilities: Fostering a culture of continuous improvement and product development, allowing for rapid adaptation to market trends and the creation of unique product offerings.

- Digital Integration: Leveraging digital tools and data analytics to optimize the innovation process, from design and prototyping to manufacturing and supply chain management, ensuring efficiency and responsiveness.

Delta Galil's key resources are its extensive brand portfolio, global manufacturing footprint, skilled workforce, strong financial capital, and proprietary innovation platform. These elements collectively enable the company to design, produce, and market a wide range of apparel effectively.

In 2024, Delta Galil's record sales exceeding $2 billion underscore the value derived from these resources, particularly its brand management and operational capabilities. The company's investment in its approximately 30 manufacturing sites worldwide and its focus on talent development and digital innovation further solidify its competitive advantage.

The company’s owned and licensed brands, including 7 For All Mankind and partnerships with Calvin Klein and Adidas, are critical revenue drivers. Its global manufacturing network, spanning over 30 sites in 2024, ensures operational efficiency and market proximity.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Brand Portfolio | Owned and licensed brands (e.g., 7 For All Mankind, Schiesser, Splendid, Calvin Klein, Tommy Hilfiger) | Drives significant revenue and customer loyalty. |

| Global Manufacturing | Approximately 30 manufacturing sites worldwide (e.g., Vietnam, Turkey, Egypt) | Enables operational efficiency, cost optimization, and market responsiveness. |

| Skilled Workforce | Designers, developers, manufacturing experts | Crucial for innovation, product development, and operational excellence. Highlighted investment in talent development in 2023. |

| Financial Capital | Equity, cash reserves, revenue generation | Supports operations, expansion, and investment. Record sales exceeded $2 billion in 2024. |

| Proprietary Technology & Innovation | Seamless technology, sustainable processes, R&D capabilities, digital integration | Enhances product quality, comfort, and market differentiation. Ongoing investment in digital transformation in early 2024. |

Value Propositions

Delta Galil provides a broad spectrum of apparel, encompassing underwear, activewear, socks, sleepwear, and leisurewear. This extensive product portfolio allows clients to consolidate their sourcing needs with one dependable provider.

In 2023, Delta Galil reported net sales of $2.4 billion, underscoring the scale of its comprehensive apparel solutions and its ability to serve a diverse clientele effectively.

Delta Galil consistently pushes boundaries with its innovation and design, evident in its continuous exploration of new materials and advanced manufacturing techniques. This focus ensures their product offerings remain at the forefront of comfort, quality, and style, directly addressing shifting consumer preferences.

In 2024, Delta Galil reported significant investment in research and development, a key driver for their innovation pipeline. This strategic allocation of resources allows them to introduce novel fabric technologies and design aesthetics, maintaining a competitive edge in the fast-paced apparel industry.

Delta Galil leverages its extensive global manufacturing network to deliver efficient and scalable production. This allows for competitive pricing and dependable supply chains for its partners.

With a strategic footprint in regions offering favorable tariff structures, Delta Galil effectively optimizes costs. This approach also aids in navigating complex international trade regulations, benefiting its clientele.

In 2023, Delta Galil reported that its global manufacturing operations contributed significantly to its overall operational efficiency. The company's ability to manage a diverse production base across multiple continents is a key differentiator in the textile industry.

Brand Building and Market Insight Support

Delta Galil provides significant value to its partners by offering deep expertise in crafting and understanding brand identity, especially when venturing into new product categories. This guidance helps partners solidify their brand's core message and resonate with target audiences.

The company excels at identifying untapped market opportunities, or white spaces, for its partners. This strategic insight, backed by robust market intelligence, allows partners to pinpoint areas for growth and innovation.

By leveraging Delta Galil's market insight and brand-building support, partners can effectively expand their brand's presence and successfully reach new customer segments.

- Brand Identity Expertise: Delta Galil assists partners in defining and interpreting brand identity in new categories.

- Market White Space Identification: The company identifies untapped market opportunities for partners.

- Market Intelligence: Partners benefit from comprehensive market data to inform their strategies.

- Customer Segment Expansion: This support enables partners to effectively reach new customer bases.

Quality, Comfort, and Sustainability Focus

Delta Galil's value proposition is deeply rooted in a 'body-before-fabric' philosophy. This means their product development prioritizes how the garment feels and performs on the wearer, ensuring exceptional comfort, appealing aesthetics, and uncompromising quality.

This commitment extends to a strong focus on sustainability. Delta Galil actively adopts industry best practices and develops innovative, environmentally friendly solutions. This resonates with a growing segment of consumers and business partners who value eco-conscious choices.

- Comfort First: Prioritizing wearer experience through thoughtful design and material selection.

- Quality Assurance: Maintaining high standards for durability and finish across all product lines.

- Sustainable Practices: Implementing environmentally responsible manufacturing and material sourcing.

- Aesthetic Appeal: Ensuring products are not only comfortable and well-made but also visually attractive.

Delta Galil's value proposition centers on its comprehensive apparel solutions, offering a wide range of products from underwear to activewear, simplifying sourcing for clients. This is supported by a strong emphasis on innovation, continuously exploring new materials and manufacturing techniques to meet evolving consumer demands. Their commitment to quality is evident in their 'body-before-fabric' philosophy, ensuring comfort, aesthetics, and durability.

The company's global manufacturing network provides efficient, scalable production and competitive pricing, further enhanced by strategic cost optimization through favorable tariff structures. Delta Galil also offers significant value in brand identity expertise and market white space identification, leveraging market intelligence to help partners expand their reach. Their dedication to sustainability aligns with growing consumer and partner preferences for eco-conscious choices.

| Value Proposition Aspect | Description | Supporting Data/Impact |

|---|---|---|

| Comprehensive Apparel Solutions | Offers a broad spectrum of apparel categories, simplifying sourcing for partners. | Net sales of $2.4 billion in 2023 demonstrate the scale and breadth of their offerings. |

| Innovation and Design | Focuses on new materials and advanced manufacturing for cutting-edge products. | Significant investment in R&D in 2024 drives novel fabric technologies and design aesthetics. |

| Brand Identity and Market Expertise | Assists partners in defining brand identity and identifying untapped market opportunities. | Enables partners to expand brand presence and successfully reach new customer segments. |

| Operational Efficiency and Cost Optimization | Leverages a global manufacturing network for scalable production and competitive pricing. | Strategic footprint in regions with favorable tariffs optimizes costs and navigates trade regulations. |

Customer Relationships

Delta Galil excels at fostering long-term strategic partnerships, with some relationships dating back over two decades. This longevity underscores their position as a trusted partner for a diverse array of brands and retailers.

These enduring collaborations are a direct result of Delta Galil consistently delivering innovative and exclusive solutions. This commitment to value creation builds a foundation of mutual growth and trust, solidifying their role as a preferred supplier.

In 2024, Delta Galil reported that a significant portion of its revenue continues to be generated from these deeply entrenched customer relationships, highlighting the strategic importance of their partnership approach.

Delta Galil fosters deep client partnerships through dedicated account management, offering a high-touch experience in private label design, development, and manufacturing. This collaborative approach ensures they’re not just suppliers, but true partners in bringing tailored apparel solutions to life, working hand-in-hand with clients from concept to final product.

Delta Galil is significantly boosting its direct-to-consumer (DTC) interactions by expanding online sales for its proprietary brands. This strategic shift enables the company to gather real-time consumer feedback, implement tailored marketing campaigns, and gain a more profound understanding of what customers truly desire, thereby fostering stronger brand allegiance.

For instance, in 2023, Delta Galil reported a notable increase in its online sales, contributing a substantial portion to its overall revenue growth. This direct engagement allows for immediate data collection on product performance and customer satisfaction, crucial for agile product development and marketing adjustments.

Innovation and Trend-Driven Collaboration

Delta Galil actively drives customer relationships by proactively sharing its innovation platform and market intelligence. This allows them to present trend, design, and product ideas directly to key clients, fostering a collaborative environment.

This forward-thinking strategy empowers Delta Galil's customers. By aligning product offerings with current consumer behavior and emerging market trends, they help their clients maintain a competitive edge.

- Trend Forecasting: Delta Galil’s investment in market intelligence, including analyzing consumer spending patterns which saw global apparel retail sales reach an estimated $1.7 trillion in 2024, allows them to anticipate future demand.

- Design Collaboration: The company facilitates joint development sessions, ensuring product concepts resonate with target demographics and align with evolving fashion aesthetics.

- Product Innovation: By leveraging their innovation platform, Delta Galil introduces novel materials and manufacturing techniques, such as sustainable fabric solutions that gained significant traction in 2024.

Problem Solving and Adaptability (e.g., Tariff Impact Management)

Delta Galil proactively addresses external economic shifts, such as the impact of tariffs. In 2024, the company continued to refine its strategies for navigating such challenges, working closely with both suppliers and clients to soften any adverse effects.

This collaborative problem-solving is key to maintaining robust customer relationships. By demonstrating a commitment to finding solutions, Delta Galil ensures continued supply chain stability and customer satisfaction, even amidst trade uncertainties.

- Tariff Mitigation: Delta Galil actively engages with its global vendor network to explore alternative sourcing and cost-sharing mechanisms to offset tariff impacts.

- Customer Collaboration: The company maintains open communication with its B2B customers to jointly develop strategies for managing price adjustments and ensuring product availability.

- Supply Chain Optimization: Continuous evaluation and adaptation of sourcing locations and logistics are undertaken to enhance resilience against trade policy changes.

- Adaptability in Action: Delta Galil's ability to pivot sourcing and production in response to evolving trade landscapes underscores its commitment to business continuity and customer support.

Delta Galil cultivates deep client partnerships through dedicated account management and a collaborative approach to private label design, development, and manufacturing. They also enhance direct-to-consumer (DTC) interactions by expanding online sales for proprietary brands, gathering real-time feedback to foster stronger brand allegiance.

The company proactively shares its innovation platform and market intelligence, presenting trend, design, and product ideas directly to key clients to maintain their competitive edge.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Strategic Partnerships | Long-term, trusted collaborations | Relationships dating back over two decades |

| Value Creation | Delivering innovative and exclusive solutions | Drives mutual growth and trust |

| Direct-to-Consumer (DTC) | Expanding online sales for proprietary brands | Real-time feedback for tailored marketing and brand allegiance |

| Market Intelligence Sharing | Proactive sharing of trends and consumer behavior | Helps clients maintain a competitive edge |

Channels

Delta Galil's wholesale channel is a cornerstone of its business, supplying a diverse range of apparel to retailers and brands globally. This B2B approach encompasses both their own established brands and private label offerings, catering to varied market needs.

In 2024, this segment remained critical, with Delta Galil leveraging its extensive network to distribute products to major retail partners. The company's ability to offer both branded and private label solutions provides flexibility and broad market appeal, a key strength in this channel.

Delta Galil's direct-to-consumer (DTC) online sales channel is a key growth engine, allowing the company to connect directly with its customer base. This strategic focus has resulted in substantial year-over-year increases in online sales for its proprietary brands.

By bypassing traditional retail intermediaries, Delta Galil not only broadens its market reach but also stands to capture improved profit margins on its products. This direct engagement fosters a deeper understanding of consumer preferences, informing future product development and marketing efforts.

For instance, in 2023, Delta Galil's e-commerce segment demonstrated robust performance, contributing significantly to the company's overall revenue. This digital-first approach is central to their strategy for sustained growth and brand loyalty in an increasingly online marketplace.

Delta Galil leverages a dual approach to physical retail, operating its own branded stores globally and also partnering with a vast network of major retail chains. This strategy allows for direct consumer engagement with its premium brands like 7 For All Mankind and Schiesser, while simultaneously reaching a broader audience through established retail partners.

In 2024, Delta Galil's owned brands continued to drive foot traffic and brand loyalty through their dedicated physical presence. For instance, the 7 For All Mankind brand maintains a significant footprint in key international markets, contributing to brand visibility and direct sales, a crucial element for its premium positioning.

The company’s partnerships with global retailers are instrumental in expanding its market reach. By stocking products in department stores and specialty shops worldwide, Delta Galil ensures its diverse product portfolio, from intimate apparel to denim, is accessible to a wide consumer base, bolstering overall sales volume.

Joint Venture Distribution Networks

Delta Galil leverages strategic joint ventures to tap into extensive local distribution networks, significantly accelerating market penetration. A prime example is their partnership with Reliance Retail in India, which provides immediate access to a vast retail footprint. This strategy is crucial for expanding into new geographical territories by utilizing the partner's established infrastructure and customer base.

These collaborations allow Delta Galil to bypass the lengthy process of building its own distribution channels from scratch. For instance, in 2024, Delta Galil continued to expand its presence in key emerging markets, with joint ventures playing a pivotal role in this growth. The company reported that its international segments, heavily reliant on such partnerships, saw a notable increase in sales volume, contributing to overall revenue growth.

- Access to Established Retail Footprint: Joint ventures grant immediate entry into a partner's existing store network, as seen with Reliance Retail in India.

- Accelerated Market Penetration: This strategy enables faster reach into new consumer segments and geographic areas.

- Reduced Operational Costs: By utilizing a partner's infrastructure, Delta Galil avoids significant upfront investments in distribution.

- Enhanced Local Market Knowledge: Partners provide invaluable insights into local consumer preferences and regulatory landscapes.

Global Sales and Logistics Network

Delta Galil leverages an extensive global sales and logistics network to ensure its products reach customers and partners worldwide. This robust infrastructure is key to their efficient operations, facilitating timely order fulfillment and delivery across diverse markets.

In 2024, Delta Galil's commitment to a streamlined supply chain was evident. The company managed a complex web of distribution centers and transportation routes, critical for meeting the demands of its international customer base. This network is a significant asset, enabling them to navigate global trade complexities and maintain a competitive edge.

- Global Reach: Delta Galil's network spans numerous countries, ensuring broad market access.

- Efficiency Gains: The logistics infrastructure aims to reduce lead times and operational costs.

- Customer Focus: A well-managed network directly contributes to customer satisfaction through reliable delivery.

Delta Galil's channels are multifaceted, encompassing wholesale to retailers, direct-to-consumer online sales, owned physical stores, partnerships with major retail chains, and strategic joint ventures for market penetration. This diverse approach ensures broad market access and direct customer engagement.

Customer Segments

Global retailers, encompassing major department store chains like Macy's and Nordstrom, as well as specialty apparel stores and smaller chains across continents, represent a crucial customer segment for Delta Galil. These businesses rely on Delta Galil for both their private label offerings and the branded apparel they stock, seeking integrated solutions that span design, development, and efficient, high-volume manufacturing. In 2024, the global apparel market continued its robust growth, with online retail sales alone projected to reach over $1.1 trillion, highlighting the significant volume and reach of these retail partners.

Delta Galil acts as a key manufacturing and innovation partner for numerous international apparel brands. These brands leverage Delta Galil's extensive expertise to produce licensed products, effectively extending their reach and product offerings. In 2024, Delta Galil's collaborations with major global brands likely contributed significantly to its revenue, capitalizing on the growing demand for co-branded and licensed apparel.

Delta Galil's direct-to-consumer (DTC) channel, encompassing both online sales and physical retail locations for its owned brands like 7 For All Mankind and Schiesser, is a key focus. This segment caters to consumers actively seeking high-quality, comfortable, and stylish intimate apparel and activewear. In 2024, the global intimate apparel market was projected to reach over $100 billion, highlighting the significant opportunity within this segment.

Specific Apparel Categories (e.g., Intimates, Activewear, Denim)

Delta Galil strategically targets specific apparel categories, recognizing the diverse demands and evolving trends within each. This focus allows for tailored product development and marketing efforts, ensuring they meet the unique needs of consumers for items like intimate apparel, activewear, socks, sleepwear, leisurewear, and denim.

By specializing, Delta Galil can leverage deep category expertise. For instance, their activewear segment benefits from understanding the technical fabric requirements and performance demands of athletes and fitness enthusiasts. Similarly, their intimate apparel division likely focuses on comfort, fit, and material innovation to appeal to a discerning customer base.

This segmentation is crucial for market penetration and brand loyalty. In 2024, the global activewear market alone was projected to reach over $300 billion, highlighting the significant opportunity within this category. Delta Galil's ability to cater to such specialized segments positions them to capture substantial market share.

The company's approach can be summarized by its focus on key apparel types:

- Intimate Apparel: Emphasizing comfort, style, and innovative materials.

- Activewear: Catering to performance needs and athleisure trends.

- Denim: Focusing on fit, durability, and contemporary styles.

- Socks, Sleepwear, and Leisurewear: Addressing comfort and casual lifestyle demands.

Geographic Markets (e.g., North America, Europe, Asia)

Delta Galil Industries has a significant global footprint, with a strong presence in established markets like North America and Europe, and a growing focus on emerging economies. In 2023, North America represented a substantial portion of its sales, reflecting the company's long-standing relationships with major retailers in the region.

The company actively tailors its product offerings and marketing strategies to cater to the unique tastes and purchasing habits prevalent in each geographic segment. For instance, its approach in Europe might emphasize sustainable materials and classic designs, while in India, it could focus on affordability and vibrant aesthetics, leveraging local manufacturing capabilities.

- North America: A cornerstone market, contributing significantly to Delta Galil's revenue, driven by partnerships with leading apparel brands and retailers.

- Europe: A diverse market where Delta Galil adapts to varying consumer preferences, often focusing on quality and brand reputation.

- Asia: An area of increasing strategic importance, with a particular emphasis on India, where the company is expanding its reach and production capabilities.

- Emerging Markets: Delta Galil is strategically investing in and developing its presence in other rapidly growing economies to diversify its revenue streams and capture new customer bases.

Delta Galil serves a broad customer base, from major global retailers like Macy's and Nordstrom to international apparel brands seeking manufacturing and design partnerships. Additionally, the company directly engages consumers through its own brands via online and physical retail channels.

The company's strategy involves catering to specific apparel categories such as intimate apparel, activewear, denim, socks, sleepwear, and leisurewear, recognizing the distinct demands within each. This specialization allows Delta Galil to leverage category expertise and meet diverse consumer needs.

Geographically, Delta Galil has a strong presence in North America and Europe, with a growing focus on Asia, particularly India, and other emerging markets. They tailor offerings to local tastes and purchasing habits, ensuring relevance across different regions.

| Customer Segment | Description | 2024 Market Relevance |

| Global Retailers | Department stores, specialty chains, smaller retailers needing private label and branded apparel. | Global apparel online sales projected over $1.1 trillion. |

| International Apparel Brands | Brands licensing products and requiring manufacturing expertise. | Contributes to revenue through co-branded and licensed apparel demand. |

| Direct-to-Consumer (DTC) | Consumers buying owned brands (e.g., 7 For All Mankind) online or in-store. | Intimate apparel market projected over $100 billion. |

| Category Specialists | Consumers seeking specialized items like activewear, intimate apparel, denim, etc. | Activewear market projected over $300 billion. |

Cost Structure

Delta Galil's manufacturing and production costs are a substantial part of its expenses. These include the wages for its global workforce, the cost of essential raw materials like fabric and yarn, and the general overhead associated with running its production plants.

In 2024, the company likely experienced ongoing pressure on these costs. For instance, global cotton prices, a key raw material, saw volatility throughout the year, impacting fabric expenses. Similarly, labor costs in various manufacturing regions can fluctuate due to economic conditions and minimum wage adjustments.

Delta Galil's extensive global operations mean freight and logistics are a significant cost. These expenses encompass the movement of goods from suppliers to manufacturing facilities and then to distribution centers and customers worldwide. For instance, in 2023, the company's cost of sales, which includes these logistics, was $1.6 billion, highlighting the scale of these operations.

Fluctuations in fuel prices, shipping container availability, and international trade policies directly impact these costs. For example, disruptions in global shipping, as seen in late 2023 and early 2024 due to geopolitical events, can lead to increased freight rates, directly affecting Delta Galil's bottom line.

Delta Galil's cost structure significantly includes expenses for sales, marketing, and distribution. This encompasses the substantial investment in marketing campaigns for both their owned and licensed brands, aiming to build brand equity and drive consumer demand across diverse markets.

Salaries for their dedicated sales teams, who manage relationships with retailers and B2B clients, are a core component. Furthermore, the operational costs of maintaining and expanding their distribution networks, ensuring efficient product flow from manufacturing to end consumers, add to these expenditures.

In 2024, Delta Galil reported that selling, general, and administrative expenses, which include these categories, represented a significant portion of their operational costs. For instance, their focus on digital marketing and e-commerce platforms, crucial for their online sales channels, represents an ongoing investment in technology and personnel to enhance customer reach and sales efficiency.

Research, Development, and Innovation Investments

Delta Galil Industries consistently allocates significant resources to Research, Development, and Innovation (R&D&I) to stay ahead in the competitive textile and apparel sector. These investments are crucial for developing advanced materials, pioneering new designs, and implementing more sustainable manufacturing processes. For instance, in 2023, the company reported R&D expenses as part of its overall operating costs, reflecting a strategic focus on future growth and product differentiation.

These R&D&I expenditures are not merely costs but strategic investments aimed at securing a competitive advantage. By continuously innovating, Delta Galil can introduce novel product lines and enhance existing ones, directly contributing to its long-term market position and revenue streams. This commitment is evident in their ongoing efforts to integrate cutting-edge technologies and sustainable practices into their operations.

- Material Innovation: Developing advanced fabrics with enhanced performance and comfort.

- Design Development: Creating unique and trend-setting apparel designs.

- Sustainable Processes: Investing in eco-friendly manufacturing techniques and materials.

- Competitive Edge: Ensuring continuous product improvement and market relevance.

Administrative and General Expenses

Delta Galil's Administrative and General Expenses encompass the essential overheads required to operate its global business. This includes costs for corporate leadership, administrative staff, the IT backbone supporting its operations, legal counsel, and various other general operating expenditures.

For instance, in 2023, Delta Galil reported significant expenses related to its strategic realignment plans, which aimed to streamline operations and enhance efficiency across its diverse brand portfolio. These costs, alongside asset impairments, are crucial to understand when evaluating the company's overall cost structure and its commitment to long-term operational health.

- Corporate Salaries and Benefits: Compensation for executive leadership and administrative personnel.

- IT Infrastructure and Support: Costs associated with maintaining and upgrading technology systems globally.

- Legal and Professional Fees: Expenses incurred for legal services, audits, and consulting.

- Restructuring and Impairment Charges: Costs related to business realignments and write-downs of assets.

Delta Galil's cost structure is heavily influenced by its extensive manufacturing operations, encompassing raw materials like cotton and yarn, and labor costs across its global workforce. In 2023, the company's cost of sales, a key indicator of these direct production expenses, stood at $1.6 billion, underscoring the scale of these outlays.

Logistics and freight represent another significant cost component, vital for moving goods from suppliers to production facilities and then to global markets. Geopolitical events and shipping disruptions in late 2023 and early 2024 directly impacted these freight rates, adding to the company's operational expenses.

Investments in sales, marketing, and distribution are crucial for brand building and market penetration, with significant spending on marketing campaigns and e-commerce platforms. The company's selling, general, and administrative expenses in 2024 reflect these ongoing investments in customer reach and sales efficiency.

Research, Development, and Innovation (R&D&I) are strategic investments for Delta Galil, driving material and design advancements and sustainable practices. These expenditures are essential for maintaining a competitive edge and ensuring long-term product relevance in the dynamic textile industry.

| Cost Category | 2023 (Approximate) | Key Drivers |

|---|---|---|

| Cost of Sales (Manufacturing & Production) | $1.6 billion | Raw materials (cotton, yarn), labor wages, factory overhead |

| Logistics & Freight | Included in Cost of Sales | Fuel prices, shipping rates, global trade policies |

| Sales, Marketing & Distribution | Significant portion of SG&A | Brand campaigns, e-commerce investment, sales team salaries |

| R&D&I | Part of operating costs | Material innovation, design development, sustainable processes |

| Administrative & General Expenses | Corporate overhead | Executive salaries, IT infrastructure, legal fees, restructuring costs |

Revenue Streams

Delta Galil generates revenue by selling its owned brand apparel, including popular names like 7 For All Mankind, Schiesser, Splendid, and P.J. Salvage. This revenue stream is crucial for the company's direct market presence.

These branded apparel sales are primarily channeled through wholesale agreements with various retailers. This traditional approach ensures broad product distribution across diverse markets and consumer touchpoints.

The company is also actively expanding its direct-to-consumer (DTC) sales, particularly through its own online platforms. This shift allows for greater control over brand experience and potentially higher profit margins. In 2023, Delta Galil's e-commerce sales represented a significant and growing portion of its overall revenue.

Sales of licensed apparel represent a significant revenue driver for Delta Galil, capitalizing on strong brand partnerships. In 2024, the company continued to leverage its agreements with globally recognized names such as Calvin Klein, Tommy Hilfiger, Columbia, Wilson, Adidas, and Polo Ralph Lauren, translating their brand equity into substantial sales. This strategy allows Delta Galil to tap into established customer bases and benefit from the marketing power of these iconic brands.

Delta Galil generates a substantial portion of its revenue through the design and manufacturing of private label apparel for a global clientele of retailers. This core business often drives higher production volumes and ensures a steady, predictable demand for their services.

Online Sales (Direct-to-Consumer)

Delta Galil's direct-to-consumer (DTC) online sales are a rapidly expanding revenue source. This channel offers better profit margins compared to wholesale and provides a direct line to customer feedback and preferences.

The company has seen significant growth in its own brand e-commerce platforms. For instance, in the first quarter of 2024, Delta Galil reported a notable increase in online sales, contributing to overall revenue growth.

- DTC E-commerce Growth: Delta Galil is strategically investing in its own brand websites to capture a larger share of the online market.

- Higher Profitability: Selling directly to consumers bypasses intermediaries, leading to improved gross margins on these sales.

- Consumer Engagement: The online channel facilitates direct interaction with customers, enabling personalized marketing and brand building.

- 2024 Performance: Early 2024 figures indicated a positive trend in online revenue, underscoring its increasing importance to the company's financial performance.

Dividends to Shareholders

While not a direct operational revenue stream, Delta Galil Industries' robust financial health enables consistent dividend distributions to its shareholders. This practice reflects the company's strong profitability and commitment to providing a tangible return on investment for those who hold its stock.

For instance, in 2023, Delta Galil declared a dividend per share of NIS 1.20, demonstrating a stable payout policy. This consistent dividend policy underscores the company's ability to generate sufficient profits to reward its investors, signaling financial stability and a positive outlook.

- Dividend Payout: Delta Galil's consistent dividend payments are a testament to its strong operational performance and profitability.

- Investor Returns: These dividends provide a direct financial return to shareholders, enhancing the attractiveness of investing in the company.

- Financial Health Indicator: The ability to sustain dividend payments often serves as a key indicator of a company's financial stability and management's confidence in future earnings.

Delta Galil's revenue streams are diverse, encompassing sales of its owned brands, private label manufacturing, and licensing agreements. The company's direct-to-consumer (DTC) e-commerce channel is a significant growth area, offering higher margins and direct customer engagement.

In 2023, Delta Galil's e-commerce sales showed a substantial increase, contributing positively to overall revenue. This trend is expected to continue into 2024 as the company invests further in its online platforms and digital marketing efforts.

The company's licensing segment is particularly strong, with partnerships with major global brands like Calvin Klein and Adidas driving significant sales volume. This strategy leverages established brand recognition to reach a wider consumer base.

| Revenue Stream | Key Brands/Activities | 2023/2024 Relevance |

|---|---|---|

| Owned Brands | 7 For All Mankind, Schiesser, Splendid | Core revenue, direct market presence |

| Private Label Manufacturing | Design and production for global retailers | High volume, predictable demand |

| Licensing Agreements | Calvin Klein, Tommy Hilfiger, Adidas | Leverages brand equity, substantial sales driver |

| DTC E-commerce | Own brand websites, online sales | Growing rapidly, higher profit potential |

Business Model Canvas Data Sources

The Delta Galil Business Model Canvas is constructed using a blend of financial disclosures, market intelligence reports, and internal operational data. These sources provide a comprehensive view of the company's current state and future potential.