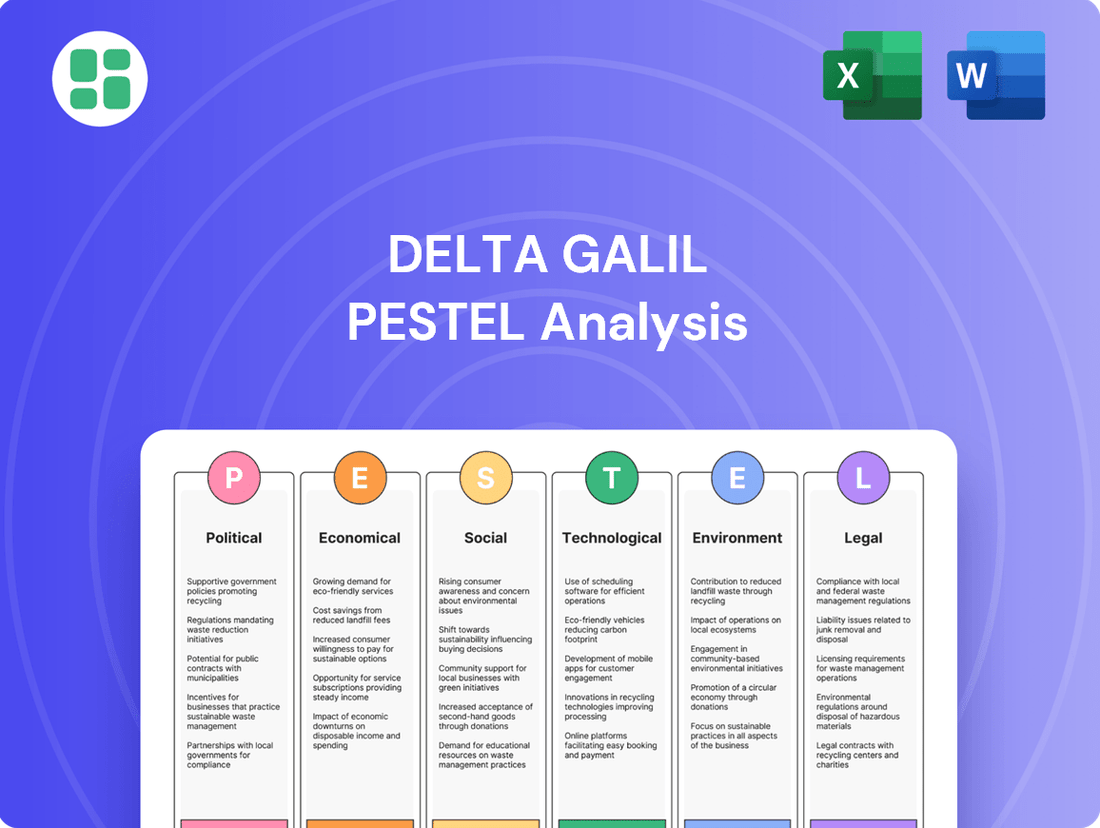

Delta Galil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Galil Bundle

Navigate the complex global landscape impacting Delta Galil with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping their operations and future growth. Gain a strategic advantage by accessing these expertly researched insights. Download the full PESTLE analysis now to make informed decisions and anticipate market shifts.

Political factors

Changes in global trade policies, including increased tariffs on key manufacturing locations like China, directly affect Delta Galil's production expenses and supply chain efficiency. For instance, the US-China trade war has already prompted companies to re-evaluate their sourcing strategies.

Delta Galil has proactively addressed these challenges, as evidenced by its efforts to mitigate the impact of US tariffs by optimizing its global sourcing network and exploring manufacturing alternatives outside of China. This strategic pivot highlights the need for flexibility in international operations.

In 2023, global trade experienced shifts, with various nations implementing new trade regulations. For the textile industry, which is heavily reliant on international supply chains, these policy adjustments can lead to increased import duties and altered cost structures, impacting profitability for companies like Delta Galil.

Delta Galil's extensive global manufacturing network, with significant operations in countries like Egypt, inherently ties its success to the political stability of these regions. Geopolitical tensions or unrest can directly impact their supply chains, potentially causing delays and increased costs. For instance, in 2023, Egypt's economy faced ongoing pressures, highlighting the need for companies like Delta Galil to actively manage these political risks.

Government policies, such as tax rebates and subsidies in key manufacturing locations, significantly impact Delta Galil's profitability and strategic investment choices. For example, a reported reduction in tax rebates in Egypt has previously affected the company's gross margin. This highlights how shifts in fiscal support can directly influence operational costs and financial performance.

Conversely, government incentives aimed at promoting sustainable manufacturing or encouraging domestic production can create new avenues for growth and investment. These initiatives can provide a competitive edge, particularly as global demand for eco-friendly textiles rises, potentially leading Delta Galil to explore opportunities aligned with these supportive policies.

International Labor Regulations and Compliance

Delta Galil's global operations necessitate strict adherence to a patchwork of international labor regulations, with a particular focus on preventing forced labor within its extensive textile supply chains. The company must navigate varying legal frameworks across its manufacturing and sourcing countries, ensuring fair labor practices are upheld throughout its value chain.

Emerging legislation, such as the EU's proposed Corporate Sustainability Due Diligence Directive (CSDDD), will significantly increase the onus on companies like Delta Galil to actively identify and mitigate human rights risks in their supply chains. This directive, expected to come into full effect in 2027, will require robust due diligence processes, impacting how companies manage supplier relationships and compliance.

- Compliance Burden: Delta Galil faces increasing regulatory scrutiny regarding labor practices, especially concerning forced labor, a persistent issue in the textile industry.

- Due Diligence Mandates: Directives like the CSDDD will compel Delta Galil to implement comprehensive due diligence, scrutinizing its supply chain for human rights violations.

- Reputational Risk: Failure to comply with international labor standards can severely damage Delta Galil's brand image and consumer trust, impacting sales and market position.

- Ethical Sourcing: Proactive engagement with labor regulations is crucial for maintaining ethical sourcing commitments and demonstrating corporate responsibility.

Consumer Protection and Product Regulations

Consumer protection and product regulations are increasingly shaping the apparel industry, directly impacting Delta Galil's operations. Stricter rules around product safety, accurate labeling, and environmental impact disclosures are becoming standard in key markets. For instance, the European Union's new Ecodesign for Sustainable Products Regulation (ESPR) and the Textile Labelling Regulation (TLR) are significantly raising the bar for product information and sustainability credentials.

These evolving regulations necessitate a proactive approach to product design, sourcing, and marketing for Delta Galil. Compliance requires meticulous attention to detail regarding material sourcing, manufacturing processes, and the transparency of information provided to consumers. Failure to adhere to these standards can result in penalties and reputational damage, underscoring the importance of integrating regulatory compliance into core business strategies.

- Ecodesign for Sustainable Products Regulation (ESPR): Aims to make products more durable, reusable, repairable, and recyclable, impacting material choices and product lifecycle management.

- Textile Labelling Regulation (TLR): Mandates clearer and more comprehensive information on textile products, including fiber composition, care instructions, and potentially environmental impact data.

- Product Safety Standards: Ongoing scrutiny of chemicals used in textiles, such as certain dyes and finishes, requires Delta Galil to ensure its products meet rigorous safety benchmarks in all operating regions.

- Environmental Disclosures: Growing consumer and regulatory demand for transparency regarding water usage, carbon footprint, and waste management throughout the supply chain is influencing Delta Galil's sustainability reporting and practices.

Political stability in key manufacturing regions like Egypt and Israel is crucial for Delta Galil's operational continuity, as geopolitical shifts can disrupt supply chains and increase costs. For instance, ongoing regional tensions in the Middle East can impact logistics and production schedules.

Government trade policies, including tariffs and import/export regulations, directly influence Delta Galil's cost of goods sold and market access. The company must navigate varying international trade agreements and potential protectionist measures implemented by governments worldwide.

Government incentives and subsidies, particularly those promoting sustainable manufacturing or technological adoption, can offer Delta Galil opportunities for cost reduction and strategic investment. Conversely, changes in fiscal policies or tax structures can affect profitability and investment decisions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Delta Galil across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and specific examples to help executives identify opportunities and threats for proactive strategy design.

A concise, actionable summary of Delta Galil's PESTLE analysis, presented in a digestible format, alleviates the pain of wading through lengthy reports, enabling faster strategic decision-making.

Economic factors

The global apparel market is anticipated to expand, mirroring a projected stable growth trajectory for the world economy in 2025. This positive outlook suggests a favorable environment for companies like Delta Galil.

However, potential economic headwinds exist. A slowdown in key markets such as the United States and China could dampen consumer demand for apparel, potentially increasing price competition and affecting Delta Galil's sales volumes.

Consumer spending confidence is paramount for discretionary items like clothing. In 2024, global consumer confidence indices showed mixed trends, with some regions experiencing improvements while others faced lingering economic uncertainties, directly impacting purchasing power for apparel.

Inflationary pressures continue to significantly impact Delta Galil's supply chain, with rising costs for raw materials, labor, transportation, and energy. These elevated expenses directly translate to higher production costs for the company.

While US apparel prices experienced a slight dip in early 2024, Delta Galil must remain vigilant. Implementing robust inventory management and stringent cost control strategies are crucial for preserving profitability amidst these ongoing economic challenges.

As a global apparel manufacturer and marketer, Delta Galil Industries' financial results are inherently sensitive to exchange rate fluctuations. For instance, a stronger US Dollar relative to currencies like the Euro or Israeli Shekel can reduce the reported value of sales and profits generated in those foreign markets when translated back into dollars. Conversely, a weaker dollar could boost these reported figures.

In 2024, the ongoing volatility in global currency markets presents a persistent challenge. For example, the Euro experienced fluctuations against the US Dollar throughout the year, impacting companies with significant operations or sales in the Eurozone. Delta Galil's financial statements and guidance regularly acknowledge these currency impacts, often detailing the assumed exchange rates used for forecasting purposes.

Evolving Retail Landscape and Online Sales Growth

The retail sector is undergoing a significant transformation, with a pronounced shift towards online shopping and direct-to-consumer (DTC) models. This trend presents both opportunities and challenges for established players like Delta Galil.

Delta Galil has actively capitalized on this economic factor, reporting robust growth in its online sales. For instance, in the first half of 2024, the company's online segment demonstrated strong performance, contributing to a notable improvement in its gross margins. This highlights the profitability potential of a well-executed e-commerce strategy.

To maintain its competitive edge, Delta Galil continues to invest strategically in its digital infrastructure and omnichannel capabilities. This focus is essential for capturing a larger share of the expanding online market and effectively competing against pure-play online retailers. The company's commitment to enhancing its digital presence is a direct response to evolving consumer purchasing habits.

- Online Sales Growth: Delta Galil experienced a significant increase in online sales, a key driver of its revenue expansion.

- Margin Improvement: The growth in e-commerce has positively impacted gross margins, demonstrating the financial benefits of DTC strategies.

- Digital Investment: Continued investment in digital channels and omnichannel approaches is critical for future success in the evolving retail landscape.

- Competitive Advantage: Adapting to online trends allows Delta Galil to better compete with online-only retailers and meet consumer demand for convenient shopping experiences.

Supply Chain Resilience and Diversification

Recent global disruptions have underscored the critical need for robust and varied supply chains. Delta Galil is actively working to enhance its resilience by optimizing sourcing and manufacturing across different regions. This includes a strategic focus on countries like Egypt, which offer favorable tariff structures, thereby reducing costs and mitigating potential disruptions.

The company is also implementing strategies such as maintaining higher inventory levels, often referred to as buffer stocks, to ensure product availability even when facing unexpected supply chain interruptions. Alongside this, Delta Galil is embracing agile manufacturing techniques that allow for quicker adaptation to changing market demands and production challenges.

- Diversification: Delta Galil is expanding its sourcing and production to countries with lower tariff rates, such as Egypt, to reduce reliance on single regions and mitigate risks.

- Inventory Management: Building buffer inventories is a key strategy to ensure product availability and smooth operations during supply chain volatility.

- Agile Manufacturing: Adopting flexible production processes allows Delta Galil to respond more effectively to changing conditions and maintain efficiency.

Global economic growth is projected to remain stable in 2025, providing a generally supportive backdrop for apparel companies like Delta Galil. However, inflation continues to be a significant factor, driving up costs for raw materials, labor, and transportation, which directly impacts Delta Galil's production expenses.

Consumer spending confidence, crucial for discretionary purchases like clothing, showed mixed trends in 2024, influencing purchasing power. Delta Galil must navigate currency fluctuations, as a stronger US Dollar can decrease the reported value of foreign sales and profits.

The company's financial performance is closely tied to these economic variables, necessitating robust cost control and strategic inventory management to maintain profitability amidst ongoing market volatility.

| Economic Factor | Impact on Delta Galil | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Provides a stable environment for sales. | Projected stable growth for 2025. |

| Inflation | Increases production costs (raw materials, labor, transport). | Persistently elevated costs impacting margins. |

| Consumer Spending Confidence | Affects demand for discretionary apparel items. | Mixed trends observed in 2024, impacting purchasing power. |

| Exchange Rate Fluctuations | Impacts reported value of foreign sales and profits. | Ongoing volatility, e.g., Euro vs. USD fluctuations in 2024. |

Preview Before You Purchase

Delta Galil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Delta Galil PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You’ll gain immediate access to this detailed report, providing actionable insights into the external forces shaping Delta Galil's strategic landscape.

Sociological factors

The demand for activewear and loungewear remains robust, a trend that perfectly suits Delta Galil's extensive product offerings. Consumers increasingly desire versatile clothing that seamlessly blends comfort, style, and practicality for both workouts and daily life.

This shift is evident in market growth figures; the global activewear market was valued at approximately $352 billion in 2023 and is projected to reach around $572 billion by 2030, demonstrating a compound annual growth rate of about 7.2% during this period. This sustained consumer interest directly benefits companies like Delta Galil, which are well-positioned to capitalize on these evolving preferences.

Specific styles are driving this segment, with trends such as wide-leg leggings, varsity-prep aesthetics, and vibrant, bold color palettes significantly influencing consumer purchasing decisions. These fashion-forward elements within the activewear and loungewear categories create ongoing opportunities for product innovation and market penetration.

Consumers are increasingly prioritizing sustainability and ethical practices in their purchasing decisions, a trend that significantly impacts the apparel industry. This growing awareness translates into a demand for products made with eco-friendly materials, transparent sourcing, and a commitment to circular economy models. For instance, a 2024 report indicated that 65% of consumers globally are willing to pay more for sustainable products.

Delta Galil must actively communicate its sustainability efforts to resonate with this expanding consumer base. Highlighting initiatives like the use of recycled polyester, organic cotton, and water-saving production methods is crucial. The company's 2024 sustainability report showcased a 15% reduction in water consumption across its manufacturing facilities compared to the previous year, demonstrating tangible progress.

Social media platforms are powerful drivers of fashion, with trends now emerging and spreading at an unprecedented pace. For Delta Galil, this means staying agile, constantly monitoring online conversations and influencer activity to inform product development and marketing. In 2024, the global social commerce market was valued at over $1.2 trillion, highlighting the critical importance of digital engagement for brands like Delta Galil.

Delta Galil's success hinges on its ability to effectively leverage these digital channels. This involves not only showcasing its own brands but also its private label capabilities to a vast online audience. A key challenge is the growing popularity of 'dupes' – affordable alternatives to high-end fashion items – which requires Delta Galil to emphasize its value proposition and brand authenticity in its digital storytelling.

Health and Wellness Lifestyle Trends

The global surge in health and wellness is a significant driver for the apparel industry, particularly for activewear. Consumers are increasingly prioritizing fitness and overall well-being, leading to greater investment in performance-oriented and comfortable clothing suitable for a wide range of physical activities. This trend directly benefits companies like Delta Galil, which has a strong focus on the activewear segment.

The activewear market is projected to continue its robust growth. For instance, the global sportswear market was valued at approximately $205.5 billion in 2023 and is anticipated to reach around $320.7 billion by 2028, demonstrating a compound annual growth rate (CAGR) of about 9.3%. This sustained interest in an active lifestyle directly translates into increased demand for the types of products Delta Galil specializes in.

Several key aspects of this trend are particularly relevant:

- Increased Demand for Performance Fabrics: Consumers seek apparel with advanced features like moisture-wicking, breathability, and stretch, driving innovation in material science.

- Growth of Athleisure: The blending of athletic and leisure wear continues to be popular, expanding the market for comfortable, stylish activewear suitable for everyday wear.

- Focus on Sustainability in Activewear: A growing segment of consumers is looking for activewear made from recycled or eco-friendly materials, presenting an opportunity for brands to differentiate.

- Rise of Niche Fitness Activities: The popularity of yoga, Pilates, running, and various outdoor sports fuels demand for specialized activewear catering to specific needs and aesthetics.

Generational Shifts in Consumption Patterns

Generational differences significantly shape how consumers approach fashion. Younger demographics, like Gen Z and Millennials, often prioritize sustainability and digital engagement, while older generations, particularly the 'Silver Generation' (those 50 and above), are increasingly recognized as a key growth segment. This latter group, often with more disposable income, shows a growing interest in comfortable, stylish apparel and values brand trust.

Delta Galil needs to acknowledge these evolving preferences. For example, a 2024 report indicated that consumers aged 55-64 are spending more on apparel than younger age groups, highlighting the economic power of older consumers.

- Millennials and Gen Z: High demand for sustainable and ethically sourced fashion, with a strong preference for online shopping and social media marketing.

- Generation X: Value quality and durability, often balancing brand loyalty with a willingness to explore new options.

- Baby Boomers and Silver Generation: Increased spending power, seeking comfort, classic styles, and brands that offer good value and customer service.

Societal shifts towards health and wellness continue to fuel demand for activewear and comfortable apparel, directly benefiting Delta Galil's core business. Consumers are increasingly prioritizing versatile clothing that supports an active lifestyle and offers both style and comfort. This trend is further amplified by the significant growth in online shopping and social commerce, with the global social commerce market exceeding $1.2 trillion in 2024, underscoring the importance of digital engagement for brands.

Generational preferences also play a crucial role, with younger consumers prioritizing sustainability and digital interaction, while older demographics, particularly the 'Silver Generation,' represent a growing market segment with increasing disposable income and a demand for comfort and value. For instance, consumers aged 55-64 were reported in 2024 to be spending more on apparel than younger age groups, indicating a significant economic opportunity.

The emphasis on sustainability is a powerful sociological factor, with a 2024 report revealing that 65% of global consumers are willing to pay more for sustainable products. Delta Galil's commitment to eco-friendly materials and transparent production, as evidenced by a 15% reduction in water consumption in 2024, directly addresses this consumer imperative.

Technological factors

Technological advancements are rapidly reshaping the textile industry, with innovations like lab-grown cotton, advanced dye recycling, and efficient fiber recovery processes gaining traction. These developments offer opportunities for more sustainable and resource-efficient manufacturing. For instance, the global smart textiles market was valued at approximately $4.5 billion in 2023 and is projected to reach over $13 billion by 2030, indicating significant growth potential.

The emergence of smart fabrics, embedded with sensors for health monitoring or environmental responsiveness, presents new avenues for product differentiation and enhanced functionality. Delta Galil, as a major player, can capitalize on these trends by integrating these cutting-edge materials into its product lines, thereby catering to the growing consumer demand for technologically advanced apparel and performance wear.

Digitalization is fundamentally reshaping the apparel supply chain, with technologies like artificial intelligence (AI), the Internet of Things (IoT), and blockchain driving significant improvements. These advancements are boosting efficiency, increasing transparency, and making operations far more responsive to market changes.

AI-powered tools are proving invaluable for enhancing demand forecasting accuracy and optimizing inventory levels, crucial for a global player like Delta Galil. Furthermore, the integration of robotics and automation in manufacturing processes can effectively mitigate labor shortages and lead to substantial cost reductions.

By embracing these technological shifts, Delta Galil is well-positioned to streamline its extensive global operations. For instance, AI in inventory management can reduce holding costs, and IoT sensors can provide real-time visibility into production and logistics, as seen in many leading apparel manufacturers adopting these solutions in 2024.

The ongoing advancement of e-commerce and direct-to-consumer (DTC) technologies is vital for Delta Galil's expansion in online sales. The company's commitment to enhancing its digital infrastructure, including user-friendly interfaces and personalized customer journeys, directly fuels its online revenue streams.

In 2023, Delta Galil reported that its online channel sales represented a substantial portion of its overall revenue, demonstrating the significant impact of these technological investments. Continued focus on seamless online experiences and efficient logistics, particularly in last-mile delivery, is expected to further bolster customer engagement and drive sales growth in 2024 and beyond.

3D Design and Prototyping Technologies

3D design and printing technologies are revolutionizing product development, offering unprecedented creative freedom and efficiency. These advancements allow for rapid prototyping, significantly reducing the time and resources needed to bring new designs to life. For Delta Galil, this translates to quicker iteration cycles and a more agile response to market trends.

The ability to create intricate and customized designs is a major advantage. Delta Galil can leverage these technologies to develop unique, personalized apparel and textile products, catering to niche markets and enhancing customer engagement. This also means a substantial reduction in sample waste, contributing to more sustainable manufacturing practices.

The financial implications are also significant. By lowering development costs and accelerating time-to-market, 3D design and prototyping can directly impact profitability. For instance, early adopters in the fashion tech space have reported up to a 30% reduction in sample costs and a 20% faster product launch cycle.

- Rapid Prototyping: Enables faster design iteration and testing, reducing development timelines.

- Reduced Waste: Minimizes material consumption and waste during the sample creation process.

- Enhanced Customization: Facilitates the creation of unique and personalized product offerings.

- Cost Efficiency: Lowers development expenses by streamlining the prototyping phase.

Data Analytics and AI for Consumer Insights

Delta Galil is increasingly leveraging data analytics and artificial intelligence to deeply understand consumer behavior. By analyzing vast datasets, the company can pinpoint emerging trends, individual preferences, and purchasing habits. This granular insight is crucial for refining product development and marketing strategies.

The application of AI allows for more precise demand forecasting, directly impacting inventory management and reducing waste. For instance, in 2024, advancements in predictive analytics helped fashion retailers like those Delta Galil supplies to anticipate seasonal shifts with greater accuracy, leading to an estimated 10-15% reduction in unsold inventory for key product lines.

- Enhanced Consumer Profiling: AI algorithms can segment customers with remarkable detail, enabling hyper-personalized product recommendations and marketing messages.

- Optimized Inventory Management: Predictive analytics, informed by AI, allows for more accurate demand forecasting, minimizing overstock and stockouts.

- Targeted Marketing Campaigns: Understanding consumer patterns through data analytics facilitates the creation of highly effective, data-driven marketing efforts that resonate with specific demographics.

- Improved Product Development: Insights into consumer preferences and purchase history directly inform product design and assortment planning, leading to offerings that better meet market demand.

Technological factors are significantly influencing Delta Galil's operations, from advanced manufacturing techniques to sophisticated data analytics. The company's investment in digital transformation, including AI and IoT, is enhancing supply chain efficiency and market responsiveness. For example, AI-driven inventory management is projected to reduce holding costs, while IoT sensors offer real-time operational visibility, mirroring trends seen across leading apparel manufacturers in 2024.

The company's embrace of e-commerce and direct-to-consumer (DTC) technologies is a key growth driver, with online sales forming a substantial revenue component in 2023. Continued enhancements to digital platforms and logistics, particularly in last-mile delivery, are expected to boost customer engagement and sales in 2024.

3D design and printing technologies are revolutionizing product development, enabling faster prototyping and reducing sample waste, with early adopters reporting up to a 30% cut in sample costs. This agility allows Delta Galil to respond more quickly to market shifts and develop unique, personalized products.

Data analytics and AI are crucial for understanding consumer behavior, leading to more accurate demand forecasting and optimized inventory. In 2024, predictive analytics helped fashion retailers reduce unsold inventory by an estimated 10-15%, a benefit Delta Galil can leverage.

| Technology Area | Impact on Delta Galil | 2024/2025 Relevance |

|---|---|---|

| Smart Textiles | Product differentiation, enhanced functionality | Growing market, potential for performance wear |

| AI & IoT | Supply chain efficiency, demand forecasting, inventory optimization | Mitigating labor shortages, cost reduction, real-time visibility |

| E-commerce & DTC | Online sales growth, customer engagement | Direct revenue streams, personalized customer journeys |

| 3D Design & Printing | Faster prototyping, reduced waste, customization | Agile product development, cost savings |

Legal factors

New legislation, particularly in the EU and some US states like California and New York, is mandating Extended Producer Responsibility (EPR) for textile products. This means companies like Delta Galil must financially and operationally manage their products from creation through end-of-life, including collection and recycling.

The EU's Corporate Sustainability Reporting Directive (CSRD) mandates extensive ESG reporting for large companies, impacting Delta Galil's textile operations. This means Delta Galil must gather and transparently disclose detailed data on its environmental, social, and governance performance, aligning with the directive's stringent requirements. For instance, as of 2024, companies are increasingly focusing on Scope 3 emissions, a complex area for supply chains like textiles, which the CSRD will require detailed reporting on.

The EU's Ecodesign for Sustainable Products Regulation (ESPR) mandates the Digital Product Passport (DPP), requiring comprehensive sustainability data for products. Delta Galil must establish robust systems, likely integrating QR codes, to furnish this transparent information, ensuring compliance with upcoming directives designed to promote product circularity and consumer awareness.

Tariff and Trade Regulations (e.g., Section 301, De Minimis)

Delta Galil's global operations are significantly influenced by tariff and trade regulations. Ongoing changes, such as the potential reinstatement or modification of Section 301 tariffs on goods from China, directly affect the cost of imported raw materials and finished products. For instance, the U.S. Trade Representative's reviews of these tariffs in 2024 will be critical for understanding future cost implications.

Furthermore, proposed reforms to the de minimis rule in the United States, which allows duty-free importation of low-value shipments, could alter Delta Galil's supply chain dynamics and fulfillment strategies. A lower de minimis threshold could increase the company's logistics costs for smaller international shipments. The company must remain agile, continuously monitoring these evolving trade policies to effectively manage financial risks and optimize sourcing decisions.

- Section 301 Tariffs: U.S. tariffs on certain Chinese goods, subject to periodic review, impacting import costs for textiles and apparel.

- De Minimis Rule: Potential U.S. legislative changes to the $800 threshold for duty-free imports could affect direct-to-consumer shipping costs.

- Trade Policy Monitoring: Delta Galil's need to track evolving trade agreements and potential protectionist measures globally.

- Supply Chain Adaptation: Strategies to mitigate risks from tariffs include diversifying sourcing locations and adjusting inventory management.

Labor and Supply Chain Due Diligence Laws

New directives, such as the EU's Corporate Sustainability Due Diligence Directive (CSDDD), are set to mandate rigorous supply chain oversight. This means companies like Delta Galil must actively identify and mitigate human rights and environmental risks, including forced labor, within their extended networks. For instance, the CSDDD, expected to be fully implemented by 2027, will require companies to establish robust due diligence processes, impacting approximately 13,000 large EU companies and their non-EU subsidiaries.

These legal obligations will significantly elevate the importance of transparent and ethical sourcing throughout Delta Galil's operations. Companies will need to demonstrate clear visibility into their entire value chain, from raw material suppliers to finished goods manufacturers. This focus on ethical practices is increasingly becoming a non-negotiable aspect of corporate responsibility and investor relations.

Key areas of focus for Delta Galil under these evolving laws will likely include:

- Supplier Audits: Implementing more frequent and stringent audits to verify labor conditions and environmental compliance.

- Traceability: Enhancing systems to track the origin of materials and components throughout the supply chain.

- Risk Assessment: Developing comprehensive frameworks to identify and assess potential human rights and environmental abuses.

- Remediation Plans: Establishing clear procedures for addressing any identified issues and providing effective remedies.

New legislation, such as the EU's Extended Producer Responsibility (EPR) for textiles and the Corporate Sustainability Due Diligence Directive (CSDDD), places significant operational and financial burdens on companies like Delta Galil. These regulations mandate comprehensive product lifecycle management and rigorous supply chain oversight, requiring detailed reporting on environmental and social impacts, with the CSDDD expected to fully impact companies by 2027.

Trade policies, including U.S. Section 301 tariffs on Chinese goods and potential changes to the de minimis rule for imports, directly influence Delta Galil's sourcing costs and logistics. Companies must actively monitor these evolving global trade dynamics, as seen in the U.S. Trade Representative's reviews in 2024, to mitigate financial risks and optimize their supply chains.

The EU's Ecodesign for Sustainable Products Regulation (ESPR) introduces the Digital Product Passport (DPP), demanding transparent sustainability data for products, likely through technologies like QR codes. This push for circularity and consumer awareness means Delta Galil needs robust systems to provide detailed product information, impacting product design and marketing strategies.

Key legal factors impacting Delta Galil include evolving trade tariffs and import regulations, such as potential changes to U.S. Section 301 tariffs on Chinese goods, which were under review in 2024. Additionally, proposed reforms to the U.S. de minimis rule could alter direct-to-consumer shipping costs, necessitating strategic supply chain adjustments like sourcing diversification.

| Legal Factor | Description | Potential Impact on Delta Galil | Relevant Data/Timeline |

| Extended Producer Responsibility (EPR) | Mandates financial and operational responsibility for products from creation to end-of-life. | Increased costs for waste management and recycling initiatives. | EU legislation actively being implemented. |

| Corporate Sustainability Due Diligence Directive (CSDDD) | Requires rigorous supply chain oversight for human rights and environmental risks. | Enhanced supplier auditing, traceability, and risk assessment processes. | Expected full implementation by 2027; impacts ~13,000 large EU companies. |

| Ecodesign for Sustainable Products Regulation (ESPR) / Digital Product Passport (DPP) | Mandates comprehensive sustainability data for products, promoting circularity. | Need for robust data collection and transparent product information systems. | EU directive requiring product passports. |

| Trade Tariffs (e.g., Section 301) | Taxes on imported goods, affecting raw material and finished product costs. | Increased cost of goods, potential need to adjust sourcing strategies. | U.S. Trade Representative reviews ongoing in 2024. |

| De Minimis Rule (U.S.) | Threshold for duty-free importation of low-value shipments. | Potential increase in logistics costs for smaller international shipments if threshold is lowered. | Subject to U.S. legislative review. |

Environmental factors

The global fashion industry is increasingly embracing the circular economy, a model focused on reducing waste and extending product lifecycles through resale, rental, repair, and recycling initiatives. This shift is driven by growing consumer awareness and regulatory pressures, with a projected 40% of the apparel market potentially being circular by 2030, according to some industry forecasts.

Delta Galil can strategically align with this trend by prioritizing product durability in its designs and exploring the implementation of take-back programs. Furthermore, investing in advanced recycling technologies will be crucial for minimizing the company's environmental impact and capitalizing on the growing demand for sustainable fashion solutions.

Growing consumer awareness and stricter regulations are significantly boosting the demand for sustainable materials like organic cotton, hemp, bamboo, and recycled fibers. Delta Galil can leverage this trend by expanding its use of these eco-friendly fabrics. For instance, in 2024, the global sustainable apparel market was valued at over $7.5 billion, with projections indicating continued strong growth.

By embracing greener manufacturing processes, Delta Galil can reduce its environmental footprint, which is increasingly important to consumers and investors. This includes initiatives to lower water consumption, minimize chemical waste, and cut carbon emissions. Many major brands reported in 2024 that over 50% of their material sourcing was from sustainable origins, a benchmark Delta Galil could aim to surpass.

New environmental regulations are significantly impacting the textile industry, with a notable focus on waste management and recycling. The European Union, for instance, is implementing stricter rules, including mandated separate collection of textile waste and a push towards increased reuse and recycling initiatives. A key development is the EU's prohibition on destroying unsold goods, a directive designed to curb waste and promote a circular economy.

These regulatory shifts necessitate robust waste management strategies for companies like Delta Galil. Developing effective partnerships for textile recovery and implementing advanced sorting and recycling technologies will be crucial. For example, the Ellen MacArthur Foundation reported that in 2022, only 15% of textile waste was recycled, highlighting the substantial room for improvement and the growing regulatory pressure to address this gap.

Carbon Footprint Reduction and Emissions Reporting

The textile sector, including companies like Delta Galil, faces intense scrutiny for its environmental impact, particularly its substantial contribution to greenhouse gas emissions. As global awareness of climate change grows, so does the demand for transparency and action from manufacturers. This pressure is translating into concrete regulatory measures, such as California's AB405, which mandates that apparel brands meticulously measure, report, and establish targets for reducing their greenhouse gas (GHG) emissions. For Delta Galil, this means a critical focus on optimizing its supply chain and manufacturing processes to achieve a tangible reduction in its environmental footprint.

To navigate these evolving environmental expectations, Delta Galil needs to implement robust strategies for carbon footprint reduction and emissions reporting. This involves a multi-faceted approach, potentially including:

- Investing in renewable energy sources for manufacturing facilities to decrease reliance on fossil fuels.

- Optimizing logistics and transportation networks to minimize emissions from shipping raw materials and finished goods.

- Developing and adopting more sustainable production methods that reduce waste and energy consumption.

- Enhancing data collection and reporting capabilities to accurately track and communicate GHG emissions in line with emerging regulations.

Water Usage and Pollution in Textile Production

Textile manufacturing is notoriously thirsty, consuming vast amounts of water and often releasing polluted wastewater laden with dyes and chemicals. This environmental impact is a significant concern for global players like Delta Galil. For instance, the fashion industry as a whole is estimated to consume around 93 billion cubic meters of water annually, enough to meet the needs of five countries the size of France.

Delta Galil, operating on a global scale, faces increasing scrutiny regarding its water footprint and the quality of its wastewater discharge. Regulatory bodies and consumers alike are demanding greater transparency and accountability. The company's commitment to sustainability directly impacts its social license to operate and its brand reputation.

To address these challenges, Delta Galil is likely focusing on implementing advanced technologies. This includes investing in dye recycling systems to reduce water and chemical consumption, and developing closed-loop water systems that minimize wastewater discharge. Such initiatives are essential not only for environmental compliance but also for long-term operational efficiency and cost savings, especially as water scarcity becomes a more pressing global issue.

- Water Consumption: The textile industry accounts for approximately 20% of global industrial water pollution.

- Chemical Discharge: Wastewater from textile dyeing can contain hazardous chemicals like heavy metals and azo dyes.

- Sustainability Investments: Companies are increasingly investing in water-saving technologies, with the global water and wastewater treatment market projected to reach $154.5 billion by 2027.

The global push for a circular economy is reshaping the fashion industry, with a focus on reducing waste and extending product lifecycles. Delta Galil can capitalize on this by enhancing product durability and exploring take-back programs, aligning with forecasts that suggest the circular apparel market could reach 40% by 2030.

Growing consumer demand for sustainable materials like organic cotton and recycled fibers, valued at over $7.5 billion globally in 2024, presents an opportunity for Delta Galil to expand its use of eco-friendly fabrics.

Stricter environmental regulations, such as the EU's prohibition on destroying unsold goods, necessitate robust waste management strategies for companies like Delta Galil, especially given that only 15% of textile waste was recycled in 2022.

The textile industry's significant contribution to greenhouse gas emissions is under scrutiny, with regulations like California's AB405 requiring brands to measure and reduce their carbon footprint, pushing Delta Galil to optimize its supply chain and manufacturing processes.

PESTLE Analysis Data Sources

Our Delta Galil PESTLE analysis is meticulously constructed using data from reputable sources such as the International Monetary Fund (IMF), World Bank, and leading market research firms. We incorporate official government reports, industry-specific publications, and environmental agency data to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the textile industry.