Delta Galil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Galil Bundle

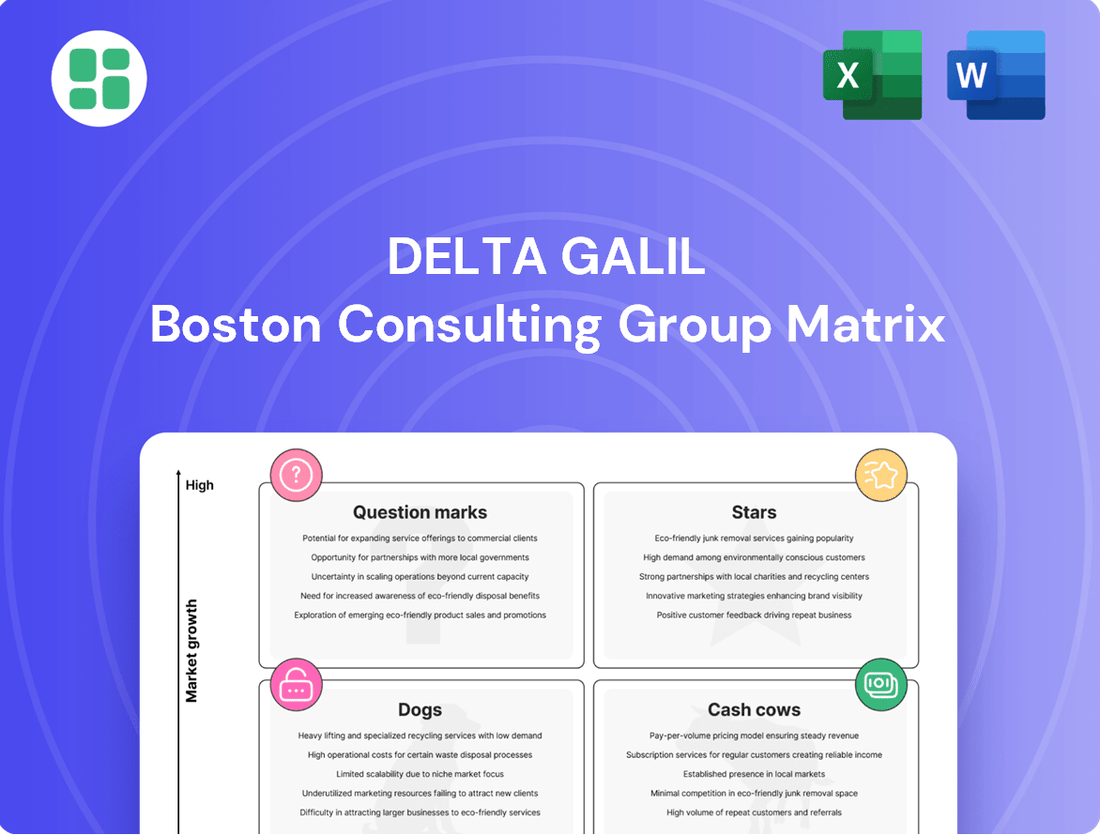

Delta Galil's BCG Matrix offers a strategic snapshot of its product portfolio, highlighting where growth and revenue generation lie. Understanding which of their brands are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your investment and product strategy.

Stars

Delta Galil's direct-to-consumer (DTC) sales channel is a significant growth engine, with online sales for its owned brands experiencing a robust 22% surge in the fourth quarter of 2024 and a 21% increase for the full year. This upward trend highlights the increasing consumer preference for online shopping, positioning DTC as a key area for future expansion.

The company's strategic focus on enhancing its e-commerce infrastructure and digital marketing efforts is crucial for maintaining its market leadership in this high-growth segment. This investment is directly contributing to Delta Galil's overall positive financial performance and its potential for sustained revenue growth.

Delta Galil's licensed activewear brands, including giants like Adidas and Columbia, are firmly positioned as Stars in the BCG matrix. This segment is experiencing robust market growth, and Delta Galil has strategically focused on enhancing sales and profitability for these globally recognized names.

The high consumer demand for activewear, coupled with the strong brand equity of Adidas and Columbia, fuels their leadership within Delta Galil's product offerings. For instance, the global activewear market was valued at approximately $350 billion in 2023 and is projected to grow significantly in the coming years, underscoring the potential of these licensed brands.

Delta Galil's activewear segment is a clear star in its BCG matrix, reflecting robust growth across all markets. This segment capitalizes on the global surge in health and wellness, with activewear sales projected to reach $350 billion by 2025, a significant jump from previous years. Delta Galil's strong market position is further solidified by its consistent revenue growth in this category, which outpaced the overall apparel market in 2023.

Premium Denim Brands (e.g., 7 For All Mankind)

Delta Galil Industries' ownership of premium denim brands, exemplified by 7 For All Mankind, positions these labels as significant players in the high-end apparel segment. These brands benefit from established consumer loyalty and a reputation for quality, allowing them to maintain a strong market presence even amidst evolving fashion cycles.

The strategic focus on enhancing profitability across Delta Galil's brand portfolio means that established premium denim brands are likely being optimized for their revenue-generating potential. This involves leveraging their existing market strength through targeted marketing initiatives and product innovation to ensure continued relevance and leadership.

- Brand Strength: 7 For All Mankind is a recognized leader in the premium denim market, contributing significantly to Delta Galil's brand equity.

- Market Position: Despite fashion's cyclical nature, premium denim brands often retain a dedicated customer base, ensuring a stable market share.

- Profitability Focus: Delta Galil's strategy aims to boost profitability across its brands, highlighting the importance of strong performers like its premium denim offerings.

- Strategic Investment: Continued investment in marketing and product development for brands like 7 For All Mankind is crucial for maintaining their competitive edge and market leadership.

Innovation-Driven Seamless Apparel

Delta Galil's innovation in seamless apparel, a key area of growth, reflects a strategic focus on advanced technologies. This segment, particularly within intimate and activewear, benefits from a 'body-before-fabric' approach, prioritizing consumer comfort and premium quality. These high-growth, tech-driven markets see Delta Galil capturing substantial share due to their commitment to cutting-edge materials and manufacturing.

- Seamless Apparel Market Growth: The global seamless apparel market is projected to reach approximately $10.5 billion by 2027, showing a compound annual growth rate of over 6%.

- R&D Investment: Delta Galil's consistent investment in R&D fuels its leadership in innovative segments like seamless wear.

- Consumer Demand: Consumer preference for comfort and performance in activewear and intimate apparel directly supports the seamless category.

- Market Share Capture: Advanced production methods allow Delta Galil to secure significant market share in these technology-forward niches.

Delta Galil's licensed activewear brands, such as Adidas and Columbia, are classified as Stars in the BCG matrix. These brands operate in a high-growth market and Delta Galil is a market leader, demonstrating strong performance. The company's strategic investments in these brands are designed to maximize their revenue and profitability.

The activewear sector is experiencing substantial global growth, driven by increasing consumer interest in health and wellness. Delta Galil's focus on these strong, licensed brands allows them to capitalize on this trend effectively. Their consistent revenue growth in activewear has outpaced the broader apparel market, solidifying their Star status.

The global activewear market's expansion, projected to reach $350 billion by 2025, directly benefits Delta Galil's Star products. These brands benefit from strong brand recognition and high consumer demand, ensuring their continued success and market dominance within Delta Galil's portfolio.

Delta Galil's commitment to innovation in seamless apparel, particularly in intimate and activewear, positions this segment for significant growth. The company prioritizes comfort and quality, leveraging advanced technologies and materials to capture market share in these tech-driven niches. This strategic focus on cutting-edge production methods and consumer-centric design fuels their leadership in this expanding category.

| Category | BCG Status | Key Brands | Market Growth | Delta Galil's Position |

|---|---|---|---|---|

| Licensed Activewear | Stars | Adidas, Columbia | High | Market Leader |

| Seamless Apparel | Stars | N/A (Technology focus) | High | Strong Market Share |

| Premium Denim | Stars | 7 For All Mankind | Moderate to High | Established Leader |

| Direct-to-Consumer (DTC) | Stars | Owned Brands | High | Significant Growth Driver |

What is included in the product

Delta Galil's BCG Matrix analyzes its brands to identify Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each brand.

Visualizes Delta Galil's business units, clarifying strategic focus and resource allocation.

Simplifies complex portfolio analysis for decisive leadership action.

Cash Cows

Delta Galil's private label apparel business is a strong Cash Cow, significantly boosting profitability and driving production volume. In 2024, this segment improved gross margins, demonstrating its consistent financial strength.

Operating in a mature market, this segment leverages Delta Galil's extensive manufacturing and retailer relationships to maintain a high market share. It generates reliable cash flow with minimal need for brand promotion, underpinning the company's overall financial stability.

Delta Galil's core intimate apparel brands, such as Schiesser and Eminence, are firmly positioned as Cash Cows within the BCG Matrix. These brands thrive in the mature, yet consistently stable, intimate apparel sector, where Delta Galil enjoys a robust market standing.

The consistent demand and deep-seated brand loyalty for Schiesser and Eminence translate into predictable and reliable cash flow generation for the company. These established names are not typically subject to aggressive expansion strategies; instead, investments are focused on maintaining operational efficiency and reinforcing their existing market presence. This strategic approach allows them to act as dependable sources of capital, underpinning the company's overall financial strength and supporting other ventures.

Delta Galil's Socks and Hosiery division is a classic Cash Cow. This segment benefits from consistent consumer demand, a mature market, and well-established distribution networks, allowing Delta Galil to maintain a strong market position. The division reliably generates predictable cash flow with limited need for substantial new investment, underpinning the company's overall financial stability.

Traditional Sleepwear and Loungewear

Brands like P.J. Salvage in Delta Galil's portfolio represent the traditional sleepwear and loungewear segment. This market is typically mature, meaning growth is steady rather than explosive. Delta Galil leverages its robust manufacturing and distribution to ensure these products remain profitable, generating consistent cash flow.

This segment offers stable revenue streams for Delta Galil. Unlike fast-fashion or trend-driven categories, traditional sleepwear and loungewear require less intensive promotional spending. For example, in 2023, Delta Galil reported overall revenue of $2.3 billion, with its lifestyle segment, which includes loungewear, contributing significantly to its stable performance.

- Mature Market: Traditional sleepwear and loungewear operate in a well-established, slower-growth market.

- Stable Cash Flow: These products consistently generate positive cash flow with lower marketing investment needs.

- Efficient Operations: Delta Galil's established infrastructure supports profitability in this segment.

- Brand Example: P.J. Salvage is a key brand within Delta Galil's offerings in this category.

Leveraged Global Manufacturing Footprint

Delta Galil's leveraged global manufacturing footprint is a prime example of a cash cow within its business portfolio. The company's strategic emphasis on enhancing factory efficiency and profitability, coupled with ongoing realignment plans, underscores a dedication to maximizing the value of its existing production assets.

This robust manufacturing infrastructure, capable of producing a wide range of apparel, is a key driver of high production volumes and cost advantages. By capitalizing on its global scale and operational expertise, Delta Galil consistently achieves strong gross margins and robust cash flow from its ongoing manufacturing activities.

- Global Manufacturing Scale: Delta Galil operates a significant global manufacturing network, enabling economies of scale and production flexibility.

- Operational Efficiency Focus: Continuous efforts to improve factory efficiency and implement realignment plans bolster profitability.

- Cost Advantages: Leveraging its established infrastructure allows for cost-effective production, contributing to strong gross margins.

- Cash Flow Generation: The high volume and cost efficiency of its manufacturing operations are significant contributors to the company's overall cash flow.

Delta Galil's private label apparel business functions as a strong Cash Cow, significantly contributing to profitability and production volume. In 2024, this segment saw improved gross margins, showcasing its consistent financial strength.

Operating within a mature market, this segment capitalizes on Delta Galil's extensive manufacturing and retailer relationships to maintain a high market share. It consistently generates reliable cash flow with minimal need for extensive brand promotion, thereby bolstering the company's overall financial stability.

Delta Galil's core intimate apparel brands, such as Schiesser and Eminence, are firmly established as Cash Cows. These brands operate in the mature but stable intimate apparel sector, where Delta Galil holds a strong market position, generating predictable cash flow with limited investment needs for expansion.

The Socks and Hosiery division is another prime example of a Cash Cow for Delta Galil. Benefiting from consistent consumer demand and established distribution, this segment reliably generates predictable cash flow with minimal new investment, reinforcing the company's financial stability.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Private Label Apparel | Cash Cow | High market share, mature market, strong retailer relationships | Significant |

| Intimate Apparel Brands (Schiesser, Eminence) | Cash Cow | Brand loyalty, stable demand, mature market | Significant |

| Socks and Hosiery | Cash Cow | Consistent demand, established distribution, mature market | Moderate |

| Sleepwear/Loungewear (P.J. Salvage) | Cash Cow | Stable revenue, lower promotional needs, mature market | Moderate |

Delivered as Shown

Delta Galil BCG Matrix

The Delta Galil BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing information – just the comprehensive strategic analysis ready for your immediate business planning needs.

Dogs

Within Delta Galil's extensive product range, some older lines might be experiencing a downturn. Think of them as products that haven't kept up with changing consumer tastes or are facing stiff competition. These segments often bring in less money and profit, and the costs to keep them running can outweigh their benefits, making them potential cash drains.

These underperforming product lines, while not specifically identified by name, could be prime candidates for a strategic review. If they consistently miss performance benchmarks, Delta Galil might consider selling them off or undertaking a significant overhaul to revitalize them. The key issue is that investments in these areas typically yield very low returns.

Delta Galil manages a portfolio of licensed brands, some of which may reside in slower-growing market segments or where the company's market share is modest. These brands might not fit neatly into Delta Galil's primary strategic expansion objectives and could be navigating fierce competition, impacting their profitability.

These less strategic licensed brands often generate just enough revenue to cover their costs, potentially immobilizing capital that could be more effectively deployed in areas with greater growth prospects. For example, in 2023, while overall revenue grew, some niche licensed categories may have shown single-digit percentage increases, indicating a need for strategic review.

A thorough assessment of these licenses is crucial to determine their ongoing strategic value and resource allocation effectiveness, ensuring that Delta Galil focuses its efforts on brands with the highest potential for future returns and market leadership.

Apparel's reliance on fashion trends means collections that miss the mark can become stale almost overnight. For instance, a significant portion of unsold seasonal clothing, estimated to be around 20-30% for many fashion retailers in 2024, can lead to substantial losses if not managed proactively.

These outdated items tie up valuable capital, incurring storage fees and eventually requiring steep markdowns that significantly dent profitability. Delta Galil, like other major apparel manufacturers, must diligently manage its product lifecycle to avoid accumulating such 'dog' category products.

Non-Core Business Units or Brands with Limited Synergy

Delta Galil Industries, known for its strategic acquisitions, may hold business units or brands that haven't fully integrated or demonstrated strong synergy with its core textile and apparel operations. These might be smaller entities with a limited market presence and subdued growth potential.

For instance, if Delta Galil acquired a niche lingerie brand in 2023 that operates independently and doesn't leverage the company's broader supply chain or marketing capabilities, it could fall into this category. Such units might represent a drag on resources if they consistently underperform.

Divesting these non-core units could free up capital and management focus for more strategic growth areas. In 2024, companies are increasingly scrutinizing their portfolios for underperforming assets. For example, a review of Delta Galil's 2024 financial reports might reveal specific brands with declining revenues or profitability that fit this description.

- Low Market Share: Units operating in niche markets with minimal competitive advantage.

- Limited Synergy: Acquired businesses that do not integrate well with Delta Galil's core competencies.

- Underperformance: Brands consistently failing to meet financial targets or contribute meaningfully to overall growth.

- Divestment Potential: Candidates for sale to streamline operations and reallocate resources.

Geographical Markets with Persistent Low Market Share

Geographical markets with persistently low market share for Delta Galil, often termed 'dogs' in the BCG matrix, represent regions where the company has found it challenging to establish a strong foothold. Despite overall positive performance, these specific areas might be experiencing stagnant or minimal growth and intense competition, making it difficult for Delta Galil to gain significant traction.

For instance, while Delta Galil Industries reported a 10% increase in revenue for the first half of 2024, reaching $799 million, certain smaller European or Asian markets might still represent areas with below-average market share for their brands. These markets, characterized by established local players or different consumer preferences, could be consuming resources without yielding substantial returns.

- Low Market Penetration: In specific, highly competitive markets, Delta Galil's brands may hold a market share below 10%, indicating limited consumer adoption.

- Stagnant Growth Prospects: These regions might exhibit a projected market growth rate of less than 2% annually, making significant future gains unlikely.

- Resource Drain: Continued investment in marketing and distribution in these low-share markets, without a clear strategy for market leadership, could negatively impact overall profitability.

- Strategic Re-evaluation: Companies often consider divesting or reducing investment in such 'dog' markets to reallocate capital to more promising ventures, as demonstrated by industry trends in apparel market consolidation.

Products or brands in the 'Dogs' category for Delta Galil represent segments with low market share and low growth prospects. These are often older product lines or licensed brands that struggle to compete or haven't adapted to market shifts. They might require significant investment to revitalize, with uncertain outcomes.

These underperforming assets can tie up capital and management attention that could be better utilized in more promising areas of the business. For example, in 2024, many fashion retailers faced challenges with excess inventory from previous seasons, a common characteristic of 'dog' products that yield low returns.

Delta Galil's strategic review likely includes identifying these 'dog' segments, which could be niche licensed products or specific geographical markets where penetration is minimal. The company must weigh the cost of maintaining these against potential divestment or restructuring to improve overall portfolio performance.

The financial implications are clear: 'dogs' typically generate just enough revenue to cover their costs, if that, and offer little in the way of future growth or profitability. For instance, a 2023 report might show certain licensed apparel lines contributing less than 1% to overall revenue growth, signaling their 'dog' status.

| Category | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Underperforming Brands | Low | Low | Low/Negative | Divestment or Restructuring |

| Niche Licensed Products | Low | Low | Low | Re-evaluation of Licensing Agreements |

| Struggling Geographical Markets | Low | Low | Low | Reduced Investment or Exit Strategy |

Question Marks

Organic Basics, acquired by Delta Galil in July 2022, operates in the fast-growing sustainable and ethical apparel market. This digitally native brand is positioned as a potential star in Delta Galil's BCG matrix, given its focus on a segment with strong consumer demand and increasing environmental consciousness.

Delta Galil aims for significant global expansion and diversification of Organic Basics into new categories like baby and kids' wear. This strategic move underscores the brand's perceived high growth potential, fueled by favorable market trends and its commitment to sustainability.

While Organic Basics exhibits strong growth prospects, its market share within Delta Galil's overall portfolio is still nascent. Consequently, it requires considerable investment to achieve its full scaling potential, characteristic of a question mark in the BCG matrix.

Delta Galil's acquisition of Chantelle in November 2023 marks a significant move into the established innerwear and nightwear market. This strategic acquisition aims to bolster Delta Galil's position in the intimate apparel sector, bringing in new customer segments and design capabilities. The company paid €250 million for the acquisition, which is expected to contribute to Delta Galil's growth trajectory.

Delta Galil's strategic focus on developing new categories with key customers for 2025 positions these initiatives as potential Stars in their BCG Matrix. These ventures target high-growth markets, aiming to capture evolving consumer demands.

Currently, these new categories likely represent Question Marks, characterized by low market share and significant investment requirements. For instance, if Delta Galil were to enter the burgeoning sustainable activewear market, it would necessitate substantial R&D for eco-friendly materials and marketing to build brand awareness against established players.

Sustainability-Focused Product Innovations

Delta Galil's commitment to sustainability is driving product innovation, with investments in eco-dyeing and the adoption of recycled and organic materials. This directly addresses the growing consumer demand for ethically produced fashion. For instance, by 2024, the global sustainable fashion market was projected to reach over $15 billion, highlighting a significant opportunity.

New product lines featuring these sustainable innovations, while aligned with a high-growth market, may initially experience lower market penetration. This is common for novel approaches in a rapidly evolving sector. Companies often need to invest heavily in consumer education and brand building to overcome initial adoption hurdles.

These forward-thinking products represent substantial future potential for Delta Galil. Continued investment is crucial to scale production, enhance consumer awareness about the benefits of eco-friendly materials, and ultimately capture a larger share of the burgeoning sustainable apparel market. By 2025, it's anticipated that over 70% of consumers will consider sustainability when making purchasing decisions.

- Eco-friendly material sourcing: Increased use of organic cotton and recycled polyester.

- Sustainable dyeing technologies: Implementation of water-saving and chemical-reducing dyeing processes.

- Circular economy initiatives: Development of products designed for recyclability and longevity.

- Consumer education campaigns: Highlighting the environmental benefits of Delta Galil's sustainable product lines.

Expansion into the Indian Market (Reliance Retail Ventures Partnership)

Delta Galil's expansion into India via its late 2024 partnership with Reliance Retail Ventures places this initiative squarely in the question mark category of the BCG matrix. This move targets India's substantial consumer base, a market experiencing significant growth driven by rising disposable incomes. For instance, India's retail market was projected to reach $1.7 trillion by 2026, highlighting the immense potential.

While the growth prospects are high, Delta Galil's current market share in India is minimal. This necessitates considerable investment in building brand presence, establishing robust distribution networks, and tailoring product offerings to local preferences. The company will need to effectively navigate this nascent market to achieve substantial penetration and capitalize on the projected growth.

- Strategic Alliance: Partnership with Reliance Retail Ventures, a major player in India's retail landscape.

- Market Potential: Tapping into India's rapidly expanding retail sector, driven by a large population and increasing consumer spending power.

- Nascent Market Share: Requires significant investment to establish a foothold and gain market share in a competitive environment.

- Growth Opportunity: High potential for future growth if market penetration strategies prove successful.

Delta Galil's expansion into India through its late 2024 partnership with Reliance Retail Ventures positions this venture as a question mark. While the Indian market offers substantial growth potential, driven by rising incomes and a vast consumer base, Delta Galil's current market share there is minimal. This necessitates significant investment in brand building and distribution to capture a meaningful presence in this nascent, yet promising, market.

BCG Matrix Data Sources

Our Delta Galil BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to accurately position each business unit.